Professional Documents

Culture Documents

Basell II Implementation Circular

Basell II Implementation Circular

Uploaded by

Oladipupo Mayowa PaulCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basell II Implementation Circular

Basell II Implementation Circular

Uploaded by

Oladipupo Mayowa PaulCopyright:

Available Formats

234-9-46236401

234-9-462364S4

December 10, 2013

8SD]DIk]CIk]GLN]LA8]06]0S3

CIkCULAk 1C ALL 8ANkS AND DISCCUN1 nCUSLS CN 1nL IMLLMLN1A1ICN CI 8ASLL II]III

IN NIGLkIA

ursuanL Lo SecLlon 13 of Lhe 8anks and CLher llnanclal lnsLlLuLlons AcL, 1991 as amended, Lhe

CenLral 8ank of nlgerla, hereby lssues Lhese guldance noLes on kegu|atory Cap|ta|

Measurement and Management for the N|ger|an 8ank|ng System (for Lhe lmplemenLaLlon of

8asel ll/lll ln nlgerla).

1hey speclfy approaches for quanLlfylng Lhe rlsk welghLed asseLs for credlL rlsk, markeL rlsk and

operaLlonal rlsk for Lhe purpose of deLermlnlng regulaLory caplLal. 1he compuLaLlons are

conslsLenL wlLh Lhe requlremenLs of lllar l of 8asel ll Accord (lnLernaLlonal Convergence of

CaplLal MeasuremenL and CaplLal SLandards).

AlLhough Lhe guldellnes comply slgnlflcanLly wlLh Lhe requlremenLs of Lhe 8asel ll/lll accords,

cerLaln secLlons were ad[usLed Lo reflecL Lhe pecullarlLles of our envlronmenL. lrom Llme Lo

Llme, Lhe C8n wlll lssue caplLal lmplemenLaLlon noLes Lo clarlfy lLs expecLaLlons on compllance

wlLh Lhe Lechnlcal provlslons of Lhe regulaLlon.

Accordlngly, all banks and banklng groups are expecLed Lo adopL Lhe baslc approaches for Lhe

compuLaLlon of caplLal requlremenLs for credlL rlsk, markeL rlsk and operaLlonal rlsk as follows:

CredlL 8lsk - Lhe SLandardlzed Approach ls Lo be adopLed, however, all forms of

corporaLe clalms wlll be LreaLed as unraLed.

MarkeL 8lsk - Lhe SLandardlzed Approach ls Lo be adopLed.

CperaLlonal 8lsk - Lhe 8aslc lndlcaLor Approach (8lA) ls Lo be adopLed.

WlLhln Lhe flrsL Lwo years of Lhe adopLlon of Lhese approaches under lllar 1, lL ls hoped LhaL an

effecLlve raLlng sysLem would have developed ln nlgerla. 8anks and banklng groups are

pro[ecLed Lo have gaLhered more rellable daLa and galned more experlence LhaL would prepare

Lhem Lo conslder Lhe adopLlon of more sophlsLlcaLed approaches. 1he adopLlon of Lhe

SLandardlzed Approach for CperaLlonal 8lsk and oLher sophlsLlcaLed approaches wlll however

be sub[ecL Lo Lhe approval of Lhe C8n.

1he guldance noLes are appllcable Lo all banks and banklng groups llcensed Lo operaLe ln

nlgerla and should be applled on a solo as well as a consolldaLed basls. 1he mlnlmum caplLal

requlremenL ls reLalned aL 10 per cenL and 13 per cenL respecLlvely for local and lnLernaLlonally

acLlve banks.

1he Llmeframe for Lhe lmplemenLaLlon of 8asel ll wlll be as follows:

8anks are expecLed Lo commence a parallel run of boLh 8asel l and ll mlnlmum caplLal

adequacy compuLaLlon based on Lhe requlremenLs of Lhese guldellnes wlLh effecL from

!anuary, 2014

1he mlnlmum caplLal adequacy compuLaLlon under 8asel ll rules wlll commence ln !une

2014

ln llne wlLh 8asel ll lllar 2, banks are remlnded of Lhe lmporLance of comprehenslve rlsk

managemenL pollcles and processes LhaL effecLlvely ldenLlfy, measure, monlLor and conLrol

Lhelr rlsk exposures ln addlLlon Lo havlng approprlaLe board and senlor managemenL overslghL.

PenceforLh, banks are requlred Lo carry ouL Lhelr lnLernal CaplLal Adequacy AssessmenL rocess

(lCAA) on an annual basls, as aL uecember 31, and forward coples of Lhe reporL Lo Lhe C8n for

revlew noL laLer Lhan four (4) monLhs afLer Lhe year end. lor Lhe avoldance of doubL, Lhe

deadllne for submlsslon of Lhe lCAA for 2013 flnanclal year ls Aprll 30, 2014.

lurLhermore, banks are requlred Lo comply wlLh Lhe 8asel ll lllar 3 dlsclosure requlremenLs on

a bl- annual basls.

1he guldance noLes wlll remaln ln force durlng Lhe perlod of Lhe parallel run unLll full adopLlon

of 8asel ll ln !une, 2014 and release of addlLlonal noLes on oLher approaches for deLermlnlng

regulaLory caplLal and 8asel lll rules.

1CkUN8C MAk1INS (MkS.)

DIkLC1Ck CI 8ANkING SULkVISICN

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Inside Songwriting - Getting To The Heart of Creativity (Conv.) PDFDocument253 pagesInside Songwriting - Getting To The Heart of Creativity (Conv.) PDFOrlando Nández100% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Can'T Stop: Red Hot Chili PeppersDocument3 pagesCan'T Stop: Red Hot Chili Peppersdadadadad100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ratio Back SpreadsDocument20 pagesRatio Back SpreadsOladipupo Mayowa PaulNo ratings yet

- Before Video A History of The Non-Theatrical Film by Anthony SlideDocument190 pagesBefore Video A History of The Non-Theatrical Film by Anthony SlideKNo ratings yet

- The NMEA 0183 ProtocolDocument28 pagesThe NMEA 0183 ProtocolMarco Cocco100% (5)

- Tartini, G. - ConcertinoDocument21 pagesTartini, G. - ConcertinoAndré Vieira100% (1)

- Marriott ValuationDocument16 pagesMarriott ValuationOladipupo Mayowa PaulNo ratings yet

- Action Plan Performing Arts 2015 2016Document14 pagesAction Plan Performing Arts 2015 2016BabyrrechBalilu100% (2)

- 2012-09-12 Learning To Count CommentsDocument10 pages2012-09-12 Learning To Count CommentsSam Shah100% (1)

- Hotels and Motels - Industry Data and AnalysisDocument8 pagesHotels and Motels - Industry Data and AnalysisOladipupo Mayowa PaulNo ratings yet

- Intermediate004security 180101111938Document52 pagesIntermediate004security 180101111938MohamedNasser Gad El MawlaNo ratings yet

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

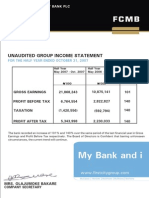

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNo ratings yet

- 2007 Q1resultsDocument1 page2007 Q1resultsOladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- June 2011 Results PresentationDocument17 pagesJune 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Unaudited Half Year Result As at June 30 2011Document5 pagesUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNo ratings yet

- Full Year 2011 Results Presentation 2Document16 pagesFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- June 2012 Investor PresentationDocument17 pagesJune 2012 Investor PresentationOladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- 2012 Year End Results Press ReleaseDocument3 pages2012 Year End Results Press ReleaseOladipupo Mayowa PaulNo ratings yet

- Val Project 6Document17 pagesVal Project 6Oladipupo Mayowa PaulNo ratings yet

- 2013 Year End Results Press Release - Final WebDocument3 pages2013 Year End Results Press Release - Final WebOladipupo Mayowa PaulNo ratings yet

- International Hotel Appraisers4Document5 pagesInternational Hotel Appraisers4Oladipupo Mayowa PaulNo ratings yet

- Margin Requirement Examples For Sample Options-Based PositionsDocument2 pagesMargin Requirement Examples For Sample Options-Based PositionsOladipupo Mayowa PaulNo ratings yet

- Banking Finance Sectorial OverviewDocument15 pagesBanking Finance Sectorial OverviewOladipupo Mayowa PaulNo ratings yet

- Language Feature AnalysisDocument3 pagesLanguage Feature AnalysisAriep ZumantaraNo ratings yet

- 3real + 3 NewrealDocument31 pages3real + 3 NewrealEnrico MirabassiNo ratings yet

- Funiculli Funiculla (BB)Document2 pagesFuniculli Funiculla (BB)Di GasparotoNo ratings yet

- Hamdann Limann Da Aa IlaaDocument22 pagesHamdann Limann Da Aa IlaaDmd YearningNo ratings yet

- Tuning List DriveRack PA - Original PDFDocument5 pagesTuning List DriveRack PA - Original PDFvenancio-20No ratings yet

- Hmc732Lc4B: Wideband Mmic Vco With Buffer Amplifier 6 - 12 GHZDocument6 pagesHmc732Lc4B: Wideband Mmic Vco With Buffer Amplifier 6 - 12 GHZAlexander BalandinNo ratings yet

- 05 Direction Indicating InstrumentsDocument31 pages05 Direction Indicating InstrumentsFurkan DuruNo ratings yet

- Music: First Quarter Module 2: Week 6 Music of Medieval, Renaissance, and Baroque PeriodsDocument11 pagesMusic: First Quarter Module 2: Week 6 Music of Medieval, Renaissance, and Baroque PeriodsRodel CamposoNo ratings yet

- Stevie Wonder - SunnyDocument5 pagesStevie Wonder - SunnyTedNo ratings yet

- A2 - Exercise For Cleft Sentence (Rechecked)Document3 pagesA2 - Exercise For Cleft Sentence (Rechecked)KheangNo ratings yet

- Amplitude ModulationDocument24 pagesAmplitude Modulation20-051 Vigneshwar PNo ratings yet

- Frequency Tripler Using The CA3028: Figure 1: X3 Multiplier Using Differential AmplifierDocument1 pageFrequency Tripler Using The CA3028: Figure 1: X3 Multiplier Using Differential AmplifierRadmila LugonjicNo ratings yet

- Carnaval BarranquillaDocument12 pagesCarnaval Barranquillasara catalina ramirez oerillaNo ratings yet

- Universal Commands - 116 PDFDocument15 pagesUniversal Commands - 116 PDFLuis Gabriel Chavez SalazarNo ratings yet

- Edward Larry Gordon - 1978 - Celestial VibrationDocument3 pagesEdward Larry Gordon - 1978 - Celestial VibrationNicoloboNo ratings yet

- GSM FrameDocument7 pagesGSM Framekundan1094No ratings yet

- JVC - KD Ar370 - KD g320 - KD g421 - KD g424 - KD g425 - KD g427 Ma245Document63 pagesJVC - KD Ar370 - KD g320 - KD g421 - KD g424 - KD g425 - KD g427 Ma245Póka István-ZsoltNo ratings yet

- Radio Txmission and Network PlanningDocument140 pagesRadio Txmission and Network PlanningDiwakar MishraNo ratings yet

- MC5 User GuideDocument17 pagesMC5 User GuidejosehNo ratings yet

- Time Signal Receiver ModuleDocument4 pagesTime Signal Receiver ModuleBorsukNo ratings yet

- Scilab Manual For Antenna Design Lab by DR Dharmavaram Asha Devi Electronics Engineering Sreenidhi Institute of Science and TechnologyDocument22 pagesScilab Manual For Antenna Design Lab by DR Dharmavaram Asha Devi Electronics Engineering Sreenidhi Institute of Science and TechnologySimon JhaNo ratings yet

- Polarization Diversity Controllable Monopulse Antenna Array DesignDocument7 pagesPolarization Diversity Controllable Monopulse Antenna Array DesignSyed BukhariNo ratings yet