Professional Documents

Culture Documents

TBCH02

TBCH02

Uploaded by

Kareyn Ann SumayloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TBCH02

TBCH02

Uploaded by

Kareyn Ann SumayloCopyright:

Available Formats

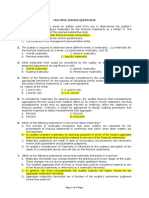

CHAPTER 2

MULTIPLE CHOICE

a. 1. Due professional care requires

a. A critical review of the work done at every level of supervision.

b. The examination of all corroborating evidence available.

c. The exercise of error-free udgment.

d. A consideration of internal control structure that includes tests of controls.

!A"#$A ADA$T%D&

c '. The first general standard requires that the audit of financial statements be performed by a person

or persons having adequate technical training and

a. "ndependence with respect to the financial statements and supplementary disclosures.

b. %xercising professional care as udged by peer reviewers.

c. $roficiency as an auditor( which likely has been acquired from previous experience.

d. )bectivity as an auditor( as verified by proper supervision. !A"#$A ADA$T%D&

d *. An auditor( while performing an audit( strives to achieve the appearance of independence in order

to

a. +educe risk and liability.

b. #omply with the generally accepted standards of fieldwork.

c. ,ecome independent in fact.

d. -aintain public confidence in the profession. !A"#$A ADA$T%D&

d .. Adequate technical training and proficiency as an auditor encompasses an ability to understand a

computer system sufficiently to identify and evaluate

a. The processing and imparting of information.

b. %ssential accounting control features.

c. All control procedures.

d. The degree to which programming conforms to the application of generally accepted accounting

principles. !A"#$A ADA$T%D&

c /. #ompetence as a certified public accountant includes all of the following except

a. 0aving the technical qualifications to perform an engagement.

b. $ossessing the ability to supervise and evaluate the quality of staff work.

c. 1arranting the infallibility of the work performed.

d. #onsulting others if additional technical information is needed. !A"#$A ADA$T%D&

a 2. 3ltimately( the decision about whether or not an auditor is independent must be made by the

a. Auditor.

b. #lient.

c. Audit committee.

d. $ublic. !A"#$A ADA$T%D&

4

c 4. -adison #orporation has a few large accounts receivable that total 51(666(666. 7assau

#orporation has a great number of small accounts receivable that also total 51(666(666. The

importance of an error in any one account is( therefore( greater for -adison than for 7assau. This

is an example of the auditor8s concept of

a. Account bias.

b. Audit risk.

c. -ateriality.

d. +easonable assurance. !A"#$A ADA$T%D&

b 9. 1hich of the following best describes what is meant by generally accepted auditing standards:

a. Acts to be performed by the auditor.

b. -easures of the quality of an auditor8s performance.

c. $rocedures used to gather evidence to support financial statements.

d. Audit obectives generally determined on audit engagements. !A"#$A ADA$T%D&

b ;. There is an inverse relationship between the effectiveness of an entity8s internal control structure

and the

a. +eliability of financial statements.

b. %xtent of detailed audit tests required.

c. Degree of staff supervision required in the performance of an audit.

d. <airness of management assertions in the financial statements.

a 16. 1hich of the following best describes the character of the three generally accepted auditing

standards classified as general standards:

a. #riteria for competence( independence( and professional care of individuals performing the audit.

b. #riteria for the content of the financial statements and related footnote disclosures.

c. #riteria for the content of the auditor8s report.

d. The requirements for planning and supervision. !A"#$A ADA$T%D&

c 11. The generally accepted standards of fieldwork relate to

a. The competence( independence( and professional care of persons performing the audit.

b. #riteria for the content of the auditor8s report on financial statements.

c. Audit planning and evidence gathering.

d. The need to maintain independence in mental attitude. !A"#$A ADA$T%D&

d 1'. 1hich of the following statements is correct concerning the concept of materiality:

a. -ateriality is determined by reference to A"#$A guidelines.

b. -ateriality depends only on the dollar amount involved.

c. -ateriality depends on the nature of an item rather than on the dollar amount.

d. -ateriality is a matter of professional udgment. !A"#$A ADA$T%D&

a 1*. The generally accepted standards of reporting encompass all of the following except

a. #onsideration of an entity8s internal control structure.

b. #onsistent application of accounting principles.

c. "nformative disclosures.

d. #onformity of financial statements with =AA$.

9

c 1.. An obective of the fourth generally accepted standard of reporting( relating to the expression of

an opinion( is to

$rohibit the auditor from issuing a report that does not include an opinion on the financial statements

taken as a whole.

"nform users that the financial statements and related notes are the oint responsibility of the auditor and

management.

$revent users of financial statements from misinterpreting the degree of responsibility assumed by the

auditor.

%nsure adequate informative disclosures in the financial statements.

d 1/. The least important evidence of a public accounting firm8s evaluation of its system of quality

controls would concern the firm8s policies and procedures with respect to

a. %mployment !hiring&.

b. #onfidentiality of audit engagements.

c. Assigning personnel to audit engagements.

d. Determination of audit fees. !A"#$A ADA$T%D&

a 12. 1hich of the following is not an element of quality control:

a. Documentation.

b. "nspection.

c. >upervision.

d. #onsultation. !A"#$A ADA$T%D&

d 14. 1illiams ? #o.( a large international public accounting firm( is due to have a peer review. The

peer review will most likely be performed by

a. %mployees and partners of 1illiams ? #o. who are not associated with the particular audit being

reviewed.

b. Audit review staff of the >ecurities and %xchange #ommission.

c. Audit review staff of the A"#$A.

d. %mployees and partners of another firm. !A"#$A ADA$T%D&

b 19. "n a financial statement audit( audit risk represents the probability that

a. "nternal control fails and the failure is not detected by the auditor8s procedures.

b. The auditor unknowingly fails to modify an opinion on materially misstated financial statements.

c. "nherent and control risk cause errors that could be material to the financial statements.

d. The auditor is not retained to conduct a financial statement audit in the succeeding year.

a 1;. "n a financial statement audit( inherent risk represents

a. The susceptibility of an account balance to error that could be material.

b. The risk that error could occur and not be prevented or detected by the internal control structure.

c. The risk that error could occur and not be detected by the auditor8s procedures.

d. The risk that the auditor fails to modify materially misstated financial statements.

d '6. 1hat is the magnitude of audit risk if inherent risk is ./6( control risk ..6( and detection risk .16:

a. .'6.

b. .16.

c. .6..

d. 7ot determinable from the facts given.

;

c '1. The @hallmark@ of auditing is

a. Available audit technology.

b. =enerally accepted auditing standards.

c. $rofessional udgment.

d. -ateriality and audit risk.

d ''. An auditor is most likely to refer to one or more of the three general auditing standards in

determining

a. The nature of a report qualification.

b. The scope of auditing procedures.

c. +equirements for the consideration of internal control.

d. 1hether the auditor should undertake an audit engagement. !A"#$A ADA$T%D&

a '*. 1hich of the following is mandatory if the auditor is to comply with the general standards of the

A"#$AAs generally accepted auditing standards:

a. Adequate technical training

b. 3se analytical procedures.

c. 3se statistical sampling when feasible on an audit engagement.

d. #onfirmation of material accounts receivable balances. !A"#$A ADA$T%D&

b '.. The first general standard requires that a person or persons have adequate technical training and

proficiency as an auditor. This standard is met by

a. 3nderstanding business and finance.

b. %ducation and experience in auditing.

c. #ontinuing professional education.

d. Bnowledge of >tatements of Auditing >tandards. !A"#$A ADA$T%D&

a '/. 1hat is the meaning of the generally accepted auditing standard that requires that the auditor be

independent:

a. The auditor must be without bias with respect to the client audited.

b. The auditor must adopt a critical attitude during the audit.

c. The auditor8s sole obligation is to third parties.

d. The auditor may have a direct ownership interest in the client8s business if it is not material.

!A"#$A

ADA$T%D&

d '2. The third general standard states that due care is to be exercised in the performance of an audit(

and should be interpreted to mean that an auditor who undertakes an engagement assumes a duty

to perform

a. 1ith reasonable diligence and without fault or error.

b. As a professional who will assume responsibility for losses consequent upon error of udgment.

c. To the satisfaction of the client and third parties.

d. As a professional possessing the degree of skill commonly possessed by others in the field.

!A"#$A

ADA$T%D&

16

a '4. The first standard of fieldwork( which states that the work is to be adequately planned( and

assistants( if any( are to be properly supervised( recogniCes that

a. %arly appointment of the auditor is advantageous both to the auditor and to the client.

b. Acceptance of an audit engagement after the close of the client8s fiscal year is generally not

permissible.

c. Appointment of the auditor subsequent to the physical count of inventories requires a disclaimer

of opinion.

d. $erformance of substantial parts of the engagement is necessary at interim dates.

!A"#$A ADA$T%D&

b '9. "n connection with the third generally accepted auditing standard of fieldwork( an auditor

examines corroborating evidential matter that includes all of the following except

a. #lient accounting manuals.

b. 1ritten client representations.

c. Dendor invoices.

d. -inutes of board meetings. !A"#$A ADA$T%D&

a ';. 1hich of the following underlies the application of generally accepted auditing standards(

particularly the standards of fieldwork and reporting:

a. The elements of materiality and risk.

b. The element of internal control.

c. The element of corroborating evidence.

d. The element of reasonable assurance. !A"#$A ADA$T%D&

c *6. The fourth generally accepted auditing standard of reporting requires an auditor to render a report

whenever an auditor8s name is associated with financial statements. The overall purpose of the

fourth standard of reporting is to require that reports

a. Assure that the auditor is independent with respect to the financial statements audited.

b. >tate that the audit has been conducted in accordance with generally accepted auditing standards.

c. "ndicate the character of the engagement and the degree of responsibility assumed by the auditor.

d. %xpress whether the accounting principles used in preparing the financial statements have been

applied consistently in the period audited. !A"#$A ADA$T%D&

d *1. The auditor8s udgment concerning the overall fairness of the presentation of financial positions(

results of operations( and cash flows is applied within the framework of

a. Euality control.

b. =enerally accepted auditing standards that include the concept of materiality.

c. The auditor8s evaluation of the audited company8s internal controls.

d. =enerally accepted accounting principles. !A"#$A ADA$T%D&

d *'. The concept of materiality would be least important to an auditor in determining

a. Transactions that should be reviewed.

b. The need for disclosing a particular transaction or event.

c. The extent of audit work planned for particular accounts.

d. The effects of an auditor8s direct financial interest in a client. !A"#$A ADA$T%D&

11

b **. The obective of quality control mandates that a public accounting firm should establish policies

and procedures for professional development that provide reasonable assurance that all

entry-level personnel

a. $repare working papers that are standardiCed in form and content.

b. 0ave the knowledge required to enable them to fulfill responsibilities assigned.

c. 1ill advance within the organiCation.

d. Develop specialties in specific areas of public accounting. !A"#$A ADA$T%D&

b *.. "n pursuing its quality control obectives with respect to assigning personnel to engagements( a

public accounting firm may use policies and procedures such as

a. +otating employees from assignment to assignment on a random basis to aid in the staff training

effort.

b. +equiring timely identification of the staffing requirements of specific engagements so that

enough qualified personnel can be made available.

c. Allowing staff to select the assignments of their choice to promote better client relationships.

d. Assigning a number of employees to each engagement in excess of the number required so as not

to overburden the staff and interfere with the quality of the audit work performed.

!A"#$A

ADA$T%D&

d */. A public accounting firm studies its personnel advancement experience to determine whether

individuals meeting stated criteria are assigned increased degrees of responsibility. This is

evidence of the firm8s adherence to

a. =enerally accepted auditing standards.

b. Attestation standards.

c. >upervision and review.

d. Euality control standards. !A"#$A ADA$T%D&

d *2. 1hich of the following statements best describes the primary purpose of >tatements on Auditing

>tandards:

a. =uides intended to set forth auditing procedures that are applicable to a variety of situations.

b. )utlines intended to narrow the areas of inconsistency and divergence of auditor opinion.

c. Authoritative statements( enforced through the code of professional conduct( and intended to limit

the degree of auditor udgment.

d. "nterpretations intended to clarify the meaning of generally accepted auditing standards.

!A"#$A ADA$T%D&

SHORT ANSWER

1. Describe what is meant by planned detection risk and what effect planned detection risk would

have on evidence.

Answer:

Detection risk is the likelihood that error could occur and not be detected by the auditorAs

procedures. Detection risk is inversely related to the amount of audit evidence an auditor would

plan to gather. As detection risk goes up( the amount of evidence gathered goes down.

1'

'. Define inherent risk and name two examples of factors that may increase inherent risk.

AnswerF

"nherent risk is the susceptibility of an account balance to error that could be material assuming

there are no related internal controls. %xamples will vary among students( includingF the client8s

business or industry( management8s predisposition to manage earnings( and insights obtained from

prior engagements.

*. 1hat is the importance of internal controls to an auditor in an audit engagement:

Answer:

The second standard of fieldwork within =AA>( requires that an auditor obtain an understanding

of an entity8s internal controls to help in planning the audit and designing audit tests.

.. 1hat is the demand for due care within an audit or attestation engagement:

Answer:

#ompetent professional staff should plan attestation and audit engagements( and the work of all

assistants assigned to the engagement should be supervised.

/. Differentiate between independence in fact and independence in appearance.

AnswerF

"ndependence of fact is a state of mind( an attitude of impartiality( which underlies both an

attestation standard and a =AA>. "ndependence in appearance is the ability to demonstrate

independence by remaining free of any overt interest in a client that would damage the

appearance of independence.

PROBLEMS

1. Gist and describe the ten =AA>.

Answer:

General Standards

1. The audit is to be performed by a person or persons having adequate technical training and

proficiency as an auditor.

'. "n all matters relating to the assignment( independence in mental attitude is to be maintained

by the auditor or auditors.

*. Due professional care is to be exercised in the performance of the audit and the preparation of

the report.

Standards of !eld Wor"

.. The work is to be adequately planned and assistants( if any( are to be properly supervised.

/. A sufficient understanding of internal control is to be obtained to plan the audit and to

determine the nature( timing( and extent of tests to be performed.

2. >ufficient competent evidential matter is to be obtained through inspection( observation(

inquiries( and confirmation to afford a reasonable and basis for an opinion regarding the

financial statements under audit.

Standards of Re#ort!n$

4. The report shall state whether the financial statements are presented in accordance with

generally accepted accounting principles.

1*

9. The report shall identify those circumstances in which such principles have not been

consistently observed in the current period in relation to the preceding period.

;. "nformative disclosures in the financial statements are to be regarded as reasonably adequate

unless otherwise stated in the report.

16. The report shall either contain an expression of opinion regarding the financial statements

taken as a whole( or an assertion to the effect that an overall opinion cannot be expressed.

1hen an overall opinion cannot be expressed( the reasons( therefore( should be stated. "n all

cases where an auditorAs name is associated with financial statements( the report should

contain a clear-cut indication of the character of the auditorAs work( if any( and the degree of

responsibility the auditor is taking.

'. The following four situations involve the process of planning audit evidence requirements.

#alculate the planned detection risk for each different situation.

Situations

+isk 1 ' * .

Acceptable Audit +isk /H /H 1H 1H

"nherent +isk 166H 26H /6H .6H

#ontrol +isk 166H .6H /6H 26H

$lanned Detection +isk : : : :

Answer:

>ituation I1 $lanned Detection +isk .6/

>ituation I' $lanned Detection +isk .'69*

>ituation I* $lanned Detection +isk .6.

>ituation I. $lanned Detection +isk .6.14

1.

You might also like

- Auditing and Assurance Principles Pre TestDocument9 pagesAuditing and Assurance Principles Pre TestKryzzel Anne JonNo ratings yet

- CH 1 Quiz With AnswersDocument7 pagesCH 1 Quiz With AnswersBeverly Ann Caparoso100% (3)

- Forensic Accounting Power PointDocument18 pagesForensic Accounting Power PointGaurav100% (2)

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- AuditingDocument36 pagesAuditingMostafa MahmoudNo ratings yet

- AUD Final Preboard QuestionsDocument12 pagesAUD Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Document35 pagesLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagNo ratings yet

- QUizzer 4 - Overall With AnswerDocument20 pagesQUizzer 4 - Overall With AnswerJan Elaine CalderonNo ratings yet

- Performing Preliminary Engagement ActivitiesDocument9 pagesPerforming Preliminary Engagement ActivitiesMarnelli CatalanNo ratings yet

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- Chapter 1 - Test Bank Auditing UICDocument15 pagesChapter 1 - Test Bank Auditing UICLana Bustami100% (4)

- Auditing Theory 100 Questions 2015Document22 pagesAuditing Theory 100 Questions 2015Louie de la TorreNo ratings yet

- Audit Documentation Test BankDocument1 pageAudit Documentation Test BankJadeNo ratings yet

- Pre EngagementDocument3 pagesPre EngagementJanica BerbaNo ratings yet

- Lspu - Audit Final ExamDocument10 pagesLspu - Audit Final ExamJamie Rose AragonesNo ratings yet

- Prelim Exam - Attempt Review Auditing 1Document24 pagesPrelim Exam - Attempt Review Auditing 1EROSNo ratings yet

- Auditing Theory TEST BANKDocument23 pagesAuditing Theory TEST BANKGelyn CruzNo ratings yet

- Chapter 8 Consideration of Internal Control in An InformatiDocument32 pagesChapter 8 Consideration of Internal Control in An Informatichristiansmilaw100% (1)

- Auditing Concepts Psa Based QuestionsDocument665 pagesAuditing Concepts Psa Based QuestionsMae Danica CalunsagNo ratings yet

- Auditing TheoryDocument11 pagesAuditing Theoryfnyeko100% (1)

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocument29 pagesSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100No ratings yet

- SW - Code of EthicsDocument1 pageSW - Code of EthicsJudy Ann ImusNo ratings yet

- Chapter 1 - Overview of Government AccountingDocument4 pagesChapter 1 - Overview of Government AccountingChris tine Mae MendozaNo ratings yet

- Multiple-Choice QuestionsDocument20 pagesMultiple-Choice QuestionsRafael GarciaNo ratings yet

- FINALS - Auditing TheoryDocument8 pagesFINALS - Auditing TheoryAngela ViernesNo ratings yet

- AT Quizzer 13 - Reporting Issues (2TAY1718) PDFDocument10 pagesAT Quizzer 13 - Reporting Issues (2TAY1718) PDFWihl Mathew Zalatar0% (1)

- Theory of Accounts - ReviewerDocument24 pagesTheory of Accounts - ReviewerKristel OcampoNo ratings yet

- Auditing Theory - MockDocument10 pagesAuditing Theory - MockCarlo CristobalNo ratings yet

- 8919 - Consolidation Subsequent To The Date of AcquisitionDocument4 pages8919 - Consolidation Subsequent To The Date of AcquisitionFayehAmantilloBingcangNo ratings yet

- TTTDocument6 pagesTTTAngelika BalmeoNo ratings yet

- Department of Accountancy: Page - 1Document5 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Pre EngagementDocument2 pagesPre EngagementCM LanceNo ratings yet

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayNo ratings yet

- Preweek Auditing Theory 2014Document31 pagesPreweek Auditing Theory 2014Charry Ramos33% (3)

- Spice Is Right ImportsDocument2 pagesSpice Is Right ImportsLaiza Grace FabreNo ratings yet

- Answer Key: Audit Planning, Understanding The Client, Assessing Risks, and RespondingDocument15 pagesAnswer Key: Audit Planning, Understanding The Client, Assessing Risks, and RespondingRizza OmalinNo ratings yet

- Audit of Cash and Cash Equivalents PDFDocument4 pagesAudit of Cash and Cash Equivalents PDFRandyNo ratings yet

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- Midterm Exam ADocument16 pagesMidterm Exam ARed YuNo ratings yet

- CHAPTER 5 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 5 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- A6 Audit of Ppe Part 2Document5 pagesA6 Audit of Ppe Part 2KezNo ratings yet

- Unit Xii Copleting The Audit Audit Reports Other ServicesDocument66 pagesUnit Xii Copleting The Audit Audit Reports Other ServicesDieter LudwigNo ratings yet

- Auditing Theory 2013Document28 pagesAuditing Theory 2013James Rythe MisercordiaNo ratings yet

- At 3rd Evals ExamDocument12 pagesAt 3rd Evals ExamJohn Remy SamsonNo ratings yet

- 1 Partnership Accounting QuestionnairesDocument11 pages1 Partnership Accounting QuestionnairesShiela MayNo ratings yet

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- The New Code of Ethics For CPA S by Atty Eranio Punsalan PDFDocument9 pagesThe New Code of Ethics For CPA S by Atty Eranio Punsalan PDFsamuel debebeNo ratings yet

- Chapter 6 Quiz KeyDocument3 pagesChapter 6 Quiz Keymar8357No ratings yet

- Aud Theo Quizzer 1Document16 pagesAud Theo Quizzer 1KIM RAGANo ratings yet

- Auditing TheoryDocument59 pagesAuditing TheoryJenn DajaoNo ratings yet

- Intercompany Sale of PPE ActivityDocument2 pagesIntercompany Sale of PPE Activitybea kullin0% (1)

- ACCT601 - Prelim Examination PDFDocument10 pagesACCT601 - Prelim Examination PDFSweet EmmeNo ratings yet

- Book 9Document2 pagesBook 9Actg SolmanNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- 2 Multiple ChoiceDocument57 pages2 Multiple ChoiceMichael Brian TorresNo ratings yet

- EvidenceDocument4 pagesEvidenceMaria Catherine GasaNo ratings yet

- Audit Theory QuestionsDocument5 pagesAudit Theory QuestionsRandyNo ratings yet

- Q1 at 1920Document4 pagesQ1 at 1920aleachonNo ratings yet

- Quiz On Auditing For 1 To 2Document10 pagesQuiz On Auditing For 1 To 2Vanjo MuñozNo ratings yet

- Assignment 1 in Auditing TheoryDocument6 pagesAssignment 1 in Auditing TheoryfgfsgsrgrgNo ratings yet

- Module 2 - Intermed3 - NCAHFSDocument8 pagesModule 2 - Intermed3 - NCAHFSArnyl ReyesNo ratings yet

- Accounting Change ModuleDocument3 pagesAccounting Change ModuleArnyl ReyesNo ratings yet

- Error CorrectionDocument2 pagesError CorrectionArnyl ReyesNo ratings yet

- TBCH01Document6 pagesTBCH01Arnyl ReyesNo ratings yet

- Parallel Learning StructureDocument8 pagesParallel Learning StructureArnyl Reyes100% (2)

- Strategic Management Accounting PDFDocument5 pagesStrategic Management Accounting PDFMuhammad SadiqNo ratings yet

- Customs-Manual-2012 Transhipment of CargoDocument19 pagesCustoms-Manual-2012 Transhipment of CargoVel VillanuevaNo ratings yet

- Unit Maintenance Direct and General Support Maintenance Repair Parts and Special Tools List (Including Depot Maintenance Repair Parts Andspecial Tools List) FORDocument27 pagesUnit Maintenance Direct and General Support Maintenance Repair Parts and Special Tools List (Including Depot Maintenance Repair Parts Andspecial Tools List) FORMichael NearyNo ratings yet

- Presented by Jayasree .S.IDocument18 pagesPresented by Jayasree .S.IGigeo S SomanNo ratings yet

- Plant Assets DepreciationDocument49 pagesPlant Assets DepreciationFurQan KhanNo ratings yet

- Lasagne Recipe - Recipes - BBC Good FoodDocument2 pagesLasagne Recipe - Recipes - BBC Good FoodmickeylNo ratings yet

- Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldDocument39 pagesPrepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldMadalina RaceaNo ratings yet

- 02 SFP AssetsDocument22 pages02 SFP AssetsIvan Gray AlvarezNo ratings yet

- Reebok India CompanyDocument3 pagesReebok India Companyimran20best1No ratings yet

- Relocation PolicyDocument8 pagesRelocation Policyashish.the7353No ratings yet

- The Wealth Report 2017 4482Document37 pagesThe Wealth Report 2017 4482Dhamma_StorehouseNo ratings yet

- Bain and Company Example ScenarioDocument21 pagesBain and Company Example ScenarioLaura Medina100% (1)

- Fb-Plan-Training ProgramDocument3 pagesFb-Plan-Training ProgramQuy Tranxuan100% (1)

- B737-600-700-800-900 BoeingDocument33 pagesB737-600-700-800-900 BoeingNeyd Ariel Calderón CastroNo ratings yet

- CA Volume IIDocument298 pagesCA Volume IIManoj DasNo ratings yet

- Planos Molde para Vulcanizado de LlantasDocument10 pagesPlanos Molde para Vulcanizado de Llantascristobal_tl2277No ratings yet

- Special Economic Zone - WikipediaDocument8 pagesSpecial Economic Zone - WikipediaDishaNo ratings yet

- Fast TraxDocument33 pagesFast TraxBipin SinghNo ratings yet

- Elasticity Exam Paper Model AnswersDocument5 pagesElasticity Exam Paper Model AnswersNicole BostanNo ratings yet

- Journal List For AccountingDocument5 pagesJournal List For AccountingNikhil Chandra ShilNo ratings yet

- Coursework Spec BBDM3133Document10 pagesCoursework Spec BBDM3133preetimutiarayNo ratings yet

- NMR Solvent Data ChartDocument2 pagesNMR Solvent Data ChartNGUYỄN HOÀNG LINHNo ratings yet

- Practice Perf CompDocument28 pagesPractice Perf CompsooguyNo ratings yet

- Questions For Case Study AssignmentDocument5 pagesQuestions For Case Study Assignmentricky_everNo ratings yet

- Business Research Methods William G. ZikmundDocument31 pagesBusiness Research Methods William G. ZikmundParth UpadhyayNo ratings yet

- LSMW PRD FiDocument526 pagesLSMW PRD FipikachudanNo ratings yet

- RR 16-86Document2 pagesRR 16-86matinikki100% (1)

- Gafta No124 - SamplingDocument16 pagesGafta No124 - SamplingLionel PinuerNo ratings yet

- General Ledger: Journal Import Process (Doc ID 130542.1) : GURUDAT (Available) Contact Us HelpDocument13 pagesGeneral Ledger: Journal Import Process (Doc ID 130542.1) : GURUDAT (Available) Contact Us HelpMadhavi SinghNo ratings yet