Professional Documents

Culture Documents

Maa Takaful Shariah Investment - Linked Funds

Uploaded by

dikirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maa Takaful Shariah Investment - Linked Funds

Uploaded by

dikirCopyright:

Available Formats

Takafulink Series

31

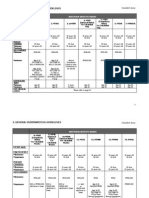

8. MAA TAKAFUL SHARIAH INVESTMENT - LINKED FUNDS

You can invest in MAA Shariah Investment-Linked funds through the purchase of MAA Takafulink Plan. The following fund is available to suit

your investment objectives, risk profiles and investment horizons:

Fund

MAA Takaful Shariah

Growth Fund

MAA Takaful Shariah

Balanced Fund

MAA Takaful Shariah

Income Fund

MAA Takaful Shariah

Flexi Fund

Description Aggressive Diversified Balanced Diversified Conservative Diversified Aggressive Diversified

Fund Objective Capital growth over the medium to long

term

Balanced mix of income returns, as well

as capital growth over the medium to

long term

Moderate level of income with some

potential for capital growth over the

medium to long term

To provide positive returns regardless

of the Malaysian equity market

condition and will also provide investors

with long term capital growth

Risk Barometer High Moderate to high Low to moderate High

Investor Profile

Looking to invest in Shariah-approved

listed companies with good growth

potential.

Looking for equity exposure through

investing in Shariah-complaint securities

listed on Bursa Malaysia for potentially

higher return.

Interested in balanced portfolio of

Shariah-compliant equities and fixed

income securities. Willing to accept

moderate to high level of volatility in

return for potential capital growth over

the medium to long term.

Looking to invest in a portfolio of

Shariah-compliant fixed income

instruments.

Looking to take advantage of sharp

price movements and other market

opportunities, via an active asset

allocation and trading strategy.

Investments of

the Fund

Predominantly Malaysian equities and

equity-related Shariah-compliant

securities.

Some Islamic debt securities, and short-

term Islamic money market instruments

Diversified portfolio of Shariah-

compliant securities, predominantly

Malaysian equities, Islamic debt

securities and short term Islamic money

market.

Primarily Islamic debt securities and

short term Islamic money market

instruments.

Some dividend-yielding Shariah-

compliant securities

Predominantly Malaysian equities and

equity-related- Shariah-compliant

securities.

Some fixed income & cash equivalent

securities.

Asset Allocation

Asset Class Range (%)

Equities &

equity-related

securities

30-95

Fixed Income

Securities

0-30

Cash & cash

equivalents

5-70

Other Assets 0-10

Asset Class Range (%)

Equities &

equity-related

securities

10-70

Fixed Income

Securities

30-55

Cash & cash

equivalents

5-60

Other Assets 0-10

Asset Class Range (%)

Equities &

equity-related

securities

0-50

Fixed Income

Securities

40-95

Cash & cash

equivalents

5-60

Other Assets 0-10

Asset Class Range (%)

Equities &

equity-related

securities

10-90

Fixed Income

Securities

10-90

Cash & cash

equivalents

5-60

Other Assets 0-10

Fund Management

Fee

Up to 1.5% per annum Up to 1.3% per annum Up to 1.0% per annum Up to 1.5% per annum

Takafulink Series

32

OUR FUND MANAGER

It is one of the Largest Asset Management companies in Malaysia.

CIMB-Principal is a joint venture between Southeast Asias premier investment banking

group, the CIMB Group and the Principal Financial Group, a leading Fortune 500

diversified global financial services group.

CIMB-Principal was formerly known as Commerce Trust Berhad. CIMB-Principal manages

in excess of RM3 Billion of Shariah compliant investments.

Shariah Funds managed encompasses, among others:

Unit Trust Funds

Takaful Investment-Linked Products

Discretionary Mandates for Institutional Clients

Experienced investment team, proven investment approach, meticulous risk management

protocols and client oriented investment strategy.

Top performing fixed income manager in Malaysia both for pooled investment (as rated by

Lipper and Micropal) and institutional funds (as rated by EPF).

Overseas expertise with office in Singapore to cater to foreign mandates.

Ability to source necessary bonds for portfolio construction. Our size allows us to lap our

banking contacts to get the best pricing and sizes.

CIMB is the leading debt originator in Malaysia, both conventional and Islamic.

SHAREHOLDERS

The shareholders of CIMB-Principal are CIMB Group and Principal Financial Group, which

respectively own 60% and 40% of the company.

CIMB Group is an investment holding company listed on the Main Board of Bursa Malaysia

and it is part of Malaysia's second largest financial services group, Bumiputra-Commerce

Holdings Berhad. CIMB Group owns 100% of Commerce International Merchant Bankers

Berhad ("CIMB"), the biggest and fully integrated investment bank in Malaysia that offers

a full range of services in the debt markets, equity markets and corporate advisory. CIMB

also provides services in lending, private banking, private equity and Islamic capital

markets as well as research capability in economics, equity and debt markets.

Principal Financial Group is a leading Fortune 500 global financial services group

established over 125 years ago. The Group offers a wide range of financial products and

Takafulink Series

33

services including retirement and investment services, life and health insurance and

mortgage banking through its diverse family of financial services companies.

AWARDS & PERFORMANCE

FUND PERFORMANCE

No. Awarded By Award Year Description

1. The Edge-Lipper

Starmine Awards

Equity Malaysia

Islamic, 3 Years

Award

2010 In recognition of CIMB-Principals

investment performance for its CIMB

Islamic DALI Equity Fund for the year

ended December 31, 2009.

2. The

International

Takaful Awards

Best Islamic Fund

2009 In recognition of CIMB-Principals

investment performance for its CIMB

Islamic DALI Equity Growth Fund.

3. Failaka Islamic

Awards

Best Malaysian

Equity Fund: Three

Year

2009 In recognition of CIMB-Principals

investment performance for its CIMB

Islamic DALI Equity Growth Fund.

OVERALL PERFORMANCE

No. Awarded By Award Year Description

1. Islamic Finance

News Awards

Polls

Best Islamic Fund

Manager

2009 In recognition of CIMB-Principal being

the Best Islamic Fund Manager across

a series of markets and sectors as

voted by readers of Islamic Finance

news from around the world.

2. Asia Asset

Management

Awards

Best Institutional

House (Malaysia)

2009 In recognition of CIMB-principals

overall achievement, including new

institutional investment capabilities,

business won and initiative launched

& planned.

3. Asia Asset

Management

Awards

CEO of the Year

(Malaysia)

2009 In recognition of CIMB-Principals CEO

Campbell Tuplings overall

achievement, in particular market

leadership.

MAA TAKAFUL SHARIAH FUNDS RETURN

NAV per unit Since Inception YTD

Fund Name

26 Sept

2007

31 Dec

2008

31 Dec

2009

% Change % Change

MAA Takaful Shariah

Balanced Fund

RM0.500 RM0.369 RM0.445 9.16% 36.41%

MAA Takaful Shariah

Balanced Fund

RM0.500 RM0.434 RM0.457 7.32% 19.46%

MAA Takaful Shariah

Income Fund

RM0.500 RM0.513 RM0.527 7.96% 6.19%

You might also like

- Corporate Profile April07Document26 pagesCorporate Profile April07Rafisuhaila RahimNo ratings yet

- CIMB-Principal KLCI-Linked Fund LeafletDocument2 pagesCIMB-Principal KLCI-Linked Fund LeafletlilanttNo ratings yet

- Public Mutual FundDocument16 pagesPublic Mutual FundPrakkash Rajan100% (1)

- Understanding Unit Trust PDFDocument4 pagesUnderstanding Unit Trust PDFJssjsjsjNo ratings yet

- BWFS2083: Chapter Five Islamic Capital Market: Equity MarketDocument40 pagesBWFS2083: Chapter Five Islamic Capital Market: Equity Markettrevorsum123No ratings yet

- CCCCCCCCCCC CCCCCCCC CCCCDocument20 pagesCCCCCCCCCCC CCCCCCCC CCCCSaurabh SrivastavaNo ratings yet

- Sbi ProjectDocument91 pagesSbi ProjectSanjeev BhatiaNo ratings yet

- En Master Prospectus Islamic Funds PDFDocument86 pagesEn Master Prospectus Islamic Funds PDFMAKK Business SolutionsNo ratings yet

- Samason Investment FundDocument8 pagesSamason Investment FundFomunungNo ratings yet

- HDFC Asset Management Company LimitedDocument12 pagesHDFC Asset Management Company LimitedAnuraag SharmaNo ratings yet

- MOFSL Case Solution FinalDocument4 pagesMOFSL Case Solution Finalsunil kumarNo ratings yet

- Report FM FinalDocument31 pagesReport FM FinalSaif JillaniNo ratings yet

- FI ReportDocument12 pagesFI Reportraf001No ratings yet

- MayaaDocument48 pagesMayaaRICHA mehtaNo ratings yet

- Mutual Fund Management: Md. Al MamunDocument34 pagesMutual Fund Management: Md. Al MamunZenet HasanNo ratings yet

- Mutual Fun Birla Sun LifeDocument16 pagesMutual Fun Birla Sun LifejaysaradarNo ratings yet

- Corporate Presentation Globe Capital Market LimitedDocument20 pagesCorporate Presentation Globe Capital Market LimitedAmeet ChandanNo ratings yet

- IPO PortoDocument23 pagesIPO PortoBayuRedgiantchildNo ratings yet

- Corporate Profile: Our IdentityDocument6 pagesCorporate Profile: Our IdentityMandu GangadharNo ratings yet

- Company Profile With Awards and RecognitionDocument2 pagesCompany Profile With Awards and RecognitionHimanshu BhalaniNo ratings yet

- Halal Sarmayakari: Hamari ZimmaydariDocument16 pagesHalal Sarmayakari: Hamari ZimmaydariAitizaz hassanNo ratings yet

- PDFDocument111 pagesPDFParas JainNo ratings yet

- Ankit .M. Tripathi: University of MumbaiDocument47 pagesAnkit .M. Tripathi: University of MumbaipradeepbandiNo ratings yet

- A Study On Risk and Return of Selected Mutual Funds Through Integrated Enterprises (India) LTDDocument68 pagesA Study On Risk and Return of Selected Mutual Funds Through Integrated Enterprises (India) LTDMakkuMadhaiyanNo ratings yet

- FIMIS Funds ManagementDocument50 pagesFIMIS Funds ManagementHitesh JawaleNo ratings yet

- Report On Mutual Fund PDFDocument69 pagesReport On Mutual Fund PDFharjotNo ratings yet

- Project Report On Ulip & Mutual FundDocument55 pagesProject Report On Ulip & Mutual FundGovind BhakuniNo ratings yet

- Kotak MahindraDocument5 pagesKotak MahindraSmith ShettyNo ratings yet

- Standard Chartered Bank Pakistan: HistoryDocument8 pagesStandard Chartered Bank Pakistan: HistoryUzair ShaikhNo ratings yet

- What Is A Mutual Fund ?: 3-Tier Structure of Mutual Funds & Other MF ConstituentsDocument9 pagesWhat Is A Mutual Fund ?: 3-Tier Structure of Mutual Funds & Other MF Constituentskk ppNo ratings yet

- Basic Sales Training-Dec 2021 Final DataDocument74 pagesBasic Sales Training-Dec 2021 Final DataApurv DixitNo ratings yet

- Top 6 Asset Management Companies in India - Dr.R.Ayyamperumal - PPSXDocument23 pagesTop 6 Asset Management Companies in India - Dr.R.Ayyamperumal - PPSXayyamperumalrNo ratings yet

- Course Fees Day One Only - Islamic Equity Instruments & Islamic Equity CapitalDocument12 pagesCourse Fees Day One Only - Islamic Equity Instruments & Islamic Equity CapitalZahid AzizNo ratings yet

- Assigment 2Document8 pagesAssigment 2Banisha Bani100% (1)

- Al Meezan Investment Management Limited: December, 2016Document43 pagesAl Meezan Investment Management Limited: December, 2016Shahzad Fateh AliNo ratings yet

- Analysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabraDocument59 pagesAnalysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabraPriyanka AggarwalNo ratings yet

- Mynamar InvestmentDocument22 pagesMynamar InvestmentSebastian ZwphNo ratings yet

- Injaz Job ShadowDocument83 pagesInjaz Job ShadowBernd SchneiderNo ratings yet

- Analysis of Mutual Fund and Selling The of Mutual Fund of RELIGAREDocument38 pagesAnalysis of Mutual Fund and Selling The of Mutual Fund of RELIGARENeha JainNo ratings yet

- Organisational Chart: Corporate ProfileDocument4 pagesOrganisational Chart: Corporate ProfileAzees AbdulNo ratings yet

- Analysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabraDocument59 pagesAnalysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabravishalbehereNo ratings yet

- Al Safi PlatformDocument15 pagesAl Safi PlatformbadrishNo ratings yet

- Awards of Reliance MutualDocument5 pagesAwards of Reliance MutualjaideepsethiaNo ratings yet

- Investment Decision and Portfolio ManagementDocument35 pagesInvestment Decision and Portfolio Managementtarunasha50% (2)

- Meezan Bank LimitedDocument13 pagesMeezan Bank LimitedAisha rashidNo ratings yet

- Internship Report: Bank Alfalah LimitedDocument54 pagesInternship Report: Bank Alfalah LimitedBadshah SalamutNo ratings yet

- Investment Linked Funds Annual Report 2019 PDFDocument54 pagesInvestment Linked Funds Annual Report 2019 PDFSafix YazidNo ratings yet

- Stock Exchange of IndiaDocument32 pagesStock Exchange of IndiaNishant9999766815No ratings yet

- Report On Different Modes of Investment of IBBLDocument72 pagesReport On Different Modes of Investment of IBBLMickey Nicholson83% (6)

- SMCDocument4 pagesSMCRahul SoodNo ratings yet

- Investment Companies in OmanDocument17 pagesInvestment Companies in OmanAfrah ZahidNo ratings yet

- Training Report On Anand RathiDocument92 pagesTraining Report On Anand Rathirahulsogani123No ratings yet

- Changed Mutual FundsDocument16 pagesChanged Mutual FundsTanmoy ChakrabortyNo ratings yet

- SapmDocument35 pagesSapmparag_85No ratings yet

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersFrom EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersNo ratings yet

- Takaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaFrom EverandTakaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaNo ratings yet

- Mutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1From EverandMutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1Rating: 4 out of 5 stars4/5 (2)

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Page 9Document7 pagesPage 9dikirNo ratings yet

- Appendices: Takafulink SeriesDocument23 pagesAppendices: Takafulink SeriesdikirNo ratings yet

- General Underwriting Guidelines: Additional Benefits/RidersDocument5 pagesGeneral Underwriting Guidelines: Additional Benefits/RidersdikirNo ratings yet

- Page 5Document15 pagesPage 5dikirNo ratings yet

- Protection Benefits: Wakalah Tharawat FeeDocument1 pageProtection Benefits: Wakalah Tharawat FeedikirNo ratings yet

- Basic Features Descriptions: 2. Takafulink Series Product FeaturesDocument6 pagesBasic Features Descriptions: 2. Takafulink Series Product FeaturesdikirNo ratings yet

- Page 1Document1 pagePage 1dikirNo ratings yet

- A Lump Sum Investment of RM 100,000 With Interest Compound Yearly, Accumulates The Amount Indicated at The Respective YearsDocument1 pageA Lump Sum Investment of RM 100,000 With Interest Compound Yearly, Accumulates The Amount Indicated at The Respective YearsdikirNo ratings yet

- Motilal Oswal Financial Services LTDDocument5 pagesMotilal Oswal Financial Services LTDseawoodsNo ratings yet

- Rbi Circular Jan2023Document8 pagesRbi Circular Jan2023Udya singhNo ratings yet

- International Banking & Foreign Exchange ManagementDocument12 pagesInternational Banking & Foreign Exchange ManagementrumiNo ratings yet

- Crisil Ratings and Rating ScalesDocument11 pagesCrisil Ratings and Rating ScalesAnand PandeyNo ratings yet

- Accounting For Foreign Currency Transactions1Document17 pagesAccounting For Foreign Currency Transactions1eliyas mohammedNo ratings yet

- Off Balance SheetDocument15 pagesOff Balance SheetHussain khawajaNo ratings yet

- A Beginners Guide To Algorithmic Trading 2017Document49 pagesA Beginners Guide To Algorithmic Trading 2017Anonymous KeU4gphVL5100% (4)

- Hedge Fund BackersDocument6 pagesHedge Fund Backers1c796e65b8a4c8No ratings yet

- Core Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalDocument8 pagesCore Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalleenardniNo ratings yet

- RuPay Cards Offer PDFDocument24 pagesRuPay Cards Offer PDFmirunmanishNo ratings yet

- Public Interest (Maslahah Mursalah) (Autosaved)Document16 pagesPublic Interest (Maslahah Mursalah) (Autosaved)hussnainNo ratings yet

- SWIFT Operations Mr. KunduDocument58 pagesSWIFT Operations Mr. KunduLokesh MahajanNo ratings yet

- ABL Deposit SlipDocument1 pageABL Deposit Slipraja.hamzafarooq786No ratings yet

- Midland Energy Case StudyDocument5 pagesMidland Energy Case Studyrun2win645100% (7)

- Continental Carriers IncDocument7 pagesContinental Carriers IncYetunde JamesNo ratings yet

- AIC Zawya ProfileDocument3 pagesAIC Zawya ProfilezammanjiNo ratings yet

- Tutorial 2Document4 pagesTutorial 2Funny CatNo ratings yet

- At Io N at Et: Federal Polytechnic Offa - 1000073Document1 pageAt Io N at Et: Federal Polytechnic Offa - 1000073Olajire KoredeNo ratings yet

- Rau IASDocument178 pagesRau IASNeeraj RåwâtNo ratings yet

- PNB BankDocument10 pagesPNB BankAries BorjaNo ratings yet

- Solution Manual For Fundamentals of Corporate Finance 8th CanadianDocument11 pagesSolution Manual For Fundamentals of Corporate Finance 8th CanadianEvan Jordan29% (7)

- Private Equity FirmsDocument10 pagesPrivate Equity Firmsaravindaero1230% (1)

- Project DunbarDocument63 pagesProject DunbarFred aspenNo ratings yet

- Wa0015. 1Document15 pagesWa0015. 1austine odhiamboNo ratings yet

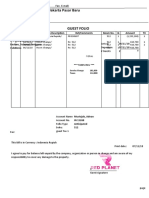

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument3 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountA&P ConsultancyNo ratings yet

- Comparative Performance Study of Conventional and Islamic Banking in EgyptDocument14 pagesComparative Performance Study of Conventional and Islamic Banking in EgyptSayed Sharif HashimiNo ratings yet

- Red Planet Jakarta Pasar BaruDocument2 pagesRed Planet Jakarta Pasar Barubung cabel100% (1)

- Investment Thesis SampleDocument7 pagesInvestment Thesis Samplestephaniebenjaminclarksville100% (2)

- ACCA SBR Flashcards QoestionDocument6 pagesACCA SBR Flashcards QoestionHub TechnologyNo ratings yet

- Jasmine ChoiDocument18 pagesJasmine ChoiChoi JasmineNo ratings yet