Professional Documents

Culture Documents

Global Supply Chain

Uploaded by

yinue0 ratings0% found this document useful (0 votes)

694 views5 pagessupply chain.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsupply chain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

694 views5 pagesGlobal Supply Chain

Uploaded by

yinuesupply chain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

Global Supply Chain

Summit Report 2008 2

2009 President and Fellows of Harvard College

Global Supply Chain

Moderator: Janice H. Hammond, Jesse Philips Professor of Manufacturing, Director of Faculty Planning

Panelists: William K.L. Fung, Group Managing Director, Li & Fung Ltd.

Willy C. Shih, Professor of Management Practice, Technology and Operations Management Unit

Marjorie M.T. Yang, Chairman, Esquel Group

Overview

The global companies profiled in this session, Esquel, Li &

Fung, and Flextronics, highlight very different global supply

chain management models. Esquel is vertically integrated;

Li & Fung has no manufacturing assets but coordinates

manufacturers; and Flextronics has the infrastructure and

capabilities to simultaneously manage supply chains for

hundreds of thousands of different products.

The global financial/economic crisis will hurt demand and

challenge the supply chains of each of these companies. It

will require becoming more efficient and responsive; better

matching supply with demand; continuing to have low prices;

and considering the opportunities and risks presented

through supplier financing.

Context

These panelists offered their thoughts on the evolution of

their companies global supply chains and responded to

questions about the impact of the financial crisis.

Key Takeaways

Li & Fung Ltd. is a global trading company that has

evolved its supply chain to address changing market

conditions and meet changing customer needs.

Mr. Fung described his companys history as a regional

and then global trading company. Li & Fung first exported

products from China, and then after 1949, exported low-

cost consumer goods from Hong Kong.

The company became global over time as it moved the

location of manufacturing to countries with lower-cost

labor. Li and Fung shifted where it had goods made from

Hong Kong to Taiwan, and then Korea, and so on to a list

that includes more than forty countries today, such as

Turkey, Honduras, Guatemala, and more.

Throughout this evolution, during which time Li & Fung has

grown to almost $12 billion in revenues, the company has

never owned its own manufacturing plants. It has a large

global network of manufacturing partners and is funda-

mentally a supply chain company that coordinates the

activities of its partners around the globe. Its global

network gives the company the ability to serve numerous

clients simultaneously and to have large orders made at

the same time by different factories in different countries.

In addition to its geographic scope, over time Li & Fung

has also offered more supply chain services to meet

customers needs. Mr. Fung recounted that The Limited

previously required all orders from Li & Fung in 30 days no

matter how large the order. But it then took The Limited

three weeks to get the items from their distribution center

to their stores. Mr. Fung offered a more efficient solution.

Besides producing the goods for The Limited, Li & Fung

could also pack and ship the items as required by each

Limited store to cut down on this customers total supply

chain timethus evolving from overseeing manufacturing

to providing more comprehensive supply chain solutions.

Despite initial objections from managers at The Limited, Li

& Fung eventually assumed this responsibility.

In general, the company has benefited from two worldwide

trends and several important decisions.

Key trends. Li & Fung benefited from the widespread

adoption of offshoring and outsourcing. Its network and

supply chain management capabilities enabled the

company to capitalize on these trends.

We are in the age of what I would call extreme

outsourcing. Nothing is sacred if somebody else can

do it better, faster, cheaper than you.

William K.L. Fung

Not owning manufacturing. The decision not to manu-

facture but to coordinate has served the company well,

resulting in partnerships with manufacturers.

Focus on specific product categories. Li & Fung focuses

on textiles; general hard goods like toys, shoes, and

other household goods; and health, beauty and

cosmetics; and is considering providing some food

products.

Focus on specific markets. Li & Fung sells mainly to

the United States, Western Europe, and Japan. The

company is also beginning to sell in China as the market

there continues to grow.

Emphasize compliance on ethical issues. Increasingly,

customers and their consumers dont just care about

price and quality; they want to know how products are

made. This has led Li & Fung to focus on issues such

as underage labor, sweatshop conditions, pollution, and

unsafe ingredients like dyes that cause cancer and lead

in products at unsafe levels.

The growth of Esquel Group is attributable to the

companys vertically integrated supply chain.

Ms. Yang explained that Esquel Group started 30 years

ago as a Chinese manufacturing company producing dress

shirts. Out of necessity, to meet the demands of customers

for high-quality products, the company vertically integrated

to control the quality of the cotton that was seeded,

farmed, and spun. Eventually the company became inter-

national as sources for high-quality cotton and inexpen-

sive labor required global reach and took account of

Global Supply Chain

Summit Report 2008 3

2009 President and Fellows of Harvard College

country-specific trading restrictions. Esquels globalization

parallels the global trajectory of China.

The growth of the company paralleled the opening

up of China.

Marjorie M.T. Yang

Esquel Group has moved increasingly into higher-end

manufacturing to avoid commoditization, taking on projects

that other companies wont do. If another company can do

something faster or cheaper, then Esquel is not interested.

This is how Esquel creates competitive advantage. The

company pushes its R&D department to meet the unique

and often demanding requirements of clients like Hugo

Boss and Nordstrom, which have extremely high stan-

dards. Ms. Yang recounted the extensive R&D and

investments in farming, spinning, and manufacturing that

were necessary to create a wrinkle-free, high-grade, cotton

shirt with excellent hand feel that will not yellow or rip.

Flextronics is a diversified company that manages

thousands of different supply chains.

Flextronics, a $35 billion company of 200,000 employees,

turns out hundreds of thousands of products per day,

mainly consumer electronics, all over the world. Each

product has its own supply chain, creating tremendous

complexity and interdependencies.

Enabling Flextronics to manage this complexity is the com-

panys infrastructure and its supply chain capabilities. The

company segregates its supply chains by consumer and

product area and factors in geographic demand, compo-

nent sourcing, and assembly. Each piece of the Flextronics

supply chain also has its own supply chains. Creating a

supply chain for a new product is extremely complicated

and can take 9-12 months; it is almost virtual vertical

integration.

This is the notion of being able to take very complex

products and break them down to unit manufactur-

ing processes, which you can then ship out to low-cost

countries and apply labor arbitrage, and then

complicated supply chains come behind that.

Willy C. Shih

The current financial crisis will test the flexibility of

established global supply chains.

Demand for various products will be affected but is beyond

the control of any company. What is controllable is how

they manage their supply chains.

Keep prices low. Mr. Fung sees the current situation as

bad for his retail customers, who are responding by

keeping low inventory. Still, they are demanding that

their suppliers have flexibility in their supply chain. The

major challenge is to keep prices low while still being

able to respond quickly.

Improve efficiency. Ms. Yang argues that while labor

costs have risen in China as wages have increased,

there is a significant opportunity to apply good manage-

ment practices to the historically poorly managed

apparel industry to wring inefficiencies from the system.

Manage the network. More than ever, success is about

managing the entire supply network. In some industries

where the time and expense of transporting components

is high, supply chain partners are locating near each

other in clusters.

Consider providing supply-side financing. As banks

stumble, suppliers are taking on an added role of

financier, providing customers with financing and flexible

terms. This has risks (like slow or no payment) but

increases a customers dependence on its supplier.

There may be an opportunity to shift from relationship-

based financing (banks) to transaction-based (supply

chain).

China will remain a great source of labor and the

Chinese domestic market will continue to grow.

Panelists were asked to share their perspectives on where

the next low-cost labor force will emerge and Chinas role

in the future.

China still provides low-cost labor. The interior of China

still holds much promise for low-cost labor and Eastern

Europe holds potential as well. Mr. Fung is also seeing

movement into North Africa. He says that movement

and investment into Southeast Asia and Vietnam are

fashionable but those investments are being called into

question by Vietnams high inflation rate.

China is not one country in a business sense. China is

still most promising as a long-term provider of low-cost

labor. But China, because of its size and diversity, is

really multiple economies under one roof.

Chinas cushion is the growth of its local market. Many

foreign investors feel safe investing in China because if

the export market slows, the growing domestic market

will take up the slack. Historically many Chinese com-

panies focused on just export-driven supply chains, but

many are building supply chains to serve the domestic

market. Ms. Yang pointed out that educated workers,

such as engineers, who are available in China, are

crucial to the product development that increases

productivity overall. Mr. Shih believes that many things

are best produced in China because that is where the

supplier networks are.

Room for international retailers. Ms. Yang believes that

Chinese consumers will pay for quality products. In the

near term international retailers have an advantage as

they are seen as higher quality and more reliable.

Chinese brands will grow. The perception that Western

brands are higher quality will change as Chinese com-

panies make better products and as they learn to brand

and not just manufacture. Ms. Yang argued that good

Chinese brands exist; they just need more time and

exposure to grow.

Other Important Points

Recommended reading. Competing in a Flat World:

Building Enterprises for a Borderless World, co-written by

Mr. Fung, tells of the Fung brothers experiences operating

in a flat world and builds on Thomas Friedmans flat world

Global Supply Chain

Summit Report 2008 4

2009 President and Fellows of Harvard College

theories in his book, The World Is Flat 3.0: A Brief History

of the Twenty-first Century.

Retail and 9/11. Mr. Shih explained that the last few

weeks in the retail sector have been reminiscent of directly

after 9/11 when sales essentially went to zero. Then as

now, there was concern and caution about the Christmas

season. Ultimately, the American economy did recover

from that low point.

Trade, not aid. Mr. Fung recounted the value of President

Clintons offering Nelson Mandela a program that

emphasized trade over aid in allowing sub-Saharan and

African countries duty-free access to the U.S. market.

Speaker Biographies

Summit Report 2008 5

2009 President and Fellows of Harvard College

Speaker Biographies

Janice H. Hammond (Moderator)

Jesse Philips Professor of Manufacturing, Director of Faculty

Planning

Jan Hammond is the Jesse Philips Professor of

Manufacturing at HBS. In the MBA Program she has taught

courses in Supply Chain Management, Technology and

Operations Management, Business Logistics and After-Sales

Service, Decision Support Systems, Quantitative Methods,

and Managerial Economics. Hammond has served as senior

associate dean of Faculty Planning and Recruiting; unit head

of the Technology and Operations Management unit; and

faculty chair of the January cohort of the MBA Program. She

has also taught in several HBS Executive Education courses

for general managers, including Managing the Supply Chain;

Manufacturing in Corporate Strategy; Retailing; and

Managing Orders, Vendors, & Customers.

Hammonds current research focuses on speed and flexibility

in manufacturing and logistics systems: specifically, how

these systems develop the attributes necessary to respond

quickly and efficiently to changing customer demand. An

important component examines how coordinating

mechanisms within organizations and along supply channels

affects those channels ability to compete. In particular, much

of her work focuses on the interface between manufacturing

and retail organizations. A portion of this research is being

conducted in the textile and apparel industries under an

industrial competitiveness grant from the Alfred P. Sloan

Foundation. She is the coauthor with Fred Abernathy, John

Dunlop, and David Weil of A Stitch in Time: Lean Retailing

and the Transformation of Manufacturing Lessons from

the Apparel and Textile Industries (1999).

Interested in e-learning, Hammond has completed two online

learning courses: a global supply-chain management

simulation and a 20-hour online quantitative analysis course.

Hammond holds a BS in applied mathematics from Brown

University and a Ph.D. in operations research from MIT. She

has published widely on the topics of logistics and channel

coordination and consulted and taught at several major U.S.

corporations.

William K.L. Fung, MBA 1972

Group Managing Director, Li & Fung Ltd.

William Fung has been group managing director of Li & Fung

Ltd. since 1986. He joined the group in 1972 and became a

director of its export trading business in 1976.

Fung graduated from Princeton University with a BS in

engineering and holds an MBA from HBS. The Hong Kong

University of Science & Technology awarded him an

honorary doctorate of business administration in 1999.

Fung is a nonexecutive director of HSBC Holdings PLC,

VTech Holdings Ltd., and Shui On Land Ltd. and a former

member of the Hong Kong Trade Development Council. He

is past chairman of the Hong Kong General Chamber of

Commerce, the Hong Kong Exporters Association, and the

Hong Kong Committee for Pacific Economic Cooperation.

Fung is the coauthor of the book Competing in a Flat World.

In 2008 the government of the Hong Kong Special

Administrative Region awarded him the Silver Bauhinia Star

for his significant contribution to the development of Hong

Kong as a leading international trading hub and for his

outstanding public service in the areas of trade promotion

and economic development.

Willy C. Shih

Professor of Management Practice, Technology and

Operations Management Unit

Willy Shih is Professor of Management Practice in the

Technology and Operations Management unit at HBS. He

teaches in the second-year elective curriculum of the MBA

Program and in the Executive Education program.

Before joining the HBS faculty in 2007, Shih spent 18 years

in the computer industry, mainly at IBM, where he played a

significant role in the development of the PowerPC

microprocessor and systems businesses, managing

engineering and developing alliances with Apple Computer

and Motorola. He later managed Digital Equipment

Corporations Alpha microprocessor-based engineering

workstation business and its early Windows NT and UNIX

marketing operations. This was followed by a stint at Silicon

Graphics Computer Systems, where he led marketing for the

Advanced Systems Division and its high-end, MIPS-

architecture-based, high-performance computing systems

and advanced graphics systems.

From 1997 until early 2005, Shih led the creation and growth

of Kodaks consumer digital business, encompassing

consumer digital cameras, printers, and consumables, and its

Internet-based photo services. This included the introduction

of Kodaks EasyShare system, which ultimately became the

top marketshare consumer digital camera system in the

United States and other significant global markets. He also

led the acquisition and integration of Ofoto Inc. and helped

lead that to become one of the top Internet photo-sharing

sites. In his last year at Kodak, Shih led the Display and

Components Group, which included businesses in CCD and

CMOS silicon sensors and OLED display devices and

associated materials. He was simultaneously the head of

corporate intellectual property strategy.

Most recently, Shih was an EVP at Thomson, based in Paris,

where he was cohead of the Technology Group. He oversaw

corporate research, intellectual property and licensing, and

two smaller businesses.

Shih is an experienced practitioner in the field of intellectual

property, having structured numerous IP licensing programs,

with extensive work in license negotiations and litigation. He

received a BS in chemistry and the life sciences from MIT

Speaker Biographies

Summit Report 2008 6

2009 President and Fellows of Harvard College

and a Ph.D. from the University of California at Berkeley. He

serves on the boards of directors of Atheros Communications

Inc. and Flextronics International and is the nonexecutive

chairman of QD Vision Inc.

Marjorie M.T. Yang, MBA 1976

Chairman, Esquel Group

Margie Yang is chairman of Esquel Group, a leading textile

and apparel manufacturer with operations throughout the

world.

After growing up in Hong Kong, Yang attended MIT, where

she earned a BS in pure mathematics. In 1976 she received

an MBA from HBS. In 1978 she returned to Hong Kong and

became a founding member of Esquel. She was named

chairman of the group in 1995.

Under Yangs leadership, Esquel has become vertically

integrated. Its operations comprise cotton farming; yarn

spinning; fabric, apparel, and accessories production; R&D;

and design and merchandising services. Esquels 47,000

employees across the world provide one-stop cotton-shirt

solutions to Abercrombie & Fitch, Brooks Brothers, Hugo

Boss, Next, Nike, Nordstrom, Polo Ralph Lauren, and

Tommy Hilfiger. Esquel produces over 65 million shirts a

year.

Yang sits on the boards of Novartis International AG., Swire

Pacific Ltd., the Hongkong and Shanghai Banking

Corporation Ltd., and CLP Holdings Ltd. She is also a

member of the MIT Corporation and an honorary member

of the Court of the Hong Kong University of Science and

Technology.

Yang is a member of the National Committee of the Chinese

Peoples Political Consultative Conference. She has a strong

interest in conserving the countrys environment and culture,

especially in Xinjiang, western China. Yang has been

chairman of the textile and clothing sector committee of the

China Association of Enterprises with Foreign Investment

(CAEFI) since 2003 and vice chairman of CAEFI since 2004.

She is dedicated to strengthening cooperation among

foreign-invested textile firms and enhancing communication

with the Chinese government.

Yang is also interested in promoting education, particularly

the development of young managers. She has been very

involved with the MBA programs at Harvard, MIT, Tsinghua,

Fudan, and Lingnan universities and sits on various advisory

boards of these institutions.

You might also like

- EsquelDocument15 pagesEsquelAnam ShoaibNo ratings yet

- Global Supply Chain Management SimulationDocument9 pagesGlobal Supply Chain Management SimulationJawadNo ratings yet

- VF Corporation'S Global Supply Chain StrategyDocument1 pageVF Corporation'S Global Supply Chain Strategypradeep0% (1)

- Five-Forces Analysis For CSD Cola Wars CDocument2 pagesFive-Forces Analysis For CSD Cola Wars CasheNo ratings yet

- Flyht Case SolutionDocument2 pagesFlyht Case SolutionkarthikawarrierNo ratings yet

- Eli LDocument6 pagesEli LKaruna GaranNo ratings yet

- GROUP 5 - Duane Morris - Balancing Growth and Culture at Law FirmDocument12 pagesGROUP 5 - Duane Morris - Balancing Growth and Culture at Law FirmDo not Spam100% (1)

- LeClub Wine Inventory OptimizationDocument2 pagesLeClub Wine Inventory OptimizationCharles Wetherbee100% (4)

- GE Health Care Case: Executive SummaryDocument4 pagesGE Health Care Case: Executive SummarykpraneethkNo ratings yet

- Global Supply Chain M11207Document4 pagesGlobal Supply Chain M11207Anonymous VVSLkDOAC133% (3)

- ITT AutoDocument4 pagesITT AutoKarthik ArumughamNo ratings yet

- Apple Computer Inc. (Case Study)Document15 pagesApple Computer Inc. (Case Study)salugee81% (16)

- An Analysis of Corporate Governance Imbroglio at InfosysDocument5 pagesAn Analysis of Corporate Governance Imbroglio at InfosysBen HiranNo ratings yet

- Group2 ITT CaseDocument16 pagesGroup2 ITT CaseAman Anshu100% (1)

- Arauco Case DiscDocument3 pagesArauco Case DiscoscarzurichNo ratings yet

- Final Project Strategic Management and PolicyDocument10 pagesFinal Project Strategic Management and PolicyBushra ImranNo ratings yet

- M4W6 GSCM SoloAssignment RecordSheetsDocument8 pagesM4W6 GSCM SoloAssignment RecordSheetsKai DooeNo ratings yet

- Operations Strategy - Simulation NotesDocument4 pagesOperations Strategy - Simulation NotesOlle Green0% (1)

- Sandilands VineyardsDocument2 pagesSandilands VineyardsShahid Parvej25% (4)

- Boston BeerDocument7 pagesBoston BeerAniket Kaushik100% (1)

- Sport Obermeyer Case StudyDocument14 pagesSport Obermeyer Case Studye3testerNo ratings yet

- Apple Inc.: Managing Global Supply Chain: Case AnalysisDocument9 pagesApple Inc.: Managing Global Supply Chain: Case AnalysisPrateek GuptaNo ratings yet

- Solutions To Chapters 7 and 8 Problem SetsDocument21 pagesSolutions To Chapters 7 and 8 Problem SetsMuhammad Hasnain100% (1)

- Summary of Learnings Derived From Organizational Design Simulation: Evolving StructuresDocument4 pagesSummary of Learnings Derived From Organizational Design Simulation: Evolving StructuresHarshad Savant100% (1)

- EC2101 Practice Problems 8 SolutionDocument3 pagesEC2101 Practice Problems 8 Solutiongravity_coreNo ratings yet

- RTS Company AndrewsDocument26 pagesRTS Company Andrewsasia0312No ratings yet

- L Oreal S ACD Supply Chain Puzzle Diagnosing The Root Causes of Underperformance Case SolutionDocument53 pagesL Oreal S ACD Supply Chain Puzzle Diagnosing The Root Causes of Underperformance Case Solutiondiegojj2225% (4)

- HP Case AnalysisDocument8 pagesHP Case AnalysisSuman PradhanNo ratings yet

- Cell Phone SimulationDocument15 pagesCell Phone SimulationSravya Doppani100% (1)

- WAC-P16052 Dhruvkumar-West Lake Case AnalysisDocument7 pagesWAC-P16052 Dhruvkumar-West Lake Case AnalysisDHRUV SONAGARANo ratings yet

- Esquel Group Value Innovation Through Sustainable Supply ChainsDocument18 pagesEsquel Group Value Innovation Through Sustainable Supply ChainsJuhi ganvirNo ratings yet

- Deere and Company - Group 11 - Sec BDocument5 pagesDeere and Company - Group 11 - Sec BVyshali KaruNo ratings yet

- Case 2 - Global Wine WarDocument2 pagesCase 2 - Global Wine Warneha nairNo ratings yet

- Case Study - 440Document4 pagesCase Study - 440Rohan ViswanathNo ratings yet

- Supply Chain 303Document5 pagesSupply Chain 303trillion5No ratings yet

- Bergerac System Case Analysis-Group 1Document11 pagesBergerac System Case Analysis-Group 1Karan Trivedi100% (1)

- Supply Chain Simulation DemoDocument4 pagesSupply Chain Simulation DemoKevin Rader0% (1)

- C-3 Six Sigma Quality at Flyrock TiresDocument3 pagesC-3 Six Sigma Quality at Flyrock TiresRahul JainNo ratings yet

- Case Study 27 V2Document10 pagesCase Study 27 V2mrchardNo ratings yet

- Assignment 1: Terracog Global Positioning Systems: Conflict and Communication On Project AerialDocument5 pagesAssignment 1: Terracog Global Positioning Systems: Conflict and Communication On Project Aerialharsh singhNo ratings yet

- Honda A: Group-Karthik, Mohit, Ramya, Rishabh, Sharvani, ShouvikDocument8 pagesHonda A: Group-Karthik, Mohit, Ramya, Rishabh, Sharvani, ShouvikKarthik BhandaryNo ratings yet

- Report - Cesim 2014 - Walphone GroupDocument2 pagesReport - Cesim 2014 - Walphone GroupNguyễn Thuỳ DươngNo ratings yet

- DGIS SiemensDocument3 pagesDGIS SiemensJuhee PritanjaliNo ratings yet

- 2017 Spring Case Study Questions SCM 479 NewDocument4 pages2017 Spring Case Study Questions SCM 479 NewSaddam AwanNo ratings yet

- Logistic & Distribution Management: Lotus Thread Company LTDDocument6 pagesLogistic & Distribution Management: Lotus Thread Company LTDSanchit GuptaNo ratings yet

- Case Analysis - Michigan Manufacturing CorporationDocument2 pagesCase Analysis - Michigan Manufacturing CorporationhemanthillipilliNo ratings yet

- Allied Services Case Study-ABC CostingDocument20 pagesAllied Services Case Study-ABC CostingSavita Soni100% (4)

- Sample LSCM Exam With SolutionsDocument4 pagesSample LSCM Exam With SolutionsDushyant ChaturvediNo ratings yet

- A Blogger in The Midst - Critical AnalysisDocument4 pagesA Blogger in The Midst - Critical AnalysisJaskaranNo ratings yet

- Scotts Miracle GroDocument10 pagesScotts Miracle GromsarojiniNo ratings yet

- Group 3 - Aldens Products Inc.Document6 pagesGroup 3 - Aldens Products Inc.sunny singhNo ratings yet

- Frito Lay PresDocument8 pagesFrito Lay PresAmber LiuNo ratings yet

- Lesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDocument5 pagesLesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case Studiesthetpainghein one0% (1)

- Analyse The Structure of The Personal Computer Industry Over The Last 15 YearsDocument7 pagesAnalyse The Structure of The Personal Computer Industry Over The Last 15 Yearsdbleyzer100% (1)

- GiveIndia Assignment Group1Document2 pagesGiveIndia Assignment Group1SAMBIT HALDER PGP 2018-20 Batch50% (2)

- Assignment 1 Boeing 737 by Group 12Document8 pagesAssignment 1 Boeing 737 by Group 12AjayNo ratings yet

- Li & Fung Global Supply ChainDocument19 pagesLi & Fung Global Supply ChainTarun UraiyaNo ratings yet

- Role of IntermediariesDocument20 pagesRole of IntermediariesAkshit Baj100% (1)

- 1 Answer Introduction: Globalization Is Defined As An Interdependence of World Economies. ItDocument7 pages1 Answer Introduction: Globalization Is Defined As An Interdependence of World Economies. ItAkshatNo ratings yet

- HTBMS (F) - 002 - Logistics and Supply Chain ManagementDocument10 pagesHTBMS (F) - 002 - Logistics and Supply Chain ManagementEshitwa AgrawalNo ratings yet

- Ammar Step by Step 1 PDFDocument26 pagesAmmar Step by Step 1 PDFyinue60% (5)

- The Seven Principles of Supply Chain ManagementDocument6 pagesThe Seven Principles of Supply Chain ManagementAnonymous ggwJDMh8No ratings yet

- International Logistics: Global Supply Chain ManagementDocument1 pageInternational Logistics: Global Supply Chain ManagementyinueNo ratings yet

- Lean Engineering Working PaperDocument17 pagesLean Engineering Working PaperyinueNo ratings yet

- One Day Training On KAIZEN: Hilton HotelDocument74 pagesOne Day Training On KAIZEN: Hilton HotelyinueNo ratings yet

- HR Pepsi CoDocument3 pagesHR Pepsi CookingNo ratings yet

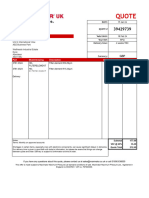

- Maximator Quote No 39429739Document1 pageMaximator Quote No 39429739William EvansNo ratings yet

- Citizen-Charter-15-Lfo-05-Issuance of Standards Compliance Certificate (SCC) For LPG Retail OutletsDocument4 pagesCitizen-Charter-15-Lfo-05-Issuance of Standards Compliance Certificate (SCC) For LPG Retail OutletsGenesis AdarloNo ratings yet

- Settlement CaseDocument14 pagesSettlement CaseSsseven GODNo ratings yet

- Report PT Bukit Uluwatu Villa 30 September 2019Document146 pagesReport PT Bukit Uluwatu Villa 30 September 2019Hanif RaihanNo ratings yet

- Incoterms Latest PDFDocument1 pageIncoterms Latest PDFAnand VermaNo ratings yet

- Canara BankDocument2 pagesCanara Banklinsonjohny34No ratings yet

- 20092018090907893chapter18 RedemptionofPreferenceSharesDocument2 pages20092018090907893chapter18 RedemptionofPreferenceSharesAbdifatah SaidNo ratings yet

- Building The Resilience of Small Coastal BusinessesDocument60 pagesBuilding The Resilience of Small Coastal BusinessesMona PorterNo ratings yet

- Price Action TradingDocument1 pagePrice Action TradingMustaquim YusopNo ratings yet

- Programmatic PosterDocument2 pagesProgrammatic PosterBorderBRENo ratings yet

- Chapter 1 - Indian Financial System - IntroductionDocument26 pagesChapter 1 - Indian Financial System - IntroductionsejalNo ratings yet

- Roll No . Sushant University, Gurgaon End Term Examination, Jan 2022Document2 pagesRoll No . Sushant University, Gurgaon End Term Examination, Jan 2022Kartik ChoudharyNo ratings yet

- RICS Course Guide BIMDocument6 pagesRICS Course Guide BIMjode2213100% (1)

- Cary Siegel, Why Didn't They Teach Me This in School 99 Personal Money Management Principles To Live By. ReportDocument6 pagesCary Siegel, Why Didn't They Teach Me This in School 99 Personal Money Management Principles To Live By. ReportDaniel50% (2)

- Customer Journey MappingDocument1 pageCustomer Journey MappingPriyanka RaniNo ratings yet

- Case-Walmarts Expansion Into Specialty Online RetailingDocument9 pagesCase-Walmarts Expansion Into Specialty Online RetailingSYAHRUL ROBBIANSYAH RAMADHANNo ratings yet

- Mini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyDocument44 pagesMini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyImran AnsariNo ratings yet

- Chapter 12 - Macroeconomic and Industry AnalysisDocument8 pagesChapter 12 - Macroeconomic and Industry AnalysisMarwa HassanNo ratings yet

- Marketing - Module 9 The Marketing Mix - PROMOTIONDocument12 pagesMarketing - Module 9 The Marketing Mix - PROMOTIONKJ Jones100% (3)

- HRM CHAPTER 10 Changes in Personnel StatusDocument8 pagesHRM CHAPTER 10 Changes in Personnel StatusBen joe CajigalNo ratings yet

- BX2011 Topic01 Tutorial Solutions 2020Document15 pagesBX2011 Topic01 Tutorial Solutions 2020Shi Pyeit Sone Kyaw0% (1)

- Project ReportDocument52 pagesProject ReportAkanksha SinhaNo ratings yet

- Business Opportunity EvaluationDocument26 pagesBusiness Opportunity EvaluationAmirNo ratings yet

- A Guide To Preparing For Sales and TradiDocument4 pagesA Guide To Preparing For Sales and TradiBrenda WijayaNo ratings yet

- Eae 7501-Msc Entrepreneurship & Innovation Assignment Guidance NotesDocument5 pagesEae 7501-Msc Entrepreneurship & Innovation Assignment Guidance Notesknowledge factory0% (1)

- Lecture 4 MCQs AnswersDocument3 pagesLecture 4 MCQs AnswersDeelan AppaNo ratings yet

- Chris Sloan ResumeDocument2 pagesChris Sloan ResumeChris SloanNo ratings yet

- FlipkartDocument18 pagesFlipkartravisittuNo ratings yet

- DHFL Pramerica Deep Value Strategy PMSDocument4 pagesDHFL Pramerica Deep Value Strategy PMSAnkurNo ratings yet