Professional Documents

Culture Documents

Analysis of Banking Ombudsman Scheme

Uploaded by

Hitesh MoreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Banking Ombudsman Scheme

Uploaded by

Hitesh MoreCopyright:

Available Formats

ANALYSIS OF BANKING OMBUDSMAN SCHEME

ANALYSIS OF BANKING OMBUDSMAN SCHEME History and Develop ent o! "#e $an%in& o $'ds an s(#e e)

The Banking Ombudsman Scheme is introduced under Section 35 A of the Banking Regulation Act, 1949 b RB! "ith effect from 1995 to #ro$ide an e%#editious and ine%#ensi$e forum to bank customers for resolution of their com#laints relating to banking ser$ices& The Scheme co$ered banking ser$ices rendered b scheduled commercial banks and scheduled #rimar coo#erati$e banks&The ob'ecti$e of the Banking Ombudsman Scheme is to be a $isible and reliable s stem of dis#ute resolution mechanism for bank customers& The Ombudsmen generall resort to conciliation or mediation for settlement of com#laints& The Banking Ombudsman Scheme "as re$ised in ())( to co$er Regional Rural Banks and to #ermit a re$ie" of the Banking Ombudsman*s A"ards against the banks b the Reser$e Bank& The Scheme "as further re$ised in ())+ gi$ing it a much "ider sco#e b including se$eral ne" areas of customer com#laints& The Banking Ombudsmen currentl ha$e their offices in 15 ,enters s#read across the countr and are full funded b the Reser$e Bank& The Banking Ombudsmen are ser$ing Officers of Reser$e Bank in the rank of ,hief -eneral .anagers and -eneral .anagers&

Constit'tion* po+ers and !'n(tions o! $an%in& o $'ds an Appoint ents ten're) The Reser$e Bank ma a##oint one or more of its officers in the rank of ,hief -eneral .anager or -eneral .anager to be kno"n as Banking Ombudsmen to carr out the functions entrusted to them b or under the Scheme& The a##ointment of Banking Ombudsman ma be made for a #eriod not e%ceeding three ears at a time& 1 Lo(ation o! o!!i(e) The office of the Banking Ombudsman shall be located at such #laces as ma be s#ecified b the Reser$e Bank& !n order to e%#edite dis#osal of com#laints, the Banking Ombudsman ma hold sittings at such #laces "ithin his area of 'urisdiction as ma be considered necessar and #ro#er b him in res#ect of a com#laint or reference before him&

,'risdi(tion* po+ers and d'ties o! $an%in& o $'ds an ) 1& The Reser$e Bank shall s#ecif the authorit of Scheme shall e%tend& (& The Banking Ombudsman shall recei$e and consider com#laints relating to the deficiencies in banking or other ser$ices filed on the grounds mentioned in the scheme and facilitate their satisfaction or settlement b agreement or through conciliation and mediation bet"een the bank concerned and the aggrie$ed #arties or b #assing an A"ard in accordance "ith the Scheme& 3& The Banking Ombudsman shall e%ercise general #o"ers of su#erintendence and control o$er his Office and shall be res#onsible for the conduct of business their o"n office& 4& The Office of the Banking Ombudsman shall dra" u# an annual budget for itself in consultation "ith Reser$e Bank and shall e%ercise the #o"ers of e%#enditure "ithin the a##ro$ed budget on the lines of Reser$e Bank of !ndia /%#enditure Rules, ())5& 5& The Banking Ombudsman shall send to the -o$ernor, Reser$e Bank, a re#ort, as on 3)th 0une e$er ear, containing a general re$ie" of the acti$ities of his Office during the #receding financial ear and shall furnish such other information as the Reser$e Bank ma direct and the Reser$e Bank ma , if it considers necessar in the #ublic interest so to do, #ublish the re#ort and the information recei$ed from the the territorial limits to "hich

each Banking Ombudsman a##ointed under the

Banking Ombudsman in such consolidated form or other"ise as it deems fit&

Co plaint #andlin& pro(ed're BY t#e $an%in& o $'ds an Gro'nds o! (o plaints +#i(# $an%in& o $'ds an is entitled to #ere) The Banking Ombudsman can recei$e and consider an com#laint relating to the follo"ing deficienc internet banking23 1& non4#a ment or inordinate dela in the #a ment or collection of che5ues, drafts, bills etc&6 (& non4acce#tance, "ithout sufficient cause, of small denomination notes tendered for an #ur#ose, and for charging of commission in res#ect thereof6 3& non4acce#tance, "ithout sufficient cause, of coins tendered and for charging of commission in res#ect thereof6 4& non4#a ment or dela in #a ment of in"ard remittances 6 5& failure to issue or dela in issue of drafts, #a orders or bankers* che5ues6 +& non4adherence to #rescribed "orking hours 6 7& failure to #ro$ide or dela in #ro$iding a banking facilit 1other than in banking ser$ices 1including

loans and ad$ances2 #romised in "riting b selling agents6

a bank or its direct

8& dela s, non4credit of #roceeds to #arties accounts, non4#a ment of de#osit or non4obser$ance of the Reser$e Bank directi$es, if an , a##licable to rate of interest on de#osits in an sa$ings,current or other account maintained "ith a bank 6 9& com#laints from 9on4Resident !ndians ha$ing accounts in !ndia in relation to their remittances from abroad, de#osits and other bank4 related matters6 1)&refusal to o#en de#osit accounts "ithout an $alid reason for refusal6 11&le$ ing of charges "ithout ade5uate #rior notice to the customer6 1(&non4adherence b the bank or its subsidiaries to the instructions of Reser$e Bank on AT.:;ebit card o#erations or credit card o#erations6 13&non4disbursement or dela in disbursement of #ension 1to the e%tent the grie$ance can be attributed to the action on the #art of the bank concerned, but not "ith regard to its em#lo ees26 14&refusal to acce#t or dela in acce#ting #a ment to"ards ta%es, as re5uired b Reser$e Bank:-o$ernment6 15&refusal to issue or dela in issuing, or failure to ser$ice or dela in ser$icing or redem#tion of -o$ernment securities6 1+&forced closure of de#osit accounts "ithout due notice or "ithout sufficient reason6

17&refusal to close or dela in closing the accounts6 18&non4adherence to the fair #ractices code as ado#ted b the bank or non4adherence to the #ro$isions of the ,ode of Bank s ,ommitments to ,ustomers issued b Banking ,odes and Standards Board of !ndia and as ado#ted b the bank 6 19&non4obser$ance of Reser$e Bank guidelines on engagement of reco$er agents b banks6 and ()&an other matter relating to the $iolation of the directi$es issued b the Reser$e Bank in relation to banking or other ser$ices& (1&A customer can also lodge a com#laint on the follo"ing grounds of deficienc in ser$ice "ith res#ect to loans and ad$ances 1& non4obser$ance of Reser$e Bank ;irecti$es on interest rates6 (& dela s in sanction, disbursement or non4obser$ance of #rescribed time schedule for dis#osal of loan a##lications6 3& non4acce#tance of a##lication for loans "ithout furnishing $alid reasons to the a##licant6 and 4& non4adherence to the #ro$isions of the fair #ractices code for lenders as ado#ted b the bank or ,ode of Bank*s ,ommitment to ,ustomers, as the case ma be6 5& non4obser$ance of an other direction or instruction of the Reser$e Bank as ma be s#ecified b the Reser$e Bank for this #ur#ose from time to time&

+& The Banking Ombudsman ma also deal "ith such other matter as ma be s#ecified b the Reser$e Bank from time to time&

Cir(' stan(es in +#i(# (o plaint not $e (onsidered $y t#e O $'ds an ) ,om#laint "ill not be considered if3 a& One has not a##roached his bank for redressal of his grie$ance first& b& One has not made the com#laint "ithin one ear from the date one has recei$ed the re#l of the bank,, or if no re#l is recei$ed if it is more than one ear and one month from the date of re#resentation to the bank&

c& The sub'ect matter of the com#laint is #ending for dis#osal : has alread been dealt "ith at an other forum like court of la", consumer court etc& d& <ri$olous or $e%atious& e& The institution com#lained against is not co$ered under the scheme& f& The sub'ect matter of the com#laint is not "ithin the ambit of the Banking Ombudsman& g& !f the com#laint is for the same sub'ect matter that "as settled through the office of the Banking Ombudsman in an #re$ious #roceedings&

pro(ed're !or !ilin& t#e (o plaint $e!ore t#e Ban%in& O $'ds an) One can file a com#laint "ith the Banking Ombudsman sim#l b

"riting on a #lain #a#er& One can also file it online& One ma lodge his: her com#laint at the office of the Banking Ombudsman under "hose 'urisdiction, the bank branch com#lained against is situated& centrali=ed o#erations, com#laints ma the customer is located& details +#i(# are re-'ired in t#e (o plaint) <or com#laints relating to credit cards and other t #es of ser$ices "ith be filed before the Banking Ombudsman "ithin "hose territorial 'urisdiction the billing address of

The com#laint should ha$e i& ii& the name and address of the com#lainant, the name and address of the branch or office of the bank against "hich the com#laint is made, iii& i$& $& $i& facts gi$ing rise to the com#laint su##orted b documents, if an , the nature and e%tent of the loss caused to the com#lainant, the relief sought from the Banking Ombudsman and a declaration about the com#liance of conditions "hich are re5uired to be com#lied "ith b the com#lainant&

li it on t#e a o'nt o! (lai

and (o pensation )

The amount, if an , to be #aid b the bank to the com#lainant b "a of com#ensation for an loss suffered b the com#lainant is limited to the amount arising directl out of the act or omission of the bank or Rs 1) lakhs, "hiche$er is lo"er& The Banking Ombudsman ma a"ard com#ensation not e%ceeding Rs 1 lakh to the com#lainant onl in the case of com#laints relating to credit card o#erations for mental agon and harassment& The Banking Ombudsman "ill take into account the loss of the com#lainant*s time, e%#enses incurred b the com#lainant,

harassment and mental anguish suffered b #assing such a"ard&

the com#lainant "hile

Sit'ations o! re.e(tion o! (o plaints $y $an%in& o $'ds an) The Banking Ombudsman ma re'ect a com#laint at an stage if it

a##ears to him that a com#laint made to him is3

not on the grounds of com#laint referred to abo$e com#ensation sought from the Banking Ombudsman is be ond Rs 1) lakh &

re5uires consideration of elaborate documentar are not a##ro#riate for ad'udication of such com#laint

and oral

e$idence and the #roceedings before the Banking Ombudsman

"ithout an sufficient cause that it is not #ursued b diligence the com#lainant "ith reasonable

in the o#inion of the Banking Ombudsman there is no loss or damage or incon$enience caused to the com#lainant&

Co plaint #andlin& pro(ed're) -enerall on recei#t of an com#laint, the Banking Ombudsman agreement bet"een the

endea$ors to resol$e the com#laint b

com#lainant and the bank named in the com#laint through a #rocess of conciliation or mediation& <or the #ur#ose of such resolution of the

com#laint, the Banking Ombudsman follo"s such #rocedures as he ma consider a##ro#riate and he is not bound b an legal rule of e$idence& !f a com#laint is not settled b agreement "ithin a #eriod of one month from the date of recei#t of the com#laint or such further #eriod as the Banking Ombudsman ma consider necessar , he ma #ass an A"ard after affording the #arties reasonable o##ortunit to #resent their case& >e shall be guided b the e$idence #laced before him b the #arties, the #rinci#les of banking la" and #ractice, directions, instructions and guidelines issued b the Reser$e Bank from time to time and such other factors, "hich in his o#inion are necessar in the interest of 'ustice&

the ste#s in$ol$ed in com#laint handling b ombudsman are Recei#t of com#laints

the banking

;ecision to handle or not Ackno"ledgement of those co$ered under the Scheme Return of those that cannot be handled under the Scheme ,all for comments from Banks ?romote a settlement through conciliation or #ass an a"ard

Appeal) !f one is not satisfied "ith the decision #assed b Ombudsman, one can a##roach the a##ellate authorit the Banking against the

Banking Ombudsmen*s decision& A##ellate Authorit is $ested "ith a

;e#ut -o$ernor of the RB!& One can also e%#lore an other recourse and:or remedies a$ailable to him:her as #er the la"& The bank also has the o#tion to file an a##eal before the a##ellate authorit under the scheme& ti e li it !or !ilin& an appeal !f one is aggrie$ed b the decision, one ma , "ithin 3) da s of the date of recei#t of the a"ard, a##eal against the a"ard before the a##ellate authorit & The a##ellate authorit ma , if he: she is satisfied that the a##licant had sufficient cause for not making an a##lication for a##eal "ithin time, also allo" a further #eriod not e%ceeding 3) da s&

Appeal #andlin& pro(ed're The a##ellate authorit ma i& dismiss the a##eal6 or

ii& iii&

allo" the a##eal and set aside the a"ard6 or send the matter to the Banking Ombudsman for fresh dis#osal in accordance "ith such directions as the a##ellate authorit ma consider necessar or #ro#er6 or

i$&

modif

the a"ard and #ass such directions as ma

be

necessar to gi$e effect to the modified a"ard6 or $& #ass an other order as it ma deem fit&

En!or(e ent o! t#e a+ard passed $y t#e $an%in& o $'ds an A co# of the A"ard shall be sent to the com#lainant and the bank named in the com#laint& An A"ard shall not be binding on a bank

against "hich it is #assed unless the com#lainant furnishes to it, "ithin a #eriod of 15 da s from the date of recei#t of co# of the A"ard, a letter of acce#tance of the a"ard in full and final settlement of his claim in the matter& !f the com#lainant does not acce#t the A"ard #assed b the Banking Ombudsman and fails to furnish his letter of acce#tance "ithin such time "ithout making an re5uest for e%tension of time to com#l "ith such re5uirements his com#laint shall be re'ected b the Banking Ombudsman & ?ro$ided that in the e$ent of the com#lainant making a "ritten re5uest for e%tension of time, the Banking Ombudsman ma sub'ect to his being satisfied "ith the e%#lanation as furnished b the com#lainant about his inabilit to consider the A"ard and furnish his letter of acce#tance, grant e%tension of time u# to further #eriod of fifteen da s for such com#liance&

So e e/a ples o! (ases #andled $y $an%in& o $'ds an Case 0 The com#lainant had a$ailed a housing loan of Rs 3,4),))):4from the bank at a fi%ed rate of interest of 8@ #er annum at 5uarterl rests on highest monthl reducing balance& The com#lainant alleged that the bank had subse5uentl increased the rate of interest to 1(&75@ contrar to terms of sanction of the loan& The bank submitted that the customer "as sanctioned loan at fi%ed interest rate, but as #er their e%tant instructions and internal circular, the interest rates are to be reset at the end of e$er t"o ears on the basis of interest rates #re$ailing at that time& Accordingl , the fi%ed interest rates "ere changed from 8@ to 1(&75@& ;uring the course of the #roceedings before the Banking Ombudsman, the bank re4"orked the a##licable interest at the contracted rate of interest and refunded the e%cess amount of Rs 17,93+:4, b credit to the com#lainantAs account& >o"e$er, the bank contended that going for"ard, the reset interest rate "ould be a##licable& The com#lainant "as also gi$en an e%it o#tion, "hich "as not acce#table to him& !f the interest rates are sub'ect to #eriodical rests, it is onl fair and reasonable that the same is e%#licitl stated in the loan agreement and sanction letter in an unambiguous and trans#arent manner& <urther, in choosing to #ro$ide a fi%ed rate loan to the customer, the bank has consciousl decided to carr the interest rate risk associated "ith the #roduct& The loan also carried a higher interest rate com#ared to floating rate #roduct as a #remium to"ards the interest rate risk& BO #assed an A"ard ad$ising the bank to strictl abide b the terms and conditions of the original arrangement and not gi$e effect to their #ro#osal to increase interest rate on the loan, unless e%#licitl consented to b the com#lainant

in "riting& The bank "as also ad$ised to #a an amount of Rs 1,))) to the com#lainant to"ards the cost of #ursuing this remed to his grie$ance& The bank has im#lemented the A"ard&

,ase ( The com#lainant "as maintaining a current account and a##roached the bank to con$ert his current account to cash credit account& <or the said #ur#ose he had #ledged 9S, amounting to Rs&1,(),))):4& Subse5uentl the bank neither sanctioned him a cash credit limit nor returned the certificates& !n the meantime the certificates "ere matured for #a ment and he re5uested the bank to return the certificates& The bank failed to return the certificates stating that the certificates had been mis#laced& The com#lainant taking u# the a##roached us "ith a re5uest to redress his grie$ances& On

matter "ith the bank, the bank assured to take u# the matter "ith the #ost office for issue of du#licate 9S,s& On recei#t of the du#licate 9S,s from the concerned #ost office, the com#lainant "as com#ensated for the loss of the original certificates& The com#lainant submitted a letter of satisfaction to the BO&

,ase 3 A com#laint relating to non4credit of che5ue amount into the account of the com#lainant "as recei$ed& The com#lainant had re#ortedl taken u# the matter "ith the bank se$eral times but there "as no res#onse b the bank to"ards credit of the che5ue amount& The com#lainant a##roached the BO for resolution of his grie$ances& On recei#t of the com#laint, BO 5uestioned the bank as to "hat action had been taken on the com#laint b them& The bank re#orted that the che5ue in 5uestion "as lost in transit resulting in non4credit of the che5ue amount to the com#lainantAs account& At the instance of BO, the bank took u# the matter "ith BT! .utual <und, ?atna b submitting letter of undertaking and death certificate& The .utual <und issued a du#licate che5ue and the amount "as credited to the com#lainantAs account& The com#lainant submitted a letter of satisfaction&

1evie+ o! Ban%in& O $'ds an S(#e e Data on 022345665 ,om#laints Recei$ed As against +)+( com#laints recei$ed during the #eriod 1998499 1A#ril4 .arch2, the number of com#laints recei$ed during 19994())), ()))4)1 and ())14)( stood at 4994, 58)3 and 59)7 res#ecti$el & As com#ared to the com#laints recei$ed during 1998499, there is a decrease of (&5@ during ())14)(& A$erage com#laints #er ear #er office decreased marginall from 4)4 to 394 during the abo$e #eriod&

?eriod

9o& of Offices 9o& of Banking com#laints recei$ed +)+( during 4994 58)3 59)7 Ombudsman 15 15 15 15

of A$erage 9o& of com#laints the 4)4&1 #er office 33(&9 38+&9 393&8

1998499 19994())) ()))4)1

1eport 75668456629 ?RO<!C/ O< ,O.?CA!9TS Sr& 9o& 1 ,om#laints brought for"ard from the #re$ious ear ( 3 4 5 ,om#laints recei$ed during the ear TOTAC ,om#laints dis#osed during the ear ,om#laints #ending at the close of the ear 4 Cess than one month ((+( 13(2 4 One to t"o months 193+ 1(72 4 T"o to three months 943 1132 4 .ore than 3 months 19+4 1(82 + A##eals recei$ed during the ear A##eals against A"ards A##eals against ;ecisions D 15 15 ) (71( 14+2 1394 1(42 8+1 1152 9(5 1152 18+ 17 1+9 38+38 447++ 37++1 71)5 47887 5499( 491)) 589( Sub'ect As on 3)&)+&)7 +1(8 3)&)+&)8 71)5

7 8

A##eals dis#osed of during the ear A##eals #ending at the close of the ear Cess than one month One to t"o months T"o to three months .ore than three months

13 (

154 3(

) ) ( ) sho" @ of

17 1) 3 ( #ending

<igure

in

brackets

D A##eals against decisions "ere allo"ed onl from .a ())7

Table4 9umber of com#laints recei$ed b the Banking Ombudsman Offices ?eriod 9o& Offices of Banking Ombudsman of No: re(eived during ear ())34 )4 ())44 )5 ())54 )+ ())+4 )7 ())74 )8 15 47887 (4 319( 15 38+38 (( (57+ 15 3173( ()) (115 15 1)5+) (8 7)4 15 8(4+ the o! Rate increase 1@ ear2 E 55) o$er #re$ious of A$erage 9o& of com#laints #er office

(o plaints

Advanta&es and disadvanta&es o! $an%in& o $'ds an s(#e e Advanta&es o! $an%in& o $'ds an) there is man ad$antages a$ailable in banking ombudsman scheme& 1i2& this mechanism #ro$ides settlement on the basis of mutual concern& 1ii2& !f there is no #ossibilit of settlement then onl ombudsman decide to take that matter for it*s ad'udication and #ass an a"ard& 1iii2& !n ombudsman #roceedings there is no fee is collected from the com#lainant 1customer2& 1i$2& ())+ scheme #ro$ide a##eal facilit , it gi$es more #ossible to the customer inter$ention& 1$2& e$en though enforcement is in the hands of com#lainant, if he gi$e his concern to enforce the a"ard the bank has the liabilit to do it& Because ombudsman is under the control of RB!& 1$i2& 9o" a da s man cases are handled b ombudsmann it to o#tain #ro#er remed "ithout 'udicial

reduces the burden of 'udiciar &

1$ii2& .ore o$er time and cost of com#lainant and res#ondent also sa$ed& 1$iii2& Regarding a##eal against ombudsman a"ard in to the 'udiciar com#aring bank side, customer side is $er less, it means that the scheme is a##ritiated and encouraged b customers& Disadvanta&es o! o $'ds an s(#e e) Fhen "e anal =e the scheme and it is #rogress there is too man loo#holes still un#lugged b RB!& The are as follo"s3 1i2& the ombudsman scheme is an o#tional one but not a #ro#er alternati$e one& Because banking ombudsman*s decisions are not binding in nature and referring the matter to ombudsman is not a statutor #ro$ision, it di##ons customer*s "ishes and choices& 1ii2& The ;ebt Reco$er Tribunal 1;RT2 is es#eciall constituted for the #ur#oses of dealing the matters of reco$er of debts& Some times ombudsman in$ol$e in this matter& This "as reflected in G durga hotel caseH& 1iii2& There is a #ossible the aggrie$ed #art of ana"ard #assed b ombudsman go to "rit on high court under article ((+ of inndian constitution& !n man cases a##eal "as made against ombudsman a"ards& 1i$2& !n man cases banks not res#onding ombudsman #roceedings including filing the same com#laint to 1;RT2 and struck do"n ombudsman*s 'urisdiction&

1$2& the enforcement of ombudsman a"ard is not in the hands of or banks, it is in the hands of the customer according to the scheme&

Con(l'sion and S'&&estions Con(l'sion) Abo$e said details gi$e a clear #icture about nature and gro"th of banking ombudsman scheme& Fhen "e go through table "h s are relating to filing cases is increasing, is sho"s the "illingness of the #eo#le to settled the dis#utes relating to banking through alternati$e rather than 'udicial ad'udication& But the success of the ombudsman de#ends the "illing of the #arties to settle the dis#ute through Banking ombudsman& !f one of the #arties is not "illing the scheme become useless&

S'&&estions) !n ())( ombudsman rules (1 and (( scheme #ro$ide arbitration #o"ers to the ombudsman es#eciall dis#utes relating to a bank and it*s constituencies and a bank and an other bank& >o"e$er the ())+ scheme is silent in this matter& ! feel that the arbitration #roceedings regarding customers grie$ances there is more #ossible to deduct the further a##eals& RB! also need to describe the 'urisdiction es#eciall matters

relating loans and ad$ances& RB! also search and find a suitable solution for se#arate the ;RT 'urisdiction from ombudsman 'urisdiction& RB! also keen to gi$e sti#ulations regarding ombudsman to all banks4 es#eciall not to dilute the ombudsman*s 'urisdiction from a dis#ute& if those changes "ill take #lace this scheme "ould be more attracti$e and effect&

You might also like

- Banking Onbudsman SchemeDocument18 pagesBanking Onbudsman SchemeSunil GargNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Banking ProjectDocument16 pagesBanking ProjectNilesh VadherNo ratings yet

- GK Capsule For Ibps ClerkDocument16 pagesGK Capsule For Ibps ClerkHitesh MendirattaNo ratings yet

- Loans & Advances Basic Bank LTDDocument19 pagesLoans & Advances Basic Bank LTDZubair RazaNo ratings yet

- International Lending SyndicationDocument5 pagesInternational Lending SyndicationMaridasrajanNo ratings yet

- Credit Policy GuidelinesDocument4 pagesCredit Policy Guidelinesnazmul099No ratings yet

- (298048505) 148308699-Credit-Appraisal-of-TJSB-BankDocument47 pages(298048505) 148308699-Credit-Appraisal-of-TJSB-Bankmbm_likeNo ratings yet

- (A) Rev ChequeDocument8 pages(A) Rev Chequeshahil_4uNo ratings yet

- BBM Notes on Cheques and CrossingDocument9 pagesBBM Notes on Cheques and CrossingFrancis Njihia Kaburu100% (1)

- General Banking Law of 2000 ReviewerDocument10 pagesGeneral Banking Law of 2000 ReviewerBryan AriasNo ratings yet

- Home Loan Procedure: Credit AppraisalDocument5 pagesHome Loan Procedure: Credit AppraisalShruthi ShettyNo ratings yet

- Banking LawDocument16 pagesBanking LawSudhir Kumar SinghNo ratings yet

- Indian Banking SystemDocument8 pagesIndian Banking SystemAnonymous kwi5IqtWJNo ratings yet

- Internship Sindh BankDocument34 pagesInternship Sindh BankKR Burki100% (1)

- OmbudsmanDocument21 pagesOmbudsmanRAYSPEARNo ratings yet

- RBI paves way for doorstep bankingDocument28 pagesRBI paves way for doorstep bankingKartik Variya100% (1)

- Project Report On Non Performing Assets of BanksDocument56 pagesProject Report On Non Performing Assets of Bankskunalkr87No ratings yet

- Honda Accord 2003 2008 Workshop ManualDocument22 pagesHonda Accord 2003 2008 Workshop Manualnaluhywe100% (15)

- Bank License - 2Document10 pagesBank License - 2Foram ShahNo ratings yet

- ECS Debit PartDocument18 pagesECS Debit PartSai PremNo ratings yet

- Foreign Exchange 1Document25 pagesForeign Exchange 1Masud Khan ShakilNo ratings yet

- Consumer Car190712Document17 pagesConsumer Car190712yahooshuvajoyNo ratings yet

- UNIT 8. BankingDocument10 pagesUNIT 8. Bankingsimona0opreaNo ratings yet

- ZARA NOTES - Banking Laws: Provided, However, That An Entity Authorized by The Bangko Sentral To Perform Universal orDocument13 pagesZARA NOTES - Banking Laws: Provided, However, That An Entity Authorized by The Bangko Sentral To Perform Universal ordonsiccuanNo ratings yet

- Reserve Bank of India (Note Refund) Rules, 2009Document12 pagesReserve Bank of India (Note Refund) Rules, 2009studentno123No ratings yet

- Payment Terms LC IncotermsDocument18 pagesPayment Terms LC IncotermsPravin MoilyNo ratings yet

- Analysis of The Banking Ombudsman SchemeDocument44 pagesAnalysis of The Banking Ombudsman SchemeSundar Babu50% (2)

- Post Issue ActivitiesDocument3 pagesPost Issue ActivitiesmgajenNo ratings yet

- 2009 Revised Rules of Procedure of The CoaDocument19 pages2009 Revised Rules of Procedure of The CoaBelarmino NavarroNo ratings yet

- 3.export Letters of CreditDocument35 pages3.export Letters of CreditHarpreet SinghNo ratings yet

- KOTAK MahindraDocument121 pagesKOTAK MahindraRahul SoganiNo ratings yet

- Agreement for Appointment of Business CorrespondentDocument13 pagesAgreement for Appointment of Business CorrespondentAjay ChouhanNo ratings yet

- News Overview: BB Takes Moves To Check Fraud in Banking SectorDocument5 pagesNews Overview: BB Takes Moves To Check Fraud in Banking SectorSanzidaKhabirNo ratings yet

- The Paris Club and The Creditors/Debtors RelationsDocument5 pagesThe Paris Club and The Creditors/Debtors RelationsAntonia RauNo ratings yet

- BM IiDocument20 pagesBM Iipriya balayanNo ratings yet

- Commercial Banks: By: Sajjad AhmadDocument27 pagesCommercial Banks: By: Sajjad AhmadHashir KhanNo ratings yet

- Customer Service in Banks - RBI RulesDocument15 pagesCustomer Service in Banks - RBI RulesRAMESHBABUNo ratings yet

- Unit III MBF22408T Credit Risk and Recovery ManagementDocument22 pagesUnit III MBF22408T Credit Risk and Recovery ManagementSheetal DwevediNo ratings yet

- General Banking On FSIBDocument12 pagesGeneral Banking On FSIBMituNo ratings yet

- BNK601 Short Notes Banking Laws & PracticesDocument7 pagesBNK601 Short Notes Banking Laws & PracticesNasir MuhammadNo ratings yet

- RA 8791-General Banking LawDocument66 pagesRA 8791-General Banking LawAgnesNo ratings yet

- Chapter 6 Banking Monies ReceivedDocument3 pagesChapter 6 Banking Monies Receivedhossainmz0% (1)

- Finance Circular 1-93Document7 pagesFinance Circular 1-93Nana Hana Kamid0% (1)

- Claim On Death of Depositors in BanksDocument2 pagesClaim On Death of Depositors in Bankssatur123No ratings yet

- Loan Policy 1Document13 pagesLoan Policy 1Vijay GangwaniNo ratings yet

- Final CIP Rule FAQs SummaryDocument10 pagesFinal CIP Rule FAQs SummaryANILNo ratings yet

- Loan PolicyDocument5 pagesLoan PolicySoumya BanerjeeNo ratings yet

- Off Balance Sheet Bank InstrumentsDocument10 pagesOff Balance Sheet Bank Instrumentsphard2345No ratings yet

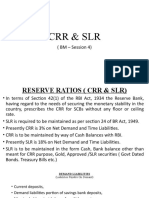

- Session. 4. CRR & SLRDocument15 pagesSession. 4. CRR & SLRArbazuddin shaikNo ratings yet

- Prudential Regulations For Consumer FinancingDocument58 pagesPrudential Regulations For Consumer FinancingSajid Ali MaariNo ratings yet

- Deficiency of Services in BanksDocument10 pagesDeficiency of Services in Banksshaqueeb nallamanduNo ratings yet

- Bank Reconciliation StatementDocument20 pagesBank Reconciliation Statement1t4No ratings yet

- BANK LIABILITY FOR FRAUDULENT CHECKSDocument34 pagesBANK LIABILITY FOR FRAUDULENT CHECKSJobelle VillanuevaNo ratings yet

- Indian Bank Global Credit Card Usage GuideDocument14 pagesIndian Bank Global Credit Card Usage GuideJijithpillaiNo ratings yet

- BPI vs. de RenyDocument4 pagesBPI vs. de RenyArvin Antonio OrtizNo ratings yet

- Know Your Customer Guidelines: Savings Bank Rules (Abridged)Document3 pagesKnow Your Customer Guidelines: Savings Bank Rules (Abridged)SatyasuryaNo ratings yet

- Know Your Customer Guidelines: Savings Bank Rules (Abridged)Document3 pagesKnow Your Customer Guidelines: Savings Bank Rules (Abridged)SatyasuryaNo ratings yet

- The Euro Bond Market's Impact on Monetary PolicyDocument22 pagesThe Euro Bond Market's Impact on Monetary PolicyHitesh MoreNo ratings yet

- PowerPoint Presentation - Chapter 16Document91 pagesPowerPoint Presentation - Chapter 16Hitesh MoreNo ratings yet

- EconomicsDocument6 pagesEconomicsHitesh MoreNo ratings yet

- 4 1 2012Document5 pages4 1 2012Maulik PatelNo ratings yet

- Check Answer ReportDocument27 pagesCheck Answer ReportHitesh MoreNo ratings yet

- One-Minute Guide: Recurring DepositDocument21 pagesOne-Minute Guide: Recurring DepositHitesh MoreNo ratings yet

- Print TicketDocument2 pagesPrint TicketSean MINo ratings yet

- Money-Market Project in FinanceDocument21 pagesMoney-Market Project in Financehamidfarah0% (2)

- Service Centre LeDocument62 pagesService Centre LeHitesh MoreNo ratings yet

- 483 PDFDocument8 pages483 PDFHitesh MoreNo ratings yet

- EconomicsDocument6 pagesEconomicsHitesh MoreNo ratings yet

- TJSBDocument2 pagesTJSBHitesh MoreNo ratings yet

- Update Current AffairsDocument15 pagesUpdate Current AffairsHitesh MoreNo ratings yet

- New Microsoft Office Word DocumentDocument4 pagesNew Microsoft Office Word DocumentHitesh MoreNo ratings yet

- Start PagesDocument6 pagesStart PagesHitesh MoreNo ratings yet

- ATOM Install Notes ReadmeDocument2 pagesATOM Install Notes ReadmeNik Syukriah AminNo ratings yet

- SP 3Document6 pagesSP 3Neelam JainNo ratings yet

- A Study On Brand Image of ICICI Prudential Life Insurance LTD MBA ProjectDocument43 pagesA Study On Brand Image of ICICI Prudential Life Insurance LTD MBA ProjectRakesh Sharma50% (2)

- 4.36 M.com Banking & FinanceDocument18 pages4.36 M.com Banking & FinancegoodwynjNo ratings yet

- ProjectDocument62 pagesProjectHitesh MoreNo ratings yet

- Mba ProjectDocument53 pagesMba Projectjignay85% (13)

- 1337x.ORGDocument1 page1337x.ORGHitesh MoreNo ratings yet

- Financial Risk AnalysisDocument9 pagesFinancial Risk AnalysisPrashant UjjawalNo ratings yet

- WN 1Document5 pagesWN 1Hitesh MoreNo ratings yet

- CBMDocument11 pagesCBMHitesh MoreNo ratings yet

- I Cici Bank Branch ListDocument82 pagesI Cici Bank Branch ListHitesh MoreNo ratings yet

- Mca2014 PDFDocument2 pagesMca2014 PDFHitesh MoreNo ratings yet

- PassportApplicationForm Main English V2.0Document2 pagesPassportApplicationForm Main English V2.0Ramya NairNo ratings yet

- Chapter 3Document11 pagesChapter 3Hitesh MoreNo ratings yet

- PassportApplicationForm Main English V2.0Document2 pagesPassportApplicationForm Main English V2.0Ramya NairNo ratings yet

- Academy of American Franciscan HistoryDocument36 pagesAcademy of American Franciscan HistoryCESAR HUAROTO DE LA CRUZNo ratings yet

- HDFC CB Apr16Document32 pagesHDFC CB Apr16Sridhar GandikotaNo ratings yet

- RECENT DEVELOPMENTS IN STANDARD CONSTRUCTION AND ENGINEERING CONTRACTSDocument2 pagesRECENT DEVELOPMENTS IN STANDARD CONSTRUCTION AND ENGINEERING CONTRACTSn0035085No ratings yet

- Project Report SCOPE OF Brand Image of Shampoos As A Person Objectives of The StudyDocument10 pagesProject Report SCOPE OF Brand Image of Shampoos As A Person Objectives of The Studyxyz abcNo ratings yet

- 09304001Document6 pages09304001AHMAD KAMIL MAKHTARNo ratings yet

- General Terms Conditions For Goods Purchase-Sale ContractDocument3 pagesGeneral Terms Conditions For Goods Purchase-Sale ContractBelal AhmadNo ratings yet

- PO GST 22230489 HanumaDocument2 pagesPO GST 22230489 HanumaSai SwaroopNo ratings yet

- Brain Synergy Institute v. UltraThera Technologies Et. Al.Document6 pagesBrain Synergy Institute v. UltraThera Technologies Et. Al.PriorSmartNo ratings yet

- Arbitration Role Playing ScriptDocument18 pagesArbitration Role Playing ScriptClimz Aether100% (1)

- Gloria JeansDocument19 pagesGloria Jeansfakethedoll50% (4)

- STS1036Document2 pagesSTS1036Shilpa AmitNo ratings yet

- Pealoza Seeks Specific Performance or Damages for Purchase of Property FloorDocument22 pagesPealoza Seeks Specific Performance or Damages for Purchase of Property Floorshirlyn cuyongNo ratings yet

- Using A Commercial Process For Simple JusticeDocument4 pagesUsing A Commercial Process For Simple JusticeTruth Press MediaNo ratings yet

- CostfinalDocument26 pagesCostfinalChenelTrixieConchaAgeasNo ratings yet

- World Class Manufacturing FinalDocument22 pagesWorld Class Manufacturing FinalSanjog Devrukhkar100% (4)

- 12 - Conclusion and Suggestion PDFDocument13 pages12 - Conclusion and Suggestion PDFAnneshaNo ratings yet

- 3 PDFDocument9 pages3 PDFSanjeev PradhanNo ratings yet

- Tech MahindraDocument11 pagesTech MahindraLUKESH ankamwar0% (1)

- Berger PaintsDocument4 pagesBerger PaintsShashank ShenoyNo ratings yet

- Emerson Electric's Strategic Planning and Performance OptimizationDocument3 pagesEmerson Electric's Strategic Planning and Performance OptimizationSilver BulletNo ratings yet

- Canary Wharfian PDFDocument1 pageCanary Wharfian PDFGleb PilipenkoNo ratings yet

- CadburyDocument82 pagesCadburyprathamesh kaduNo ratings yet

- The Family Finance WorkshopDocument40 pagesThe Family Finance WorkshopPierre PucheuNo ratings yet

- SCOR-P Certification HandbookDocument18 pagesSCOR-P Certification HandbookVincent Tan100% (2)

- Facility LocationDocument56 pagesFacility Locationanon-930959100% (7)

- Brains and BrandsDocument8 pagesBrains and BrandsMarina MarinakiNo ratings yet

- FM Leverage SailDocument19 pagesFM Leverage SailMohammad Yusuf NabeelNo ratings yet

- DBA1732Document209 pagesDBA1732Shashi Bhushan SinghNo ratings yet

- Customer Care FunctionDocument35 pagesCustomer Care FunctionBIRIKUMANA AlbertNo ratings yet

- Allan Symes CV 1Document3 pagesAllan Symes CV 1api-368993634No ratings yet