Professional Documents

Culture Documents

BG Databook 2013

Uploaded by

stluciabarbadosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BG Databook 2013

Uploaded by

stluciabarbadosCopyright:

Available Formats

BGGroup plc

100 Thames Valley Park Drive

Reading, Berkshire RG6 1PT

United Kingdom

www.bg-group.com

Registered in England & Wales No. 3690065

Designed & produced by Addison Group,

www.addison-group.net

B

G

G

r

o

u

p

D

a

t

a

B

o

o

k

2

0

1

3

A global portfolio

Data Book 2013

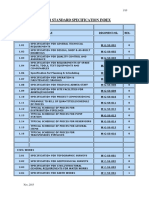

E&P production volumes

(kboed)

2012 2011 2010 2009 2008

619

641

657 646 644

0

100

200

300

400

500

600

700

Gas

Oil & liquids

E&P reserves and resources

(a)

(mmboe)

SEC proved reserves Discovered resources

Probable reserves Risked exploration

18000

15 000

12000

9000

6000

3 000

0

2010 2009 2008 2011 2012

13 126

14 494

16 180

17 130

18 511

LNG delivered volumes

(mtpa)

Asia North America

South America Europe

12

14

10

8

6

4

2

0

2010 2009 2008 2011 2012

13.4

13.1 12.9 12.8

12.1

Upstream total operating prot

(b)

($m)

8 000

6 000

4 000

2 000

0

2008

6 899

2009

3 504

2010

4 092

2011

5 439

2012

5 467

LNG Shipping & Marketing

total operating prot

(b)

3 000

2 500

2 000

1 500

1 000

500

0

2008

2 799

2009

2 121

2010

2 135

2011

2 282

2012

2 577

($m)

Oil and gas production 2012

Egypt 20%

Kazakhstan 15%

UK 15%

USA 12%

Trinidad and Tobago 11%

Tunisia 6%

Thailand 5%

Bolivia 4%

Brazil 4%

India 4%

Australia 4%

Norway 0%

Total 100%

BG GROUPS VISION IS TO BE A HIGH-GROWTH, GLOBAL

EXPLORATION & PRODUCTION AND LNG COMPANY.

WE WILL DELIVER INDUSTRY-LEADING GROWTH IN

SHAREHOLDER VALUE THROUGH EXCELLENCE IN

EXECUTION, WORLD-CLASS EXPLORATION AND

OUR DISTINCTIVE LNG BUSINESS MODEL.

OUR VISION

KEY DATA

(a) See page 4 for reserve and resource denitions.

(b) Business performance (see page 36 for a description) including share of pre-tax operating

results from joint ventures and associates, restated to reect the adoption of the amended

IAS 19 in respect of dened benet pension obligations.

STATISTICAL SUPPLEMENT Introduction and legal notices 36

Social, environmental and climate change data 37

Group nancial data 41

Exploration and Production 43

Liquefaction 48

LNG Shipping and Marketing 48

Oil Marketing 49

Corporate information 50

Cover image

West Eminence drill rig.

The West Eminence is a

sixth generation, dynamic

positioning, deep water,

semi-submersible drilling

unit chartered for use in the

Santos Basin, offshore Brazil.

Image courtesy of Seadrill.

Inside cover image

Miskar production

platform, Tunisia.

First production from

the Miskar eld began

in 1996. Gas from the

eld is processed at

the BG Group-operated

Hannibal plant.

MORE ONLINE

Detailed corporate reports,

including the Annual Report

and Accounts, BGGroup Data

Book and the Sustainability

Report, canbefoundonline at

www.bg-group.com/reports

CONTENTS Areas of Palestinian Authority 30

Australia 08

Bolivia 25

Brazil 05

Canada 21

China 31

Egypt 10

Global Energy Marketing and Shipping 32

Honduras 29

India 26

Kazakhstan 12

Kenya 28

Madagascar 28

Norway 17

Singapore 31

Tanzania 27

Thailand 24

Trinidad and Tobago 18

Tunisia 23

United Kingdom 14

United States of America 21

Uruguay 29

01

Exploration and Production (E&P)

Liqueed Natural Gas (LNG)

Transmission and Distribution (T&D)

Power Generation

India

United Kingdom

United States

of America

Uruguay

Brazil

Madagascar

Tanzania

Australia

Norway

Kazakhstan

Bolivia

Tunisia

China

Thailand

Chile

Trinidad and Tobago

Egypt

Singapore

Japan

Areas of

Palestinian

Authority

Kenya

Honduras

Canada

Exploration and Production

Liquefaction

LNG Shipping & Marketing

Exploration and Production (Upstream)

Liquefaction (Upstream)

LNG Shipping & Marketing

BG Groups strategy is to create value by

leveraging its distinctive capabilities in

exploration and from its unique LNG business.

The Groups Upstream production is currently

sourced from base assets in 10 countries and key

growth projects in Brazil and Australia. Wide

geological technical expertise combined with

commercial agility enables the Group to access

exploration opportunities, targeting low-cost

early entry positions. BG Group also explores

at existing hubs, aiming to leverage basin

knowledge and existing infrastructure.

In LNG, the Groups skills and capabilities

span the whole LNG value chain.

WHERE WE OPERATE

BG GROUP HAS OPERATIONS

IN MORE THAN 20 COUNTRIES

ON FIVE CONTINENTS.

TOTAL OPERATING PROFIT

business performance*

$8 050m (+4.1%)

2011 $7 731m**

* Business Performance see page 36 for description

** 2011 results have been restated to reect the presentation

of the majority of the businesses that comprised the T&D

segment as discontinued operations (see note 7, page 102

of the 2012 annual report and accounts (ARA) and the

change in the remaining reporting segments from E&P

and LNG

02 www.bg-group.com Data Book 2013

Exploration and Production (E&P)

Liqueed Natural Gas (LNG)

Transmission and Distribution (T&D)

Power Generation

India

United Kingdom

United States

of America

Uruguay

Brazil

Madagascar

Tanzania

Australia

Norway

Kazakhstan

Bolivia

Tunisia

China

Thailand

Chile

Trinidad and Tobago

Egypt

Singapore

Japan

Areas of

Palestinian

Authority

Kenya

Honduras

Canada

UPSTREAM

BG Group explores for, develops, produces and markets gas

and oil around the world. The Upstream business segment

covers exploration and production activities plus liquefaction

operations associated with integrated LNG projects.

Total operating prot business performance*

$5 467m (+0.5%)

2011 $5 442m**

LNG SHIPPING & MARKETING

The LNG Shipping & Marketing segment covers the Groups

purchasing, shipping, marketing and sales of LNG, as well as

BG Groups interests and capacity in regasication facilities.

Total operating prot business performance*

$2 577m (+13%)

2011 $2 282m**

03

HoA Heads of Agreement

HPHT High-Pressure High-Temperature

JV Joint venture

kboed Thousand barrels of oil equivalent per day

km Kilometres

LNG Liqueed Natural Gas

LPG Liqueed petroleum gas

m Million

mmbbls Million barrels of oil

mmboe Million barrels of oil equivalent

mmboed Million barrels of oil equivalent per day

mmbopd Million barrels of oil per day

mmbtu Million British thermal units

mmbtud Million British thermal units per day

mmcm Million cubic metres

mmcmd Million cubic metres per day

mmscf Million standard cubic feet

mmscfd Million standard cubic feet per day

MoU Memorandum of Understanding

mtpa Million tonnes per annum

NBP National Balancing Point

NGV Natural Gas Vehicle

P10 At least a 10% probability that the quantities actually

recovered will equal or exceed the high estimate

P90 At least a 90% probability that the quantities actually

recovered will equal or exceed the low estimate

partner An entity with whom BGGroup has formed an incorporated

or unincorporated association or joint venture for the

purposes of pursuing its business activities and the term

partner in this context is not intended to, nor shall be

deemed to, create or constitute a partnership between

BGGroup and any such entity for the purposes of the

Partnership Act 1890 or any similar law in any jurisdiction

in which such activities may be conducted

PDO Plan for development and operation

PEDL Production, exploration and development licence

PJ Petajoules

PSC or PSA Production Sharing Contract/Production Sharing Agreement

SEC The United States Securities and Exchange Commission

SPA Sale and Purchase Agreement

sq km Square kilometres

tcf Trillion cubic feet

UKCS United Kingdom Continental Shelf

RESERVES AND RESOURCES

Proved reserves

BGGroup utilises the SEC denition of proved reserves. Further

information on proved reserves can be found in BGGroups Annual

Report and Accounts 2012, page128.

Probable reserves

BGGroup adopted the SEC denition of probable reserves in 2009.

Further information on probable reserves can be found in BGGroups

Annual Report and Accounts 2012, page128.

Discovered resources

Discovered resources are dened by BGGroup as the best estimate of

recoverable hydrocarbons where commercial and/or technical maturity

is such that project sanction is not expected within the next three years.

Risked exploration

Risked exploration resources are dened by BGGroup as the best

estimate (mean value) of recoverable hydrocarbons in a prospect

multiplied by the chance of success.

Total resources

Total resources are dened by BG Group as the aggregate of proved

and probable reserves plus discovered resources and risked exploration.

Total resources may also be referred to as total reserves and resources.

The term gross reserves means gross proved reserves plus gross

probable reserves.

For details of BGGroups Reserves and Resources as at 31December2012,

see page 15 of BG Groups Annual Report and Accounts 2012.

US investors should refer to the explanatory note on page36 of this

Data Book.

For the purpose of this document the following denitions apply:

2D Two-dimensional seismic

3D Three-dimensional seismic

$ or US$ US Dollars

or UK UK Pounds Sterling

bbls Barrels

bcf Billion cubic feet

bcfd Billion cubic feet per day

bcm Billion cubic metres

bcma Billion cubic metres per annum

BGGroup

or the Group

BGGroup plc and its subsidiary undertakings,

joint ventures or associated undertakings

billion or bn One thousand million

boe Barrels of oil equivalent. BG Group uses a conversion

factor of 1 boe equals 6 000 cubic feet of natural gas

boed Barrels of oil equivalent per day

bopd Barrels of oil per day

btu British thermal units

CIF Carriage, insurance and freight

cm Cubic metre

CNG Compressed natural gas

CO

2

e Carbon dioxide equivalent

CSG Coal seam gas

DCQ Daily Contracted Quantity

delivered volumes Comprises all LNG volumes discharged in a given period,

excluding LNG utilised by the ships

DoC Declaration of Commerciality

drill stem test A procedure for isolating and testing the area

surrounding a well

DST Drill stem test

E&A Exploration and Appraisal

E&P Exploration and Production

EIA Environmental Impact Assessment

EPC Engineering Procurement Construction

EWT Extended well test

extended well test A test to evaluate production and characteristics

of a reservoir

FEED Front End Engineering Design

FOB Free On Board

FPSA Final Production Sharing Agreement

FPSO Floating production, storage and ofoading vessel

GSA Gas Sales Agreement

GWh Gigawatt hours

04 www.bg-group.com Data Book 2013

DEFINITIONS

10

8

6

4

2

0

2010 2011 2012

1.6

4.9

9.3

Gas

Oil & liquids

BG Group net production (mmboe)

0 100 km

CABINAS

SOUTH

ATLANTIC

OCEAN L

U

L

A

M

E

X

I

L

H

O

P

I

P

E

L

I

N

E

C

A

B

I

N

A

S

P

I

P

E

L

I

N

E

M

A

R

I

C

P

I

P

E

L

I

N

E

RIO DE JANEIRO

CARAGUATATUBA

BRAZIL BRAZIL

BM-S-50

BM-S-11

BM-S-9

BM-S-10

Iracema

Iara

Lula

Carioca

Sapinho

BRAZIL

BAR-M-215

BAR-M-217

BAR-M-298

BAR-M-300

BAR-M-252

BAR-M-254

BAR-M-340

BAR-M-342

BAR-M-388

BAR-M-344

0 100 km

BG GROUP IS DEVELOPING ITS WORLD-CLASS

BIG FIVE DISCOVERIES IN THE SANTOS BASIN.

BRAZIL IS A KEY GROWTH ASSET IN THE GROUP

PORTFOLIO, OFFERING SIGNIFICANT RESERVES AND

EASE OF ACCESS TO WORLD CRUDE OIL MARKETS.

NEW INFORMATION

First FPSO on Sapinho commenced production

Second FPSO on Lula (Lula North-East)

commenced production

Joint venture FPSO programme increased

to 15 vessels

Awarded 10 exploration blocks in the

Barreirinhas Basin

KEY DATES

2000 Acquired pre-salt non-operated acreage

in the Santos Basin

2006 Lula (BM-S-11) oil and gas discovery made

in the Santos Basin

2008 Sapinho announced as an oil discovery

on BM-S-9

Iara announced as a material oil discovery

on BM-S-11

2010 Production from rst permanent FPSO

on Lula commenced

2011 Reserves and resources doubled since

2010; upside potential 8 billion boe*

Reservoir performance signicantly

reduces unit costs; unit resource

value increased

BG Group has interests in four blocks in the

Santos Basin, offshore Brazil. The exploration

success, scale of resources discovered and

production performance in the Santos Basin to

date have been exceptional. BG Group currently

has three permanent oating production,

storage and ofoading (FPSO) vessels from

which it is exporting crude oil. The rst vessels

on the Lula and Sapinho elds were brought

into production around four years after

exploration success.

In June 2011, BG Group issued a material

reserves and resources upgrade* for its interests

in the pre-salt Santos Basin. Mean total reserves

and resources are estimated to amount to some

6 billion barrels of oil equivalent (boe) net to

BG Group. The aggregate range of total reserves

and resources net to BG Group is from

4 billion boe (P90) to 8 billion boe (P10).

The Lula, Sapinho, Iracema, Iara and Carioca

discoveries account for 95% of BG Groups total

reserves and resources in the Santos Basin.

In July 2012, BG Group received updated

independent expert certication of these

resource estimates from the oil and gas

consulting rm Miller and Lents, Ltd (MLL).

This certication conrmed BG Groups current

estimate of the reserves and resources range

of 4 billion boe to 8 billion boe, with a mean

of 6 billion boe*. MLL was given full access to

BG Groups data and development models

for these elds in order to undertake its

probabilistic analysis**.

* Based on BG Group estimates, not the operator or consortium view

** MLL was not asked to differentiate reserves from total discovered resource volumes

05

BRAZIL

KEY TO OPERATIONS

Gas pipeline

Proposed gas pipeline

Oil

Oil pipeline

BG Group operated block

BGGroup non-operated block

AREAS OF OPERATION

Brazil 2

Barreirinhas Basin

Brazil 1

Santos Basin

1

2

The current 15 FPSO programme in the

Santos Basin will deliver 2.6 mmboed of gross

capacity and some 500 kboed of production

net to BG Group by 2020.

In BG Groups view*, the full development of

the BM-S-9 and BM-S-11 elds could result in

peak BG Group net production well in excess

of 600 kboed at current equity levels.

The low unit cost of the Santos Basin

development is a result of the excellent reservoir

characteristics, which deliver high margins and

an economic break-even at less than $40/bbl.

Upstream: E&P

BM-S-9

Sapinho

In 2008, the Sapinho well (BG Group 30%)

was announced as a discovery. Since the initial

discovery there have been further drilling

successes including Sapinho North and

Sapinho South.

In 2011, BG Group and partners announced

the Declaration of Commerciality (DoC) with

the Brazilian National Agency of Petroleum,

Natural Gas and Biofuels (ANP) for the

accumulation of light oil and gas in the

Sapinho area. The DoC marks the start

of the commercial production phase for

the eld and sets the licence period to run

to 2038. In January 2013, rst production from

the Sapinho eld commenced through the

120 000 barrels of oil per day (bopd) and

177 million standard cubic feet of gas per day

(mmscfd) FPSO Cidade de So Paulo (FPSO 2).

Following commissioning of the gas processing

and reinjection systems, the facility produced

around 25 000 boed from just one well. Further

wells are expected to be connected through

2013 and 2014 enabling the vessel to achieve

full capacity.

In February 2013, an extended well test started

in the Sapinho North area in preparation for

the next phase of development in the northern

area of the eld. A further FPSO (FPSO 4),

with capacity of up to 150 000 bopd and

212 mmscfd gas, is planned to be in operation

in the third quarter of 2014.

Carioca

In 2007, the Carioca well (BG Group 30%) was

declared a discovery. Since the initial discovery

there have been further drilling successes

including Iguau, Abar West, Carioca

North-East, Abar and in August 2013

Iguau Mirim.

In 2011, the results of an extended well

test (EWT) on Carioca North-East indicated

potential production of approximately

28 000 bopd, above initial expectations.

DoC is expected to be taken on the Carioca eld

by the end of 2013 with rst production scheduled

for 2016, from a single FPSO development.

BM-S-10

In 2006, the Parati well (BG Group 25%) was

declared a discovery. Work continues on this

discovery and the remaining prospectivity.

BM-S-11

Lula and Iracema

Lula and Iracema in BM-S-11 (BG Group 25%)

are very large structures with signicant

reserves potential. The Lula discovery well

was drilled in 2006 and the Iracema discovery

well, which conrmed the presence of light

oil in the north-west of the evaluation area,

was drilled in 2009.

There has been signicant activity on Lula and

Iracema since the original discoveries were made

including appraisal wells, drill stem tests (DSTs),

EWTs and the start-up of the rst two

permanent FPSOs.

SANTOS BASIN BLOCKS

Block BG Group (%) Partners (%) Discoveries

BM-S-9 30 Petrobras 45, Repsol Sinopec Brasil 25 Carioca, Sapinho, Iguau,

Abar West, Abar, Iguau Mirim

BM-S-10 25 Petrobras 65, Partex 10 Parati

BM-S-11 25 Petrobras 65, Petrogal Brasil 10 Lula, Iara, Iracema

BM-S-50 20 Petrobras 60, Repsol Sinopec Brasil 20 Sagitrio

BIG FIVE DISCOVERIES

Discovery Block Exploration well DoC First FPSO production

Lula BM-S-11 2006 2010 2010

Sapinho BM-S-9 2008 2011 2013

Iracema BM-S-11 2009 2010 Expected 2014

Carioca BM-S-9 2007 Expected 2013 Expected 2016

Iara BM-S-11 2008 Expected 2013 Expected 2017

The rst EWT, on Lula, owed rst oil in May 2009

and completed operations in December 2010.

A second EWT, on Lula North-East, commenced

operations in April 2011 and completed operations

in November 2011.

A third EWT, on Iracema, commenced

operations in March 2012 and operated

in the area for approximately six months.

The information gathered will support

the development of a 150 000 bopd and

283 mmscfd gas capacity FPSO (FPSO 5),

planned to be in operation in the fourth

quarter of 2014.

Production from the rst permanent FPSO

on the Lula eld commenced in October 2010.

The FPSO Cidade de Angra dos Reis (FPSO 1)

has capacity to process up to 100 000 bopd

and up to 177 mmscfd gas. The FPSO has been

producing close to capacity from just four

producing wells, one injector well and one

water alternating gas (WAG) well.

Production from the second permanent FPSO,

at Lula North-East, commenced in June 2013.

The FPSO Cidade de Paraty (FPSO 3) has capacity

to process 120 000 bopd and 177 mmscfd gas.

Following commissioning of the gas processing

and reinjection systems in August 2013, the

facility produced around 30 000 boed from

just one well. Further wells are expected to be

connected through 2013 and 2014 for the vessel

to achieve full capacity.

Following the addition of two FPSOs to the

partnerships Lula eld development plan in

2012, studies are ongoing by the partnership

into further FPSOs for Lula. BG Group expects

decisions on potential further expansion

to be supported by data from wells being

drilled in the southern and northern ends

of the eld, and EWT results in 2013 and 2014.

In October 2012, WAG secondary recovery

mechanisms started in Lula with the rst

water injection cycle. This shifted to the gas

injection cycle in June 2013.

* Based on BG Group estimates, not the operator

or consortium view

06 www.bg-group.com Data Book 2013

Iara

In 2008, BG Group announced the successful

completion of drilling on the Iara well, also in

the BM-S-11 concession on a step-out block.

In 2011, BG Group announced the successful

completion of drilling on the Iara Horst well.

The well encountered good quality oil in a thick

reservoir section. Initial results from Iara Horst

demonstrated superior reservoir characteristics

to the discovery well located around eight

kilometres away. A DST, completed in 2011,

conrmed reservoir quality and well productivity.

In April 2012, BG Group announced the

successful completion of drilling on the Iara

West well. The results conrmed the westerly

extension of the Iara accumulation and

demonstrated the high potential of the pre-salt

reservoirs within that area. In July 2013, a fourth

appraisal well at Iara was drilled and tested

with excellent results. As of July 2013, a further

Iara appraisal well is underway. This is a

high-angle well drilling through the reservoir.

Iara is a giant eld with similar oil in place to

Lula. At present, the operator has a placeholder

of just two FPSOs for Iara. The partners are

currently working on front-end development

ideas. BG Group expects decisions on the

expansion of the eld development plan to

follow the major 2013 and 2014 appraisal

programme. The DoC on Iara is expected

to be taken by the end of 2013.

BM-S-50

In February 2013, the Sagitrio well

(BG Group 20%) was declared a discovery.

It was the rst well to be drilled on the

BM-S-50 concession and conrmed the

presence of good quality oil. Appraisal

activities are being planned for 2014.

Barreirinhas Basin

In May 2013, BG Group was awarded 10 offshore

blocks in the Barreirinhas Basin, along Brazils

northern equatorial margin. Concession

contracts are expected to be signed with

the ANP later in 2013. BG Groups equity

in the blocks is:

Six blocks 100% holding; and

Four blocks 50% and operator,

partnering Petrobras (40%) and

Galp (10%). This partnership replicates

the BM-S-11 consortium currently

developing the giant Lula and Iara elds.

FPSOs

BG Group is progressing a further 12 FPSOs,

six leased and six owned, in addition to

the three currently producing on Lula and

Sapinho. These are due to come onstream

progressively over the period to 2018 and

provide gross capacity of 2.6 mmboed.

Oil evacuation

During 2011, BG Group took delivery of the oil

tanker Windsor Knutsen, which is being used

to transport BG Groups equity oil from Brazil.

The Windsor Knutsen was converted from a

conventional Suezmax tanker into the worlds

largest shuttle tanker, with the capacity to

hold 1.1 million barrels (mmbbls) of crude oil.

First crude oil from the Lula FPSO was lifted

in July 2011 and delivered in August 2011. As at

July 2013, a total of 14 liftings of 1 mmbbls have

been made from the permanent facilities at

Lula and Sapinho by BG Group. The Group

has also committed to charter four further

Suezmax shuttle tankers. The Samba Spirit

arrived in Brazil in June 2013, with two of the

other three vessels scheduled for delivery

later in 2013, and the third in early 2014. Oil

evacuation activities are managed by GEMS

(see pages 32 to 34 for details).

Gas evacuation

Development plans for the associated gas

resources in the Groups Santos Basin interests

have continued to advance.

In 2010, a new pipeline was installed connecting

the Lula eld to the Mexilho gas hub. This

pipeline has been used to export gas from

FPSO 1 since September 2011 and will also be

connected to the second and third FPSOs.

A second export route, the Cabinas pipeline,

is currently under construction. The pipeline

will span approximately 380 kilometres and will

connect the Lula eld to a terminal in Cabinas,

180 kilometres north-east of Rio de Janeiro.

The pipeline represents the next major phase

of gas export infrastructure, providing capacity

for up to four additional FPSOs.

FPSO SCHEDULE

Number Field Location/reference Chartered/owned Start-up

Capacity oil

(kbopd)

Capacity gas

(mmscfd)

1 Lula Lula Chartered 2010 (onstream) 100 177

2 Sapinho Sapinho South Chartered 2013 (onstream) 120 177

3 Lula Lula North East Chartered 2013 (onstream) 120 177

4 Sapinho Sapinho North Chartered 2014 150 212

5 Iracema Iracema South Chartered 2014 150 283

6 Iracema Iracema North Chartered 2015 150 283

7 Lula Lula Alto Chartered 2016 150 212

8 Lula Lula Central Chartered 2016 150 212

9 Carioca Carioca Chartered 2016 100 177

10 Lula Lula South Owned 2016-2018 150 212

11

BM-S-9 and BM-S-11 (5 replicant hulls)

P67 Owned 2016-2018 150 212

12 P68 Owned 2016-2018 150 212

13 P69 Owned 2016-2018 150 212

14 P70 Owned 2016-2018 150 212

15 P71 Owned 2016-2018 150 212

07

10

8

4

6

2

0

2010 2011 2012

7.7 7.6

9.2

Gas

BG Group net production (mmboe)

Oil & liquids

0 120 km

Queensland Curtis LNG

GLADSTONE

ROMA

CHINCHILLA

SURAT

MILES

CONDAMINE

TARA

KOGAN

DALBY

TOOWOOMBA

ST GEORGE

MOURA

THANGDOL

ROCKHAMPTON

EMERALD

BLACKWATER

MORANBAH

CLERMONT

MACKAY

COLLINSVILLE

BOWEN

TOWNSVILLE

BRISBANE

Export pipeline

Gas collection header

QUEENSLAND QUEENSLAND

NEW SOUTH WALES

QUEENSLAND

S

O

U

T

H

A

U

S

T

R

A

L

I

A

0 120 km

BG GROUP IS DEVELOPING A TWO-TRAIN 8.5 MTPA LNG

PLANT SUPPLIED BY COAL SEAM GAS, WITH FIRST LNG

EXPECTED IN 2014. AUSTRALIA IS A KEY GROWTH ASSET

AND HAS MULTIPLE EXPLORATION OPPORTUNITIES AND

POTENTIAL FOR EXPANSION.

NEW INFORMATION

Binding agreements signed for the sale

of certain interests in the QCLNG project

for $1.93 billion

KEY DATES

2008 Alliance with Queensland Gas Company

(QGC) established

2009 QGC acquisition completed

Pure Energy acquired

2010 Queensland Curtis LNG (QCLNG)

project sanctioned

Contract signed with CNOOC for sale

of 3.6 mtpa of LNG

2011 Contract signed with Tokyo Gas

for sale of 1.2 mtpa of LNG

Agreement signed with Chubu

Electric Power for sales of up to

122 LNG cargoes

BG Group entered Australia in 2008 via an

alliance with Queensland Gas Company (QGC),

acquiring a 20% interest in QGCs coal seam

gas (CSG) assets in the Surat Basin, southern

Queensland, and a 9.9% stake in QGC. After a

successful drilling campaign and the decision

to develop a multi-train LNG project, the Boards

of BG Group and QGC agreed the terms of

a takeover, completed in 2009. To secure

additional CSG resource BG Group also acquired

Pure Energy Resources Limited in 2009.

Upstream: E&P

Production

Production is currently sold into the domestic

market. Future production will principally

supply the LNG project. On plateau, it is

envisaged that gross production to supply

the LNG plant and the domestic market will

be around 250 000 boed.

QCLNG project

The rst phase upstream development

is expected to comprise approximately

2 000 wells by the end of 2014, rising to

more than 6 000 wells over the life of the

two LNG trains. Drilling is on track, with more

than 1 500 wells drilled by end of July 2013.

BG Group expects to drill on average 50 wells

per month and at the end of July 2013 had

11 drilling rigs operating in the Surat Basin.

The rst water treatment plant, at Windibri,

is in operation and has a capacity of some

six million litres per day. The rst major water

treatment facility at Kenya, a 98 million litre per

BG Groups Australian reserves and resources

at the end of 2012 were 29 tcf (gross). The Group

owns interests in onshore concessions covering

about 33 000 square kilometres. To date, only

a fraction of the total area under lease has

been explored.

QCLNG

BG Group is developing a two-train 8.5 mtpa

LNG plant supplied by CSG. The plant is being

built on a 270 hectare site on Curtis Island,

Gladstone, on the Queensland coast. First LNG

exports are expected in 2014.

BG Group is constructing a 540 kilometre

pipeline network to link the gas elds in the

Surat Basin to the LNG plant on Curtis Island.

At the end of July 2013, BG Group had contracts

and other agreements in place for more than

95% of the $20.4 billion total budget for the rst

phase scope to the end of 2014. At this stage,

the rst phase scope of the project was around

64% complete on a value of work done basis.

08 www.bg-group.com Data Book 2013

AUSTRALIA

KEY TO OPERATIONS

Gas pipeline

Gas export pipeline

Gas collection header

BGGroup acreage interests

AREAS OF OPERATION

QCLNG Phase 1

Bowen CSG

Bowen Deep Gas

Surat CSG

Australia 1

Surat and

Bowen Basins

Australia 2

Cooper Basin

1

2

BG Group 50

CNOOC 50

Partners QCLNG Train 1

*

(%)

* Reects equity interests post completion of binding

agreements signed in May 2013

BG Group 97.5

Tokyo Gas 2.5

Partners QCLNG Train 2

(%)

day plant, has been commissioned and rst

water was exported in July 2013. Activity is also

well advanced at the Ruby Jo central processing

plant (CPP) and the six associated eld

compressor stations (FCS). These facilities

are critical for delivering rst LNG in 2014.

In 2010, BG Group and Australia Pacic

LNG (APLNG) agreed a framework for the

development of jointly owned CSG tenements

ATP 648P and ATP 620P. BG Group also entered

into conditional gas purchase agreements with

APLNG under which BG Group expects to buy

190 petajoules (PJ) of gas over an initial two-year

period from APLNG, reducing thereafter to an

average of 25 PJ per annum. The start of gas

sales is aligned with the start of commercial

operations at the QCLNG project.

Additionally, to help manage gas ramp-up,

BG Group has entered into an agreement

with AGL Energy Limited (AGL) whereby AGL

will use a depleted eld near Wallumbilla

in the Surat Basin to store QGC gas for a fee

for seven years from 2011.

The QCLNG project involves the construction

of a 200 kilometre, 42-inch gas collection header

pipeline, a 340 kilometre, 42-inch export pipeline

to Gladstone and additional pipeline to gather

nearby CSG resources. The entire gas collection

header is now in the ground and backlled. At

the end of July 2013, all of the mainline welding

for the export pipeline was complete, with over

75% of the pipeline lowered into the ground.

Importantly, the 2.3 kilometre Narrows Crossing

pipeline was laid across Gladstone harbour in

February 2013 without injury or incident. This

was a signicant engineering achievement and

Australias longest large-diameter underwater

pipe-pull. It is the rst gas pipeline to connect

Curtis Island with the mainland. The full pipeline

is expected to be completed by the end of 2013.

Upstream: Liquefaction

QCLNG project

Construction of the 8.5 mtpa LNG plant

continues on Curtis Island, with activities

completed at the module pre-fabrication yard

in Thailand. All 62 modules required for Train 1

and ve of the 18 modules that support

Train 2 have been delivered. The remaining

modules for Train 2 are scheduled to be

delivered by year end. Both LNG storage tank

roofs were raised in the rst half of 2013. It is

anticipated that the LNG plant will be ready to

start commissioning with gas around the end of

2013. First LNG sales are expected to commence

in the second half of 2014.

Exploration activities

BG Group has multiple exploration opportunities

in Australia, in addition to CSG being developed

in the Surat Basin, which could be used to

underpin a potential third LNG train at the

QCLNG project.

In the Bowen Basin, BG Group has both CSG

and deep gas sands opportunities. In the

Bowen CSG, appraisal is ongoing. Testing is

nearing completion in the Bowen deep gas sands

where four wells have been drilled, including one

of the deepest wells ever in Queensland.

In the Cooper Basin, BG Group and its partner

Drillsearch are exploring both tight gas sands

and shale gas potential. 3D seismic acquisition

has been carried out and the partners are

looking to commence drilling later in 2013.

LNG Shipping & Marketing

QCLNG is rmly underpinned by BG Groups

global LNG supply agreements, including sales

to Chile, China, Japan and Singapore.

In 2010, BG Group signed a LNG sales contract

with CNOOC. Under the terms of parallel

agreements between BG Group and CNOOC:

CNOOC will be supplied with 3.6 mtpa

of LNG over a 20-year period;

CNOOC acquired a 5% equity interest in the

reserves and resources of certain BG Group

tenements in the Surat Basin in Queensland;

CNOOC became a 10% equity investor in

Train 1; and

BG Group and CNOOC agreed to participate

jointly in a consortium to construct two

LNG ships in China that will be owned

by the consortium.

Further, on 31 October 2012, BG Group

announced it had signed a Heads of Agreement

(HoA) with CNOOC for the sale of certain

interests in the QCLNG project for $1.93 billion

and the sale of an additional 5 mtpa of LNG

from BG Groups global portfolio, beginning

in 2015. Additionally, CNOOC will reimburse

BG Group for its share of QCLNG project

expenditure incurred from 1 January 2012.

In May 2013, BG Group announced it had

signed binding agreements covering the HoA.

Completion of the transaction is expected

by the end of 2013, subject to government,

regulatory and other relevant approvals

and to the nalising and execution of certain

other related documentation. Under the

terms of the agreements:

CNOOC will acquire a 40% equity interest in

Train 1, increasing its equity ownership from

10% to 50%;

CNOOC will acquire a 20% equity interest in

reserves and resources of certain BG Group

tenements in the Surat Basin, increasing its

equity ownership from 5% to 25%;

CNOOC will acquire a 25% working interest

in certain upstream tenements held by

BG Group in the Bowen Basin;

BG Group and CNOOC will jointly invest in

the construction of two further LNG ships

in China; and

CNOOC will have the option to participate

as a 25% partner in the rst of any potential

expansion trains at QCLNG.

The agreements exclude any interest in the

Train 2 liquefaction facility, pipelines and

QCLNG project common facilities**.

In 2011, BG Group signed a sales agreement

with Tokyo Gas. Under the agreement:

Tokyo Gas will buy 1.2 mtpa of LNG for

20 years from 2015;

Tokyo Gas acquired a 1.25% interest in the

reserves and resources of certain BG Group

tenements in the Walloons Fairway; and

Tokyo Gas became a 2.5% equity investor in

the second of the two liquefaction trains.

BG Group also signed a sales agreement with

Chubu Electric Power Co. Inc, (Chubu Electric)

for the long-term supply of LNG. Under the

agreement, Chubu Electric will purchase up

to 122 cargoes over 21 years, starting in 2014.

Condamine Power Station

BG Group also operates Condamine Power

Station, which is fuelled by CSG produced

at QGCs gaselds in the Surat Basin.

With a potential generating capacity of

140 megawatts, the station provides power

to the National Electricity Market.

** BG Group retains majority ownership of the QCLNG project.

In particular, BG Group will have:

Around 74% of its original interest in the upstream

resource and related infrastructure; and

100% of the projects common facilities on Curtis Island

(including LNG storage tanks and jetty) and the

540 kilometre natural gas pipeline network linking

the gas elds to Curtis Island. Together, these items

represent approximately 30% of the estimated

$20.4 billion 2011-2014 project spend

09

60

40

20

0

2010 2011 2012

54.1

49.4

48.1

Gas

Oil & liquids

BG Group net production (mmboe)

MEDITERRANEAN SEA

ALEXANDRIA

EGYPT EGYPT

IDKU

DAMIETTA LNG

PORT SAID

CAIRO

Silva

SimSat-P1

Simian, Sienna

Mina-1

Sienna-Up

Rashid North

Solar

SimSat-P2

Swan

Sapsat-2

Sapsat-1

Sama

Egyptian LNG Trains 1 & 2

Serpent, Sparrow

Scarab, Saffron

Sapphire

Saurus

Libra

Sequoia

East El Burullus

Rashid -1,-2,-3

El Manzala

Harmattan Deep-1

El Burg

N. Gamasa

0 100 km

BGGROUP PLAYED A LEADING ROLE IN THE

DEVELOPMENT OF EGYPTS NATURAL GAS INDUSTRY,

AND IS ONE OF THE COUNTRYS LARGEST GAS

PRODUCERS. THE GROUPS ACTIVITIES IN EGYPT SPAN

THE GAS CHAIN FROM EXPLORATION, THROUGH

DEVELOPMENT AND PRODUCTION, TO LNG.

NEW INFORMATION

West Delta Deep Marine (WDDM) Phase 9a

sanctioned and commenced

Farm-in to East El Burullus concession

KEY DATES

1995 Rosetta and WDDM

Concessions awarded

2001 Rosetta rst production

2003 Scarab, Saffron rst production

2004 Additional 40% in Rosetta acquired

2005 Egyptian LNG Trains 1

and 2 exports began

Simian, Sienna and Sapphire onstream

2009 Start-up of Sequoia eld

unitised development

2011 WDDM Phase 7 pipeline project onstream

2012 WDDM Phase 7 compression

project onstream

WDDM Phases 8a and 8b onstream

BGGroups business in Egypt comprises:

Operatorship of two gas-producing areas

offshore the Nile Delta:

the Rosetta Concession; and

the WDDM Concession.

Operatorship of three other concessions

offshore the Nile Delta:

El Manzala Offshore (EMO);

El Burg Offshore (EBO); and

North Gamasa Offshore (NGO).

Non-operated interest in the East El Burullus

Offshore Concession (EEBO); and

Major shareholdings in the two-train

Egyptian LNG project.

Upstream development and production activities

in Egypt are undertaken through joint operating

companies. In the case of Rosetta, this is through

Rashid Petroleum Company (Rashpetco), and in

the case of WDDM, this is through Burullus Gas

Company (Burullus). These operating companies

are 50% owned by the Egyptian General

Petroleum Corporation (EGPC), the body

representing the Egyptian government in the

petroleum sector. BG Group and its partners in

each concession hold the remaining 50%.

Upstream: E&P

Rosetta Concession

Rosetta supplies gas to the domestic market

and started production in 2001, with RN1

and RN2 reservoirs onstream in 2008.

Sequoia

The unitised development (Rosetta

Phase 4/WDDM Phase 6) of the Sequoia

eld (BG Group 62.99%), which lies across

the boundary of the WDDM and Rosetta

Concessions, was sanctioned in 2008.

It consists of six sub-sea wells: three wells

on each of WDDM and Rosetta tied back

to existing infrastructure.

WDDM Concession

Since 1994, BG Group and partners have

discovered 19 gas elds, with Scarab, Saffron,

Simian, Sienna, Sapphire, Serpent, Saurus, Sequoia,

SimSat-P2, Sapsat-1, Sapsat-2 and Swan in

production. WDDM supplies gas to the domestic

market and Egyptian LNG at Idku. In 2013, the

currently producing third-party Libra eld was

proved to extend into the WDDM Concession.

10 www.bg-group.com Data Book 2013

EGYPT

KEY TO OPERATIONS

Gas

Gas pipeline

Oil pipeline

BGGroup-operated block

BGGroup non-operated block

AREAS OF OPERATION

20 80 20

50 10 40 10

50 50

25 50 25

BG Group Edison

EGPC PETRONAS

Rosetta Concession*

Rashid Petroleum Company

WDDM Concession*

Burullus Gas Company

* BG Group operator

Partners (%)

Scarab, Saffron

Scarab, Saffron, the rst deep water sub-sea

developments in Egypt, started production in

2003 and supply gas to the domestic market.

These facilities consist of eight sub-sea wells

connected to a sub-sea manifold, in turn

connected by pipelines to an onshore

processing terminal. Electrical and hydraulic

lines connect the wells to the onshore control

room. The elds are located approximately

90 kilometres from the shore and in water

depths of more than 700 metres.

Simian, Sienna and Sapphire

The Simian and Sienna elds supply

Egyptian LNG Train 1, while the Sapphire

eld supplies Egyptian LNG Train 2. These

elds are located approximately 120 kilometres

offshore Idku, near Alexandria. The facilities

consist of 16 sub-sea wells tied into the existing

WDDM gas gathering network and a shallow

water control platform. The onshore processing

facilities form part of the Idku Gas Hub where

the Egyptian LNG facilities are located.

WDDM additional phases

The WDDM elds have undergone a

number of development phases to maximise

hydrocarbon recovery. Phase 4 brought seven

additional wells onstream during 2008, with

Phase 6 in 2009 adding three unitised Sequoia

wells, and Phases 8a and 8b delivering another

17 sub-sea wells between 2011 and 2012. With

the completion of the Phase 8a and 8b projects,

the WDDM Concession has a total of 53 sub-sea

wells. Phases 5 and 7 were compression projects,

including installation of seven onshore

compressors in total and additional gas

gathering and receiving facilities, including a

new 68 kilometre, 36-inch offshore pipeline.

After the onset of production declines,

as a result of increased water production,

BG Group and partners initiated a four-point

recovery plan incorporating:

Improved forecasts of eld performance;

Increased production from existing well stock

(for example, through sub-sea workovers);

The Phase 9a drilling programme; and

Near-eld exploration close to existing

infrastructure.

Phase 9a was sanctioned in the rst quarter

of 2013 and the drilling programme commenced

in May. Production is expected in the second

half of 2014.

El Manzala Offshore and El Burg

Offshore Concessions

In 2005, BG Group signed the EBO and EMO

concession agreements for the exploration

of gas and oil with the Egyptian Natural Gas

Holding Company (EGAS). Exploration drilling

on EBO and EMO commenced in 2008.

BG Group holds 50% equity in EMO, upon which

the Zonda well was drilled in 2011 but failed to

discover commercial hydrocarbons. A two-well

programme on EBO commenced in 2012. The

rst well, Harmattan Deep-1, was declared a

discovery in July 2012, while the high-impact,

long-duration Notus well, which is testing a

new Oligocene play, commenced drilling in

late 2012 with a result expected later in 2013.

North Gamasa Offshore Concession

BG Group holds 60% equity in, and is

operator of, Block 1. The block covers an

area of 281 square kilometres and is located

20 kilometres from the coast in shallow water.

The concession agreement formalising the award

was signed in early 2010 with 3D seismic

acquisition completed later that year.

East El Burullus Offshore Concession

BG Group farmed in to the EEBO Concession

in 2012, taking a 40% interest, with the partners

scheduled to drill the Kala-1 well in the third

quarter of 2013. This prospect is located close

to the existing WDDM Infrastructure.

Upstream: Liquefaction

Egyptian LNG

The Egyptian LNG facilities, located at Idku,

comprise the two LNG production trains and

include the common facilities such as storage

tanks, loading jetty and utilities.

Egyptian LNG Company owns both the

Egyptian LNG site and common facilities.

Its sister company, The Egyptian Operating

Company for Natural Gas Liquefaction Projects

(Opco) (BG Group 35.5%) undertakes the

operation of all trains and common facilities.

El Beheira Natural Gas Liquefaction Company

(Train 1 Co.) (BG Group 35.5%) owns Train 1,

and Idku Natural Gas Liquefaction Company

(Train 2 Co.) (BG Group 38%) owns Train 2.

BG Group and partners supply Trains 1 and 2

of Egyptian LNG with gas from the Simian,

Sienna, Sapphire and Sequoia elds in WDDM.

Together, these trains have a productive

capacity of 7.2 mtpa of LNG.

The 3.6 mtpa productive capacity of Train 1 has

been sold to GDF SUEZ under a 20-year SPA.

The rst LNG cargo was lifted in May 2005.

The 3.6 mtpa productive capacity of Train 2 has

been sold under a 20-year agreement to BGGM,

a wholly owned BG Group subsidiary which is

operated by GEMS. The rst LNG cargo was

lifted in September 2005.

GDF SUEZ 100% BGGroup 50%

Train 1 3.6 mtpa

Tolling plant

BGGroup 35.5%

PETRONAS 35.5%

EGPC 12%

EGAS 12%

GDF SUEZ 5%

565 mmscfd

WDDM

BGGroup 100% BGGroup 50%

Train 2 3.6 mtpa

Tolling plant

BGGroup 38%

PETRONAS 38%

EGPC 12%

EGAS 12%

565 mmscfd

WDDM

Gas supply Train equity LNG purchase

Upstream Train equity Downstream

T

r

a

i

n

1

(

s

t

a

r

t

d

a

t

e

2

0

0

5

)

T

r

a

i

n

2

(

s

t

a

r

t

d

a

t

e

2

0

0

5

)

Gas LNG

Gas LNG

11

WDDM: INTEGRATED UPSTREAM PROJECT

50

40

30

20

10

0

2010 2011 2012

37.8 37.4

36.0

Gas

Oil & liquids

BG Group net production (mmboe)

CPC

BLACK SEA

CASPIAN SEA

BOLSHOI CHAGAN

ORENBURG

ATYRAU

TENGIZ

AKTAU

ASTRAKHAN

NOVOROSSIYSK

UKRAINE UKRAINE

KAZAKHSTAN KAZAKHSTAN

RUSSIA RUSSIA

CPC

Karachaganak

Atyrau-Samara

pipeline

Karachaganak

-to-CPC pipeline

BG GROUP HAS BEEN ACTIVE IN KAZAKHSTAN FOR

MORE THAN 20 YEARS. IT IS JOINT OPERATOR OF THE

GIANT KARACHAGANAK GAS CONDENSATE FIELD,

WHERE IT HAS A 40-YEAR CONCESSION, AND IS A

SHAREHOLDER IN THE CASPIAN PIPELINE CONSORTIUM.

Upstream: E&P

Karachaganak

Karachaganak, discovered in 1979, is one of

the worlds largest gas and condensate elds.

Located in north-west Kazakhstan, it holds

estimated hydrocarbons initially in place (HIIP)

totalling 9 billion bbls of condensate and 48 tcf

of gas, with estimated gross reserves of more

than 2.4 billion bbls of condensate and 16 tcf

of gas. Only around 10% of the HIIP has been

recovered to date.

Production from the Karachaganak eld

began in 1984. Since the signing of the Final

Production Sharing Agreement (FPSA) in 1997,

the Karachaganak partners have made

substantial investment in wells, facilities and

pipelines. In addition to its size, Karachaganak

presents the operators with formidable

challenges because of extreme climate swings

(+/- 40 degrees centigrade) and the requirement

to re-inject high pressure sour gas.

The FPSA envisaged a phased development

programme. Phase 2, which came onstream

in 2004, involved investment to enhance the

existing facilities, construction of new gas and

liquids processing and gas injection facilities,

workover of more than 100 wells, construction

of a 120 megawatt power station and a new

650 kilometre pipeline to connect the eld to

the CPC pipeline at Atyrau.

Most of the liquids are exported to the west

(92% in 2012), with some oil and all raw gas

sold locally and into Russia. Since 2004, oil

exports have been mainly via the CPC pipeline

and, since 2006, additional oil exports have

been routed via the Atyrau-Samara pipeline

enabling sales to achieve international prices.

In 2011, a fourth liquids stabilisation train

commenced operation. The project increased

rm stabilisation capacity up to 10.3 mtpa.

KEY DATES

1997 Karachaganak FPSA signed

2004 Phase II Karachaganak

development completed

First exports via Novorossiysk

on the Black Sea

2006 Oil exports commenced via the

Atyrau-Samara pipeline

2008 Upstream and downstream cooperation

agreements with KazMunaiGas signed

2010 CPC expansion project sanctioned

2011 Start-up of the fourth liquids

stabilisation train

2012 Binding settlement agreement

resulting in KazMunaiGas joining

the contractor group

12 www.bg-group.com Data Book 2013

0 400 km

KAZAKHSTAN

AREAS OF OPERATION

KEY TO OPERATIONS

Gas and Oil/Condensate

Gas pipeline

Oil pipeline

Stabilised oil

Un-stabilised oil

Capacity 2012 * Firm capacity of 7.0 mtpa plus access

to additional capacity

Gas

Karachaganak export routes and capacity

KARACHAGANAK

FIELD

Orenburg

8.4 bcm

Small renery

0.6 mtpa

Gas

re-injection

Orenburg

4 mtpa

Atyrau-Samara

3.3 mtpa

CPC

8.4 mtpa*

BG Group (joint operator) 29.25

Eni (joint operator) 29.25 Kaz MunaiGas 10.00

Chevron 18.0

LUKOIL 13.50

Partners Karachaganak (%)

BG Group (joint operator) 29.25

Eni (joint operator) 29.25 KazMunaiGas 10.00

Chevron 18.0

LUKOIL 13.50

Partners Karachaganak

(%)

Stabilised oil

Un-stabilised oil

Capacity 2012 * Firm capacity of 7.0 mtpa plus access

to additional capacity

Gas

Karachaganak export routes and capacity

KARACHAGANAK

FIELD

Orenburg

8.4 bcm

Small renery

0.6 mtpa

Gas

re-injection

Orenburg

4 mtpa

Atyrau-Samara

3.3 mtpa

CPC

8.4 mtpa*

BG Group (joint operator) 29.25

Eni (joint operator) 29.25 Kaz MunaiGas 10.00

Chevron 18.0

LUKOIL 13.50

Partners Karachaganak (%)

BG Group (joint operator) 29.25

Eni (joint operator) 29.25 KazMunaiGas 10.00

Chevron 18.0

LUKOIL 13.50

Partners Karachaganak

(%)

In 2012, a settlement agreement between the

Republic of Kazakhstan (the Republic) and the

Karachaganak partners was completed. Under

the terms of the agreement, the Republic

acquired a 10% interest in the FPSA from the

consortium for $2.0 billion cash and $1.0 billion

non-cash consideration (pre-tax) including the

nal and irrevocable settlement of all cost

recovery claims, with each of the contracting

companies equity shares reducing

proportionately (BG Groups share reducing

from 32.5% to 29.25%). The Republics interest is

held by a subsidiary of the national oil company,

KazMunaiGas (KMG). The consideration under

the agreement also includes the allocation of

an additional 2 mtpa capacity in the CPC export

pipeline over the remaining life of the FPSA,

bringing total capacity for the use of the

Karachaganak project to 10 mtpa on completion

of the CPC expansion project, expected in 2015.

The partners are currently conducting a

programme aimed at extending the liquids

offtake from the eld. This includes an ongoing

drilling programme comprising horizontal

development wells into the oil rim and a

number of medium-sized projects intended

to de-bottleneck the elds gas processing

and injection facilities.

BG Group and its partners are also working

to dene the next phase of major eld

development. The Karachaganak Expansion

Project is exploring opportunities to identify

the optimal method of installing additional

gas handling capacity to maximise utilisation

of liquid stabilisation trains as the elds

gas-oil ratio increases.

KazMunaiGas (KMG) agreements

In 2008, BG Group announced an agreement

with KMG and its subsidiary KazMunaiGas

Exploration and Production (KMG EP) to

cooperate in exploring a range of upstream

opportunities in Kazakhstan and other countries.

In 2010, KMG EP acquired a 35% interest in

the P1722 licence in the UK North Sea, which

contained the White Bear prospect. The

prospect was drilled, but was written off

following post-well evaluation.

A second, downstream, cooperation agreement

was signed with KMG to examine ways to

increase gas utilisation in Kazakhstan. In 2010,

BG Group, in partnership with KazTransGas

(KTG), opened the rst CNG station in Almaty

where a eet of 200 CNG buses now operate.

In April 2013, BG Group concluded this highly

successful cooperation and signed an agreement

with KTG to transfer BG Group-owned CNG

equipment in the Almaty CNG station to KTG.

Other

Caspian Pipeline Consortium (CPC)

BG Group has a 2% equity share in the pipeline

but is entitled to 2.75 mtpa (55 000 bopd) of

capacity (around 10% of the total), which is

used to transport liquids. BG Group and

the Karachaganak partners also have the

opportunity to capture capacity unused by

other shareholders. Liquids deliveries into CPC

began in 2004 and, in 2012, 8.4 million tonnes

of liquids from Karachaganak were transported

via CPC (BG Group 2.1 million tonnes).

In 2010, the CPC shareholders sanctioned

the CPC expansion project, which will more

than double capacity in three phases, with

completion expected in 2015. Total gross

capacity will increase to 67 mtpa. Following

expansion, and the allocation of an additional

2 mtpa capacity to the Karachaganak partners

as part of the 2012 settlement agreement,

BG Groups entitlement will rise to 3 mtpa

(60 000 bopd) while the total capacity for

BG Group and the Karachaganak partners will

increase to 10 mtpa. The CPC expansion project

includes the addition of 10 pump stations in

Russia and Kazakhstan, six crude oil storage

tanks near Novorossiysk and a third single-point

mooring at the CPC Marine Terminal.

Shareholders CPC (%)

BGGroup 2.00

Russian government 24.00

Kazakh government 19.00

Chevron 15.00

LUKARCO 12.50

ExxonMobil 7.50

Rosneft-Shell 7.50

CPC Company 7.00

Eni 2.00

Oryx 1.75

KPV 1.75

13

M

E

D

I

A

N

L

I

N

E

NORTH SEA

B

R

E

N

T

NINIAN

FLOTTA

SULLOM VOE

NORWAY NORWAY

UK UK

F

R

I

G

G

S

A

G

E

B

R

ITA

N

N

IA

FORTIES

FULMAR

C

A

T

S

L

A

N

G

E

L

E

D S

E

A

L

W

A

G

E

S

F

L

A

G

S

N

O

R

P

IP

E

ABERDEEN

ST. FERGUS

Maria

Gaupe

Armada

Seymour

Everest

Lomond

Elgin

Erskine

Jackdaw

Jade

Buzzard

Blake

Faroe Island Licence

Bedlington

Glenelg

Jasmine

Judy/Joanne

Franklin

Dragon LNG

Milford Energy

IRISH

SEA

UK

TEESSIDE

BACTON

ZEEBRUGGE

READING

SULLOM VOE

ABERDEEN

ST.FERGUS

FLOTTA

NORTH

SEA

LONDON

EASINGTON

0 100 km

BGGROUP HAS A SIGNIFICANT E&P BUSINESS

OFFSHORE UK WITH INTERESTS FOCUSED ON

THE CENTRAL NORTH SEA. BG GROUP EMPLOYS

A HUB STRATEGY TO MAXIMISE VALUE FROM

ITS UK PORTFOLIO.

NEW INFORMATION

Everest East expansion rst production

in March 2013

Elgin/Franklin restarted in March 2013

KEY DATES

1993 Everest and Lomond rst production

1997 Armada and J-Block rst production

2001 Blake and Elgin/Franklin rst production

2002 Jade rst production

2003 Seymour rst production

2007 Buzzard, West Franklin and Maria

rst production

2009 Asset exchange with BP, concentrating

operations in the central North Sea

Dragon LNG operational

2010 Commercial operations commenced

at Milford Energy Limited power plant

2012 First production from Gaupe, a tie-back

from the Norwegian sector of the North

Sea to Armada

14 www.bg-group.com Data Book 2013

KEY TO OPERATIONS

Gas

Oil

Gas pipeline

Oil pipeline

BGGroup-operated block

BGGroup non-operated block

Oil/Gas/Condensate

UNITED KINGDOM

AREAS OF OPERATION

60

30

40

50

10

20

0

2010 2011 2012

49.0

38.2

35.2

Gas

Oil & liquids

BG Group net production (mmboe)

BGGroup believes there is signicant remaining

potential in the UK Continental Shelf (UKCS).

BG Groups position is focused in the central

North Sea where the Group is operator of

three key platforms and infrastructure hubs

Armada, Everest and Lomond allowing both

the operational performance of mature elds

to be optimised and the development of other

opportunities in the surrounding area. The Group

is actively pursuing the opportunities around

these infrastructure hubs by identifying nearby

exploration prospectivity, inll wells and

third-party business. Tie-backs to these hubs

are also possible from across the median

line in the Norwegian Continental Shelf.

In addition to core production hubs and

exploration and appraisal interests on the

UKCS, BG Group has interests in the Central

Area Transmission System (CATS) offshore

pipeline and onshore processing facilities,

the Shearwater Elgin Area Line (SEAL), and

in the SEAL Interconnector Link (SILK) pipeline.

Upstream: E&P

Operated assets

Armada Hub Area

The Armada gas condensate elds (Fleming,

Drake and Hawkins) extend more than

31 square kilometres and span ve exploration

blocks with rst production in 1997.

The SW Seymour area of the Seymour eld was

appraised successfully and drilled from the

Armada platform, with rst production in 2003.

A second well in the NW Seymour area was

brought into production in 2006 and a

replacement well was drilled in 2011.

In 2003, BGGroup assumed operatorship

of thefallow Maria 16/29a-11Y discovery.

Appraisal drilling identied and conrmed

the viability of this discovery and the adjacent

Maria Horst prospect. Maria was developed

via two sub-sea wells tied back to the Armada

platform, with rst production in 2007.

The commingled stream of Armada, Seymour

and Maria gas is exported via the CATS terminal

on Teesside. Liquids are transported through

the Forties Pipeline System (FPS) to the Kinneil

processing plant at Grangemouth.

The Armada hub also services two elds in

the Norwegian sector of the North Sea via

tie-backs: the third-party Rev eld and the

BG Group-operated Gaupe eld.

Blake

The Blake eld, located in the Outer Moray Firth,

had rst production in 2001.

The eld was developed in two phases.

Phase One was the Blake Channel, which

is a sub-sea development of six producing

wells and two water-injection wells, tied back

to an existing oating production, storage

and ofoading vessel (FPSO) located over the

third-party Ross eld some 9.5 kilometres away.

Development of Phase Two, Blake Flank, was

completed and production commenced from

two wells in 2003. This sub-sea development

is tied back through the existing Blake facilities

to the Ross FPSO.

Everest and Lomond

Everest and Lomond are located in the central

North Sea and rst production began on each

in 1993. Gas produced from the two elds is

exported via the CATS pipeline and produced

liquids are exported via FPS to the Kinneil

processing plant.

Hub 2012 net production

(mmboe)

Field/Block BGGroup

(%)

Other partners

(%)

Operated

Armada Area 4.97 Armada 76.4 Centrica23.6

Seymour 57.0 Centrica43.0

Maria 36.0 Centrica64.0

Blake 1.21 44.0 Talisman53.6, Idemitsu 2.4

Everest and

Lomond

7.05 Everest 100.0

Lomond 100.0

Jackdaw N/A 40.9 Maersk 29.2, GDF 9.8, OMV 9.7,

ConocoPhillips 6.5, JX Nippon 1.7

Non-operated*

Buzzard 13.18 21.7 Nexen 43.2, Suncor Energy29.9,

Edinburgh Oil & Gas5.2

Elgin/Franklin Area 1.36 Elgin

14.1

Total 46.2, Eni 21.9, E.ON 5.2, Esso 4.4,

Chevron 3.9, Dyas 2.2, Summit 2.2

Franklin

Glenelg 14.7 Total 49.5, E.ON 18.6, GDF SUEZ 9.3,

Eni 8.0

Erskine 1.29 32.0 Chevron 50.0, BP 18.0

J-Block and

Jade Area

6.18 J-Block 30.5 ConocoPhillips 36.5, Eni 33.0

Jade 35.0 ConocoPhillips 32.5, Chevron 19.9,

Eni 7.0, OMV 5.6

Jasmine 30.5 ConocoPhillips 36.5, Eni 33.0

* The rst company listed is operator

The Everest East expansion project, which

comprises two sub-sea wells tied back to

the North Everest platform and browneld

modications to the existing production

system, achieved rst production in

March 2013 with initial peak production

of 10 kboed. Total reserves are estimated

at around 16 mmboe.

Jackdaw

Appraisal drilling has been completed

on Jackdaw. Results from the exploration

and appraisal programme are being used

to evaluate potential development concepts.

Project sanction is expected in 2015.

Non-operated assets

Buzzard

The Buzzard oil eld in the Outer Moray Firth

came onstream in 2007. The facilities consist

of a complex of four bridge-linked platforms,

with oil export via FPS and gas export via

the Frigg System. Gross estimated ultimate

recoverable resources are approximately

700 mmboe.

In 2010, an additional processing platform to

remove hydrogen sulphide and extend plateau

production was installed. Commissioning and

start-up of this platform was completed in 2011.

15

Elgin/Franklin Area

The high-pressure/high-temperature (HPHT)

Elgin/Franklin gas condensate elds are located

in the Central Graben Area of the central North

Sea. The elds began production in 2001.

Production at Elgin/Franklin was shut-in as

a result of a well control issue that occurred

on the Elgin wellhead platform in March 2012.

A successful well intervention was carried

out in May 2012. In March 2013, production

restarted from three wells. However,

Elgin/Franklin is not expected to recover

to pre shut-down production levels until 2015,

which will require new inll wells to be drilled.

West Franklin started production in 2007.

In 2008, the West Franklin B appraisal well

identied additional potential reserves which

were sufcient for the Phase 2 development.

In 2010, Phase 2 of the development of the

West Franklin eld was sanctioned, and aims

to produce estimated reserves of 85 mmboe.

The development involves the drilling of three

wells and the installation of a new platform tied

back to the Elgin/Franklin facilities. Production

is expected to commence in 2014.

The HPHT Glenelg eld started production

in 2006. The eld has been developed

through a single well drilled from the

Elgin wellhead platform.

Elgin/Franklin, West Franklin and Glenelg gas

is exported through SEAL to the onshore gas

reception facilities at Bacton in Norfolk.

Liquids are exported through FPS to the

Kinneil processing plant at Grangemouth.

Erskine

Gas and liquids produced from the HPHT

Erskine eld, located in the central North Sea,

are processed on the Lomond platform, with

gas then transported via the CATS pipeline,

and liquids via FPS.

J-Block and Jade Area

The Judy/Joanne (J-Block) gas condensate/oil

elds and Jade gas condensate eld are located

in the central North Sea. Production from J-Block

commenced in 1997 and from Jade in 2002.

The Joanne eld is a sub-sea development tied

back to the manned Judy platform through

two 5.5 kilometre pipelines. The Judy/Joanne

elds currently produce from 16 wells.

Jade was developed using a normally

unmanned wellhead platform and currently

produces from eight wells. Production from

Jade is exported via a sub-sea pipeline to the

Judy platform where it is commingled and

processed with Judy and Joanne production.

Gas processed on the Judy platform is

transported through the CATS pipeline and

liquids are transported to Teesside through the

Norpipe system.

The Jasmine discovery lies nine kilometres east

of the Judy platform and straddles Blocks 30/6

and 30/7 with mid-case recoverable reserves

estimated at 200 mmboe. The Jasmine

development comprises a wellhead platform,

with a separate bridge-linked accommodation

platform, tied back via a multi-phase pipeline

and a new riser platform to the existing Judy

production facilities. The project received

government approval in 2010. Offshore

installation of two Jasmine platforms and the

Judy riser platform was successfully completed

in April 2013. Well perforation and testing

activities are being coordinated, with rst

production anticipated in the fourth quarter

of 2013 from up to nine development wells.

Offshore pipelines

CATS

BGGroup has a 62.78% interest in the

404 kilometre CATS pipeline and terminal

system. The CATS pipeline transports gas to

Teesside from the following elds: Armada,

Banff, Eastern Trough Area Project, Erskine,

Everest, Huntington, Montrose-Arbroath area,

Jade, J-Block, Lomond, Rev and Seymour. The

pipeline has a peak capacity of approximately

1 700 mmscfd. Onshore, the terminal includes

two gas processing trains, with a total capacity

of approximately 1 200 mmscfd.

SEAL and SILK

BGGroup has a 7.86% interest in SEAL,

a 474 kilometre gas export pipeline to the

Bacton terminal. With capacity of around

1 150 mmscfd of dry gas, it has been

transporting gas from the Elgin/Franklin

and Shearwater elds since 2001.

BGGroup also has a 15.98% interest in the

900 metre SILK pipeline that provides direct

access from the SEAL pipeline to the

UK-Continent Interconnector pipeline.

LNG Shipping & Marketing

BGGroups UK downstream activities are

managed by GEMS and encompass LNG

importation, via Dragon LNG, and energy

marketing. BGGroup sells gas on a wholesale

basis and exports gas to, and imports from,

mainland Europe via the Interconnector.

For details, see pages 32 to 34.

16 www.bg-group.com Data Book 2013

1.2

0.6

0.8

1.0

0.2

0.4

0

2010 2011 2012

1.1

Gas

Oil & liquids

BG Group net production (mmboe)

NORWAY NORWAY

SWEDEN

HAUGESUND

STAVANGER

KRISTIANSUND

NYHAMNA

UK

PL522

PL599

PL395

PL393

Gaupe

PL407

PL143

PL534

MID-NORWAY

NNS

CNS

PL374S

PL638

Knarr

PL679S

PL688

BARENTS SEA

PL395

PL534

PL393

0 500 km

BGGROUP ENTERED NORWAY IN 2003 AND NOW

HAS 14 LICENCES (10 AS OPERATOR) LOCATED IN

FOUR CORE AREAS.

NEW INFORMATION

PL679S and PL688 awarded

KEY DATES

2003 First licence (PL297) awarded

2008 Discoveries made at Gaupe, Ververis

and Knarr

2011 PDO for Knarr eld approved

Awarded block PL599

2012 Gaupe eld rst production

Awarded block PL638

Upstream: E&P

Many of the plays being explored in Norway are

similar to those developed and matured in the

UK. BG Groups UK and Norwegian assets work

closely to enhance opportunities in the region.

Central North Sea (CNS)

(4 licences, 3 operated)

BGGroup rst entered Norway in the Central

North Sea, applying its UK Central Graben

expertise and experience across the Norwegian

median line area.

In 2008, a discovery was declared on Pi North,

now renamed Gaupe. Gaupe spans PL292 and

PL292B (BGGroup 60% and operator). The eld

began production in 2012 through a two-well

sub-sea tie-back to the Groups Armada

infrastructure in the UK.

In July 2013, BG Group agreed to dispose of its

interest in the Bream eld (PL407), subject to

approval from the Norwegian government.

Northern North Sea (NNS)

(5 licences, 4 operated)

In 2008, a discovery was made with the Jordbr

exploration well (PL373S) (BG Group 45% and

operator), renamed Knarr. The development

of Knarr West was integrated into the Knarr

project in 2011, raising gross reserves to around

80 mmboe. First production is expected in 2014.

In 2010, a discovery was announced on Blbr

(BGGroup 45% and operator) (PL374S), a

potential tie-back to the Knarr FPSO.

In 2012, BG Group was awarded PL638 in the

Knarr area (BG Group 36% and operator).

Two further licences, PL679S (BG Group 60%

and operator) and PL688 (BG Group 50%),

were awarded in February 2013.

Mid-Norway

(2 licences, 2 operated)

In 2009, BG Group completed a seismic survey

on PL522 and drilled a commitment well in 2011.

In the 21st licensing round in 2011, BGGroup was

awarded PL599 (BGGroup 40% and operator).

Seismic data for both licences have been

merged into a single enhanced dataset for

the combined area.

Barents Sea

(3 licences, 1 operated)

In 2007, the Nucula well in PL393 (BGGroup 20%)

was declared a discovery and was subsequently

appraised in 2008.

In 2008, a well on the Ververis prospect (PL395)

(BGGroup 30%) was declared a discovery.

The Hegg licence (PL534) (BGGroup 40%

and operator), was awarded in 2009 and

a 3D seismic survey acquired in 2010.

17

NORWAY

KEY TO OPERATIONS

Gas

Oil

Gas pipeline

Pipeline proposed

or under construction

Oil pipeline

BGGroup-operated block

BGGroup non-operated

block

AREAS OF OPERATION

CARIBBEAN SEA

ATLANTIC OCEAN

GULF OF

PARIA

VENEZUELA

TRINIDAD AND TOBAGO

POINT FORTIN

BEACHFIELD

PHOENIX PARK

PORT OF SPAIN

TRINIDAD TRINIDAD

TOBAGO TOBAGO

VENEZUELA VENEZUELA

North Coast Marine Area (NCMA)

East Coast Marine Area (ECMA)

Petrotrin Renery Pointe--Pierre

Poinsettia

Chaconia

Hibiscus

Endeavour

Block 5(c)

Bounty

Starsh

Block E

Victory

Block 5(d)

Dolphin Deep

Atlantic LNG

Central Block

Block 6(b)

Block 5(a)

Dolphin

Loran-Manatee

Block 6(d)

40

30

20

10

0

2010 2011 2012

30.2

27.4 26.8

Gas

BG Group net production (mmboe)

Oil & liquids

0 100 km

BG GROUP IS A KEY GAS PRODUCER IN TRINIDAD AND

TOBAGO, OPERATING SINCE 1989. BG GROUP SUPPLIES

AROUND ONE-THIRD OF ITS GAS PRODUCTION TO THE

DOMESTIC MARKET, WITH THE BALANCE SUPPLIED TO

ATLANTIC LNG FOR EXPORT.

NEW INFORMATION

ECMA Starsh project sanctioned

KEY DATES

1996 Dolphin rst production

1999 Atlantic LNG Train 1 start-up

2002 Atlantic LNG Train 2 start-up

2003 Atlantic LNG Train 3 start-up

2005 Manatee-1 discovery

Atlantic LNG Train 4 start-up

2008 Victory and Bounty wells

on Block 5(c) successful

2009 New 220 mmscfd contract to supply