Professional Documents

Culture Documents

Internal Capital Adequacy Assessment - Q4 2021

Uploaded by

suedtCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal Capital Adequacy Assessment - Q4 2021

Uploaded by

suedtCopyright:

Available Formats

Contents Page

1. Introduction ...................................................................................................................................................................................................................................3

2. Process for determining the solvency need ............................................................................................................................................................4

2.1 Basis for capital management..........................................................................................................................................................................4

2.2 Risk identification ......................................................................................................................................................................................................4

2.3 Danske Bank’s internal assessment of its solvency need.............................................................................................................5

3. Stress test method and assumptions .........................................................................................................................................................................9

4. Additional information ............................................................................................................................................................................................................9

Danske Bank / Internal Capital Adequacy Assessment 2/10

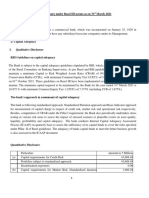

1. Introduction

The objective of this Internal Capital Adequacy Assessment report is to address the disclosure requirements stipulated in

the Danish Executive Order of 3 December 2020 on Calculation of Risk Exposures, Own Funds and Solvency Need (schedule

2) and in the Danish Financial Business Act. The report concerns the Danske Bank Group, Danske Bank A/S, the Realkredit

Danmark Group (sub-group) and Realkredit Danmark A/S.

This report is a supplement to the Danske Bank Group’s annual Risk Management report, which contains further details.

This document includes

a description of the process and method for determining the solvency need

a calculation of the solvency need

a description of the stress test method and assumptions

The Danske Bank Group monitors its risks through the coordinated efforts of credit and risk departments at both Danske

Bank A/S and Realkredit Danmark A/S. Realkredit Danmark A/S is a subsidiary of Danske Bank A/S and is included in the

report on the Danske Bank Group in accordance with the Danish Executive Order on Calculation of Risk Exposures, Own

Funds and Solvency Need. The present report, including the description of the process and method used for determining the

solvency need, covers the companies mentioned above and is published on the websites of the individual companies.

Conclusion

At the end of December 2021, the Danske Bank Group’s solvency need amounted to DKK 98.1 billion, or 11.4% of its total

risk exposure amount (REA). With total capital of DKK 192.8 billion and a total capital ratio of 22.4%, the Danske Bank

Group had DKK 46.3 billion in excess of the sum of its solvency need and combined buffer requirement.

Danske Bank / Internal Capital Adequacy Assessment 3/10

2. Process for determining the solvency need

2.1 Basis for capital management

The primary objectives of the Group’s capital management practices are to support the Group’s business strategy and to

ensure a sufficient level of capital to withstand even severe downturns without breaching regulatory requirements.

Credit institutions assume risks as part of conducting business, and sometimes financial losses occur. The first response

to losses is the individual institution’s earnings. In a given year, if earnings are not sufficient to cover losses, they are covered

by excess capital, that is, the part of the institution’s capital that exceeds its solvency need.

The Group’s capital management ensures that the Group has sufficient capital to cover the risks associated with its

activities. The Group uses advanced approaches for all significant risk types in combination with adjustments based on

expert assessments, if necessary.

The Group develops its capital management framework on an ongoing basis, taking international guidelines and best-

practice recommendations into consideration. The Group monitors national and international measures that may influence

its capital position and capital management framework.

The Group’s capital management is based on the Internal Capital Adequacy Assessment Process (ICAAP). As its primary

capital management tool, the Group’s ICAAP, including the ICAAPs of its subsidiaries, helps provide a clear picture of capital

and risks throughout the Group.

The regulatory framework for the Group’s capital management is rooted in the Capital Requirements Regulation (CRR) and

the Capital Requirements Directive (CRD), which can be divided into three pillars:

Pillar I contains a set of mathematical formulas for the calculation of risk exposure amounts for credit risk, market risk

and operational risk. The minimum capital requirement is 8% of the total REA.

Pillar II contains the framework for the contents of the ICAAP, including the identification of a credit institution’s risks,

the calculation of its solvency need and stress testing. It also includes the Supervisory Review and Evaluation Process

(SREP), which is a dialogue between an institution and the relevant financial supervisory authority on the institution’s

ICAAP.

Pillar III deals with market discipline and sets forth disclosure requirements for risk and capital management.

While Pillar I entails the calculation of risks and the capital requirement on the basis of uniform rules for all credit

institutions, the ICAAP under Pillar II takes into account the individual characteristics of a given institution and covers all

relevant risk types, including risks not addressed under Pillar I.

As part of the ICAAP, management identifies the risks to which the Group is exposed for the purpose of assessing its risk

profile. When the risks have been identified, the Group determines the means by which they will be mitigated. These are

usually business procedures, contingency plans and other measures. Finally, the Group determines what risks will be

covered by capital. In the ICAAP, the Group determines its solvency need on the basis of internal models and other means,

and it conducts stress tests to ensure that it always has sufficient capital to support its chosen business strategy.

2.2 Risk identification

The Group is involved in a number of business activities. These activities can be divided roughly into five segments: banking,

market, asset management, insurance, and group-wide activities. The latter category covers management activities that are

not specific to any of the first four business activities but broadly support them all. Each of these activities entails various

risks, which fall into the nine main categories of the Group’s enterprise risk management framework. These risks can be

mapped to the risk types listed in the Danish Executive Order on Calculation of Risk Exposures, Own Funds and Solvency

Need.

Danske Bank / Internal Capital Adequacy Assessment 4/10

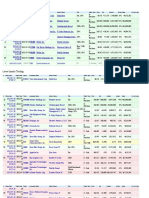

Risk identification by Danish FSA risk type

Danske Bank Group risk categories

Financial risks Non-financial risks

Financial

Danish FSA Liquidity, Regulatory

Credit Market Operational Technology control and Financial

funding and Model risk compliance

risk types risk risk risk and data risk strategic crime risk

capital risk risk

risk

Earnings

Credit growth

Credit risk

Concentration risk

Market risk

Interest risk outside

the banking book

Liquidity risk

Operational risk

Gearing

Other risk*

Control environment

* Includes strategy risk, reputational risk, external risk, group risk and settlement risk.

The Danske Bank Group’s Risk Management 2021 report, published at the same time as the Group’s Annual Report 2021,

provides detailed information about the individual risk types. The report is available at www.danskebank.com/reports.

2.3 Danske Bank’s internal assessment of its solvency need

The ICAAP under Pillar II entails the Group’s calculation of its solvency need. The process is adjusted to address the

conditions at the individual credit institution, and it covers all material risks.

An important part of the process of determining the solvency need is to evaluate whether the calculation takes into account

all material risks to which the Group is exposed. The Group uses add-ons to the solvency need if the result of the model

calculations does not appear to be sufficiently conservative – for example if the Group believes that there is a need for a

more conservative approach than what is indicated by the Pillar I approach. The Group has established a process that

quantifies the add-ons on the basis of input from internal experts. The capital add-ons are additive although they may overlap

one another, and the process thus represents a conservative and careful assessment of the Group’s solvency need.

The Group does not set aside capital for liquidity risk but rather mitigates such risk by means of stress test analyses,

contingency plans and other measures. The Group recognises that a strong capital position is necessary for maintaining a

strong liquidity position.

The Group assesses its solvency need on the basis of internal models and ensures that the proper risk management

systems are used. The ICAAP also includes capital planning to ensure that the Group always has sufficient capital to support

its chosen business strategy. Stress testing is an important tool used for capital planning purposes.

The Group complies with approved risk limits and risk monitoring through a defined cycle of reporting on changes in risk

objectives to the Board of Directors and the Executive Leadership Team. An expanded ICAAP report is submitted to the

Board of Directors and the Executive Leadership Team for approval once a year. As part of the ICAAP, the Board of Directors

evaluates an annual report that describes the Group’s risk profile. At quarterly board meetings, the Board of Directors

reviews and approves the Group’s solvency need.

As stipulated in Danish legislation, a credit institution must disclose its solvency need and solvency need ratio. For the

Group, this requirement applies to Danske Bank A/S and Realkredit Danmark A/S.

The solvency need is the total capital of the size, type and composition needed to cover the risks to which an institution is

exposed.

Danske Bank / Internal Capital Adequacy Assessment 5/10

The Group’s solvency need is based on Pillar I but also takes into account risks other than those included under Pillar I,

including pension and business risks, as well as specific credit risks in the current economic cycle. The Group assesses on

an ongoing basis whether its capital level is sufficiently conservative.

The regulatory framework provides some discretionary leeway for selecting the appropriate method for determining the

solvency need. The Group believes that it has adopted a sufficiently conservative approach:

Capital is added to the capital requirement under Pillar I to reflect risks not captured by Pillar I.

The Group takes the uncertainty of the risk models into account and makes quantitative as well as qualitative adequacy

assessments of its capital level on an ongoing basis.

The Group’s solvency need can be broken down into capital for the most important risk types.

Danske Bank / Internal Capital Adequacy Assessment 6/10

Danske Bank Group and Danske Bank A/S

Breakdown of Danske Bank's solvency need Danske Bank Group Danske Bank A/S

At 31 December 2021 (DKK billions) (% of total REA) (DKK billions) (% of total REA)

Credit risk 66.5 7.7 57.2 7.8

Market risk 9.9 1.1 9.9 1.3

Operational risk 21.6 2.5 20.7 2.8

Other risks 0.2 0.0 0.2 0.0

Solvency need and solvency need ratio 98.1 11.4 87.9 12.0

Combined buffer requirement 48.3 5.6 41.4 5.6

Solvency need and solvency need ratio

146.4 17.0 129.3 17.6

(incl. combined buffer requirement)

- portion from CET1 capital 107.9 12.5 95.2 13.0

Total capital and total capital ratio 192.8 22.4 194.0 26.5

- portion from CET1 capital 151.9 17.7 153.2 20.9

Excess capital 46.3 5.4 64.7 8.8

Excess CET1 capital 44.0 5.1 58.0 7.9

At the end of December 2021, the Danske Bank Group’s solvency need amounted to DKK 98.1 billion, or 11.4% of its total

REA. With total capital of DKK 192.8 billion and a total capital ratio of 22.4%, the Danske Bank Group had DKK 46.3 billion

in excess of the sum of its solvency need and combined buffer requirement. The Danske Bank Group had excess CET1 capital

of DKK 44.0 billion, or 5.1% of its total REA.

At 7.7%, credit risk represented by far the largest component of the individual risks covered by capital according to the

Danske Bank Group’s determination of its solvency need. Market risk and operational risk combined represented 3.6%. The

main component of the “Other risks” category, which represented less than 0.1% of the total REA, was pension risk.

Danske Bank / Internal Capital Adequacy Assessment 7/10

Realkredit Danmark Group and Realkredit Danmark A/S

Breakdown of Realkredit Danmark's solvency need Realkredit Danmark Group Realkredit Danmark A/S

At 31 December 2021 (DKK billions) (% of total REA) (DKK billions) (% of total REA)

Credit risk 15.5 8.5 15.5 8.5

Market risk 2.1 1.1 2.1 1.1

Operational risk 0.8 0.5 0.8 0.5

Other risks 0.0 0.0 0.0 0.0

Solvency need and solvency need ratio 18.5 10.1 18.4 10.1

Combined buffer requirement 10.1 5.5 10.1 5.5

Solvency need and solvency need ratio 28.6 15.6 28.6 15.6

(incl. combined buffer requirement)

- portion from CET1 capital 20.5 11.2 20.5 11.2

Total capital and total capital ratio 46.4 25.3 46.4 25.3

- portion from CET1 capital 45.7 24.9 45.7 24.9

Excess capital 17.8 9.7 17.8 9.7

At the end of December 2021, the Realkredit Danmark Group’s solvency need amounted to DKK 18.5 billion, or 10.1% of

its total REA. With total capital of DKK 46.4 billion and a total capital ratio of 25.3%, the Realkredit Danmark Group had

DKK 17.8 billion in excess of the sum of its solvency need and combined buffer requirement.

At 8.5%, credit risk represented by far the largest component of the individual risks covered by capital according to the

Realkredit Danmark Group’s determination of its solvency need. Market risk and operational risk combined represented

1.6%. The main component of the “Other risks” category, which represented less than 0.1% of the total REA, was pension

risk.

Danske Bank / Internal Capital Adequacy Assessment 8/10

3. Stress test method and assumptions

Stress testing is part of the ICAAP and is an important means of analysing the Group’s risk profile since it gives management

a better understanding of how the Group’s portfolios are affected by macroeconomic changes, including any adverse effects

on the Group’s capital. Stress testing also forms part of the internal capital planning process.

When determining its solvency need, the Group uses recession scenarios in accordance with statutory obligations. In its

internal capital planning, the Group uses a number of stress test scenarios that are more severe than the statutory

requirements.

Since 2005, the Group has been conducting quarterly stress tests showing the effects of various economic scenarios over

a period of three to five years.

There are four steps in the Group’s stress test methodology: (1) choice of scenario; (2) translation of scenario; (3) stress

test calculations; and (4) evaluation of results and methodology. The Group evaluates the main scenarios and their relevance

on an ongoing basis. The most relevant scenarios in terms of the current economic situation and related risks are analysed

at least once a year. New scenarios may be added when necessary. The scenarios form an essential part of the Group’s

capital planning in the ICAAP.

According to the stress tests, the Group is sufficiently capitalised to withstand the effects of the scenarios applied.

4. Additional information

The present report is updated on a quarterly basis and is published together with the Danske Bank Group’s interim and

annual reports. It can be downloaded from Danske Bank’s and Realkredit Danmark’s websites (at

www.danskebank.com/reports and at www.rd.dk/da-dk/investor/about-us/pages/financial-reports, respectively).

The Risk Management 2021 report, published at the same time as Annual Report 2021, contains a detailed description of

the Group’s risk organisation, capital management, risk profile, exposure and other information. The report is available at

www.danskebank.com/reports.

Danske Bank / Internal Capital Adequacy Assessment 9/10

You might also like

- Internal Capital Adequacy Assessment 2018Document10 pagesInternal Capital Adequacy Assessment 2018Ahmed FouadNo ratings yet

- Class IV-FinanceDocument19 pagesClass IV-FinanceVinayak RaoNo ratings yet

- Credit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDDocument46 pagesCredit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDzaman asadNo ratings yet

- The Simple Rules of Risk: Revisiting the Art of Financial Risk ManagementFrom EverandThe Simple Rules of Risk: Revisiting the Art of Financial Risk ManagementNo ratings yet

- Cid Mag Financial Risk Jan09Document30 pagesCid Mag Financial Risk Jan09Annapurna Vinjamuri100% (1)

- Risk Management in Commercial BanksDocument43 pagesRisk Management in Commercial BanksDave92% (12)

- Risk ManagementDocument140 pagesRisk ManagementTejas Jadhav100% (1)

- Credit Risk Management - Axis-2018Document71 pagesCredit Risk Management - Axis-2018Mohdmehraj PashaNo ratings yet

- Solvency IIDocument28 pagesSolvency IIamingwaniNo ratings yet

- Pnadk 970Document64 pagesPnadk 970Kasolo DerrickNo ratings yet

- Ismal 2010Document18 pagesIsmal 2010David FloresNo ratings yet

- Risk Management For Banking SectorDocument46 pagesRisk Management For Banking SectorNaeem Uddin88% (17)

- CIMA Mag Financial Risk Jan09Document30 pagesCIMA Mag Financial Risk Jan09cherikokNo ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument32 pagesRisk Management Systems in Banks Genesis, Significance and Implementationmahajan87No ratings yet

- Risk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarDocument9 pagesRisk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarKunTal MoNdalNo ratings yet

- (Bank Policy) BASELDocument30 pages(Bank Policy) BASELprachiz1No ratings yet

- 09 TASK PERFORMANCE 1 - GovDocument2 pages09 TASK PERFORMANCE 1 - GovJen DeloyNo ratings yet

- 1.RISK CompediumDocument95 pages1.RISK CompediumyogeshthakkerNo ratings yet

- Identification Assessment of Risks 2022 4Document13 pagesIdentification Assessment of Risks 2022 4nNo ratings yet

- 2013 FRM Level 1 Practice ExamDocument93 pages2013 FRM Level 1 Practice ExamDũng Nguyễn TiếnNo ratings yet

- Basel NormsDocument66 pagesBasel NormsShanmathiNo ratings yet

- Cid TG Fin Risk MGMT May08 PDFDocument16 pagesCid TG Fin Risk MGMT May08 PDFSheelaMaeMedinaNo ratings yet

- Chapter 1 - Risk Management in Banks and Financial InstitutionsDocument23 pagesChapter 1 - Risk Management in Banks and Financial InstitutionsSkanda Kumar100% (1)

- Risk Management IN Islamic Finance: Mahyuddin KhalidDocument24 pagesRisk Management IN Islamic Finance: Mahyuddin KhalidshittuidNo ratings yet

- Paper On Risk ManagementDocument8 pagesPaper On Risk ManagementSANTOSHNo ratings yet

- LegacyDocument42 pagesLegacyMeeroButtNo ratings yet

- Finance AssignmentDocument14 pagesFinance AssignmentWadud LimonNo ratings yet

- PG Auditing Credit Risk ManagementDocument41 pagesPG Auditing Credit Risk ManagementErik100% (5)

- Takeaways Group DDocument44 pagesTakeaways Group DVignesh ChandramohanNo ratings yet

- Risk Management and Basel II: Bank Alfalah LimitedDocument72 pagesRisk Management and Basel II: Bank Alfalah LimitedCarl RodriguezNo ratings yet

- Risk Management in The Banking SectorDocument47 pagesRisk Management in The Banking SectorGaurEeshNo ratings yet

- A Risk Framework For BanksDocument31 pagesA Risk Framework For BanksAziz RahmanNo ratings yet

- Risk Management Guidelines For Commercial Banks & DfisDocument19 pagesRisk Management Guidelines For Commercial Banks & DfisJuly SalgueroNo ratings yet

- Unit 12 Risk Management: An Overview: ObjectivesDocument33 pagesUnit 12 Risk Management: An Overview: ObjectivesSiva Venkata RamanaNo ratings yet

- 7389 RA Treasury Risk ManagementDocument14 pages7389 RA Treasury Risk ManagementZainSamiNo ratings yet

- Risk Management and Basel II: Bank Alfalah LimitedDocument72 pagesRisk Management and Basel II: Bank Alfalah LimitedtanhaitanhaNo ratings yet

- Book 1 - Foundations of Risk Management PDFDocument19 pagesBook 1 - Foundations of Risk Management PDFmohamed0% (1)

- Module 1 - Financial Regulation 1103Document51 pagesModule 1 - Financial Regulation 1103林木田No ratings yet

- Unit 13 Credit Risk Management: ObjectivesDocument41 pagesUnit 13 Credit Risk Management: ObjectivesSiva Venkata RamanaNo ratings yet

- ERM Application Case StudiesDocument62 pagesERM Application Case StudiesMarcos Araújo100% (3)

- CCFA03 - S4 Financial Institution & Risk Management - Lecture OneDocument9 pagesCCFA03 - S4 Financial Institution & Risk Management - Lecture OnemonirNo ratings yet

- TYBBI ProjectDocument57 pagesTYBBI ProjectPranav ViraNo ratings yet

- Core Risks in BankingDocument52 pagesCore Risks in BankingSoloymanNo ratings yet

- Pillar 3 USB Disclosure 6-30-17Document33 pagesPillar 3 USB Disclosure 6-30-17Siva RenjithNo ratings yet

- ERM-Application Week 7-8Document49 pagesERM-Application Week 7-8Ken TuazonNo ratings yet

- Proposal For The Bank's Risk Appetite Definition - 11 04 2011Document32 pagesProposal For The Bank's Risk Appetite Definition - 11 04 2011Dindin KamaludinNo ratings yet

- Risk Management in The Banking Basic Principles and ApproachesDocument16 pagesRisk Management in The Banking Basic Principles and ApproachesJhon McClane SuarezNo ratings yet

- Credit Risk ManagementDocument78 pagesCredit Risk ManagementSanjida100% (1)

- RFS Study NotesDocument13 pagesRFS Study NotesMaher G. BazakliNo ratings yet

- 6 - Eco749b - Ethics - Financial RegulationsDocument61 pages6 - Eco749b - Ethics - Financial Regulationsbabie naaNo ratings yet

- Financial Risk Management: BY S.LingeswariDocument26 pagesFinancial Risk Management: BY S.Lingeswarilvinoth5No ratings yet

- Effec I EncyDocument9 pagesEffec I EncyAnonymous ed8Y8fCxkSNo ratings yet

- OFR Annual Report 2021Document156 pagesOFR Annual Report 2021SeanNo ratings yet

- Risk Management and Basel II: Indian Institute of Banking and FinanceDocument31 pagesRisk Management and Basel II: Indian Institute of Banking and FinanceKaran AsraniNo ratings yet

- 9593-Risk Management Policies June 2019Document33 pages9593-Risk Management Policies June 2019Yewubdar AdugnaNo ratings yet

- Credit Risk ModellingDocument40 pagesCredit Risk ModellingSwaraj Dhar100% (2)

- Disclosure Under Basel III For 31st March 2021Document54 pagesDisclosure Under Basel III For 31st March 2021Nithin YadavNo ratings yet

- Layout 1Document32 pagesLayout 1suedtNo ratings yet

- Fact Book Q4 2021Document49 pagesFact Book Q4 2021suedtNo ratings yet

- Conference Call Presentation 2021Document36 pagesConference Call Presentation 2021suedtNo ratings yet

- Danske Bank Annual Report 2021Document236 pagesDanske Bank Annual Report 2021suedtNo ratings yet

- Latest Insider Trading - 072122Document10 pagesLatest Insider Trading - 072122suedtNo ratings yet

- Community First Bancshare ... S1a 20170209Document447 pagesCommunity First Bancshare ... S1a 20170209suedtNo ratings yet

- Debt Investor Update - Q4 2021Document51 pagesDebt Investor Update - Q4 2021suedtNo ratings yet

- Vornado Realty Trust 2016 Annual ReportDocument216 pagesVornado Realty Trust 2016 Annual ReportsuedtNo ratings yet

- Platform Solutions AR16 HRDocument175 pagesPlatform Solutions AR16 HRsuedtNo ratings yet

- Vornado Realty Trust 2016 Annual ReportDocument216 pagesVornado Realty Trust 2016 Annual ReportsuedtNo ratings yet

- Microsoft - 2017 Shareholder LetterDocument5 pagesMicrosoft - 2017 Shareholder LettersuedtNo ratings yet

- ZEN Disclosure StatementDocument78 pagesZEN Disclosure StatementsuedtNo ratings yet

- FB - 4500 Innovation Fort Collins CODocument9 pagesFB - 4500 Innovation Fort Collins COsuedtNo ratings yet

- Clifton Savings Bank S-1Document414 pagesClifton Savings Bank S-1suedtNo ratings yet

- WCRX - Event Transcript of War (59527527)Document21 pagesWCRX - Event Transcript of War (59527527)suedtNo ratings yet

- Bar Bending Schedule Notes PDF DownloadDocument6 pagesBar Bending Schedule Notes PDF DownloadGAURAV100% (1)

- SC Qual 145r4-10 Combined Document Finnish Proposal and Checklist DVS-Zert Germany ISO 3834 PDFDocument53 pagesSC Qual 145r4-10 Combined Document Finnish Proposal and Checklist DVS-Zert Germany ISO 3834 PDFAlienshowNo ratings yet

- Case#2 CEBU OXYGEN vs. DRILONDocument2 pagesCase#2 CEBU OXYGEN vs. DRILONRio TolentinoNo ratings yet

- Mnif2020 The Effect of Islamic Banks - Specific CG Mechanisms On Compliance With AAOIFI Governance StandardsDocument23 pagesMnif2020 The Effect of Islamic Banks - Specific CG Mechanisms On Compliance With AAOIFI Governance StandardsAchmad SyuqranNo ratings yet

- 71575iasb57608 Sia 130Document9 pages71575iasb57608 Sia 130mayavannanNo ratings yet

- LAWS1116 Lecture 7 - Corporations PowerDocument8 pagesLAWS1116 Lecture 7 - Corporations PowerThoughts of a Law StudentNo ratings yet

- Qatar WPS - OCT2015 FinalDocument3 pagesQatar WPS - OCT2015 Finalanwarali1975No ratings yet

- Entry and Regulation of Foreign Banks in IndiaDocument26 pagesEntry and Regulation of Foreign Banks in IndiaSuvedhya ReddyNo ratings yet

- SRC and FIADocument29 pagesSRC and FIAflordeluna ayingNo ratings yet

- Memorandum For Discharge For Property TaxesDocument4 pagesMemorandum For Discharge For Property TaxesGary Krimson100% (17)

- Professional Regulation Commission: Legal BasisDocument4 pagesProfessional Regulation Commission: Legal BasisKimberly SolisNo ratings yet

- QuestionDocument3 pagesQuestionThirah TajudinNo ratings yet

- Peter The RabbitDocument30 pagesPeter The Rabbittamiamus2002No ratings yet

- Cesti Que Vie Act 1666Document4 pagesCesti Que Vie Act 1666washscribd01100% (2)

- WA - King Couty - Building Code-2014Document87 pagesWA - King Couty - Building Code-2014pguosNo ratings yet

- 2.1 Training & Familiarisation Ship StaffDocument7 pages2.1 Training & Familiarisation Ship StaffRosaPorzioNo ratings yet

- Chapter 10 Applications To Natural Resources: ObjectiveDocument38 pagesChapter 10 Applications To Natural Resources: ObjectiveRidwan Fadil ArifNo ratings yet

- EC ChickenDocument40 pagesEC ChickenThư Huỳnh Trầm MinhNo ratings yet

- Philippines Local Government System and The Concepts of Local AutonomyDocument3 pagesPhilippines Local Government System and The Concepts of Local AutonomyBuddy Brylle YbanezNo ratings yet

- Terms and Conditions EToroDocument42 pagesTerms and Conditions EToroZhess BugNo ratings yet

- A 262 Registration EES EFTA Foreign NationalDocument5 pagesA 262 Registration EES EFTA Foreign NationalNulLaNo ratings yet

- Club Rules & Regulations: A. Oakridge Executive Club (The "Club") FacilitiesDocument4 pagesClub Rules & Regulations: A. Oakridge Executive Club (The "Club") FacilitiesChristine DumiligNo ratings yet

- Request For Proposal: Engineering, Procurement & Construction (EPC) ModeDocument84 pagesRequest For Proposal: Engineering, Procurement & Construction (EPC) ModeSwanandNo ratings yet

- Deepak Fertilisers and Petrochemicals Corporation LimitedDocument4 pagesDeepak Fertilisers and Petrochemicals Corporation LimitedSrikanth ReddyNo ratings yet

- The Determination of Equilibrium Market PricesDocument20 pagesThe Determination of Equilibrium Market Pricesapi-217192353100% (1)

- Fair Practice Code SeilDocument11 pagesFair Practice Code SeilSiddharth KumarNo ratings yet

- Rule: Income Taxes: Stock Transfer Rules Carryover of Tax AttributesDocument28 pagesRule: Income Taxes: Stock Transfer Rules Carryover of Tax AttributesJustia.comNo ratings yet

- GRS Chemical AssessmentDocument6 pagesGRS Chemical AssessmentTian TiNo ratings yet

- IAF General Brochure 0112Document8 pagesIAF General Brochure 0112VrtniPatuljakNo ratings yet

- Market Structures EditDocument26 pagesMarket Structures Editapi-213462480No ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameFrom EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameNo ratings yet

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Other People's Money: The Real Business of FinanceFrom EverandOther People's Money: The Real Business of FinanceRating: 4 out of 5 stars4/5 (34)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)