Professional Documents

Culture Documents

Fabillo V

Uploaded by

Lex AmarieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fabillo V

Uploaded by

Lex AmarieCopyright:

Available Formats

FABILLO V.

IAC

Juliana Fabillo, in her last will and testament dated Aug. 16, 1957, bequeathed to her brother,Florencio,

a house and lot in San Salvador, Palo, Leyte and to his husband Gregorio D. Brioso a piece of land in

Pugahanay, Palo, Leyte.

After Justinas death, Florencio filed a petition for the probate of said will.

Florencio sought the assistance of Atty. Alfredo M. Murillo in recovering the San Salvador property.

Florencio and Murillo entered into a contract, stipulating therein that Murillo shall represent Florencio

in the conclusion of the two cases, and in consideration of Murillos legal services, he shall be paid, in

case of success 40% of what he may acquire from the favorable judgment.

In case that the properties are sold, mortgaged or leased, Murillo shall be entitled to 40% of the

purchase price, proceeds of the mortgage, or rentals, respectively.

Pursuant to the said contract, Murillo filed a civil case against Gregorio D. Brioso to recover the

SanSalvador property. However, the case was terminated when the parties entered into a compromise

agreement declaring Florencio as the lawful owner of not only the San Salvador property but also of the

parcel of land located at Pugahanay.

As a result, Murillo proceeded to implement the contract of services between him and Florencio by

taking possession and exercising rights of ownership over 40% of said properties.

In 1966, Florencio claimed exclusive right of ownership over the two properties and refused to give to

Murillo his share of the properties.

Murillo filed in the CFI a complaint for ownership of the parcel of land.

ISSUE: WON THE CONTRACT OF SERVICES VIOLATED THE PROVISION OF ART. 1491, NCC.

HELD:NO! The contract of services did not violate Art. 1491, NCC.

The said prohibition applies only if the sale or assignment of the property takes place during the

pendency of the litigation involving the clients property.

Thus, the contract between the a lawyer and a client stipulating a contingent fee is not covered by said

prohibition under Art. 1491(5), CC because the payment of said fee is not made during the pendency of

the litigation but only after the judgment was rendered final.

As long as the lawyer did not exert undue influence on his client, that no fraud is committed or

implication applied, or that the compensation is clearly not excessive as to amount to extortion, a

contract for contingent fee is valid and enforceable.

However, the Court disagrees that the contingent fee stipulated by the parties is 40% of the properties

subject of the litigation.

A careful scrutiny of the contract shows that the parties intended 40% of the value

of the properties as Murillos contingent fee.

This is borne out by the stipulation that in case of success of any or both cases, Murillo shall be paid

the sum equivalent to 40% of whatever benefit Fabillo would derive from favorable judgments.

Moreover, the herein contract was vague with respect to a situation wherein the properties are neither

sold, mortgaged nor leased because Murillo is allowed to have the option of occupying or leasing to

any interested party 40% of the house and lot.

Had the parties intended that Murillo should be the lawful owner of 40% of the properties, it would

have been stipulated in the contract considering that the Fabillos would part with actual portions of

their properties and cede the same to Murillo.

The ambiguity of said provision should be resolved against Murillo as it was him who drafted the

contract.

SPOUSES SALERA, VS. SPOUSES RODAJE

G.R. No. 135900

August 17, 2007

Facts:

On May 7, 1993, spouses Avelino and Exaltacion Salera, now petitioners, filed with the Regional Trial

Court (RTC), Branch 11, Calubian, Leyte, a complaint for quieting of title, docketed as Civil Case No. CN-

27, against spouses Celedonio and Policronia Rodaje, herein respondents. Petitioners alleged that they

are the absolute owners of a parcel of land situated at Basud, San Isidro, Leyte with an area of 448.98

square meters, more or less. They acquired the property from the heirs of Brigido Tonacao as shown by

a Deed of Absolute Sale executed on June 23, 1986. They had the document registered in the Registry

of Deeds of Iloilo on July 1, 1986. When they asked the Provincial Assessor to declare the property

under their names for taxation purposes, they found that Tax Declaration No. 2994 (R-5) in the name of

Brigido was already cancelled and another one, Tax Declaration No. 2408, was issued in the names of

respondents. Petitioners further alleged that they have been in possession of the property and the

house they built thereon because they had paid the purchase price even before the execution of the

deed of sale.

In their answer to the complaint, respondents claimed that they are the absolute owners of the same

property. They acquired it from Catalino Tonacao, the father of Brigido, in a Deed of Absolute Sale

dated June 6, 1986. The sale was registered in the Registry of Deeds of Leyte on June 10, 1986 and Tax

Declaration No. 2408 was issued in their names. Prior thereto, or on January 11, 1984, they had a

verbal contract of sale with Catalino. They paid him P1,000.00 as downpayment. They agreed that the

balance of P4,000.00 shall be paid upon execution of the deed of sale. Since then, they have been

exercising their right of ownership over the property and the building constructed thereon peacefully,

publicly, adversely and continuously. Apart from being the first registrants, they are buyers in good

faith.

On July 17, 1995, the RTC rendered a Decision declaring petitioners the rightful and legal owners of the

property, declaring as null and void the sale made by Catalino Tonacao to herein defendants for lack of

capacity to sell;

On appeal, the Court of Appeals, in a Decision dated October 9, 1998, reversed and set aside the trial

courts Decision, declaring respondents the true and lawful owners of the property in dispute, The Court

of Appeals, in upholding the validity of the sale in favor of respondents, relied on Article 1544 of the Civil

Code on double sale.

Issue:

Which of the two contracts of sale is valid?

Held:

The contract of sale between Brigido Tonacao and Spouses Salera is valid. While tax declarations are not

conclusive proofs of ownership, however, they are good indicia of possession in the concept of owner,

for no one in his right mind would be paying taxes for a property that is not in his actual or at least

constructive possession. Hence, as between Brigido and Catalino, the former had better right to the

property. In other words, Catalino, not being the owner or possessor, could not validly sell the lot to

respondents. The CA erred in applying Article 1544. Article 1544 of the Civil Code contemplates a case of

double sale or multiple sales by a single vendor. More specifically, it covers a situation where a single

vendor sold one and the same immovable property to two or more buyers. It cannot be invoked where

the two different contracts of sale are made by two different persons, one of them not being the owner

of the property sold. In the instant case, the property was sold by two different vendors to different

purchasers. The first sale was between Catalino and herein respondents, while the second was between

Brigidos heirs and herein petitioners.

You might also like

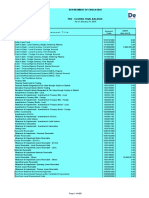

- #REF! #REF! #REF! #REF!: Pay Slip Pay SlipDocument13 pages#REF! #REF! #REF! #REF!: Pay Slip Pay SlipLex AmarieNo ratings yet

- PLI March 2020Document19 pagesPLI March 2020Lex AmarieNo ratings yet

- DEPED Division of Surigao del Norte Disbursement VouchersDocument179 pagesDEPED Division of Surigao del Norte Disbursement VouchersLex AmarieNo ratings yet

- Worksheet 2019Document1,366 pagesWorksheet 2019Lex AmarieNo ratings yet

- Uacs CodingDocument42 pagesUacs CodingLex AmarieNo ratings yet

- FS CONSOLIDATOR NEW FORMAT V.3.31.2020 RevisedDocument2,043 pagesFS CONSOLIDATOR NEW FORMAT V.3.31.2020 RevisedLex AmarieNo ratings yet

- Demand Letter Reminds Teachers of Unpaid LoansDocument21 pagesDemand Letter Reminds Teachers of Unpaid LoansLex AmarieNo ratings yet

- Surigao Del Norte Pay SlipsDocument13 pagesSurigao Del Norte Pay SlipsLex AmarieNo ratings yet

- Pli Dec 2019Document19 pagesPli Dec 2019Lex AmarieNo ratings yet

- Transmittal of PRDocument2 pagesTransmittal of PRLex AmarieNo ratings yet

- I Iiii.J L ( (I3Ji4) (J85I (!8? Iiuii Lirirl Leir J Retir Rent ' ' Ii - ,' - Ilairr"!: I..,I 75,008Document1 pageI Iiii.J L ( (I3Ji4) (J85I (!8? Iiuii Lirirl Leir J Retir Rent ' ' Ii - ,' - Ilairr"!: I..,I 75,008Lex AmarieNo ratings yet

- Individual: Performance Commitment and Review (Ipcr)Document13 pagesIndividual: Performance Commitment and Review (Ipcr)Lex AmarieNo ratings yet

- Department of Education Fund Disbursement RecordsDocument7 pagesDepartment of Education Fund Disbursement RecordsLex AmarieNo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- Clearance SignedDocument2 pagesClearance SignedLex AmarieNo ratings yet

- Purchase and Sales ReportDocument6 pagesPurchase and Sales ReportLea Madelon BecerroNo ratings yet

- WORKSHEET 2020 VDocument1,383 pagesWORKSHEET 2020 VLex AmarieNo ratings yet

- Summary of Interest Per MonthDocument141 pagesSummary of Interest Per MonthLex AmarieNo ratings yet

- Worksheet 2019Document1,366 pagesWorksheet 2019Lex AmarieNo ratings yet

- Tax Remittance Advice For The Calendar Year 2019Document1 pageTax Remittance Advice For The Calendar Year 2019Lex AmarieNo ratings yet

- 7 Remedial PDFDocument66 pages7 Remedial PDFMinahNo ratings yet

- Department of Education: Individual Performance Commitment and Review (Ipcr)Document7 pagesDepartment of Education: Individual Performance Commitment and Review (Ipcr)Lex AmarieNo ratings yet

- (Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees)Document1 page(Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees)Lex AmarieNo ratings yet

- DEPED Caraga Region Additional Loans for Extreme Emergencies Jan-May 2020Document4 pagesDEPED Caraga Region Additional Loans for Extreme Emergencies Jan-May 2020Lex AmarieNo ratings yet

- 2007-2013 REMEDIAL Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Document198 pages2007-2013 REMEDIAL Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh93% (123)

- Annual Implementation Plan 2018Document2 pagesAnnual Implementation Plan 2018Lex AmarieNo ratings yet

- Amando A. Fabio Memorial National High SchoolDocument1 pageAmando A. Fabio Memorial National High SchoolLex AmarieNo ratings yet

- (Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees)Document1 page(Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees) (Excluding Due From Officers and Employees)Lex AmarieNo ratings yet

- Revised - Instant FS Comparative - PROVIDENT - As of June 30 2019Document428 pagesRevised - Instant FS Comparative - PROVIDENT - As of June 30 2019Lex AmarieNo ratings yet

- Provident Control VoucherDocument4 pagesProvident Control VoucherLex AmarieNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shewaram Vs Pal To Robles Vs SantosDocument12 pagesShewaram Vs Pal To Robles Vs SantosRose Mary G. EnanoNo ratings yet

- A01 in Re Borromeo 1B-JCDocument2 pagesA01 in Re Borromeo 1B-JCDahl Abella TalosigNo ratings yet

- Comilang v. BelenDocument16 pagesComilang v. BelenRogelio BataclanNo ratings yet

- Foreign Judgments in Context of Matrimonial DisputesDocument5 pagesForeign Judgments in Context of Matrimonial DisputesChinmoy MishraNo ratings yet

- B.C. Supreme Court Decision To Stay Charges Against James Kyle BaconDocument5 pagesB.C. Supreme Court Decision To Stay Charges Against James Kyle BaconThe Vancouver SunNo ratings yet

- United States v. Kalchstein, 4th Cir. (2010)Document5 pagesUnited States v. Kalchstein, 4th Cir. (2010)Scribd Government DocsNo ratings yet

- CAAP-EU v. CAAP, Et Al.: DecisionDocument20 pagesCAAP-EU v. CAAP, Et Al.: DecisionIRRANo ratings yet

- Power of Supreme Court To Transfer The CaseDocument11 pagesPower of Supreme Court To Transfer The CaseAdv Aastha MakkarNo ratings yet

- Obligation and Contracts Case SummaryDocument14 pagesObligation and Contracts Case SummaryPat TrickNo ratings yet

- Doctrine of Isolated TransactionDocument2 pagesDoctrine of Isolated Transactionangelo_uy2No ratings yet

- Non-joinder of indispensable parties in land dispute caseDocument9 pagesNon-joinder of indispensable parties in land dispute caseElyn ApiadoNo ratings yet

- Ex-Parte Proceedings, Procedure To Set Aside Ex-Parte Orders and DecreeDocument30 pagesEx-Parte Proceedings, Procedure To Set Aside Ex-Parte Orders and DecreeNitu sharmaNo ratings yet

- Motion For Preliminary InjunctionDocument17 pagesMotion For Preliminary InjunctionJon OrtizNo ratings yet

- Exf8347 DC Magnus Machona Nkomola Vs Ispector General of Police and Another (Civil Case 16 of 2022) 2023 TZHC 16378 (27 March 2023)Document7 pagesExf8347 DC Magnus Machona Nkomola Vs Ispector General of Police and Another (Civil Case 16 of 2022) 2023 TZHC 16378 (27 March 2023)Amini mmariNo ratings yet

- Tung Chin Hui V RodriguezDocument4 pagesTung Chin Hui V Rodriguezabbiemedina100% (1)

- Website Design AgreementDocument21 pagesWebsite Design AgreementPierrot Mamba100% (1)

- CrimPro Cases (Rule 116)Document45 pagesCrimPro Cases (Rule 116)elvinperiaNo ratings yet

- Up Vs de Los AngelesDocument2 pagesUp Vs de Los Angelesmcris101No ratings yet

- Tan Shuy vs. MaulawinDocument13 pagesTan Shuy vs. MaulawinAaron CariñoNo ratings yet

- Petitioner vs. VS.: Third DivisionDocument4 pagesPetitioner vs. VS.: Third DivisionJessica Melle GaliasNo ratings yet

- Morigo v. PeopleDocument5 pagesMorigo v. PeoplePrinsesaJuuNo ratings yet

- I Was Injured by A Stoned DriverDocument5 pagesI Was Injured by A Stoned DriverMona DeldarNo ratings yet

- Sep 11-Q&A-1Document7 pagesSep 11-Q&A-1pdkprabhath_66619207No ratings yet

- Dr. Shakuntala Misra National Rehabilitation University LucknowDocument9 pagesDr. Shakuntala Misra National Rehabilitation University LucknowAnvesha ChaturvediNo ratings yet

- Aragon V CADocument1 pageAragon V CANap GonzalesNo ratings yet

- Constitutional Law-2008-Long OutlineDocument125 pagesConstitutional Law-2008-Long Outlineapi-19852979No ratings yet

- TortDocument98 pagesTortnnnnnnnNo ratings yet

- Case Digest in Credi TransactionsDocument22 pagesCase Digest in Credi TransactionsYsabelleNo ratings yet

- Class Notes DecreeDocument6 pagesClass Notes DecreeKarandeep SaundNo ratings yet

- Case Digest G.R. Nos. 100264-81Document3 pagesCase Digest G.R. Nos. 100264-81Kenshin HealerNo ratings yet