Professional Documents

Culture Documents

Accounting Cycle Summary

Uploaded by

RanaAbdulAzizCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

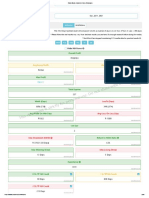

Accounting Cycle Summary

Uploaded by

RanaAbdulAzizCopyright:

Available Formats

The accounting cycle consists of a series of steps that record financial transactions and produce financial statements.

Some data entry steps may occur at any time during the accounting cycle, other transactions occur only during financial statement production. This process repeats itself for every accounting period, whether for large companies or small businesses. Large companies frequently divide these tasks in departments. A small company may make the entire cycle the responsibility of one bookkeeper.

Sponsored Link

Attendance & Payroll

HRSuite Attendance, Leave and Payroll Management Software www.softrack.com.pk

Transaction Entry Steps

The accounting cycle begins with recording financial transactions. Although this begins the accounting cycle, transaction entry may occur at any time prior to closing the accounting period. Entering all transactions assures a complete record for the accounting period. Accounting transactions require a source document. Invoices for goods or services received constitute source documents. Sales receipts provide another example. Source documents form an important part of the audit trail, which provides proof of the validity of a companys financial records. The accountant or bookkeeper must analyze the document and determine the correct accounts to debit and credit. Recording this information into the appropriate ledger enables the accounting system to summarize it on the appropriate report at the end of the accounting cycle.

Beginning the Closing Process

The process of closing the books and producing financial statements begins with the trial balance. This document lists the current balance of every account. Prior to the use of computers, this document confirmed that the books balanced, debits equaling credits. Computerized accounting systems do not allow unbalanced entries. An unbalanced report indicates an error in the report itself, such as a nonprinting account. After correcting such problems, if any, the accountant reviews the trial balance and plans adjusting entries.

Adjusting Entries

Adjusting journal entries -- AJEs -- serve several functions. They correct minor entry errors such as debiting or crediting the wrong account. AJEs also record various accrual

entries such as unpaid taxes or payroll, or unrecorded income such as interest earned but not paid. The trial balance report typically provides space to note adjusting debits and credits and the anticipated ending balance of the accounts. This report provides an internal source document and forms a critical part of the audit trail.

Financial Statements and Period Closing

The accounting cycle concludes with the production of financial statements. A complete set of standard financial statements consists of balance sheet, income statement and a cash flow statement. Many companies include various internal reports as part of the financial statement package. Prior to computerized systems, the closing process concluded with transferring the balances of the income and expense accounts to retained earnings. This task is now performed by the computer, finalizing one accounting cycle and starting another.

THE ACCOUNTING CYCLE SUMMARY The accounting cycle, also commonly referred to as accounting process, is a series of procedures in the collection, processing, and communication of financial information. As defined in a lesson earlier, accounting involves recording, classifying, summarizing, and interpreting phases. Financial information is communicated through the financial statements the end products of an accounting system. But before the financial statements can be prepared, accountants need to gather information about accountable transactions, record and collate them to come up with the values to be reported in the reports. Nonetheless, the cycle does not end with the presentation of these reports. Several steps are needed to be done to prepare the accounting system for the next cycle. The following diagram presents the nine steps in the accounting cycle.

Accounting Cycle Steps

1. Identifying and Analyzing Business Transactions The accounting process starts with identifying and analyzing business transactions and events. Not all transactions and events are entered into the accounting system. Only those that pertain to the business entity are included in the process. Thus, a loan made by the owner in his name that does not have anything to do with the entity is not accounted for (accounting entity assumption). The transactions identified are then analyzed to determine the accounts affected and the amounts to be recorded. The first step also includes the preparation of business documents, or source documents. A business document serves as basis for recording a transaction.

2. Recording in the Journals A journal is a book paper or electronic in which transactions are recorded. Business transactions are recorded using the double-entry bookkeeping system. They are recorded in journal entries containing at least two accounts (one debited and one credited). To simplify the recording process, special journals are often used for transactions that recur frequently such as sales, purchases, cash receipts, and cash disbursements. A general journal is used to record transactions that cannot be entered in the special books. Transactions are recorded in chronological order and as they occur. Hence, journals are also known as Books of Original Entry. 3. Posting to the Ledger Also known as Books of Final Entry, a ledger is a collection of accounts that shows the changes made to each account as a result of past transactions, and their current balances. This is the core of the classifying phase. After the posting process, the balances of each account can then be determined. For example, all journal entries made to Cash would be transferred into the Cash account in the ledger. All increases and decreases in cash will be entered into one ledger account. Thus, the ending balance of Cash can be determined. 4. Unadjusted Trial Balance A trial balance is prepared to test the equality of the debits and credits. All account balances are extracted from the ledger and arranged in one report. Afterwards, all debit balances are added. All credit balances are also added. The total debits should be equal to total debits. When errors are discovered, correcting entries are made to rectify them or reverse their effect. Take note however that the purpose of a trial balance is only test the equality of total debits and total credits and not to determine the correctness of accounting records. Some errors could exist even if debits are equal to credits, such as double posting or failure to record a transaction. 5. Adjusting Entries

Adjusting entries are prepared as an application of the accrual basis of accounting. At the end of the accounting period, some expenses may have been incurred but not yet recorded in the journals. Some income may have been earned but not entered in the books. Thus, adjusting entries are prepared to have the accounts updated before they are summarized into the financial statements. Adjusting entries are made for accrual of income, accrual of expenses, deferrals(income method or liability method), prepayments (asset method or expense method), depreciation, and allowances. 6. Adjusted Trial Balance An adjusted trial balance may be prepared after adjusting entries are made and before the financial statements are prepared. This is to test if the debits are equal to credits after adjusting entries are made. 7. Financial Statements When the accounts are already up-to-date and equality between the debits and credits have been tested, the financial statements can now be prepared. The financial statements are the end-products of an accounting system. A complete set of financial statements is made up of a Statement of Comprehensive Income or Income Statement and Other Comprehensive Income, Statement of Changes in Equity, Statement of Financial Position or Balance Sheet, Statement of Cash Flows, and Notes to Financial Statements. 8. Closing Entries Temporary or nominal accounts, i.e. income statement accounts, are closed to prepare them for the next accounting period. Temporary accounts include income, expense, and withdrawal accounts. These items are measured periodically. The accounts are closed to a summary account (often, Income Summary) and then closed further to the appropriate capital account. Take note that closing entries are made only for temporary accounts. Real or permanent accounts, i.e. balance sheet accounts, are not closed. 9. Post-Closing Trial Balance

In the accounting cycle, the last step is to prepare a post-closing trial balance. It is prepared to test the equality of debits and credits after closing entries are made. Since temporary accounts are already closed at this point, the postclosing trial balance contains real accounts only. *Reversing Entries: Optional step at the beginning of the new accounting period Reversing entries are optional. They are prepared at the beginning of the new accounting period to facilitate a smoother and more consistent recording process. In this step, the adjusting entries made for accrual of income, accrual of expenses, deferrals under the income method, and prepayments under the expense method are reversed. Autor's Notes: So there you have the nine steps in the accounting cycle. This is just an overview of the accounting process. Each step will be illustrated one by one in the next lessons of the Accounting Basics section.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- PimDocument7 pagesPimRanaAbdulAzizNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Case For PlanningDocument8 pagesCase For PlanningRanaAbdulAzizNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Revenue With Pool (A)Document6 pagesRevenue With Pool (A)RanaAbdulAzizNo ratings yet

- Code of Governance 2Document28 pagesCode of Governance 2RanaAbdulAzizNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Sales ManagementDocument202 pagesSales ManagementdsatyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- MACRS DepreciationDocument3 pagesMACRS DepreciationRanaAbdulAzizNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 10 of 25 Key DimensionsDocument30 pages10 of 25 Key DimensionsRanaAbdulAzizNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Summary of Negative MessageDocument3 pagesSummary of Negative MessageRanaAbdulAzizNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Distorted or Absent Price SignalsDocument10 pagesDistorted or Absent Price SignalsRanaAbdulAzizNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Transication Affects On Accounting EquationDocument2 pagesTransication Affects On Accounting EquationRanaAbdulAzizNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Routine Letters & Goodwill MessagesDocument58 pagesRoutine Letters & Goodwill MessagesRanaAbdulAzizNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shariah Audit/ Islamic Financial Advisory Meezan Bank: Instructor Mufti Naveed AlamDocument15 pagesShariah Audit/ Islamic Financial Advisory Meezan Bank: Instructor Mufti Naveed AlamRanaAbdulAzizNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Chapter 8 (Summary) - 2Document2 pagesChapter 8 (Summary) - 2RanaAbdulAzizNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Routine Letters and Goodwill Messages: Mary Ellen Guffey, Business CommunicationDocument57 pagesRoutine Letters and Goodwill Messages: Mary Ellen Guffey, Business CommunicationRanaAbdulAzizNo ratings yet

- Informal Reports: Mary Ellen Guffey, Essentials of Business Communication, 6eDocument26 pagesInformal Reports: Mary Ellen Guffey, Essentials of Business Communication, 6eRanaAbdulAzizNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 10 SummaryDocument4 pagesChapter 10 SummaryRanaAbdulAzizNo ratings yet

- Writing Improvement ExercisesDocument6 pagesWriting Improvement ExercisesRanaAbdulAzizNo ratings yet

- CKR Ib4 Inppt 12Document38 pagesCKR Ib4 Inppt 12hunble personNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- ECT Readers GuideDocument85 pagesECT Readers GuideMaame Akua Adu BoaheneNo ratings yet

- CSEC Principles of Accounts SEC. 9-Cooperative AccountingDocument31 pagesCSEC Principles of Accounts SEC. 9-Cooperative AccountingEphraim PryceNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Uy, Mia Fe - Competency ExamDocument5 pagesUy, Mia Fe - Competency ExammEOW SNo ratings yet

- Draft HALA RecommendationsDocument38 pagesDraft HALA RecommendationsThe UrbanistNo ratings yet

- AFC 1000 Exam 2012 S2Document9 pagesAFC 1000 Exam 2012 S2tusharNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CDP Jaitwara EnglishDocument376 pagesCDP Jaitwara EnglishCity Development Plan Madhya PradeshNo ratings yet

- Entrepreneurship and Small Business Management Diana DumitruDocument14 pagesEntrepreneurship and Small Business Management Diana DumitruDumitru Dragos RazvanNo ratings yet

- Quiz 3Document15 pagesQuiz 3help215No ratings yet

- Argentina StandaloneDocument3 pagesArgentina StandaloneBAE NegociosNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 2021 Catalonia BioRegion ReportDocument40 pages2021 Catalonia BioRegion ReportDaniel FusterNo ratings yet

- Askari Asset Allocation Term SheetDocument1 pageAskari Asset Allocation Term SheethakkanisirajNo ratings yet

- Philippine Financial Reporting Standards Number Title Effective DateDocument3 pagesPhilippine Financial Reporting Standards Number Title Effective DateBam PamNo ratings yet

- Accounting For Income, Collections and Related TransactionsDocument4 pagesAccounting For Income, Collections and Related TransactionsKristofer TacadenaNo ratings yet

- Ramon Magsaysay Technological University Graduate School DepartmentDocument4 pagesRamon Magsaysay Technological University Graduate School DepartmentJerson AgsiNo ratings yet

- Year Ahead 2022Document72 pagesYear Ahead 2022Dan CraneNo ratings yet

- Stock Mock - Backtest Index StrategiesDocument95 pagesStock Mock - Backtest Index StrategiesThE BoNg TeChniCaLNo ratings yet

- Bus 685 Group AssignmentDocument18 pagesBus 685 Group AssignmentAnnoor Ayesha Siddika 1411306042No ratings yet

- Session 5-3: Thailand Case Study by Kraiyos PatrawartDocument30 pagesSession 5-3: Thailand Case Study by Kraiyos PatrawartADBI Events100% (1)

- Income From House PropertyDocument26 pagesIncome From House PropertysnehalgaikwadNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MITC Credit CardDocument11 pagesMITC Credit CardAbhishek KumarNo ratings yet

- Money MarketDocument21 pagesMoney MarketPratik ShethNo ratings yet

- USA 1919-41 Notes RemyDocument33 pagesUSA 1919-41 Notes RemyBryan NgoNo ratings yet

- SwissBorg Pitch Deck (English)Document19 pagesSwissBorg Pitch Deck (English)Suzie EvansNo ratings yet

- Working Capital Management - VizagDocument93 pagesWorking Capital Management - VizagSahil Goutham100% (1)

- Questions and Answers For Essay QuestionsDocument12 pagesQuestions and Answers For Essay QuestionsPushpendra Singh ShekhawatNo ratings yet

- Guide To Marketing Strategy PresentationDocument21 pagesGuide To Marketing Strategy PresentationKago KhachanaNo ratings yet

- Business Plan FinalDocument53 pagesBusiness Plan FinalMadrick Ace Villa100% (2)

- JPMorgan Chase Mortgage Settlement DocumentsDocument291 pagesJPMorgan Chase Mortgage Settlement DocumentsFindLaw100% (2)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (14)