Professional Documents

Culture Documents

A - New - Growth - Consensus With PDF

Uploaded by

gauravOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A - New - Growth - Consensus With PDF

Uploaded by

gauravCopyright:

Available Formats

HT PAREKH FINANCE COLUMN

A New Growth Consensus?

C P Chandrasekhar

The Reserve Bank of India and the government are taking contradictory approaches on liquidity and interest rates. The one eases liquidity but keeps interest rates high, the other promotes debt-nanced consumption and pushes for cheaper consumer credit. This seems to be a new growth strategy based on a combination of liquidity infusion and interest rate reduction for consumer loans. But is this prudent? What of the fragility of the nancial sector?

series of apparently contradictory trends and measures point to a dangerous new consensus on the functional role of banks in India. To start with, in his rst monetary policy review after assuming ofce, Reserve Bank of India (RBI) governor Raghuram Rajan decided to run with the hare and hunt with the hounds. He disappointed those who were expecting a cut in interest rates, by hiking the repo rate, arguing that the battle against ination had not been won. On the other hand, in what appeared to be a minor concession to those arguing that easy and inexpensive liquidity was needed to boost demand and agging growth, he chose to lower the interest rate on the RBIs marginal standing facility (MSF), established in 2011, under which banks can borrow funds at a rate linked to but set higher than the repo. The September 2013 Mid-Quarter Review of Monetary Policy reduced the earlier 2 percentage point differential between the MSF rate and repo rate by 75 basis points (bps) to 9.5%. The consequent ability of the banks to obtain funds at a lower cost without collateral was seen as a measure aimed at boosting banking sector liquidity. Two Contradictory Planks Thus, there appeared to be two contradictory planks to RBI policy. Keep interest rates high to curb excess borrowing in order to curb demand and ght ination. Ease liquidity conditions so that banks can lend to genuine borrowers who would, however, have to bear the burden that a higher interest rate implied. Not surprisingly, industry was not too impressed since higher borrowing costs would deter those who were planning to borrow to buy their much-desired house, automobile or consumer durable. At the same time, the purpose of the higher base rate to combat ination by curbing

october 26, 2013

C P Chandrasekhar (cpchand@gmail.com) is with the Centre for Economic Studies and Planning, Jawaharlal Nehru University, New Delhi.

demand and debt-nanced speculation appeared to be defeated. Demand would increase as a result of new debt. And those expecting higher returns such as speculators in commodity, real estate and stock markets would be willing to bear the higher interest costs. Barely a month after this initial contradictory foray by the new governor, a set of developments that followed meetings between the union nance minister and the RBI governor pointed to a method behind this confusion. In early October, the RBI strengthened its liquidity enhancement measures aimed at increasing bank access to lower cost funds by: (i) further reducing the MSF rate by 50 bps to 9%; (ii) conducting open market operations (OMOs) involving the purchase of government securities to the tune of Rs 9,974 crore to inject liquidity into the system; and (iii) providing additional liquidity through term repos of 7- and 14-day tenors for a notied amount equivalent to 0.25% of net demand and time liabilities (NDTL) of the banking system. Clearly, the RBIs decision to maintain high interest rates is not aimed at curbing credit and liquidity in the system. These accommodative initiatives on the part of the RBI were matched by another unusual measure: this time on the part of the Ministry of Finance. In early October the government announced that it would infuse capital into public sector banks in excess of the Rs 14,000 crore provided for in the union budget, with the specic intent of enabling them to lend to borrowers in selected sectors such as two-wheelers, consumer durables, etc at lower rates in order to stimulate demand. Clearly, measures aimed at augmenting liquidity and enhancing the banking systems capacity to create credit is being viewed as the solution to the growth slowdown. Debt-nanced private consumption is being seen as the appropriate stimulus for growth. Since the banking system would in principle be able to create credit that is a multiple of the sums infused by the government, every rupee spent from the governments budget could generate demand that is much larger if banks pushed loans.

vol xlviiI no 43

EPW Economic & Political Weekly

10

HT PAREKH FINANCE COLUMN

Hence, as a follow-up to its enhanced capital infusion announcement, the nance ministry has reportedly asked the banks to (i) specify by how much they would be willing to reduce the interest rates at which they lend for purchases of commodities such as two-wheelers and consumer durables; and (ii) agree to enhance lending to the chosen sectors by at least 10 times the capital infused, with periodic reporting on retail lending volumes to satisfy the government. The argument seems to be that since the government is infusing low or near-zero cost capital into the banking system, the latter should in turn provide cheaper loans in areas identied by the government. The message is clear. Capital infusion is being seen not just as a means of recapitalising the banking system that has been recording increases in non-performing assets, but also as a means of providing an interest rate subsidy or subvention to boost demand in particular sectors. A government that limits spending for the poor because of the need to curb the scal decit is willing to subsidise a consumption splurge by the middle class with cheap credit in times of slack demand. A combination of liquidity infusion and interest rate reduction realised through administrative at that serves as the means to stimulate growth seems to be the strategy on which there is a new consensus between the RBI and the nance ministry. This is not the conventional shift away from dependence on the scal lever to a reliance on monetary and banking policy. The use of capital infusion as an additional device implies that the strategy has a scal component as well. But for any given increase in the scal decit, the demand generated in the rst round can be much larger. For such a strategy to be successful, the banks would have to draw into the universe of borrowers a larger number of individuals than it was willing to accommodate in the past. Reducing interest rates would partly help by serving as a teaser. But some dilution of norms with regard to assessment of creditworthiness may also be necessary to hike buyer numbers in the selected sectors. Further, once the process begins, if the government is not to appear partial in the favours it dispenses,

Economic & Political Weekly EPW

requests from other sectors for such demand-stimulating support would have to be accepted. It did not need the subprime disaster in the US to persuade anyone that this method of spurring growth is built on a debt bubble that is fragile. As the RBI deputy governor, K C Chakraborty, is reported to have said after the measure was announced: It is not a very prudent measure to increase consumption by lowering interest rates. If the rate goes up it will become [a] NPA. This strategy is, however, not new. With neo-liberal scal reform requiring forbearance with respect to taxation, and scal consolidation in the form of decit reduction at levels of debt that are arbitrary and wildly different across countries, the role of tax- or debtnanced public expenditure as a stimulus to growth has signicantly declined. The pressure not to resort to the scal route to spur growth is immense. But claims that the animal spirits unleashed by reform would spur sustained growth have not been realised either. Thus many countries, including India, have come to rely on debt-nanced private consumption, facilitated by an easy monetary and liberal banking policy, as the principal stimulus to growth. A consequence is that growth rides on a bubble blown by debt and is therefore fragile and ephemeral. Three Trends in Lending In India, the pursuit of this strategy is reected in three trends. The rst is a sharp rise in the ratio of scheduled bank credit to GDP from around 20% to more than 50% during the years of high growth after 2000. The second is a signicant increase in the share of retail lending in total scheduled commercial bank lending, with lending for individual housing investments, automobile purchases, purchases of consumer durables, credit card expenditures and education. The third is enhanced bank lending to infrastructure, with the ratio of such lending to total lending to industry rising sharply, despite the obvious maturity mismatches involved in using the money of depositors to fund bulky, illiquid loans to a few infrastructural projects. All of these can increase bank fragility. The role of the government in driving these trends is clear from the fact that they

vol xlviiI no 43

apply more to public sector banks than to either domestic or foreign private banks, with a few exceptions. But that has in the past been associated with a conict between the central bank and the nance ministry. The RBI has made ination its principal concern and relied heavily on interest rate increases and monetary restrictions to combat ination. The government on the other hand has demanded an easy monetary policy with low interest rates as the means to stimulate growth. The RBI has opposed this not only because of its focus on ination, but also because of the implications that trajectory could have for non-performing loans in and the stability of the banking sector. This has often meant a subtle but noticeable stand-off between these two arms of state. This points to the new consensus suggested by the contrary policy developments of recent times. While the RBI is sticking with its policy of keeping interest rates high, it seems to be going along with the idea of (i) infusing liquidity into the system; (ii) persuading banks to use that additional liquidity to lend to selected sectors to stimulate demand and drive growth; and (iii) allow the government to use capital infusion as a device to get banks to reduce interest rates in order to induce consumers into borrowing (especially in the festival season when the pressure to spend is high). In the process the RBI seems to be ignoring the potential increase in bank fragility, which it should be concerned about. Not surprisingly, RBI governor Rajan had to defend the measures by saying that the MSF rate cut combined with recapitalisation would spur certain kinds of investments, though he grudgingly admitted, indirectly some consumption will also get nanced. However, it should matter to the RBI that the cheaper liquidity released through this process would undermine the use of a high repo rate to address ination, if that were possible at all. Perhaps Rajans commitment to high interest rates is motivated by some other factor. One possibility is the need to keep domestic nancial markets attractive to foreign investors and lenders, so as to attract capital, easily nance the current account decit and stabilise the rupee. That too smacks of short-termism.

11

october 26, 2013

You might also like

- N PDFDocument1 pageN PDFgauravNo ratings yet

- N PDFDocument1 pageN PDFgauravNo ratings yet

- Transgender Rights in IndiaDocument1 pageTransgender Rights in IndiagauravNo ratings yet

- Botany UPSC SyllabusDocument3 pagesBotany UPSC SyllabusgauravNo ratings yet

- NDocument1 pageNgauravNo ratings yet

- Chapter 1 View of LifeDocument1 pageChapter 1 View of LifegauravNo ratings yet

- Botany I PDFDocument7 pagesBotany I PDFAshish Kumar PandeyNo ratings yet

- Julbot 11Document2 pagesJulbot 11gauravNo ratings yet

- PCM 2012Document2 pagesPCM 2012gauravNo ratings yet

- AromatherapyDocument20 pagesAromatherapygauravNo ratings yet

- SportsDocument1 pageSportsgauravNo ratings yet

- AwardsDocument1 pageAwardsgauravNo ratings yet

- List of Cable OperatorsDocument4 pagesList of Cable OperatorsgauravNo ratings yet

- TGL AibyDocument42 pagesTGL AibygauravNo ratings yet

- Distinctive Words To Describe Sleep, Dreaming, and Flashcards - DictionaryDocument9 pagesDistinctive Words To Describe Sleep, Dreaming, and Flashcards - DictionarygauravNo ratings yet

- One Day WorkshopDocument1 pageOne Day WorkshopgauravNo ratings yet

- Þ CC) C' (CC& +C++C: CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCDocument12 pagesÞ CC) C' (CC& +C++C: CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCgauravNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Salary and Interest On SecuritiesDocument27 pagesSalary and Interest On SecuritiesShamsuzzaman SazuNo ratings yet

- CPAR Tax On Estates and Trusts (Batch 92) - HandoutDocument10 pagesCPAR Tax On Estates and Trusts (Batch 92) - HandoutNikkoNo ratings yet

- Nikhil Equitas StatementDocument2 pagesNikhil Equitas Statementprem yadav100% (1)

- The International Monetary Fund (IMF)Document3 pagesThe International Monetary Fund (IMF)basit ubasitNo ratings yet

- Sip PPT 2018Document16 pagesSip PPT 2018Rajat GuptaNo ratings yet

- PDF Review Materials On Capital Budgeting DLDocument7 pagesPDF Review Materials On Capital Budgeting DLRose Ann Juleth LicayanNo ratings yet

- Financial Management Core Concepts 4th Edition Brooks Test BankDocument35 pagesFinancial Management Core Concepts 4th Edition Brooks Test Banktrancuongvaxx8r100% (21)

- Mandira Sarma PaperDocument30 pagesMandira Sarma Paperaanand_38No ratings yet

- Icici Project For BBM Customer Attitude Towards Financial Services Provided by Icici BankDocument119 pagesIcici Project For BBM Customer Attitude Towards Financial Services Provided by Icici BankNaveen Kumar50% (2)

- Momo Statement ReportDocument2 pagesMomo Statement ReportHolybabyNo ratings yet

- Sunpass Is A Registered Trademark of The Florida Department of TransportationDocument1 pageSunpass Is A Registered Trademark of The Florida Department of Transportationyo d.No ratings yet

- Sap Fico TutorialDocument29 pagesSap Fico Tutorialkmurali321No ratings yet

- Card Monthly Summary 10072022023013Document5 pagesCard Monthly Summary 10072022023013Marsha BaconNo ratings yet

- 29 06 Main TradingDocument14 pages29 06 Main TradingZahir Khan100% (1)

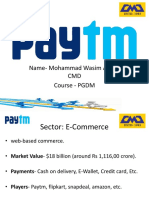

- MD Wasim Ansari, Paytm, PPTDocument20 pagesMD Wasim Ansari, Paytm, PPTMd WasimNo ratings yet

- Financial Advertising......... FinalDocument12 pagesFinancial Advertising......... FinalomthakerNo ratings yet

- Corporate DerivativesDocument13 pagesCorporate Derivativesmbilalkhan88No ratings yet

- Role of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractDocument12 pagesRole of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractAkshay BoladeNo ratings yet

- Analysis of Annual Report - UnileverDocument7 pagesAnalysis of Annual Report - UnileverUmair KhizarNo ratings yet

- RRLDocument2 pagesRRLJOHN AXIL ALEJONo ratings yet

- Financial Management Strategy FinalDocument24 pagesFinancial Management Strategy FinalsayedhossainNo ratings yet

- 2022 Thorwallet Pitch Deck V4Document19 pages2022 Thorwallet Pitch Deck V4Guillaume VingtcentNo ratings yet

- Capital Asset Pricing Model: Learning ObjectivesDocument17 pagesCapital Asset Pricing Model: Learning ObjectivesShobha ThallapalliNo ratings yet

- Kisan Credit CardDocument2 pagesKisan Credit CardManoj Tiwari100% (1)

- NeerajDocument2 pagesNeerajSheelu SinghNo ratings yet

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Question PDFDocument2 pagesQuestion PDFISLAM KHALED ZSCNo ratings yet

- Final Report On BankingDocument70 pagesFinal Report On Bankingbharat sachdevaNo ratings yet

- Outline of NESARA GESARA - 2023Document14 pagesOutline of NESARA GESARA - 2023jpes100% (4)

- ManagmentDocument91 pagesManagmentHaile GetachewNo ratings yet