Professional Documents

Culture Documents

Break Even and CVP

Uploaded by

Ishmael Oneya0 ratings0% found this document useful (0 votes)

222 views2 pagesThe document contains information about several companies' contribution margin income statements, including sales, variable expenses, fixed expenses, contribution margins, break-even points, and margin of safety calculations. It also includes multiple questions asking to prepare new income statements reflecting changes in sales, expenses, products, and pricing and to calculate resulting break-even points and margins of safety.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains information about several companies' contribution margin income statements, including sales, variable expenses, fixed expenses, contribution margins, break-even points, and margin of safety calculations. It also includes multiple questions asking to prepare new income statements reflecting changes in sales, expenses, products, and pricing and to calculate resulting break-even points and margins of safety.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

222 views2 pagesBreak Even and CVP

Uploaded by

Ishmael OneyaThe document contains information about several companies' contribution margin income statements, including sales, variable expenses, fixed expenses, contribution margins, break-even points, and margin of safety calculations. It also includes multiple questions asking to prepare new income statements reflecting changes in sales, expenses, products, and pricing and to calculate resulting break-even points and margins of safety.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

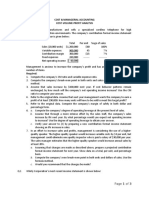

Following is the contribution margin income statement of a single product company:

Total Per unit

Sales $1,200,000 $80

Less variable expenses $840,000 $56

-

Contribution margin 360,000 $24

Less fixed expenses 300,000 -

Net operating income $60,000

Required:

1. Calculate break-even point in units and dollars.

2. What is the contribution margin at break-even point?

3. Compute the number of units to be sold to earn a profit of $36,000.

4. Compute the margin of safety using original data.

5. Compute CM ratio. Compute the expected increase in monthly net operating if sales increase by

$160,000 and fixed expenses do not change.

Metro International manufactures two products plasma TV and high quality laptop. Plasma TV

sells for $800 and high quality laptop for $1200. Company sells its products through its own stores and

other outlets. Total fixed expenses of Metro International are $132,000 per month. Variable expenses

and monthly sales data are given below:

Plasma TV Laptop

Variable expenses per unit $480 $240

Monthly sales in units 200 Units 80 Units

Required:

1. Prepare a contribution margin format income statement showing dollars and percent columns for

products and for the company as a whole.

2. Compute the break-even point in dollars and margin of safety.

3. Metro International is considering to manufacture another product an inverter. The addition of new

product will not effect the fixed cost of the company. The variable expenses to manufacture and sell an

inverter will be $1,200. If the new product is sold for $1,600 the monthly expected sales are 40

inverters.

(a). Prepare a new contribution margin income statement.

(b). Compute the new break-even point and margin of safety of the company.

4. The president is unable to understand the increase in break-even sales because the new product has

increased the sales revenue and contribution margin without any increase in fixed costs. Explain to the

president the reason of increase in break-even sales.

PNG electric company manufactures a number of electric products. Rechargeable light is one of the

PNGs products that sells for $180/unit. Total fixed expenses related to rechargeable electric light are

$270,000 per month and variable expenses involved in manufacturing this product are $126 per unit.

Monthly sales are 8,000 rechargeable lights.

Required:

1. Compute break-even point of the company in dollars and units.

2. According to a research conducted by sales department, a 10% reduction in sales price will result in

25% increase in unit sale. Prepare two income statements in contribution margin format, one using the

current price and one using proposed price (10% below the old sales price).

3. Compute the number of rechargeable lights to be sold to earn a net operating income of $144,000 per

month.

Zoltrixound company manufactures high quality speakers for desktop and laptop computers. Last

month Zoltrixound suffered a loss of $18,000. The income statement of the last month is as follows:

Sales (13,500 units $40) 540,000

Less variable expenses 378,000

Contribution margin 162,000

Less fixed expenses 180,000

Net operating loss $(18,000)

Required:

1. Compute the break-even point and contribution margin ratio of Zoltrixound company?

2. Sales department feels that if monthly advertising budget is increased by $16000, the sales will be

increased by $140,000. Show the effect of this change.

3. If sales price is reduced by 20% and monthly advertising expenses are increased by $70,000, the unit

sales are expected to increase by 100%. Show the effect of this change by preparing a new income

statement of Zoltrixound company.

4. The Zoltrixound wants to make the packing of its product more attractive. The new packing would

increase cost by $1.20 per unit. Assuming no other changes, compute the number of units to be sold

to earn a net operating income of $9,000.

5. The company is planning to purchase a new machine. The installation of new machine will increase

fixed cost by $236,000 and decrease unit variable expenses by 50%.

(a). Compute the CM ratio and break-even point if the new machine is installed.

(b). Company expects a sale of 20,000 units for the next month. Prepare two income statement, one

assuming that the machine is not installed and one assuming that it is installed.

(c) Should the company install new machine. Give your recommendations.

You might also like

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- CVP Review Problem P 6.29 P 6.30Document4 pagesCVP Review Problem P 6.29 P 6.30nehal hasnain refath0% (1)

- Outboard Engines World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Engines World Summary: Market Sector Values & Financials by CountryNo ratings yet

- COST VOLUME PROFIT ANALYSIS - ExercisesDocument4 pagesCOST VOLUME PROFIT ANALYSIS - ExercisesLloyd Vincent O. TingsonNo ratings yet

- Inboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryFrom EverandInboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Activity 005Document2 pagesActivity 005Kelvin Jay Sebastian SaplaNo ratings yet

- HW 2.2 Afm SendDocument10 pagesHW 2.2 Afm SendAbiodun OlokodanaNo ratings yet

- Chapter 6 ReviewDocument13 pagesChapter 6 Reviewkwathom1No ratings yet

- CAC Activity2Document3 pagesCAC Activity2Jasper John NacuaNo ratings yet

- CVP H101Document4 pagesCVP H101poppy2890No ratings yet

- Cost Volume Profit Relationship Solving ProblemsDocument11 pagesCost Volume Profit Relationship Solving ProblemsMahruf OpuNo ratings yet

- Chap 4 - ActivitiesDocument3 pagesChap 4 - Activities31211022392No ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentSYED MUHAMMAD MOOSA RAZANo ratings yet

- CVP Analysis and Absorption vs Variable CostingDocument3 pagesCVP Analysis and Absorption vs Variable CostingBenjamin0% (1)

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Document2 pages3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- CVP Analysis Exercise-OLDDocument3 pagesCVP Analysis Exercise-OLDIftekhar Uddin M.D EisaNo ratings yet

- 6e Brewer CH05 B EOCDocument18 pages6e Brewer CH05 B EOCLiyanCenNo ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthMohitNo ratings yet

- STRAT ReviewerDocument13 pagesSTRAT ReviewerCrisel SalomeoNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAnne BacolodNo ratings yet

- Cost-Volume-Profit Analysis Techniques for Managerial Decision MakingDocument3 pagesCost-Volume-Profit Analysis Techniques for Managerial Decision Makingmohammad bilal0% (1)

- Accounting Questions Week 3Document2 pagesAccounting Questions Week 3milleranNo ratings yet

- Strategic Cost - CVP Analysis ReviewerDocument2 pagesStrategic Cost - CVP Analysis ReviewerChristine AltamarinoNo ratings yet

- Review Problem: CVP Relationships: RequiredDocument6 pagesReview Problem: CVP Relationships: RequiredMaika J. PudaderaNo ratings yet

- Calculate Degree of Operating Leverage & Break-Even Point for ECG CompanyDocument2 pagesCalculate Degree of Operating Leverage & Break-Even Point for ECG CompanyUMAIR AFZALNo ratings yet

- Contabilidad M3Document13 pagesContabilidad M3Azin RostamiNo ratings yet

- Exercise Sheet 4 - CVP Analysis (Revised)Document2 pagesExercise Sheet 4 - CVP Analysis (Revised)Kievs GtsNo ratings yet

- Incremental Analysis GuideDocument4 pagesIncremental Analysis Guidedestinyv07100% (1)

- Question 3 - CVP AnalysisDocument13 pagesQuestion 3 - CVP AnalysisMsKhan0078100% (1)

- Test 2 Sample Questions With Correct AnswersDocument8 pagesTest 2 Sample Questions With Correct AnswersBayoumy ElyanNo ratings yet

- MANACO AssignmentDocument2 pagesMANACO AssignmentKarl Phillip Ramoran Alcarde0% (1)

- Advanced Managerial Accounting Final Exam Questions Gaza Company Project NPV IRRDocument7 pagesAdvanced Managerial Accounting Final Exam Questions Gaza Company Project NPV IRRRabah ElmasriNo ratings yet

- CVP Exercise Ref. Bautista, Cancino, Rada, SarmientoDocument5 pagesCVP Exercise Ref. Bautista, Cancino, Rada, SarmientoRodolfo ManalacNo ratings yet

- Discussion Questions on Break-Even Analysis and Operating LeverageDocument2 pagesDiscussion Questions on Break-Even Analysis and Operating LeverageAnnamarisse parungaoNo ratings yet

- BREAK EVEN ANALYSISDocument7 pagesBREAK EVEN ANALYSISZubair JuttNo ratings yet

- 12 CVP Analysis SampleDocument12 pages12 CVP Analysis SampleMaziah Muhamad100% (1)

- Additional Practice For MidtermDocument81 pagesAdditional Practice For MidtermMohmmad OmarNo ratings yet

- DMMR CVP MathDocument2 pagesDMMR CVP MathSabbir ZamanNo ratings yet

- Cost Volume Profit Analysis - With KEYDocument8 pagesCost Volume Profit Analysis - With KEYPatricia AtienzaNo ratings yet

- Managerial Accounting Exam CHDocument17 pagesManagerial Accounting Exam CH808kailuaNo ratings yet

- Brewer Chapter 6Document8 pagesBrewer Chapter 6Sivakumar KanchirajuNo ratings yet

- Discussion Set 5Document2 pagesDiscussion Set 5blaisebedduNo ratings yet

- Pringle Company monthly break-even analysisDocument3 pagesPringle Company monthly break-even analysisIshu GunasekaraNo ratings yet

- Strategic Cost MidtermDocument15 pagesStrategic Cost MidtermhsjhsNo ratings yet

- MEMO FAX CVP Analysis SampleDocument26 pagesMEMO FAX CVP Analysis SampleLita LinvilleNo ratings yet

- HW 6-19Document9 pagesHW 6-19tgawri100% (2)

- CVP AssignmentDocument2 pagesCVP AssignmentMichael CayabyabNo ratings yet

- Glove Co variance analysis and production manager performanceDocument10 pagesGlove Co variance analysis and production manager performanceNguyễn NgaNo ratings yet

- Managerial Accounting Chapter 8 CVP AnalysisDocument4 pagesManagerial Accounting Chapter 8 CVP AnalysisZia Uddin0% (1)

- Cost Behavior and CVP AnalysisDocument2 pagesCost Behavior and CVP AnalysisShaira VillaflorNo ratings yet

- Finals SolutionsDocument9 pagesFinals Solutionsi_dreambig100% (3)

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

- MAS 03 CVP AnalysisDocument4 pagesMAS 03 CVP AnalysisJoelyn Grace MontajesNo ratings yet

- Lecture-11 Relevant Costing LectureDocument6 pagesLecture-11 Relevant Costing LectureNazmul-Hassan Sumon0% (2)

- Strat Cost PAA1Document12 pagesStrat Cost PAA1Katrina Jesrene DatoyNo ratings yet

- Man Acc Qs 1Document6 pagesMan Acc Qs 1Tehniat Zafar0% (1)

- Variable Costing and Absorption Costing CalculationsDocument4 pagesVariable Costing and Absorption Costing Calculationsgio gioNo ratings yet

- Exam161 10Document7 pagesExam161 10patelp4026No ratings yet

- Managerial Accounting Practice Problems2 PDFDocument9 pagesManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- 203 Practice WTR 2013 PDFDocument22 pages203 Practice WTR 2013 PDFKarim IsmailNo ratings yet

- Nokia - The Story of The Once-Legendary Phone MakerDocument105 pagesNokia - The Story of The Once-Legendary Phone MakerIshmael OneyaNo ratings yet

- Insurance and The Law of Obligations (Merkin, Robert M. Steele, Jenny)Document457 pagesInsurance and The Law of Obligations (Merkin, Robert M. Steele, Jenny)Suzanne Booyens100% (1)

- Legal CommunicationDocument357 pagesLegal CommunicationIshmael OneyaNo ratings yet

- National Land PolicyDocument49 pagesNational Land PolicyIshmael OneyaNo ratings yet

- Chapter 332-The Income Tax Act R.e.2022Document104 pagesChapter 332-The Income Tax Act R.e.2022Ishmael OneyaNo ratings yet

- Challenges Faced in Corporate and Criminal Investigations Process in Tanzania IncludeDocument5 pagesChallenges Faced in Corporate and Criminal Investigations Process in Tanzania IncludeIshmael OneyaNo ratings yet

- Queen Elizabeth II-A Life in Pictures - BBC NewsDocument4 pagesQueen Elizabeth II-A Life in Pictures - BBC NewsIshmael OneyaNo ratings yet

- Chapter 438-The Tax Administration Act R.E. 2022Document62 pagesChapter 438-The Tax Administration Act R.E. 2022Ishmael OneyaNo ratings yet

- The Legitimacy of Investment Arbitration Empirical PerspectivesDocument582 pagesThe Legitimacy of Investment Arbitration Empirical PerspectivesIshmael Oneya0% (1)

- Administrative FunctionsDocument3 pagesAdministrative FunctionsIshmael OneyaNo ratings yet

- The Impact of The 2004 Olympic Games On The Greek EconomyDocument111 pagesThe Impact of The 2004 Olympic Games On The Greek EconomyIshmael OneyaNo ratings yet

- Taxi InvestigationDocument7 pagesTaxi InvestigationangaNo ratings yet

- SSRN-id2316233 Presumptive Collection - A Prospect Theory Approach To Increasing Small Business Tax ComplianceDocument58 pagesSSRN-id2316233 Presumptive Collection - A Prospect Theory Approach To Increasing Small Business Tax ComplianceIshmael OneyaNo ratings yet

- MacBook Pro (15-Inch, 2017) - Technical SpecificationsDocument5 pagesMacBook Pro (15-Inch, 2017) - Technical SpecificationsIshmael OneyaNo ratings yet

- Ouster ClausesDocument4 pagesOuster ClausesIshmael OneyaNo ratings yet

- Csae2015 1093 2Document19 pagesCsae2015 1093 2Ishmael OneyaNo ratings yet

- Audi Alteram Partem and Nemo Debet Esse Judex in Propria Causa'Document6 pagesAudi Alteram Partem and Nemo Debet Esse Judex in Propria Causa'Ishmael OneyaNo ratings yet

- KIPP DC Employee HandbookDocument52 pagesKIPP DC Employee HandbookIshmael OneyaNo ratings yet

- Stamp Duty Act Cap 189, R.E.2019Document57 pagesStamp Duty Act Cap 189, R.E.2019Ishmael OneyaNo ratings yet

- DTA ZambiaDocument9 pagesDTA ZambiaIshmael OneyaNo ratings yet

- DTA NorwayDocument14 pagesDTA NorwayIshmael OneyaNo ratings yet

- DTA SouthafricaDocument13 pagesDTA SouthafricaIshmael OneyaNo ratings yet

- Theories and Rules Involved in PILDocument6 pagesTheories and Rules Involved in PILIshmael OneyaNo ratings yet

- Connecting Factors in Private International LawDocument9 pagesConnecting Factors in Private International LawIshmael OneyaNo ratings yet

- Unit Titles Act GuideDocument46 pagesUnit Titles Act GuideIshmael OneyaNo ratings yet

- Introduction To VATDocument25 pagesIntroduction To VATIshmael OneyaNo ratings yet

- Conflict of Laws Relating To ContractsDocument14 pagesConflict of Laws Relating To ContractsIshmael OneyaNo ratings yet

- Public Service Social Security Fund ACT No SWDocument69 pagesPublic Service Social Security Fund ACT No SWErick KimashaNo ratings yet

- Vat RegistrationDocument72 pagesVat RegistrationIshmael OneyaNo ratings yet

- Indirect TaxesDocument18 pagesIndirect TaxesIshmael OneyaNo ratings yet

- Reading 25 Non-Current (Long-Term) LiabilitiesDocument18 pagesReading 25 Non-Current (Long-Term) LiabilitiesARPIT ARYANo ratings yet

- GlobalizationDocument42 pagesGlobalizationjiwon kim1995100% (1)

- Introduction To Financial StatementsDocument10 pagesIntroduction To Financial StatementsRalph H. VillanuevaNo ratings yet

- Odel AssignmentDocument13 pagesOdel Assignmentsam71367% (3)

- UK Railways Rolling Stock Procurement and LeasingDocument20 pagesUK Railways Rolling Stock Procurement and Leasingsanto_tango100% (1)

- Energy Pro USA - Executive SummaryDocument7 pagesEnergy Pro USA - Executive SummaryS. Michael Ratteree100% (2)

- GLOBAL COMPETITIOeuropean Auto IndustryDocument25 pagesGLOBAL COMPETITIOeuropean Auto IndustryMaria SverneiNo ratings yet

- Constraints For Growth of Small and Medium Scale Entreprises FinalDocument80 pagesConstraints For Growth of Small and Medium Scale Entreprises FinalPrince Kennedy Mark OgucheNo ratings yet

- Case 2Document6 pagesCase 2api-356809876No ratings yet

- Doubling, Nick Leeson's Trading StrategyDocument24 pagesDoubling, Nick Leeson's Trading Strategyapi-3699016No ratings yet

- 2011 Q3 Call TranscriptDocument21 pages2011 Q3 Call TranscriptcasefortrilsNo ratings yet

- 33868053Document72 pages33868053Douglas LimNo ratings yet

- CHAPTER 3 (MANACC) Understanding Financial StatementsDocument38 pagesCHAPTER 3 (MANACC) Understanding Financial StatementsEVELINA VITALNo ratings yet

- Transfer Pricing Impact on Divisional and Company ProfitsDocument8 pagesTransfer Pricing Impact on Divisional and Company ProfitsSoham SahaNo ratings yet

- Bogleheads Forum Discussion on Buying Precious Metals from APMEXDocument18 pagesBogleheads Forum Discussion on Buying Precious Metals from APMEXambasyapare1No ratings yet

- Company Name Year 1 Year 2 Year 3 Year 4 Year 5Document4 pagesCompany Name Year 1 Year 2 Year 3 Year 4 Year 5Larasati LalatNo ratings yet

- Why businesses tend to grow or remain smallDocument10 pagesWhy businesses tend to grow or remain smallAnuvrat ShankerNo ratings yet

- A Nation Without Education Is Little More Than A Gathering ofDocument3 pagesA Nation Without Education Is Little More Than A Gathering ofĀLįįHaiderPanhwerNo ratings yet

- Is 617Document15 pagesIs 617Anupam0103No ratings yet

- The Attractive CharacterDocument3 pagesThe Attractive Characterwhitneyhenson994150% (2)

- PWC Clarifying The RulesDocument196 pagesPWC Clarifying The RulesCA Sagar WaghNo ratings yet

- 3.research MethodologyDocument10 pages3.research Methodologymokshgoyal259750% (2)

- FI - Financial Accounting - Asset ManagementDocument37 pagesFI - Financial Accounting - Asset Managementdjango111100% (4)

- Avoid Pitfalls of Small ProjectsDocument4 pagesAvoid Pitfalls of Small Projectsscribd_spiceNo ratings yet

- Date Open High Low Close Shares Traded Turnover (Rs. CR)Document2 pagesDate Open High Low Close Shares Traded Turnover (Rs. CR)Akshit JhingranNo ratings yet

- Price Discovery and Causality in The Indian Derivatives MarketDocument4 pagesPrice Discovery and Causality in The Indian Derivatives MarketmeetwithsanjayNo ratings yet

- Market EfficiencyDocument55 pagesMarket Efficiencyjeet_singh_deepNo ratings yet

- Prelimnary Audit of 2013 PREPA Bond Issue Econd Interim Pre-Audit Report On 2013 PREPA Debt Emission Con Anejos PDFDocument53 pagesPrelimnary Audit of 2013 PREPA Bond Issue Econd Interim Pre-Audit Report On 2013 PREPA Debt Emission Con Anejos PDFDebtwire MunicipalsNo ratings yet

- Long Term Capital Gain: When Sale Price Is Less Than Cost of Acquisition (Case 2) : An Equity Share Is Acquired On 1st ofDocument2 pagesLong Term Capital Gain: When Sale Price Is Less Than Cost of Acquisition (Case 2) : An Equity Share Is Acquired On 1st ofRashi GuptaNo ratings yet

- Feasibility Study On Establishment of A Boondi Manufacturing PlantDocument35 pagesFeasibility Study On Establishment of A Boondi Manufacturing PlantSukitha KothalawalaNo ratings yet

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (795)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (19)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesFrom EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesRating: 5 out of 5 stars5/5 (21)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (363)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (708)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouFrom EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouRating: 5 out of 5 stars5/5 (1)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 4.5 out of 5 stars4.5/5 (23)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesFrom EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesRating: 4.5 out of 5 stars4.5/5 (99)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)