Professional Documents

Culture Documents

Chinese Cotton Policy Summary and Desk Reference PDF

Uploaded by

Esakkimuthu.N0 ratings0% found this document useful (0 votes)

24 views2 pagescotton policy of china has changed and its effect on the cotton growing countries, mainly India.

Original Title

Chinese Cotton Policy Summary and Desk Reference .PDF

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcotton policy of china has changed and its effect on the cotton growing countries, mainly India.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views2 pagesChinese Cotton Policy Summary and Desk Reference PDF

Uploaded by

Esakkimuthu.Ncotton policy of china has changed and its effect on the cotton growing countries, mainly India.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

CHNESE COTTON POLCY

Cotton Market Fundamentals

!"#$% '()#$%*+, -(./' )%.0+*

"(- )1!" -#// !"#$% #)2(.*3

!"##"$ &'()*+ ,'* *-&*)#*. #" .*)/($* ($ #0* )"1($2 )'"&

3*,' .4* #" 5"'*),+#+ "5 ($)'*,+*. +#")6+ "4#+(.* "5 !0($,7

8 +(2$(5(),$# 4$6$"9$: 0"9*;*': (+ 0"9 14)0 )"##"$ !0($,

1(20# (1&"'# 5"//"9($2 '*)*$# '*;(+("$+ #" &"/()37

<5 !0($*+* (1&"'#+ ,'* 0(20*' #0,$ )4''*$#/3 5"'*),+#*.: #0*

&"++(=/* .*)/($* ($ &'()*+ )"4/. =* +1,//*'7 >(1(/,'/3: /"9*'

/*;*/+ "5 (1&"'#+ )"4/. 1*,$ /"9*' 2/"=,/ )"##"$ &'()*+7

>"4')*? @>A8: ,// 5(24'*+ ,'* ,;*',2*+ 5"' #0* #0'** )'"& 3*,'+ 90*$ &'()*

24,',$#**+ 9*'* *$5"')*. =3 '*+*';* &4')0,+*+7 B0* +#")6+ 5(24'* (+ 5"' CDEFGEH

,$. '*&'*+*$#+ , )414/,#(;* *55*)# "5 #0*+* &"/()(*+7

In 2010/11, lower cotton acreage contributed to record

prices. At the same time prices peaked, China announced a

plan to stabilize Chinese acres. This plan involved

guaranteed prices enforced by the reserve system and

continued control over import volumes.

After the price spike, world cotton prices fell as global stocks

were rebuilt and climbed to record levels. Meanwhile,

Chinese prices remained high and stable near the

governments guaranteed prices.

2(/#!4 (.#5#$,

B0* !0($*+* 2";*'$1*$# 0,+ ,$$"4$)*. &/,$+ #" */(1($,#* #0*

&'()* 24,',$#** *$5"')*. =3 #0* '*+*';* +3+#*1 ,$. #" '*&/,)*

#0,# +3+#*1 9(#0 "$* =,+*. "$ , I#,'2*# &'()*7J K0*$ 1,'6*#

&'()*+ 5,// =*/"9 #0* #,'2*#: #0* 2";*'$1*$# 9(// )"1&*$+,#* #0*

2'"9*' 9(#0 #0* .(55*'*$)*7 B0(+ )0,$2* (+ (1&"'#,$# =*),4+* (#

)"4/. '*.4)* #0* 0(20L&'()* =4'.*$ 5,)*. =3 !0($*+* 1(//+ ($

'*)*$# 3*,'+7

,"#6*#$5 2(/#!4

M;*' 0,/5 "5 9"'/. +#")6+ $"9 '*+(.*

($ #0* )"4$#'3: *$0,$)($2 !0($*+*

($5/4*$)* "$ 9"'/. &'()* .('*)#("$

-789: ,;7<=>

?@A

!0($*+* 1(//+ +&($ ";*' "$* "4# "5

#0'** =,/*+ )"$+41*. 2/"=,//3

!0($, '*&'*+*$#+ 1"'* #0,$

5"'#3L&*')*$# "5 2/"=,/ (1&"'# .*1,$.

!7B>CDE;F7B

GHA

!0($, 2'"9+ $*,'/3 "$* #0('. "5 #0*

9"'/.N+ )"##"$

8+ #0* 9"'/.N+ /,'2*+# )"##"$ 2'"9*': )"$+41*': ,$. (1&"'#*':

,$3 )0,$2* #" !0($,N+ )"##"$ +(#4,#("$ ,55*)#+ &'()*+ ,'"4$.

#0* 9"'/.7

287:C<;F7B

IJA

In recent years, when much of the Chinese crop was moving

into reserves, China imported more cotton. This situation kept

supplies outside of China tight and supported prices globally.

With China holding a large supply of cotton in reserves, and

with reforms allowing cotton to again flow directly from field

to gin to mill, an important question for the world market

is-how much will China import in future crop years?

The Bottom Line: Reforms to Chinese policy allow for the

re-creation of a domestic market, with cotton grown in China

able to flow from farm to mills without falling under

government control. The availability of supply from the

harvest, as well as through sales from reserves, suggest

ample domestic supply. Chinese import demand is uncertain,

but lower Chinese imports should imply higher stocks outside

of China and lower prices everywhere.

-(./' )%.0+* #)2%!*,

#DE78;>

KIA

<1&/(*+ upward &'*++4'* "$ 9"'/.

)"##"$ &'()*+

O"'* )"##"$ (1&"'#+

($#" !0($,

P*++ )"##"$ (1&"'#+

($#" !0($,

<1&/(*+ downward &'*++4'* "$ 9"'/.

)"##"$ &'()*+

#)2(.* L1(*% (2*#($,

There are three categories of

Chinese import quota:

1. Tariff-Rate Quota (TRQ)

2. Government Discretionary

- Sliding-Scale quota

- Processing trade quota

3. Outside the quota system

(40% tariff)

The type and volume of imports

accessed by mills determines the

raw material costs.

Chinese import quota is issued

on a calendar year basis.

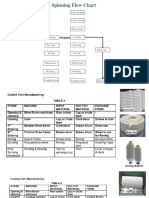

6/(- (6 !"#$+,+ !(**($ 6.() 6#+/' *( ,2#$$#$5 )#//

Tariff-Rate Quota (TRQ): Part of

Chinas accession to the WTO in

2001 requires that 4.1 million

bales be allowed into the country

at a low 1% tariff rate. The

government allocates this quota

among mills.

Government Discretionary: The

volume and allocation of this quota

type is determined by the

government and can change from

year-to-year. Tariffs applied to

sliding-scale quota vary with world

cotton prices (5 to 40%). With the A

Index near 90 cents/lb., the sliding

scale tariff is about 10%. If a mill is

export-oriented, they may receive a

tariff-free processing trade quota

from the government.

Outside of Quota: Mills pay a

high 40% tariff. Given the size of

the tariff, this option was not

considered feasible before the

record gap between Chinese and

world prices. In the fall of 2012,

the price disparity was wide

enough for Chinese mills to

profitably import outside the

quota. If the separation between

Chinese and world prices widens

to levels that make this option

profitable again, Chinese import

demand could increase and pull

world prices back to levels

where this option is no longer

viable.

Regardless of the tariff rate,

all cotton imports are subject

to a 13% value added tax.

CHNESE COTTON POLCY

Cotton Market Fundamentals

*-( 2(/#!4 *((/, #$ (2+.%*#($M

% /((0 %* *"+ .+,+.N+ ,4,*+) O #)2(.* L1(*%

#)2(.*,

@

I

G

The government can use the reserve system

to buy and withhold cotton from the market.

Accumulated reserves are mostly domestic

cotton, but also contain some imported fiber.

The cotton held in reserves is sold in

government auctions; the current selling

price is 17,250 RMB/ton (126 cents/lb).

5#$, )#//, 5.(-+.,

To incentivize purchases from reserves, the

government created two ratio programs. A

3:1 ratio gives mills the right to buy one

bale of foreign cotton held in reserves for

every three tons of Xinjiang-produced

cotton purchased. A separate 4:1 ratio

gives mills access to one ton of sliding-scale

quota for every four tons purchased from

reserves.

Q"' 4&L#"L.,#* 1,'6*# ($5"'1,#("$: ;(+(# 0##&?GG9997)"##"$($)7)"1G)"'&"',#*GO,'6*#LA,#,G!"##"$LO,'6*#LR".),+#+ S CDEH !"##"$ <$)"'&"',#*.

.+,+.N+ ,4,*+)

When the market price is below the

established "target price, the

government pays the difference to

the grower.

With policy reforms, Chinese cotton can flow from farms to mills without passing through the reserve system.

In China, the cotton containing seeds is

sold to gins. After separating the seeds

from the fiber, gins then move the cotton

to mills. In between each stage, merchants

may be involved to facilitate transactions.

Following recent reforms, mills have

possible sources of supply from 1) the

Chinese crop, 2) sales from reserves and

3) the international market. The amount

of cotton imported will affect world prices.

5(N+.$)+$*

The Chinese government uses

its reserve system and import

quota policies to regulate the

domestic cotton market.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Clothing & Pollution: ReferenceDocument6 pagesClothing & Pollution: Referenceranjann349No ratings yet

- He Dressmaking Gr9 q1 Module-2Document23 pagesHe Dressmaking Gr9 q1 Module-2reymilyn zuluetaNo ratings yet

- Relience Weaving Mills LTDDocument82 pagesRelience Weaving Mills LTDMuhammad Fahim Khan80% (5)

- Lect2 - Blow Room 1Document18 pagesLect2 - Blow Room 1Mina Samy abd el zaherNo ratings yet

- International Trade in BangladehDocument5 pagesInternational Trade in BangladehRatul MahmudNo ratings yet

- Manufacturing Industries-2Document7 pagesManufacturing Industries-2Riya AggarwalNo ratings yet

- Annual Report 2020 21 8d4584486bDocument135 pagesAnnual Report 2020 21 8d4584486bRahul BhagatNo ratings yet

- Jack Herer The Emperor Wears No ClothesDocument123 pagesJack Herer The Emperor Wears No ClothesVandamme NeoNo ratings yet

- 11 Free Christmas Crochet Patterns For Your Home EbookDocument44 pages11 Free Christmas Crochet Patterns For Your Home Ebooklaura100% (2)

- Subburaj Spinning MillDocument29 pagesSubburaj Spinning MillSuresh KumarNo ratings yet

- Business Project Gohar Tixtile Mills PVT Name:. Muhammad Shahid Roll No: 21882 Semester:. 8th E (B) MarketingDocument8 pagesBusiness Project Gohar Tixtile Mills PVT Name:. Muhammad Shahid Roll No: 21882 Semester:. 8th E (B) MarketingShahid RajpoutNo ratings yet

- Industrial Sector of PakistanDocument23 pagesIndustrial Sector of PakistanNabeel Safdar33% (3)

- Industry ReportDocument14 pagesIndustry ReportGiang NguyễnNo ratings yet

- Agri. Extension System in PunjabDocument48 pagesAgri. Extension System in PunjabKashan GilaniNo ratings yet

- Denim Exports Price IndicatorsDocument2 pagesDenim Exports Price IndicatorsgdjasujaNo ratings yet

- Vardhman Textiles LTD VarunDocument5 pagesVardhman Textiles LTD VarunVarun Kaul0% (1)

- An Initial Look at Robotics in Cotton HarvestingDocument4 pagesAn Initial Look at Robotics in Cotton HarvestingAchraf ZharNo ratings yet

- Growth and Instability of Cotton Crop in Major Cotton Growing States in IndiaDocument5 pagesGrowth and Instability of Cotton Crop in Major Cotton Growing States in IndiaMultidisciplinary JournalNo ratings yet

- Agriculture: One Mark QuestionsDocument6 pagesAgriculture: One Mark QuestionsMariyam AfsalNo ratings yet

- Aspects of Craft Production in Pre-Modern South Kanara by Dr. Nagendra RaoDocument22 pagesAspects of Craft Production in Pre-Modern South Kanara by Dr. Nagendra RaoRanbir Singh PhogatNo ratings yet

- Iasbaba S October 2016Document177 pagesIasbaba S October 2016chitransh90No ratings yet

- Jamshed Ji Tata ProfileDocument4 pagesJamshed Ji Tata ProfilewilltournerNo ratings yet

- 00 RoadMap Presentation Compiled 040121Document87 pages00 RoadMap Presentation Compiled 040121Debele ChemedaNo ratings yet

- Nternship Report On Gohar Textlle Pvt. Ltd.Document86 pagesNternship Report On Gohar Textlle Pvt. Ltd.Waqar KhanNo ratings yet

- Forest and Paper Industry: A Mature Industry That Has Done Much To Clean Up Its ActDocument21 pagesForest and Paper Industry: A Mature Industry That Has Done Much To Clean Up Its ActLevy GrativolNo ratings yet

- Yarn Hot ReportDocument15 pagesYarn Hot ReportJigneshSaradavaNo ratings yet

- Sunaina Ratio AnalysisDocument90 pagesSunaina Ratio AnalysisGaurav SharmaNo ratings yet

- Annual T and A Industry Report-2021Document47 pagesAnnual T and A Industry Report-2021pavithra nirmalaNo ratings yet

- About Ten Tree ApparelDocument13 pagesAbout Ten Tree ApparelprasannaNo ratings yet

- Design and Analysis of Two Spindle Amber Charkha - A ReviewDocument4 pagesDesign and Analysis of Two Spindle Amber Charkha - A ReviewEditor IJRITCCNo ratings yet