Professional Documents

Culture Documents

Ipr-7 1 2015 PDF

Uploaded by

bpkreddy6810 ratings0% found this document useful (0 votes)

12K views6 pagesOriginal Title

IPR-7.1.2015.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12K views6 pagesIpr-7 1 2015 PDF

Uploaded by

bpkreddy681Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

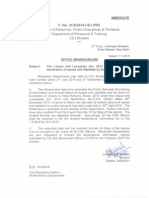

IMMEDIATE

F. No. 21/2/2014-CS.1 (PR)

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

CS.I Division

2" Floor, Loknayak Bhawan,

Khan Market, New Delhi

Dated: 7.1.2015

OFFICE MEMORANDUM

Subject: The Lokpal and Lokayktas Act, 2013 - Submission of

declaration of assets and liabilities by the public servants

Ministries/ Departments may refer to CS.| Division, DoPT's O.M. of

even number dated 31% July 2014 and 9" September 2014 on the subject

mentioned above

2. The Government has since amended the Public Servants (Furnishing

of Information and Annual Return of Assets and Liabilities and the limits for

Exemption of Assets in Filing Retums) Rules, 2014 under the Lokpal and

Lokayuktas Act, 2013 vide Notification No.G.S.R. 918(E) dated 26"

December 2014, in terms of which, the last date of revised returns of assets

and liabilities by public servants has been extended to 30" April 2015. The

Notification is available on the website of this Department. Further, the Govt

have also modified Form No.II and Form No. IV for filing of the retums. The

revised formats are attached herewith. Accordingly, all the CSS Officers

shall be required to file the revised declarations, information as on the

18.2014 by 30.4.2015,

3. The extended date and the modified formats for filing of the returns

may be brought to the notice of all CSS Officers. Ministries/ Departments

ate also requested to forward the declarations, information, returns

submitted by US and above level officers of CSS to CS.I Division, DoPT for

records,

(uth ri)

rector

Telefax: 24629411

Encl.: As above

Joint Secretary (Admn.)

All Ministries/ Departments

APPENDIX-1

fRule3(1)

Return of Assets and Liabilities on First Appointment or as on the 1 August, 2014/31" March 20....*

(Under Sec.44 of the Lokpal and Lokayuktas Act, 2013)

1. Name of the Public servant in full

{in block letters)

2. (a) Present public position held

(Designation, name and address

of organization)

(b) Service to which belongs

{if applicable)

Declaration:

I hereby declare that the return enclosed namely, Forms | to IV are complete, true and correct to the

best of my knowledge and belief, in respect of information due to be furnished by me under the

provisions of section 44 of the Lokpal and Lokayuktas Act, 2013.

Date ... Signature

in case of first appointment please indicate date of appointment.

Note 1: This return shall contain particulars of all assets and liabilities of the public servant either in his/her

‘own name or in the name of any other person. The return should include details in respect of

assets/liabilties of spouse and dependent children as provided in Section 44(2) of the Lokpal and

Lokayuktas Act, 2013,

(Section 44(2}: A public servant shall, within a period of thirty days from the date on which he

makes and subscribes an oath or affirmation to enter upon his office, furnish to the competent

authority the information relating to

{a) The assets of which he, his spouse and his dependent children are, jointly or severally, owners

or beneficiaries;

(b) His liabilities and that of his spouse and his dependent children.)

Note 2: If a public servant is a member of Hindu Undivided Family with co-parcenary rights in the properties

of the family either as a ‘Karta’ or as a member, he should indicate in the return in Form Noll the

value of his share in such property and where It Is not possible to indicate the exact value of such

share, its approximate value, Suitable explanatory notes may be added wherever necessary.

Note 3: “dependent children” means sons and daughters who have no separate means of earning and are

wholly dependent on the public servant for their livelihood. (Explanation below Section 44(3) of

Lokpal and Lokayuktas Act, 2013

APPENDIX.

Rule 3(1

FORM No.l

Details of Public Servant, his/her spouse and dependent children

Public Position held, Whether return being

if any filed by him/her,

separately

1 [self

2 [Spouse

3 |Dependent-1

4 |Dependent-2

S* [Dependent-3

+ Add more rows, if necessary.

Date Signature

FORM No.l

Statement of movable property on first appointment or as on 1.8.2014/31st March 20.

(Use separate sheets for self, spouse and each dependent child )

Name of public servant/spouse/dependent child

Sno [ Description Remar Fany

{)* [Cashin Bank Balance

(iy [insurance (Premia paid)

Fixed/Recurring Deposit(e)

[shares/Bonds

[Matual Fundis)

Pension Scheme/Provident Fund

Other investments, any

Personal loans/ advance given to any person or entity including Firm, Company, Trust, ete

land other receivables from debtors and the amount (exceeding two months basic pay or|

[Rupees One lakh as the case may be)

Motor Vehicles

(Details of Make/registration number / year of purchase and amount paid)

liewellery

[Give details of approximate weight (plus or minus 10 gms in respect of gold and precious

stones, plus or minus 100 gms in respect of slver)]

[core

iver

[Precious metals and precious stones

[Composite tems

(indicate approximate value)***

[Any other assets (Give detials of movable assets not covered i (i) to (v) above]

fa) Furniture

[(b) Fotures

(ey Antiques

(d) Paintings

[e) Electronic equipments

(Others

[indicate the details of an asset, only if the total current value of any particular asset in any,

particular category (e.g. furniture, fixtures, electronic equipments, etc.) exceeding two

Jmonths basic pay or Rs 1.00 lakhs, as the case may be]

Date Signature .

“= Details of deposits in the foreign Bank(s) to be given separately,

"+ Investments above Rs. 2 lakhs to be reported individually. Investments below Rs. 2 lakhs may be reported together.

***. Value indicated in the first return need not be revised in subsequent returns as long as no new composite item had been

‘acquired or no existing items had been disposed of, during the relevant year,

ua1 Jo yuawiAed ayy jo Ayoipouiad ayy pue ‘wai Buo] 10 way WOYs S11 JayTaYM ‘asea] aya 40 way ay) 40 aandadsaus! UUUN|OD SID

Lu; umoys aq pinoys asea] e yons ‘ueALaS quaLUZaAoD al Yale sBUljeap [e!240 BuIAEY UosiAd e WO paulego 5) Auadosd aiqenowUs Jo asea) aya ‘sanaMOY “914M

quad Ajseak e Buyuasai J0 Jeak uo Suypaanxa wa} Aue 404 10 49K 0} 1eaK wos AYadosd ajqenowul jo aseaj & UeALY Pjnom ,2sea}, WHO} B42 “6 UNJO Jo asodand 404: 9:0N,

aimeusis ae al

“wonsinboe Jo 2509]

ue (mojaq T 210N 225}

aseaig) (pauseouon|

suosiad/uossad

‘aya yaim ‘Aue

‘quenas wauusano5|

‘yp 4o uons2uuo09|

ue ssasppe]

pasinboe wou auenias (2x9

(paresipur] wo suosiad /uosiad jand ay oy Aue| ‘yaquinu announsip

aq Aew sosievap yum \ysuonea ur ose pue

*huadorg]anjenxosdde) aweu pue (asimsayno| say/siy ‘Auadosd] (s8uipyngl parenys si Auadoid] (219 jexnsnpul

ay woy} ‘umouy rou) 30 4t8 ‘aouewayul pue pjoy oweu papuel} pue purl] aya yoiya ui aBeyn| /Soys/e}

awoouil anjen zexe s)] ——_‘aseay ‘ole 0U soy ul ares 4o.aseo] 40 asea] pueynjey ‘uoisinig} —_/asnoH/puer)

renuue|Ayadoig aun jo|‘aseysund Aq sayroym)| uonysinboe| quensas ayqnd| ysasoqui] ur puel| 1) pue}|_‘sounsIq Jo owen) ‘Auadoig] “ont

syeway] evo] anjenquasaig Pauinbse mow] jo ayeq|jo aweu ul yous] joruerxa] jo amen] _joeary| _UoneD0| asi2014) _jouondurseq] 5}

Tusipyy wapuadap pue asnods s04/s1y queAr9s 24nd Aq PIOH |

(212 ‘s8u1pying say9 ‘sdoys ‘asno4 ‘spuey 2)

jSdOUE 3|qEAOWILN| JO WSUOIETS

‘ON WHOS

JeNPIAIPU! Woy pue juaLWULaR

aneis/ieswuag ‘suompsut je!sueuy ‘salueduod ‘syueq Wo4y Uaye) (T 210N Ul anjen au Sujpa92%a) sBouenpe PUe SUED] SNOLIeA apnjouI pINoYs jaWiayeIs BYL -Z AION

papnyou! aq ou paau sase2 1ay}0 U! Ye] OO'T'SY pue (alqeatidde a18ym) Aed 21Seq syuOW om} BuIpaaax— JOU SUED] Jo SWAY JENPIAIPUI : @I0N

aumeuais area

z s v z

(vaspiuo|

qunowe quapuadag 10 asnods/sj95)

syreway pue Amigeiijgap so a1eN) 4oupain Jo ssauppy pue awen 20yqaa] “ons

12 DAW ISTE/PTOZ'S'T UO Se 10 uBUNUIOdde ys1y UO sarge JayIO pue sigag Jo IUawAIEIS

AVON WHOS

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ipr-7 1 2015 PDFDocument6 pagesIpr-7 1 2015 PDFbpkreddy681No ratings yet

- Gazette Notification On LokapalDocument1 pageGazette Notification On Lokapalbpkreddy681No ratings yet

- 45 2015 PDFDocument10 pages45 2015 PDFbpkreddy681No ratings yet

- All India Association of Central Excise Gazetted Executive OfficersDocument1 pageAll India Association of Central Excise Gazetted Executive Officersbpkreddy681No ratings yet

- Izt Order 2015 PDFDocument12 pagesIzt Order 2015 PDFbpkreddy681100% (1)

- Off Odr192 2014 Annexure 2 PDFDocument12 pagesOff Odr192 2014 Annexure 2 PDFbpkreddy681No ratings yet

- Off Odr192 2014 Annexure I PDFDocument37 pagesOff Odr192 2014 Annexure I PDFbpkreddy681No ratings yet

- Trade Notice - Hyd Zone.Document61 pagesTrade Notice - Hyd Zone.bpkreddy681No ratings yet

- Audit OrderDocument6 pagesAudit OrderVigneshwar Raju PrathikantamNo ratings yet

- Supdt - Inter ZonalDocument12 pagesSupdt - Inter ZonalVigneshwar Raju PrathikantamNo ratings yet

- Annexure I To IVDocument9 pagesAnnexure I To IVbpkreddy681No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)