Professional Documents

Culture Documents

Transports Moved Back Below Its Quarterly Pivot at 8256.

Uploaded by

Richard Suttmeier0 ratings0% found this document useful (0 votes)

6 views2 pagesWith the Dow Transportation Average below its quarterly pivot at 8256 there’s a lot of room down to semiannual and annual value levels at 16301, 14835 and 13437 Dow Industrials, 1789.3, 1539.1 and 1442.1 S&P 500, 3972, 3471, 3063 Nasdaq, 7423, 6249 and 5935 Dow Transports and 1139.81, 966.72 and 879.39 Russell 2000.

Original Title

Transports moved back below its quarterly pivot at 8256.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWith the Dow Transportation Average below its quarterly pivot at 8256 there’s a lot of room down to semiannual and annual value levels at 16301, 14835 and 13437 Dow Industrials, 1789.3, 1539.1 and 1442.1 S&P 500, 3972, 3471, 3063 Nasdaq, 7423, 6249 and 5935 Dow Transports and 1139.81, 966.72 and 879.39 Russell 2000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesTransports Moved Back Below Its Quarterly Pivot at 8256.

Uploaded by

Richard SuttmeierWith the Dow Transportation Average below its quarterly pivot at 8256 there’s a lot of room down to semiannual and annual value levels at 16301, 14835 and 13437 Dow Industrials, 1789.3, 1539.1 and 1442.1 S&P 500, 3972, 3471, 3063 Nasdaq, 7423, 6249 and 5935 Dow Transports and 1139.81, 966.72 and 879.39 Russell 2000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com.

ValuEngine is a fundamentally-based quant research firm in Melbourne, FL. ValuEngine

covers over 8,000 stocks every day.

A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks,

and commentary can be found http://www.valuengine.com/nl/mainnl

To unsubscribe from this free email newsletter list, please click

http://www.valuengine.com/pub/Unsubscribe?

Jul y 8, 2014 Tr anspor t s moved bac k bel ow i t s quar t er l y pi vot at 8256.

With the Dow Transportation Average below its quarterly pivot at 8256 theres a lot of room down to

semiannual and annual value levels at 16301, 14835 and 13437 Dow Industrials, 1789.3, 1539.1 and

1442.1 S&P 500, 3972, 3471, 3063 Nasdaq, 7423, 6249 and 5935 Dow Transports and 1139.81,

966.72 and 879.39 Russell 2000.

The weekly charts remain positive with overbought conditions on Dow Industrials, S&P 500, Nasdaq

and Dow Transports and rising stochastics on the Russell 2000 with the five-week modified moving

averages at 16790 Dow Industrial, 1937.2 S&P 500, 4317 Nasdaq, 8064 Dow Transports and 1169.14

Russell 2000. These are the key supports on a weekly closing basis.

Weekly pivots / risky levels are 17072 Dow Industrials, 2006.6 S&P 500, 4570 Nasdaq, 8538 Dow

Transports and 1222.94 Russell 2000.

Monthly, quarterly and semiannual risky levels are 17364, 17753 and 18522 Dow Industrials, 1994.2,

2052.3 and 2080.3 S&P 500, 4529, 4569 and 4642 Nasdaq, 8365 and 8447 Dow Transports and

1215.89, 1293.11 and 1285.37 on Russell 2000,

Dow Industrials: (17024) Semiannual and annual value levels are 16301, 14835 and 13467 with daily

and weekly pivots at 17058 and 17072, the J uly 3 all-time intraday high at 17074.65 and monthly,

quarterly and semiannual risky levels at 17364, 17753 and 18552.

S&P 500 (1977.7) Semiannual and annual value levels are 1789.3, 1539.1 and 1442.1 with the J uly

3 all-time intraday high at 1985.29 and daily, monthly, weekly, quarterly and semiannual risky levels at

1989.3, 1994.2, 2006.5, 2052.3 and 2080.3.

NASDAQ (4452) Semiannual and annual value levels are 3972, 3471 and 3063 with the J uly 3

multiyear intraday high at 4485.93 and daily, monthly, quarterly, weekly and semiannual risky levels at

4510, 4529, 4569, 4570 and 4642.

NASDAQ 100 (NDX) (3911) Semiannual and annual value levels are 3515, 3078 and 2669 with a

quarterly pivot 3894, the J uly 3 multiyear intraday high at 3923.15, and daily, monthly, weekly and

semiannual risky levels at 3953, 3936, 4014 and 4105.

Dow Transports (8209) Semiannual and annual value levels are 7423, 6249 and 5935 with a

quarterly pivot at 8256, the J uly 3 all-time intraday high at 8298.17 and daily, monthly, semiannual and

weekly risky levels at 8329, 8365, 8447 and 8538.

Russell 2000 (1186.74) Semiannual and annual value levels are 1201.91, 1139.81, 966.72 and

879.39 with the J uly 1 all-time intraday high at 1213.55, and daily monthly, weekly, semiannual and

quarterly risky levels at 1211.86, 1215.89, 1222.94, 1285.37 and 1293.11.

The SOX (646.10) Quarterly, semiannual and annual value levels are 626.96, 608.02, 512.94,

371.58 and 337.74 with monthly and daily pivots at 642.34 and 650.96, and the J uly 3 multiyear

intraday high 651.42 and weekly risky level at 663.15.

Dow Utilities: (556.08) Annual, quarterly, semiannual and annual value levels are 548.70, 536.44,

523.72 and 497.53, with weekly, monthly and daily risky levels at 561.34, 563.54 and 563.99, the J une

30 all-time intraday high at 576.98 and semiannual risky level at 612.49.

10-Year Note (2.614) Monthly and quarterly value levels are 2.787 and 3.048 with daily, weekly,

annual and semiannual risky levels at 2.574, 2.528, 2.263, 1.999 and 1.779.

30-Year Bond (3.439) Monthly and quarterly value levels are 3.486 and 3.971 with daily, weekly,

annual and semiannual risky levels at 3.414, 3.355, 3.283, 3.107 and 3.082.

Comex Gold ($1320.5) Weekly, quarterly and monthly value levels are $1298.0, $1234.6 and

$1233.8 with a daily pivot at $1324.9, and semiannual and annual risky levels at $1613.0, $1738.7,

$1747.4 and $1818.8.

Nymex Crude Oil ($103.45) No value levels with daily and monthly pivots at $103.66 and $105.23,

and semiannual, annual, weekly and quarterly risky levels at $106.48, $107.52, $108.56 and $113.12..

The Euro (1.3603) Weekly, annual and semiannual value levels are 1.3486, 1.3382 and 1.2203 with

a daily pivot at 1.3667 and monthly, quarterly, semiannual and annual risky levels at 1.3819, 1.4079,

1.4617 and 1.5512.

The Dollar versus Japanese Yen (101.87) My annual value level is 93.38 with daily and weekly

pivots at 101.55 and 102.13 and monthly and quarterly risky levels at 106.47 and 112.83.

The British Pound (1.7127) Weekly, quarterly and annual value levels are 1.7045, 1.6874 and

1.6262 with daily, semiannual and monthly risky levels at 1.7211, 1.7302 and 1.7438.

To learn more about ValuEngine check out www.ValuEngine.com. Any comments or questions contact

me at RSuttmeier@gmail.com.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Plan Taiere Pardoseala: 1 Detaliu Rost ContactDocument1 pagePlan Taiere Pardoseala: 1 Detaliu Rost ContactVlad CiubotaruNo ratings yet

- The History and Evolution of Money - LifeMathMoneyDocument20 pagesThe History and Evolution of Money - LifeMathMoneyKimberly ANo ratings yet

- Suttmeier Weekly Market Briefing, March 9, 2015Document4 pagesSuttmeier Weekly Market Briefing, March 9, 2015Richard SuttmeierNo ratings yet

- Suttmeier Weekly Market BriefingDocument2 pagesSuttmeier Weekly Market BriefingRichard SuttmeierNo ratings yet

- Suttmeier Weekly Market BriefingDocument4 pagesSuttmeier Weekly Market BriefingRichard SuttmeierNo ratings yet

- Suttmeier Morning Briefing, February 3, 2015Document1 pageSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierNo ratings yet

- Suttmeier Morning Briefing, January 30, 2015Document1 pageSuttmeier Morning Briefing, January 30, 2015Richard SuttmeierNo ratings yet

- Suttmeier Morning Briefing, January 27, 2015Document1 pageSuttmeier Morning Briefing, January 27, 2015Richard SuttmeierNo ratings yet

- Suttmeier Weekly Market BriefingDocument3 pagesSuttmeier Weekly Market BriefingRichard SuttmeierNo ratings yet

- Suttmeier ETF WeeklyDocument2 pagesSuttmeier ETF WeeklyRichard SuttmeierNo ratings yet

- Suttmeier Morning BriefingDocument1 pageSuttmeier Morning BriefingRichard SuttmeierNo ratings yet

- Suttmeier Morning Briefing, January 13, 2015Document1 pageSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierNo ratings yet

- 1412229SuttmeierWeeklyBriefinSuttmeier Weekly Briefing, Dec. 29, 2014Document2 pages1412229SuttmeierWeeklyBriefinSuttmeier Weekly Briefing, Dec. 29, 2014Richard SuttmeierNo ratings yet

- You Are Considering An Investment in The Stock Market andDocument1 pageYou Are Considering An Investment in The Stock Market andLet's Talk With HassanNo ratings yet

- Quant Percentages-864ec1f4Document11 pagesQuant Percentages-864ec1f4Yuvraj KakodiyaNo ratings yet

- IJREAMV05I0452086745Document4 pagesIJREAMV05I0452086745yash wankhadeNo ratings yet

- IM Module 2Document57 pagesIM Module 2vanitha gkNo ratings yet

- Addis Ababa City Adminstration Educational Bureau: Time Allowed: 2:30 Hours General DirectionsDocument14 pagesAddis Ababa City Adminstration Educational Bureau: Time Allowed: 2:30 Hours General DirectionsErmiasNo ratings yet

- Stock Broker in AhmedabadDocument7 pagesStock Broker in AhmedabadABK Securities Private LimitedNo ratings yet

- Derivatives Security MarketDocument18 pagesDerivatives Security MarketYujinNo ratings yet

- PPF Practice QuestionsDocument7 pagesPPF Practice QuestionssumitNo ratings yet

- ReportHistory 160048399Document12 pagesReportHistory 160048399Okhuarobo SamuelNo ratings yet

- bLvgBkYW2Dw (201 400) (101 200)Document100 pagesbLvgBkYW2Dw (201 400) (101 200)pepNo ratings yet

- Test 2 Marking KeyDocument12 pagesTest 2 Marking KeyThabo ChuchuNo ratings yet

- About MoneyDocument2 pagesAbout MoneyKayceeNo ratings yet

- Administrative Reforms of Alauddin KhiljiDocument8 pagesAdministrative Reforms of Alauddin Khiljikeshavnaikk789No ratings yet

- Commodity Future Market in India: A Literature Review On Price Discovery of Agricultural CommodityDocument4 pagesCommodity Future Market in India: A Literature Review On Price Discovery of Agricultural CommodityShilpa PrasadNo ratings yet

- Theory of Demand and SupplyDocument45 pagesTheory of Demand and SupplyThabo ChuchuNo ratings yet

- Topic01-Orders C6gF8Document43 pagesTopic01-Orders C6gF8Chika Nwogu-AgbakuruNo ratings yet

- Rsi 5 PDFDocument9 pagesRsi 5 PDFManoj RaiNo ratings yet

- 2.6 PesDocument18 pages2.6 PesSanskar GuptaNo ratings yet

- LNG Daily - 30092021Document21 pagesLNG Daily - 30092021Đức Vũ NguyễnNo ratings yet

- ECON 112 Chapter 5 SummariesDocument11 pagesECON 112 Chapter 5 SummariesdewetmonjaNo ratings yet

- Nism 8 - Test-6 - Equity Derivatives - PracticeDocument29 pagesNism 8 - Test-6 - Equity Derivatives - PracticeAbhijeet KumarNo ratings yet

- Chapter 13: International Trade Patterns: - Learning Objectives in This ChapterDocument22 pagesChapter 13: International Trade Patterns: - Learning Objectives in This ChapterShafrid AhmedNo ratings yet

- FXOverdrive5 ManualDocument5 pagesFXOverdrive5 Manualmohammed sadiqNo ratings yet

- Stock Broking Firms 2003Document41 pagesStock Broking Firms 2003sudipkudasNo ratings yet

- Foreign Exchange MarketDocument34 pagesForeign Exchange MarketDhiraj SinghNo ratings yet

- Stock Market Indicators: Fundamental, Sentiment, & TechnicalDocument19 pagesStock Market Indicators: Fundamental, Sentiment, & TechnicalSABUESO FINANCIERONo ratings yet

- Outlay MethodDocument6 pagesOutlay Methodinfinity warzNo ratings yet

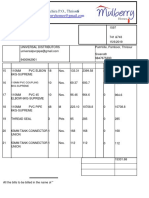

- Purchase Order: 12/323, Mundupalam JN., Kuriachira P.O., Thrissur - 6 Tel: 0487 2251192, E - MailDocument1 pagePurchase Order: 12/323, Mundupalam JN., Kuriachira P.O., Thrissur - 6 Tel: 0487 2251192, E - MailMelwin PaulNo ratings yet