Professional Documents

Culture Documents

Tds Chart Fy2009 10

Uploaded by

hka90Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds Chart Fy2009 10

Uploaded by

hka90Copyright:

Available Formats

TAXMANNINDIA Downloaded from www.taxmannindia.blogspot.

com

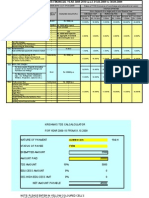

TDS Rate Chart for Financial Year 2009 - 2010

th st

Upto 30 Sptember 2009 From 1 October 2009

If recipient is an If recipient is an

Company / Company / Date within which Qtrly.

Exemption

Sec Nature of Payments Firm/ Co‐op Individual Firm/ Co‐op Individual TDS has to be Return

Limit

(Per annum) Society/ Local HUF Society/ Local HUF remitted Form No.

Authority Authority

192 Salaries

Resident Woman Below 65 Years 190,000 Average Rate Average Rate Average Rate Average Rate Within 1 week from

Individual Residents Aged 65 Yrs And Above 240,000 last day of the

Average Rate Average Rate Average Rate Average Rate 24Q

month in which the

Others 160,000 Average Rate Average Rate Average Rate Average Rate deduction is made

194A Interest other than Interest on Securities 5,000 10.00% 10.00% 10.00% 10.00% Same as above 26Q

194C Payment to Contractors 20,000 2.00% 2.00% 2.00% 1.00% Same as above 26Q

194C Payment to Sub Contract/Adv Contract 20,000 1.00% 1.00% 2.00% 1.00% Same as above 26Q

194C Payment to transporter, (PAN is available)** 20,000 2.00% 2.00% Nil Nil Same as above 26Q

194D Insurance Commission 5,000 10.00% 10.00% 10.00% 10.00% Same as above 26Q

194H Commission/Brokerage 2,500 10.00% 10.00% 10.00% 10.00% Same as above 26Q

194I Rent on Plant / Machinery 120,000 10.00% 10.00% 2.00% 2.00% Same as above 26Q

194I Rent other than on Plant / Machinery 120,000 20.00% 15.00% 10.00% 10.00% Same as above 26Q

194J Fees for Professional / Technical Services 20,000 10.00% 10.00% 10.00% 10.00% Same as above 26Q

194B Winning from Lotteries & Puzzles 5,000 30.00% 30.00% 30.00% 30.00% Same as above 26Q

** Higher TDS rate of 20% for not furnishing correct PAN: Requirement to furnish PAN is compulsory to deductor otherwise TDS shall be deducted @20%. W.E.F. 01.04.2010

Notes:

1. For Payment to Contractors/Sub Contractors Rs. 20000 for single payment & Rs. 50000 for aggregate Payment during a financial year.

2. Where income referred in Sections 193, 194A, 194C, 194D, 194G, 194H, 194I & 194J is credited to account of payee as on date up to which accounts are

made, TDS has to be deposited in Government Account within 2 months from the end of the month in which the date falls.

3. An Individual or a HUF whose total sales, gross receipts or turnover from business or profession carried on by him exceeds the monetary limits under Clause (a) or (b) of

Sec.44AB during the preceding financial year shall also be liable to deduct tax u/s.194A,194C, 194H, 194I & 194J.

4. For Advance Tax computation: Advance tax is not required in case amount of tax payable for the entire year is less than INR 10,000/ Further EC should be

applied in respect of advance tax payments by all taxpayers.

5. Banking company and co-operative society engaged in the banking business making payments of the aggregate amount of less than INR 10,000 in a

financial year are not liable to deduct tax U/s 194A

You might also like

- TDS Rates For AY 10-11 PDFDocument1 pageTDS Rates For AY 10-11 PDFjiten1986No ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- Tds Income Tax Rates Fy 2010-11Document13 pagesTds Income Tax Rates Fy 2010-11Surender KumarNo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document13 pagesTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramNo ratings yet

- 27 Tds Calculator Rate ChartDocument5 pages27 Tds Calculator Rate ChartasareereNo ratings yet

- Tdsrateschart2008 09Document2 pagesTdsrateschart2008 09Libins SebastianNo ratings yet

- TdsPac RateCard 0910Document2 pagesTdsPac RateCard 0910Ebanezer PaulrajNo ratings yet

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceChaitany Joshi0% (2)

- Changes in TDS Limits - F Y 2010-11Document1 pageChanges in TDS Limits - F Y 2010-11Ronak RanaNo ratings yet

- TDS - Rates - 07 - 08Document3 pagesTDS - Rates - 07 - 08KRISHNAKUMARNo ratings yet

- TDS Ready Reckoner (1) 11Document1 pageTDS Ready Reckoner (1) 11senthilkumar_kskNo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document1 pageTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Shwetta GogawaleNo ratings yet

- Hand BookDocument82 pagesHand Booknmshamim7750No ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- Tax-Alert - October 2022 - Key Income Tax Changes Proposed in The Inland Revenue (Amendment) Bill 2022Document6 pagesTax-Alert - October 2022 - Key Income Tax Changes Proposed in The Inland Revenue (Amendment) Bill 2022jdNo ratings yet

- Bhubaneswar 08112015 Session I PDFDocument42 pagesBhubaneswar 08112015 Session I PDFsachin NegiNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument13 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- OPT Notes PDFDocument3 pagesOPT Notes PDFKendrick SiaoNo ratings yet

- TDS ChartDocument3 pagesTDS ChartmmrkfastNo ratings yet

- TDS Rate Chart 1Document1 pageTDS Rate Chart 1bulu1987No ratings yet

- Group 6 Tax AssignmentDocument14 pagesGroup 6 Tax Assignmentdianaowani2No ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument5 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rate Chart For FY 2022-2023Document15 pagesTDS Rate Chart For FY 2022-2023leelathecaNo ratings yet

- PWC - Budget - 2020 - Analysis - 20 FebDocument35 pagesPWC - Budget - 2020 - Analysis - 20 FebGaury DattNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument11 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS RatesDocument1 pageTDS Ratespankaj_adv5314No ratings yet

- Tax VAT Supplementy Duty Changes in Finance Bill 2020Document24 pagesTax VAT Supplementy Duty Changes in Finance Bill 2020nurulaminNo ratings yet

- Cambodia Tax Booklet January 2016Document44 pagesCambodia Tax Booklet January 2016David MNo ratings yet

- TDS Notes in Hindi PDFDocument8 pagesTDS Notes in Hindi PDFRohit VermaNo ratings yet

- TDS Section Nature of Payment Rate of TDS Threshold LimitDocument3 pagesTDS Section Nature of Payment Rate of TDS Threshold LimitBiswajit GhoshNo ratings yet

- Capital Trainers Full PPT On TDSDocument78 pagesCapital Trainers Full PPT On TDSYamuna GNo ratings yet

- Budget 2010 Highlights Income TaxDocument8 pagesBudget 2010 Highlights Income TaxparthsomaiyaNo ratings yet

- Scheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Document8 pagesScheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Anonymous ckTjn7RCq8No ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- Revised TDS Rate Chart (FY 2009-10)Document1 pageRevised TDS Rate Chart (FY 2009-10)haldharkNo ratings yet

- Tax HomeworkDocument4 pagesTax HomeworkMatthew WittNo ratings yet

- Nepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsDocument7 pagesNepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsSajjal GhimireNo ratings yet

- Income Tax ChangesDocument30 pagesIncome Tax ChangesColors of LifeNo ratings yet

- SOBC 2024 - January To June - Web EnglishDocument29 pagesSOBC 2024 - January To June - Web EnglishMuhammad QasimNo ratings yet

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding TaxesJimbo ManalastasNo ratings yet

- Tax InformationDocument11 pagesTax InformationHenry WoodsNo ratings yet

- TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Document12 pagesTAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Ciarie Salgado0% (1)

- ScheduleofChargeJulytoDecember2018 (UBL)Document31 pagesScheduleofChargeJulytoDecember2018 (UBL)ShoaibUlHassanNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- Tds Rate ChartDocument1 pageTds Rate Chartremesh78No ratings yet

- Schedule of Charges - English - July To DecemberDocument15 pagesSchedule of Charges - English - July To DecemberBurairNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 1 s2.0 S0959652618323667 MainDocument12 pages1 s2.0 S0959652618323667 MaintaliagcNo ratings yet

- Production of BiodieselDocument49 pagesProduction of Biodieselteja100% (1)

- HCL Corporate-PresentationDocument14 pagesHCL Corporate-Presentationtony_reddyNo ratings yet

- Metric MIL-STD-1504C (USAF) 01 March 2007 Supersedes MIL-STD-1504B 8 June 1989Document11 pagesMetric MIL-STD-1504C (USAF) 01 March 2007 Supersedes MIL-STD-1504B 8 June 1989HenryNo ratings yet

- Virtual Asset Insurance Risk Analysis - OneDegreeDocument3 pagesVirtual Asset Insurance Risk Analysis - OneDegreeShaarang BeganiNo ratings yet

- EAU 2022 - Prostate CancerDocument229 pagesEAU 2022 - Prostate Cancerpablo penguinNo ratings yet

- Definition of Unit HydrographDocument5 pagesDefinition of Unit HydrographPankaj ChowdhuryNo ratings yet

- Technical Schedule World BankDocument249 pagesTechnical Schedule World BankPramod ShastryNo ratings yet

- Project On Brand Awareness of ICICI Prudential by SajadDocument99 pagesProject On Brand Awareness of ICICI Prudential by SajadSajadul Ashraf71% (7)

- Artificial Intelligence/Search/Heuristic Search/astar SearchDocument6 pagesArtificial Intelligence/Search/Heuristic Search/astar SearchAjay VermaNo ratings yet

- EU MDR FlyerDocument12 pagesEU MDR FlyermrudhulrajNo ratings yet

- San Miguel ReportDocument8 pagesSan Miguel ReportTraveller SpiritNo ratings yet

- PF2579EN00EMDocument2 pagesPF2579EN00EMVinoth KumarNo ratings yet

- Piping Tie in Procedure Rev A PDFDocument15 pagesPiping Tie in Procedure Rev A PDFMohammed Sibghatulla100% (1)

- 03 Zero Emissions and Eco-Town in KawasakiDocument21 pages03 Zero Emissions and Eco-Town in KawasakiAlwi AmarNo ratings yet

- GB Programme Chart: A B C D J IDocument2 pagesGB Programme Chart: A B C D J IRyan MeltonNo ratings yet

- Unclaimed Abandoned Vehicles Feb 2022Document66 pagesUnclaimed Abandoned Vehicles Feb 2022kumar himanshuNo ratings yet

- Harmonic Distortion CSI-VSI ComparisonDocument4 pagesHarmonic Distortion CSI-VSI ComparisonnishantpsbNo ratings yet

- GG&G 2012 CatDocument111 pagesGG&G 2012 Cattyrant88No ratings yet

- Teit Cbgs Dmbi Lab Manual FH 2015Document60 pagesTeit Cbgs Dmbi Lab Manual FH 2015Soumya PandeyNo ratings yet

- SANAKO Study700 V 500 BrochureDocument4 pagesSANAKO Study700 V 500 BrochureDwi PrihantoroNo ratings yet

- Lynette Hawkins, BMG Awesome InsightDocument2 pagesLynette Hawkins, BMG Awesome Insightawesomei100% (1)

- Assignment Brief HNHM301 The Contemporary Hospitality IndustryDocument6 pagesAssignment Brief HNHM301 The Contemporary Hospitality IndustryTanjum Tisha100% (1)

- Battlab Report 12 FinalDocument48 pagesBattlab Report 12 FinalLianNo ratings yet

- Sample Rubrics MakingDocument4 pagesSample Rubrics MakingKerstmis “Scale” NataliaNo ratings yet

- Train TicketDocument2 pagesTrain TicketGautam KumarNo ratings yet

- Honeywell Aquatrol 2000 PDFDocument60 pagesHoneywell Aquatrol 2000 PDFvsilickasNo ratings yet

- Book of Abstracts: Philippine Projects To The Intel International Science and Engineering FairDocument84 pagesBook of Abstracts: Philippine Projects To The Intel International Science and Engineering FairJimarie BithaoNo ratings yet

- HYD CCU: TICKET - ConfirmedDocument2 pagesHYD CCU: TICKET - ConfirmedRahul ValapadasuNo ratings yet

- Malik Tcpdump FiltersDocument41 pagesMalik Tcpdump FiltersombidasarNo ratings yet