Professional Documents

Culture Documents

Error Correction

Uploaded by

Arnyl ReyesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Error Correction

Uploaded by

Arnyl ReyesCopyright:

Available Formats

Problem No.

1

During the course of your examination, of the 2020 financial statements of Diluc-Itto-Childe-

Kaeya-Zhongli (DICKZ) Corporation, the following data were discovered:

1. Office equipment, purchased January 2, 2019, at a cost of P22,000, having an estimated

salvage value of P2,000 and estimated useful life of 5 years, now is reestimated to have a

total life of 10 years from January 2, 2019. The straight-line method of depreciation is

used.

2. Interest deducted in advance on notes payable amounts to P5,000. The Interest Expense

account has a debit balance of P7,500. The company failed to record interest deducted in

advance at the end of 2018, P3,000; and at the end of 2019, P3,1000. All original entries

were made to the Interest Expense account.

3. Merchandise in transit, December 31, 2020, FOB Shipping point, of P15,000 was not

included in inventory as of December 31, 2020, but was entered in the purchases account

in 2020.

4. Merchandise costing P6,000 was included in the inventory as of December 31,2019, but

was not entered in the purchase account until January 10, 2020.

5. On July 1, 2020, a three-year insurance policy was purchased for P3,600. Prepaid

Expense did not appear on December 2020 balance sheet.

Prepare proposed adjusting entries as of December 31, 2020

Problem No. 2

State the effect of the following errors committed in 2020 upon the balance sheets and the

income statement prepared for 2020 and 2021.

a. The ending inventory is understated as a result of an error in the count of goods on hand

b. The ending inventory is overstated as a result of the inclusion of goods acquired and held

on consignment basis

c. A purchase of merchandise at the end of 2020 is not recorded until payment is made for

the goods in 2021; the goods purchased were included in the inventory at the end of

2020.

d. A sale of merchandise at the end of 2020 is not recorded until cash is received for the

goods in 2021; the goods sold were excluded from the inventory at the end of 2020.

e. Good shipped to consignee in 2020 were reported as sales; goods in hands of consignees

at the end of 2020 were not recognized for inventory purposes; sales of goods in 2021

and collection on such sales were recorded as credits to the receivables established with

consignee in 2020.

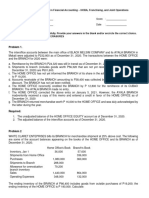

Please fill up the table below : (U = understated, O = overstated, N = no effect)

2020 2021

Balance Sheet I/S Balance Sheet I/S

Transaction

Net Net

Assets Liabilities Equity Assets Liabilities Equity

income income

a

b

c

d

e

You might also like

- Fa2 Mock Test 3Document14 pagesFa2 Mock Test 3Vinh Ngo Nhu57% (7)

- Additional Input FlyByU AGDocument2 pagesAdditional Input FlyByU AGChiara AnindaNo ratings yet

- Remedies On COA DisallowanceDocument20 pagesRemedies On COA DisallowanceIan dela Cruz Encarnacion100% (2)

- Parallel Learning StructureDocument8 pagesParallel Learning StructureArnyl Reyes100% (2)

- Chapter 09 SolutionsDocument43 pagesChapter 09 SolutionsDwightLidstromNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Accruals and Deferrals ActivityDocument2 pagesAccruals and Deferrals ActivityReese KimNo ratings yet

- 5 6079864208529295481Document4 pages5 6079864208529295481Razel MhinNo ratings yet

- Afar 2 - Installment SalesDocument1 pageAfar 2 - Installment SalesPanda ErarNo ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- Acctg 205B Prelim ExamDocument1 pageAcctg 205B Prelim ExamBella AyabNo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- (Template) Assignment - Audit of InventoriesDocument5 pages(Template) Assignment - Audit of InventoriesEdemson NavalesNo ratings yet

- FAR Problem SET A PDFDocument11 pagesFAR Problem SET A PDFNicole Aragon0% (1)

- QUIZ Correction of ErrorsDocument7 pagesQUIZ Correction of ErrorsJanelleNo ratings yet

- ASSET 2019 Mock Boards - AFARDocument8 pagesASSET 2019 Mock Boards - AFARKenneth Christian Wilbur0% (1)

- Error Correction Exercise (2021-2022 2nd Sem) TestDocument2 pagesError Correction Exercise (2021-2022 2nd Sem) TestEMELY EMELYNo ratings yet

- Error Correction - ExercisesDocument4 pagesError Correction - ExercisesDe Chavez May Ann M.No ratings yet

- ERROR FinalDocument21 pagesERROR FinalDebbie Grace Latiban LinazaNo ratings yet

- Reviewer Interm 2Document3 pagesReviewer Interm 2Mae DionisioNo ratings yet

- Effects of Errors 2021Document2 pagesEffects of Errors 2021Ali SwizzleNo ratings yet

- 5 6053042764831000707Document16 pages5 6053042764831000707SoNam ZaNgmoNo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- 3957CL 2. Accounting MA2021Document3 pages3957CL 2. Accounting MA2021Md SiamNo ratings yet

- Sample Problem AdjustingDocument17 pagesSample Problem AdjustingHanna Mae CatudayNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- Correction of Errors QuizDocument3 pagesCorrection of Errors QuizEISEN BELWIGANNo ratings yet

- At December 31Document9 pagesAt December 31Josephine MercadoNo ratings yet

- Sample QuestionsDocument9 pagesSample QuestionsLorena DeofilesNo ratings yet

- Acctg 9a Midterm Exam CH 9 15 CabreraDocument4 pagesAcctg 9a Midterm Exam CH 9 15 CabreraDonalyn BannagaoNo ratings yet

- Fa2 Mock Test 3Document14 pagesFa2 Mock Test 3chandoraNo ratings yet

- SDOADocument2 pagesSDOAassoc.uls2324No ratings yet

- Unithibs LTDDocument4 pagesUnithibs LTDRobert Daniel AquinoNo ratings yet

- Quiz 5 ReceivablesDocument1 pageQuiz 5 ReceivablesPanda ErarNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet

- HOMEWORK ON CORRECTION OF ERRORS ZoomDocument26 pagesHOMEWORK ON CORRECTION OF ERRORS ZoomJazehl Joy Valdez100% (1)

- Auditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Document16 pagesAuditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Moira C. Vilog100% (1)

- First Preboard FAR ReviewDocument26 pagesFirst Preboard FAR Reviewlois martinNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- 5.1 - AUDIT ON RECEIVABLES (Problems)Document10 pages5.1 - AUDIT ON RECEIVABLES (Problems)LorraineMartinNo ratings yet

- Fa2 Mock Test 2Document7 pagesFa2 Mock Test 2Sayed Zain ShahNo ratings yet

- Irrecoverable Debts & Provision For Irrecoverables DebtsDocument5 pagesIrrecoverable Debts & Provision For Irrecoverables DebtsYomi AmvNo ratings yet

- Untitled DocumentDocument21 pagesUntitled DocumentczarinaNo ratings yet

- Mle02 Far 1 Answer KeyDocument9 pagesMle02 Far 1 Answer KeyCarNo ratings yet

- T3int 2010 Jun QDocument9 pagesT3int 2010 Jun QMuhammad SaadNo ratings yet

- Multiple Choice QuestionsDocument8 pagesMultiple Choice QuestionsPrashant Sagar Gautam100% (1)

- Audit of ReceivablesDocument5 pagesAudit of ReceivablesandreamrieNo ratings yet

- AP W1 Correction of ErrorsDocument4 pagesAP W1 Correction of ErrorsALYZA ANGELA ORNEDONo ratings yet

- Deferred Income Tax Asset and LiabilityDocument4 pagesDeferred Income Tax Asset and Liabilityalcazar rtuNo ratings yet

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

- Midterm ExaminationDocument11 pagesMidterm ExaminationEdemson NavalesNo ratings yet

- ReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsDocument24 pagesReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsLuna V100% (2)

- Adjusting Entries With AnswersDocument7 pagesAdjusting Entries With AnswersMichael Magdaog100% (1)

- Adjusting EntriesDocument7 pagesAdjusting EntriesMichael MagdaogNo ratings yet

- FAR Vol 2 Chapter 16 18Document14 pagesFAR Vol 2 Chapter 16 18Allen Fey De Jesus100% (1)

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- IAC 15 HOBr Supplementary HandoutDocument2 pagesIAC 15 HOBr Supplementary Handout72hkffw24nNo ratings yet

- FAR AssessmentDocument4 pagesFAR AssessmentLuna VNo ratings yet

- MULTIPLE CHOICE. Choose The Letter That Best Represents The Answer. Write The Capital Letter of The Corresponding Correct AnswerDocument9 pagesMULTIPLE CHOICE. Choose The Letter That Best Represents The Answer. Write The Capital Letter of The Corresponding Correct AnswerKristen IjacoNo ratings yet

- Exam Type With Answer KeyDocument7 pagesExam Type With Answer KeyAngelieNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Module 2 - Intermed3 - NCAHFSDocument8 pagesModule 2 - Intermed3 - NCAHFSArnyl ReyesNo ratings yet

- 2013-1a DPWH DepedDocument1 page2013-1a DPWH DepedArnyl ReyesNo ratings yet

- Accounting Change ModuleDocument3 pagesAccounting Change ModuleArnyl ReyesNo ratings yet

- TBCH01Document6 pagesTBCH01Arnyl ReyesNo ratings yet

- TBCH02Document8 pagesTBCH02Arnyl ReyesNo ratings yet

- Employee BenefitsDocument3 pagesEmployee BenefitsArnyl ReyesNo ratings yet

- Bus Pol CHAP2Document7 pagesBus Pol CHAP2Arnyl ReyesNo ratings yet

- Bus Pol Chap1Document4 pagesBus Pol Chap1Arnyl ReyesNo ratings yet

- Caustic - Soda - 17.02.2020 PDFDocument53 pagesCaustic - Soda - 17.02.2020 PDFsanjay sharmaNo ratings yet

- Expansion Junction 1Document1 pageExpansion Junction 1kojjasNo ratings yet

- Project Planning and Monitoring Tool: Important NoticeDocument13 pagesProject Planning and Monitoring Tool: Important Noticemanja channelNo ratings yet

- CW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Document3 pagesCW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Adrian WensenNo ratings yet

- Prince SopDocument3 pagesPrince Sopvikram toorNo ratings yet

- Fortran 77 BookDocument211 pagesFortran 77 Bookjohn effiongNo ratings yet

- 08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBDocument1 page08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBChristian ParedesNo ratings yet

- Industrial Disputes Act1947 Cases: By: Anil Ashish Topno ROLL NO: 12003 Retail Management 2 YearDocument15 pagesIndustrial Disputes Act1947 Cases: By: Anil Ashish Topno ROLL NO: 12003 Retail Management 2 YearAnil Ashish Topno100% (1)

- NDA Report No DSSC-452-01 - Geological Disposal - Engineered Barrier System Status ReportDocument146 pagesNDA Report No DSSC-452-01 - Geological Disposal - Engineered Barrier System Status ReportVincent LinNo ratings yet

- Suite Popular Brasileira: 5. Shorinho Heitor Villa-LobosDocument4 pagesSuite Popular Brasileira: 5. Shorinho Heitor Villa-Loboshuong trinhNo ratings yet

- 18 Kadek Devy Crisna S - Emcee ScriptDocument6 pages18 Kadek Devy Crisna S - Emcee ScriptSugar HoneyTheoryNo ratings yet

- Barangay San Pascual - Judicial Affidavit of PB Armando DeteraDocument9 pagesBarangay San Pascual - Judicial Affidavit of PB Armando DeteraRosemarie JanoNo ratings yet

- Volkswagen Passat R Line Price ListDocument2 pagesVolkswagen Passat R Line Price ListDr Uvarani Sp Care Rawang TinNo ratings yet

- Mulberry VarietiesDocument24 pagesMulberry VarietiesKUNTAMALLA SUJATHANo ratings yet

- SEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Document5 pagesSEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Diya PandeNo ratings yet

- Purposeful InnovationDocument6 pagesPurposeful InnovationKeith Tanaka MagakaNo ratings yet

- Fuzzy Based Techniques For Handling Missing ValuesDocument6 pagesFuzzy Based Techniques For Handling Missing ValuesFarid Ali MousaNo ratings yet

- SDN5025 GREEN DC Electrical Inspection and Test Certificate V1.1Document11 pagesSDN5025 GREEN DC Electrical Inspection and Test Certificate V1.1JohnNo ratings yet

- Section 2 Structure and FunctionDocument42 pagesSection 2 Structure and FunctionRached Douahchua100% (1)

- File System ImplementationDocument35 pagesFile System ImplementationSát Thủ Vô TìnhNo ratings yet

- KUTAI MCCB Circuit Breaker Transfer Switch With Remote Monitoring OptionsDocument11 pagesKUTAI MCCB Circuit Breaker Transfer Switch With Remote Monitoring OptionsJanice LuNo ratings yet

- FBS Ii enDocument10 pagesFBS Ii enunsalNo ratings yet

- Chapter 6 Game Theory TwoDocument9 pagesChapter 6 Game Theory TwoMextli BarritaNo ratings yet

- Child Has Does: The Adultery, Child Be and Entitled His Own, The Child's That His DueDocument1 pageChild Has Does: The Adultery, Child Be and Entitled His Own, The Child's That His DuerickmortyNo ratings yet

- SL 70953 Liebert Gxt5 Lithium Ion 1 3kva I 230v Ups User GuideDocument70 pagesSL 70953 Liebert Gxt5 Lithium Ion 1 3kva I 230v Ups User Guidepetermaroko69No ratings yet

- Automotive Workshop Practice 1 Report - AlignmentDocument8 pagesAutomotive Workshop Practice 1 Report - AlignmentIhsan Yusoff Ihsan0% (1)

- G1 - Introduction Generator ProtectionDocument21 pagesG1 - Introduction Generator ProtectionOoi Ban JuanNo ratings yet

- RRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1Document58 pagesRRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1arpitrockNo ratings yet

- Fridge Zanussi ZK2411VT5 ManualDocument14 pagesFridge Zanussi ZK2411VT5 ManualDragos MoscuNo ratings yet