Professional Documents

Culture Documents

All in Rate - Skilled Labour

Uploaded by

LokuliyanaN0 ratings0% found this document useful (0 votes)

52 views1 pageestimation

Original Title

1. All in Rate- Skilled Labour

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentestimation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

52 views1 pageAll in Rate - Skilled Labour

Uploaded by

LokuliyanaNestimation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

All in rate for a skilled labor calculation-Example

Question-Calculation of All-in rate for skilled labour-Hourly all-in rate for labour to be calculated

Number of weeks per year 49

Hours per week 44 (8 hours per day)

Annual holidays per year 14 days (should deduct form total number of hours)

Sick leave per year 21 days (should deduct form total number of hours)

Public holidays per year 25 days (should deduct form total number of hours)

Allow 2% for inclement weather and non productive

Basic weekly wage of a craftsman Rs. 6500.00

Employers contribution for EPF and ETF 15%

Insurance scheme 3.5% paid by employer

Allow for Tool money 2.5%

Answer

Total Number of hours

49

Weeks

44

Hrs per week

Deduct

Number of hours for Annual Holidays

Number of hours for Annual leaves

Number of hours for Public Holidays

14

21

25

Days

Days

Days

x

x

x

8

8

8

Hrs per day

Hrs per day

Hrs per day

Total working hours

Deduct

Number of hours for Inclement whether

2%

From

1,676.00

Hrs

Say

(33.52)

(34.00)

Hrs

Hrs

Hrs

Hrs

2

3

4

Hrs

1+2+3+4

Hrs

1,642.00

Weekly wage for a skilled labour

Rs.

6500

Yearly wage for a skilled labour

Rs.

6500

49

15.0%

3.5%

2.5%

x

x

x

318,500.00

318,500.00

318,500.00

Weeks

Total per year

Hourly rate per hour

(112.00)

(168.00)

(200.00)

1,676.00

Number of productive hours

Add:

15 % ETF/EPF

3.5% for insurance

2.5% for tool money

2,156.00

Total amount spend per skilled labour

Total Number of actual working hours

1+2+3+4+5

318,500.00

47,775.00

11,147.50

7,962.50

b

c

d

385,385.00

a+b+c+d

385,385.00

1,642.00

All in rate for a skilled labour

234.70

Per Hour

You might also like

- Planning Plant ProductionDocument10 pagesPlanning Plant ProductionjokoNo ratings yet

- Overtime Pay in The PhilippinesDocument4 pagesOvertime Pay in The PhilippinesReinaflor TalampasNo ratings yet

- OEE CalculatorDocument11 pagesOEE CalculatorosbertodiazNo ratings yet

- 01-02-03-Aggregate Sales & Operations PlanningDocument65 pages01-02-03-Aggregate Sales & Operations Planningfriendajeet123No ratings yet

- Risk Management - Insurances, Bonds and Collateral Warranties-1Document68 pagesRisk Management - Insurances, Bonds and Collateral Warranties-1LokuliyanaNNo ratings yet

- 3.1 Work Measurement - Time Study - W4Document28 pages3.1 Work Measurement - Time Study - W4Saiful Azrie100% (1)

- HR Manager KPIDocument4 pagesHR Manager KPIAyman MotenNo ratings yet

- Aggregate Production Planning in Industrial EngineeringDocument26 pagesAggregate Production Planning in Industrial EngineeringSuneel Kumar MeenaNo ratings yet

- Ocupational HealthDocument19 pagesOcupational HealthLokuliyanaNNo ratings yet

- Incentives: Presentation By: Omkar Chodankar Rupesh Padwalkar Vivek Narvekar Naresh Gosavi Mandar UpadhyeDocument45 pagesIncentives: Presentation By: Omkar Chodankar Rupesh Padwalkar Vivek Narvekar Naresh Gosavi Mandar UpadhyepavithralalNo ratings yet

- Production Planning and ControlDocument80 pagesProduction Planning and ControlRazi Haziq100% (1)

- Negligence Project Manager in Construction Industry English Literature EssayDocument21 pagesNegligence Project Manager in Construction Industry English Literature EssayLokuliyanaNNo ratings yet

- Chapter 18 - Recording Payroll TransactionsDocument64 pagesChapter 18 - Recording Payroll Transactionsshemida100% (2)

- A Comparison of NEC and JCTDocument3 pagesA Comparison of NEC and JCTArul Sujin100% (2)

- Employee ProductivityDocument45 pagesEmployee Productivitywintoday01100% (2)

- Building ProcurementDocument27 pagesBuilding ProcurementLokuliyanaNNo ratings yet

- Role of The Quantity SurveyorDocument13 pagesRole of The Quantity SurveyorLokuliyanaNNo ratings yet

- Remote Projects Follow-up with Scrum-Excel Burn Down Chart: Scrum and Jira, #1From EverandRemote Projects Follow-up with Scrum-Excel Burn Down Chart: Scrum and Jira, #1No ratings yet

- Motivation and Reward SystemDocument25 pagesMotivation and Reward SystemAbhinav JhaNo ratings yet

- AccountingDocument9 pagesAccountingButternut23No ratings yet

- Accounting For Factory LaborDocument37 pagesAccounting For Factory LaborLeonard GumapacNo ratings yet

- AFARDocument38 pagesAFARRazmen Ramirez PintoNo ratings yet

- 4920240419191256-Summary Discussion MidtermDocument11 pages4920240419191256-Summary Discussion Midtermsanycarlos101202No ratings yet

- Hours Days Hours: Total Time Per DayDocument4 pagesHours Days Hours: Total Time Per DayIbrahim El SharNo ratings yet

- Work Order, Warrants, PWE, Idle Time, Incentive BonusDocument45 pagesWork Order, Warrants, PWE, Idle Time, Incentive BonusSATYENDRA KUMARNo ratings yet

- Pricing Information Batch 5&6 T2.2Document2 pagesPricing Information Batch 5&6 T2.2LokuliyanaNNo ratings yet

- Aggregate PlanningDocument57 pagesAggregate Planningamitr_scribdNo ratings yet

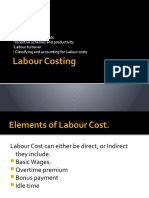

- Labour CostDocument3 pagesLabour CostQuestionscastle FriendNo ratings yet

- E 28 Calculating Physician ProductivityDocument8 pagesE 28 Calculating Physician ProductivitySema Sadullayeva02No ratings yet

- Fma - 3Document35 pagesFma - 3Hammad QasimNo ratings yet

- Conditions and EmploymentDocument54 pagesConditions and EmploymentBenedict SheaNo ratings yet

- Compensation Problem ExcersizeDocument9 pagesCompensation Problem ExcersizesephNo ratings yet

- 218acc205 Handouts3 LaborDocument3 pages218acc205 Handouts3 LaborCynthia PenoliarNo ratings yet

- ViewPDF PDFDocument17 pagesViewPDF PDFaishwarya bhusandeNo ratings yet

- CH 3Document18 pagesCH 3Dejene DayNo ratings yet

- Incentive Scheme 21 JET 1Document39 pagesIncentive Scheme 21 JET 1Saptarshi PalNo ratings yet

- Learning & Experience CurveDocument28 pagesLearning & Experience CurvewaqasalitunioNo ratings yet

- D2 Accounting For LabourDocument13 pagesD2 Accounting For LabourNkatlehiseng MabuselaNo ratings yet

- Unit 3 Accounting For Labour CostsDocument54 pagesUnit 3 Accounting For Labour Costsjoseswartzsr31No ratings yet

- Corporate Planning Manish Maheswari 140Document29 pagesCorporate Planning Manish Maheswari 140Manish MaheswariNo ratings yet

- Prime Cost of Daywork Rates 2014-15Document1 pagePrime Cost of Daywork Rates 2014-15Peter Jean-jacquesNo ratings yet

- Ch16 Aggregate PlanningDocument3 pagesCh16 Aggregate PlanningPutri Rizky DwisumartiNo ratings yet

- Labour Cost ProblemsDocument5 pagesLabour Cost ProblemsM211110 ANVATHA.MNo ratings yet

- Wage Rates (Labor Law I)Document9 pagesWage Rates (Labor Law I)Miguel Anas Jr.No ratings yet

- Frequently Asked Questions - NWPCDocument16 pagesFrequently Asked Questions - NWPCNap MissionnaireNo ratings yet

- Nigel Mutukwa Question 9 PresentationDocument10 pagesNigel Mutukwa Question 9 PresentationJeremiah NcubeNo ratings yet

- LABOUR Problems 2024 2Document8 pagesLABOUR Problems 2024 2Umra khatoonNo ratings yet

- Productivity 20-01-2014Document15 pagesProductivity 20-01-2014Shibli ShadikNo ratings yet

- Solutions Manual: Ch30-Compensation Systems-S: Review QuestionsDocument9 pagesSolutions Manual: Ch30-Compensation Systems-S: Review QuestionsASAD ULLAHNo ratings yet

- Article 87. Overtime Work. Work May Be Performed Beyond Eight Hours A Day Provided ThatDocument4 pagesArticle 87. Overtime Work. Work May Be Performed Beyond Eight Hours A Day Provided ThatMoises A. AlmendaresNo ratings yet

- MBA6404 - Managing For Productivity & Quality: Session 02: MEASUREMENT OF Productivity and Productivity BenchmarkingDocument34 pagesMBA6404 - Managing For Productivity & Quality: Session 02: MEASUREMENT OF Productivity and Productivity BenchmarkingNilushi FonsekaNo ratings yet

- Employees Gross Earnings and Incentive Pay PlanDocument17 pagesEmployees Gross Earnings and Incentive Pay PlanErickajean Cornelio LabradorNo ratings yet

- Aggregate Planning Transportation MethodDocument28 pagesAggregate Planning Transportation Methodchuankit92No ratings yet

- Basic Pay 1000 12000 DA 200 2400 Bonus 240 2880 120 1440 Other Allowance 250 3000 1810 21720 Employer's Contribution To PFDocument15 pagesBasic Pay 1000 12000 DA 200 2400 Bonus 240 2880 120 1440 Other Allowance 250 3000 1810 21720 Employer's Contribution To PFParth VijayNo ratings yet

- Accounting For Labor: 2 Compositions of Factory PayrollDocument33 pagesAccounting For Labor: 2 Compositions of Factory PayrollolafedNo ratings yet

- CHAP 6 9 Business MathematicsDocument21 pagesCHAP 6 9 Business MathematicsCressa Catacutan75% (4)

- Accounting For LabourDocument43 pagesAccounting For LabourMunyaradzi Onismas ChinyukwiNo ratings yet

- Labour CostDocument22 pagesLabour CostNeetu KhandelwalNo ratings yet

- Process CostDocument3 pagesProcess Costaroraankur12No ratings yet

- Labor CostingDocument34 pagesLabor CostingnimraNo ratings yet

- KPI CalcDocument12 pagesKPI Calchraj1350% (2)

- Lec 10 QSCE LabourDocument38 pagesLec 10 QSCE LabourRajaAsdylNo ratings yet

- Aggregate PlanningDocument42 pagesAggregate PlanningMadhavan DakshNo ratings yet

- Ch19 Aggregate PlanningDocument3 pagesCh19 Aggregate Planningnurul_azizah01No ratings yet

- Labour CostingDocument26 pagesLabour CostingArunkumar MyakalaNo ratings yet

- Interrelation Between TEVT and General EducationDocument9 pagesInterrelation Between TEVT and General EducationLokuliyanaNNo ratings yet

- Jan 2017-2 DR Nimsiri PrasantaionDocument44 pagesJan 2017-2 DR Nimsiri PrasantaionLokuliyanaNNo ratings yet

- Summary of BOQ: A PreliminariesDocument4 pagesSummary of BOQ: A PreliminariesLokuliyanaNNo ratings yet

- Curriculum Advisory Committees Engineering TechnologyDocument2 pagesCurriculum Advisory Committees Engineering TechnologyLokuliyanaNNo ratings yet

- MM MMDocument19 pagesMM MMjoseph_dadaNo ratings yet

- CDC Members ET & ITDocument4 pagesCDC Members ET & ITLokuliyanaNNo ratings yet

- Minuets of The Second SCTVE MeetingDocument11 pagesMinuets of The Second SCTVE MeetingLokuliyanaNNo ratings yet

- Malasiya ReportDocument3 pagesMalasiya ReportLokuliyanaNNo ratings yet

- Criteria Comments Achievement (Y / N)Document7 pagesCriteria Comments Achievement (Y / N)LokuliyanaNNo ratings yet

- Dying To Work Health and Safety in SrilanksDocument4 pagesDying To Work Health and Safety in SrilanksLokuliyanaNNo ratings yet

- Criteria Comments Achievement (Y / N)Document7 pagesCriteria Comments Achievement (Y / N)LokuliyanaNNo ratings yet

- Model Answers Cost Studies 2013 AugDocument7 pagesModel Answers Cost Studies 2013 AugLokuliyanaNNo ratings yet

- Department of Technology Education Faculty of Science and TechnologyDocument2 pagesDepartment of Technology Education Faculty of Science and TechnologyLokuliyanaNNo ratings yet

- Assignment - Professional Commiunications and Negotiation Skills-1Document5 pagesAssignment - Professional Commiunications and Negotiation Skills-1LokuliyanaN33% (3)

- Tortlaw 1Document33 pagesTortlaw 1LokuliyanaNNo ratings yet

- Explaining Negligence in The Construction IndustryDocument2 pagesExplaining Negligence in The Construction IndustryLokuliyanaNNo ratings yet

- Contract CloseoutDocument12 pagesContract CloseoutLokuliyanaNNo ratings yet

- Contract Close Out Discussion Questions 2 Complete AnswerDocument6 pagesContract Close Out Discussion Questions 2 Complete AnswerLokuliyanaNNo ratings yet

- Vet GhanaDocument69 pagesVet GhanaTariq RahimNo ratings yet

- Establishment of College of Education For TechnologyDocument1 pageEstablishment of College of Education For TechnologyLokuliyanaNNo ratings yet

- Constract LawDocument1 pageConstract LawLokuliyanaNNo ratings yet

- Plan 2 Task2Document1 pagePlan 2 Task2LokuliyanaNNo ratings yet

- Best Practice Teachers ResourcesDocument7 pagesBest Practice Teachers Resourcesapi-243721743No ratings yet

- Construction TechnologyDocument15 pagesConstruction TechnologyLokuliyanaNNo ratings yet