Professional Documents

Culture Documents

TDS Rates

Uploaded by

Gaurav Malhotra0 ratings0% found this document useful (0 votes)

11 views2 pagesTDS RATES APPLICABLE FROM 01.10.2009 Section Code Nature of Payment Thresholds Limit to in case recipient is deduct tax an individual / HUF.

Original Description:

Original Title

TDS RATES

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTDS RATES APPLICABLE FROM 01.10.2009 Section Code Nature of Payment Thresholds Limit to in case recipient is deduct tax an individual / HUF.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesTDS Rates

Uploaded by

Gaurav MalhotraTDS RATES APPLICABLE FROM 01.10.2009 Section Code Nature of Payment Thresholds Limit to in case recipient is deduct tax an individual / HUF.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

TDS RATES APPLICABLE FROM 01.10.

2009

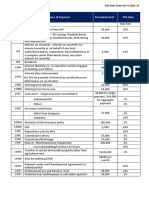

Section Nature of Payment Thresholds Limit to In case recipient is If the recipient is

Code deduct tax an Individual / HUF other than

Individual / HUF

194-A Interest other than Rs.10,000/- p.a. 10 % 10 %

interest on

securities

Interest from

Banking Company

194-A Interest other than Rs.5,000/- p.a. 10 % 10 %

interest on

securities

Interest other than

from Banking

Company

194-C Payment to Rs.20,000/- Per 1% 2%

Contractor Single Contract or

Rs.50,000/- exceed

during the financial

year

194-C Payment to Rs.20,000/- Per 1% 2%

Advertising Single Contract or

Contractor / Sub Rs.50,000/- exceed

Contractor during the financial

year

194-C Payment to If PAN Quoted NIL NIL

transport contractor

/ sub contractor

194-C Payment to If PAN not quoted 1% 2%

transport contractor

/ sub contractor *20% from *20% from

01.04.2010 01.04.2010

194-H Payment of Rs.2,500/- p.a. 10 % 10 %

commission or

brokerage to

resident

194-I Payment of Rent Rs.1,20,000/- p.a. 10% 10%

*20% from *20% from

01.04.2010 01.04.2010

194-I Payment of Rent for Rs.1,20,000/- p.a. 2% 2%

use of Plant ,

Machinery or *20% from *20% from

Equipment 01.04.2010 01.04.2010

194-J Payment of Rs.20,000/- p.a. 10 % 10 %

professional or

technical services

Note :

1. Surcharge ,Education Cess and Health Cess is not applicable for TDS.

2. w.e.f 01-10-2009, the nil rate will be applicable if the transporter quotes his PAN. If

PAN is not quoted the rate will be 1% for an individual/HUF transporter and 2% for

other transporters up to 31-03-2010

3. The Rate of TDS will be 20% in all cases, if PAN is not quoted by the deductee

(including transporter) w.e.f. 01-04-2010

You might also like

- Life Orientation Grade 11 Revision Term 2 - 2021 FinalDocument16 pagesLife Orientation Grade 11 Revision Term 2 - 2021 FinalTeeshan VerappenNo ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2veena_hewalekarNo ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- Karvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not ProvidedDocument1 pageKarvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not Providedarjun_cwaNo ratings yet

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- 56 Tds Tcs Rate Chart W e F 01 10 09Document1 page56 Tds Tcs Rate Chart W e F 01 10 09Shankar BidadiNo ratings yet

- TDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inDocument1 pageTDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inGajendra Singh Rajpurohit Chadwas IIINo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- Tds Rate Chart Fy 2020Document4 pagesTds Rate Chart Fy 2020KAUTUK KOLINo ratings yet

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument11 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument5 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- TDS EntryDocument11 pagesTDS Entryश्रीनाथ राजाराम दातेNo ratings yet

- Income Tax Update: Budget 2019-20: TDS - Tax Deduction at SourceDocument6 pagesIncome Tax Update: Budget 2019-20: TDS - Tax Deduction at SourceAjeet KumarNo ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- Ssra Tds Rates 2021-2022Document10 pagesSsra Tds Rates 2021-2022deepu kNo ratings yet

- TDS Chart FY 23-24Document6 pagesTDS Chart FY 23-24kuldeep singhNo ratings yet

- Tds Income Tax Rates Fy 2010-11Document13 pagesTds Income Tax Rates Fy 2010-11Surender KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- New TDS Rate Fy-2009-10-30.12Document3 pagesNew TDS Rate Fy-2009-10-30.12saikat12No ratings yet

- TDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Document5 pagesTDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Audit ManifestNo ratings yet

- Changes in TDS Limits - F Y 2010-11Document1 pageChanges in TDS Limits - F Y 2010-11Ronak RanaNo ratings yet

- TDS Rate Chart FY 2024-25Document4 pagesTDS Rate Chart FY 2024-25MOQADDARNo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document13 pagesTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramNo ratings yet

- All About TDS Part 2Document9 pagesAll About TDS Part 2Animesh Kumar TilakNo ratings yet

- Section 192:: Payment of SalaryDocument7 pagesSection 192:: Payment of SalaryCacptCoachingNo ratings yet

- Instapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355Document7 pagesInstapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355skassociatetaxconsultantNo ratings yet

- What Is TDS?: Tax Deducted at Source (TDS)Document8 pagesWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootNo ratings yet

- Rates of TDS For Major Nature of Payments For The Financial Year 2010-11 Particulars Rates From 1.4.10 To 31.03.2011Document2 pagesRates of TDS For Major Nature of Payments For The Financial Year 2010-11 Particulars Rates From 1.4.10 To 31.03.2011Bhupinder SinghNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument13 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- Income TaxDocument77 pagesIncome TaxSachin KumarNo ratings yet

- Tax Deduction at SourceDocument7 pagesTax Deduction at SourceEnvy NvNo ratings yet

- Normal Slab Rate: Section 194ADocument3 pagesNormal Slab Rate: Section 194ASridharan DhanasekaranNo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- TDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Document9 pagesTDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Sumukh TemkarNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- Important Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDocument1 pageImportant Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDaljeet SinghNo ratings yet

- TdsPac RateCard 0910Document2 pagesTdsPac RateCard 0910Ebanezer PaulrajNo ratings yet

- Hand BookDocument82 pagesHand Booknmshamim7750No ratings yet

- TDS ChartDocument3 pagesTDS ChartmmrkfastNo ratings yet

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- A) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Document17 pagesA) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Sonika GuptaNo ratings yet

- TDS Rate Chart 1Document1 pageTDS Rate Chart 1bulu1987No ratings yet

- TDS Summary SRDocument2 pagesTDS Summary SRdokkalaspiNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- TDS RatesDocument1 pageTDS Ratespankaj_adv5314No ratings yet

- 57 TDS Rate Chart BOARDDocument1 page57 TDS Rate Chart BOARDSatish GoenkaNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Document1 pageWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNo ratings yet

- Tds Rate ChartDocument49 pagesTds Rate ChartSANJEEVNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- Biography of Murray (1893-1988) : PersonologyDocument6 pagesBiography of Murray (1893-1988) : PersonologyMing100% (1)

- InfertilityDocument8 pagesInfertilityrivannyNo ratings yet

- Gambaran Professional Quality of Life Proqol GuruDocument7 pagesGambaran Professional Quality of Life Proqol Gurufebrian rahmatNo ratings yet

- Osma Osmadrain BG Pim Od107 Feb 2017pdfDocument58 pagesOsma Osmadrain BG Pim Od107 Feb 2017pdfDeepakkumarNo ratings yet

- Creative An Inclusive ClassroomDocument3 pagesCreative An Inclusive Classroommuneeba zafarNo ratings yet

- Emergency War Surgery Nato HandbookDocument384 pagesEmergency War Surgery Nato Handbookboubiyou100% (1)

- Ems em FW Paneel Firetec enDocument2 pagesEms em FW Paneel Firetec enzlatkokrsicNo ratings yet

- Allison Burke Adime 4Document8 pagesAllison Burke Adime 4api-317577095No ratings yet

- Diplomate Course and Conferment RequirementsDocument1 pageDiplomate Course and Conferment Requirementsabigail lausNo ratings yet

- WP DeltaV Software Update Deployment PDFDocument8 pagesWP DeltaV Software Update Deployment PDFevbaruNo ratings yet

- Differential Partitioning of Betacyanins and Betaxanthins Employing Aqueous Two Phase ExtractionDocument8 pagesDifferential Partitioning of Betacyanins and Betaxanthins Employing Aqueous Two Phase ExtractionPaul Jefferson Flores HurtadoNo ratings yet

- Nikki CV FormatedDocument2 pagesNikki CV FormatedSaif AlamNo ratings yet

- Exterior Wall PrimerDocument2 pagesExterior Wall PrimerAsian PaintsNo ratings yet

- Anglo American - Belt Conveyor Design CriteriaDocument19 pagesAnglo American - Belt Conveyor Design CriteriaIgor San Martín Peñaloza0% (1)

- Babok Framework Overview: BA Planning & MonitoringDocument1 pageBabok Framework Overview: BA Planning & MonitoringJuan100% (1)

- Prestress 3.0Document10 pagesPrestress 3.0Jonel CorbiNo ratings yet

- Polyken 4000 PrimerlessDocument2 pagesPolyken 4000 PrimerlessKyaw Kyaw AungNo ratings yet

- Leon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3Document3 pagesLeon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3WCTV Digital TeamNo ratings yet

- Fitness Program: Save On Health Club Memberships, Exercise Equipment and More!Document1 pageFitness Program: Save On Health Club Memberships, Exercise Equipment and More!KALAI TIFYNo ratings yet

- Mediclinic Weekly Progress Report No 29Document27 pagesMediclinic Weekly Progress Report No 29Julius Ceasar SanorjoNo ratings yet

- Non-Binary or Genderqueer GendersDocument9 pagesNon-Binary or Genderqueer GendersJuan SerranoNo ratings yet

- SPKT Thiet Ke Co Khi 1Document33 pagesSPKT Thiet Ke Co Khi 1Chiến PhanNo ratings yet

- The Mystique of The Dominant WomanDocument8 pagesThe Mystique of The Dominant WomanDorothy HaydenNo ratings yet

- IS 11255 - 7 - 2005 - Reff2022 Methods For Measurement of Emission From Stationary Sources Part 7 Oxides of NitrogenDocument10 pagesIS 11255 - 7 - 2005 - Reff2022 Methods For Measurement of Emission From Stationary Sources Part 7 Oxides of NitrogenPawan SharmaNo ratings yet

- Texas Steering and Insurance DirectionDocument2 pagesTexas Steering and Insurance DirectionDonnie WeltyNo ratings yet

- Dysfunctional Uterine Bleeding (DUB)Document1 pageDysfunctional Uterine Bleeding (DUB)Bheru LalNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross Incomericamae saladagaNo ratings yet

- Easy Rasam Recipe Made Without Rasam PowderDocument6 pagesEasy Rasam Recipe Made Without Rasam PowderPrantik Adhar SamantaNo ratings yet

- Reaction Paper On Water PollutionDocument1 pageReaction Paper On Water PollutionAztah KivycNo ratings yet