Professional Documents

Culture Documents

Thesis Proposal

Uploaded by

elizabethanhdoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesis Proposal

Uploaded by

elizabethanhdoCopyright:

Available Formats

VIETNAM NATIONAL UNIVERSITY - HOCHIMINH CITY

INTERNATIONAL UNIVERSITY

SCHOOL OF BUSINESS

THE IMPACT OF SUPPLY CHAIN FINANCE ON VIETNAM CORPORATION

PERFORMANCE: IMPROVING SUPPLY CHAIN EFFICIENCY AND

INCREASING PROFITABILITY.

In Partial Fulfillment of the Requirements of the Degree of

MASTER OF BUSINESS ADMINISTRATION

In (Finance)

By

Ms: Th Hong Anh

ID: MBA06002

International University - Vietnam National University HCMC

August 2014

THE IMPACT OF SUPPLY CHAIN FINANCE ON VIETNAM CORPORATION

PERFORMANCE: IMPROVING SUPPLY CHAIN EFFICIENCY AND

INCREASING PROFITABILITY.

In Partial Fulfillment of the Requirements of the Degree of

MASTER OF BUSINESS ADMINISTRATION

In (Finance)

By

Ms: Th Hong Anh

ID: MBA06002

International University - Vietnam National University HCMC

August 2014

Under the guidance and approval of the committee, and approved by all its members, this

thesis has been accepted in partial fulfillment of the requirements for the degree.

Approved:

---------------------------------------------- ---------------------------------------------

Chairperson Committee member

---------------------------------------------- ---------------------------------------------

Committee member Committee member

---------------------------------------------- ---------------------------------------------

Committee member Committee member

- i -

ACKNOWLEDGE

- 2 -

Plagiarism Statements

I would like to declare that, apart from the acknowledged references, this thesis either

does not use language, ideas, or other original material from anyone; or has not been previously

submitted to any other educational and research programs or institutions. I fully understand that

any writings in this thesis contradicted to the above statement will automatically lead to the

rejection from the MBA program at the International University Vietnam National University

Hochiminh City.

- 3 -

Copyright Statement

This copy of the thesis has been supplied on condition that anyone who consults it is

understood to recognize that its copyright rests with its author and that no quotation from the

thesis and no information derived from it may be published without the authors prior consent.

Do Thi Hoang Anh/ MBA06002/2014

- 4 -

TABLE OF CONTENTS

LIST OF TABLES............................................................................................... viii

LIST OF FIGURES............................................................................................. ix

ABSTRACT ......................................................................................................... x

CHAPTER I: INTRODUCTION........................................................................ 1

1.1 Backgrounds....................................................................................................... 5

1.2 Problem statement .............................................................................................. 7

1.2.1 A general framework of research .................................................................... 8

1.2.2 Research questions ........................................................................................ 10

1.3 Research methodology ......................................................................................... 13

1.3.1 The research process ..................................................................................... 13

1.3.2 Hypothesis .................................... .16

1.4 Delimitation ......................................................................................................... 17

1.5 Thesis outline ....................................................................................................... 18

CHAPTER II: LITERATURE REVIEW........................................................... 7

2.1 Theoretical review.................................................................................... 7

2.1.1 Working Capital .................................................................................. 7

2.1.1.1 Definition ....................................................................................... 7

2.1.1.2 Characteristics ............................................................................... 8

2.1.1.3 Working Capital Accounts .............................................................. 9

2.1.1.4 Measure of Working Capital........................................................... 9

iv

- 5 -

2.1.1.5 Working Capital Requirement ........................................................ 12

2.1.1.6 Working Capital Management and its Components......................... 12

2.1.2 Profitability and Liquidity ................................................................... 14

2.1.2.1 Profitability .................................................................................... 14

2.1.2.2 Liquidity......................................................................................... 15

2.1.2.3 Relationship between Profitability and Liquidity ............................ 15

2.1.3 Relationship between Working Capital and Profitability .................... 15

2.2 Review of empirical studies ..................................................................... 16

2.2.1 Developing-nation group..................................................................... 16

2.2.2 Developed-nation group ...................................................................... 19

2.3 Conclusions............................................................................................... 21

2.4 Construction and Building material sector in Vietnam.......................... 21

CHAPTER III: RESEARCH DESIGN AND METHODOLOGY .................... 24

3.1 Theoretical Framework ........................................................................... 25

3.1.1 The variables ....................................................................................... 24

3.1.2 Models and Hypotheses ....................................................................... 27

3.2 Research Methodology............................................................................. 29

3.2.1 Research Design.................................................................................. 29

3.2.2 Sampling Design ................................................................................. 30

v

- 6 -

3.2.2.1 Target population........................................................................... 30

3.2.2.2 Sample............................................................................................ 31

3.2.3 Data Collection.................................................................................... 31

3.2.4 Data Analysis ...................................................................................... 31

3.2.4.1 Descriptive Statistics ...................................................................... 31

3.2.4.2 Correlation Test ............................................................................. 31

3.2.4.3 Multiple Linear Regression Analysis............................................... 32

CHAPTER IV: DATA ANALYSIS AND DISCUSSIONS ................................ 33

4.1 Descriptive Statistics ................................................................................ 33

4.2 Correlation ............................................................................................... 34

4.3 Multiple Linear Regressions.................................................................... 36

4.3.1 Assumptions ........................................................................................ 36

4.3.1.1 Heterokedasticity............................................................................ 36

4.3.1.2 Cross-section weight ...................................................................... 36

4.3.1.3 Hausman Tests for correlated random effect................................... 36

4.3.1.4 Multicollinearity with Variance Inflation Factor (VIF) ................... 36

4.3.1.5 Autocorrelation .............................................................................. 37

4.3.2 Multiple Linear Regressions Results ...................................................... 37

4.3.2.1 Result of the hypothesis 1 .................................................................. 37

vi

- ii -

4.3.2.2 Result of the hypothesis 2 .................................................................. 40

4.3.2.3 Result of the hypothesis 3 .................................................................. 43

4.3.2.4 Result of the hypothesis 4 .................................................................. 45

4.3.3 Discussions of the results ....................................................................... 47

CHAPTER V: CONCLUSIONS AND RECOMMENDATIONS ..................... 51

5.1 Conclusions............................................................................................... 51

5.2 Recommendations .................................................................................... 52

5.3 Limitations and Suggestions for Further Research ................................ 53

LIST OF REFERENCES .................................................................................... 54

APPENDIX: RESULTS OF HAUSMAN TEST FOR CORRELATED RANDOM

EFFECT............................................................................................................... 58

- iii -

List of Tables

List of tables here

- iv -

List of Figures

List of figures here

- v -

LIST OF ACRONYMS & ABBREVIATIONS

SCF - Supply Chain Finance

FSCM - Financial Supply Chain Finance

EVA - Economic Value Added

BSC - Balance Scorecard

SCM - Supply Chain Management

KPI - Key Performance Indicators

LC - Letter of Credit

CCC - Cash Conversion Cycle

DIO - Days of Inventory Outstanding

DSO - Days of Sales Outstanding

DPO - Days of Payable Outstanding

AR - Account Receivable

AP - Account Payable

IV - Inventory Value

IT - Inventory Turnover

COGS - Cost of Goods Sold

CR - COGS as % of Revenue

SR - SG&A as % of Revenue

ROE - Return on Equity

ROA Return on Assets

ROS - Return on Sales

WACC - Weighted Average Cost of Capital

- vi -

ABSTRACT

This thesis provides an introduction to supply chain finance, studies the application of supply

chain finance (SCF) in the supply chain management, describes its impact on Truong Thanh

Furniture Corporation and Wooyang Vina II Co., ltd.

Supply chain finance (SCF) provides short-term credit that optimizes working capital for

both the buyer and the seller. It aims to lower financing costs, improve the financial

efficiency of the supply chain, and increase profitability. It allows buyers to extend payment

terms while providing suppliers access to better financing rates. It creates a true win-win for

all the parties involved as one of the most attractive tools for companies to diversify funding

sources, enrich and solidify the customer relationships.

The impact of SCF on corporate performance reflects in the improved supply chain efficiency

in terms of cost saving payable processes and payment term extension. The performance

indicators derived from the financial supply chain management (FSCM) have influences on

profitability. On the SCF program, decreased costs of goods sold (COGS) obviously can

increase return on invested capital (ROIC) and return on equity (ROE) in short term. The

cause-effect relationships between the FSCM performance indicators and profitability are

established by the EVA model and tested in linear regression analysis. (Dan Xu Brentsen

2012)

The supply chain finance is a financial tool that provides win-win solution for all the

participants. Particularly in the economic recession, the positive impact of SCF on company

performance can lead to the profitability, and lower financing costs.

Keywords: Supply chain finance , Cost optimization, Competitive advantage,

Liquidity, Working capital, Automated trade finance solutions

- vii -

CHAPTER 1

INTRODUCTION

As businesses face an ever-changing global environment, the increasing pressure of meeting

short term liquidity needs, maximizing cash generation, managing working capital, and

supporting the credit needs of the supplier base become more and more important in order to

lower financing costs, increase profitability and enhance shareholder value. Therefore,

Todays CFOs and treasurers are turning their attention to supply chain management and

procurement and taking a fresh look at how their physical supply chain is impacting their

companies cash flow and working capital management.

Currently there is little financial provision of supply chain activities to developing economies

in Africa, Eastern Europe and Asia, especially in Vietnam. Such financial inefficiencies are

increasingly becoming a risk to downstream firms. An approach that addresses these

challenges is Supply Chain Finance (SCF).

Supply chain finance programs are most prominently developed in the United States,

followed by Europe, particularly in the United Kingdom and Germany. Asia is gaining

momentum especially in India and Chinaand is expected to become the fastest growing

market in supply chain finance in the coming years. The industries in which supply chain

finance programs are most prevalent are retail, manufacturing, consumer products,

automotive, agriculture, chemicals, and pharmaceuticals. The three common attributes of

companies in those industries that make them good candidates for supply chain finance are

that (1) all of them are global, (2) all of them have extensive supply chains, and (3) all of

them have significant lead time from the time inventory gets ordered to the time a purchase

order gets approved.

Supply Chain

Since the 1990s, market competition is no longer between the individual enterprises, but is

competition between supply chains. Supply chain is a concept which refers to the process of

purchasing raw materials, manufacturing to selling to the customers. It includes energy

enterprises, manufacture enterprises, commercial enterprises and so on. It essence further

extended to the demand forecasting, materials management and production planning.

Wikipedia explains supply chain. A supply chain is a system of organizations, people,

technology, activities, information and resources involved in moving a product or service

from supplier to customer. Supply chain activities transform natural resources, raw materials

and components into a finished product that is delivered to the end customer.

- viii -

Figure 1 Source - GXS

Economic Value Added

Wikipedia explains EVA Economic Value Added or EVA, is an estimate of a firm's

economic profit being the value created in excess of the required return of the company's

investors (being shareholders and debt holders). Quite simply, EVA is the profit earned by

the firm less the cost of financing the firm's capital. The idea is that value is created when the

return on the firm's economic capital employed is greater than the cost of that capital.

Supply Chain Finance

Supply chain finance may be defined as a finance tool as a link between the buyer and seller

aided by the credibility of the buyer to have liquidity in the system. Supply Chain Finance

(SCF) is generating much enthusiasm amongst banks and their corporate customers as a

means of substituting for lower credit availability. SCF structures not only allow large

corporations to extend their credit terms with suppliers, but also to use the credit quality of

- ix -

their payables to allow their banking partner to finance their suppliers outstanding

invoices at a favourable rate.

Figure 2 Source - GXS

As of exaggerated globalization companies are more diversified in their operations which led

to complex supply chain networks. Dynamic discounting, early discount payment and

lengthening payment terms are crucial for corporates to deal with insolvencies and remain

competitive at the same time.

Supply chain finance program has gained attentions since the financial crisis. The SCF

program aligns the third party financial services, large and small participants through the

open account.

Lambert and Pohlen (2001) use the EVA model to integrate the supply chain operational

processes to financial performance.

- x -

Gomm (2010) embraces the key performance indicators for both supply chains and financial

flows in to a single corporate performance evaluation based on the EVA model. The EVA

model works also on capturing how the companies drive value and profitability including the

cost of capital in the supply chain.

Wang (2010) has conducted an empirical analysis to test the impact of the SCF program on

corporate performance before financial crisis. The improvements of operational and financial

indicators can be observed in short term.

Kerle (2010) has further provided the evidences of maximizing the current scarcity of

liquidity by applying the SCF program.

IMDs survey (2009) shows over half of respondents have admitted the implementation

of SCF to SCM can help improve supplier relations.

The Letter of credit and bank guarantee helped international business partners manage cash

flows. However, the impact of financial crisis amplified counterparty risks and

increasestransaction costs. Problems of aging payables and increasing credit risks have

become the main reasons to cause inefficiency in operational and financial performances.

Hendricks and Singhal (2005) show that companies suffering decreases in 33-40%lower

stock returns relative to their industry benchmarks because of supply chain glitches caused by

suppliers.

Avanzo et al.(2003) show the impact of supply chain performance on financial indicators.

Kerle (2010) show that the risks in the supply chain management associated with

volatility and supplier failure had increased 54% between mid-2007 and mid-2008.

Snell 2010 show that 90% of films felt threatened by supply-side risks.

Demica report (2011) studies the growth trend of a financial solution on supply-sidetrade

relations.

- xi -

Obviously decentralized supply chain inevitably leads to decentralization of financial

management and economic resources, so it is difficult to integrate various resources from

supply chain. To increase the efficiency of the supply chain optimization of economic

resources is very important. Financial instruments like SCF are new tools to integrate this

aspect. When goods are moving into supply chain, cash flows are in motion simultaneously

because flows of logistics and cash flows are inseparable. There is inalienable relationship

between finance and logistics.so we can conclude the competition between the supply chain

efficiency is now changed into how to use finance instruments in supply chains. Thus

analysing the relationship between supply chains and cash flows has become a crucial

question.

Working Capital Aspect-

Wikipedia defines Working capital (abbreviated WC) is a financial metric which

represents operating liquidity available to a business, organization or other entity, including

governmental entity. Along with fixed assets such as plant and equipment, working capital is

considered a part of operating capital. Net working capital is calculated as current assets

minus current liabilities

Working capital is amount of owners capital into business. More or less working capital

from a optimum level is harmful to the company. An optimum level is required.

Working capital is one of the most important indicators of efficiency in a supply chain (Farris

and Hutchison 2003). It is defined as current assets less current liabilities. Current in this

context usually refers to a time horizon of a year or less (Emery and Finnerty 1997).

- xii -

Source- http://www.springer.com/978-3-642-17565-7

Traditional methods for improving working capital

Enforced DPO extension: Strong buyers enforce their dominating position to delay the

payments to small suppliers.

Just-in-time and other inventory reduction techniques:

Enforced DSO reduction: strong suppliers use bargaining power to force smaller, less

powerful buyers to pay early.

Currently, as the impact of the global credit crunch has the knock-on effect of tightening

credit criteria for corporate lending, financial directors need to look for alternative means of

raising their working capital.

Companies are more focused now to unhide their hidden potential in working capital.

According to various studies, there is at least USD 400 billion trapped in the working capital

cycle of corporates. Supply chain finance is highly appreciated tool to unhide potential by

reducing the working capital to an optimum level, which otherwise leading to credit crunch in

- xiii -

the system. Supply chain finance leverages the credit rating of the buyer with the electronic

platform of the bank to finance the seller by right amount at right time.

At present, SCF is getting popular in banks and companies. Large numbers of companies are

now applying this concept of supply chain finance. However, in practice, many issues arising

in operation have not been given enough attention by researchers, functional departments and

the management. Financial risks arising from supply chain has received little attention and

rarely researched.

However, this is the key to the development of supply chain finance and to sustainable and

healthy development in global market.

LITERATURE REVIEW

In 2008 economic crisis laid more emphasis on the concept of SCF in financing the supply

chain operations. The strategic link between supply chain and financial flows is considered an

inevitable solution while improving performance of the company.

Development of supply chain

Supply chain term was first introduced by U.S industry consultants in early 1980s (Oliver

1982). The expansion of physical capabilities in international logistics has started since the

early 1990s, and the trend of global economic integration becomes evident everywhere. With

the development of robust information technology for communication and trade integration

worldwide buyers and suppliers become quicker in trade terms.

Globalization brought more challenges to supply chain as of complex trade mechanism. This

also leads to a broad inclusive view of logistics, which is not only responsible for one to one

business, but a network of multiple businesses and relationships.

The links of business processes have direct effects on the levels of decision making, such as

operations and financial planning, supplier risk and customer services management.

- xiv -

Thus, analyzing and designing an efficient and effective supply chain have gained an

increasing attention, and models of evaluating supply chain performance

Farris and Hutchison (2002) have emphasized the cash-to-cash cycle concept to the supply

chain management perspectives. It contains three important leverages which are account

payables, account receivables and inventory. In the meanwhile, the idea of cash management

has also been sentient in supply chain business processes.

Badell (2005) addresses that the financial flow optimization in operation processes will

satisfy shareholders as well as improve supply chain efficiencies.

The cash inflows and cash outflows in supply chains are strongly dictated to the capital

capacities in companies. The synchronized level between supply chain management and the

financial flows can be seen as indicator to measure the operational efficiency and as a result

the financial liquidity in the companies.

Financial performance in connection to supply chain activities are always seen as cost

reduction, market share growth and profit increase (Chien 2007).

There are positive relations between financial factors and the innovative supply chain

practices.

The improved supply chain business processes can benefit company by Better financial

performance; the increased corporation profit and market position are accompanied by an

increase of the overall corporate performance.

- xv -

Figure 3

Above figure shows the concept of supply chain finance.

From the buyers point of view (blue dotted line) lengthening the days in payables is

rational to shorten the cash conversion cycle.

From the suppliers point of view (red dotted line) shortening the days in account

receivables can help the company lower the cash conversion cycle. The shorter the cash

conversion cycle, the healthier a company generally is, because less time capital is tied up

into business processes.

The improved operating cycle will leads to the profitability of both the companies in the

business. The improved efficiency will generate more cash flows ( increases the liquidity ) in

the system. Also it results in better rating of both of the organizations.

Supply Chain Finance

Supply chain finance (SCF) is an approach that aims to improve the supply chain efficiency.

It is intended to improve payment terms, to reduce costs and to accelerate cash flows.

Overall, thewell-gained credit rating to the small/weak participants from the strong/large

- xvi -

participants (Myers 2002) and the simplicity of payable processes (Hartley-Urquhart 2000)

will enhance thesupplier-buyer partnerships.

Vietnamese Scenario-

Some Vietnamese origin banks are providing supply chain finance e.g Standard Charterd

Bank, ANZ, BIDV, HSBC

Standard Charted Bank is leading in this context.

We take the example of Standard Charted Bank to explain the key concept behind this tool.

Standard Charted Bank introduces Supply Chain Finance by leveraging its state of the art

technology for the convenience of the customers. SCF will strengthen the relationship of

Standard Charted Bank with the Corporate World by financing their supply chain partners.

Two types of Supply Chain Financing (SCF)

1. Supplier Finance Programmes (SFP): Financing for Suppliers recommended by Anchor

and suppliers can choose to be paid upfront by the Bank while the corporate fulfils its

payment obligation on the due dates

2. Buyer Finance Programmes (BFP): Financing for Buyers/Distributors recommended by

Anchor and SCB can pay the Anchor on behalf of its buyers/dealers and is repaid on due

date by the dealers/buyers

- xvii -

Figure 4

Source-

www.sbionline.com

RESEARCH DESIGN

RESEARCH QUESTIONS

The introduction of SCF to the corporate world will help them to conquer financial

constraints and develop cash flow effectively. A general framework of research is designed

containing the financial issues in supply-side value chain and the application of a financial

solution for improvement. The subsequent research questions are designed to explore and

analyze the possibilities.

- xviii -

Two main research problems are expected to be answered:

Does the use of SCF have positive effect on the performance of a company?

How SCF can improve profitability as well as control supply-side risks of a company?

Several sub-questions are required to be studied regarding the main research problems:

1)What is the SCF, and how to integrate SCF into SCM?

2)What are the performance and financial indicators SCF?

3)Could SCF have impact on short-term company finance?

4)What is the practical application of the SCF in the supply-side value chain?

6)How could large participants use the SCF with small participants in business?

7)What are the expected outcomes by the application of the SCF?

8)What are the most significant benefits and achievements for business partners traded via

SCF?

RESEARCH OBJECTIVE

The objective of the research is to analysis the key contributors of supply chain program

which enhance the performance of the company.

It further include various analysis tools to get concrete analysis of what needed the most for

SCF to be part of supply chain in future.

FRAMEWORK OF RESEARCH

- xix -

In the house of supply chain management in figure 1, there are two business partners under

the roof, one is the supplier and the other is the buyer. The buyer is considered stronger

having good credit rating in comparison to the seller. The impact of financial crisis destroyed

mutual trust between the system and lead to credit crunch in the system. Therefore, the lack

of efficiency in supply chains causes the difficulties in the flows of financial resources

between organizations.

In order to increase liquidity, the supplier promotes terms on early discount payment with

cost of money and the buyer applies dynamic discounting method with upfront cash reserves.

This phenomenon works well until there is no credit crunch, but in case of financial crisis

buyer starts lengthening the credit period to fulfil internal financing activities in the company

which leads to difficulty to the supplier. Now supplier has to go for bank to have credit at

higher interest rates which lowers the profitability of the supplier. In the meanwhile it is not

rational anymore for the supplier to offer early discount payment, because the lower credit

ratings may lead to bankruptcy at the end.

The consequence of supplier failures in the supply chain is expensive; hereby the resolution

to help the buyer and the supplier live on from the transitory overwhelming turmoil is a

further contribution of this study. The introduction of the SCF program in the supplier-

buyer trade relations breaks the door to the next level of supply chain management

financial supply chain management (FSCM).

- xx -

- xxi -

Figure 5 - Financial issues on supplier-buyer relationships in supply chain management and

benefits of applying the SCF program

Source - The Impact of Supply Chain Finance on Corporate Performance by Dan Xu

Barentsen

The application of the SCF program brings a new financial solution to supply chain

management, considering the third party financial services. The reverse factoring allows the

- xxii -

buyer to help the supplier receive better terms of capital financing through the IT platform

provided by the financial provider. The SCF program is a superior solution for the supply-

side value chain management.

Both the buyer and the supplier can benefit on the SCF program. Most importantly, the buyer

can pursue a tactic strategy to lengthen payment terms without extracting extra costs from the

supplier as well as improving the economic value added (EVA). As for the supplier, lower

cost of financing and speed-up cash flows are the most significant achievements. Supplier

risks are mitigated as the supplier strengthens its cash flow and as a result it has a better

liquidity which is especially helpful in the financial crisis; eventually the supplier can

improve its credit rating and become stronger in the marketplace.

The SCF program has the insight of becoming popular concerning the positive outcomes

from the perspectives of both the buyer and the suppler. The financial crisis is seen as a

significant driver of interest in SCF, because corporates as well as their financial institutions

are seeking to free up cash flow in supply chains while reducing risks. Undoubtedly, the SCF

program has the competence to develop the flows of financial resources in supply chain

management

Finance Supply Chain Management (FSCM) Performance Indicators

KPI are known as key success indicators. There are various KPIs that are used for the

measurement of financial supply chain management. FSCM performance indicators will be

defined from both supply chain operations and financial flows

COGS Cost of goods sold

It is the cost of the goods incurred by the company during manufacturing.

CCC - Cash conversion cycle-

May be defined as the time between the cash given to supplier in return of the raw materials

procured and cash received from the customers against goods sold.

- xxiii -

Profitability Ratios

ROI (Return on invested capital)

I t is the return on the capital employed by the owners

WACC (Weighted Average Cost of Capital)

Investopedia explains A calculation of a firm's cost of capital in which each category of

capital is proportionately weighted. All capital sources - common stock, preferred stock,

bonds and any other long-term debt - are included in a WACC calculation.

EVA =(ROI C- WACC) x I nvested Capital

thers are

Cooperation with Suppliers

The target for 2007 was to develop a step-by-step procedure for how and when to further

develop cooperation with suppliers on issues of sustainability. In line with this target, we

developed a new method in 2007 for responsible purchasing that considers the risks and

opportunities in our supply chain. Our target for 2008 is to carry out a pilot test of this new

responsible purchasing model in all regions with the aim of implementing it in 2009.

Novozymes annual report (2007)

RESEARCH METHODOLOGY

- xxiv -

Research questions are drafted regarding the impact of SCF on the company performance

bysupply-side value chain efficiency. A sophisticated research process is developed to

accomplish the research of interests.

The Research Process

The research methodology is designed in accordance to quantitative method only. Random

collected sample is used to test the hypotheses in the research work. The data are randomly

collected from various resources. The data analysis will be done by IBM SPSS Statistics

software.

Hypothesis, testing methods and research questions

Referred to the main research questions and sub-questions, the purpose of this study is about

to figure out the positive effects of using the SCF program on the corporate performance

Following are research questions that will be tested on the subject of quantitative research

method:

H1: The application of the SCF has a positive impact on short-term corporate performance.

H2: The FSCM performance indicators and profitability are correlated.

H3: There are cause-effect relationships between the FSCM performance indicators and the

profitability ratios.

H4: SCF increases the mutual relationship between buyer and seller.

H5: SCF hedges the insecurity of defaulting in trade transaction.

H6: SCF increases liquidity in the system.

- xxv -

ATA ANALYSIS AND FINDINGS

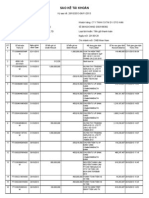

We have 57 respondents for the six questions asked. Following is the table showing the

response:

h1 h2 h3 h4 h5 h6 h7

1 6 5 3 5 6 3 6

2 6 6 4 6 7 3 7

3 6 5 5 7 5 5 7

4 6 4 5 6 6 4 6

5 7 5 6 7 7 4 7

6 7 6 5 6 6 4 6

7 7 5 4 7 5 3 7

8 6 6 3 6 4 3 6

9 7 5 4 5 5 4 7

10 7 5 5 5 6 5 6

11 6 6 6 7 6 6 7

12 7 5 3 5 7 3 6

13 6 4 4 6 6 2 7

14 7 5 3 5 6 3 6

15 7 6 4 5 7 4 7

16 7 5 5 5 6 5 6

17 7 4 6 4 5 5 7

18 6 5 5 5 5 4 6

19 7 6 4 6 6 3 7

20 7 5 5 6 7 4 6

21 6 5 6 6 6 4 7

22 7 6 5 5 5 3 6

23 7 5 4 5 6 4 7

24 6 6 5 4 7 3 6

25 7 5 6 5 6 2 6

26 7 5 6 6 5 3 7

27 7 5 7 7 6 6 6

28 7 6 7 4 5 4 7

29 6 6 6 5 6 3 6

30 7 6 4 6 7 3 6

31 7 6 5 6 6 3 6

32 7 5 4 7 5 4 7

33 7 5 3 6 5 4 6

34 6 5 4 5 6 4 7

35 7 6 5 5 5 3 7

36 6 5 4 6 5 3 6

37 7 6 5 7 6 2 7

38 7 5 6 6 7 3 6

39 6 6 5 6 6 3 6

40 7 5 4 7 7 6 7

- xxvi -

41 7 6 3 6 6 4 6

42 7 5 5 7 6 5 7

43 7 6 5 4 6 4 7

44 7 5 6 5 5 3 7

45 7 6 5 6 6 4 6

46 7 5 5 5 6 4 6

47 7 6 4 6 7 3 6

48 6 5 5 7 6 3 6

49 6 6 4 6 5 4 6

50 6 5 5 6 6 5 6

51 7 6 6 7 5 4 6

52 7 5 5 6 4 3 7

53 6 4 4 7 5 4 7

54 6 4 3 6 6 3 7

55 6 5 4 5 7 2 7

56 7 5 5 6 6 3 6

57 6 5 6 5 5 3 6

CONCLUSION

First Highest Response H1

It can be stated form the above results of the survey that

H1: The application of the SCF has a positive impact on short-term corporate performance

Have topmost essence in the profitability of the organization.

Next highest response H7:

The popularity of applying the SCF is increasing

Is also holds true because the 2008 sub-prime financial crisis made trade untrustworthy and

SCF proved a viable option in that aspect. SCF is thus catching more and more attention day

by day.

Afterwards H4 & H5

Both H4: SCF increases the mutual relationship between buyer and seller and,

H5: SCF hedges the insecurity of defaulting in trade transaction is held at same position SCF

is new in concept and mutual relationships developed are not recognized as such. Also,

hedging is not justified as bank is solely trading of the behave of the credit rating of the

buyer.

- xxvii -

Next H2 & H 3

Both H2: The FSCM performance indicators and profitability are correlated and,

H3: There are cause-effect relationships between the FSCM performance indicators and the

profitability ratios are at par as supply chain though crucial but play a small part of the

company working so cant be heavily weighted with the profitability of the company.

Last H6

H6: SCF increases liquidity in the system is justified by the fact that SCF though facilitates

the quick movement of the money but is confined to very less business processes.

- xxviii -

This page is intentionally left blank

- 1 -

References

Articles and books:

Aczel, Amir D (2006): Complete Business Statistics, Boston: McGraw-Hill/Irwin, 6th

edition.

Altman, Edward I. (2000): Predicting financial distress of companies: Revisiting the

core and Zeta models, Stern School of Business, New York University.

Assadej Vanichchinachai and Barbara Igel (2011): The impact of total quality

management on supply chain management and firms supply performance, International

Journal of Production Research, 49 (11), 3405-3424.

Badell, M., Pomero, J. and Puigjaner, L. (2005): Optimal budget and cash flows during

retrofitting periods in batch chemical process industries, International Journal of

Production Economics, 95 (3), 359-372.

Barnett, V. and Lewis, T. (1994): Outliers in Statistical Data, John Wiley & Sons, 3rd

edition.

Bauer David F. (1972): Constructing confidence sets using rank statistics, Journal of

the American Statistical Association 67, 687690.

Beamon, B. (1998): Supply chain design and analysis: Models and methods,

International Journal of Production Economics, 55 (3), 281-294.

Beaver, William H. (1966): Financial Ratios as Predictors of Failure, Journal of

Accounting Research, 4, 71-111.

Berk, Jonathan DeMarzo., Peter (2007): Corporate Finance, Pearson International

Edition, Addison-Wesley.

Bhagwat, Rajat and Sharma, Milind Kumar (2007): Performance measurement of supply

chain management: A balanced scorecard approach, Computers & Industrial

Engineering 53, 43-62.

Birnbaum, Z. W. and Tingey, Fred H. (1951): One-sided confidence contours for

probability distribution functions The Annals of Mathematical Statistics, 22 (4), 592

596.

Blome, Constantin and Schoenherr, Tobias (2011): Supply chain risk management in

financial crisisA multiple case-study approach, International Journal of Production

Economics 134, 4357.

Camerinelli, Enrico (2009): Supply chain finance, Journal of Payments Strategy &

Systems, 3 (2), 114-128.

Ceccarello, C., et al. (2002): Financial indicators and supply chain integration, a

European study, Supply Chain Forum, 3 (1), 44-52. 75

- 2 -

Appendix

Appendix here

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Simulation Game - Record SheetDocument5 pagesSimulation Game - Record Sheetyyy65% (20)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Construction Business Plan TemplateDocument15 pagesConstruction Business Plan Templateelizabethanhdo100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Dell Challenges To Operational StrategyDocument12 pagesDell Challenges To Operational StrategyAli Arsalan SyedNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Case 25Document1 pageCase 25elizabethanhdoNo ratings yet

- Case 25Document1 pageCase 25elizabethanhdoNo ratings yet

- Talk About Good MannersDocument7 pagesTalk About Good MannerselizabethanhdoNo ratings yet

- Sample Data Alcoholic Drinks BeerDocument1,641 pagesSample Data Alcoholic Drinks BeerelizabethanhdoNo ratings yet

- Best Beers Available in VietnamDocument6 pagesBest Beers Available in VietnamelizabethanhdoNo ratings yet

- 3 Edition: ©2010 Pearson EducationDocument9 pages3 Edition: ©2010 Pearson EducationelizabethanhdoNo ratings yet

- Family Vocabulary for Talking About RelativesDocument3 pagesFamily Vocabulary for Talking About RelativeselizabethanhdoNo ratings yet

- AerobicDocument32 pagesAerobicelizabethanhdoNo ratings yet

- HTTP 1Document65 pagesHTTP 1elizabethanhdoNo ratings yet

- Ivory Bridal & Formal: Pre-Wedding Workout PlanDocument20 pagesIvory Bridal & Formal: Pre-Wedding Workout PlanelizabethanhdoNo ratings yet

- Thong Bao Chieu Sinh Lop Chung Chi PP Giang Day Tieng Anh VUE DIP. TESOLDocument1 pageThong Bao Chieu Sinh Lop Chung Chi PP Giang Day Tieng Anh VUE DIP. TESOLelizabethanhdoNo ratings yet

- Airport Check-in Dialogue - Yes/No QuestionsDocument1 pageAirport Check-in Dialogue - Yes/No QuestionselizabethanhdoNo ratings yet

- HTTPDocument19 pagesHTTPelizabethanhdoNo ratings yet

- Strengths, Weaknesses, and Job RequirementsDocument5 pagesStrengths, Weaknesses, and Job RequirementselizabethanhdoNo ratings yet

- Delta: Handbook For Tutors and CandidatesDocument77 pagesDelta: Handbook For Tutors and CandidatesIlze Allena100% (3)

- Master of Financial Management Thesis TopicsDocument2 pagesMaster of Financial Management Thesis TopicselizabethanhdoNo ratings yet

- Ac STMTDocument2 pagesAc STMTelizabethanhdoNo ratings yet

- Homework 2Document16 pagesHomework 2elizabethanhdoNo ratings yet

- A Conceptual Framework For Supply Chain Coordination in Fuzzy EnvironmentDocument13 pagesA Conceptual Framework For Supply Chain Coordination in Fuzzy EnvironmentelizabethanhdoNo ratings yet

- Excel Solutions To CasesDocument38 pagesExcel Solutions To CaseselizabethanhdoNo ratings yet

- Financial Management3161Document15 pagesFinancial Management3161elizabethanhdoNo ratings yet

- OctoberDocument19 pagesOctoberelizabethanhdoNo ratings yet

- IcdsAbstract BookDocument120 pagesIcdsAbstract BookelizabethanhdoNo ratings yet

- Introduction MBA IU 2013Document29 pagesIntroduction MBA IU 2013elizabethanhdoNo ratings yet

- Financial Management3161Document15 pagesFinancial Management3161elizabethanhdoNo ratings yet

- Size Standards Table Updated 070213-1Document34 pagesSize Standards Table Updated 070213-1elizabethanhdoNo ratings yet

- SchultzDocument45 pagesSchultzelizabethanhdoNo ratings yet

- Marketing AustraliaDocument12 pagesMarketing AustraliaelizabethanhdoNo ratings yet

- 2011 Pittsburgh Black Business DirectoryDocument100 pages2011 Pittsburgh Black Business DirectoryConstance A Portis100% (1)

- Sales Management A Concise Guide To Sales ManagementDocument11 pagesSales Management A Concise Guide To Sales ManagementAnuranjanSinha100% (6)

- Documents: Search Books, Presentations, Business, Academics..Document10 pagesDocuments: Search Books, Presentations, Business, Academics..Rakesh Sharma0% (1)

- Dahai Xing Resume Ind NoRefDocument4 pagesDahai Xing Resume Ind NoRefyourbob1023No ratings yet

- CIS 2200 Chapter 10 OutlineDocument3 pagesCIS 2200 Chapter 10 OutlineAaiysha MistryNo ratings yet

- Logistics and Supply Chain Management DefinedDocument10 pagesLogistics and Supply Chain Management DefinedMeenakshi SinghNo ratings yet

- Knec Courses and CodesDocument17 pagesKnec Courses and CodesKyalo Martin0% (2)

- McDonalds India Supply ChainDocument38 pagesMcDonalds India Supply ChainKajal TamgadgeNo ratings yet

- Ikea Group 1Document27 pagesIkea Group 1euniceNo ratings yet

- Report of National FoodsDocument6 pagesReport of National FoodsSumairNo ratings yet

- Penerapan Konsep Manajemen Rantai Pasok 7e71d4a5 PDFDocument19 pagesPenerapan Konsep Manajemen Rantai Pasok 7e71d4a5 PDFHotma Ida TampubolonNo ratings yet

- SCM NotesDocument29 pagesSCM NotesNisha Pradeepa100% (2)

- Planning Strategies: Production PlanningDocument22 pagesPlanning Strategies: Production Planningpprasad_g9358No ratings yet

- SAP A AssignmentDocument9 pagesSAP A Assignmentssathya1986100% (1)

- Supply ChainDocument58 pagesSupply ChainrominvelawalaNo ratings yet

- Logistics - Theory and Practice PDFDocument47 pagesLogistics - Theory and Practice PDFMohamed Salah El Din100% (1)

- Chapter 2 - Purchasing Management - FTU - 2019Document45 pagesChapter 2 - Purchasing Management - FTU - 2019Chạch MậpNo ratings yet

- Emerging Trends in WarehousingDocument21 pagesEmerging Trends in Warehousingvineetmg50% (2)

- SAP IBP/SCM Consultant ResumeDocument5 pagesSAP IBP/SCM Consultant Resumeptcl1No ratings yet

- ESI Assets SCM Project Business Blueprint SummaryDocument107 pagesESI Assets SCM Project Business Blueprint SummaryrupakbNo ratings yet

- Supply Chain Management ABbDocument37 pagesSupply Chain Management ABbSuneel KumarNo ratings yet

- Ikea PDFDocument25 pagesIkea PDFY&U PartnersNo ratings yet

- Logistic Coordinator: About MeDocument5 pagesLogistic Coordinator: About MeAnonymous VJId0t2rNo ratings yet

- Organization Change Management & Software Configuration ManagementDocument14 pagesOrganization Change Management & Software Configuration ManagementqasemkhanNo ratings yet

- Consumer Satisfaction Level Towards Pantaloon Retail StoreDocument72 pagesConsumer Satisfaction Level Towards Pantaloon Retail StoreshadabNo ratings yet

- Anjans Supply ChainDocument26 pagesAnjans Supply ChainSazzad Hussain ChowdhuryNo ratings yet

- NikeDocument19 pagesNikepundri100% (1)