Professional Documents

Culture Documents

Economic Survey 2012 Ch5 - Banking Sector Intermediaries

Uploaded by

ajays2539Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Survey 2012 Ch5 - Banking Sector Intermediaries

Uploaded by

ajays2539Copyright:

Available Formats

Economy (http://mrunal.

org/category/economy) / 1 year Ago /

64 Comments (http://mrunal.org/2013/04/economic-survey-ch5-financial-intermediaries-banks-rrbs-nbfcs-part-3-of-3.html#comments)

, !

1. Prologue

2. Banks and interest rates

3. Rural Banking: Background

Governments action

Timeline: Banking in rural areas

After independence

Why RRB?

How is RRB different from commercial banks?

Rural Infrastructure Development Fund (RIFD)

Financial Inclusion

Swabhimaan scheme

Ultra Small Branches

SHG Bank linkage program

4. Development Banks/AIFI

1.ICICI

2.SIDBI

3.IDBI

4.IFCI

5.IIBI

6.NABARD

7.NHB

Reverse Mortgage product

[Economic Survey Ch5] Financial Intermediaries: Banks, RRBs, NBFCs

(Part 3 of 3)

16 Days to CGL13'T2

36 Days to IBPS-PO

44 Days to CGL14

100 Days to Mains

4 4

Mrunal (http://mrunal.org/)

E

5. FINANCIAL PERFORMANCE OF BANKS

Capital Adequacy Ratio

NPA: steps taken to reduce it

6. Chindus Budget speech

More cash to NABARD

Multilateral Development banks: Roads in NE

Bank for Women?

Urban housing fund

7. Core Banking Solution (CBS)?

Why is CBS in news?

Why UCBs havent implemented CBS?

8. Conclusion (Chapter 5)

9. Mock Questions

Prologue

In the earlier articles, we saw

What is financial intermediaries? Why are they important for Economy?

Then in part 1 of 3, we saw insurance sector

In part 2 of 3, capital market

In this third and final part, well see the banks and NBFCs.

Banks

What do banks do? They collect deposits from savers and lend it as loan to the

borrowers, and earn Commission in between. Hence theyre one type of financial

intermediaries.

We already know that banks have to invest some of their deposit money in govt.

securities (and high rated corporate bonds) under the statutory liquidity ratio (SLR).

For past few years, this SLR rate has remained steady 23-24%. Yet banks have invested

more than 30% of their deposits in Government securities.

Recall that Government securities are safe investments and if an investment is safe

then it wont give much profit.

So why are the bank investing more money in Government securities, even above the

SLR requirement?

1. because they think it is safer investment (compared to lending it to the likes of

Kingfisher) and or

2. because businessmen are not coming forward to take loans and or

3. Consumers are also not coming forward for getting loans for bike, car, or home loans

(due to inflation).

Interest rate

There are mainly three type of bank account:

Current

Account

Savings

account

Term deposits/Fixed Deposit

Interest paid by

bank

0% 4-6*%

Depends on how long you keep the

money. 6-8*%

These rates change from bank to bank, ^these are just approximate numbers for

illustration.

For banks Current account and savings account (CASA) are most important. Why?

Because on these deposits, bank has to pay very low interest. So if bank gets lot money

from CASA source, and lends it as car/bike/home/business/personal loans @12-18%

=there is big profit margin.

Interest rate change

Deposit rates (bank pays to accounts

holders)

Lending rate (bank charging to loan takers)

RBI controls the interest rates on

foreign currency non-resident account

(FCNR).

In 2011, RBI deregulated the interest

rates on savings deposits.

Still no public sector bank has

increased its savings deposit rate. (they

just offer 4%). Although private sector

banks offer higher.

2012: RBI deregulated the interest rate

on loans given to exporters (in foreign

currency). This was done to improve

the exports.

In 2012-13 period, RBI started reducing

the repo rate and consequently banks

too lowered their loan interest rates a

bit.

Rural Banking: Background

During the British raj and the initial years after independence, the banks (and insurance

companies) only operated in the urban areas. Why?

1. Staff/Manpower: easy availability of educated youth in cities.

2. Urban areas had better availability of electricity, telephone, telegram, railways, office

supplies etc.

3. Customers: Main Target audience of banks and insurance companies= educated middle

class, rich people and businessmen. They live in cities.

4. At that time, Banks and insurance companies were controlled by private players: they

had only one motive=Profit. And city folks have more surplus income compared to

villagers.

Result:

Villagers did not get facility of banking / insurance, and they had to rely on the (evil)

money lender who charged whatever interest rate he wanted to.

Sometimes they paid more money in interest, than the actual principle they had

borrowed.

And thus villagers remained in debt and poverty forever.

Governments action

Over the years, Government certain things to achieve following objectives:

1. To help the villagers get easy loans for buying cows, buffalos, diesel pump sets, seeds,

fertilizers, digging wells and bores in their farms etc.

2. increase the penetration of banking services in rural areas

3. To achieve financial inclusion in rural areas

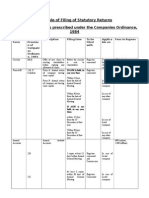

Timeline: Banking in rural areas

50s Cooperative banks / societies

55 Birth of SBI and ICICI (although not related with rural banking directly)

60s Bank nationalization (first round)

75 Regional rural banks were setup

80s NABAD was setup.+ Bank nationalization (second round)

Early 90s Self Help groups (SHG) and bank linking

Late 90s Kisan Credit Card

Mid-2000s

1. No-frills account

2. Banking Business correspondence Agents (BCA)

3. Interest subvention scheme on crop loans

2011 Swabhiman scheme

Now lets fill in the details

After independence

The structure looked like this (for rural banking)

1. RBI

2. State cooperative banks

3. Central cooperative banks (@District level.) || Urban cooperative banks (in cities and

small towns)

4. Primary Agriculture Credit societies (PCAS) (@village level)

Then came RRB and NABARD.

Why RRB?

1975: Government appointed MM Narsimhan Committee to look into rural banking.

Narsimhan observed that Commercial banks (such as SBI, BoB) have high cost structure

(building, staff etc.) so they prefer to open branches in cities rather than villages-

Because city branches make more profit.

The staff of commercial banks= expert in banking and financial matters but not aware of

the problems of rural people.

On the other hand, the Primary agriculture Cooperative societies have members from

the villagers themselves, so they are more aware of the needs and problems of the

villagers.

Therefore, we need to create a hybrid institution that has positive characters of both

1. Financial strength and expertise of commercial banks) +

2. Grassroot problem awareness of cooperative society).

Thus, Regional rural banks were born.

RRB provides loan and savings facilities to villagers. These villagers include

1. farmers (small and marginal)

2. agri laborers

3. rural artisans

4. rural entrepreneurs

5. cooperative societies

6. primary agriculture credit societies

RRBs are sponsored by Commercial banks.

The Sponsor bank provides training to the staff of Regional rural bank.

The sponsor bank also provides initial capital to setup the regional rural bank.

According to the RRB Act, the paid up capital is Central Government : State Government :

Sponsor bank = 50 : 15 : 35

How is RRB dierent from commercial banks?

Commercial Bank RRB

Area of

operation

Huge. Small.

Whole India (although mainly

concentrated in urban areas

and small towns)

One or a few districts. (rural)

Source of

finance

Savings accounts, fixed

deposit etc.

Borrowing from RBI and other

sources

Borrowing from NABARD, SIDBI.

They also have savings account of

villagers, but it is not sufficient to

cover the loan demands.

Apart from RRBs, villagers also get services from cooperative credit societies,

Microfinance institutions;

Even commercial banks such as SBI also serve the villagers via BCA (Banking

correspondence agents).

And the urban-rural geographical breakup has changed a lot since the birth of RRBs.

(Many places that were villages in 70s have now become small towns).

In this context, it was necessary to consolidate/merge various RRBs- to reduce their

overhead expenses and make them more competitive

Therefore in 2005: Government of India started amalgamation of RRB. So now the

number of RRBs have decreased.

Till 1 January 2013, 22 RRBs had already been amalgamated into 9 RRBs.

Rural Infrastructure Development Fund (RIFD)

Started in mid 90s.

NABARD operates the Rural Infrastructure Development Fund (RIDF).

This fund provides cheap loans to states and state-owned corporations

So they can quickly complete projects related to

1. medium and minor irrigation,

2. soil conservation,

3. watershed management

4. Flood Protection;

5. Forest Development;

6. Cold storage

7. Community Irrigation wells for the village as a whole;

8. Village Knowledge Centres;

9. Desalination plants in coastal areas;

10. Building schools, Anganwadi Centres etc.

11. Building toilet blocks in existing schools, specially for girls

12. Rural Roads, Bridges

13. and other forms of rural infrastructure.

Banks who do not meet their Priority sector lending requirements, provide money to this

rural infrastructure development fund.

Financial Inclusion

Financial inclusion = getting all poor people in the banking, insurance, pension net. So

they dont become victims of evil money lenders who charge 36% compound interest

rates (or even more).

Swabhimaan scheme

Weve already discussed this scheme and Banking business correspondents (BCs) in

earlier article. Click me (http://mrunal.org/2013/01/economy-banking-business-

correspondents-agents-bca-meaning-functions-financial-inclusion-swabhimaan-

common-service-centres-csc.html)

Budget 2012, Chindu Pranab had announced that Swabhimaan would be extended to

habitations with population more than 1,000 in the north-eastern and hilly states and

population more than 1,600 in the plains areas as per Census 2001.

Ultra Small Branches

Ultra small branches (USBs) are being set up in all villages covered through Banking

Correspondence Agents. (Weve already discussed Banking business correspondents in

earlier article. Click me (http://mrunal.org/2013/01/economy-banking-business-

correspondents-agents-bca-meaning-functions-financial-inclusion-swabhimaan-

common-service-centres-csc.html))

These Ultra small branches (USBs) will have a small area of 100-200 sq. feet.

A bank officer will be available here with a laptop on pre-determined days.

The Banking Correspondence agents will offer cash service to villagers (e.g. depositing or

taking out money),

This bank officer (in Ultra small branch) will offer other services, undertake field

verification (for loan applications), and follow up banking transactions.

A total of over 40,000 Ultra small branches (USBs) have so far been set up in the country.

SHG Bank linkage program

Self-Help Group (SHG)-Bank Linkage Programme started in early 90s.

Under this programs, self-help group open savings account in the bank. They get loans for

their projects, deposit money from members (and NGOs earn commission in between).

It is being implemented by

1. commercial banks,

2. regional rural banks (RRBs)

3. Cooperative banks.

Development Banks/AIFI

They can be further classified based on their target audience

Agro Housing Industry Import-export

NABARD National Housing Bank

1. SIDBI

2. IDBI

3. ICICI

4. IFCI

5. IIBI

EXIM bank

Out of ^them, names highlighted in bold (NABARD, NHB, SIDBI, EXIM) = All Indian financial

institutions (AIFI). Rest are development banks.

Industrial Development Bank?

First question: How is industrial development bank different from regular (commercial)

banks such as SBI, PNB etc.?

Industrial

development bank

Commercial Bank

Examples

1. ICICI*

2. IDBI

3. SIDBI (AIFI)

4. IFCI

5. IIBI

Public Sector

1. SBI

2. PNB

3. BoB

Pvt.Sector

1. ICICI*

2. HDFC

Accept

deposit

from

public?

No Yes

Job?

Provide

medium/long term

finance to ONLY

industries.

Provide short/medium/long term finance to

both common men

(car/bike/home/education/personal loans) + to

industries.

*The ICICI started in 1955 to provide finance to industries. In 1994 they also started ICICI

Bank. And in 2002, the original parent (ICICI) was merged with ICICI Bank Ltd.

how do Industrial development banks provide finance to industries?

1. By directly giving loans to a company.

2. By buying shares and bonds of a company.

3. By underwriting new IPOs.

In the beginning, these organizations started as All India financial institutions, their job

was to provide medium / long term finance to companies.

But after the LPG reforms in the 90s, capital market become popular. Now businessmen

had more options to arrange for finance (via IPOs, bonds). So these All India financial

institutions (AIFI) lost their original glamour and government converted them into

Development banks (as per Narsimhan Committees recommendation).

Now only four AIFI left: NABARD, SIDBI, EXIM and NHB. They are regulated by RBI.

In the (part 2 of 3), we had seen that now SIDBI and NHB are allowed to borrow via

external commercial borrowing (ECB) route.

1.ICICI

Full name: Industrial Credit and Investment Corporation of India.

Private sector development bank

Setup in 55. (same year SBI was also born).

2002: Merged it with ICICI Bank ltd.

2.SIDBI

Small industries development bank of India

Started in 1990.

SIDBI helps the micro, small and medium enterprises (MSME).

It provides finance to State Industrial Development Corporation

(SIDC), State finance corporations, Commercial banks, cooperative

banks and regional rural banks. And then those organizations

deliver loans/finance to the ultimate target group (MSME

industries).

Industrial development bank of India

UTI is a subsidiary of IDBI

3.IDBI

It borrows money by issuing bonds (and then lends that money to

industries at a higher interest rate.)

4.IFCI

Industrial finance corp. of India

Setup in 1948: that makes it the first industrial financial institution

in India.

5.IIBI

Industrial investment Bank of India.

6.NABARD

NABARD = National bank for Agriculture and rural development

It was setup in early 80s. (Regional rural banks (RRB) were started

in 75, that means first RRB came and then NABARD came).

It acts as the regulatory authority for cooperative banks and

regional rural banks

NABARD lends it downwards to State cooperative banks (SCB),

Regional Rural banks (RRBs), Microfinance institutions,

cooperative credit societies etc.

Thats how farmers, villagers, cottage/handicraft, self help group

(SHG) get loans at reasonable interest rate.

NABARD operates the Rural Infrastructure Development Fund

(RIFD)

7.NHB

National Housing Bank (NHB)

Started in late 80s

As the subsidiary of RBI

It is the apex institution for housing finance in India (just like how

NABARD is for rural / agri).

Reverse Mortgage product

Launched by National Housing bank.

For senior citizen

The senior citizen can mortgage his house and hell be given monthly income.

He doesnt need to repay loan or pay any EMIs, but when he dies, bank will take over his

house and auction it to recover the loan money. (and if house fetches more than loan

dues, then bank will give that extra money to heirs of the dead person.)

Punjab National bank also has a scheme like that, called PNB Baghban.

FINANCIAL PERFORMANCE OF BANKS

NPA = Non performing asset, in crude term, bank gave loan to someone but he is not

repaying it back on time.

Reasons for rising NPAs

1. current macroeconomic situation in the country;

2. increased interest rates in the recent past;

3. lower economic growth;

4. aggressive lending by banks in earlier good economic times (i.e. prior to 2007). And now

some of those businessmen / salaried individuals are not earning enough due to slow

down, hence unable to repay the loans.

5. Our banks had also loaned to some State electricity boards and airline companies (but

they are not paying back on time) so the banks NPA increased.

6. switchover to system-based identification of NPAs by Public Sector Banks

Capital Adequacy Ratio

A measure of a banks ability to absorb losses.

Formula: value of its capital divided by the value of risk-weighted assets.

To put this crudely : CAR= banks capital / banks risky assets.

A low capital adequacy ratio (CAR) = bank has a limited ability to absorb losses (meaning

bank is more likely to collapse if people start defaulting on their loans.)

High CAR= bank has good ability to absorb losses.

In public sector banks, government of India (GoI) has regularly infused capital to keep

the CAR high. But over the years, GoI too is running low on cash (thanks to fiscal deficit),

so government had formed a committee, and committee recommended that

Government should create a new financial holding company. This company will raise

money from domestic and international sources and then infuse it as equity in public

sector banks.

NPA: steps taken to reduce it

1. SARFAESI act and asset reconstruction companies (ARCs) (already discussed, click me

(http://mrunal.org/2012/12/economy-sarfaesi-asset-reconstruction-company-arc-

security-receipt-sr-qib-drt.html))

2. nodal officers in banks for each Debts Recovery Tribunal (DRT);

3. close watch on NPAs

RBI has also announced the following remedial measures:

1. sanction of fresh loans/ad-hoc loans from 1st Jan 2013 will be made on the basis of

sharing of information among banks;

2. banks will conduct sector- /activity-wise analysis of NPAs;

3. banks will put in place a robust mechanism for early detection of sign of distress,

amendments in recovery laws, and strengthening of loan appraisal and post credit

monitoring.

Chindus Budget speech

Interest subvention scheme

It was started in 2006

Govt. will continue this scheme for 2013-14 also.

Given for short term crop loans

For loan Upto Rs.3 lakh

Time period: 1 year.

Under this scheme, farmer can get loan @7% interest rate.

But if he repays the loan on time, then he will get additional 4% interest subvention.

(meaning loan would cost him 7-4=3% interest rate only.)

So far, the scheme has been applied to loans taken from public sector banks, RRBs and

cooperative banks.

Chindu proposed to extend this scheme to crop loans borrowed from private sector

scheduled commercial banks as well.

In case you wonder WHY? Why is govt. giving 3% interest subversion to farmer who repay

the loans on time? Earlier the interest subvention was 1% (2009), It was increased to 2%

(2010) and 3%(2011).

Because, in 2009, govt. had launched debt waiver scheme. (Meaning farmers didnt have

to repay the loans they had taken earlier.) Govt. say they are doing it to prevent farmers

suicides, but experts believe it was more of an election gimmick.

It hurt the economy in two ways

1. It increased fiscal deficit of the government.

2. The farmers who had been regularly repaying loan, felt cheated. Now they also dont

repay the loans on time, thinking sooner or later govt. would announce another debt-

waiver.

Thus, banks, particularly regional rural banks (RRBs) are facing really hard time recovering

the loan money. Thats why Chindu is doing two things

1. On one hand, he offers additional interest subersion to farmers who repay loans on

time.

2. On the other hand, he is also working for amalgation of RRBs.

More cash to NABARD

Govt. will provide Rs. 5000 crore to NABARD

NABARD will give it as loan for construction of warehouses, godowns, silos and cold

storage units both in the public and the private sectors.

Panchayats can also use this money for construction of godowns to help farmers to

store their produce.

Multilateral Development banks: Roads in NE

These banks operate at international level. They are formed by group of countries.

Examples of MDB= Word Bank, Asian Development Bank (ADB), African development

bank.

Chindu wants to get loan from both World Bank and the Asian Development Bank to

build roads connecting North East India with Myanmar. This will help in our look east

policy and improve the economic prosperity of north eastern States of India.

Bank for Women?

At present, there is no bank that exclusively serves women.

Chindu porposed that we should have have a bank that

1. lends mostly to women and women-run businesses,

2. supports women SHGs and womens livelihood,

3. employs predominantly women,

4. addresses gender related aspects of empowerment and financial inclusion

for this,

MBN Rao committee = theyll prepare the blueprint for the countrys first womens bank.

Govt. shall provide Rs 1,000 crore as initial capital to start this bank.

Chindu hopes RBI will give banking license to this by October, 2013.

Urban housing fund

There is already Rural Housing Fund set up through the National Housing Bank.

In this system, govt. gives cash to NHB. And NHB lends it to other banks operating in

rural areas >> finally those bank lend it to villagers to construct houses.

Chindu has proposed to start similar fund for Urban housing under National housing

bank.

Banking

1. Govt. will provide capital infusion to public sector banks and make sure they meet BASEL

III norms.

2. All scheduled commercial banks and all RRBs are on core banking solution (CBS) and

on the electronic payment systems (NEFT and RTGS).

3. Public sector banks have assured Chindu that well set up ATM in all our branches by the

end of March 2014

4. We are working with RBI and NABARD to bring all other banks, including some

cooperative banks, on CBS and e-payment systems by the end of December 2013.

What is Core Banking Solution (CBS)?

Core banking solution= Bank integrates all of its branches in a single IT network.

Whenever you take out money or deposit money from your account, the database is

updated in the central server directly.

Any branch of the bank, can access this date from the central server.

Thus Core banking solution helps customers to operate their accounts, and avail

banking services from any branch of the Bank on CBS network, regardless of which

branch he had opened the account.

The customer is no more the customer of a Branch. He becomes the Banks Customer.

Thus CBS = Anywhere and Anytime Banking.

You can deposit money in any branch-office, you can give cheque, you can take out

money, you can get your account statement, etc...as long as that branch is part of the

core banking solution.

CBS branch is like a Sales & Service Delivery Center. Internet banking, mobile banking,

ATM are all interconnected in Core banking solution.

Why is CBS in news?

Because of two reasons

#1: Chindus budget speech

All scheduled commercial banks and all RRBs are on core banking solution (CBS) and on

the electronic payment systems (NEFT and RTGS).

We are working with RBI and NABARD to bring all other banks, including some

cooperative banks, on CBS and e-payment systems by the end of December 2013.

#2: RBIs notice to UCB

in March 2013, RBI issued a notice that

Many Urban Co-operative Banks (UCBs) havent implemented the core banking solutions

(CBS) yet. Were giving them deadline: Dec 2013.

If they do not implement core-banking solutions by that time, then we (RBI) could deny

them various approvals (e.g. permission to open new branch etc.)

Why UCBs havent implemented CBS?

All the state-owned commercial banks have implemented CBS system already.

But other Urban cooperative banks at district level are unable do it due Lack of funds

(takes lot of money to setup server, buy licensed softwares, intenet bill etc).

Although RBI maintains that in long term, use of Information technology and CBS will

reduce the cost of operation so its a win-win situation if UCBs implemented the CBS.

Finally, conclusion, summary, what do we get from fifth chapter?

Conclusion

Indian Government started reforming the financial markets under LPG reforms in 90s.

The results of these reforms have been encouraging.

Today, India has one of the most vibrant and transparent capital markets in the world.

But still there are certain challenges before Indian capital market becomes an important

avenue for investors both foreign and domestic.

1) Our corporate sector requires long term funds (@low cost), and

2) we need lot of money for infrastructure project.

To help ^these two, we need three things

1. Well developed Banking systemalready present

2. Well developed equity market.already present.

3. Well developed corporate bond marketyet to develop.

So, Government needs to take policy initiatives for developing a robust corporate bond

market. These policy initiatives include:

1. Need to strengthen the legal, regulatory framework for corporate debt market.

2. Legal regulatory framework for financial products which is new or still in nascent stage

e.g. municipal bonds, credit default swaps.

3. At present our public sector organizations related to pension-insurance sector (LIC,

EPFO) cannot invest lot money in corporate debts. Government needs to relax their

investment guidelines.

Infrastructure development funds (IDF)

IDF are already discussed in earlier article click me (http://mrunal.org/2012/12/economy-

infrastructure-debt-funds-idf-withholding-tax-epfo-angle-meaning-concept-

explained.html)

Infrastructure Development funds will financing the long term infrastructure projects

@cheaper cost.

However, for the IDF to become effective, Government needs to take policy initiatives.

(allowing public sector insurance and pension funds to invest in them).

Financial literacy

Investment will not come just by relaxing the legal/regulatory framework.

You need to encourage people to invest in capital market. (and to prevent them from

investing all their money in gold- because gold purchase increases current account

deficit and creates more problems for Indian economy).

Govt also tried to give the carrot of RGESS. But challenge : much of the target audience

doesnt have PAN card and DEMAT account.

Banks

Banking Laws (Amendment) Act 2012 already discussed click me

(http://mrunal.org/2012/12/economy-banking-amendment-bill-issues-features-

problems-reforms-meaning-explained.html)

This will give more regulatory and supervisory to RBI and

help banks in raising funds from the capital market for expanding their banking

business.

SARFAESI act amendment help banks reduce their NPAs.

Other issues related to RRBs, NABARD etc given in this article itself.

Pension

Pension reforms in India

1. Will facilitate the flow of long-term savings for development

2. Will help establish a credible and sustainable social security system in the country

But challenge: NPS is not popular due to low commission, bill pending in parliament. More

explained earlier, click me (http://mrunal.org/2013/04/economy-new-pension-scheme-

swavalamban-nps-lite-pfrda-meaning-issues.html)

Insurance

Chindu gave revival package.

Challenge: Less insurance penetration, FDI Bill pending in parliament

Mock Questions

1. Correct Chronological order (older to newer)

a. NABARD, RRB, SHG-Bank linking program

b. SHG-Bank linking program, RRB, NABARD

c. RRB, NABARD, SHG-Bank linking program

d. None of Above

2. RRBs are sponsored by

a. NABARD

b. RBI

c. Commercial banks

d. None of Above

3. Correct statement about Priority sector lending (PSL)

a. RBI has mandated that banks should lend maximum 40% of their advances to PSL.

b. As per RBI rules, the Priority sector lending target for foreign banks is higher than

Indian banks.

c. Both A and B

d. None

4. Who benefits from Priority Sector Lending?

a. Small scale industrialist

b. exporter

c. education loan seeker

d. All of above

5. Priority sector lending targets _____

a. Are Uniform for all foreign banks in India

b. Depend on number of branches a foreign bank has.

c. Donot apply to any foreign banks.

d. None of above.

6. Priority sector lending (PSL) target for foreign banks, is decided by

a. Department of Economic affairs

b. NABARD

c. RBI

d. None of above

7. Ultra Small (bank) branches are meant for

a. Army cantonments

b. Near SEZ units

c. Village covered through Banking Correspondence Agents

d. Major and Minor sea Ports

8. The main purpose of Ultra Small (Bank) branches is

a. Provide easy loans to exporters

b. Provide easy loans to importers

c. Achieve financial inclusion

d. None of above

9. Swabhiman scheme is associated with _____ sector.

a. Healthcare

b. Pension

c. Education

d. Banking

10. Swavalamban scheme is associated with _____ sector.

a. Healthcare

b. Pension

c. Education

d. Banking

11. Rural Infrastructure Development Fund is operated by

a. Ministry of Rural affairs

b. Planning commission

c. NABARD

d. None of above

12. Who among the following implements SHG-Bank linkage program?

a. Commercial banks

b. Regional rural banks (RRBs)

c. Cooperative banks.

d. All of above

13. RBI regulates the interest rates on

a. Interest rates on loans given to exporters

b. FCNR

c. Savings deposits

d. None of above

14. Arrange these bank accounts in the ascending order of interest offered to customer

(smaller to bigger)

a. Current, Savings, Term deposit

b. Term deposit, savings, current

c. current, term deposit, savings

d. none of above.

15. What is the similarity between industrial development bank and a commercial bank?

a. Both accept deposits from public

b. both provide short term finance to industries.

c. Both A and B

d. None

16. Which of the following is All India Financial institution

a. SIDBI

b. NABARD

c. NHB

d. All of above

17. first industrial financial institution in India was

a. IFCI

b. ICICI

c. SIDBI

d. UTI

18. National housing bank has launched Reverse mortgage product for benefits

a. Senior citizens

b. students

c. industrialists setting up new colonies

d. None of above

19. Which of the following has not fully implemented core banking solution yet?

a. Scheduled commercial banks

b. Regional rural banks

c. Urban cooperative banks

d. None of above

20. Core banking solution means

a. Bank doesnt sell mutual funds, insurance policies but concentrates on its core

banking operation.

b. Information related to a customers account is stored in a centralized server.

c. Indian bank offering outsourcing services to foreign banks.

d. None of above.

21. For a bank customer, Core banking solution

a. Prevents him from getting services from branches other than his local branch.

b. helps him avail banking services from any branch of his bank.

c. Helps him buy mutual fund and insurance policies via local branch.

d. None of above.

22. Which of the following is an example of NBFC?

a. Infrastructure Finance Companies,

b. Infrastructure Debt Fund

c. Both A and B

d. None

23. correct statement about NBFC-factoring companies

a. Theyre infrastructure companies that help entrepreneur in setting up new factory.

b. Theyve to register themselves with RBI.

c. Both A and B

d. None

24. A gold loan company

a. is an example of NBFC

b. Has to follow the Loan to Value ratio stipulated by SEBI

c. Both A and B

d. None

25. for a bank, low Capital adequacy ratio (CAR) means

a. It has low capacity to absorb losses.

b. It has high capacity to absorb losses.

c. Bank will be exempted from SLR requirement

d. None of above

26. If you have to deposit your savings, which of the following bank is most reliable?

a. Bank with low CAR and low NPA

b. Bank with low CAR and high NPA

c. Bank with high CAR and high NPA

d. Bank with high CAR and low NPA

27. If you have to deposit your savings, which of the following bank is least reliable?

a. Bank with low CAR and low NPA

b. Bank with low CAR and high NPA

c. Bank with high CAR and high NPA

d. Bank with high CAR and low NPA

28. Correct statement

a. A Bank customer doesnt earn interest on current account

b. A Bank doesnt earn interest on CRR

c. Both A and B

d. None

29. Who among the following, will help a bank reduce its NPA?

a. Asset reconstruction company

b. NBFC-factor company

c. Both A and B

d. None

30. Interest subvention scheme

a. was started in 2006 and stopped in 2012

b. is applicable to long term agriculture loans

c. both

d. None

31. Example of Multilateral development bank?

a. SIDBI

b. IDBI

c. ADB

d. None of above

32. Who among the following, is outside the regulatory control of RBI?

a. Urban cooperative banks

b. SIDBI, NHB and EXIM bank

c. Multilateral development banks

d. None of above

33. MBN Rao is to prepare the blueprint for _____

a. GAAR

b. Food security

c. Indias first womens bank

d. Indias first multilateral bank

For more on Economy related articles, visit mrunal.org/economy

(http://mrunal.org/economy)

$ Tags: Economic Survey 2012 (http://mrunal.org/tag/economic-survey-2012)

Print | PDF (need Chrome) (http://mrunal.org/2013/04/economic-survey-ch5-

financial-intermediaries-banks-rrbs-nbfcs-part-3-of-3.html/print/)

Q Get notified whenever I post new article!

(http://feedburner.google.com/fb/a/mailverify?uri=CivilServiceExam)

@

Mrunal recommends

UPSC Civil Service

SSC CGL: Staff selection

IBPS Bank Exams

CDS: Defense Services

CAT/IIM MBA Entrance

+

+

+

+

+

Q

More from this category

[Economic Survey] Corrections in the previous articles + Parting words

before Qatl ki Subha (http://mrunal.org/2014/08/economic-survey-

corrections-in-the-previous-articles.html)

[Economy] Inflation Indexed Bonds IIB, IINSS-C: Salient Features, real

interest rate, nominal interest rate (http://mrunal.org/2014/08/economy-

inflation-indexed-bonds-iib-iinss-c-salient-features-benefits-investment-

limits.html)

[Economic Survey] Ch4: Measures of Money Supply, M0-M1-M2-M3-M4;

Reserve-Narrow-Broad Money, Money multiplier & Velocity

(http://mrunal.org/2014/08/explained-measures-of-money-supply-m0-m1-

m3-narrow-money-broad-money-money-multiplier.html)

[Economic Survey] Ch4: Monetary Policy Trends, Reforms, RBI Restructuring

program (http://mrunal.org/2014/08/economic-survey-ch4-monetary-

policy-trends-reforms-rbi-restructuring-program.html)

[Economy] Index Theory: WPI, CPI, IIP, Components, Baseyear; Core vs

So far 64 Comments posted

Headline inflation, Laspeyres formula explained

(http://mrunal.org/2014/08/explained-wpi-cpi-iip-index-component-core-

inflation-headline-inflation-laspeyre.html)

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 0 7 9 #R E S POND)

Manish

04.21.2013 AT 2:20 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51079)

aaj iss article ko bina padhe nahi sounga

thankkyou sir

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 0 8 0 #R E S POND)

Manish

04.21.2013 AT 2:38 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51080)

xlnt work

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 0 9 0 #R E S POND)

IITian

04.21.2013 AT 5:15 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51090)

Civils Main exam delayed; scheduled from Dec. 1

http://www.thehindu.com/news/cities/Hyderabad/civils-main-exam-

delayed-scheduled-from-dec-1/article4637451.ece?homepage=true

(http://www.thehindu.com/news/cities/Hyderabad/civils-main-exam-

delayed-scheduled-from-dec-1/article4637451.ece?homepage=true)

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 3 0 #R E S POND)

Bibliophile

04.21.2013 AT 1:03 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51130)

I just loved the 5 day concept.Its a good news for working

professionals.One week off and job is done!

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 0 9 1 #R E S POND)

mannu

04.21.2013 AT 6:15 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51091)

thankyou sir,the way u write articles i like it..

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 0 9 4 #R E S POND)

nav

04.21.2013 AT 7:33 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51094)

switchover to system-based identification of NPAs by Public Sector

Banks?????

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 0 9 7 #R E S POND)

manukoleth

04.21.2013 AT 7:46 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51097)

Switchover to system-based identification of NPA by Public Sector

Banks System-based identification of NPA means Automated-

Computer based identification. Computer-based NPA recognition

removes the subjectivity that the banker may exercise in

classifying a loan as non-performing. So RBI has asked, in 2011,

all subsidiary banks to switch to this system.

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S -

B A NK S - R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 6 6 #R E S POND)

nav

04.21.2013 AT 8:23 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-

CH5-FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-

3.HTML/COMMENT-PAGE-1#COMMENT-51166)

thank u very much manukoleth

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S -

B A NK S - R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 2 0 4 #R E S POND)

bhaz

04.21.2013 AT 10:53 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-

CH5-FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-

3.HTML/COMMENT-PAGE-1#COMMENT-51204)

thanks. have been trying to find out what it meant for a

long time

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 0 1 #R E S POND)

manu

04.21.2013 AT 9:31 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51101)

bhai

it would be nice if u could finish your economic survey series before

the SBI PO exam ( just a request)

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 0 2 #R E S POND)

TPK

04.21.2013 AT 9:43 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51102)

thank you bhai

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 0 5 #R E S POND)

phani

04.21.2013 AT 10:00 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51105)

01.C

02.A

03.B

04.B

05.A

06.C

07.C

08.C

09.D

10.B

11.C

12.D

13.C

14.A

15.B

16.D

17.B

18.A

19.C

20.B

21.B

22.C

23.C

24.A

25.A

26.D

27.B

28.C

29.A

30.D

31.C

32.C

33.C post the comment if answer is wrong..

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 0 6 #R E S POND)

Mohanbabu

04.21.2013 AT 10:22 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51106)

Very useful

Thanks

Answers

1c

2c

3a

4d

5b

6c

7c

8c

9d

10b

11c

12d

13b

14a

15b

16a

17a

18a

19c

20b

21b

22a

23b

24a

25a

26d

27b

28c

29a

30d

31c

32c

33c

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 1 1 #R E S POND)

Bibliophile

04.21.2013 AT 10:45 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51111)

What are the BASEL III norms?????

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 5 4 1 #R E S POND)

SHANDEV

04.22.2013 AT 10:24 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51541)

basel- a city is swiz.Its just a regulatory standards for the capital

adequency of the commercial banks..its jst a set of rles so that a

bank can withstand losses..yo can read those rules in Ramesh

singh or just google it..

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S -

B A NK S - R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 8 1 5 #R E S POND)

Bibliophile

04.24.2013 AT 12:11 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-

CH5-FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-

3.HTML/COMMENT-PAGE-1#COMMENT-51815)

thanks.Appreciate that.

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 1 2 #R E S POND)

CSN

04.21.2013 AT 10:48 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51112)

The last joke was awesome,its only way congis can allure youth voter

towards it

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 1 7 #R E S POND)

smit

04.21.2013 AT 11:27 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51117)

c

c

d

d

b

c

c

c

d

b

c

d

b

a

b

d

a

a

c

b

c

c

b

a

a

d

b

c

a

d

d

c

c

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 1 8 #R E S POND)

Amar

04.21.2013 AT 11:38 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51118)

Thanx mrunal bhai

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 2 3 #R E S POND)

TRA

04.21.2013 AT 11:57 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51123)

1.c 10.b 19.c 28.c

2.c 11.c 20.b 29.c

3.a 12.d 21.b 30.d

4.d 13.b 22.c 31.c

5.b 14.a 23.b 32.c

6.c 15.d 24.a 33.c

7.c 16.d 25.a

8.c 17.a 26.d

9.d 18.a 27.b

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 4 9 #R E S POND)

Praghu

04.21.2013 AT 5:37 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51149)

will NBFC help in reducing NPAs, are u sure in 29th ?

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S -

B A NK S - R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 5 5 #R E S POND)

TRA

04.21.2013 AT 7:32 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-

CH5-FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-

3.HTML/COMMENT-PAGE-1#COMMENT-51155)

not sure.ostensibly it doesnt.

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L -

I NT E R ME DI A R I E S - B A NK S - R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ?

R E PL YT OCOM= 5 1 2 7 8 #R E S POND)

Praghu

04.22.2013 AT 8:34 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-

SURVEY-CH5-FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-

3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-51278)

I also think so , bcz , in SARFEASI ACT (recent

amendment), there is no such provision. its ARCs

who participate via QIB.

~

TRA

04.22.2013 AT 5:57 PM

(HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-

3.HTML/COMMENT-PAGE-1#COMMENT-51455)

definitely not.factoring has nothing to do with

NPAs.genesis of factoring relates to a non

conventional lending spree in tough times in a

vertical different altogether from normal

lending routes).though it helped businesses

mitigate short term liquidity crises,etc etc.

moreover RBI doesnt encourage factoring

business anymore. for ex factoring arm of citi,

sbi are mostly redundant mulling merger.(dont

know their current status,it was in news

sometimes back for NPAs)

also in no way a scheduled comm bank can

approach nbfc factoring for NPAs mitigation.

~

TRA

04.22.2013 AT 7:27 PM

(HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-

3.HTML/COMMENT-PAGE-1#COMMENT-51472)

*by factoring i meant NBFC factor company and

not factoring per se

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 9 3 9 #R E S POND)

Murali

04.24.2013 AT 3:48 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51939)

3-d

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 3 1 #R E S POND)

mama

04.21.2013 AT 1:03 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51131)

Thanks for ur contibution..

Answers

A3,14,17,18,24,25

B5,10,13,20,21,23,27

C1,2,6,7,8,11,19,22,28,29,31,32,33

D4,9,12,15,16,26,30

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 3 6 #R E S POND)

Rohin kotwal

04.21.2013 AT 2:13 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51136)

Gud one sir ji

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 4 1 #R E S POND)

Ritu Sharma

04.21.2013 AT 3:24 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51141)

Dear Sir,

Is it true that the exam suppose to be held on 28th april is further

postponed to 19th may??

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 7 6 #R E S POND)

Mrunal (http://mrunal.org)

04.21.2013 AT 9:16 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51176)

yes that is correct.

i) The SSC Combined Graduate Level Examination 2013, which

was initially scheduled to be held on 14th April, 2013 will now be

held on 19th May, 2013.

ref: sscnr.net.in/newlook/NoticeDetail/Notice15413.aspx

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 4 3 #R E S POND)

kundan

04.21.2013 AT 3:35 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51143)

excellent job sir hatts off you

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 5 1 #R E S POND)

Aftab Ahmad Khan

04.21.2013 AT 5:56 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51151)

Dear Sir,

Is it true that the exam suppose to be held on 28th april is further

postponed to 19th may??

or not??

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 7 5 #R E S POND)

Mrunal (http://mrunal.org)

04.21.2013 AT 9:15 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-51175)

thats correct. please see Northern regions website:

http://sscnr.net.in/newlook/NoticeDetail/Notice15413.aspx

(http://sscnr.net.in/newlook/NoticeDetail/Notice15413.aspx)

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 5 6 #R E S POND)

Aakansha

04.21.2013 AT 7:33 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51156)

reli thankful for this info..

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 1 6 1 #R E S POND)

krish

04.21.2013 AT 8:02 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51161)

ccdddcccdbcdbcbdaacbbdddbdbcadccc

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 3 4 4 #R E S POND)

Hemant

04.22.2013 AT 12:13 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51344)

thanks mrunal sir

plzz keep helping garib aspirants like us

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 3 7 0 #R E S POND)

Krishnam Naidu

04.22.2013 AT 1:20 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51370)

@ Mrunal , U told that NABARD only takes care of RIDF but when u

tabulated banks into different categories U have typed that NABARD

wud b working to cater needs of only AGRO industries . plz explain

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 3 9 3 #R E S POND)

love shandilya

04.22.2013 AT 2:36 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51393)

i want 2 ask a question tht under IT ACT SECTION 67,67 A N 68

Publishing or transmitting obscene material in electronic

form./pornography/child pornography LED TO Imprisonment term up

to 5/7 years and fine up to 10 lakh rupees so why porn sites n people

postin such pics not booked under tht???

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 4 2 8 #R E S POND)

A random mrunal fan

04.22.2013 AT 4:33 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51428)

hi Mrunal,

I have learnt so much from your articles, specialy economy, that It

wouldve been quite ungrateful on my part to not to thank you I

really appreciate you for doing all the dirty work for us. And I marvel at

your pateince of reading and answering the queries in comments.

PS. Did u know u r a genious?

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 4 3 9 #R E S POND)

Sameer

04.22.2013 AT 5:10 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51439)

Thanks Mrunal.. great job..keep posting..:)

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 6 8 6 #R E S POND)

Prashant

04.23.2013 AT 1:46 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51686)

1c

2c

3a

4d

5b(http://www.rbi.org.in/scripts/FAQView.aspx?Id=87

(http://www.rbi.org.in/scripts/FAQView.aspx?Id=87))

6c

7c

8c

9d

10b

11c

12d

13b

14d

15d

16d

17a

18a

19c

20b

21b

22c

23b

24a

25a

26d

27b

28c

29a

30d

31c

32c

33c

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 5 6 5 4 #R E S POND)

PIRAI

05.09.2013 AT 3:38 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-55654)

check ur 14th answer

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 1 7 5 8 #R E S POND)

somia1314

04.23.2013 AT 7:14 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

51758)

i want to sell my brilliant tutorials mains sociology material. it contain

12 sets of socio wid previous years papers is der any1 interested . can

mail me at snsharma1007@gmail.com

(mailto:snsharma1007@gmail.com).

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 2 1 5 8 #R E S POND)

vinod simha

04.25.2013 AT 2:24 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

52158)

1. c

2. a

3. d

4. d

5. b

6. c

7. c

8. c

9. d

10. b

11. c

12. d

13. c

14. a

15. b

16. d

17. a

18. a

19. c

20. b

21. b

22. c

23. c

24. a

25. a

26. d

27. b

28. c

29. c

30. d

31. c

32. c

33. c

Correct me if i am wrong

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 2 3 2 1 #R E S POND)

Suresh

04.26.2013 AT 6:29 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

52321)

1. c

2. c

3. d

4. d

5. b

6. c

7. c

8. c

9. d

10. b

11. c

12. d

13. b

14. a

15. d

16. d

17. a

18. a

19. c

20. b

21. b

22. d

23. d

24. d

25. a

26. d

27. b

28. c

29. a

30. d

31. c

32. c

33. c

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 2 7 0 6 #R E S POND)

sunil

04.27.2013 AT 5:03 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

52706)

1 c

2 c

3 d

4 d

5 b

6 c

7 c

8 c

9 d

10 b

11 c

12 d

13 b

14 a

15 d

16 d

17 a

18 a

19 c

20 b

21 b

22 c

23 murnal plz give solution

24 murnal plz give solution

26 d

27 b

28 c

29 a

30 d

31 c

32 c

33 c

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 3 0 2 0 #R E S POND)

Mrunal (http://mrunal.org)

04.29.2013 AT 10:54 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-53020)

23 only B Theyve to register themselves with RBI.

24 only A it is an example of NBFC.

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 8 6 2 5 #R E S POND)

keerti

05.19.2013 AT 6:58 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-58625)

@ Sunil

Q 3 ans is (A)

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S -

B A NK S - R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 9 2 9 5 8 #R E S POND)

priti

09.18.2013 AT 12:42 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-

CH5-FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-

3.HTML/COMMENT-PAGE-1#COMMENT-92958)

yup its (a) (ref rbi site)

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 2 7 2 9 #R E S POND)

david

04.27.2013 AT 6:54 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

52729)

hey mrunal,appreciate your great work. those of us who are unable to

join coaching institute or lacks exposure to various exams are major

beneficiaries. here is a doubt in me whether Vice president of India is a

member of Rajya Sabha. this question was recently asked in CGL.

thanks.

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 3 5 0 3 #R E S POND)

monu

05.01.2013 AT 2:49 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-53503)

vice president is the ex officio chairman of the rajya sabha but

not the member

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 3 0 4 3 #R E S POND)

Simran

04.29.2013 AT 11:45 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

53043)

Can you explain NBFCs a little more please? And What are NBFC-factors

which is introduced this year?

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 3 1 6 8 #R E S POND)

totallyRed

04.29.2013 AT 9:30 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

53168)

Hi Mrunal,

Can you please write more (here or in a separate article) on NBFCs and

Priority Sector LendingI was not able to find much about them.

Thanks a Ton!

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 3 2 9 0 #R E S POND)

Dc

04.30.2013 AT 2:40 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

53290)

What is the correct ans for Q no . 3 and 29 ??????

IS THIS STATEMENT CORRECT

RBI has mandated that banks should lend MAXIMUM 40% of their

advances to PSL.

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 6 3 1 4 #R E S POND)

Abhishek Kumar

05.11.2013 AT 8:15 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

56314)

I found the FAQs section on RBI Website Useful

http://www.rbi.org.in/scripts/FAQDisplay.aspx

(http://www.rbi.org.in/scripts/FAQDisplay.aspx)

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 6 7 8 8 #R E S POND)

sandip

05.13.2013 AT 12:24 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

56788)

Mrunal sirplz also give the correct answers to the MCQs

Thanks a ton

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 7 6 3 0 #R E S POND)

bb+

05.16.2013 AT 1:14 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

57630)

Excellent saab.

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 8 5 5 5 #R E S POND)

SONIYA

05.19.2013 AT 2:22 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

58555)

mrunal sir can u plzz put on d answerkey.problem wid few

questions

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 9 0 1 0 #R E S POND)

SONIYA

05.20.2013 AT 4:08 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

59010)

mrunal sir can u plzz put on d answerkey.problem wid few

questions

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 5 9 1 2 6 #R E S POND)

smit

05.21.2013 AT 1:34 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

59126)

as per eco survey 2013 in Interest subvention scheme the subvantion

is 3 % not 4%..

please correct me if i am wrong

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 7 9 9 7 4 #R E S POND)

Kris

08.06.2013 AT 4:30 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

79974)

01.C

02.C

03.MRUNAL SIR PLZ GIVE ME ANS TO THIS QUESTION

04.D

05.B

06.C

07.C

08.C

09.D

10.B

11.C

12.D

13.B

14.A

15.D

16.D

17.A

18.A

19.C

20.B

21.B

22.MRUNAL SIR PLZ GIVE ME ANS TO THIS QUESTION

23.B

24.A

25.A

26.D

27.B

28.C

29.A

30.D

31.C

32.C

33.C

~

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S -

R R B S - NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 8 0 0 7 9 #R E S POND)

Kris

08.06.2013 AT 9:25 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-

FI NANCI AL-I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-

PAGE-1#COMMENT-80079)

@mrunal sir please give me answers to 3rd and 22nd

questionsplease

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 8 2 6 4 7 #R E S POND)

kris

08.15.2013 AT 8:34 AM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

82647)

sir,

what is priority sector lending for commercial banks with less than 20

branches?

R E PL Y ( / 2 0 1 3 / 0 4 / E CONOMI C- S U R VE Y- CH 5 - FI NA NCI A L - I NT E R ME DI A R I E S - B A NK S - R R B S -

NB FCS - PA R T - 3 - OF- 3 . H T ML ? R E PL YT OCOM= 9 2 8 8 5 #R E S POND)

Search b4 asking

Recent Comments

Name?

Q

Email ID?

Wri te your message!

What is your Message? Search before asking questions & confine discussions to exams

related matter only.

Notify me of follow-up comments by email.

Notify me of new posts by email.

priti

09.17.2013 AT 9:15 PM (HTTP://MRUNAL.ORG/2013/04/ECONOMI C-SURVEY-CH5-FI NANCI AL-

I NTERMEDI ARI ES-BANKS-RRBS-NBFCS-PART-3-OF-3.HTML/COMMENT-PAGE-1#COMMENT-

92885)

The paid up capital Central Government : State Government : Sponsor

bank is 60%, 20%, 20% now?

Post Message

Search

WHYDFACE1 { HappY Teachers DaY sirrr :) } [Answerkey] CSAT-2014: Environment &

Biodiversity, Common Myna, Crabs, Montreux... (http://mrunal.org/2014/09/answerkey-

csat-2014-environment.html/comment-page-1#comment-246516)

KUNAL { The question is asking problem of soil erosion is associated with terrace cultivation

or not and not whether terrace cultivation is associated with the problem... } [Answerkey]

CSAT-2014: Environment & Biodiversity, Common Myna, Crabs, Montreux...

(http://mrunal.org/2014/09/answerkey-csat-2014-environment.html/comment-page-

1#comment-246514)

SAHIL { Happy Teachers Day Sir... :) :) } [Answerkey] CSAT-2014: Environment &

Biodiversity, Common Myna, Crabs, Montreux... (http://mrunal.org/2014/09/answerkey-

csat-2014-environment.html/comment-page-1#comment-246509)

RAJIV { Happy teachers' day sir......... } [Answerkey] CSAT-2014: Environment &

Biodiversity, Common Myna, Crabs, Montreux... (http://mrunal.org/2014/09/answerkey-

csat-2014-environment.html/comment-page-1#comment-246507)

KARTHIK { | [[ 0_u mrunal..:-) ( happy teacher's day

mrunal ) } [Answerkey] CSAT-2014: Environment & Biodiversity, Common Myna, Crabs,

Montreux... (http://mrunal.org/2014/09/answerkey-csat-2014-

environment.html/comment-page-1#comment-246505)

HS { Regarding question of soil erosion take it take Terrace Cultivation is a solution associated

with the problem of Soil erosion. what you guys say? } [Answerkey] CSAT-2014:

Environment & Biodiversity, Common Myna, Crabs, Montreux...

(http://mrunal.org/2014/09/answerkey-csat-2014-environment.html/comment-page-

1#comment-246503)

ABHISHEK { thanks sir } [Answerkey] CSAT-2014: Environment & Biodiversity,

Common Myna, Crabs, Montreux... (http://mrunal.org/2014/09/answerkey-csat-2014-

environment.html/comment-page-1#comment-246489)

MONISH { Regarding this question: "Which of the following adds/add carbon dioxide to the

carbon cycle on the planet Earth?" I don't know why people are disregarding... } [Answerkey]

CSAT-2014: Environment & Biodiversity, Common Myna, Crabs, Montreux...

(http://mrunal.org/2014/09/answerkey-csat-2014-environment.html/comment-page-

1#comment-246488)

AMIT { Happy teachers day sir } [Answerkey] CSAT-2014: Environment & Biodiversity,

Common Myna, Crabs, Montreux... (http://mrunal.org/2014/09/answerkey-csat-2014-

environment.html/comment-page-1#comment-246484)

ANSHU SHARMA { Happy teacher's day mrunal sir....u r really a source of motivation for all

of us....my heartiest respect and charansparsh.... } [Answerkey] CSAT-2014: Environment &

Biodiversity, Common Myna, Crabs, Montreux... (http://mrunal.org/2014/09/answerkey-

csat-2014-environment.html/comment-page-1#comment-246480)

@ EXAM DATES

IBPS-Clerk (http://ibps.in/career_pdf/CWE_PO_MT_IV_27_06_2014.pdf) Dec 06-27

IBPS-PO (http://ibps.in/career_pdf/CWE_PO_MT_IV_27_06_2014.pdf):11'Oct to 2'Nov

SSC-CGL 2014 (http://www.ssc-cr.org/noticeboard/EXAM_CALANDER_2014.pdf):Oct 19|26

CAT (http://iimcat.ac.in/):16 & 22 Nov

CDS (http://www.upsc.gov.in/exams/notifications/2014/cds2/CDS-II%20ENGLISH.pdf):Oct 26

MAT (http://apps.aima.in/matbschool/): 7 & 13 Sep

O

BANKING

18-Sep: SBI Ass.BankPO (2986)

(https://www.sbi.co.in/webfiles/uploads/files/SBI_PO_RECRUITMENT_FOR_ASSOCIATE_BANKS_ENGLISH_ADVERT.pdf)

15-Sep: Punjab Gramin RRB (http://www.pgbho.com/Recruitments.html)

MBA

23-Aug: MAT-2014 (http://apps.aima.in/matbschool/)

30-Sep: CAT-IIM (https://iimcat.ac.in/EForms/Mock/Web_App_Template/756/1/index.html?1@@1@@1)

State Services