Professional Documents

Culture Documents

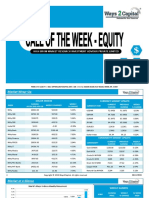

Commodity Report 09 Oct 2014 by Ways2Capital

Uploaded by

Ways2Capital0 ratings0% found this document useful (0 votes)

13 views9 pagesWays2Capital is one of the leading research house across the globe. The company basically provides recommendations for stocks cash & F&O traded in NSE & BSE,commodities including bullions, metals and agro commodities traded in MCX & NCDEX.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWays2Capital is one of the leading research house across the globe. The company basically provides recommendations for stocks cash & F&O traded in NSE & BSE,commodities including bullions, metals and agro commodities traded in MCX & NCDEX.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views9 pagesCommodity Report 09 Oct 2014 by Ways2Capital

Uploaded by

Ways2CapitalWays2Capital is one of the leading research house across the globe. The company basically provides recommendations for stocks cash & F&O traded in NSE & BSE,commodities including bullions, metals and agro commodities traded in MCX & NCDEX.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

Web: www.ways2capital.com | Mail: info@ways2capital.

com | Call: 0731-655125

NCDEX DAILY LEVELS

DALLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

!"#$%&'($ 20-)#*-1 622 612 602 5+, 5+2 5,, 5,2 572 562

!"-%.)'($ 20-)#*-1 310 3052 3000 2+71 2+, 2+12 2,+6 2, 27+2

$M!%%( 20-)#*-1 3730 36+0 3660 360 3610 35,0 350 3505 37+

/%%$.0)/1. 20-)#*-1 11325 11135 10+5 10,23 10756 10633 10555 103,5 101,6

(1.)'". 20-)#*-1 13133 12+20 12703 1257 12,, 12362 12273 1205, 11,3

C.!2#$!%%( 20-)#*-1 +1+ ,13 707 67 601 51 +5 3,+ 2,3

NCDEX WEEKLY LEVELS

WEEKLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

!"#$%&'($ 20-)#*-1 655 633 611 602 5,+ 5,0 567 55 523

!"-%.)'($ 20-)#*-1 33+ 32,, 3133 3027 2++, 2+0+ 2,00 270 2613

$M!%%( 20-)#*-1 3+5 3,73 3,03 3673 35+3 3536 3,0 33 33,6

/%%$.0)/1. 20-)#*-1 1133, 11111 10,20 106+0 1055 1020 10210 ++++ +715

(1.)'". 20-)#*-1 13105 1272 12310 120,5 1117, 11575 112, 107 103+5

C.!2#$!%%( 20-)#*-1 763 5+7 12 2+, 1,7 002 3,+5 3,0 3710

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

CX DAILY LEVELS

DALLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

.30M')'0M 30-!%4-1 123 121 11+ 11, 117 116 115 113 111

C#44%$ 2+-.05-1 27 21 1 0+ 01 3+6 3+1 3,6 3,1

C$0(% #'3 1+-.05-1 5+7, 5+00 5,20 5730 560 5560 5510 570 512

5#3( 03-#C2-1 2,030 27575 27120 26,30 2665 26375 26210 25755 25300

3%.( 2,-.05-1 132 130 12, 127 126 125 123 120 11,

.

).20$.3 5.! 26-.05-1 260 25, 253 2+ 26 2 23, 235 231

)'C6%3 2,-.05-1 1160 1120 10,0 100 1010 +,0 +5 +10 ,+2

CX WEEKLY LEVELS

WEEKLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

.30M')'0M 2,-.05-1 12 121 11, 116 11 111 10, 105 103

C#44%$ 2+-.05-1 35 27 20 0, 00 3+3 3,6 3,1 376

C$0(% #'3 1+-.05-1 6325 612 5+25 5,61 570 5620 570 5220 5000

5#3( 03-#C2-1 2+100 2,,00 27500 27100 26,00 26300 25+50 2530 25015

3%.( 2,-.05-1 136 13 132 12+ 127 125 123 121 11,

).20$.3 5.! 26-.05-1 2+0 266 250 23, 220 206 1+5 1,, 173

)'C6%3 2,-.05-1 1220 1160 10+0 1060 100 1010 ++0 +30 ,,0

!'3*%$ 5-!%42-1 2700 2100 0600 3++00 3+200 3,700 3,050 37300 35700

7')C 2,-.05-1 151 1, 16 1 137 13 131 12, 123

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

CX ' WEEKLY NEWS LE++E/S

IN+E/NA+I0NAL NEWS

UKs National HPI dropped by 0.2 % in Sept as against a obtain of 0.8 % in Aug.

Current Account dropped by 23.1 billion dollars. Last GDP increased by 0.9 % in the

one fourth finished July as in comparison to a obtain of 0.8 % in the before one fourth.

Japans Tankan MFG. Index increased partially to 13-mark in Q3 of 2014 as against a

increase of 12-level in Q2 of 2014. Tankan Non-Manufacturing index fallen to 13-level

for the one fourth finishing in June14 from 19-mark in past one fourth.

1. Indias RBI kept repo & opposite repo prices at 8 & 7 %.

2. US CB Cunsumer confidence dropped by 6.4 factors to 86-mark in Sep14.

3. Euro unemployment Rate the same at 11.5 % in Aug.

4. UKs National HPI dropped by 0.2 % in the last month.

The Indian Rupee decreased around 0.6 % in yesterdays trading period. The currency

decreased after rise in US economic growth in the previous week raised concerns of

earlier than reports increase in attention levels. Further, dollar demand from oil and

other importers, weak domestic market demand along with RBI keeping the repo and

source repo prices the same at 8 % and 7 % respectively in its meeting on Wednesday

which applied downside pressure on the currency. The RBI promises that attention

levels will remain the same until they anticipate a target of 6 % rising prices by Jan16.

Precious Metals

On the MCX, silver price dropped by around 2.13 % and closed at Rs.38516/kg. Silver

price in the worldwide marketplaces delved by 3 % in combination with decrease in

gold and base metal price. Also, strength in the DX which is hanging at 4-year peaks

drawn price further.

Gold Price dropped by 0.6 % on Wednesday and closed at their minimum level of the

season, leading to a rout in other metal, as weak european zone rising prices numbers

supported the case for the European Central Bank to declare more stimulus at the

conclusion of its meeting later in the week.

Also, outlook for higher U.S. Int. Rates and a stronger dollar cut demand for gold and

hedge against inflation. Moreover, holdings in SPDR Gold Trust, the top gold-backed

exchange-traded fund, dropped 2.39 loads to 769.86 loads on Wednesday - the smallest

since Dec 2008 showed falling interest in the gold. Prices in the worldwide

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

marketplaces moved a low of $/tonne on Wednesday.

On the MCX, gold price obtained by around 0.8 % due to Rupee devaluation and closed

at Rs.27129/10 gms.

Base metal

In the Indian market, base metals followed the way of global trend in Metals. Base

metals on the LME exchanged fell considered down by a strong dollar and concerns

about slack requirement from China suppliers after a production evaluate dropped from

an initial reading in the greatest user of the steel. Also, poor consumer confidence data

from the US served as a negative factor.

On the improvements front, China financial institution cut home loan rates and down

payment levels for some real estate buyers for the first time since the 2008 global

financial trouble, one of its greatest goes this year to boost an economic system

confronted by a declining real estate industry.

LME copper dropped by 1.2 % on Wednesday and dropped to the smallest since May

after a evaluate of China production activity revealed the country's production industry

growing at a more slowly speed than previously thought, fuelling problems about

requirement from the world's top customer of the metals.

In the Indian market, copper price dropped by 0.9 % and closed at Rs.416/kg in the last

period.

Energy

Nymex Crude oil price declined by 3.6 % on Wednesday as provides from the Company

of the Oil Dispatching Nations hit their maximum stage in two years in Sept, thanks to

higher output from Saudi Arabic and Libya. With supply of nearly 31 thousand drums,

the output exceeded OPEC's demand prediction for its own raw of 29.2 thousand

barrels.

Also, U.S. oil manufacturing averaged 8.5 thousand barrels a day in July for the second

straight month to the biggest stage since 1986 applied disadvantage stress on price.

Further, the United states Oil Institution said stocks fell by 460,000 barrels last week

did not support prices.

On the MCX, Crude oil price drooped by around 3 % in line with worldwide styles and

closed at Rs.5673/bbl.

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

LME Inventory 01-10-2014

NCDEX - WEEKLY NEWS LETTERS

SOYABEAN / REFI. SOYA

Soyabean trading started higher on short covers, greater CBOT price in the past day

and requirement for soy oil. However, price fixed from greater levels on collect stress of

the new plants and resolved partially greater 0.07%. Inadequate soy food trade

requirement also condensed prices. Routes have started in Maharashtra in small

regions.

According to Secretary of state for Farming soybean growing as on Twenty fifth Sept is

revealed at 11.02 mn ha in comparison to 12.22 mn ha last season. CCEA has kept the

MSP of soybean the same at Rs. 2500-2560/qtl.

The Secretary of state for Farming in its 1th Advance Reports, estimated 2014-15

soybean output at 11.82 mn tn as against 11.99 mn tn in 2012-13. Soy food exports in

Aug 14 have dropped 98.49% to 2,778 tn from 183,555 tn in Aug 13 on poor

requirement and reduced accessibility for smashing due to greater indian quotations for

international customers.

CBOT Soya bean exchanged on adverse observe on Wednesday and dropped to a 4

season low condensed by improved growing and resolved 1.11% reduced. Excellent

plants circumstances, objectives of greater results in and a fender outcome also

condensed costs. USDA prediction greater than predicted outcome. Harvest is 10%

finish in comparison to 10% last season.

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

Metal C8an9e f:om p:e;io<s =ay

.l<mini<m -600

Coppe: -275

3ea= 250

)ic>el 233

2in -215

7inc -675

The USDA per month plants review in Sept prediction 2014-15 outcome at 3.913 bn

bsh against 3.289 bn bsh last season while end shares are prediction at 475 mn bsh

against 430 mn bsh prediction in This summer. 2013-14 end shares are prediction at

140 mn bsh. The review prediction South america outcome at 94 mn tn against of 87.5

mn tn and Argentina outcome at 55 mn tn against 54 mn tn last season.

Planting in the US is finish at 84.839 mn miles. Excellent to excellent condition was

standing at 72% against 71% last week. According to NOPA, soybean smashing in Aug

was revealed at 110.633 mn bsh, against 119.620 mn bsh in June

RAPE/MUSTARD SEED

Mustard seeds futures trading exchanged on a positive note on Wednesday on good

requirement for oil as well as food exports and settled 0.5% greater. NCDEX has made

changes in agreements expiring in Apr 15 and thereafter. Please relate the round for

information.

Mustard food business improved 16.13% to 105,375 tn in Aug 14 in comparison to

90,735 tn in Aug13. Planting of mustard seeds in 2013-14 was standing at 7.13 mn ha

as against 6.73 mn ha last year. Farming ministry in its 4th enhance reports has placed

2013-14 mustard output at 7.96 mn tn, down 0.85% in comparison to 8.03 mn tn in

2012-13.

CHANA

Chana futures trading with a positive note on Wednesday as reduced purchasing and

joyful requirement reinforced price at lower levels. However, comfortabel supplies of

chana and imports of yellow-colored beans assigned distinct benefits and closed 0.25%

heigher. Prices have dropped over the last few several weeks on gradual requirement in

the actual marketplaces along with history chana output in 2013-14.

According to India Pulses and Grains Association, Apr-Dec13 stood at import 2.4 mn tn

vs 2.8 mn tn last year. In value terms, India imported $2.3 billion of pulses in 2012-13,

almost 28% higher over $1.85 billion in the preceding year. However, imports in 2013-

14 season may decline 11% to 3.2 mn tn on expectations of higher output.

According to APEDA, Pulses exports (kabuli chana) between Apr-Feb 14 rose 228% to

517,095 tn as against 157,799 tn between Apr-Feb 13.

According to the Secretary of state for Farming, planting of kharif impulses as on

Twenty fifth Sept appears 6.5% reduced at 10.11 mn ha as against 10.81 mn ha last

season. planting of tur, urad and moong take a position at 3.56 mn ha, 2.5 mn ha and

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

2.15 mn ha respectively.

CCEA improved the MSP of tur and urad by Rs.50 to Rs.4,350 each, while the MSP of

moong was improved by Rs.100 to Rs.4,600/qtl.

The 4th Enhance Reports placed complete impulses outcome for 2013-14 at 19.27 mn

tn, up from 18.34 mn tn previously. There was a wait in the growing of the chana

plants along with some plants harm in Madhya Pradesh, Rajasthan, Maharashtra and

Andhra Pradesh.

As per the Secretary of state for Farming, place under Rabi Pulses 2013-14 was

standing at 161.9 lakh ha as against 152.65 lakh ha last season. Chana planting was

standing at 10.21 mn ha in comparison to 9.51 mn ha during the same interval last

season.

JEERA

Jeera futures fixed from greater stages and settled 1.86% reduced on benefit taking as

the price hit the higher routine restrict on Thursday. Prices obtained considerably on

company exports information. Prices have dropped over the last few several weeks on

gradual household requirement and large carryover shares.

Area under jeera in Gujarat was revealed at 455,000 ha as against 335,200 ha last

season while about 390,000 ha were planted in Rajasthan.

Geo-political stress in Syria and Poultry have led to a provide crisis in the international

marketplaces increasing provide issues from the two significant dispatching nations.

Business purchases are redirected to Indian. Manufacturing is also predicted to drop in

Syria and Poultry due to plants failing.

Exports of Jeera between Apr-July 2014 was standing at 58,000 tn, up 40% as against

43,898 tn between Apr-July 2013. (Source: Spices or herbs Board)

According to IBIS Indias Jeera exports have surpassed 1,00,000 loads until Feb14.

Manufacturing of Jeera in 2013-14 is predicted around 45-50 lakh purses (55 kgs

each), greater than 40-45 lakh purses last season.

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

28is (oc<ment 8as been p:epa:e= by Ways2Capital ?. (i;ision of 1i98 -:ow Ma:>et

$esea:c8 'n;estment .=;iso:y 4;t 3t=@. 28e info:mationA analysis an= estimates containe=

8e:ein a:e base= on Ways2Capital %B<ityCCommo=ities $esea:c8 assessment an= 8a;e been

obtaine= f:om so<:ces belie;e= to be :eliable. 28is =oc<ment is meant fo: t8e <se of t8e

inten=e= :ecipient only. 28is =oc<mentA at bestA :ep:esents Ways2Capital %B<ityCCommo=ities

$esea:c8 opinion an= is meant fo: 9ene:al info:mation only. Ways2Capital

%B<ityCCommo=ities $esea:c8A its =i:ecto:sA office:s o: employees s8all not in any way to be

:esponsible fo: t8e contents state= 8e:ein. Ways2Capital %B<ityCCommo=ities $esea:c8

eDp:essly =isclaims any an= all liabilities t8at may a:ise f:om info:mationA e::o:s o: omissions

in t8is connection. 28is =oc<ment is not to be consi=e:e= as an offe: to sell o: a solicitation to

b<y any sec<:ities o: commo=ities.

.ll info:mationA le;els E :ecommen=ations p:o;i=e= abo;e a:e 9i;en on t8e basis of tec8nical

E f<n=amental :esea:c8 =one by t8e panel of eDpe:t of Ways2Capital b<t we =o not accept any

liability fo: e::o:s of opinion. 4eople s<:fin9 t8:o<98 t8e website 8a;e :i98t to opt t8e p:o=<ct

se:;ices of t8ei: own c8oices.

.ny in;estment in commo=ity ma:>et bea:s :is>A company will not be liable fo: any loss =one

on t8ese :ecommen=ations. 28ese le;els =o not necessa:ily in=icate f<t<:e p:ice moment.

Company 8ol=s t8e :i98t to alte: t8e info:mation wit8o<t any f<:t8e: notice. .ny b:owsin9

t8:o<98 website means acceptance of =isclaime:.

Web: www.ways2capital.com | ail: i!"o#ways2capital.com | Co!tact: $%&&'(&$&'2&&) *+oll ,-ee.

You might also like

- Commodity Research Report 12 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 12 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 03 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 03 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 06 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 06 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 18 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 18 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 21 January 2019 Ways2CapitalDocument13 pagesCommodity Research Report 21 January 2019 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 20 November 2018 Ways2CapitalDocument13 pagesCommodity Research Report 20 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 27november 2018 Ways2CapitalDocument13 pagesCommodity Research Report 27november 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 11 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 11 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 27 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 13 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 12 September 2018 Ways2CapitalDocument13 pagesCommodity Research Report 12 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 09 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 09 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 06 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 06 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 23 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 23 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 25 September 2018 Ways2CapitalDocument13 pagesCommodity Research Report 25 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 16 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 16 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 18 September 2018 Ways2CapitalDocument13 pagesCommodity Research Report 18 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 04 September 2018 Ways2CapitalDocument13 pagesCommodity Research Report 04 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 21 August 2018 Ways2CapitalDocument13 pagesCommodity Research Report 21 August 2018 Ways2CapitalWays2CapitalNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Proforma For Revision of Pension/Family PensionDocument2 pagesProforma For Revision of Pension/Family PensionHriday AgarwalNo ratings yet

- Sales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingDocument67 pagesSales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingRishav Ch100% (1)

- Pif 12 VoDocument10 pagesPif 12 VoJohn Lee PueyoNo ratings yet

- Chapter 08Document46 pagesChapter 08Ivo_NichtNo ratings yet

- Chapter Seven: Cost-Volume-Profit AnalysisDocument35 pagesChapter Seven: Cost-Volume-Profit AnalysisMade Ari HandayaniNo ratings yet

- Competitive Strategy Notes at MBADocument26 pagesCompetitive Strategy Notes at MBABabasab Patil (Karrisatte)No ratings yet

- Caterpillar ReportDocument20 pagesCaterpillar ReportMinea CornelNo ratings yet

- Output Messaging: ISO 15022 Message LayoutsDocument36 pagesOutput Messaging: ISO 15022 Message Layoutsatularvin231849168No ratings yet

- Module 6 - Profit Planning (Budgeting)Document82 pagesModule 6 - Profit Planning (Budgeting)CristineNo ratings yet

- Post Qua Report FOAM MPMDocument4 pagesPost Qua Report FOAM MPMKim Patrick VictoriaNo ratings yet

- Auditing Notes PadmasunDocument11 pagesAuditing Notes PadmasunPadmasunNo ratings yet

- 07 Hewlett PackardDocument16 pages07 Hewlett Packard9874567No ratings yet

- Your M&S Credit Card Statement: %%mail - BarcodeDocument3 pagesYour M&S Credit Card Statement: %%mail - BarcodecarlNo ratings yet

- S3 The PTH of A Finaal MoDocument18 pagesS3 The PTH of A Finaal Mosuhasshinde88No ratings yet

- Initiating Coverage On JP Associates LTDDocument23 pagesInitiating Coverage On JP Associates LTDVarun YadavNo ratings yet

- Lump Sum LiquidationDocument4 pagesLump Sum LiquidationKara Manansala LayuganNo ratings yet

- NMDC LTD: ESG Disclosure ScoreDocument6 pagesNMDC LTD: ESG Disclosure ScoreVivek S MayinkarNo ratings yet

- Ias 10Document1 pageIas 10Muhammad Farooq ZaheerNo ratings yet

- Budget Circular 2011-12: Government of IndiaDocument87 pagesBudget Circular 2011-12: Government of IndiaShravan KondapakaNo ratings yet

- NpoDocument4 pagesNpoChelsea Anne Vidallo100% (2)

- Cint 2018 Ar PDFDocument177 pagesCint 2018 Ar PDFAkun GloryNo ratings yet

- 15 County Clerk Judge Attorney Fraud Title 18 Crimes Generic For Ideas ONLYDocument8 pages15 County Clerk Judge Attorney Fraud Title 18 Crimes Generic For Ideas ONLYAriesWayNo ratings yet

- Consignment Tutorial and Review Questions Question OneDocument6 pagesConsignment Tutorial and Review Questions Question OneCristian RenatusNo ratings yet

- Real Estate MortgageDocument2 pagesReal Estate MortgageLia LBNo ratings yet

- 1st Amendment To Valvino Operating AgreementDocument6 pages1st Amendment To Valvino Operating AgreementJeff BoydNo ratings yet

- Civil Law Review Ii: Part One - Obligations and ContractsDocument31 pagesCivil Law Review Ii: Part One - Obligations and ContractsLawrence Y. CapuchinoNo ratings yet

- Well'S Consulting Services Worksheet For The Month Ended January 31, 2X1XDocument1 pageWell'S Consulting Services Worksheet For The Month Ended January 31, 2X1Xariane pileaNo ratings yet

- 2nd Quater - Gen Math - Quiz No 1Document1 page2nd Quater - Gen Math - Quiz No 1MA. JEMARIS SOLISNo ratings yet

- IIB - Slides - Export and Import Practices - Lesson 9Document28 pagesIIB - Slides - Export and Import Practices - Lesson 9LattaNo ratings yet

- Tacn1 HVTCDocument9 pagesTacn1 HVTCNgô Khánh HuyềnNo ratings yet