Professional Documents

Culture Documents

Top International Design 2011 PDF

Uploaded by

cesperon390 ratings0% found this document useful (0 votes)

32 views4 pagesTop 200 International Design Firms saw 9.9% revenue increase in 2010, to $57. Billion from $52. Billion in 2009. International revenue from projects in Asia and Australia rose 21.3% in 2010 to $13. Billion. The global financial crisis of the past few years has hurt the overall market, particularly in developed countries.

Original Description:

Original Title

Top International Design 2011.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTop 200 International Design Firms saw 9.9% revenue increase in 2010, to $57. Billion from $52. Billion in 2009. International revenue from projects in Asia and Australia rose 21.3% in 2010 to $13. Billion. The global financial crisis of the past few years has hurt the overall market, particularly in developed countries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views4 pagesTop International Design 2011 PDF

Uploaded by

cesperon39Top 200 International Design Firms saw 9.9% revenue increase in 2010, to $57. Billion from $52. Billion in 2009. International revenue from projects in Asia and Australia rose 21.3% in 2010 to $13. Billion. The global financial crisis of the past few years has hurt the overall market, particularly in developed countries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

subscribe contact us advertise careers events FAQ ENR Subscriber Login

share: more print email

Text size: A A

Slide Show

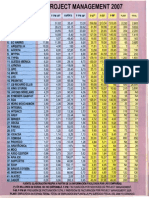

Source: McGraw-Hill Construction Research &

Analytics/ENR

Related Links:

The Top 200 International Design Firms Rankings

List

The Top 150 Global Design Firms Rankings List

Complete Top 200 International Design Firms List

(subscription)

----- Advertising -----

comment

Issue: 07/25/2011

ENR's Top 200 International Design Firms for 2011

07/20/2011

By Gary Tulacz

[ Page 1 of 3 ]

The shift in the markets for large international design firms is reflected in ENR's Top 200 International Design Firms list.

As a group, the Top 200 saw a 9.9% revenue increase in 2010, to $57.66 billion from $52.45 billion in 2009, from

projects outside their respective home countries. However, domestic revenue for these firms rose only 0.3%, to $59.40

billion in 2010 from $59.37 billion in 2009. Overall, the group enjoyed a 4.8% increase in overall design revenue, to

$117.20 billion in 2010 from$111.81 billion in 2009.

The real story is that the struggling markets in the U.S.

and Europe have been offset by surges in Asia and

Australia, Africa and Latin America. International revenue

from projects in Asia and Australia rose 21.3% in 2010 to

$13.31 billion, making that region the top regional

destination for international designers. The African

market, particularly in north Africa, also surged, rising

14.0% to $4.65 billion. Latin America was up 11.9%, to

$3.54 billion.

Europe also was up in 2010, rising 6.7% to $13.26 billion.

The U.S. market also showed a gain, hitting $6.78 billion

in 2010 from $6.24 billion in 2009. However, the U.S.

gains are misleading. For example, since Balfour Beatty

acquired New York-based engineering giant Parsons

Brinckerhoff in 2009, PB's domestic U.S. revenue of $733

million now is counted as international revenue for Balfour

Beatty. Without PB's contribution to Balfour Beatty's U.S.

revenue, the U.S. market actually declined by 3.2% in

2010.

The global financial crisis of the past few years has hurt

the overall market, particularly in developed countries.

There's no doubt that the recession had an impact on the

capital markets and on lenders' appetite for risk,says

J ohn Pearson, global managing energy director for

Canada's Hatch Group.

Many international design firms worry infrastructure

projects, employed as a fiscal stimulus, will decline

because of government debt concerns. With public debt

problems now coming to the forefront in many countries,

there is a tapering off of public infrastructure spending,

and private-sector spending has not yet necessarily

bounced back to the point where it is filling the gap,says

Keith Reynolds, group chief executive of New Zealand's

Beca Group.

The recession has also meant some owners have put the

brakes on projects. We have seen delays in powerplant

projects and also in privately financed renewable-energy

projects,says Bernd Kordes, CEO of Lahmeyer

International.

However, Pearson says resource-rich countries have

suffered the least from the recession and have recovered

the quickest. [Canada] is probably the best example of a

country that had a relatively light bump in the road economically, compared to the United States and much of Europe,

he says. Chile, Brazil and South Africa also have recovered well, he adds.

The recession has caused the global market to move from developed countries to emerging nations. There has been a

recent shift in economic prosperity from the Western world to the East,says Wael Allan, regional managing director for

the Middle East for Hyder Consulting. He says the Western world is a mature market, with less demand for

infrastructure. There are more opportunities in the East, where there are emerging markets and a much greater

demand for enhanced infrastructure.

These emerging markets increasingly are drawing private corporate investment to feed a growing middle class. Our

clients are investing in new facilities in Russia, China, Vietnam, Indonesia and India,says Ton van der Velden, board

member at Tebodin. He says countries in the Middle East are providing opportunities not just in oil and gas but in

general infrastructure. The area also is becoming a consumer market, resulting in investments in all sorts of facilities

[that produce] for the local market,he says.

U.K. Firms Seek Stability

With risks spread geographically and across sectors, large European firms report stable business with some prospect

of growth. The U.K.'s Arup Group, Halcrow Group and Mott MacDonald Group see little change in sales over last year,

though profits have dipped.

Mott's managing director, Richard Williams, attributes the company's consistency, despite the European recession, to

its geographical spread. Demand in Asia and Latin America compensates for weakening European and U.S. orders,

adds Halcrow's business development director, Mark Brown.

----- Advertising -----

Free White Papers

Mobile & Wireless Solutions in

Construction: Driving Improved

Decision Making Speed and

Scalability:

Control Employee Spending by use

of Business Prepaid Cards.:

This week's content

Archive

Subscribe to ENR

Order back issues

Manage Subscription

Video

View all

Blogs: ENR Staff Blogs: Other Voices

Critical Path: ENR's editors and bloggers deliver their

insights, opinions, cool-headed analysis and hot-headed

rantings

Obama-Boehner Talks Break

Down

By: tom_ichniowski

7/22/2011 7:40 PM CDT

UPDATE 7/22: Airport Grants On

Hold as FAA Authorization About

to Lapse

By: tom_ichniowski

7/22/2011 4:49 PM CDT

Senate Bill Would Boost

Environmental Cleanup of Gulf

By: pamela_hunter

7/21/2011 2:52 PM CDT

View all Posts

Project Leads/Pulse

Subscribe to ENR Magazine for only

$82 a year (includes full web access)

Search our site:

INFRASTRUCTURE BLDGS BIZ MGMT POLICY EQUIPMENT PEOPLE MULTIMEDIA OPINION TECH EDUCATION ECONOMICS TOP LISTS REGIONS

SAFETY & HEALTH WORKFORCE FINANCE BANKING & CREDIT CRISIS COMPANIES PROJECT DELIVERY ETHICS & CORRUPTION ECONOMIC STIMULUS

Page 1of 2 ENR's Top 200 International Design Firms for 2011 | ENR: Engineering News Record...

25/07/2011 http://enr.construction.com/business_management/companies/2011/0725-howthetopin...

Williams

Facing excess European design capacity, DHV Group is on a two-year program to cut staff in its

Netherlands base by 25%, to 1,800, by year's end, says company President Bertrand van Ee. DHV

global staffing will shrink at a slower pace, to around 5,200 employees from 5,500. We see

continuing high demand for world-class competence,he says.

U.K.-based W.S. Atkins plc last month reported a 12.7% rise on global sales. Our strategy is

working. We are keeping to our core business,says CEO Keith Clarke, who retires this month.

Lars-Peter Sbye, CEO of Denmark's Cowi A/S, is also bullish. Business is now much betterthan

in 2010, he says. I expect growth to pick up.The nearby Nordic market is robust, and Sbye

sees growth globally in transportation.

Keywords: The Top 200 International Design Firms;International Architects;International Engineers;ENR's Top

Lists;Largest Building Engineers;Parsons Brinckerhof;Balfour Beatty

[ Page 1 of 3 ]

Gives readers a glimpse of who is planning and

constructing some of the largest projects throughout the

U.S. Much information for pulse is derived from

McGraw-Hill Construction Dodge.

For more information on a project in Pulse that has a

DR#, or for general information on Dodge products and

services, please visit our Website at

www.dodge.construction.com.

Information is provided on construction projects in

following stages in each issue of ENR: Planning,

Contracts/Bids/Proposals and Bid/Proposal Dates.

View all Project Leads/Pulse

Subscribe to ENR | Back Issues | Manage your subscription

Reader Comments:

Add a comment

Submit

Marketplace Links

Printed Hardhats Fast Free Freight No Minimum

Free Freight, No minimum Free 2 color logo all models, msa, fibremetal,erb,jackson

#1 Cost Modeling Software Using Real Buildings as a Benchmark

D4COST is the #1 Software for Reliable Conceptual Square Foot Cost Estimates. LEARN More!

Conceptual Estimates In Minutes

Model Conceptual Estimates using REAL Buildings. LEARN MORE!

Buy a link now >>

View This Week's Magazine | Go to Magazine Archives | Subscribe to ENR | Order Back Issues

resources | editorial calendar | contact us | about us |

submissions | site map | ENR subscriber login | ENR community

back issues | advertise | terms of use | privacy notice | 2011

The McGraw-Hill Companies, Inc. All Rights Reserved

Page 2of 2 ENR's Top 200 International Design Firms for 2011 | ENR: Engineering News Record...

25/07/2011 http://enr.construction.com/business_management/companies/2011/0725-howthetopin...

subscribe contact us advertise careers events FAQ ENR Subscriber Login

share: more print email

Text size: A A

comment

Issue: 07/25/2011

ENR's Top 200 International Design Firms for 2011

07/20/2011

By Gary Tulacz

[ Page 2 of 3 ]

Although Arup's margins are down, its sales are doing better, says Chairman Philip Dilley, who forecasts modest

improvement. With increasing mergers and acquisitions, the marketplace is changing very rapidly,he adds. Arup will

not grow through acquisitions, says Dilley. He sees alliances as a way to achieve a necessary operational scale.

Last month, Arup took a major step along this route, signing a memorandum of understanding with China Railway

Group for bids in Africa, the Middle East, South America and Southeast Asia. The agreement will boost China Railway's

ambition for global growth in the years ahead,notes the company's international general manager, Chen Zhigong

The slowdown in established markets in Europe and the U.S. has caused many Western firms to look at the developing

markets in Asia, Africa and Latin America. But this shift has caused some concern for firms already in those markets.

For example, the biggest worry about the international market for Australia's SMEC is increased competition from

established companies in the U.K. and U.S.A. into SMEC markets,says Ross Hitt, CEO.

Aurecona 2009 merger between Connell Wagner, Australia, and Africon and Ninham Shand, both of South Africa

managed to diversify while spreading the risk of economic downturns. The merger helped reduce the risk by increasing

global diversification and enabling greater access to growing economies, especially in the developing world,says Paul

Lombard, Aurecon's general manager, emerging regions.

The one bright spot for many global design firms is the flourishing market in natural resources. Commodity prices are

solid, and our clients are going forward with their development plans to pull ore out of the ground and get it to market as

efficiently as possible,says Pearson. He says the surge in the mining and metals market also requires energy

upgrades and infrastructure investments as the facilities need power and the products need to be transported.

This increase in commodity prices has helped sophisticated firms in the metals and mining market. Often these

projects are located in difficult-to-reach areas that are engineering-intensive,says Reynolds.

Mixed Signals on China

In China, Arup is doing brilliantly,says Dilley. The firm has increased its bases to six cities fromthree cities. But the

market remains elusive for many firms, notes Mott's Williams. Mott MacDonald is doing well on high-speed rail projects,

he says.

[In China], you need to be a niche player,opines Van Ee. DHV is selling water treatment technology and, this month,

won the master-plan design competition for a vast domestic airport in Beijing. Able to handle 130 million passengers a

year, the airport will have four large terminals.

India is increasingly seen as a larger prospect than China. India continues to see growth,says van Ee, highlighting

public-private highway projects. Cowi aims to expand its mapping business into engineering, says Sbye. For Arup's

young business in India, the challenge is sorting out the one job that's going to happen from the 15 that don't,says

Dilley.

Getting work in India has its drawbacks. There was a big increase in [international] competition when Dubai started to

suffer its problems,says Halcrow's Brown, who says the firm is investing heavilyin India.

Among other positive markets, Australia is booming on the back of natural-resource exports to China, says Mott's

Williams. Anything connected with commodities is doing brilliantly,agrees Dilley. But the domestic economy is not so

good.

However, many firms believe Australia has great potential beyond natural resources. Australia has an attractive

business environment, offers good local project financing options and has enormous infrastructure development

potential,says Reynolds.

Latin America also is attracting new interest. Arup has set up a small office in Brazil, which has a difficult commercial

environment, says Dilley. The company plans to persevere but with caution, he says.

Halcrow is building on its long presence in Argentina to grow in the region, says Brown. Halcrow is a the government

adviser on the Rio-So Paulo high-speed-rail project.

Keywords: The Top 200 International Design Firms;International Architects;International Engineers;ENR's Top

Lists;Largest Building Engineers;Parsons Brinckerhof;Balfour Beatty

[ Page 2 of 3 ]

----- Advertising -----

This week's content

Archive

Subscribe to ENR

Order back issues

Manage Subscription

Video

View all

Blogs: ENR Staff Blogs: Other Voices

Other Voices: Highly opinionated industry observers offer

commentary fromaround he world.

Looking For Savings in All the

Wrong Places on a Fast-Track,

Guaranteed Maximum Price

Project

By: donshort

7/21/2011 4:15 PM CDT

Feds, Florida Sign Off on SunRail

Funding

By: debwood

7/19/2011 9:48 AM CDT

Subscribe to ENR | Back Issues | Manage your subscription

Reader Comments:

Mobile & Wireless Solutions in Construction: Driving Improved Decision Making Speed and

Scalability

Today more than ever engineering and construction firms need to manage and have insight into

the entire project lifecycle. Competitive success is t...

Subscribe to ENR Magazine for only

$82 a year (includes full web access)

Search our site:

INFRASTRUCTURE BLDGS BIZ MGMT POLICY EQUIPMENT PEOPLE MULTIMEDIA OPINION TECH EDUCATION ECONOMICS TOP LISTS REGIONS

SAFETY & HEALTH WORKFORCE FINANCE BANKING & CREDIT CRISIS COMPANIES PROJECT DELIVERY ETHICS & CORRUPTION ECONOMIC STIMULUS

Page 1of 2 ENR's Top 200 International Design Firms for 2011 | ENR: Engineering News Record...

25/07/2011 http://enr.construction.com/business_management/companies/2011/0725-HOWTHET...

subscribe contact us advertise careers events FAQ ENR Subscriber Login

share: more print email

Text size: A A

Dilly

comment

Issue: 07/25/2011

ENR's Top 200 International Design Firms for 2011

07/20/2011

By Gary Tulacz

[ Page 3 of 3 ]

Resiliency in Middle East

Despite political unrest, the Middle East is resilient,says Brown. Halcrow repatriated seven staff members from Libya,

but we are in a number of sectors in quite a few countries,he adds. Sbye says the unrest delayed projects, such as

the Bahrain-Qatar causeway. Public procurement in Oman is at a standstill,he adds.

Many Middle Eastern countries have active markets. Abu Dhabi and Qatar are the two places with

promise,says Dilley, noting increasing competition. We are not bidding to win the work at any

cost.

Atkins' regional order book is beyond excellent,says Clarke. There is very strong planned

economic growth now in the Middle East in infrastructure.Atkins has been recovering delayed

payments, he adds.

The Middle East's growing population will require a lot of investment in infrastructure, and the

demand is great in all aspects of life,says Allan of Hyder. He says that while the U.A.E. is steady,

there are great opportunities in Qatar and Saudi Arabia.

Fuelled by natural-resource exports, Mozambique is undergoing unbelievable growth,says van Ee. From struggling to

find work for 30 staff members two years ago, DHV now has 90 people at work in Mozambique, he adds. Our Africa

division has been the fastest-growing division,adds Hitt of SMEC.

U.S. Continues To Attract

Though the U.S. has poor finances, it retains European interest. DHV finds the aviation sector attractive. [North

America] will go from strength to strength,adds Cowi's Sbye. Arup is maintaining its U.S. workload, helped by large

transportation infrastructure projects. Commercial work is down, but Arup has won several jobs for cultural buildings,

says Dilley.

Atkins already is shipping work to its U.S. acquisition, Florida-based PBSJ Corp., notably from Saudi Arabia, says

Clarke. Now named Atkins North America, PBSJ has undergone quite radical change at the topbut has lost few of its

core staff, he adds.

The picture is mixed in Europe. Apart from the Nordic region and the U.K., Cowi has little work in Western Europe, says

Sbye. The firm aims to be even more focused on selected countriesin Eastern Europe. The Russian market is OK,

but the business environment is quite difficult,Sbye adds.

European public spending will continue to be down for the near future,says van Ee. He expects privatization,

especially in Portugal and Greece, to generate high-level advisory work. Poland continues to struggle with its

infrastructure projects, he adds.

The U.K. government is cutting budgets deeply but has listened to the need to keep some [infrastructure] investment

going,says Williams. Arup's Dilley reports ample transportation infrastructure work and a reviving commercial market

in London.

The current market has forced design firms to become responsive to quick market changes. Few firms on the Top 200

were tested this year more than New Zealand's Beca Group. Reynolds says the firm's work on search-and-rescue,

damage assessment and the initial rebuild in the wake of February's devastating earthquake in Christchurch, New

Zealand, reinforced the need for us to maintain flexibility and fluidity in our decision-making to enable us to react

quickly to rapidly changing and developing events.

Keywords: The Top 200 International Design Firms;International Architects;International Engineers;ENR's Top

Lists;Largest Building Engineers;Parsons Brinckerhof;Balfour Beatty

[ Page 3 of 3 ]

----- Advertising -----

Free White Papers

Mobile & Wireless Solutions in

Construction: Driving Improved

Decision Making Speed and

Scalability:

Control Employee Spending by use

of Business Prepaid Cards.:

This week's content

Archive

Subscribe to ENR

Order back issues

Manage Subscription

Video

View all

Blogs: ENR Staff Blogs: Other Voices

Other Voices: Highly opinionated industry observers offer

commentary fromaround he world.

Looking For Savings in All the

Wrong Places on a Fast-Track,

Guaranteed Maximum Price

Project

By: donshort

7/21/2011 4:15 PM CDT

Feds, Florida Sign Off on SunRail

Funding

By: debwood

7/19/2011 9:48 AM CDT

New Master Plan Aims to Put

Edmonton on the Sustainability

Map

By: tdnewcomb

7/18/2011 4:28 PM CDT

View all Posts

Subscribe to ENR | Back Issues | Manage your subscription

Reader Comments:

Subscribe to ENR Magazine for only

$82 a year (includes full web access)

Search our site:

INFRASTRUCTURE BLDGS BIZ MGMT POLICY EQUIPMENT PEOPLE MULTIMEDIA OPINION TECH EDUCATION ECONOMICS TOP LISTS REGIONS

SAFETY & HEALTH WORKFORCE FINANCE BANKING & CREDIT CRISIS COMPANIES PROJECT DELIVERY ETHICS & CORRUPTION ECONOMIC STIMULUS

Page 1of 2 ENR's Top 200 International Design Firms for 2011 | ENR: Engineering News Record...

25/07/2011 http://enr.construction.com/business_management/companies/2011/0725-HOWTHET...

You might also like

- Cost of Doing Business Study, 2012 EditionFrom EverandCost of Doing Business Study, 2012 EditionNo ratings yet

- ENR04232012 500 Section Final1782916695Document71 pagesENR04232012 500 Section Final1782916695Mohammad OmairNo ratings yet

- Broken Buildings, Busted Budgets: How to Fix America's Trillion-Dollar Construction IndustryFrom EverandBroken Buildings, Busted Budgets: How to Fix America's Trillion-Dollar Construction IndustryRating: 3.5 out of 5 stars3.5/5 (4)

- Top 200 Design FirmsDocument66 pagesTop 200 Design Firmssitara1987No ratings yet

- High-Profit IPO Strategies: Finding Breakout IPOs for Investors and TradersFrom EverandHigh-Profit IPO Strategies: Finding Breakout IPOs for Investors and TradersNo ratings yet

- Top 200 EnrDocument69 pagesTop 200 EnrasaithambikNo ratings yet

- Infrastructure Finance: The Business of Infrastructure for a Sustainable FutureFrom EverandInfrastructure Finance: The Business of Infrastructure for a Sustainable FutureRating: 5 out of 5 stars5/5 (1)

- Top 200 Design Firms PDFDocument72 pagesTop 200 Design Firms PDFVasilica BarbarasaNo ratings yet

- The Cost of Doing Business Study, 2022 EditionFrom EverandThe Cost of Doing Business Study, 2022 EditionNo ratings yet

- Top 200 Engg Design FirmDocument66 pagesTop 200 Engg Design FirmVishnu LalNo ratings yet

- The Cost of Doing Business Study, 2019 EditionFrom EverandThe Cost of Doing Business Study, 2019 EditionNo ratings yet

- 2011-Top 225 International ContractorsDocument63 pages2011-Top 225 International ContractorsAlan MooreNo ratings yet

- ENR 2012-Top 400 ContractorsDocument47 pagesENR 2012-Top 400 ContractorsAnte PaliNo ratings yet

- 2011-Top 225 International ContractorsDocument63 pages2011-Top 225 International ContractorsKaan EralpNo ratings yet

- Investment Opportunities in the United Kingdom: Parts 4-7 of The Investors' Guide to the United Kingdom 2015/16From EverandInvestment Opportunities in the United Kingdom: Parts 4-7 of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- ENR TOP250 Classifiche 1Document76 pagesENR TOP250 Classifiche 1syampkNo ratings yet

- Accounting & Financial Management for Residential Construction, Sixth EditionFrom EverandAccounting & Financial Management for Residential Construction, Sixth EditionNo ratings yet

- Top 225 International Contractors - ENR. June, 2011 - 0Document63 pagesTop 225 International Contractors - ENR. June, 2011 - 0Sachin SuvarnaNo ratings yet

- Top Contractors SourcecbookDocument55 pagesTop Contractors SourcecbookThomas ReubenNo ratings yet

- ENR Top 400 Contractors 2010Document39 pagesENR Top 400 Contractors 2010bones2jNo ratings yet

- 2011-Top Design Build FirmsDocument6 pages2011-Top Design Build FirmsGowtham VasireddyNo ratings yet

- ENR Top 250 International Contractors-2015Document77 pagesENR Top 250 International Contractors-2015OnurUmanNo ratings yet

- Top225 International Contractors - 2010Document63 pagesTop225 International Contractors - 2010sondeanisNo ratings yet

- ENR Top 500 - Apr 2013 Issue PDFDocument76 pagesENR Top 500 - Apr 2013 Issue PDFManoj JaiswalNo ratings yet

- ENR The Top 225 International Design Firms 2013Document96 pagesENR The Top 225 International Design Firms 2013shanmars100% (1)

- ENR Top 225 International Design Firms 2014Document83 pagesENR Top 225 International Design Firms 2014vhiribarneNo ratings yet

- Newsletter: Latest UpdatesDocument7 pagesNewsletter: Latest Updatesapi-199476594No ratings yet

- Boeing SWOTDocument12 pagesBoeing SWOTtirath5u100% (3)

- BoozCo The 2012 Global Innovation 1000 Media ReportDocument22 pagesBoozCo The 2012 Global Innovation 1000 Media Reportmyownhminbox485No ratings yet

- 2014 Enr Top 500 Design FirmsDocument76 pages2014 Enr Top 500 Design FirmskpglemonNo ratings yet

- Bruce Shaw Handbook 2010Document83 pagesBruce Shaw Handbook 2010haroub_nasNo ratings yet

- 2014 ENR Top 250 Global Contractors 090114Document72 pages2014 ENR Top 250 Global Contractors 090114freannNo ratings yet

- Newsletter: Montreal Banking TourDocument7 pagesNewsletter: Montreal Banking Tourapi-199476594No ratings yet

- Top International Contractors and Design Firms in General BuildingDocument91 pagesTop International Contractors and Design Firms in General BuildinghhkkllNo ratings yet

- IB - Doing Business in China - 2011Document27 pagesIB - Doing Business in China - 2011Srikanth Kumar KonduriNo ratings yet

- Market Bulletin 4 April 2014: PO Box 191 Driffield YO25 1BB T 0845 226 2831 Info@piafs - Co.uk WWW - Piafs.co - UkDocument1 pageMarket Bulletin 4 April 2014: PO Box 191 Driffield YO25 1BB T 0845 226 2831 Info@piafs - Co.uk WWW - Piafs.co - Ukapi-251779816No ratings yet

- Silverwood Partners - NAB 2012 - Strategic Industry AnalysisDocument57 pagesSilverwood Partners - NAB 2012 - Strategic Industry AnalysisBrian ZapfNo ratings yet

- The Top 500 Design Firms 2007: April 18, 2007Document23 pagesThe Top 500 Design Firms 2007: April 18, 2007iabhiuceNo ratings yet

- Hindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsDocument4 pagesHindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsSandeep KumarNo ratings yet

- 07 25 08 NYC JMC UpdateDocument9 pages07 25 08 NYC JMC Updateapi-27426110No ratings yet

- ENR The Top 225 International Design Firms 2013Document96 pagesENR The Top 225 International Design Firms 2013sorzomNo ratings yet

- BusinessSpectator IndustriesDocument12 pagesBusinessSpectator IndustriesnatissjaaliasNo ratings yet

- 2011 Global Manufacturing Outlook Survey-FinalDocument36 pages2011 Global Manufacturing Outlook Survey-FinalvendattaNo ratings yet

- Drivers of International BusinessDocument4 pagesDrivers of International Businesskrkr_sharad67% (3)

- Private Equity-Backed IPO Exits Top $10bn in 2011 Year To DateDocument1 pagePrivate Equity-Backed IPO Exits Top $10bn in 2011 Year To DatePushpak Reddy GattupalliNo ratings yet

- Marketing Internship Final Paper - GutierrezDocument19 pagesMarketing Internship Final Paper - Gutierrezapi-614551230No ratings yet

- Shale CPDocument2 pagesShale CPDylanNo ratings yet

- Usiness: Van Wert ProfileDocument8 pagesUsiness: Van Wert ProfileThe Delphos HeraldNo ratings yet

- Accenture Achieving High Performance Construction IndustryDocument12 pagesAccenture Achieving High Performance Construction IndustryvasantsunerkarNo ratings yet

- TBRC Construction Global Market Briefing Report 2016 - SampleDocument16 pagesTBRC Construction Global Market Briefing Report 2016 - SamplemichaelceasarNo ratings yet

- Digital Media and Internet Sector Update - Spring 2012 FinalDocument52 pagesDigital Media and Internet Sector Update - Spring 2012 Finalstupac7864No ratings yet

- RLB International Report Third Quarter 2012Document40 pagesRLB International Report Third Quarter 2012local911No ratings yet

- In This Special ReportDocument6 pagesIn This Special ReportArjun SinghNo ratings yet

- Module 1 - Canvas SlidesDocument40 pagesModule 1 - Canvas SlidesAniKelbakianiNo ratings yet

- Pitchbook: The Private Equity 2Q 2012 BreakdownDocument14 pagesPitchbook: The Private Equity 2Q 2012 BreakdownpedguerraNo ratings yet

- Oil & Gas Financial Journal - 2013.06Document73 pagesOil & Gas Financial Journal - 2013.06Eric YvesNo ratings yet

- 5 Biggest Threats Facing The Construction IndustryDocument7 pages5 Biggest Threats Facing The Construction IndustryRamya RajendranNo ratings yet

- Top Global Contractors SourcebookDocument59 pagesTop Global Contractors SourcebookThomas ReubenNo ratings yet

- Investing in GermanyDocument44 pagesInvesting in Germanycesperon39No ratings yet

- EPC Proposal 3x660 MWDocument11 pagesEPC Proposal 3x660 MWSameer BetalNo ratings yet

- Peter Heywood - Midshipman Acquitted at Age 15Document3 pagesPeter Heywood - Midshipman Acquitted at Age 15cesperon39No ratings yet

- Peter HeywoodDocument14 pagesPeter Heywoodcesperon39No ratings yet

- Investing in ItalyDocument19 pagesInvesting in Italycesperon39No ratings yet

- EPC Document (05-10-2010)Document200 pagesEPC Document (05-10-2010)Superb HeartNo ratings yet

- Emerging Markets - Africa The Middle East 2011Document38 pagesEmerging Markets - Africa The Middle East 2011cesperon39No ratings yet

- European Shooping Centres Development Report April 2014Document3 pagesEuropean Shooping Centres Development Report April 2014cesperon39No ratings yet

- Investing in LondonDocument36 pagesInvesting in Londoncesperon39No ratings yet

- Office Space Across The World 2012Document29 pagesOffice Space Across The World 2012cesperon39No ratings yet

- The Torsional ChamberDocument18 pagesThe Torsional ChamberGaston ChauNo ratings yet

- Manual ReporterDocument140 pagesManual Reportercesperon39No ratings yet

- Registro en ICE en Great Britain 1Document6 pagesRegistro en ICE en Great Britain 1cesperon39No ratings yet

- Piles Load Testing HandbookDocument28 pagesPiles Load Testing HandbookMalcolm Gingell100% (2)

- Urban Drainage Design Manual: Hydraulic Engineering Circular No. 22, Third EditionDocument478 pagesUrban Drainage Design Manual: Hydraulic Engineering Circular No. 22, Third Editiondisgusting4allNo ratings yet

- Top 200 Environmental Firms 2008 Rankings and ReportDocument14 pagesTop 200 Environmental Firms 2008 Rankings and Reportcesperon39No ratings yet

- About The Eiffel TowerDocument27 pagesAbout The Eiffel Towerjunaid fNo ratings yet

- Sony KDL 32V2000 KDL 40V2000 KDL 46V2000Document100 pagesSony KDL 32V2000 KDL 40V2000 KDL 46V2000ducuyoNo ratings yet

- Top Global Design 2011 PDFDocument6 pagesTop Global Design 2011 PDFcesperon39No ratings yet

- The United States ConstitutionDocument19 pagesThe United States Constitutionkellyk100% (8)

- Ranking Project Management 2007 PDFDocument1 pageRanking Project Management 2007 PDFcesperon39No ratings yet

- Atv-A 128eDocument8 pagesAtv-A 128ecesperon39No ratings yet

- Form AIA C132 - 2009Document22 pagesForm AIA C132 - 2009cesperon39No ratings yet

- Isambard Kingdom BrunelDocument13 pagesIsambard Kingdom Brunelcesperon39No ratings yet

- Werlin (2003) Poor Nations, Rich Nations - A Theory of Governance PDFDocument14 pagesWerlin (2003) Poor Nations, Rich Nations - A Theory of Governance PDFlittleconspirator100% (1)

- NCERT Simplified ECODocument33 pagesNCERT Simplified ECOcanvartletaNo ratings yet

- ESG ReportDocument13 pagesESG ReportWangchukNo ratings yet

- Emerging Issues in Indian Banking SectorDocument31 pagesEmerging Issues in Indian Banking SectorShradha JindalNo ratings yet

- CAUSES OF UNDERDEVELOPMENT AND CONCEPTS FOR DEVELOPMENTDocument12 pagesCAUSES OF UNDERDEVELOPMENT AND CONCEPTS FOR DEVELOPMENTmariel100% (1)

- Global E CommerceDocument619 pagesGlobal E Commerceapi-3719303No ratings yet

- PestelDocument12 pagesPestelsamy7541No ratings yet

- Agenda 2000Document184 pagesAgenda 2000Anonymous 4kjo9CJ100% (1)

- A Project Report On Emergence of Logistics Business in The Recent Past and Its PotentialDocument62 pagesA Project Report On Emergence of Logistics Business in The Recent Past and Its PotentialAnkita Goyal80% (10)

- Environment & Ecosystem Notes PDFDocument26 pagesEnvironment & Ecosystem Notes PDFK 309 Divya ChaudharyNo ratings yet

- Hemadri - Luxoticca Eyewear - KaranDocument31 pagesHemadri - Luxoticca Eyewear - KaranKaran HemadriNo ratings yet

- Copper Market PrimerDocument206 pagesCopper Market Primeruser1218210% (1)

- Economic Development of Pakistan: Study GuideDocument44 pagesEconomic Development of Pakistan: Study Guidefaizan rajaNo ratings yet

- Vietnam Labour Market Risk Rep PDFDocument28 pagesVietnam Labour Market Risk Rep PDFÂn THiên100% (1)

- Investment Map en 2021Document190 pagesInvestment Map en 2021Laith Salman0% (1)

- What Are The Main Factors Affecting The Oil ImportDocument12 pagesWhat Are The Main Factors Affecting The Oil ImportAshikur RahmanNo ratings yet

- BUS 225 Milestone OneDocument9 pagesBUS 225 Milestone Oneben mwanziaNo ratings yet

- Case StudyDocument13 pagesCase StudyJohn Myer Dela CruzNo ratings yet

- VISION Doc U.P.Document392 pagesVISION Doc U.P.Parnika GoyalNo ratings yet

- Endeavor-Gd TopicsDocument3 pagesEndeavor-Gd Topicsapi-3755813No ratings yet

- S CurveDocument5 pagesS CurvelusavkaNo ratings yet

- Assignment 3Document6 pagesAssignment 3Kumaran ViswanathanNo ratings yet

- Esurvey HaryanaDocument199 pagesEsurvey HaryanaSahilHoodaNo ratings yet

- Selim Raihan - Inequality and Public Policy in AsiaDocument20 pagesSelim Raihan - Inequality and Public Policy in AsiaWasif ArefinNo ratings yet

- Juilee Deepak PatilDocument88 pagesJuilee Deepak Patilshubhamare11No ratings yet

- Introduction To Permaculture 1499790632Document167 pagesIntroduction To Permaculture 1499790632Ravnish Batth100% (2)

- Economics Paper 2 HL MarkschemeDocument20 pagesEconomics Paper 2 HL MarkschemeZhaoNo ratings yet

- FAO Statistics Book PDFDocument307 pagesFAO Statistics Book PDFknaumanNo ratings yet

- The Geography of Transport SystemsDocument10 pagesThe Geography of Transport SystemsFasumus FaisalNo ratings yet

- 117 GSL Chasseur Chickens Case Study 1 S113Document51 pages117 GSL Chasseur Chickens Case Study 1 S113NEWVISIONSERVICES100% (1)