Currency Risk Management, LLC

Foreign Exchange

Risk Management

A primer on protecting and increasing profits

In international transactions and investments

kr

K

kr

Q

S/.

R$

R

�Currency Risk Management, LLC

The Problem:

FX Risk

Currency Volatility

The Solution:

Hedging concepts and tools

Success stories

Range of hedging solutions

Implementing the Solution

Banking

Getting Started

Conclusions

�Currency Risk Management, LLC

FX Risk

Theres always FX risk in an international transaction

Payment spot

Contracted Spot

EUR/USD

Volatility = 13%

Contracted Spot

Payment spot

Case1:

If Exporter bills in EUR, you get a 11% windfall profit.

If Exporter bills in USD, EU importer pays 11% less

Case2:

If Exporter bills in EUR, you see a 8% loss.

If Exporter bills in USD, EU importer pays 8% more

�Currency Risk Management, LLC

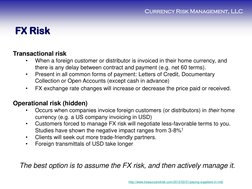

FX Risk

Transactional risk

When a foreign customer or distributor is invoiced in their home currency, and

there is any delay between contract and payment (e.g. net 60 terms).

Present in all common forms of payment: Letters of Credit, Documentary

Collection or Open Accounts (except cash in advance)

FX exchange rate changes will increase or decrease the price paid or received.

Operational risk (hidden)

Occurs when companies invoice foreign customers (or distributors) in their home

currency (e.g. a US company invoicing in USD)

Customers forced to manage FX risk will negotiate less-favorable terms to you.

Studies have shown the negative impact ranges from 3-8%1

Clients will seek out more trade-friendly partners.

Foreign transmittals of USD take longer

The best option is to assume the FX risk, and then actively manage it.

[Link]

�Currency Risk Management, LLC

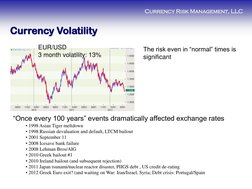

Currency Volatility

EUR/USD

3 month volatility: 13%

The risk even in normal times is

significant

Once every 100 years events dramatically affected exchange rates

1998 Asian Tiger meltdown

1998 Russian devaluation and default, LTCM bailout

2001 September 11

2008 Icesave bank failure

2008 Lehman Bros/AIG

2010 Greek bailout #1

2010 Ireland bailout (and subsequent rejection)

2011 Japan tsunami/nuclear reactor disaster, PIIGS debt , US credit de-rating

2012 Greek Euro exit? (and waiting on War: Iran/Israel, Syria; Debt crisis: Portugal/Spain

�Currency Risk Management, LLC

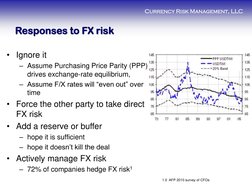

Responses to FX risk

Ignore it

Assume Purchasing Price Parity (PPP)

drives exchange-rate equilibrium,

Assume F/X rates will even out over

time

Force the other party to take direct

FX risk

Add a reserve or buffer

hope it is sufficient

hope it doesnt kill the deal

Actively manage FX risk

72% of companies hedge FX risk1

1.0 AFP 2010 survey of CFOs

�Currency Risk Management, LLC

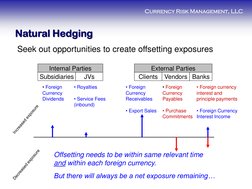

Natural Hedging

Seek out opportunities to create offsetting exposures

Internal Parties

Subsidiaries

JVs

Foreign

Currency

Dividends

Royalties

Service Fees

(inbound)

External Parties

Clients Vendors Banks

Foreign

Currency

Receivables

Foreign

Currency

Payables

Foreign currency

interest and

principle payments

Export Sales

Purchase

Foreign Currency

Commitments Interest Income

Offsetting needs to be within same relevant time

and within each foreign currency.

But there will always be a net exposure remaining

�Currency Risk Management, LLC

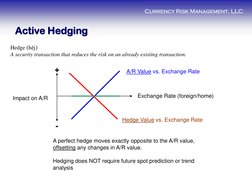

Active Hedging

Hedge (hj)

A security transaction that reduces the risk on an already existing transaction.

A/R Value vs. Exchange Rate

Exchange Rate (foreign/home)

Impact on A/R

Hedge Value vs. Exchange Rate

A perfect hedge moves exactly opposite to the A/R value,

offsetting any changes in A/R value.

Hedging does NOT require future spot prediction or trend

analysis

�Currency Risk Management, LLC

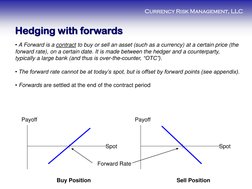

Hedging with forwards

A Forward is a contract to buy or sell an asset (such as a currency) at a certain price (the

forward rate), on a certain date. It is made between the hedger and a counterparty,

typically a large bank (and thus is over-the-counter, OTC).

The forward rate cannot be at todays spot, but is offset by forward points (see appendix).

Forwards are settled at the end of the contract period

Payoff

Payoff

Spot

Spot

Forward Rate

Buy Position

Sell Position

�Currency Risk Management, LLC

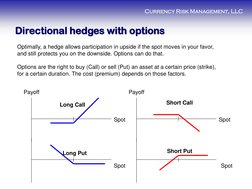

Directional hedges with options

Optimally, a hedge allows participation in upside if the spot moves in your favor,

and still protects you on the downside. Options can do that.

Options are the right to buy (Call) or sell (Put) an asset at a certain price (strike),

for a certain duration. The cost (premium) depends on those factors.

Payoff

Payoff

Short Call

Long Call

Spot

Spot

Short Put

Long Put

Spot

Spot

�Currency Risk Management, LLC

Hedging with One Option

Long

Underlying

Exposure

Long Put

Spot

Spot

premium

Advantages

Strike

No collateral or FX LoC required

Combinations (Puts, Calls, long/short)

allow upside or neutral position with

spot

Best for hedging forecast cash flows

(uncertainty of exposure)

Spot

Break even

Disadvantages

Premium more expensive than

forwards, paid upfront

Long durations are expensive

If volatility of underlying is high,

premiums are expensive

�Currency Risk Management, LLC

Success story

NGT secured a sales contract in March 2011 with an EU customer for

$469,708, or 343,028 (EUR/USD 1.369)

A series of four performance payments were scheduled from April

through Nov: design approval, major components, factory acceptance,

and site acceptance.

EUR/USD

The first two payments were hedged with Puts at 1.42

The second two hedged with forwards (due to long

duration)

As the EUR fell throughout 2011, NGTs hedges

saved over $47,000

�Currency Risk Management, LLC

Success story

SM sells sporting goods into Canada, collecting monthly payments

from their distributors.

SM wanted to not only preserve their margin, but use hedging to add

to the bottom line. SM and CRM jointly decide to hedge 80% of

monthly receivables with forwards, and use a profit-generating multioption strategy for the remaining 20%

CRMs option-based hedge

structure added 3% nonoperating revenue at

inception, and retained that

profit throughout the term of

the hedge.

USD/CAD

(P&L in red)

�Currency Risk Management, LLC

Success story

US-based FE (a Connecticut-based hedge fund) invests in Brazil.

Their exposure is $2M every quarter, with a Value-at-Risk of $358k.

Hedging USD/BRL is challenging for two reasons:

Brazilian interest rates are very high, making forwards very expensive

(160 bps/qtr)

USD/BRL volatility is very high, increasing the cost of options. In

addition, the skew between Calls and Puts is very high.

CRMs multiple option-based

hedge created a synthetic

forward, but cost only 84 bps

As the USD/BRL rose from 1.8

to 1.93, the synthetic forward

saved FE $144,000

USD/BRL

�Currency Risk Management, LLC

Flexibility and ease of hedging solutions

Almost any exposure

From just one contract to a series of monthly payments

Certain (contract) or uncertain (forecast) cash flows

From very short (one week) to very long (5 years) duration

Almost any currency

Hedges can be designed to simply eliminate risk

or designed to allow some participation in currency upside

Fire and forget: once your hedge is in place (5 min phone call to

bank), you can focus on your core business and not worry about

exchange rates

�Currency Risk Management, LLC

Working with Banks

Banks are essential partners in international trade.

They provide multi-currency accounts, ACH, EFT, Lockboxes, foreign wires

They provide the hedging instruments we needhowever-

However - pricing of forwards, options, swaps etc. is opaque

Forward points - a 20 bps misquote of interbank rates could double your hedge cost.

Option premiums - a 5% difference in implied volatility could increase premiums 50%

Spot rate quotes from the bank may be delayed or skewed

Setting expectations

Bank bid-ask spread is 20-50 bps over interbank/market pricing. Shop carefully

They expect you to know what youre doing, what you want, and how to accurately specify

products based on your exposure

What they may suggest optimizes their profit and risk, not yours

Best to have expert third-party assistance

Selection of optimum hedge components and specification (notional, strike, tenor, expiry)

Access to interbank data for price verification

Assistance with hedge inception documentation and accounting

�Currency Risk Management, LLC

Working with CRM

We eliminate your FX risk, taking the worry out of international transactions.

All we need from you is cash flow information (amount, dates), and we take

care of the complexities. Your sales & finance staff remain focused on their job

We can match specific or forecast exposures, almost any currency, any

duration.

CRMs inside access to inter-bank pricing helps us negotiate the lowest

premiums and tightest spreads for you. Our own fees are very small (0.25% to

0.5%)

This is our specialty. The CRM team has over 25 years of FX experience. We

are happy to share anonymized deal histories and client referrals

No Conflict of Interest - we are consultants only - we do not access your

brokerage account, and we do not earn any fees from banks or market-makers

�Currency Risk Management, LLC

Getting Started

Establish relationships

A banking relationship which provides the FX instruments (forwards,

options). Its best if this is an existing account, as business deposits can

count towards any margin required. If a new account is needed, be

advised banking Know Your Customer (KYC), and Anti Money

Laundering (AML) processes can take several weeks

Execute the Currency Risk Management consulting agreement. This 3page agreement doesnt carry any obligation or expense, it only

establishes our business relationship

Operational Phase

Client confirms cash flows and timing to CRM, and orders hedge

CRM designs a hedge structure for each unique cash flow/transaction

Joint Client/bank calls to initiate hedges

CRM reports interim results, assists in any necessary changes

�Currency Risk Management, LLC

Conclusions

Any exporter or importer will have unavoidable and significant FX risk in its

international transactions

FX risk is easily mitigated (with the right expertise)

As a guideline, the all-in cost1 is approximately 1% of contract value for G-7

currencies (easily built in to your contracts). This much, much less than the

average Value-at-Risk of 12-15%.

It costs nothing, but takes time to get ready to hedge your international

transactions. Start now!

1. FX derivatives, bank spread and CRM fees

�Currency Risk Management, LLC

Appendix

�Currency Risk Management, LLC

Using forwards

Forwards are best suited to:

Certain exposures i.e. contractual exposures, not forecast cash flows.

Long duration hedges

Currencies with low interest rate differentials

The expiry date can be easily (and inexpensively) extended if a

customer payment is delayed

Forwards sometimes require margin or collateral, and in general do

not allow upside.

Forwards are available in more complex flavors (e.g. participating

forwards, accumulator forwards, knock-in forwards)

�Currency Risk Management, LLC

Determining the forward rate

Fwd

contract

Near date

FX Bank

Exporter

767

Far date

(6 months)

EUR/USD Spot rate

USD 6 mo interest rate

EUR 6 mo interest rate

1.3140

0.955%,

0.714%

Today, $1,000 = 769

In 6 months,

769 invested at 0.714% = 774.50

$1,000 invested at 0.955% = $1,009.5

Gives a Forward rate of 1009.5/774.5 = 1.3034

$1,000

If the forward rate was the same as todays spot, an arbitrageur could make a riskless profit

For EUR, GBP, CAD, JPY, the rate is very similar to the spot.

For currencies with high interest rate differentials (BRL, AUD), the rate will vary more

�Currency Risk Management, LLC

Value at Risk (VaR)

A standard measure of potential loss, VaR assumes that spot prices vary

randomly about a mean, with a normal distribution. That is, smaller price

changes are more common than larger ones.

Mean

Value at Risk then is the potential loss, with a certain level of

confidence, e.g. 90%, 95%, 99%.

Lets calculate VaR for a $1M contract with volatility of 13%,

to a 90% confidence. 90% is 1.28 standard deviations (the

z-value, in statistical terms)

Spot

1 Std Dev = 68.3%

2 Std Dev = 95.4%

3 Std Dev = 99.7%

90% VaR = 1.28*Std Dev*contract value

90% VaR = 1.28*13%*$1M = $166,400

This is not a maximum loss. We used a 90% confidence

level. 10% of the time, it could be more...

�Currency Risk Management, LLC

Case Study #1 $1M USD hedged with forward

EUR/USD spot 1.3140

$1M = 769,000 at inception

3 month volatility 11%

Value-at-Risk = $140,800 (14%)

Hedge

Forward Contract to

sell 769,000 in 3

months

Forward points

.00069 (.07%)

Resulting forward

rate 1.31469

End result P&L indifferent to spot changes

�Currency Risk Management, LLC

Case Study #2 $1M EU sale hedged with long

option

Spot 1.314, volatility 11%

3 month EUR Put option, strike 1.3,

Premium 1.7%, break-even spot 1.278

�Currency Risk Management, LLC

Case Study #3 Hybrid hedges

Two options, one bought, one sold, different strikes and notionals

Net 4% premium to hedger, break-even spot 1.23

�Currency Risk Management, LLC

CRM Fee

The first transactional consulting fee is 0.5% of the notional or face amount of

each individual exposure hedged, with a minimum notional of $50,000

The consulting fee is discounted as the aggregated sum of all previous hedge

notionals exceeds levels according to the following schedule:

Aggregated notional

Above $1,000,000

Above $5,000,000

Above $10,000,000

Fee

0.45% (45 bps)

0.40% (40 bps)

0.35% (35 bps)

Considering random FX movement of 50-100 bps/day,

mitigation of 10-15% Value-at-Risk,

and potential savings in bank bid-ask spreads, CRM easily pays for itself.