Professional Documents

Culture Documents

TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF Others

Uploaded by

RajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF Others

Uploaded by

RajCopyright:

Available Formats

TDS Rate Chart FY 2021-2022

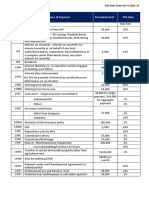

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

192 Payment of salary As per income tax Normal Slab Rate -

OPTION TO CHOOSE BETWEEN NEW AND OLD TAX SLAB slab

REGIME FOR SALARIED EMPLOYEES

192A Payment of accumulated balance of Provident 50,000 p.a 10% -

fund which is taxable in the hands of an

employee.

193 Interest on Securities (Debentures, any security 2,500 p.a 10% 10%

of the Central or State Government and any

other security )

194 Dividend 5,000 p.a 10% -

This amendment proposes to amend second proviso to

section 194 of the Act to further provide that the

provisions of section 194 i.e. TDS on dividend shall also

not apply to dividend income credited or paid to a

business trust by a special purpose vehicle or payment

of dividend to any other person as may be notified.

This means that no TDS needs to be deducted to AIF

Category III also.

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

194A i) Interest other than “Interest on securities” 5,000 P.a 10% 10%

(Other Than Bank Deposit/Post Office

Deposit/Banking Co-Society Deposit)

ii) Interest on Bank Deposit/Post Office Senior Citizen - 10% 10%

Deposit/Banking Co-Society Deposit 50,000 P.a

(Interest other than “Interest on securities” ) Others -40,000 P.a

194B Winnings from lotteries, crossword puzzles, 10,000 P.a 30% 30%

card games and other games of any sort

194BB Winnings from horse races 10,000 P.a 30% 30%

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

194C A Payment to contractor/sub-contractor 30,000 ( single bill) 1% 2%

(30,000 per contract or Rs 1,00,000 for aggregate /100,000 p.a

amount during the year)

194D Insurance commission 15,000 p.a 5% 10%

194DA A Payment in respect of LIC 100,000 p.a 5% 5%

194E Payment to non-resident sportsmen / sports - - 20%

association

194 EE A Payment in respect of deposit under 2,500 p.a 10% 10%

National Savings scheme

194F Payment on account of repurchase of unit by - 20% 20%

Mutual Fund or Unit Trust of India

194G Commission, etc., on sale of lottery tickets 15,000 p.a 5% 5%

194H Commission or brokerage 15000 p.a 5% 5%

194I Rent-Plant & Machinery 2,40,000 p.a 2% 2%

Rent- Land or building or furniture or fitting 2,40,000 p.a 10% 10%

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

194 IA Payment on transfer of certain immovable 50,00,000 p.a 1% 1%

property other than agricultural land

194 IB A Payment of rent by individual or HUF not 50,000 Per month 5% -

liable to tax audit

194 IC Payment of monetary consideration under - 10% 10%

Joint Development Agreements

194J A Payment for Professional fee- Fee for 30,000 p.a 2% 2%

technical services

A Payment for Professional fee- Fee in other all 30,000 p.a 10% 10%

cases ( like Professional fee , or royalty ) per

Section 194J

194K Payment of any income in respect of: - 10% 10%

a) Units of a Mutual Fund as per Section

10(23D)

b) The Units from the administrator

c) Units from specified compan

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

194 LA A Payment of compensation on acquisition of 2, 50,000 p.a 10% 10%

certain immovable property

194M Payment of commission (not being insurance 50 lakh 5% 5%

commission), brokerage, contractual fee,

professional fee to a resident person by an

Individual or a HUF who are not liable to

deduct TDS under section 194C, 194H, or 194J.

194N i) Cash withdrawal in excess of Rs. 1 crore Rs. 1 Crore 2% 2%

during the previous year from one or more

account maintained by a person with a

banking company, co-operative society

engaged in business of banking or a post

office

ii) in excess of Rs. 20 lakhs (for those persons 20 lakh 2% 2%

who have not filed return of income (ITR) for

three previous years immediately preceding

the previous year in which cash is withdrawn,

and the due date for filing ITR under section

139(1) has expired.) The deduction of tax

under this situation shall be at the rate of:

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

b) On amount withdrawn in cash if the b) 1 Crore 5% 5%

aggregate of the amount of

withdrawal exceeds Rs. 1 crore

during the previous year;

194-O Payment or credit of amount by the e- 5lakh 1% 1%

commerce operator to e-commerce

participant

194-Q Purchase of goods (applicable w.e.f 50 Lakh 0.10% 0.10%

01.07.2021)

206AB TDS on non-filers of ITR at higher rates Note-1

(applicable w.e.f 01.07.2021)

Note-1

TDS Rate

The proposed TDS rate in this section is higher of the followings rates –

•twice the rate specified in the relevant provision of the Act; or

•twice the rate or rates in force; or

•the rate of 5%

•Consequential amendment is also proposed in section 206AA(1) of the Act and insert second proviso to

further provide that where the tax is required to be deducted under section 194Q and PAN is not provided, the

TDS shall be at the rate of 5%

Non-Applicability

This section shall not apply where the tax is required to be deducted under sections 192, 192A, 194B, 194BB,

194LBC or 194N of the Act.

You might also like

- Tds Rate Chart Fy 2020Document4 pagesTds Rate Chart Fy 2020KAUTUK KOLINo ratings yet

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- TDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Document4 pagesTDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Sahay AlokNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- TDS Rate chart FY 2024-25Document4 pagesTDS Rate chart FY 2024-25MOQADDARNo ratings yet

- Section 192:: Payment of SalaryDocument7 pagesSection 192:: Payment of SalaryCacptCoachingNo ratings yet

- TDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inDocument1 pageTDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inGajendra Singh Rajpurohit Chadwas IIINo ratings yet

- TDS EntryDocument11 pagesTDS Entryश्रीनाथ राजाराम दातेNo ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- TDS Rates ChartDocument11 pagesTDS Rates ChartSarat KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- Notification TDS Rates - FV AMC BillDocument8 pagesNotification TDS Rates - FV AMC Billamit chavariaNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument5 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rates For FY 2021-22Document12 pagesTDS Rates For FY 2021-222022 YearNo ratings yet

- Particulars TDS Rates (In %)Document6 pagesParticulars TDS Rates (In %)Amiy Anand PandeyNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document9 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ajayNo ratings yet

- TDS Rate Chart: (For Assessment Year 2017-18)Document10 pagesTDS Rate Chart: (For Assessment Year 2017-18)Ajay SimonNo ratings yet

- TDS and TCS-rate-chart-2023 RemovedDocument4 pagesTDS and TCS-rate-chart-2023 Removeddurgeshsonawane65No ratings yet

- TDS and TCS Rate Chart 2023Document5 pagesTDS and TCS Rate Chart 2023DEEPAK SHARMANo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument13 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedAnkur ShahNo ratings yet

- TDS_and_TCS-rate-chart-2025Document5 pagesTDS_and_TCS-rate-chart-2025jsparakhNo ratings yet

- TDS Rate Chart'Document8 pagesTDS Rate Chart'PUSHKAR GARGNo ratings yet

- Budget 2019 Updates - Key Income Tax Changes and TDS RatesDocument6 pagesBudget 2019 Updates - Key Income Tax Changes and TDS RatesAjeet KumarNo ratings yet

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- Ssra Tds Rates 2021-2022Document10 pagesSsra Tds Rates 2021-2022deepu kNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document7 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ABHISHEKNo ratings yet

- TDS Rates Applicable from 01.10.2009Document2 pagesTDS Rates Applicable from 01.10.2009Gaurav MalhotraNo ratings yet

- What Is TDS?: Tax Deducted at Source (TDS)Document8 pagesWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootNo ratings yet

- Tax Deduction at SourceDocument13 pagesTax Deduction at SourceSwati SumanNo ratings yet

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Document1 pageWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNo ratings yet

- IT Rates For Tax Deduction at SourceDocument12 pagesIT Rates For Tax Deduction at SourceArun EmmiNo ratings yet

- TDS Summary May 24Document2 pagesTDS Summary May 24Akil MalekNo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument13 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- Instapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355Document7 pagesInstapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355skassociatetaxconsultantNo ratings yet

- TDS RatesDocument11 pagesTDS RatesRAVI DWIVEDINo ratings yet

- TDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Document5 pagesTDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Audit ManifestNo ratings yet

- TDS Chart FY 23-24Document6 pagesTDS Chart FY 23-24kuldeep singhNo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- TDS Rates Ay 2022-23Document10 pagesTDS Rates Ay 2022-23Suriyakumar ShanmugavelNo ratings yet

- Ty Tax Project (Final)Document14 pagesTy Tax Project (Final)raj_s_harmaNo ratings yet

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- Karvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not ProvidedDocument1 pageKarvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not Providedarjun_cwaNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- Revised TDS Wef 14.05.20Document7 pagesRevised TDS Wef 14.05.20MANAN KOTHARINo ratings yet

- TDS Provisions under Income Tax Act 1961Document77 pagesTDS Provisions under Income Tax Act 1961Sachin KumarNo ratings yet

- Tds Rate ChartDocument49 pagesTds Rate ChartSANJEEVNo ratings yet

- Changes in TDS Limits - F Y 2010-11Document1 pageChanges in TDS Limits - F Y 2010-11Ronak RanaNo ratings yet

- What Are The Incomes Specified For TDSDocument6 pagesWhat Are The Incomes Specified For TDSaniket thakurNo ratings yet

- Referencer For Quick Revision: Final Course Paper-1: Financial ReportingDocument55 pagesReferencer For Quick Revision: Final Course Paper-1: Financial ReportingRajNo ratings yet

- Financial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Document2 pagesFinancial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Mahesh Shinde100% (1)

- Accounting Standard (AS) 2 Valuation of InventoriesDocument6 pagesAccounting Standard (AS) 2 Valuation of InventoriesRajNo ratings yet

- Taxable Person Guide June 2018Document59 pagesTaxable Person Guide June 2018Mehroz AhmedNo ratings yet

- Deduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToDocument169 pagesDeduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToRajNo ratings yet

- Deduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToDocument169 pagesDeduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToRajNo ratings yet

- Experienced Purchasing Officer CVDocument2 pagesExperienced Purchasing Officer CVRajNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Experienced Purchasing Officer CVDocument2 pagesExperienced Purchasing Officer CVRajNo ratings yet

- Revenue Regulations No. 31-2020Document2 pagesRevenue Regulations No. 31-2020zelayneNo ratings yet

- ITAD Ruling 102-2002 May 28, 2002Document5 pagesITAD Ruling 102-2002 May 28, 2002Aine Mamle TeeNo ratings yet

- Audit Case - Audit of Noncurrent LiabilitiesDocument6 pagesAudit Case - Audit of Noncurrent LiabilitiesKristine Lirose BordeosNo ratings yet

- Telegram Channel: @kasexamDocument45 pagesTelegram Channel: @kasexammanjunathNo ratings yet

- Ias 12Document45 pagesIas 12Reever RiverNo ratings yet

- 10 TP 1 Income Tax San LuisDocument9 pages10 TP 1 Income Tax San Luislenlen100% (1)

- NHBF Newsletter 18july 2019Document16 pagesNHBF Newsletter 18july 2019Anubhav JainNo ratings yet

- Prudential SurrenderDocument5 pagesPrudential SurrenderBriltex IndustriesNo ratings yet

- ANGELES UNIVERSITY LAW STUDENT EXAMINES FALLACIESTITLE JUCO PAPER ON IDENTIFYING FALLACIOUS LEGAL REASONING TITLE ANALYZING FALLACIES IN LEGAL ARGUMENTS BY JUCODocument6 pagesANGELES UNIVERSITY LAW STUDENT EXAMINES FALLACIESTITLE JUCO PAPER ON IDENTIFYING FALLACIOUS LEGAL REASONING TITLE ANALYZING FALLACIES IN LEGAL ARGUMENTS BY JUCOWest Gomez JucoNo ratings yet

- Tax Answers - Chapter 3Document4 pagesTax Answers - Chapter 3Jonathan VelaNo ratings yet

- 03the Economic Times WealthDocument5 pages03the Economic Times WealthvivoposNo ratings yet

- QuizDocument2 pagesQuizGilang LestariNo ratings yet

- End of Unit Test 2 (HP4 K44)Document9 pagesEnd of Unit Test 2 (HP4 K44)Thư Mai100% (2)

- El Muebles Company Trial Balance As of September 30, 2020: Total 691,245.00 691,245.00Document6 pagesEl Muebles Company Trial Balance As of September 30, 2020: Total 691,245.00 691,245.00PaupauNo ratings yet

- Career Ladder WorkshitDocument4 pagesCareer Ladder WorkshitLiliana VrabieNo ratings yet

- 2307 TemplateDocument4 pages2307 TemplateMarianneRoseBrusolaNo ratings yet

- Main Sample Social Security Verification LetterDocument1 pageMain Sample Social Security Verification LetterSucre100% (1)

- Taxation ReviewerDocument4 pagesTaxation ReviewerAesha Tamar PastranaNo ratings yet

- Tax SyllabusDocument21 pagesTax Syllabusjb13_ruiz4200No ratings yet

- Fish 2018Document136 pagesFish 2018Anto KristianNo ratings yet

- Question and Answer - 53Document30 pagesQuestion and Answer - 53acc-expertNo ratings yet

- An Investor Education Initiative Powered by (AMFI)Document18 pagesAn Investor Education Initiative Powered by (AMFI)Samdarshi KumarNo ratings yet

- rc685 Fill 22eDocument4 pagesrc685 Fill 22ePreetpaul ThiaraNo ratings yet

- Financial Modelling FundamentalsDocument44 pagesFinancial Modelling FundamentalsNguyen Binh MinhNo ratings yet

- Fresh Ideas For A New Generation: Liam Nichols Campaign Platform 2018-2022 Whitby Town CouncilDocument21 pagesFresh Ideas For A New Generation: Liam Nichols Campaign Platform 2018-2022 Whitby Town CouncilLiam NicholsNo ratings yet

- Income From SalaryDocument54 pagesIncome From SalaryMohsin ShaikhNo ratings yet

- Stretagy For New India @75Document240 pagesStretagy For New India @75Deep GhoshNo ratings yet

- Assignment 1Document11 pagesAssignment 1Anh LanNo ratings yet

- Deliverable Acceptance FormDocument1 pageDeliverable Acceptance FormRyan LincayNo ratings yet

- Tax systems of countriesDocument12 pagesTax systems of countriesIryna HoncharukNo ratings yet