Professional Documents

Culture Documents

Due Dates April 2014

Uploaded by

Ramesh KrishnanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Due Dates April 2014

Uploaded by

Ramesh KrishnanCopyright:

Available Formats

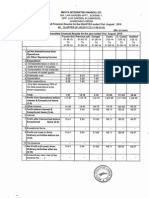

Yoganandh & Ram, Chartered Accountants

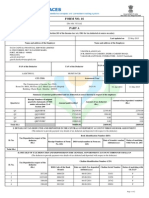

DATE

PURPOSE

FORM NO. / CHALLAN NO.

COMPLIANCE REQUIRED

10-Apr-14

EXCISE

ER 1

Monthly returns for production and removal of goods and cenvat credit for Mar 2014

10-Apr-14

EXCISE

ER 2

Monthly returns of excisable goods manufactured & receipt of inputs & capital goods by units

in eou, stp, htp for Mar 2014

10-Apr-14

EXCISE

ER 6

Monthly returns of informations relating to principal inputs for Mar 2014 by manufacturer of

specified goods who paid duty>=Rs. 1 crore during fy 2013-14 by PLA/cenvat/both

10-Apr-14

EXCISE

ER 3

Quarterly returns of production and removal of goods by SSI for the quarter ending Mar 2014

CST/TN VAT

FORM 1 / FORM I

Monthly returns and payment of cst and vat collected during Mar 2014 for assessees whose

yearly sales turnover > Rs. 200 crores in the fy 2013-14

CST/TN VAT

FORM 1 / FORM I

EXCISE

ER 8

Monthly returns and payment of cst and vat collected during Mar 2014 for assessees whose

yearly sales turnover > Rs. 200 crores in the fy 2013-14

Quarterly returns of assessees paying 1% or 2% excise and not manufacturing any other

goods for quarter ending Mar 2014

EXCISE

ER 3

12-Apr-14

14-Apr-14

15-Apr-14

15-Apr-14

Quarterly return of cenvat by first stage and second stage dealers for quarter ending Mar 2014

Payment of epf contribution for Mar 2014

15-Apr-14

EPF

15-Apr-14

EPF

12A

15-Apr-14

EPF

5 /10

Monthly returns of employees who joined/left the organisation in Mar 2014

15-Apr-14

PT

Payment of professional tax for half year ending oct 2013 to Mar 2014

21-Apr-14

EXCISE

ER 3

Quarterly return of production, removal and cenvat by specified manufacturers of yarns and

ready made garments for quarter ending Mar 2014

21-Apr-14

CST/TN VAT

FORM 1 / FORM I

21-Apr-14

ESI

25-Apr-14

SERVICE TAX

ST 3

25-Apr-14

SERVICE TAX

ST 3A

30-Apr-14

INCOME TAX

281

30-Apr-14

INCOME TAX

26QAA

30-Apr-14

EXCISE

ER 5

30-Apr-14

EXCISE

ER 7

30-Apr-14

SERVICE TAX

ST 3

30-Apr-14

EPF

3A

30-Apr-14

EPF

6A

30-Apr-14

INCOME TAX

COPY OF 60/61

Consolidated statements of dues and remittances under epf and edli for Mar 2014

Monthly returns and payment of cst and vat collected during Mar 2014 for assessees whose

yearly sales turnover <Rs. 200 crores in the fy 2013-14

Deposit of esi contributions and collections for Mar 2014

Half yearly return for the half year ending 31st March 2014

Memorandum of provisional deposits provisional assessment cases half yearly returns

Payment of tds on credits given on 31st Mar 2014

Quarterly return of non-deduction of tax at source u/s 206a for quarter ending Mar 2014

Annual declaration on principal inputs by assessees who in fy 2013-14 paid>=Rs. 1 crore as

pla/cenvat/both

Annual installed capacity statement by all assessees

Half yearly return for period ending 31st Mar 2014 by input service distributors

Annual returns showing monthwise recoveries from members

Consolidated annual contribution statement

Forwarding of copies of declaration in form 60/61 (not being received at the time of opening a

bank account) received between 1st oct and 31st mar to dit and cit

You might also like

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Dvat ReplyDocument1 pageDvat ReplyABHISHEKNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Submission March 2014Document7 pagesSubmission March 2014332156879554No ratings yet

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaNo ratings yet

- Tax Audit RequirementDocument2 pagesTax Audit Requirementbh_mehta_06No ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Submission February 2014Document6 pagesSubmission February 2014332156879554No ratings yet

- Name/Title of Required Report Legal/Regulatory Basis FrequencyDocument6 pagesName/Title of Required Report Legal/Regulatory Basis FrequencyAnonymous gzsN1pQRNo ratings yet

- Statutory Compliances - GeneralDocument25 pagesStatutory Compliances - GeneralajaydhageNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Important Financial Date(s) Reminder For Fin. Year-2014-2015Document16 pagesImportant Financial Date(s) Reminder For Fin. Year-2014-2015SureshArigelaNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- 25 - MCQ Late Filing Fees and PenaltyDocument12 pages25 - MCQ Late Filing Fees and PenaltyParth UpadhyayNo ratings yet

- Tax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableDocument1 pageTax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableCA Arpit YadavNo ratings yet

- ANKIT DESAI - 7778044242: Naresh Tradelink Pvt. LTDDocument1 pageANKIT DESAI - 7778044242: Naresh Tradelink Pvt. LTDAnkit A DesaiNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Reminder-I: Modern IndustriesDocument3 pagesReminder-I: Modern IndustriesManoj Kumar TanwarNo ratings yet

- Income Tax Return Due Date ExtensionDocument2 pagesIncome Tax Return Due Date Extensionbh_mehta_06No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Return of IncomeDocument13 pagesReturn of IncomeParth UpadhyayNo ratings yet

- GENSANDocument73 pagesGENSANraffyNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Rap2x Love Taka SobraDocument18 pagesRap2x Love Taka SobraRalph Christer MaderazoNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document3 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Aleena Textile Reply After Appeal OrderDocument2 pagesAleena Textile Reply After Appeal OrderAsif IqbalNo ratings yet

- Professional Training ReportDocument10 pagesProfessional Training Reportjaya sreeNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For February 28, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For February 28, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Do RememberDocument6 pagesDo RememberRohit KariwalaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- All About Tds and AccountsDocument6,872 pagesAll About Tds and AccountsNikhil KasatNo ratings yet

- Financial Calendar 2011-12Document3 pagesFinancial Calendar 2011-12Delma SebastianNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For March 31, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- LetterDocument2 pagesLetterShiv Kiran SademNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Payu Payments Private Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014Document74 pagesPayu Payments Private Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014junkyNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Result)Document13 pagesFinancial Results & Limited Review For Sept 30, 2014 (Result)Shyam SunderNo ratings yet

- Assessment ProcedureDocument7 pagesAssessment Procedurebabajan_4No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 1Q14 Quarterly Information (ITR)Document99 pages1Q14 Quarterly Information (ITR)MPXE_RINo ratings yet

- Key Dates November 2014 DUE Dates Particulars Form / Challan NumberDocument2 pagesKey Dates November 2014 DUE Dates Particulars Form / Challan NumberAnkur AroraNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderNo ratings yet

- Annual Report 2014 Prime Bank PDFDocument443 pagesAnnual Report 2014 Prime Bank PDFripon117No ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Raymond (Design of Warehouse Ops)Document11 pagesRaymond (Design of Warehouse Ops)rizwan bajwaNo ratings yet

- Shape Shape 2 BLADDocument1 pageShape Shape 2 BLADInterweave50% (2)

- Sherry Serafini - GliteratiDocument7 pagesSherry Serafini - GliteratiMary008100% (3)

- Ict - 9Document5 pagesIct - 9Joshkorro GeronimoNo ratings yet

- Lotus Fiber StudyDocument47 pagesLotus Fiber StudyArts and WeavesNo ratings yet

- Allen Solly Case StudyDocument3 pagesAllen Solly Case Studydjdhananjaykr0% (1)

- Winter Wonderland 17 Winter Patterns To Crochet PDFDocument65 pagesWinter Wonderland 17 Winter Patterns To Crochet PDFinformatica.paula6988100% (1)

- 4579 10715 1 SM 1 PDFDocument14 pages4579 10715 1 SM 1 PDFPutriiNo ratings yet

- International Sales Business Development Director in United States Resume Eric BardetDocument1 pageInternational Sales Business Development Director in United States Resume Eric BardetEricBardetNo ratings yet

- Industrial VisitDocument18 pagesIndustrial VisitRakshith RockNo ratings yet

- Masita CatalogusDocument99 pagesMasita CataloguspavlikdcNo ratings yet

- Hannah Nelson The Retail Environment Wednesday 12:00pmDocument13 pagesHannah Nelson The Retail Environment Wednesday 12:00pmDanielleMuntyan100% (1)

- Report On The Lembaga Ilmu Pengetahuan IDocument127 pagesReport On The Lembaga Ilmu Pengetahuan IiwanNo ratings yet

- Fabindia - A Silent Social WorkerDocument8 pagesFabindia - A Silent Social Workershiva snekhaNo ratings yet

- 3m Emi Shielding TapeDocument8 pages3m Emi Shielding TapebernardNo ratings yet

- PantaloonsDocument14 pagesPantaloonsMeenakshi Dixit100% (1)

- DNCSDocument20 pagesDNCSksankar_2005No ratings yet

- Clothing E-Commerce Site Business Plan PDFDocument28 pagesClothing E-Commerce Site Business Plan PDFअभितोष यादवNo ratings yet

- Bridal Buyer Jul Agosto 2012Document100 pagesBridal Buyer Jul Agosto 2012mohzgoNo ratings yet

- SeraQuestC PXDocument4 pagesSeraQuestC PXTrinhTruongNo ratings yet

- Chemicals-In-textiles Risk To Human Health and The EnvironmentDocument142 pagesChemicals-In-textiles Risk To Human Health and The EnvironmentJuan CubasNo ratings yet

- Cassava Flour Session 2 Current UseDocument103 pagesCassava Flour Session 2 Current UseestiononugrohoNo ratings yet

- Eco Labelling PDFDocument9 pagesEco Labelling PDFPravin KumarNo ratings yet

- Pfaff 261-262Document57 pagesPfaff 261-26216711070444970% (1)

- TM-10-8340-221-13 Tent Shelter Half and MountainDocument32 pagesTM-10-8340-221-13 Tent Shelter Half and Mountainc126358100% (1)

- Stretch Conductive Fabric: 49OO - Technical DatasheetDocument1 pageStretch Conductive Fabric: 49OO - Technical DatasheetAdrian PramantaNo ratings yet

- Assignment 3 International BusinessDocument24 pagesAssignment 3 International BusinessHa PhuongNo ratings yet

- A Study On Financial Statement Analysis of Lakshmigraha Worldwide IncDocument77 pagesA Study On Financial Statement Analysis of Lakshmigraha Worldwide IncSurendra SkNo ratings yet

- Ril Ar 2013-14 - 21052014Document292 pagesRil Ar 2013-14 - 21052014dhaval2011No ratings yet

- Sme Report Toc March 2023Document9 pagesSme Report Toc March 2023shantanu soniNo ratings yet