Professional Documents

Culture Documents

Chapter 5

Chapter 5

Uploaded by

traceljane05Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5

Chapter 5

Uploaded by

traceljane05Copyright:

Available Formats

CHAPTER 5

TRUE/FALSE

1. True 6. True

2. True 7. True

3. False 8. True

4. True 9. True

5. True 10. False

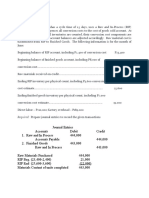

Problem 1 Stillwater Manufacturing

1) Raw and In Process 356,000

Accounts Payable 356,000

2) Finished goods 373,700

Raw and In Process 373,700

Raw materials purchased 356,000

RIP beg. (42,600-6,900) 35,700

RIP end (22,500-4,500) ( 18,000)

Mat. content of units completed 373,700

3) Cost of goods sold 390,700

Finished goods 390,700

Mat. content of units completed 373,700

FG beg.(45,000-17,000) 28,000

FG. End (16,000-5,000) ( 11,000)

Mat. content of units sold 390,700

4) Cost of goods sold 14,400

Raw and In Process 2,400

Finished goods 12,000

Conversion cost RIP FG

End 4,500 5,000

Beg. ( 6,900) (17,000)

Increase (decrease) ( 2,400) ( 12,000)

Problem 2 Magnolia Corporation

1) Raw and In Process 444,000

Accounts payable 444,000

2) Finished goods 442,460

Raw and In process 442,460

Purchases 444,000

Mat. In RIP beg (23,400-7,020) 16,380

Mat. In RIP end (25,600-7,680) ( 17,920)

Mat. Content of FG 442,460

Cost of goods sold 730,000

Accrued payroll 350,000

FO Applied 380,000

3) Cost of goods sold 445,960

Finished goods 445,960

Mat. Content of FG 442,460

Mat. In FG beg. (24,000-7,200) 16,800

Mat. In FG end (19,000-5,700) ( 13,300)

Mat. Content of units sold 445,960

4) Raw and In Process 660

Cost of goods sold 660

Conversion cost in RIP end 7,680

Conversion cost in RIP beg ( 7,020)

Adjustment 660

5) Cost of goods sold 1,500

Finished goods 1,500

Conversion cost in FG end 5,700

Conversion cost in FG beg (7,200)

Adjustment (1,500)

Problem 3 Smart Manufacturing Company

1. Materials purchased 146,000

Materials in RIP beg (15,000 4,400) 10,600

Materials in RIP end (24,000 7,800) ( 16,200)

Materials backflushed from RIP to FG 140,400

2. Materials backflushed from RIP to FG 140,400

Materials in FG beg (36,000-10,800) 25,200

Materials in FG end (18,000-6,500) ( 11,500)

Materials backflushed from FG to CofGS 154,100

3) a) Raw and In process 146,000

Accounts payable 146,000

b) Cost of goods sold 180,000

Accrued payroll 80,000

FO Applied 100,000

c) Finished goods 140,400

Raw and In Process 140,400

d) Cost of goods sold 154,100

Finished goods 154,100

e) Raw and In Process 3,400

Cost of goods sold 900

Finished goods 4,300

RIP FG

End 7,800 6,500

Beginning (4,400) (10,800)

Increase (decrease( 3,400 ( 4,300)

Problem 4 Chiz Manufacturing Company

1) Raw and In Process 230,000

Accounts payable 230,000

2) Finished goods 245.200

Raw and In Process 245,200

Materials purchased 230,000

Materials in RIP beg. (40,000-12,000) 28,000

Materials in RIP end (28,500-15,700) ( 12,800)

Materials backflushed from RIP 245,200

3) Cost of goods sold 264,700

Finished goods 264,700

Materials backflushed from RIP 245,200

Materials in FG beg. (35,000-8,800) 26,200

Materials in FG end ( 19,800-13,100) ( 6,700)

Materials backflushed from CofGS 264,700

4) Cost of goods sold 405,000

Accrued payroll 180,000

FO Applied 225,000

5) Finished goods 4,300

Cost of goods sold 600

Raw and In Process 3,700

RIP FG

End 12,000 13,100

Beginning (15,700) ( 8,800)

Increase (decrease) (3,700) 4,300

You might also like

- Cost Accounting 7 & 8Document26 pagesCost Accounting 7 & 8Kyrara79% (19)

- Accounting For LaborDocument7 pagesAccounting For LaborKrizel Dixie ParraNo ratings yet

- TimeBook PayrollDocument3 pagesTimeBook PayrollRaffy Roncales50% (6)

- Contract of Lease Commercial BuildingDocument4 pagesContract of Lease Commercial BuildingRaffy Roncales88% (8)

- Cost Accounting Answer Chapter 2Document5 pagesCost Accounting Answer Chapter 2Raffy Roncales71% (7)

- XYZ Company: An Integrated Capital Budgeting Instructional CaseDocument7 pagesXYZ Company: An Integrated Capital Budgeting Instructional CaseCindy Faye CrusanteNo ratings yet

- Answers To Cost Accounting Chapter 8Document4 pagesAnswers To Cost Accounting Chapter 8Raffy Roncales54% (13)

- Chapter 3Document10 pagesChapter 3Roann Bargola100% (4)

- Chapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyDocument4 pagesChapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyCertified Public AccountantNo ratings yet

- MGMT Acct Case AnalysisDocument3 pagesMGMT Acct Case AnalysisAriel DicoreñaNo ratings yet

- 2016 Vol 1 CH 4 AnswersDocument15 pages2016 Vol 1 CH 4 AnswersIsabella Sandigan Marilag100% (2)

- CH 3 Cost Accounting Matz 7edDocument27 pagesCH 3 Cost Accounting Matz 7edZainab Abizer Merchant50% (8)

- Cost Accounting - Chapter 16 - GuerreroDocument6 pagesCost Accounting - Chapter 16 - Guerrerobeth alviolaNo ratings yet

- Rule On Custody of Minors and Writ of Habeas CorpusDocument2 pagesRule On Custody of Minors and Writ of Habeas CorpusRaffy Roncales100% (1)

- Epcc of Ngds of Pipeline Project Procedure: Procurement PlanDocument22 pagesEpcc of Ngds of Pipeline Project Procedure: Procurement PlanApiz Travolta100% (1)

- 29 Leadership Secrets by Jack WelchDocument31 pages29 Leadership Secrets by Jack Welchsvenkataramana1100% (2)

- Syllabus OM Core PGP IIMB 2020-21 6oct20 PDFDocument7 pagesSyllabus OM Core PGP IIMB 2020-21 6oct20 PDFPratyush GoelNo ratings yet

- Cost Accounting - Chapter 4 CostDocument13 pagesCost Accounting - Chapter 4 Costxxxxxxxxx25% (4)

- Cost Accounting - Chapter 10Document14 pagesCost Accounting - Chapter 10xxxxxxxxx67% (6)

- Cost Accounting Answers Chapter 4Document17 pagesCost Accounting Answers Chapter 4Raffy RoncalesNo ratings yet

- Answers To Cost Accounting Chapter 10Document15 pagesAnswers To Cost Accounting Chapter 10Raffy Roncales100% (2)

- Chapter 7Document8 pagesChapter 7Roann Bargola60% (5)

- Cost Accounting Chapter 7Document7 pagesCost Accounting Chapter 7Raffy Roncales75% (12)

- Chapter-8 de Leon 2014Document4 pagesChapter-8 de Leon 2014'Jaurie'TwentyFour86% (7)

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- Accounting For MaterialsDocument40 pagesAccounting For MaterialsAngel Alejo Acoba100% (1)

- Chapter 8 de LeonDocument1 pageChapter 8 de LeonRose Ann De GuzmanNo ratings yet

- Cost AccountinCAgADocument86 pagesCost AccountinCAgAJenifer Belangel100% (4)

- Cost AccountingDocument128 pagesCost AccountingCarl Adrian Valdez50% (2)

- Problems 1 ProblemsDocument3 pagesProblems 1 ProblemsAlyza Noeri Mercado80% (5)

- Chapter 3 Cost Accounting Cycle Multiple Choice - TheoriesDocument36 pagesChapter 3 Cost Accounting Cycle Multiple Choice - TheoriesAyra Pelenio100% (2)

- Answers To Cost Accounting Chapter 9Document6 pagesAnswers To Cost Accounting Chapter 9Raffy Roncales0% (1)

- Cost Accounting Chapter 5 PDFDocument5 pagesCost Accounting Chapter 5 PDFRommel CabalhinNo ratings yet

- Cost Accounting - Chapter - 5Document5 pagesCost Accounting - Chapter - 5xxxxxxxxxNo ratings yet

- Chapter 5Document5 pagesChapter 5chocolatebears67% (3)

- Cost Accounting Chapter 5Document5 pagesCost Accounting Chapter 5Iah GomezNo ratings yet

- Cost Accounting - de LeonDocument5 pagesCost Accounting - de LeonIah GomezNo ratings yet

- Chapter 6Document4 pagesChapter 6Rose Ann GarciaNo ratings yet

- Chapter 6 AssignmentDocument4 pagesChapter 6 AssignmentJohnray ParanNo ratings yet

- Casibang ch5Document3 pagesCasibang ch5Krung KrungNo ratings yet

- Jit PDFDocument28 pagesJit PDFRona S. Pepino - AguirreNo ratings yet

- A 6. C 2. B 7. C 3. D 8. A 4. A 9. A 5. A 10. C: Answers To Multiple Choice - TheoreticalDocument6 pagesA 6. C 2. B 7. C 3. D 8. A 4. A 9. A 5. A 10. C: Answers To Multiple Choice - Theoreticalsweetwinkle09No ratings yet

- Just in Time and Backflush CostingDocument12 pagesJust in Time and Backflush Costings.gallur.gwynethNo ratings yet

- Chapter 10-SolManDocument15 pagesChapter 10-SolManJulyanneErikaMigriñoMeñuzaNo ratings yet

- Answer Key (SW1 To SW3)Document6 pagesAnswer Key (SW1 To SW3)MA. CRISSANDRA BUSTAMANTENo ratings yet

- CH 4 AnswersDocument9 pagesCH 4 AnswersElaineSmith83% (6)

- 1611 Job Order CostingDocument21 pages1611 Job Order CostingDiane PascualNo ratings yet

- Unit 8: Activity Based Costing and Back-FlushDocument5 pagesUnit 8: Activity Based Costing and Back-FlushCielo PulmaNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 3Document10 pagesKey To Corrections - LEVEL 2 MODULE 3UFO CatcherNo ratings yet

- ACC203 Seminar 2Document5 pagesACC203 Seminar 2Choy Ying Rui AlbaharNo ratings yet

- Answer Question One: Assignment-1 Managerial AccountingDocument8 pagesAnswer Question One: Assignment-1 Managerial AccountingMina OsamaNo ratings yet

- Just in TimeDocument3 pagesJust in TimeHenry SeeNo ratings yet

- Afar 2612 Job Order CostingDocument25 pagesAfar 2612 Job Order Costingcorpnet globalNo ratings yet

- Joint, By, Raw Mat, FOHDocument5 pagesJoint, By, Raw Mat, FOHQuinXG ChannelNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- P 41085Document16 pagesP 41085Sandeep PeddadaNo ratings yet

- Answer Key in Post Test Problem 1: Total: 10 PtsDocument2 pagesAnswer Key in Post Test Problem 1: Total: 10 Ptsayra napayNo ratings yet

- Quiz 1 Answers KeyDocument3 pagesQuiz 1 Answers KeyDesiree100% (1)

- Conversion Cost ($30,000 + $39,000) ÷ 4,600 $15 Per Equivalent UnitDocument3 pagesConversion Cost ($30,000 + $39,000) ÷ 4,600 $15 Per Equivalent Unitford_antonio26No ratings yet

- Practice Problems For Chapter 2 Part 1Document3 pagesPractice Problems For Chapter 2 Part 1Elisha MonteroNo ratings yet

- ASE3017 Revised Syllabus - Specimen Paper Answers 2008Document7 pagesASE3017 Revised Syllabus - Specimen Paper Answers 2008luckystar2013No ratings yet

- Numerical - Cost Accountancy 2019Document20 pagesNumerical - Cost Accountancy 2019Namonarayan SinghalNo ratings yet

- Chapter 6 ProjectDocument6 pagesChapter 6 Projectprmsusecgen.nfjpia2324No ratings yet

- Problem 2 JitDocument2 pagesProblem 2 JitChristian J. AbbatuanNo ratings yet

- Quiz On Job Order CostingDocument5 pagesQuiz On Job Order CostingnaomiNo ratings yet

- Advanced Processing and Manufacturing Technologies for Nanostructured and Multifunctional Materials IIIFrom EverandAdvanced Processing and Manufacturing Technologies for Nanostructured and Multifunctional Materials IIITatsuki OhjiNo ratings yet

- Motion For LeaveDocument2 pagesMotion For LeaveRaffy RoncalesNo ratings yet

- Estrada V DesiertoDocument2 pagesEstrada V DesiertoRaffy RoncalesNo ratings yet

- Meadows and Mountains: RefrainDocument3 pagesMeadows and Mountains: RefrainRaffy RoncalesNo ratings yet

- Jobi Nicole Regidor Roncales Fundamentals of Accountancy, Business, and Management - 1 Grade 11 - Zobel de AyalaDocument1 pageJobi Nicole Regidor Roncales Fundamentals of Accountancy, Business, and Management - 1 Grade 11 - Zobel de AyalaRaffy RoncalesNo ratings yet

- LEGAL ETHICS BAR EXAM With Suggested Answers.Document5 pagesLEGAL ETHICS BAR EXAM With Suggested Answers.Blake Clinton Y. Dy91% (11)

- Let Heaven Rejoice - SatbDocument2 pagesLet Heaven Rejoice - SatbRaffy Roncales100% (1)

- Brgy. Resolution TFYD 2017Document1 pageBrgy. Resolution TFYD 2017Raffy RoncalesNo ratings yet

- Strengthenic Youth MinsitersDocument8 pagesStrengthenic Youth MinsitersRaffy RoncalesNo ratings yet

- Tan Vs Comelec 142 SCRA 727Document1 pageTan Vs Comelec 142 SCRA 727Raffy Roncales100% (1)

- Abbas Vs ComelecDocument1 pageAbbas Vs ComelecRaffy RoncalesNo ratings yet

- ITB - Construction of Covred CourtDocument2 pagesITB - Construction of Covred CourtRaffy Roncales100% (1)

- David Vs Comelec Case DigestDocument2 pagesDavid Vs Comelec Case DigestRaffy Roncales100% (1)

- Criteria For Judging SummaryDocument1 pageCriteria For Judging SummaryRaffy RoncalesNo ratings yet

- Borja Vs Comelec Case DigestDocument3 pagesBorja Vs Comelec Case DigestRaffy RoncalesNo ratings yet

- Working Papers Hand OutsDocument4 pagesWorking Papers Hand OutsRaffy RoncalesNo ratings yet

- 2008 Bar Q Legal Ethics Final RequirementDocument5 pages2008 Bar Q Legal Ethics Final RequirementRaffy Roncales100% (1)

- Case of Wassmer v. Velez: Formally Set A Wedding and GoDocument4 pagesCase of Wassmer v. Velez: Formally Set A Wedding and GoRaffy RoncalesNo ratings yet

- PornographyDocument32 pagesPornographyRaffy Roncales67% (3)

- Lent 3rd Sunday 2016Document65 pagesLent 3rd Sunday 2016Raffy RoncalesNo ratings yet

- Affidavit of Undertaking To Produce Motor VehicleDocument4 pagesAffidavit of Undertaking To Produce Motor VehicleRaffy Roncales0% (1)

- General Power of AttorneyDocument2 pagesGeneral Power of AttorneyRaffy RoncalesNo ratings yet

- Writ of AmparoDocument5 pagesWrit of AmparoRaffy Roncales100% (2)

- Writ of AmparoDocument2 pagesWrit of AmparoRaffy Roncales100% (2)

- Songs For LentDocument2 pagesSongs For LentRaffy RoncalesNo ratings yet

- IBS301m - International Business Strategy - Session 1-4Document47 pagesIBS301m - International Business Strategy - Session 1-4Nguyen Trung Hau K14 FUG CTNo ratings yet

- Case Solution FinalDocument9 pagesCase Solution FinalpiyushmitNo ratings yet

- Chapter 2 &3Document4 pagesChapter 2 &3dipeshNo ratings yet

- GGA Strategic Planning Whitepaper A Road Map To Club Survival SuccessDocument8 pagesGGA Strategic Planning Whitepaper A Road Map To Club Survival SuccessSay VierNo ratings yet

- 2022.01.07 FOC Request (07012022)Document13 pages2022.01.07 FOC Request (07012022)RaniNo ratings yet

- VTech Telecommunications Australia) Pty LTD AR - 08 - 09Document11 pagesVTech Telecommunications Australia) Pty LTD AR - 08 - 09Tsuna SawadaNo ratings yet

- Case The Lean System at Wipro TechnologiesDocument2 pagesCase The Lean System at Wipro TechnologiesScribdTranslationsNo ratings yet

- Instrument ListDocument2 pagesInstrument ListJackNo ratings yet

- Master Scheduling - For StudentsDocument7 pagesMaster Scheduling - For StudentsNaseeb Ullah TareenNo ratings yet

- Alana Kaye - Diploma of Leadership and Management+ Graduate Diploma of Management (Learning)Document3 pagesAlana Kaye - Diploma of Leadership and Management+ Graduate Diploma of Management (Learning)Abdel Rafee HamsirajiNo ratings yet

- Model Bun Scrisoare de IntentieDocument1 pageModel Bun Scrisoare de IntentieAdry AnnaNo ratings yet

- CACC1Document5 pagesCACC1Marielle JalandoniNo ratings yet

- 2930-1633422379879-HND OB W9 Assignment Briefing LO3Document8 pages2930-1633422379879-HND OB W9 Assignment Briefing LO3Lily ChapraNo ratings yet

- Top-Level Management: Core CharacteristicsDocument2 pagesTop-Level Management: Core CharacteristicsZach YolkNo ratings yet

- Quiz - Chapter 1 - Overview of Government AccountingDocument2 pagesQuiz - Chapter 1 - Overview of Government AccountingRoselyn Mangaron SagcalNo ratings yet

- Marketing Management: 7 Analyzing Business MarketsDocument31 pagesMarketing Management: 7 Analyzing Business MarketsSatyam ChauhanNo ratings yet

- Lean AccountingDocument16 pagesLean AccountingSanti YopieNo ratings yet

- The SaaS CFO Blog Post Guide v1.0Document12 pagesThe SaaS CFO Blog Post Guide v1.0jacksonmoise1985No ratings yet

- Competetion PolicyDocument41 pagesCompetetion PolicyCicero CastroNo ratings yet

- Muhammad Rashid CV - 3Document2 pagesMuhammad Rashid CV - 3Muhammad shehryar KhanNo ratings yet

- Résultat Orientation EtudiantsDocument2 pagesRésultat Orientation EtudiantsAnis TissaouiNo ratings yet

- 2022 Account Payables Performance IOFMDocument25 pages2022 Account Payables Performance IOFMCRISNo ratings yet

- Introduction To Hotel Rooms DivisionDocument21 pagesIntroduction To Hotel Rooms DivisionKatrina SanchezNo ratings yet

- Kgisl Selected Students ListDocument4 pagesKgisl Selected Students ListNishanthNo ratings yet

- RFP Supply of CoffeeDocument12 pagesRFP Supply of CoffeeMinh TuyềnNo ratings yet

- Module 4-Pre1Document14 pagesModule 4-Pre1Jhon Paulo RojoNo ratings yet