Professional Documents

Culture Documents

IBI - GrandLargeYachting - March 14

Uploaded by

Gomez Gomez0 ratings0% found this document useful (0 votes)

31 views3 pagesGrand Large yachting is proof that even in these tough times a shipyard can start up from scratch in Europe, and in a relatively short period become a success story. Founded under the Allures Yachting brand in 2003 by Stephan Constance and Xavier Desmarest. The Groupe is expecting consolidated turnover to hit $14m for 2013 after year-on-year growth of 40%.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGrand Large yachting is proof that even in these tough times a shipyard can start up from scratch in Europe, and in a relatively short period become a success story. Founded under the Allures Yachting brand in 2003 by Stephan Constance and Xavier Desmarest. The Groupe is expecting consolidated turnover to hit $14m for 2013 after year-on-year growth of 40%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views3 pagesIBI - GrandLargeYachting - March 14

Uploaded by

Gomez GomezGrand Large yachting is proof that even in these tough times a shipyard can start up from scratch in Europe, and in a relatively short period become a success story. Founded under the Allures Yachting brand in 2003 by Stephan Constance and Xavier Desmarest. The Groupe is expecting consolidated turnover to hit $14m for 2013 after year-on-year growth of 40%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Strategy & Finance

FRANCE | GRAND LARGE YACHTING

59 International Boat Industry | FEBRUARY MARCH 2014 www.ibi-plus.com

SPOTTING AN OPENING IN THE MARKET FOR ALUMINIUM SAILING CRUISERS, TWO

ENTREPRENEURS EMBARKED ON SETTING UP THEIR OWN BOATBUILDING OPERATION. A

DECADE ON AND GRAND LARGE YACHTING COMPRISES FOUR BRANDS, ALL IN GROWTH MODE

WORDS: OLIVIER VOITURIEZ

Full speed ahead

G

rand Large Yachting is proof that even in

these tough times a shipyard can start up

from scratch in Europe, and in a relatively

short period become a success story. Founded

under the Allures Yachting brand in 2003 by Stphan

Constance and Xavier Desmarest, the Groupe is

expecting consolidated turnover to hit $14m for 2013

after year-on-year growth of 40%. Today Allures is

joined by three other yards Outremer, Garcia and

Alumarine making up a Grand Large portfolio of

cruising boats offered in sail and motor, mono and

multihull, and in aluminium and composite.

It was a chance to sail the globe during

a sabbatical year from their jobs as strategy

consultants at Boston Consulting Group, that the

seeds for Grand Large were sown in the minds of

Constance and Desmarest, two fellow graduates

and friends from Ecole Centrale in Lyon. The two

engineers looked at all the boats that would t their

specic needs but found nothing that suited.

They noted that they were not alone. Their

frustration was shared by many leisure boat sailors

and ocean travellers. Ever the consultants, the two

men spotted a business opportunity to develop the

ultimate sailing cruiser.

They sat down at their desks. They needed to dene

a product, it would be an aluminium centreboarder.

The lengthy process then began of bringing on board

the right specialists and sub-contractors that could

turn the dream into a reality.

ALLURES YACHTING

Constance and Desmarest contacted CMN

(Constructions Mcaniques de Normandie) in

Cherbourg, Normandy. The boatyard, run by Jean-

Pierre Balmer, had a staff of 400 and since 1945 had

built over 350 boats and luxury yachts. Now the

yard was on hand to help the young entrepreneurs

launch their project. CMN took them under their

wing, made the aluminium hull, assembled the rst

Allures 45, found and managed the subcontractors:

2B composite for the deck and James for the cabinet

work. In exchange, CMN was charging for hours in

architecture and the manufacture of the hulls.

We were extremely lucky at the outset to have

been helped by a boatyard of the stature of CMN.

They took us in hand, explained how to make a boat,

remembers Stphan Constance. The fact that they

were behind us reassured the customers. We were

able to use the CMN Alliance partnership to full

advantage. But the clock was ticking and it would

take a mammoth effort to present the rst prototype

at Septembers Grand Pavois de La Rochelle, just

eight months after the brand was ofcially launched.

They made it, just, and the boat was sold.

Allures was born from scratch. There was nothing at

the beginning. Not a product, nor a tool, nor the funds.

But our success proves that an industrial start-up was

possible in France in the year 2000, adds Constance. To

start off the two entrepreneurs put down $20,000 and

raised $2m in venture capital from their families, friends

and business contacts, as well as love money from

business angels who believed in the project.

Reaction to the boat was good. The two

entrepreneurs rmly believed that there was a place

for a new product in the under-exploited market of

C

O

U

N

T

R

Y

R

E

P

O

R

T

Grand Large

Yachtings

founders Stphan

Constance (left)

and Xavier

Desmarest

P

h

o

t

o

:

M

o

r

r

i

s

a

d

a

n

t

60 FEBRUARY MARCH 2014 | International Boat Industry www.ibi-plus.com

Strategy & Finance

FRANCE | GROUPE GRAND LARGE YACHTING

aluminium centerboarders. The

key to Allures success was to

associate the freedom offered

by this type of boat, the safety

guaranteed by aluminium

hulls, the performance of

composite superstructures

and a good level of comfort

for on-board living. The

coupling of an aluminium hull

with a composite deck was

not new in naval architecture,

but what was innovative was

using the technology CMN had for superyachts on

smaller leisure boats. We wondered why this procedure

hadnt been used before for sailing boats, says Xavier

Desmarest, attributing this to the cottage-industry way

of building of yachts, where one boatyard specialised in

one type of product and a standard size. We patented the

technological procedure of assembling hull and deck.

With its offer of boats that were better thought out,

and less expensive than the others,

Allures saw rapid growth. Three sailing

boats were sold in 2004, six in 2005 and

12 in 2006, when the company moved

to its own workshops in Tourlaville, near

Cherbourg. Twenty units were marketed

in 2007. From nothing, the turnover

of the boatyard had reached $6m.

And then... Lehmann Brothers threw a

spanner in the works.

CAT CHALLENGE

Although Allures suffered from the downturn in the

market, the crisis was offset by an opportunity for

growth elsewhere. In October 2007, Constance and

Desmarest bought out the Outremer boatyard that was

in receivership at the Commercial courts of Montpellier.

Outremer, founded in 1984 at La Grande Motte (on the

Mediterranean coast), specialised in large composite

cruising cats from 45ft-60ft. The company had had

nancial difculties following a difcult handover and

poor management. We very quickly saw Outremers

potential and the good drivers it had for growth. The

boatyard was similar to ours. They had the same problems

as us (aftersales servicing, tools, etc), says Constance.

It was intrepid on our part, a challenge, but it was an

opportunity for us to enter the catamaran market which

was then very promising. In 2000 it was a niche market,

today its a market full stop.

Allures managers attribute the catamaran boom to a

new generation of sailing enthusiasts who like this type of

boat, and this new generation included women. Their role

and choices were also important. As was the rental

market which was introducing the boat to a much larger

public. Outremer was to benet from this niche market,

a rare growth sector in yachting. When the company

changed hands in 2007, the boatyards turnover was

$1.7m. It has since grown fourfold and in 2013 reached

$8.5m. The workforce has doubled over the same

period, from a staff of 30 to the present 60. It is largely

thanks to Outremers success they have built over 200

catamarans since 1984 that Grand Large has had such

strong overall growth.

PROFITABLE SINCE 2006

At the time of Outremers acquisition, Allures

Yachting had to cut back its own production on

account of the downturn. But our prots went up

during the contraction, Desmarest points out. The

boatyard has been protable since 2006. Small

prots, thats life in the nautical world. Allures had

a staff of 30 and a turnover of $4.3m in 2013. Five

models the Allures 44, 40, 51, 45 and this years

Allures 39.9 have been launched;

a total of 100 boats have been built

by the Norman yard.

Since the boatyard started in

2003, all prots have been ploughed

back, giving the Group a strong equity

of approximately $2m.

Astute management has

produced an average and

approximate 40% annual growth

since 2004. The two founders hold

the majority of the ownership of the group, together

with patient shareholders who have received no

dividends on their initial investment. Our investors

are able to both take risks and wait 10 to 20 years

before getting anything back, as reasonable capitalism

dictates, Constance acknowledges.

NEW GROWTH WITH GARCIA

A new opportunity for external growth came in spring

2010 in the form of Garcia boatyard. It was another

good brand, also in receivership. Specialising in 50-

110ft aluminium custom-built sailing cruisers, the

Normandy boatyard had carved a strong reputation

for itself since 1974. When Grand Large took over,

they re-launched production, and came up with the

new Garcia Trawler 54, the groups rst motorboat,

diversifying its product base still further. They will

soon be launching the Garcia Exploration, a 45ft

sailing cruiser made for global sailor Jimmy Cornell.

Garcia boatyard is located at Cond-sur-Noireau

in Normandy, and is now an integral part of Groupe

It is madness

to start up a

boatyard in France

today. We were so lucky

with Allures...

Grand Large

is forecasting

sales of 14 in

2013

61 International Boat Industry | FEBRUARY MARCH 2014 www.ibi-plus.com

Staff: 125 people

Turnover 2013: 14m (estimate)

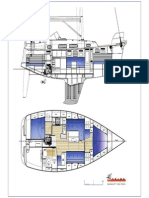

Allures Yachting, run by Stphan Constance, is

based in Tourlaville, near Cherbourg. It builds ocean-

going aluminium centerboard monohulls from 40ft-52ft.

Outremer Yachting, directed by Xavier Desmarest,

is based at La Grande Motte (Languedoc). It has

specialised in ocean-going catamarans for almost

30 years, with a range from 45ft-59ft.

Garcia Yachting, directed by Benot Lebizay, builds

45ft-115ft custom aluminium boats. The boatyard is

located in Cond-sur-Noireau.

Alumarine Shipyard in Couron, near Nantes, has

been building commericial boats and aluminium

ocean-going catamarans since 1986.

Grand Large Services handles aftersales,

maintenance, repair, ret, delivery, training,

brokerage and other services for Groupe Grand

Large Yachtings customers.

Grand Large. The yards builds 15-20 aluminium hulls

a year for Allures models from 40-50ft. We gave

our orders to Garcia as our usual provider had to be

replaced at exactly that time, says Constance, who

conrms that he is totally committed to the boatyard

and its remaining staff who turned their backs on

advantageous redundancy packages during the

receivership period and preferred to work and earn

their living with dignity. To meet new orders, 10 new

welders were hired. The turnover of the boatyard run

by Benot Le Bizay with a staff of 15 is expected to be

$1.5-$2m next year.

Constance acknowledges in hindsight that it is

much easier to take over a boatyard than to start from

scratch. Its madness to start up a boatyard in France

today. We were so lucky with Allures. At the time, we

never dreamt of expanding externally.

The acquisition of Outremer and then of Garcia

were unexpected, but as things worked well, the

entrepreneurs started looking at other available

companies. But with a golden rule: existing teams at

the yards should be favourable to re-structuring plans

put forward by Grand Large. In 2010, the group made

a bid for the Alliage boatyard that was rejected in

favour of one from Alubat. They were the two French

builders specialising in aluminium sailing cruisers.

Alliage subsequently went bankrupt in 2011. Alubat,

in receivership in autumn 2013, was acquired by a

private investor at the end of the year.

COMPLETE PRODUCT RANGE

Grand Larges last push for external growth was

in October 2013 with the successful acquisition

of AluMarine, a Nantes boatyard focusing on

aluminium work and leisure boats. The yard was also

in receivership. Synergy and common equipment

between Grand Large and AluMarine meant we were

interested in making a bid, Desmarest explains.

AluMarine builds large (40ft-100ft) custom leisure

power and sailing cats, as well as commercial barges

and service vessels. The rescue plan ensured jobs

for 14 of the staff of 20 and turnover for next year is

expected to be between $1.5 and $2m.

CAREFUL ORGANISATION

Desmarest and Constance put extremely careful

organisation and a focus on immediate protability

as core to their success. An Enterprise Resource

Planning and computer assisted production

management tool is shared by all the yards and is

the pilot for all departments, including production.

All the boat models are designed on this ERP, which

manages building, timing and traceability.

Controlling quality of production methods is also

vital. Grand Large has control tools that were designed

by a former quality manager at the Institut Pasteur.

Computer Aided Design (CAD) means production

issues are resolved at design stage and not on the

prototype. These are very expensive tools that soon

pay their way, and they are vital. They mean that teams

in the different boatyards can work at the same time on

cross-Group projects, says Constance. Sharing common

tools means that the design teams at the four boatyards

can back each other up for rush jobs, and it also means

rigorous cost control and global accounting.

EXPORT MARKETS

Seventy per cent of Grand Large Yachtings

production is for the export market. There is an

active international sales team in some 15 countries,

including Northern Europe, the US and New Zealand.

Each brand has its own territory; Allures the colder

climes, Outremer the warm seas.

With its undisputed industrial and commercial

success, service is the new focus of strategic

development for this very dynamic group who feel

that they should offer more than one product.

Describing themselves as a one stop shop, Grand Large

Services wants to be the portal for ocean-going vessels,

global project management for the Groups customers,

from aftersales service to brokerage, and including ret,

coaching and boat delivery.

At a glance: Grand Large Yachting

You might also like

- Setting Sail 2024: Your First-Time Cruisers Guide: Xtravix Travel Guides, #2From EverandSetting Sail 2024: Your First-Time Cruisers Guide: Xtravix Travel Guides, #2No ratings yet

- The Yacht SectorDocument49 pagesThe Yacht SectorBasile Parovel100% (1)

- Bernard Gallay Yacht Brokerage Newsletter Episode10 PDFDocument24 pagesBernard Gallay Yacht Brokerage Newsletter Episode10 PDFAlexander FlorinNo ratings yet

- Business in Shipping IndustryDocument36 pagesBusiness in Shipping IndustrypdaszNo ratings yet

- Boat International - March 2014 UKDocument244 pagesBoat International - March 2014 UKBaris AkgülNo ratings yet

- Carnival CorpDocument18 pagesCarnival Corpaluva_007No ratings yet

- Setting Sail: Your First-Time Cruisers Guide: Xtravix Travel Guides, #1From EverandSetting Sail: Your First-Time Cruisers Guide: Xtravix Travel Guides, #1Rating: 5 out of 5 stars5/5 (1)

- Top 10 Biggest Cruise Ships in The WorldDocument15 pagesTop 10 Biggest Cruise Ships in The WorldWai Lana ButlerNo ratings yet

- Blue MarlinDocument23 pagesBlue MarlinsaulotenorNo ratings yet

- 38 1 English BrochureDocument21 pages38 1 English Brochureozer7100% (1)

- CarnivalDocument43 pagesCarnivalgdkhNo ratings yet

- Tawara Yacht Brokers: Draft Report By: Mai Ahmed BarakatDocument3 pagesTawara Yacht Brokers: Draft Report By: Mai Ahmed BarakatMay swiftNo ratings yet

- Cruise Weekly For Thu 21 Feb 2013 - Windstar Eyes Oz, Learn and Earn With Orion, Tauck Newbuilds, Six New Scenic Ships and Much More....Document5 pagesCruise Weekly For Thu 21 Feb 2013 - Windstar Eyes Oz, Learn and Earn With Orion, Tauck Newbuilds, Six New Scenic Ships and Much More....cruiseweeklyNo ratings yet

- Tawara Yacht Brokers Global AnalysisDocument18 pagesTawara Yacht Brokers Global AnalysisMahmoud A.RaoufNo ratings yet

- Bulk Carrier: Jump To Navigation Jump To SearchDocument27 pagesBulk Carrier: Jump To Navigation Jump To SearchteodoraNo ratings yet

- Tug OperationsDocument14 pagesTug Operationsseamaniac100% (1)

- Kongsberg The Full Picture Magazine 1 16Document100 pagesKongsberg The Full Picture Magazine 1 16LifeatseaNo ratings yet

- Versatile 80m Multibuster Workboat Wins Top AwardDocument28 pagesVersatile 80m Multibuster Workboat Wins Top AwardtonyNo ratings yet

- Yacht Marina ReviewDocument21 pagesYacht Marina ReviewPn EkanayakaNo ratings yet

- Workboat World Article On Safehaven MarineDocument1 pageWorkboat World Article On Safehaven MarineFrank KowalskiNo ratings yet

- Activity-1 1Document7 pagesActivity-1 1Mariel ManueboNo ratings yet

- Study of Strategy Adopted by Maersk Tanker - Onkar Singh BhatiDocument47 pagesStudy of Strategy Adopted by Maersk Tanker - Onkar Singh BhatiOnkar Singh BhatiNo ratings yet

- Bulk Carrier EnglezaDocument11 pagesBulk Carrier EnglezaAlexandru Kabumus0% (1)

- Significant Ships 2008Document104 pagesSignificant Ships 2008aveselov88100% (3)

- Cruise Weekly For Thu 04 Apr 2013 - CLIA The Way Forward, Uniworld, Paul Gauguin, HAL, PDocument5 pagesCruise Weekly For Thu 04 Apr 2013 - CLIA The Way Forward, Uniworld, Paul Gauguin, HAL, PcruiseweeklyNo ratings yet

- Q4 2006 DownloadDocument84 pagesQ4 2006 DownloadAlberto Lagos100% (1)

- Top cruise companies comparedDocument5 pagesTop cruise companies comparedEsthel VillamilNo ratings yet

- CruiseDocument12 pagesCruiseAmando M. Cotangco IIINo ratings yet

- CR 9955Document24 pagesCR 9955jbloggs2007No ratings yet

- Nonstop 2006-02 E PDFDocument48 pagesNonstop 2006-02 E PDFmaxamaxaNo ratings yet

- Advantages and Disadvantages of Water Transportation: 4000 B.C: Egyptian Reed BoatDocument4 pagesAdvantages and Disadvantages of Water Transportation: 4000 B.C: Egyptian Reed BoatLovely Diane TabunanNo ratings yet

- Royal Caribbean International: Overview of The BusinesssDocument2 pagesRoyal Caribbean International: Overview of The Businesssama0290No ratings yet

- Dockwiser December 2009Document44 pagesDockwiser December 2009d_mazieroNo ratings yet

- Tawara Yacht Brokers: Draft Report By: Candidate AdilDocument2 pagesTawara Yacht Brokers: Draft Report By: Candidate Adilhezu kaziNo ratings yet

- BROKER - RTF Ex.4Document3 pagesBROKER - RTF Ex.4syeda mahnoor fatimaNo ratings yet

- Inside Amels 2012Document31 pagesInside Amels 2012mart2014No ratings yet

- AMEM Cruise Ship Owners and OperatorsDocument102 pagesAMEM Cruise Ship Owners and OperatorsSecond Space100% (1)

- WEB MPC Shipping Brochure 2012Document8 pagesWEB MPC Shipping Brochure 2012Eric MangionNo ratings yet

- AMEM Cruise Ships On OrderDocument10 pagesAMEM Cruise Ships On OrderDudu LauraNo ratings yet

- Bulk CarrierDocument17 pagesBulk Carrierverortega100% (1)

- SS2012Document105 pagesSS2012David Moreno Cabrera0% (1)

- Sea TransportationDocument42 pagesSea Transportationellelelelee268No ratings yet

- BROKERDocument2 pagesBROKERsaadaamir166No ratings yet

- J226SUPERDocument2 pagesJ226SUPERMAHJABEEN NASEEMNo ratings yet

- Harmony of The Seas JabolinDocument10 pagesHarmony of The Seas JabolinCielo LynNo ratings yet

- Merchant Ship Bulk Cargo Cargo HoldsDocument1 pageMerchant Ship Bulk Cargo Cargo HoldsMuhammed RazeemNo ratings yet

- Pilar - English PorjectDocument14 pagesPilar - English PorjectANGGELO DAGOMAR PILAR DIAZNo ratings yet

- Largest Yachts in The World 2023 - YachtWorldDocument1 pageLargest Yachts in The World 2023 - YachtWorlddaudatedsundayNo ratings yet

- Marina World PDFDocument5 pagesMarina World PDFPelangi FitriNo ratings yet

- Catalogo MarlowDocument56 pagesCatalogo MarlowZhi ShuNo ratings yet

- Rigamarole Fall 2014sDocument37 pagesRigamarole Fall 2014sIvan CruzNo ratings yet

- BROKERDocument2 pagesBROKEREain ThuNo ratings yet

- The Magazine of The: International Maritime OrganizationDocument40 pagesThe Magazine of The: International Maritime Organizationjbloggs2007No ratings yet

- Research Paper About ShipsDocument5 pagesResearch Paper About Shipsc9spy2qz100% (1)

- RCL 2012 ArDocument102 pagesRCL 2012 ArDudu LauraNo ratings yet

- GBH 8 45 DV Professional Manual 167048Document170 pagesGBH 8 45 DV Professional Manual 167048Gomez GomezNo ratings yet

- GBH 36 V Ec Compact 2 0 Ah Professional Manual 146082Document237 pagesGBH 36 V Ec Compact 2 0 Ah Professional Manual 146082Gomez GomezNo ratings yet

- GBH 18 V Li Compact 3 Ah Professional Manual 160711Document181 pagesGBH 18 V Li Compact 3 Ah Professional Manual 160711Gomez GomezNo ratings yet

- GBH 36 VF Li Professional Manual 148897Document249 pagesGBH 36 VF Li Professional Manual 148897Gomez GomezNo ratings yet

- GBH 18 V Ec 4 Ah Professional Manual 162991Document196 pagesGBH 18 V Ec 4 Ah Professional Manual 162991Gomez GomezNo ratings yet

- GBH 5 40 Dce Professional Manual 165911Document156 pagesGBH 5 40 Dce Professional Manual 165911Gomez GomezNo ratings yet

- GBH 11 de Professional Manual 117987Document75 pagesGBH 11 de Professional Manual 117987prasanna2210No ratings yet

- GBH 18 V Ec 4 Ah Professional Manual 162991Document196 pagesGBH 18 V Ec 4 Ah Professional Manual 162991Gomez GomezNo ratings yet

- GBH 7 46 de Professional Manual 170945Document73 pagesGBH 7 46 de Professional Manual 170945Gomez GomezNo ratings yet

- Hallberg OpstillingDocument9 pagesHallberg OpstillingGomez GomezNo ratings yet

- GBH 5 38 D Professional Manual 163093Document143 pagesGBH 5 38 D Professional Manual 163093Gomez GomezNo ratings yet

- GBH 4 32 DFR Professional Manual 161465Document188 pagesGBH 4 32 DFR Professional Manual 161465Gomez GomezNo ratings yet

- GBH 3 28 Dre Professional Manual 144832Document225 pagesGBH 3 28 Dre Professional Manual 144832Gomez GomezNo ratings yet

- GBH 2 23 Rea Professional Manual 118360Document91 pagesGBH 2 23 Rea Professional Manual 118360Gomez GomezNo ratings yet

- Clean With A System: Range For 2013/2014Document40 pagesClean With A System: Range For 2013/2014Gomez GomezNo ratings yet

- GBH 2 20 D Professional Manual 162121Document167 pagesGBH 2 20 D Professional Manual 162121Gomez GomezNo ratings yet

- HR31 MK IIcolourDocument5 pagesHR31 MK IIcolourGomez GomezNo ratings yet

- FR Allures51 BrochureDocument29 pagesFR Allures51 BrochureGomez GomezNo ratings yet

- Hallberg Rassy 64 3Document32 pagesHallberg Rassy 64 3Gomez GomezNo ratings yet

- Cigale 18 New Amenagement 00Document1 pageCigale 18 New Amenagement 00Gomez GomezNo ratings yet

- Brochure 1985 S WeDocument14 pagesBrochure 1985 S WeGomez GomezNo ratings yet

- GA SideDocument1 pageGA SideGomez GomezNo ratings yet

- FR Zoning Allure 45Document5 pagesFR Zoning Allure 45Gomez GomezNo ratings yet

- ST196 Boat Test Allures39 DK V6Document3 pagesST196 Boat Test Allures39 DK V6Gomez GomezNo ratings yet

- 268 FileAllegatoDocument7 pages268 FileAllegatoGomez GomezNo ratings yet

- Presse A44 YatchingMonthlyDocument5 pagesPresse A44 YatchingMonthlyGomez GomezNo ratings yet

- 265 FileAllegatoDocument5 pages265 FileAllegatoGomez GomezNo ratings yet

- 252 FileAllegatoDocument5 pages252 FileAllegatoGomez GomezNo ratings yet

- 248 FileAllegatoDocument2 pages248 FileAllegatoGomez GomezNo ratings yet

- This Study Resource Was: Date of RecordDocument8 pagesThis Study Resource Was: Date of RecordMarjorie PalmaNo ratings yet

- International FinanceDocument24 pagesInternational FinanceShOaib Khan LOdhiNo ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- Annual Report 2017 - BCA FinanceDocument483 pagesAnnual Report 2017 - BCA FinanceMaya Wahyu SaputriNo ratings yet

- Business Combinations Notes Ch 1-3Document4 pagesBusiness Combinations Notes Ch 1-3Mary Jescho Vidal AmpilNo ratings yet

- Tata MotorsDocument10 pagesTata MotorsGourav BainsNo ratings yet

- Preparing An Income Statement, Statement of Retained Earnings, and Balance SheetDocument5 pagesPreparing An Income Statement, Statement of Retained Earnings, and Balance SheetJames MorrisonNo ratings yet

- Hacienda Luisita Vs PARC (Digest)Document10 pagesHacienda Luisita Vs PARC (Digest)Arahbells100% (1)

- PPT4-Consolidated Financial Statement After AcquisitionDocument57 pagesPPT4-Consolidated Financial Statement After AcquisitionRifdah SaphiraNo ratings yet

- Right Vs BonusDocument3 pagesRight Vs BonusMEMORY NGALANDENo ratings yet

- BSRM Credit Rating ReportDocument1 pageBSRM Credit Rating ReportRadioactivekhanNo ratings yet

- MermatDocument32 pagesMermatDottoSafariNo ratings yet

- Bajaj Corp IPO GradingDocument11 pagesBajaj Corp IPO GradingSatyabrataNayakNo ratings yet

- Accounting - ProblemsDocument11 pagesAccounting - ProblemsAzfar JavaidNo ratings yet

- Corporate Governance Short NotesDocument8 pagesCorporate Governance Short NotesVivekNo ratings yet

- Financial Reporting ReviewerDocument30 pagesFinancial Reporting ReviewerElla Marie Lopez100% (1)

- Legal Forms of Business OrganizationDocument18 pagesLegal Forms of Business Organizationfikru100% (1)

- 17 ConclusionDocument13 pages17 ConclusionAjayGupta100% (1)

- Harshit Saxena - Lifting The Corporate VeilDocument24 pagesHarshit Saxena - Lifting The Corporate VeilHimanshu MishraNo ratings yet

- Balance Sheet PDFDocument48 pagesBalance Sheet PDFkalaivanan sNo ratings yet

- The Cisco CaseDocument2 pagesThe Cisco CaseKemajou PamelaNo ratings yet

- Chapter 13 - Statement of Cash FlowsDocument31 pagesChapter 13 - Statement of Cash Flowselizabeth karina100% (1)

- Jupiter Asset Management Series PLC - Notice of Annual General MeetingDocument7 pagesJupiter Asset Management Series PLC - Notice of Annual General MeetingSaif MonajedNo ratings yet

- Grupo ADO SA de CV in Travel and Tourism (Mexico)Document4 pagesGrupo ADO SA de CV in Travel and Tourism (Mexico)Betto VillalobosNo ratings yet

- Beams11 ppt04Document49 pagesBeams11 ppt04Rika RieksNo ratings yet

- Introduction and Design of The StudyDocument14 pagesIntroduction and Design of The StudyhelloNo ratings yet

- Initial Public Offering - WikipediaDocument12 pagesInitial Public Offering - WikipediajubsNo ratings yet

- Western Institute of Technology v. SalasDocument1 pageWestern Institute of Technology v. SalasJudy RiveraNo ratings yet

- Chapter 7 (CFAS)Document2 pagesChapter 7 (CFAS)Vince PeredaNo ratings yet

- CH 2 ProbsDocument4 pagesCH 2 ProbsEnas FandosNo ratings yet