Professional Documents

Culture Documents

Tds Rate Chart Fy 2020

Uploaded by

KAUTUK KOLI0 ratings0% found this document useful (0 votes)

73 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

73 views4 pagesTds Rate Chart Fy 2020

Uploaded by

KAUTUK KOLICopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

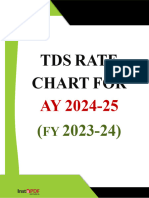

TDS Rate Chart FY 2020-2021

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

192 Payment of salary As per income tax Normal Slab Rate -

slab

192A Payment of accumulated balance of Provident 50,000 p.a 10% -

fund which is taxable in the hands of an

employee.

193 Interest on Securities (Debentures, any security 10,000 p.a 10% 10%

of the Central or State Government and any

other security )

194 Dividend 5,000 p.a - 10%

194A An Income by way of interest other than 40,000 p.a 10% 10%

“Interest on securities”

194B Income by way of winnings from lotteries, 10,000 p.a 30% 30%

crossword puzzles, card games and other

games

194 BB Income by way of winnings from horse races 10,000 p.a 30% 30%

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

194C A Payment to contractor/sub-contractor 30,000 ( single bill) 1% 2%

(30,000 per contract or Rs 1,00,000 for aggregate /100,000 p.a

amount during the year)

194D Insurance commission 15,000 p.a 5% 10%

194DA A Payment in respect of LIC 100,000 p.a 5% 5%

194E Payment to non-resident sportsmen / sports - - 20.8%

association

194 EE A Payment in respect of deposit under 2,500 p.a 10% 10%

National Savings scheme

194F Payment on account of repurchase of unit by - 20% 20%

Mutual Fund or Unit Trust of India

194G Commission, etc., on sale of lottery tickets 15,000 p.a 5% 5%

194H Commission or brokerage 15000 p.a 5% 5%

194I Rent-Plant & Machinery 2,40,000 p.a 2% 2%

Rent- Land or building or furniture or fitting 2,40,000 p.a 10% 10%

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

194 IA Payment on transfer of certain immovable 50,00,000 p.a 1% 1%

property other than agricultural land

194 IB A Payment of rent by individual or HUF not 50,000 Per month 5% -

liable to tax audit

194 IC Payment of monetary consideration under - 10% 10%

Joint Development Agreements

194J A Payment for Professional fee- Fee for 30,000 p.a 2% 2%

technical services

A Payment for Professional fee- Fee in other all 30,000 p.a 10% 10%

cases ( like Professional fee , or royalty ) per

Section 194J

194K Payment of any income in respect of: - 10% 10%

a) Units of a Mutual Fund as per Section

10(23D)

b) The Units from the administrator

c) Units from specified compan

Section Nature Of Payment Threshold (in Rs. ) TDS Rate ( in %)

Code Indv/HUF Others

194 LA A Payment of compensation on acquisition of 2, 50,000 p.a 10% 10%

certain immovable property

194M Payment of commission (not being insurance - 5% 5%

commission), brokerage, contractual fee,

professional fee to a resident person by an

Individual or a HUF who are not liable to

deduct TDS under section 194C, 194H, or 194J.

194N Cash withdrawal in excess of Rs. 1 crore during Rs. 1 Crore 2% 2%

the previous year from one or more account

maintained by a person with a banking

company, co-operative society engaged in

business of banking or a post office

194 O Applicable for E-Commerce operator for sale of - 1% 1%

goods or provision of service facilitated by it

through its digital or electronic facility or

platform

You might also like

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- TDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Document4 pagesTDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Sahay AlokNo ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- TDS Rate Chart FY 2024-25Document4 pagesTDS Rate Chart FY 2024-25MOQADDARNo ratings yet

- Section 192:: Payment of SalaryDocument7 pagesSection 192:: Payment of SalaryCacptCoachingNo ratings yet

- TDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inDocument1 pageTDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inGajendra Singh Rajpurohit Chadwas IIINo ratings yet

- TDS EntryDocument11 pagesTDS Entryश्रीनाथ राजाराम दातेNo ratings yet

- Income Tax Update: Budget 2019-20: TDS - Tax Deduction at SourceDocument6 pagesIncome Tax Update: Budget 2019-20: TDS - Tax Deduction at SourceAjeet KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument11 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument5 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- TDS - and - TCS Rate Chart 2025Document5 pagesTDS - and - TCS Rate Chart 2025jsparakhNo ratings yet

- Notification TDS Rates - FV AMC BillDocument8 pagesNotification TDS Rates - FV AMC Billamit chavariaNo ratings yet

- Instapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355Document7 pagesInstapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355skassociatetaxconsultantNo ratings yet

- Karvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not ProvidedDocument1 pageKarvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not Providedarjun_cwaNo ratings yet

- TDS Chart FY 23-24Document6 pagesTDS Chart FY 23-24kuldeep singhNo ratings yet

- Ssra Tds Rates 2021-2022Document10 pagesSsra Tds Rates 2021-2022deepu kNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- Particulars TDS Rates (In %)Document6 pagesParticulars TDS Rates (In %)Amiy Anand PandeyNo ratings yet

- TDS Summary May 24Document2 pagesTDS Summary May 24Akil MalekNo ratings yet

- TDS and TCS-rate-chart-2023 RemovedDocument4 pagesTDS and TCS-rate-chart-2023 Removeddurgeshsonawane65No ratings yet

- TDS and TCS Rate Chart 2023Document5 pagesTDS and TCS Rate Chart 2023DEEPAK SHARMANo ratings yet

- TDS RatesDocument2 pagesTDS RatesGaurav MalhotraNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument13 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rates For FY 2021-22Document12 pagesTDS Rates For FY 2021-222022 YearNo ratings yet

- TDS Rate Chart: (For Assessment Year 2017-18)Document10 pagesTDS Rate Chart: (For Assessment Year 2017-18)Ajay SimonNo ratings yet

- TDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Document5 pagesTDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Audit ManifestNo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument13 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedAnkur ShahNo ratings yet

- TDS Rate Chart'Document8 pagesTDS Rate Chart'PUSHKAR GARGNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document9 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ajayNo ratings yet

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Document1 pageWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document7 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ABHISHEKNo ratings yet

- Tax Deduction at SourceDocument13 pagesTax Deduction at SourceSwati SumanNo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- TDS RatesDocument11 pagesTDS RatesRAVI DWIVEDINo ratings yet

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- TDS Summary SRDocument2 pagesTDS Summary SRdokkalaspiNo ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- IT Rates For Tax Deduction at SourceDocument12 pagesIT Rates For Tax Deduction at SourceArun EmmiNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- TDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Document9 pagesTDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Sumukh TemkarNo ratings yet

- What Is TDS?: Tax Deducted at Source (TDS)Document8 pagesWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootNo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- Income TaxDocument77 pagesIncome TaxSachin KumarNo ratings yet

- TDS Rates Ay 2022-23Document10 pagesTDS Rates Ay 2022-23Suriyakumar ShanmugavelNo ratings yet

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- Reduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Document6 pagesReduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Kranthi Kumar KatamreddyNo ratings yet

- TDS Rate Chart For FY 2022-2023Document15 pagesTDS Rate Chart For FY 2022-2023leelathecaNo ratings yet

- TDS Rates Chart Fy 2020 21 Ay 2021 22Document6 pagesTDS Rates Chart Fy 2020 21 Ay 2021 22Brijendra SinghNo ratings yet

- What Are The Incomes Specified For TDSDocument6 pagesWhat Are The Incomes Specified For TDSaniket thakurNo ratings yet

- 1st Research Paper IndexDocument1 page1st Research Paper IndexKAUTUK KOLINo ratings yet

- Cfi Accounting EbookDocument66 pagesCfi Accounting EbookAmjid MalNo ratings yet

- Cfi Accounting EbookDocument66 pagesCfi Accounting EbookAmjid MalNo ratings yet

- The Malad Sahakari Bank LimitedDocument6 pagesThe Malad Sahakari Bank LimitedKAUTUK KOLINo ratings yet

- Certificate Course On Concurrent Audit by ICAIDocument1 pageCertificate Course On Concurrent Audit by ICAIKAUTUK KOLINo ratings yet

- Certificate Course On Concurrent Audit by ICAIDocument1 pageCertificate Course On Concurrent Audit by ICAIKAUTUK KOLINo ratings yet

- Tds Rate Chart Fy 2020Document4 pagesTds Rate Chart Fy 2020KAUTUK KOLINo ratings yet

- Certificate Course On Concurrent Audit by ICAIDocument1 pageCertificate Course On Concurrent Audit by ICAIKAUTUK KOLINo ratings yet

- Certificate Course On Concurrent Audit by ICAIDocument1 pageCertificate Course On Concurrent Audit by ICAIKAUTUK KOLINo ratings yet

- Certificate Course On Concurrent Audit by ICAIDocument1 pageCertificate Course On Concurrent Audit by ICAIKAUTUK KOLINo ratings yet

- The Malad Sahakari Bank LimitedDocument6 pagesThe Malad Sahakari Bank LimitedKAUTUK KOLINo ratings yet

- Coldroom Brochure 2020 (Email Version)Document12 pagesColdroom Brochure 2020 (Email Version)MOHAMED FAHMIE SYAFIQ BIN AHMAD BAKRI (LKIM)No ratings yet

- Chapter 09 SolutionsDocument43 pagesChapter 09 SolutionsDwightLidstromNo ratings yet

- 08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBDocument1 page08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBChristian ParedesNo ratings yet

- Project Planning and Monitoring Tool: Important NoticeDocument13 pagesProject Planning and Monitoring Tool: Important Noticemanja channelNo ratings yet

- TechRef SoftstarterDocument11 pagesTechRef SoftstarterCesarNo ratings yet

- Selenium Question and AnswerDocument35 pagesSelenium Question and AnswerManas Jha50% (2)

- Regional Planning PDFDocument50 pagesRegional Planning PDFAayansh AnshNo ratings yet

- As 2419Document93 pagesAs 2419Craftychemist100% (2)

- Q No. Questions CO No.: C C W That Results in GDocument2 pagesQ No. Questions CO No.: C C W That Results in GSamarth SamaNo ratings yet

- Parts of A Business LetterDocument7 pagesParts of A Business LetterCharmine SacdalanNo ratings yet

- SDN5025 GREEN DC Electrical Inspection and Test Certificate V1.1Document11 pagesSDN5025 GREEN DC Electrical Inspection and Test Certificate V1.1JohnNo ratings yet

- Jacob Engine Brake Aplicación PDFDocument18 pagesJacob Engine Brake Aplicación PDFHamilton MirandaNo ratings yet

- Problem 4. Markov Chains (Initial State Multiplication)Document7 pagesProblem 4. Markov Chains (Initial State Multiplication)Karina Salazar NuñezNo ratings yet

- Case Study-Hain Celestial: Student Name Institution Affiliation DateDocument5 pagesCase Study-Hain Celestial: Student Name Institution Affiliation DategeofreyNo ratings yet

- Tendon Grouting - VSLDocument46 pagesTendon Grouting - VSLIrshadYasinNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced Levelmehmet mutluNo ratings yet

- CF34-10E LM June 09 Print PDFDocument301 pagesCF34-10E LM June 09 Print PDFPiipe780% (5)

- قدرة تحمل التربةDocument3 pagesقدرة تحمل التربةjaleelNo ratings yet

- CW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Document3 pagesCW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Adrian WensenNo ratings yet

- Delivery For OutSystems Specialization Sample Exam - enDocument8 pagesDelivery For OutSystems Specialization Sample Exam - enmahesh manchalaNo ratings yet

- Managing Digital Transformations - 1Document105 pagesManaging Digital Transformations - 1RamyaNo ratings yet

- Evolution of Human Resource ManagementDocument13 pagesEvolution of Human Resource Managementmsk_1407No ratings yet

- ReDocument3 pagesReSyahid FarhanNo ratings yet

- E-Business & Cyber LawsDocument5 pagesE-Business & Cyber LawsHARSHIT KUMARNo ratings yet

- Integrated Weed Management 22.11.2021Document8 pagesIntegrated Weed Management 22.11.2021Izukanji KayoraNo ratings yet

- Laser Ignition ReportDocument26 pagesLaser Ignition ReportRaHul100% (2)

- PMP Cheat SheetDocument9 pagesPMP Cheat SheetzepededudaNo ratings yet

- Artificial Intelligence and Applications: Anuj Gupta, Ankur BhadauriaDocument8 pagesArtificial Intelligence and Applications: Anuj Gupta, Ankur BhadauriaAnuj GuptaNo ratings yet

- Impact of Child Labour On School Attendance and Academic Performance of Pupils in Public Primary Schools in Niger StateDocument90 pagesImpact of Child Labour On School Attendance and Academic Performance of Pupils in Public Primary Schools in Niger StateJaikes100% (3)

- Install GuideDocument11 pagesInstall GuideRodrigo Argandoña VillalbaNo ratings yet