Professional Documents

Culture Documents

United States District Court Eastern District of New York

Uploaded by

Lisbon Reporter100%(1)100% found this document useful (1 vote)

1K views17 pagesCourt action.

Original Title

7gov.uscourts.nyed.356512.1.0

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCourt action.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

1K views17 pagesUnited States District Court Eastern District of New York

Uploaded by

Lisbon ReporterCourt action.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

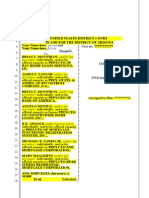

UNITED STATES DISTRICT COURT

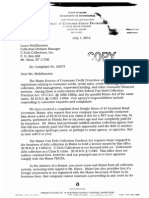

EASTERN DISTRICT OF NEW YORK

x

J ENNIFER BABCOCK, an individual; on

behalf of herself and all others similarly

situated,

Plaintiffs,

vs.

C.TECH COLLECTIONS, INC., a New York

Corporation; J OEL R. MARCHIANO,

individually and in his official capacity; J AMES

W. ARGENT, individually and in his official

capacity; CYNTHIA A. MICHELS,

individually and in her official capacity; and

J OHN AND J ANE DOES NUMBERS 1

THROUGH 25,

Defendants.

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

x

CASE NO.

CLASS ACTION

COMPLAINT FOR VIOLATIONS OF

THE FAIR DEBT COLLECTION

PRACTICES ACT

DEMAND FOR JURY TRIAL

I. PRELIMINARY STATEMENT

1. Plaintiff, J ENNIFER BABCOCK (Plaintiff or BABCOCK), on behalf of

herself and all others similarly situated, and demanding a trial by jury, brings this action for the

illegal practices of Defendants, C.TECH COLLECTIONS, INC. (C.TECH), J OEL R.

MARCHIANO (MARCHIANO), J AMES W. ARGENT (ARGENT), and CYNTHIA A.

MICHELS (MICHELS), (collectively referred to hereinafter as Defendants) who, inter alia,

used false, deceptive, misleading, unconscionable, and other illegal practices, in connection with

their attempts to collect an alleged debt from the Plaintiff and other similarly situated consumers.

2. The Plaintiff alleges that the Defendants collection practices violate the Fair Debt

Collection Practices Act, 15 U.S.C. 1692, et seq. (FDCPA), and New York General Business

Law 349 (NY GBL 349), which prohibits deceptive acts or practices in the conduct of any

business, trade or commerce or in the furnishing of any service.

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 1 of 17 PageID #: 1

-2-

3. The FDCPA regulates the behavior of collection agencies attempting to collect a

debt on behalf of another. The United States Congress has found abundant evidence of the use of

abusive, deceptive, and unfair debt collection practices by many debt collectors, and has

determined that abusive debt collection practices contribute to a number of personal bankruptcies,

marital instability, loss of jobs, and invasions of individual privacy. Congress enacted the FDCPA

to eliminate abusive debt collection practices by debt collectors, to ensure that those debt collectors

who refrain from using abusive debt collection practices are not competitively disadvantaged, and

to promote uniform State action to protect consumers against debt collection abuses. 15 U.S.C.

1692(a) - (e).

4. The FDCPA is a strict liability statute, which provides for actual or statutory

damages upon the showing of one violation. The Second Circuit has held that whether a debt

collectors conduct violates the FDCPA should be judged from the standpoint of the least

sophisticated consumer. Clomon v. Jackson, 988 F.2d 1314 (2d Cir. 1993).

5. To prohibit deceptive practices, the FDCPA, at 15 U.S.C. 1692e, outlaws the use

of false, deceptive, and misleading collection practices and names a non-exhaustive list of certain

per se violations of false and deceptive collection conduct. 15 U.S.C. 1692e(1)-(16). Among

these per se violations prohibited by that section are: false representations concerning the

character, amount, or legal status of any debt, 15 U.S.C. 1692e(2)(A); and false representations

concerning any services rendered or compensation which may be lawfully received by any debt

collector for the collection of a debt, 15 U.S.C. 1692e(2)(B).

6. To prohibit unconscionable and unfair practices, the FDCPA at 15 U.S.C. 1692f,

outlaws the use of unfair or unconscionable means to collect or attempt to collect any debt and

names a non-exhaustive list of certain per se violations of unconscionable and unfair collection

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 2 of 17 PageID #: 2

-3-

conduct. 15 U.S.C. 1692f(1)-(8). Among these per se violations prohibited by that section are:

collecting an amount not authorized by contract or permitted by law. 15 U.S.C. 1692f(1).

7. To protect the interests of consumers, the New York State Legislature through NY

GBL 349 has authorized individuals to act as private attorney generals by filing claims asserting

violations of any acts or statutes by, e.g. a corporation.

8. The Plaintiff, on behalf of herself and all others similarly situated, seeks statutory

damages, actual damages, punitive damages, injunctive relief, declaratory relief, attorney fees,

costs, and all other relief, equitable or legal in nature, as deemed appropriate by this Court, pursuant

to the FDCPA, NY GBL 349, and all other applicable common law or statutory regimes.

II. PARTIES

9. BABCOCK is a natural person.

10. At all times relevant to this complaint, BABCOCK resided in the Village of Glen

Oaks, Queens County, New York.

11. At all times relevant to this complaint, C.TECH is a for-profit corporation existing

pursuant to the laws of the State of New York. C.TECH maintains its principal business address

at 5505 Nesconset Hwy, Suite 200, Hamlet of Mount Sinai, Suffolk County, New York, 11766.

12. Plaintiff is informed and believes, and on that basis alleges, that MARCHIANO, is

a natural person who resides in the Village of Port J efferson, Suffolk County, New York.

13. Plaintiff is informed and believes, and on that basis alleges, that ARGENT, is a

natural person who resides in the Town of Smithtown, Suffolk County, New York.

14. Plaintiff is informed and believes, and on that basis alleges, that MICHELS, is a

natural person who resides in the Hamlet of Coram, Suffolk County, New York.

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 3 of 17 PageID #: 3

-4-

15. Defendants, J OHN AND J ANE DOES NUMBERS 1 THROUGH 25, are sued

under fictitious names as their true names and capacities are yet unknown to Plaintiff. Plaintiff will

amend this complaint by inserting the true names and capacities of these DOE defendants once

they are ascertained.

16. The Plaintiff is informed and believes, and on that basis alleges, that Defendants,

J OHN AND J ANE DOES NUMBERS 1 THROUGH 25, are natural persons and/or business

entities all of whom reside or are located within the United States who personally created, instituted

and, with knowledge that such practices were contrary to law, acted consistent with, oversaw, and

engaged in the illegal policies and procedures, used by C.TECH employees, that are the subject of

this complaint. Those Defendants personally control the illegal acts, policies, and practices utilized

by C.TECH and, therefore, are personally liable for all of the wrongdoing alleged in this

Complaint.

III. JURISDICTION & VENUE

17. J urisdiction of this Court arises under 15 U.S.C. 1692k(d) and 28 U.S.C. 1331,

1337.

18. Supplemental jurisdiction for Plaintiffs state law claims arises under 28 U.S.C.

1367.

19. Declaratory relief is available pursuant to under 28 U.S.C. 2201, 2202.

20. Venue is appropriate in this federal district pursuant to 28 U.S.C. 1391(b) because

a substantial part of the events giving rise to Plaintiffs claims occurred within this federal judicial

district, and because each of the Defendants are subject to personal jurisdiction in the State of New

York at the time this action is commenced.

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 4 of 17 PageID #: 4

-5-

IV. FACTS CONCERNING PLAINTIFF

21. Sometime prior to J anuary 4, 2014, Plaintiff allegedly incurred a financial

obligation to J ason Hitner, M.D. (Hitner Obligation).

22. The Hitner Obligation arose out of a transaction in which the money, property,

insurance, or services, which are the subject of the transaction, are primarily for personal, family,

or household purposes.

23. Defendants contend that the Hitner Obligation is in default.

24. The alleged Hitner Obligation is a debt as defined by 15 U.S.C. 1692a(5).

25. Plaintiff is, at all times relevant to this lawsuit, a consumer as that term is defined

by 15 U.S.C. 1692a(3).

26. Plaintiff is informed and believes, and on that basis alleges, that sometime prior to

J anuary 4, 2014, the creditor of the Hitner Obligation either directly or through intermediate

transactions assigned, placed, or transferred, the debt to C.TECH for collection.

27. C.TECH collects, and attempts to collect, debts incurred, or alleged to have been

incurred, for personal, family, or household purposes on behalf of creditors using the U.S. Mail,

telephone, and Internet.

28. C.TECH is, at all times relevant to this complaint, a debt collector as defined by

15 U.S.C. 1692a(6).

29. At all times relevant to this complaint the Defendants were engaged in conduct that

was part of a scheme or business of making or collecting illegal charges from the Plaintiff and

other similarly situated consumers in the State of New York.

30. On or about J anuary 4, 2014, C.TECH mailed a collection letter concerning the

Hitner Obligation, which is dated J anuary 4, 2014, and which Plaintiff received in the ordinary

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 5 of 17 PageID #: 5

-6-

course of mail. (1/4/2014 Letter). A true and correct copy of the 1/4/2014 Letter is attached

hereto as Exhibit A, except that the undersigned counsel has, in accordance with Fed. R. Civ. P.

5.2, partially redacted the financial account numbers in an effort to protect Plaintiffs privacy.

31. The 1/4/2014 Letter was sent, or caused to be sent, by persons employed by

Defendants as a debt collector as defined by 15 U.S.C. 1692a(6).

32. The 1/4/2014 Letter was sent to Plaintiff in connection with the collection of a

debt as defined by 15 U.S.C. 1692a(5).

33. The 1/4/2014 Letter is a communication as defined by 15 U.S.C. 1692a(2).

34. On information and belief, the 1/4/2014 Letter is a mass-produced, computer-

generated, form letter that is prepared by the Defendants and sent to consumers in the State of New

York, such as Plaintiff, from whom they are attempting to collect a debt.

35. The 1/4/2014 Letter, inter alia, provides a box for the Consumer to complete and

provide their credit card information in making payment for the alleged debt. Immediately above

the credit card information box is a statement, which is in lighter and much smaller font, that [a]

$3.00 convenience fee will be added for credit card payments.

36. Immediately below the credit card information box, the 1/4/2014 Letter states,

MAIL ALL CORRESPONDENCE & PAYMENTS TO: C.TECH COLLECTIONS, INC.,

PO Box 402, Mt. Sinai, NY 11766-0402. (Emphasis in original). Nowhere in the 1/4/2014 Letter

is the Consumer provided with information as to whom to make a check payable to should the

Consumer wish to write a check rather than provide their credit card information; and thereby

avoid the $3.00 convenience fee.

37. The 1/4/2014 Letter does not have a detachable form with included information

regarding Plaintiffs outstanding debt, such as a space where Plaintiff could indicate an Amount

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 6 of 17 PageID #: 6

-7-

Enclosed.

38. Plaintiff is informed, and believes, and therefore alleges that C.TECHS collection

letter is intended to falsely convey the message that Plaintiff may only make payment via credit

card; thereby incurring a $3.00 convenience fee.

39. Plaintiff is informed, and believes, and therefore alleges that C.TECHS collection

letter is intended to falsely convey the message that Plaintiff must make payment in full with her

first payment or incur a $3.00 charge with each payment made to C.TECH

40. Plaintiff is informed, and believes, and therefore alleges that C.TECHS collection

letter is intended to falsely convey that C.TECH is legally permitted to charge a $3.00 convenience

fee for credit card payments, when in fact such a fee/charge is neither authorized by contract nor

permitted by law.

41. Defendants representations on the 1/4/2014 Letter are materially false, deceptive,

and misleading in that, inter alia, they falsely suggest to consumers they must make credit card

payments, C.TECH is legally allowed to charge a $3.00 convenience fee for those credit card

payments, and each individual payment will result at a $3.00 convenience fee.

42. Defendants intended that their materially false statements contained in the 1/4/2014

Letter cause Plaintiff and other consumers confusion about the exact amount of money they

allegedly owed and the form of payment consumers may remit.

43. Defendants intended that their materially false and deceptive statements contained

in the 1/4/2014 Letter cause Plaintiff and other consumers to incorrectly believe they would benefit

financially by immediately sending payment for the full amount demanded in Defendants

collection letters rather than making several payments over time.

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 7 of 17 PageID #: 7

-8-

44. Plaintiff paid the alleged Hitner Obligation in-full using her credit card and

Defendants charged and took an additional $3.00 when processing Plaintiffs payment.

45. The additional $3.00 convenience fee charged and collected by Defendants

constitutes the collection of an amount incidental to the principal obligation that is not expressly

authorized by the agreement creating the debt or permitted by law.

46. The Defendants characterization of the additional $3.00 charge as a convenience

fee is false, deceptive, and misleading in that it is well in excess of the actual amount, if any,

Defendants incurred with respect to Plaintiffs credit card payment.

47. The Defendants characterization of the additional $3.00 charge as a convenience

fee is false, deceptive, and misleading in that it fails to disclose the true nature of the fee and

misrepresents the actual amount, if any, of the fee.

48. The Defendants characterization of the additional $3.00 charge as a convenience

fee is false, deceptive, and misleading in that it is well in excess of what any bank or payment

processing entity would charge to process Plaintiffs credit card transaction.

49. The Defendants characterization of the additional $3.00 charge as a convenience

fee is false, deceptive, and misleading in that Plaintiff understood it to mean, as would the least

sophisticated consumer, that Defendants are legally entitled to receive the fee when, in fact, they

are not legally entitled to receive it.

V. POLICIES AND PRACTICES COMPLAINED OF

50. It is Defendants policy and practice to send written collection communications, in

the form attached as Exhibit A, that violate the FDCPA by, inter alia:

(a) Making false representations concerning the character, amount, or legal status of

any debt;

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 8 of 17 PageID #: 8

-9-

(b) Making false representations concerning any services rendered or compensation

which may be lawfully received by any debt collector for the collection of a debt;

and

(c) Collecting amounts that are incidental to the principal obligation, which amounts

are not expressly authorized by the agreement creating the debt or permitted by law.

51. On information and belief, the Defendants written communications, in the form

attached as Exhibit A and as alleged in this complaint under the Facts Concerning Plaintiff, number

in at least the hundreds.

VI. CLASS ALLEGATIONS

52. This action is brought as a class action. Plaintiff brings this action on behalf of

herself and on behalf of all other persons similarly situated pursuant to Rule 23 of the Federal

Rules of Civil Procedure.

53. Plaintiff seeks to certify one class, which contains a sub-class.

54. With respect to the Plaintiff Class, this claim is brought on behalf of a class of (a)

all natural persons in the State of New York, (b) to whom Defendants sent a written communication

in the form attached as Exhibit A, (c) that was not returned as undeliverable (d) in connection with

Defendants attempt to collect a debt, (e) which written communications included the statement

that a $3.00 convenience fee will be added for credit card payments, (f) during a period

beginning one year prior to the filing of this initial action and ending 21 days after the filing of this

Complaint.

55. With respect to the Plaintiff Class, this claim is brought on behalf of a sub-class of

all persons who meet the class definition set forth, supra, and who paid their alleged debt(s) with

a credit card and were charged a convenience fee by Defendants will be added for credit card

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 9 of 17 PageID #: 9

-10-

payments, (f) during a period beginning three years prior to the filing of this initial action and

ending 21 days after the filing of this Complaint.

56. The identities of all class members are readily ascertainable from the Defendants

business records and the records of those businesses and governmental entities on whose behalf

they attempt to collect debts.

57. Excluded from the Plaintiff Classes are the Defendants and all officers, members,

partners, managers, directors, and employees of the Defendants and their respective immediate

families, and legal counsel for all parties to this action and all members of their immediate families.

58. There are questions of law and fact common to the Plaintiff Classes, which common

issues predominate over any issues involving only individual class members. The principal issues

are whether the Defendants written communications, in the form attached as Exhibit A, violate

15 U.S.C. 1692e, 1692e(2)(A), 1692e(2)(B), 1692f, and 1692f(1), and NY GBL 349.

59. The Plaintiffs claims are typical of the class members, as all are based upon the

same facts and legal theories.

60. The Plaintiff will fairly and adequately protect the interests of the Plaintiff Classes

defined in this complaint. The Plaintiff has retained counsel with experience in handling consumer

lawsuits, complex legal issues, and class actions, and neither the Plaintiff nor her attorneys have

any interests, which might cause them not to vigorously pursue this action.

61. This action has been brought, and may properly be maintained, as a class action

pursuant to the provisions of Rule 23 of the Federal Rules of Civil Procedure because there is a

well-defined community interest in the litigation:

(a) Numerosity: The Plaintiff is informed and believes, and on that basis alleges, that

the Plaintiff Classes defined above are so numerous that joinder of all members

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 10 of 17 PageID #: 10

-11-

would be impractical.

(b) Common Questions Predominate: Common questions of law and fact exist as to

all members of the Plaintiff Classes and those questions predominate over any

questions or issues involving only individual class members. The principal issues

are whether the Defendants written communications, in the form attached as

Exhibit A, violate 15 U.S.C. 1692e, 1692e(2)(A), 1692e(2)(B), 1692f, and

1692f(1), and NY GBL 349.

(c) Typicality: The Plaintiffs claims are typical of the claims of the class members.

Plaintiff and all members of the Plaintiff Classes have claims arising out of the

Defendants common uniform course of conduct complained of herein.

(d) Adequacy: The Plaintiff will fairly and adequately protect the interests of the class

members insofar as Plaintiff has no interests that are adverse to the absent class

members. The Plaintiff is committed to vigorously litigating this matter. Plaintiff

has also retained counsel experienced in handling consumer lawsuits, complex

legal issues, and class actions. Neither the Plaintiff nor her counsel has any

interests, which might cause them not to vigorously pursue the instant class action

lawsuit.

(e) Superiority: A class action is superior to the other available means for the fair and

efficient adjudication of this controversy because individual joinder of all members

would be impracticable. Class action treatment will permit a large number of

similarly situated persons to prosecute their common claims in a single forum

efficiently and without unnecessary duplication of effort and expense that

individual actions would engender.

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 11 of 17 PageID #: 11

-12-

62. Certification of a class under Rule 23(b)(2) of the Federal Rules of Civil Procedure

is also appropriate in that a determination that Defendants letters, which are attached hereto as

Exhibit A, violate 15 U.S.C. 1692e, 1692e(2), or 1692f, is tantamount to declaratory relief and

any monetary relief under the FDCPA would be merely incidental to that determination.

Additionally, NY GBL 349 specifically provides for injunctive relief as a remedy.

63. Certification of a class under Rule 23(b)(3) of the Federal Rules of Civil Procedure

is also appropriate in that the questions of law and fact common to members of the Plaintiff Classes

predominate over any questions affecting an individual member, and a class action is superior to

other available methods for the fair and efficient adjudication of the controversy.

64. Based on discovery and further investigation (including, but not limited to,

Defendants disclosure of class size and net worth), Plaintiff may, in addition to moving for class

certification using modified definitions of the Classes, Class Claims, and the class periods, seek

class certification only as to particular issues as permitted under Fed. R. Civ. P. 23(c)(4).

VII. FIRST CAUSE OF ACTION

VIOLATIONS OF THE FAIR DEBT COLLECTION PRACTICES ACT

(AGAINST ALL DEFENDANTS)

65. Plaintiff realleges and incorporates by reference the allegations in the preceding

paragraphs of this Complaint.

66. Defendants violated the FDCPA. Defendants violations with respect to their

written communications, in the form attached as Exhibit A, include, but are not limited to, the

following:

(a) Using false, deceptive, and misleading representations or means in connection with

the collection of any debt in violation of 15 U.S.C. 1692e;

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 12 of 17 PageID #: 12

-13-

(b) Making false, deceptive, and misleading representations concerning the character,

amount, or legal status of any debt in violation of 15 U.S.C. 1692e(2)(A);

(c) Making false, deceptive, and misleading representations concerning any services

rendered or compensation which may be lawfully received by any debt collector

for the collection of a debt in violation of 15 U.S.C. 1692e(2)(B);

(d) Using an unfair or unconscionable means to collect or attempt to collect any debt

in violation of 15 U.S.C. 1692f

(e) Collecting amounts that are incidental to the principal obligation, which amounts

are not expressly authorized by the agreement creating the debt or permitted by law

in violation of 15 U.S.C. 1692f(1).

VIII. SECOND CAUSE OF ACTION

VIOLATIONS OF NEW YORK GENERAL BUSINESS LAW 349

(AGAINST ALL DEFENDANTS)

67. Plaintiff realleges and incorporates by reference the allegations in the preceding

paragraphs of this Complaint.

68. The Defendants collection actions complained of herein, include sending written

communications to consumers that make false, deceptive, and misleading representations

concerning the character, amount, or legal status of those debts, which constitutes a deceptive

business practice in violation of NY GBL 349.

69. The Defendants collection actions complained of herein, include sending written

communications to consumers that make false, deceptive, and misleading representations

concerning the services rendered or compensation which may be lawfully received by Defendants

for the collection of those debts, which constitutes a deceptive business practice in violation of NY

GBL 349.

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 13 of 17 PageID #: 13

-14-

70. The Defendants collection actions complained of herein, also include the

collection and attempted collection of amounts from consumers that are incidental to the principal

obligation, which amounts are not expressly authorized by the agreement creating the debt or

permitted by law, and Defendants made false, deceptive, and misleading representations to

consumers that Defendants are legally entitled to collect these additional amounts of money, which

constitutes a deceptive business practice in violation of NY GBL 349.

71. Defendants engaged in deceptive acts and practices, in violation of NY GBL 349

by collecting, and attempting to collect, additional monies from consumers to Defendants were not

legally or contractually entitled to collect.

72. The Defendants actions complained of herein were committed in the conduct of

business, trade, commerce or the furnishing of a service in this state and constituted a violation of

NY GBL 349 independent of whether it also constituted a violation of any other law.

73. The Defendants actions complained of herein are consumer-oriented, involving

deceptive representations made in form/standardized correspondence with large numbers of

consumers. The violations alleged herein are recurring and have a broad impact upon the public.

74. Indeed, although Plaintiff cannot say with certitude exactly how many such

deceptive form letters were sent over the past three years, it is virtually certain to be in the

hundreds, if not thousands.

75. Plaintiff is informed and believes, and on that basis alleges that Defendants

collection letter in the form attached hereto as Exhibit A, which makes false and deceptive

representations, coupled with Defendants collection of monies to which they have no legal or

contractual entitlement to collect from consumers, is part of a policy and practice that is designed

and has the effect of unlawfully increasing Defendants profits.

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 14 of 17 PageID #: 14

-15-

76. Defendants deceptive acts, by their nature, involve material misrepresentations of

the amounts chargeable to the accounts that Defendants are attempting to collect.

77. Defendants engaged in such conduct in the course of trade and commerce.

78. Defendants knowingly and/or recklessly disregarded the unlawful nature of the

debts they sought to collect from Plaintiff and other similarly situated consumers in the State of

New York.

79. As a result of Defendants violations of NY GBL 349, Plaintiff, and the sub-

class of consumers she seeks to represent, has suffered actual and statutory damages of up to

$1,000.00, attorneys fees, and costs as a result of these violations

IX. PRAYER FOR RELIEF

80. WHEREFORE, Plaintiff respectfully requests that the Court enter judgment in her

favor and in favor of the Plaintiff Class as follows:

A. For the FIRST CAUSE OF ACTION:

(i) An order certifying that the First Cause of Action may be maintained as a class

pursuant to Rule 23 of the Federal Rules of Civil Procedure and appointing

BABCOCK and the undersigned counsel to represent the Plaintiff Class as

previously set forth and defined above.

(ii) An award of the maximum statutory damages for BABCOCK and the Plaintiff

Class pursuant to 15 U.S.C. 1692k(a)(2)(B);

(iii) An award of actual damages for BABCOCK and the Plaintiff Class, in an amount

to be determined at trial, pursuant to 15 U.S.C. 1692k(a)(1);

(iv) For declaratory relief pursuant to 28 U.S.C. 2201, 2202 adjudging Defendants

written collection communications, in the form attached hereto as Exhibit A, violate

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 15 of 17 PageID #: 15

-16-

the FDCPA;

(v) Attorneys fees, litigation expenses, and costs pursuant to 15 U.S.C. 1692k(a)(3);

and

(vi) For such other and further relief as may be just and proper.

B. For the SECOND CAUSE OF ACTION:

(i) An order certifying that the Second Cause of Action may be maintained as a class

pursuant to Rule 23 of the Federal Rules of Civil Procedure and appointing Plaintiff

and the undersigned counsel to represent the Plaintiff Sub-Class as previously set

forth and defined above;

(ii) An award of actual damages or $50.00 whichever is greater, and treble damages up

to $1000.00, to Plaintiff and each member of the Plaintiff Sub-Class pursuant to

NY GBL 349(h);

(iii) Declaratory relief adjudging that the Defendants written collection

communications, in the form attached hereto as Exhibit A, violate NY GBL

349(h);

(iv) Declaratory relief adjudging that the Defendants collection of a convenience fee

violates NY GBL 349(h);

(v) Injunctive relief enjoining the Defendants from engaging in the unlawfully

deceptive acts complained of herein including, but not limited to, collecting monies

from consumers that are incidental to their alleged principal obligation, which

amounts are not expressly authorized by the agreement creating the debt or

permitted by law, and sending written collection communications, in the forms

attached hereto as Exhibit A;

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 16 of 17 PageID #: 16

-17-

(vi) Attorneys fees, litigation expenses, and costs pursuant to NY GBL 349(h); and

(vii) For such other and further relief as may be just and proper.

X. JURY DEMAND

Plaintiff hereby demands that this case be tried before a J ury.

DATED: Uniondale, New York

May 19, 2014

s/ Abraham Kleinman

Abraham Kleinman (AK-6300)

KLEINMAN LLC

626 RXR Plaza

Uniondale, NY 11556-0626

Telephone: (516) 522-2621

Facsimile: (888) 522-1692

E-Mail: akleinman@kleinmanllc.com

Attorney for Plaintiff, Jennifer Babcock, and

all others similarly situated

Case 1:14-cv-03124-PKC-MDG Document 1 Filed 05/19/14 Page 17 of 17 PageID #: 17

You might also like

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- Chapter 13 Bankruptcy in the Western District of TennesseeFrom EverandChapter 13 Bankruptcy in the Western District of TennesseeNo ratings yet

- Baptiste V NACS National Attorney Collection Services FDCPA ComplaintDocument13 pagesBaptiste V NACS National Attorney Collection Services FDCPA ComplaintghostgripNo ratings yet

- GIPSON 05 18 20 - Complaint and Jury DemandDocument5 pagesGIPSON 05 18 20 - Complaint and Jury DemandPrevin WickNo ratings yet

- Fair Collections and Outsourcing Debt Collector Complaint FDCPA MarylandDocument8 pagesFair Collections and Outsourcing Debt Collector Complaint FDCPA Marylandghostgrip100% (1)

- Adverse Rial ComplaintDocument37 pagesAdverse Rial Complainttymakor100% (1)

- Larson V Money Control Inc Christopher Clarkson Riverside California FDCPA ComplaintDocument8 pagesLarson V Money Control Inc Christopher Clarkson Riverside California FDCPA ComplaintghostgripNo ratings yet

- Us Loan AuditorsDocument28 pagesUs Loan Auditorsdean6265No ratings yet

- Foreclosure Opposition To Demurrer FORMDocument15 pagesForeclosure Opposition To Demurrer FORMKenneth Zwick100% (2)

- COVID-19 Civil Rights Claim To Release From MDCDocument86 pagesCOVID-19 Civil Rights Claim To Release From MDCWalt PavloNo ratings yet

- Complaint Against Picower Estate Over Madoff ClaimsDocument12 pagesComplaint Against Picower Estate Over Madoff ClaimsDealBookNo ratings yet

- Case in Point - Foreclosure Mills, Judicial Fraud, Consumer ExploitationDocument2 pagesCase in Point - Foreclosure Mills, Judicial Fraud, Consumer ExploitationBarbara Ann JacksonNo ratings yet

- Complaint Foreclosure With Restitution CoaDocument28 pagesComplaint Foreclosure With Restitution Coajoelacostaesq100% (1)

- Ud Tenantanswer PDFDocument6 pagesUd Tenantanswer PDFMikeNo ratings yet

- US Department of Justice Antitrust Case Brief - 00702-2004Document6 pagesUS Department of Justice Antitrust Case Brief - 00702-2004legalmattersNo ratings yet

- 2016-11-28 - Robert Wallace - Lis Pendens Fed CTDocument4 pages2016-11-28 - Robert Wallace - Lis Pendens Fed CTapi-339692598No ratings yet

- USCOURTS Utd 2 - 17 CV 00563 0 PDFDocument11 pagesUSCOURTS Utd 2 - 17 CV 00563 0 PDFTriton007No ratings yet

- Slavin Lawsuit ThreeDocument19 pagesSlavin Lawsuit ThreeKeegan StephanNo ratings yet

- Civil Lawsuit BriefDocument19 pagesCivil Lawsuit Briefroyslay01No ratings yet

- Supreme Court of The United States: Petitioners Pro SeDocument72 pagesSupreme Court of The United States: Petitioners Pro SeNye LavalleNo ratings yet

- Attention:: What Are Ftds and Why Are They Important?Document3 pagesAttention:: What Are Ftds and Why Are They Important?scripdsucksNo ratings yet

- C C C CCCCCCC CC CDocument4 pagesC C C CCCCCCC CC CAdriana Paola GuerreroNo ratings yet

- 2010 08 30 Whitaker V Deutsch Bank Violation of FDCPADocument3 pages2010 08 30 Whitaker V Deutsch Bank Violation of FDCPAgeoraw9588100% (1)

- SEC Bankplus 1 ComplaintDocument36 pagesSEC Bankplus 1 Complaintthe kingfish100% (2)

- Wells Fargo's Unauthorized Customer AccountsDocument3 pagesWells Fargo's Unauthorized Customer AccountsSammy ChegeNo ratings yet

- The FCA As A Tool in Business LitigationDocument19 pagesThe FCA As A Tool in Business LitigationJonathan TyckoNo ratings yet

- Barber Letter To Secretary of StateDocument199 pagesBarber Letter To Secretary of StateDylan SmithNo ratings yet

- Southern District of New York New Local RulesDocument124 pagesSouthern District of New York New Local RulesRay DowdNo ratings yet

- Banking Practice and Procedure Chapter ThreeDocument31 pagesBanking Practice and Procedure Chapter ThreeDEREJENo ratings yet

- Complaint Smallman v. MGMDocument30 pagesComplaint Smallman v. MGMAshley ForestNo ratings yet

- Affidavit of Mark MillerDocument83 pagesAffidavit of Mark MillerCOASTNo ratings yet

- State of Ohio V GMAC, ALLY, Jeffrey StephanDocument175 pagesState of Ohio V GMAC, ALLY, Jeffrey StephanForeclosure Fraud100% (1)

- Writ in The Nature of Request Discovery and Disclosure: T Moorish National Republic Federal GovernmentDocument3 pagesWrit in The Nature of Request Discovery and Disclosure: T Moorish National Republic Federal GovernmentfluellynNo ratings yet

- Brown-Harris v. City of BuffaloDocument18 pagesBrown-Harris v. City of BuffaloAnji MalhotraNo ratings yet

- State Court Ruling Deals Blow To Bank Mortgage SystemDocument2 pagesState Court Ruling Deals Blow To Bank Mortgage SystemTeodoro Cabo San LucasNo ratings yet

- Banking On MiseryDocument15 pagesBanking On MiseryScutty StarkNo ratings yet

- 09 16 10 ComplaintDocument22 pages09 16 10 ComplaintMike Rothermel100% (1)

- Investors Sue Ligand Pharmaceuticals (NASDAQ: LGND) For $3.8 BillionDocument28 pagesInvestors Sue Ligand Pharmaceuticals (NASDAQ: LGND) For $3.8 Billionamvona100% (1)

- Quiet Title Virginia Greg BrylDocument2 pagesQuiet Title Virginia Greg BrylRK Corbes100% (1)

- Declaration of Billie Rene Frances Lillian Powers in Support ofDocument11 pagesDeclaration of Billie Rene Frances Lillian Powers in Support ofKhnBsm ScientistMinistriesNo ratings yet

- Privatized Justice, MosesDocument16 pagesPrivatized Justice, Mosespinter_rNo ratings yet

- Fdcpa HandoutsDocument7 pagesFdcpa HandoutsStephen MonaghanNo ratings yet

- JP Morgan Chase V US Dept of TreasuryDocument11 pagesJP Morgan Chase V US Dept of TreasuryForeclosure Fraud100% (1)

- ReviewerDocument19 pagesReviewerailynvdsNo ratings yet

- Reasons To Revoke Broker License of Laura Halls and EAH PDFDocument12 pagesReasons To Revoke Broker License of Laura Halls and EAH PDFJason SmithNo ratings yet

- CorruptionDocument18 pagesCorruptionKeeta Campbell100% (1)

- United States Bankruptcy Court: Southern District of West VirginiaDocument54 pagesUnited States Bankruptcy Court: Southern District of West VirginiaWVGOP Research100% (1)

- Negotiable Instrument: Private International LawDocument20 pagesNegotiable Instrument: Private International LawAnkita SinhaNo ratings yet

- The Missing Assignment DilemmaDocument5 pagesThe Missing Assignment Dilemmarhouse_1100% (1)

- Humpity DumpityDocument3 pagesHumpity DumpityA. CampbellNo ratings yet

- 3 Nof Ca Irs 3176CDocument2 pages3 Nof Ca Irs 3176CMichael KovachNo ratings yet

- Securities and Exchange Commission (SEC) - Form18-KDocument3 pagesSecurities and Exchange Commission (SEC) - Form18-KhighfinanceNo ratings yet

- Redacted Memorandum in Support of Motion For Tro.1Document9 pagesRedacted Memorandum in Support of Motion For Tro.1George OttNo ratings yet

- Uber Fair Credit Class ActionDocument20 pagesUber Fair Credit Class Actionjeff_roberts881No ratings yet

- BY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaDocument31 pagesBY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaaditibakshiNo ratings yet

- Contreras V Nationstar Class Action - Third Amended ComplaintDocument84 pagesContreras V Nationstar Class Action - Third Amended ComplaintCapital & MainNo ratings yet

- Amended Motion To Vacate Judgment-1st-Counterclaim-Rev3Document12 pagesAmended Motion To Vacate Judgment-1st-Counterclaim-Rev3Todd WetzelbergerNo ratings yet

- David Grimaldi v. Thomas P GordonDocument26 pagesDavid Grimaldi v. Thomas P GordonI1I1I1I1I1I111INo ratings yet

- Documents For Town Council Meeting 08.04/2015Document85 pagesDocuments For Town Council Meeting 08.04/2015Lisbon ReporterNo ratings yet

- Lisbon Police Personnel StudyDocument32 pagesLisbon Police Personnel StudyLisbon ReporterNo ratings yet

- Lisbno Town Council June 30, 2015 Public Info. PacketDocument80 pagesLisbno Town Council June 30, 2015 Public Info. PacketLisbon ReporterNo ratings yet

- Supplement B To 06302015 Council MeetingDocument9 pagesSupplement B To 06302015 Council MeetingLisbon ReporterNo ratings yet

- Town Council Meeting July 7, 2015Document27 pagesTown Council Meeting July 7, 2015Lisbon ReporterNo ratings yet

- Dep Consent AgreementDocument6 pagesDep Consent AgreementLisbon ReporterNo ratings yet

- Lisbno Town Council June 30, 2015 Public Info. PacketDocument80 pagesLisbno Town Council June 30, 2015 Public Info. PacketLisbon ReporterNo ratings yet

- Sheriff Samson LetterDocument3 pagesSheriff Samson LetterLisbon ReporterNo ratings yet

- 6 ExcelspreadsheetCDocument4 pages6 ExcelspreadsheetCLisbon ReporterNo ratings yet

- 10 FinanceLitigationThirdParty Economics 5 2014Document40 pages10 FinanceLitigationThirdParty Economics 5 2014Lisbon ReporterNo ratings yet

- Brooks' LetterDocument3 pagesBrooks' LetterLisbon ReporterNo ratings yet

- A-Mystery of The Andersonville Dove - Andersonville National Historic Site (U.S. National Park Service)Document2 pagesA-Mystery of The Andersonville Dove - Andersonville National Historic Site (U.S. National Park Service)Lisbon ReporterNo ratings yet

- 8-Have You Ever Been Sued Over A Debt Help ProPublica Investigate Collection Practices - ProPublicaDocument5 pages8-Have You Ever Been Sued Over A Debt Help ProPublica Investigate Collection Practices - ProPublicaLisbon ReporterNo ratings yet

- Title 1 Section 408-A Maine Revised StatuteDocument1 pageTitle 1 Section 408-A Maine Revised StatuteLisbon ReporterNo ratings yet

- 9 FightingLegallInnumeracy 2014v17n3 Articles ChengDocument8 pages9 FightingLegallInnumeracy 2014v17n3 Articles ChengLisbon ReporterNo ratings yet

- 4 WrighttoMe CtechHines 7-14-14gmail Complaint No. 20373Document3 pages4 WrighttoMe CtechHines 7-14-14gmail Complaint No. 20373Lisbon ReporterNo ratings yet

- 3 CtechWithdrawalfromBill 7-10-14rectodayDocument1 page3 CtechWithdrawalfromBill 7-10-14rectodayLisbon ReporterNo ratings yet

- Therriault & Therriault, Town AttorneysDocument1 pageTherriault & Therriault, Town AttorneysLisbon ReporterNo ratings yet

- 5 CFPA 7 20 14 ComplaintsconsumerDocument35 pages5 CFPA 7 20 14 ComplaintsconsumerLisbon Reporter100% (1)

- 2 LetterfromMaineAttorneyGeneral Ctech p1&2 7 1 14Document2 pages2 LetterfromMaineAttorneyGeneral Ctech p1&2 7 1 14Lisbon ReporterNo ratings yet

- Title 1 Section 408-A Maine Revised StatuteDocument1 pageTitle 1 Section 408-A Maine Revised StatuteLisbon ReporterNo ratings yet

- 1CtechComplainttoMaineAttorneyGeneral 6-14-14 PETscanDocument2 pages1CtechComplainttoMaineAttorneyGeneral 6-14-14 PETscanLisbon ReporterNo ratings yet

- Title 1 Section 408-A Maine Revised StatuteDocument1 pageTitle 1 Section 408-A Maine Revised StatuteLisbon ReporterNo ratings yet

- Budget Presentation March 42014 Town CouncilDocument9 pagesBudget Presentation March 42014 Town CouncilLisbon ReporterNo ratings yet

- Cost Center 6 YearDocument1 pageCost Center 6 YearLisbon ReporterNo ratings yet

- Community Informational Night April 9, 2014Document15 pagesCommunity Informational Night April 9, 2014Lisbon ReporterNo ratings yet

- Therriault & Therriault, Town AttorneysDocument1 pageTherriault & Therriault, Town AttorneysLisbon ReporterNo ratings yet

- School Overview 2014 March 4Document3 pagesSchool Overview 2014 March 4Lisbon ReporterNo ratings yet

- Referral FormDocument2 pagesReferral FormRipujoy BoseNo ratings yet

- Velarde Vs Court of Appeals G.R. No. 108346. July 11, 2001Document2 pagesVelarde Vs Court of Appeals G.R. No. 108346. July 11, 2001Joshua Ouano100% (1)

- Dryan Arbitration DemandDocument8 pagesDryan Arbitration DemandTechCrunchNo ratings yet

- Alano vs. Magud-LogmaoDocument14 pagesAlano vs. Magud-Logmaochristian villamanteNo ratings yet

- A.M. Oreta and Co., Inc. V NLRCDocument2 pagesA.M. Oreta and Co., Inc. V NLRCJett PascuaNo ratings yet

- Presumption Against Exceeding Constitutional PowersDocument5 pagesPresumption Against Exceeding Constitutional PowersAnju Panicker100% (2)

- Tort Remedies Review OutlineDocument4 pagesTort Remedies Review OutlineKat-Jean FisherNo ratings yet

- Deed of Absolute Sale-CondominiumDocument3 pagesDeed of Absolute Sale-CondominiumKat Rapada75% (4)

- People v. EmpanteDocument1 pagePeople v. EmpanteRCNo ratings yet

- 2022 S C M R 19Document5 pages2022 S C M R 19Hamza AbbasiNo ratings yet

- SALES - de Leon MidtermsDocument32 pagesSALES - de Leon MidtermsBea de Leon100% (1)

- Rmit University VietnamDocument4 pagesRmit University VietnamTuan MinhNo ratings yet

- Barut Vs CabacunganDocument7 pagesBarut Vs CabacunganCharm Divina LascotaNo ratings yet

- Alejandro Toledo: Justicia de EE - UU. Resuelve Que Expresidente Puede Ser Extraditado A PerúDocument30 pagesAlejandro Toledo: Justicia de EE - UU. Resuelve Que Expresidente Puede Ser Extraditado A PerúClaudia OrtizNo ratings yet

- BILL No. 27 of 2021 TNDocument4 pagesBILL No. 27 of 2021 TNMala deviNo ratings yet

- Agreement To Assign Contract For Sale and PurchaseDocument1 pageAgreement To Assign Contract For Sale and PurchaseJ InTheBoxNo ratings yet

- HCLDocument14 pagesHCLAnupam GuptaNo ratings yet

- Affidavit of UndertakingDocument2 pagesAffidavit of UndertakingWeblio JaneNo ratings yet

- UCPB General Insurance V Masagana TelemartDocument3 pagesUCPB General Insurance V Masagana TelemartArtemisTzy100% (1)

- Motion To Revive and Withdraw InformationDocument2 pagesMotion To Revive and Withdraw InformationPnix Hortinela0% (1)

- US VS., BustosDocument4 pagesUS VS., BustosAldrinmarkquintanaNo ratings yet

- Position Paper - PlaintiffDocument11 pagesPosition Paper - PlaintiffJozele Dalupang100% (2)

- EQT Production Company v. Robert Adair, 4th Cir. (2014)Document56 pagesEQT Production Company v. Robert Adair, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Assignment 2 Probate La FinalDocument69 pagesAssignment 2 Probate La FinalKekwa ManisNo ratings yet

- Estarija vs. Ranada, 492 SCRA 652Document16 pagesEstarija vs. Ranada, 492 SCRA 652radny enageNo ratings yet

- PP vs. Buesa (G.R. No. 237850, September 16, 2020)Document4 pagesPP vs. Buesa (G.R. No. 237850, September 16, 2020)Tokie TokiNo ratings yet

- Canlas vs. Tubil Full CaseDocument12 pagesCanlas vs. Tubil Full CaseMaritZi KeuNo ratings yet

- Prudential Bank vs. MartinezDocument3 pagesPrudential Bank vs. MartinezRomy Ian LimNo ratings yet

- 06 Tankiko v. Cezar (1999)Document9 pages06 Tankiko v. Cezar (1999)Kirk BejasaNo ratings yet

- CONQUAS StandardDocument9 pagesCONQUAS StandardBOYNo ratings yet