Professional Documents

Culture Documents

The Study of Credit Risk Evaluation Based On DEA Method

Uploaded by

phuongivyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Study of Credit Risk Evaluation Based On DEA Method

Uploaded by

phuongivyCopyright:

Available Formats

The study of credit risk evaluation based on DEA method

Huaipeng Li

Department of Mathematics & Institute of Finance

Engineering, Jinan University

Guangzhou, China

lihp2006@163.com

Sulin Pang

Department of Public Administration & Institute of Finance

Engineering, School of Management, Jinan University

Guangzhou, China

pangsulin@163.com

AbstractBased on studying the KMV default distance model,

the work of this paper is to calculate the default distance using

BCC model in DEA methodology to quantify the credit risk.

The principle idea is to use DEA value of the company to

replace the market value of the company in KMV model, and

use average DEA points of ST companies within the industry

instead of default point, then get the Default Distance. The

third part is an empirical analysis which using 17 Chinese

textile companies in 2007 and 2008, the result shows that

default distance calculated with the DEA method does not

completely reflect the company's credit risk, but as a

discussion of method, the default distance with the DEA

method still have research value.

Keywords-credit risk; default distance; DEA;

BCC model

I. INTRODUCTION

Credit risk is that one party in a deal is in the risk of loss

while the other party is unable to keep the promise, but also

that the default bring the creditor risk of loss caused by

debtor who is unable to repay its debt. It can be translated

into the measurement of the financial situation of enterprises

that banks measure its customers credit risk, because the

formation of credit risk - whether the enterprise can be

scheduled debt service depends on the financial situation of

enterprises. There are many factors affecting the financial

situation, so, to assess the financial situation, we should use

multi-dimensional indicators affecting the financial situation,

but not a particular indicator [1].

So far, scholars analysis enterprises credit risk by using

various methods which generally can be attributed to the

following two ways[2]: one is a comprehensive analysis

based on financial ratios, of which the typical

representations are linear probability model, Logistic model,

Probit model, and discriminate analysis model, etc. The

other is a analysis phase based on modern financial theory

and information science theory including the KMV model,

Credit risk + model, Credit metrics models.

In recent years, a classification method called non-

parameter data envelopment analysis (DEA) is paid attention

widespread and studied deeply. It integrates multi-input

indicators to a composite input index, and multi-output

indicators to a composite output index, then determines the

two composite indexes rationality and effectiveness and

divides the evaluated subjects into two major categories of

relatively effective and ineffective, representing counter-

performance and default, respectively.

Yeh was one of the first scholars using financial ratios to

analysis DEA [3]; she combined DEA method with the

analysis of financial ratio to study bank performance. By

empirical analysis ,she found that DEA method can be used

to analysis bank's financial operating strategy through

dividing financial ratios into different dimensions according

to different meanings effectively . Emel and others used

DEA method to evaluate the company's credit risk according

to financial indicators [4]. Troutt and others, in 1996,

proposed a decision-making system based on an credit

accepted cases set given by experts, which formed piece

wise linear separating hyper plane as the credit boundary of

accepted set and refused set, talked about how to determine

the credit status of new units only knowing the credit stand

of good credit flats [5]. In 1998, Teiford, who improved the

system, proposed a DEA-type linear programming model, so

that we can judge new cases credit easier, and can easily

determine the location of new case relative to the boundary

[6]. Zhaohan Sheng, Guangmou Wu and others have studied

that in the DEA model, with the number of evaluation

indicators increasing, the effectiveness factor of each

decision making unit will increase. Most or all of DMU

efficiency would reach 1, if the number of indictors is up to

a certain extent [7]. In order to get a reasonable degree of

differentiation evaluation result we usually take that the

number of objects DMU is not less than two times of the

total number of input and output indicators [8], there are still

researchers thinking that the number of DMU should be at

least three times of the total number of input and output

indicators [9]. When the number of DMU changes largely,

we must re-select the evaluation index, which is obviously

undesirable.

II. THE KMV / DEA MODEL OF CREDIT RISK

A Introduction of KMV model

KMV model is developed as a credit risk measurement

tool by risk management firm called KMV. In the KMV

model, default risk is defined as probability that enterprises

asset value is less than default point. Default distance is a

ratio index measuring the size of default risk, it can embody

the degree that how company's assets is close to default

point before the financial crisis. Default distance is

calculated in KMV model as follows:

2010 International Conference on Computational Intelligence and Security

978-0-7695-4297-3/10 $26.00 2010 IEEE

DOI 10.1109/CIS.2010.25

82

2010 International Conference on Computational Intelligence and Security

978-0-7695-4297-3/10 $26.00 2010 IEEE

DOI 10.1109/CIS.2010.25

81

2010 International Conference on Computational Intelligence and Security

978-0-7695-4297-3/10 $26.00 2010 IEEE

DOI 10.1109/CIS.2010.25

81

'

( )

( ')*

E V DP

DD

E V

. (1)

In formula (1), represents expected asset value,

( ') E V

represents the companys assets volatility (it can be

substituted by standard deviation of capital gains in a certain

period). and

( ') E V

are calculated in the classic model

called Black-Scholes-Merton option pricing model.

DP represents the default point namely the debt that the

company must repay after a certain period, In KMV model,

default occurs when the company's asset value below a

certain level. At this level, the value of the assets is defined

as the default point (DP). KMV Company found that the

most frequent critical default point is equal to half of current

liabilities plus long-term liabilities according to a lot of

empirical analysis. That is DP = SD +0.5 * LD [10], SD is

the company's short-term liabilities, LD is the company's

long-term liabilities.

Although default distance can quantify credit risk, and

warn the companys financial crisis effectively, but there are

still shortcomings in KMV model: (1) The model assumes

that assets value satisfy the normal distribution, but in reality

not all of the borrowers assets value meet normal

distribution; (2)For non-listed companies, we must use the

historical financial data, whose timeliness greatly reduce; (3)

Default point is set too hastily, which are not able to

distinguish between different types of long-term debt, nor

take industry and macroeconomic conditions into

consideration, although the set of default points is supported

by the United States empirical data, but Chinese economic

and capital market is still in the high-speed development,

and differ from the U.S. economic situation.

B Introduction of DEA method

DEA (Data Envelopment Analysis, DEA) is a new

interdisciplinary research field among operation research,

management science and mathematical economics [11]. It is

made by Charnels and Cooper in 1978 [12]. DEA method is

based on concept of relative efficiency, take mathematical

programming as the main tool and optimization as the main

method, then according to many indicators of input and

output data of multiple indicators the same type of units

(departments or enterprises) to evaluate the relative

effectiveness or efficiency of multi-comprehensive

evaluation of indicators.

Specifically, the first step is finding out indicators

affecting decision making unit(DMU)efficiency level, then

analysis how they affect the efficiency level: the greater

indicator value is, the higher DMU efficiency levels is, or

inverse [13]. Take the latter indicators as input variables,

and the former indicators as output variables. We can

measure the relative position of the effectiveness of decision

making units by using DEA model that is the relative level

of efficiency ranking. According to input-oriented DEA

formula, the performance indicators of output is denoted as

E, and E ranges from 0 to 1 [14].

CCR model is the first model of DEA method which is

used to evaluate the relative efficiency of decision making

units. CCR model has four basic assumptions, namely

convexity, invalidity, minimum and constant returns to scale.

It is obviously not appropriate to assume constant returns to

scale when evaluating company efficiency, therefore, we

should abandon CCR model, and take the BCC model with

variable returns to scale.

C KMV/DEA model

In this paper, we take 3 steps when taking KMV / DEA

model: First, calculate efficiency value (DEA value) of each

decision making unit (that is company in this paper) through

the BCC model. Second, compute the value of each

company. Finally, calculate default distance for each

company. Model used as follows:

Assume there are n decision making units (1in), Each

unit has m inputs and s outputs. Denote the input and output

indictors of DMU as vector form as follows:

1 2

( )

T

i i i mi

x x x x

1 2

( )

T

i i i si

y y y y

For each decision making unit (1 i n), solute the

following maximization problem:

*

0 0

1 1 1

min

. . , , 1, 0,1,2

, 0,

n n n

j j j j j j

j j j

st X S X Y S Y j n

S S

(2)

The model (2) is input-oriented BCC model.

Banker(1984) pointed out that there can exists negative

output factors in input-oriented BCC model and negative

input factors an in output-oriented BCC model according to

the theorem of invariance under the transformation. The

optimal value

*

is the efficiency value of DMU (DEA

value), then put it in the default distance in KMV model:

'

( )

( ')*

E V DP

DD

E V

. (3)

The optimal value

*

also represents companys credit

level, so it can substitute the objective assets value .

Then, taking ST companies average DEA value as default

point and the standard deviation of quarterly Rate of Return

on Common Stockholders Equity as the company's capital

volatility

( ') EV

, we can get relative default distance.

III. EMPIRICAL ANALYSES

A. Index for selection

Combining research purposes, data sciences and the

characteristics of credit risk evaluation, we select short-term

debt / current liabilities, asset-liability ratio, current

liabilities / Prime operating revenue as input indicators,

83 82 82

receivable turnover ratio, profit rate of asset, and current

ratio as the output indicators.

Input factors: the short-term debt / current liabilities can

reflect the short-term debt accounted for the proportion of

current liabilities. This indicator can fully reflect bank loans

in the proportion of the corporate loans , indicating that the

smaller the value is, the weaker dependence of the

company's debt on banks, the more easily enterprise repay

the loans and the smaller possibility of default. Current

liabilities / Prime operating revenue can reflect the solvency

of an enterprise, the smaller the indicator is, the stronger the

companys solvency is, the smaller corporate default risk is;

asset-liability ratio can explain the situation of capital

structure, the smaller the value is, the stronger corporate

liquidity is, the smaller corporate default risk is.

Output factors: the greater current ratio is, the better

capital liquidity is, the more easily repay the debt; profit rate

of asset is a measure of the profitability of enterprises, and

the larger it is, the stronger company's profitability is. That

means enterprises have more funds to repay bank loans, so it

can be said that the larger the index is, the better the credit

status of enterprises is. Receivable turnover ratio measures

the enterprise's management ability, the larger it is, the better

business conditions is [15].

In summary, 3 input indicators and 3 output indicators

are used in this empirical analysis as table shows as

follows:

TABLEI. INDICTORS USED IN THIS PAPER.

Item Input

indicators

Output

indicators

Ind-

ex

X1 X2 X3 Y1 Y2 Y3

Me-

anin

g

short-

term

debt

/current

liability-

es

Current

liability-

es /Prime

operati-

ng reve-

nue

asset-

liabilit

y ratio

current

ratio

Profit

rate

of

asset

Rece-

ivable

turno-

ver

ratio

B. Samples for selection

There are industry differences between listed

companies and seasonal differences between selling

products, in order to avoid error caused by the above

differences ,we select 17 textile companies in 2007 (of

which 3 ST companies )and 16 textile companies in 2008(of

which 6 ST companies) as samples, which are listed

companies in China Stock Exchange A. All the data come

from financial statements, such as quarterly reports,

semiannual reports and annual reports in Resset database

(www.resset.cn) and Genius of financial database.

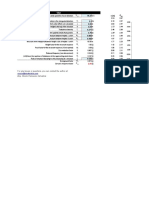

C. Results

Using input-oriented BCC model, we can get the

companies operating efficiency (DEA value) through

MyDEA software. Then, taking ST companies average

DEA value as default point and the standard deviation of

quarterly Rate of Return on Common Stockholders Equity

as the company's capital volatility, applying the definition

principle of default distance in KMV model, we can get the

default distance of each company as table ] and table ]

show as follows:

TABLEII. l Dll^|T DTST^\Cl Ol ! Tl\TTl COMl^\TlS T\ ?00. T|

Stock

TABLEIII. T|l Dll^|T DTST^\Cl Ol !b Tl\TTl COMl^\TlS T\ ?008.

Stock

Code

Stock

Name

DEA

value

Standard

Deviation

Default

Distance

000712

GOLDEN

DRAGON 1 1.36 18.312

000803 JYAC 1 3.263 7.632

000301 CESM 0.907 2.32 7.414

000045 STHC 1 4.172 5.969

000779

SANMAO

PAISHEN (2009ST) 1 4.731 5.263

000726 LTTC 1 5.994 4.154

000018

VICTOR

ONWARD (2009ST) 1 7.415 3.358

000681

FAREASTSTOCK

CO.LTD(2009ST) 1 10.174 2.448

000976 CHGF 1 14.933 1.667

000955 XLKG (2009ST) 0.539 21.342 -1.843

000036 UDC (2009ST) 0.577 12.786 -2.358

000158 CSTEX 0.707 2.528 -2.462

Code

Stock

Name

DEA

value

Standard

Deviation

Default

Distanc

e

000018 VICTOR

ONWARD(2008ST)

1 18.87 0

000301 CESM 1 2.111 0

000681 FAR EAST

STOCK CO.LTD

1 25.681 0

000712 GOLDEN DRAGON 1 5.06 0

000726 LTTC 1 7.194 0

000779 SANMAO-

PAISHEN (2008ST)

1 3.954 0

000976 CHGF 1 1.082 0

000982 ZHONGYIN

CASHMERE(2008ST)

1 31.911 0

000803 JYAC 0.793 4.938 -5.286

000036 UDC 0.53 10.782 -8.225

200160 DALU-B (2008ST) 0.337 23.563 -8.349

000810 CRJH 0.713 3.96 -10.165

000955 XLKG 0.581 6.424 -11.227

000971 HB MAIYA(2008ST) 0.417 11.504 -12.153

000045 STHC 0.784 1.231 -22.385

000809 JOINT-WIT MEDICAL 0.652 2.256 -23.657

000158 CSTEX 0.491 1.17 -88.636

84 83 83

000971 HB MAIYA (2009ST) 0.402 6.854 -12.666

000810 CRJH 0.582 1.697 -17.116

000982

ZHONGYIN

CASHMERE 0.353 5.449 -20.69

000809 JOINT-WIT MEDICAL 0.592 1.009 -26.62

In 2007, there are 3 ST companies of the selected 17

textile companies, 000982 ZHONGYIN CASHMERE,

000681 FAR EAST STOCK CO.LTD, and 000779

SANMAO PAISHEN. Therefore, the number of sample

calculating default point is 3. Table 4.1 shows results of 17

company's default distance, of which three ST companies

DEA value reach the maximum 1, that is, the credit level is 1,

but the standard deviation of Rate of Return on Common

Stockholders Equity is large, that is, the volatility of

corporate profitability is very large, so the 3 companies

continues to be ST in 2008. 000018 VICTOR ONWARD is

classified as ST shares due to the same reason. It is

reasonable that 200160 DALU-B and 000971 HB MAIYA

is also assigned to ST category in 2008 because of their low

level credit and large volatile profitability .Other companies

were normal because there credit level is 1 or near 0.6 and

earnings volatility is small in 2008. In summary, it is

combining DEA and the quarterly standard deviation of Rate

of Return on Common Stockholders Equity, but not just

sorting default point, can reflect the true credit risk of the

company effectively.

In 2008as DALU-Bs missing data, there are 5 ST

companies, respectively 000982 ZHONGYIN CASHMERE,

000971 HB MAIYA, 000018 VICTOR ONWARD,

000681FAR EAST STOCK CO.LTD, 000779 SANMAO

PAISHEN, of which 3 ST companies DEA value is 1 and

default distance is positive, but still be ST in 2009. 00971

HB MAIYA still be ST in 2009 as its DEA value is 0.402

and default distance is negative. Comparatively, 00982

ZHONGYIN CASHMERE was finally normal, but its DEA

value is 0.352, the smallest of the sample, and default point

is second smallest of the sample.000036 UDC and 000712

GOLDEN DRAGON are classified to ST category due to

their large profitable volatility. In summary, it neither fully

reflects the difference between the ST companies and the

normal, nor accurately predicts the credit risk of listed

companies in China just according to default distance.

From the data of ST companies in 2007 and 2008, we

can conclude that default distance does not explain the

relative credit risk of the company well resulting from their

large DEA value and high credit level. The irrational results

are caused by the follow reasons: firstly, some data is

missing or inaccurate in some companies financial report.

For example, the short debt of 000018 VICTOR ONWARD

is 0 in 2007, the data of 200160 DALU-B is not incomplete.

Secondly, the selected sample is not reasonable enough; the

gap of some indicators is very large. Such as the receivable

turnover ratio of 200160 DALU-B is 0.7 in 2007 while the

number is 91.38 from 000976 CHGF. It makes DEA value

unreasonable indirectly. Other factors making default

distance reflect credit risk not well include: there is few ST

companies in the sample, then, it is not objective to compute

default point, that is ,the sample size making default point

difficult to reflect the industry level. it has little effect on the

sort of companies, but the number of companies with

negative default distance will change greatly.

IV. CONCLUTION

The results of this study show that: Although the

theoretical results using DEA method to calculate the default

distance does not match the actual situation, it still has

research value as a discussion of method, especially there is

not a kind of effective means to measure the credit risk of

the debtor.

From the results, experience, and method in the

empirical ,I think results will be better if doing some

improvement and try in the model as follows: First of all,

enlarging the number of samples, especially increasing the

number of ST companies, which make the default point

objective, scientific, and fair . Secondly, we should eliminate

the industry differences, seasonal differences of selling

products and make sure data maintaining integrity relatively

when we select samples. Finally, DEA method has been

developed and improved perfectly in the past 30 years; there

are also other comprehensive models, such as FG, ST,

Logistic DEA model, stochastic DEA model, and inverse

DEA model which also can be tried for research of default

distance.

ACKNOWLEDGEMENT

The paper is supported by the National Natural Science

Foundation (70871055); the New Century Talents plan of

Ministry of Education of China (NCET-08-0615); the Key

Programs of Science and Technology Department of

Guangdong Province (2010B010600028)

REFERENCES

[1] Chunfeng Wang, Haihui Wan, Wei Zhang. Credit Risk Assessment

of Commercial bank and Empirical Study. Management Science,

1998,1:68-72.

[2] Hengyu Liu, Jianping Lian. The mainstream model of credit risk

assessment based on statistical analysis. Financial view. 16. 2008

[3] Yeh Q J. The application of data envelopment analysis in

conjunction with financial ratios for bank performance evaluation.

Journal of the Operational Research Society, 1996,47(8):980988..

[4] Emel A B, Oral M, Riesman A, et al. A credit scoring approach for

the commercial banking sector. Socio-Economic Planning Sciences,

2003,37(2):103-123.

[5] Troutt MD, Rai A, Zhang A. The potential use of DEA for credit

applicant acceptance systems. Computers and Operations Research.

1996,23:405-408.

[6] Seiford LM, Zhu J. An acceptance system decision rule with data

envelopment analysis. Computers and Operations Research.

1998,25(4):329-332..

85 84 84

[7] Zhaohan Sheng, Qiao Zhu, Guangmou Wu. DEA Theory, Methods,

and Applications. Beijing: Science Press,2002.Caouette JB, Altman

EI, Narayanan P. Managing Credit Risk: the Next Great Financial

Challenge. Wiley frontiers in finance. New York. 1998.

[8] Guangmou Wu, Zhaohan Sheng. The relationship between indicator

and DEA effectiveness. Southeast University Jounal.

1992,22(5):124127.

[9] Banker RD. An introduction to data envelopment analysis with

some of its models and their uses. Research in Government and

Nonprofit Accounting, 1989, 5:125163.

[10] P Crosbie, Jeffrey R Bohn. Modeling default risk. KMV

Corporation. 1997.

[11] Quanling Wei. Data Envelopment Analysis (DEA). Science Bulletin,

2000,45(17):1783-1808.

[12] Charnes A, Cooper WW. Programming with linear fractional

functional. Naval Research Logistics Quarterly, 1962, 9:181-185.

[13] Charnes A, Cooper WW. Rhodes E. Measuring the efficiency of

decision making units. European Journal of Operational Research,

1978,3:429-444.

[14] Jinxiang Wang. Construction and study of production boundary.

Tianjin University Jounal ,2003

[15] Dongyue Cheng. Risk Management of Chinese Financial Leasing .

Zhejiang Unversity Jounal. 2005

86 85 85

You might also like

- Total Assets of Banks: Contact Person at The IMAD: Marjan HafnerDocument1 pageTotal Assets of Banks: Contact Person at The IMAD: Marjan HafnerphuongivyNo ratings yet

- The DEA Method in Managing The Credit RiskDocument10 pagesThe DEA Method in Managing The Credit RiskphuongivyNo ratings yet

- Bank Credit - Chester Arthur PhillipsDocument383 pagesBank Credit - Chester Arthur Phillipsmiguel_zas_1No ratings yet

- Data Envelopment Analysis and Commercial Bank Performance: A Primer With Applications To Missouri BanksDocument15 pagesData Envelopment Analysis and Commercial Bank Performance: A Primer With Applications To Missouri BanksPiyush OzarkarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Finite Element Method Terminology and ConceptsDocument11 pagesFinite Element Method Terminology and ConceptsSudhakar UppalapatiNo ratings yet

- MCQ On Laplace TransformDocument4 pagesMCQ On Laplace TransformVirag Kothari100% (1)

- V Imp ExampleDocument24 pagesV Imp ExamplealiNo ratings yet

- Mohr's Theorem and Corollaries PDFDocument8 pagesMohr's Theorem and Corollaries PDFEvaNo ratings yet

- Deep Basements & Cut & Cover - 3Document86 pagesDeep Basements & Cut & Cover - 3bsitlerNo ratings yet

- Oracle Datatypes: Data Types For Oracle 8 To Oracle 11gDocument9 pagesOracle Datatypes: Data Types For Oracle 8 To Oracle 11gRathish KumarNo ratings yet

- Basic Calculus: Derivatives ExplainedDocument25 pagesBasic Calculus: Derivatives ExplainedKrrje INo ratings yet

- Mod Exam Mah PDFDocument3 pagesMod Exam Mah PDFjaja riveraNo ratings yet

- Integral Calculus SYLLABUSDocument2 pagesIntegral Calculus SYLLABUSCAHEL ALFONSONo ratings yet

- Lesson Plan On ForcesDocument3 pagesLesson Plan On Forcesapi-226755313No ratings yet

- Boylestad - Formula SheetDocument2 pagesBoylestad - Formula SheetZain AliNo ratings yet

- Dynamic Response Factor As Per As 1170.2Document2 pagesDynamic Response Factor As Per As 1170.2Zarna ModiNo ratings yet

- Uncertainty of MeasurementDocument24 pagesUncertainty of MeasuremententicoNo ratings yet

- 1.operations ResearchDocument36 pages1.operations ResearchPiuShan Prasanga Perera100% (1)

- OBIS Identification Codes de LANDISDocument8 pagesOBIS Identification Codes de LANDISDario Miguel Fernandez100% (1)

- KSR-Numerical MethodsDocument3 pagesKSR-Numerical Methodskpgs12No ratings yet

- Reservoir Simulation BasicsDocument11 pagesReservoir Simulation Basicsoliver_34No ratings yet

- EE719 Tutorial Assigment 1Document24 pagesEE719 Tutorial Assigment 1Siddhesh SharmaNo ratings yet

- Representing Sequences Recursively and ExplicitlyDocument4 pagesRepresenting Sequences Recursively and Explicitlytwitch tv caibingweiNo ratings yet

- SF-2200H Operating ManualDocument36 pagesSF-2200H Operating ManualuripssNo ratings yet

- Human Induced Vibrations On Footbridges: Application and Comparison of Pedestrian Load ModelsDocument140 pagesHuman Induced Vibrations On Footbridges: Application and Comparison of Pedestrian Load ModelsktricoteNo ratings yet

- (Mathematical Logic) : Jhjeong@kyungpook - Ac.krDocument68 pages(Mathematical Logic) : Jhjeong@kyungpook - Ac.krJ-in KimNo ratings yet

- Application of Machine Learning Techniques in Project ManagementDocument11 pagesApplication of Machine Learning Techniques in Project ManagementRoderick PerezNo ratings yet

- Demand System Estimation NewDocument13 pagesDemand System Estimation NewGaurav JakhuNo ratings yet

- Task Sheet #4 For Lesson 4 REMOROZA, DINNAH H.Document4 pagesTask Sheet #4 For Lesson 4 REMOROZA, DINNAH H.dinnah100% (1)

- Pref 1Document3 pagesPref 1neiljohn2009No ratings yet

- Real Number Properties WorksheetsDocument4 pagesReal Number Properties Worksheetsapi-150536296No ratings yet

- Zeiss Gear Pro 2016 Release Infomation enDocument56 pagesZeiss Gear Pro 2016 Release Infomation enyraju88100% (1)

- Chapter 2Document19 pagesChapter 2TearlëşşSufíåñNo ratings yet

- Syllabi Master of TechnologyDocument63 pagesSyllabi Master of TechnologyRanjit Kumar ShahNo ratings yet