Professional Documents

Culture Documents

Tax

Uploaded by

Cristina Kiki NiculaeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax

Uploaded by

Cristina Kiki NiculaeCopyright:

Available Formats

7/5/2015

TaxWikipedia,thefreeencyclopedia

Tax

FromWikipedia,thefreeencyclopedia

Atax(fromtheLatintaxo"rate")isafinancialchargeorotherlevyimposeduponataxpayer(an

individualorlegalentity)byastateorthefunctionalequivalentofastatetofundvariouspublic

expenditures.[1]Afailuretopay,orevasionoforresistancetotaxation,isusuallypunishablebylaw.

Taxesarealsoimposedbymanyadministrativedivisions.Taxesconsistofdirectorindirecttaxesand

maybepaidinmoneyorasitslabourequivalent.Fewcountriesimposenotaxationatall,suchasthe

UnitedArabEmirates.[2]

Contents

1Overview

2Purposesandeffects

3Kindsoftaxes

3.1Taxesonincome

3.2Socialsecuritycontributions

3.3Taxesonpayrollorworkforce

3.4Taxesonproperty

3.5Taxesongoodsandservices

3.6Tariff

3.7Othertaxes

3.8Descriptivelabelsgivensometaxes

3.9Feesandeffectivetaxes

4History

4.1Taxationlevels

4.2Formsoftaxation

5Economiceffects

5.1Taxincidence

5.2Increasedeconomicwelfare

5.3Reducedeconomicwelfare

6Taxationindevelopingcountries

6.1Keyfacts

6.2Summary

7Viewsontaxation

7.1Supportfortaxation

7.2Oppositiontotaxation

7.3Socialistview

7.4Taxchoice

7.5GeoistView

8Theoriesontaxation

8.1Laffercurve

8.2Optimaltax

8.3Taxrates

9Seealso

9.1Bycountryorregion

10Notes

11Furtherreading

12Externallinks

http://en.wikipedia.org/wiki/Tax

1/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Overview

Thelegaldefinitionandtheeconomicdefinitionoftaxesdifferin

thateconomistsdonotregardmanytransferstogovernmentsas

taxes.Forexample,sometransferstothepublicsectorare

comparabletoprices.Examplesincludetuitionatpublic

universitiesandfeesforutilitiesprovidedbylocalgovernments.

Governmentsalsoobtainresourcesby"creating"moneyand

coins(forexample,byprintingbillsandbymintingcoins),

throughvoluntarygifts(forexample,contributionstopublic

universitiesandmuseums),byimposingpenalties(suchastraffic

PieterBruegheltheYounger,Thetax

fines),byborrowing,andbyconfiscatingwealth.Fromtheview

collector'soffice,1640

ofeconomists,ataxisanonpenal,yetcompulsorytransferof

resourcesfromtheprivatetothepublicsectorleviedonabasis

ofpredeterminedcriteriaandwithoutreferencetospecificbenefitreceived.

Inmoderntaxationsystems,governmentslevytaxesinmoneybutinkindandcorvetaxationare

characteristicoftraditionalorprecapitaliststatesandtheirfunctionalequivalents.Themethodof

taxationandthegovernmentexpenditureoftaxesraisedisoftenhighlydebatedinpoliticsand

economics.TaxcollectionisperformedbyagovernmentagencysuchastheCanadaRevenueAgency,

theInternalRevenueService(IRS)intheUnitedStates,orHerMajesty'sRevenueandCustoms

(HMRC)intheUnitedKingdom.Whentaxesarenotfullypaid,thestatemayimposecivilpenalties

(suchasfinesorforfeiture)orcriminalpenalties(suchasincarceration)onthenonpayingentityor

individual.[3]

Purposesandeffects

Moneyprovidedbytaxationhasbeenusedbystatesandtheirfunctionalequivalentsthroughouthistory

tocarryoutmanyfunctions.Someoftheseincludeexpendituresonwar,theenforcementoflawand

publicorder,protectionofproperty,economicinfrastructure(roads,legaltender,enforcementof

contracts,etc.),publicworks,socialengineering,subsidies,andtheoperationofgovernmentitself.A

portionoftaxesalsogotopayoffthestate'sdebtandtheinterestthisdebtaccumulates.Governments

alsousetaxestofundwelfareandpublicservices.Theseservicescanincludeeducationsystems,health

caresystems,pensionsfortheelderly,unemploymentbenefits,andpublictransportation.Energy,water

andwastemanagementsystemsarealsocommonpublicutilities.Colonialandmodernizingstateshave

alsousedcashtaxestodraworforcereluctantsubsistenceproducersintocasheconomies.

Mosteconomists,especiallyneoclassicaleconomists,arguethatalltaxationcreatesmarketdistortion

andresultsineconomicinefficiency.Theyhavethereforesoughttoidentifythekindoftaxsystemthat

wouldminimizethisdistortion.[4]RecentscholarshipsuggeststhatintheUnitedStates,thefederal

governmenteffectivelytaxesinvestmentsinhighereducationmoreheavilythanitsubsidizeshigher

education,therebycontributingtoashortageofskilledworkersandunusuallyhighdifferencesinpretax

earningsbetweenhighlyeducatedandlesseducatedworkers.[4]

Governmentsusedifferentkindsoftaxesandvarythetaxrates.Thisisdonetodistributethetaxburden

amongindividualsorclassesofthepopulationinvolvedintaxableactivities,suchasbusiness,orto

redistributeresourcesbetweenindividualsorclassesinthepopulation.Historically,thenobilitywere

supportedbytaxesonthepoormodernsocialsecuritysystemsareintendedtosupportthepoor,the

disabled,ortheretiredbytaxesonthosewhoarestillworking.Inaddition,taxesareappliedtofund

foreignaidandmilitaryventures,toinfluencethemacroeconomicperformanceoftheeconomy(the

http://en.wikipedia.org/wiki/Tax

2/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

government'sstrategyfordoingthisiscalleditsfiscalpolicyseealsotaxexemption),ortomodify

patternsofconsumptionoremploymentwithinaneconomy,bymakingsomeclassesoftransaction

moreorlessattractive.

Anation'staxsystemisoftenareflectionofitscommunalvaluesandthevaluesofthoseincurrent

politicalpower.Tocreateasystemoftaxation,anationmustmakechoicesregardingthedistributionof

thetaxburdenwhowillpaytaxesandhowmuchtheywillpayandhowthetaxescollectedwillbe

spent.Indemocraticnationswherethepublicelectsthoseinchargeofestablishingthetaxsystem,these

choicesreflectthetypeofcommunitythatthepublicwishestocreate.Incountrieswherethepublicdoes

nothaveasignificantamountofinfluenceoverthesystemoftaxation,thatsystemmaybemoreofa

reflectiononthevaluesofthoseinpower.

Alllargebusinessesincuradministrativecostsintheprocessofdeliveringrevenuecollectedfrom

customerstothesuppliersofthegoodsorservicesbeingpurchased.Taxationisnodifferentthe

resourcecollectedfromthepublicthroughtaxationisalwaysgreaterthantheamountwhichcanbeused

bythegovernment.Thedifferenceiscalledthecompliancecostandincludesforexamplethelabour

costandotherexpensesincurredincomplyingwithtaxlawsandrules.Thecollectionofataxinorderto

spenditonaspecifiedpurpose,forexamplecollectingataxonalcoholtopaydirectlyforalcoholism

rehabilitationcentres,iscalledhypothecation.Thispracticeisoftendislikedbyfinanceministers,since

itreducestheirfreedomofaction.Someeconomictheoristsconsidertheconcepttobeintellectually

dishonestsince,inreality,moneyisfungible.Furthermore,itoftenhappensthattaxesorexcisesinitially

leviedtofundsomespecificgovernmentprogramsarethenlaterdivertedtothegovernmentgeneral

fund.Insomecases,suchtaxesarecollectedinfundamentallyinefficientways,forexamplehighway

tolls.

Sincegovernmentsalsoresolvecommercialdisputes,especiallyincountrieswithcommonlaw,similar

argumentsaresometimesusedtojustifyasalestaxorvalueaddedtax.Others(e.g.,libertarians)argue

thatmostorallformsoftaxesareimmoralduetotheirinvoluntary(andthereforeeventually

coercive/violent)nature.Themostextremeantitaxviewisanarchocapitalism,inwhichtheprovision

ofallsocialservicesshouldbevoluntarilyboughtbytheperson(s)usingthem.

Kindsoftaxes

TheOrganisationforEconomicCooperationandDevelopment(OECD)publishesananalysisoftax

systemsofmembercountries.Aspartofsuchanalysis,OECDdevelopedadefinitionandsystemof

classificationofinternaltaxes,[5]generallyfollowedbelow.Inaddition,manycountriesimposetaxes

(tariffs)ontheimportofgoods.

Taxesonincome

Incometax

Manyjurisdictionstaxtheincomeofindividualsandbusinessentities,includingcorporations.Generally

thetaxisimposedonnetprofitsfrombusiness,netgains,andotherincome.Computationofincome

subjecttotaxmaybedeterminedunderaccountingprinciplesusedinthejurisdiction,whichmaybe

modifiedorreplacedbytaxlawprinciplesinthejurisdiction.Theincidenceoftaxationvariesby

system,andsomesystemsmaybeviewedasprogressiveorregressive.Ratesoftaxmayvaryorbe

constant(flat)byincomelevel.Manysystemsallowindividualscertainpersonalallowancesandother

nonbusinessreductionstotaxableincome,althoughbusinessdeductionstendtobefavoredoverpersonal

deductions.[4]

http://en.wikipedia.org/wiki/Tax

3/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Personalincometaxisoftencollectedonapayasyouearnbasis,withsmallcorrectionsmadesoon

aftertheendofthetaxyear.Thesecorrectionstakeoneoftwoforms:paymentstothegovernment,for

taxpayerswhohavenotpaidenoughduringthetaxyearandtaxrefundsfromthegovernmentforthose

whohaveoverpaid.Incometaxsystemswilloftenhavedeductionsavailablethatlessenthetotaltax

liabilitybyreducingtotaltaxableincome.Theymayallowlossesfromonetypeofincometobecounted

againstanother.Forexample,alossonthestockmarketmaybedeductedagainsttaxespaidonwages.

Othertaxsystemsmayisolatetheloss,suchthatbusinesslossescanonlybedeductedagainstbusiness

taxbycarryingforwardthelosstolatertaxyears.

Negativeincometax

Ineconomics,anegativeincometax(abbreviatedNIT)isaprogressiveincometaxsystemwherepeople

earningbelowacertainamountreceivesupplementalpayfromthegovernmentinsteadofpayingtaxes

tothegovernment.

Capitalgainstax

Mostjurisdictionsimposinganincometaxtreatcapitalgainsaspartofincomesubjecttotax.Capital

gainisgenerallyagainonsaleofcapitalassetsthatis,thoseassetsnotheldforsaleintheordinary

courseofbusiness.Capitalassetsincludepersonalassetsinmanyjurisdictions.Somejurisdictions

providepreferentialratesoftaxoronlypartialtaxationforcapitalgains.Somejurisdictionsimpose

differentratesorlevelsofcapitalgainstaxationbasedonthelengthoftimetheassetwasheld.Because

taxratesareoftenmuchlowerforcapitalgainsthanforordinaryincome,thereiswidespread

controversyanddisputeabouttheproperdefinitionofcapital.Sometaxscholarshavearguedthat

differencesinthewaysdifferentkindsofcapitalandinvestmentaretaxedcontributetoeconomic

distortions.[4]

Corporatetax

Corporatetaxreferstoincome,capital,networth,orothertaxesimposedoncorporations.Ratesoftax

andthetaxablebaseforcorporationsmaydifferfromthoseforindividualsorothertaxablepersons.

Socialsecuritycontributions

Manycountriesprovidepubliclyfundedretirementorhealthcaresystems.[6]Inconnectionwiththese

systems,thecountrytypicallyrequiresemployersand/oremployeestomakecompulsorypayments.[7]

Thesepaymentsareoftencomputedbyreferencetowagesorearningsfromselfemployment.Taxrates

aregenerallyfixed,butadifferentratemaybeimposedonemployersthanonemployees.[8]Some

systemsprovideanupperlimitonearningssubjecttothetax.Afewsystemsprovidethatthetaxis

payableonlyonwagesaboveaparticularamount.Suchupperorlowerlimitsmayapplyforretirement

butnothealthcarecomponentsofthetax.Somehavearguedthatsuchtaxesonwagesareaformof

"forcedsavings"andnotreallyatax,whileotherspointtoredistributionthroughsuchsystemsbetween

generations(fromnewercohortstooldercohorts)andacrossincomelevels(fromhigherincomelevels

tolowerincomelevels)whichsuggestthatsuchprogramsarereallytaxandspendingprograms.[4]Some

taxscholarsarguethatsupportingsocialsecurityprogramsexclusivelythroughtaxesonwages,rather

thanthroughbroadertaxesthatincludecapital,createsdistortionsandunderinvestmentinhuman

capital,sincethereturnstosuchinvestmentswillbetaxesaswages.[4]

Taxesonpayrollorworkforce

http://en.wikipedia.org/wiki/Tax

4/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Unemploymentandsimilartaxesareoftenimposedonemployersbasedontotalpayroll.Thesetaxes

maybeimposedinboththecountryandsubcountrylevels.[9]

Taxesonproperty

Recurrentpropertytaxesmaybeimposedonimmovableproperty(realproperty)andsomeclassesof

movableproperty.Inaddition,recurrenttaxesmaybeimposedonnetwealthofindividualsor

corporations.[10]Manyjurisdictionsimposeestatetax,gifttaxorotherinheritancetaxesonpropertyat

deathorgifttransfer.Somejurisdictionsimposetaxesonfinancialorcapitaltransactions.

Propertytax

Apropertytax(ormillagetax)isanadvaloremtaxlevyonthevalueofpropertythattheownerofthe

propertyisrequiredtopaytoagovernmentinwhichthepropertyissituated.Multiplejurisdictionsmay

taxthesameproperty.Therearethreegeneralvarietiesofproperty:land,improvementstoland

(immovablemanmadethings,e.g.buildings)andpersonalproperty(movablethings).Realestateor

realtyisthecombinationoflandandimprovementstoland.

Propertytaxesareusuallychargedonarecurrentbasis(e.g.,yearly).Acommontypeofpropertytaxis

anannualchargeontheownershipofrealestate,wherethetaxbaseistheestimatedvalueofthe

property.Foraperiodofover150yearsfrom1695awindowtaxwasleviedinEngland,withtheresult

thatonecanstillseelistedbuildingswithwindowsbrickedupinordertosavetheirownersmoney.A

similartaxonhearthsexistedinFranceandelsewhere,withsimilarresults.Thetwomostcommontype

ofeventdrivenpropertytaxesarestampduty,chargeduponchangeofownership,andinheritancetax,

whichisimposedinmanycountriesontheestatesofthedeceased.

Incontrastwithataxonrealestate(landandbuildings),aLandValueTax(orLVT)isleviedonlyon

theunimprovedvalueoftheland("land"inthisinstancemaymeaneithertheeconomicterm,i.e.,all

naturalresources,orthenaturalresourcesassociatedwithspecificareasoftheEarth'ssurface:"lots"or

"landparcels").Proponentsoflandvaluetaxarguethatitiseconomicallyjustified,asitwillnotdeter

production,distortmarketmechanismsorotherwisecreatedeadweightlossesthewayothertaxesdo.[11]

Whenrealestateisheldbyahighergovernmentunitorsomeotherentitynotsubjecttotaxationbythe

localgovernment,thetaxingauthoritymayreceiveapaymentinlieuoftaxestocompensateitforsome

oralloftheforegonetaxrevenues.

Inmanyjurisdictions(includingmanyAmericanstates),thereisageneraltaxleviedperiodicallyon

residentswhoownpersonalproperty(personalty)withinthejurisdiction.Vehicleandboatregistration

feesaresubsetsofthiskindoftax.Thetaxisoftendesignedwithblanketcoverageandlargeexceptions

forthingslikefoodandclothing.Householdgoodsareoftenexemptwhenkeptorusedwithinthe

household.[12]Anyotherwisenonexemptobjectcanloseitsexemptionifregularlykeptoutsidethe

household.[12]Thus,taxcollectorsoftenmonitornewspaperarticlesforstoriesaboutwealthypeople

whohavelentarttomuseumsforpublicdisplay,becausetheartworkshavethenbecomesubjectto

personalpropertytax.[12]Ifanartworkhadtobesenttoanotherstateforsometouchups,itmayhave

becomesubjecttopersonalpropertytaxinthatstateaswell.[12]

Inheritancetax

http://en.wikipedia.org/wiki/Tax

5/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Inheritancetax,estatetax,anddeathtaxordutyarethenamesgiventovarioustaxeswhichariseonthe

deathofanindividual.InUnitedStatestaxlaw,thereisadistinctionbetweenanestatetaxandan

inheritancetax:theformertaxesthepersonalrepresentativesofthedeceased,whilethelattertaxesthe

beneficiariesoftheestate.However,thisdistinctiondoesnotapplyinotherjurisdictionsforexample,if

usingthisterminologyUKinheritancetaxwouldbeanestatetax.

Expatriationtax

Anexpatriationtaxisataxonindividualswhorenouncetheircitizenshiporresidence.Thetaxisoften

imposedbasedonadeemeddispositionofalltheindividual'sproperty.OneexampleistheUnitedStates

undertheAmericanJobsCreationAct,whereanyindividualwhohasanetworthof$2millionoran

averageincometaxliabilityof$127,000whorenounceshisorhercitizenshipandleavesthecountryis

automaticallyassumedtohavedonesofortaxavoidancereasonsandissubjecttoahighertaxrate.[13]

Transfertax

Historically,inmanycountries,acontractneededtohaveastampaffixedtomakeitvalid.Thecharge

forthestampwaseitherafixedamountorapercentageofthevalueofthetransaction.Inmostcountries

thestamphasbeenabolishedbutstampdutyremains.StampdutyisleviedintheUKonthepurchaseof

sharesandsecurities,theissueofbearerinstruments,andcertainpartnershiptransactions.Itsmodern

derivatives,stampdutyreservetaxandstampdutylandtax,arerespectivelychargedontransactions

involvingsecuritiesandland.Stampdutyhastheeffectofdiscouragingspeculativepurchasesofassets

bydecreasingliquidity.IntheUnitedStates,transfertaxisoftenchargedbythestateorlocal

governmentand(inthecaseofrealpropertytransfers)canbetiedtotherecordingofthedeedorother

transferdocuments.

Wealth(networth)tax

Somecountries'governmentswillrequiredeclarationofthetaxpayers'balancesheet(assetsand

liabilities),andfromthatexactataxonnetworth(assetsminusliabilities),asapercentageofthenet

worth,orapercentageofthenetworthexceedingacertainlevel.Thetaxmaybeleviedon"natural"or

legal"persons".AnexampleisFrance'sISF.

Taxesongoodsandservices

Valueaddedtax(GoodsandServicesTax)

Avalueaddedtax(VAT),alsoknownasGoodsandServicesTax(G.S.T),SingleBusinessTax,or

TurnoverTaxinsomecountries,appliestheequivalentofasalestaxtoeveryoperationthatcreates

value.Togiveanexample,sheetsteelisimportedbyamachinemanufacturer.Thatmanufacturerwill

paytheVATonthepurchaseprice,remittingthatamounttothegovernment.Themanufacturerwill

thentransformthesteelintoamachine,sellingthemachineforahigherpricetoawholesaledistributor.

ThemanufacturerwillcollecttheVATonthehigherprice,butwillremittothegovernmentonlythe

excessrelatedtothe"valueadded"(thepriceoverthecostofthesheetsteel).Thewholesaledistributor

willthencontinuetheprocess,chargingtheretaildistributortheVATontheentirepricetotheretailer,

butremittingonlytheamountrelatedtothedistributionmarkuptothegovernment.ThelastVAT

amountispaidbytheeventualretailcustomerwhocannotrecoveranyofthepreviouslypaidVAT.For

aVATandsalestaxofidenticalrates,thetotaltaxpaidisthesame,butitispaidatdifferingpointsin

theprocess.

http://en.wikipedia.org/wiki/Tax

6/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

VATisusuallyadministratedbyrequiringthecompanytocompleteaVATreturn,givingdetailsof

VATithasbeencharged(referredtoasinputtax)andVATithaschargedtoothers(referredtoas

outputtax).ThedifferencebetweenoutputtaxandinputtaxispayabletotheLocalTaxAuthority.If

inputtaxisgreaterthanoutputtaxthecompanycanclaimbackmoneyfromtheLocalTaxAuthority.

Salestaxes

Salestaxesareleviedwhenacommodityissoldtoitsfinalconsumer.Retailorganizationscontendthat

suchtaxesdiscourageretailsales.Thequestionofwhethertheyaregenerallyprogressiveorregressiveis

asubjectofmuchcurrentdebate.Peoplewithhigherincomesspendalowerproportionofthem,soa

flatratesalestaxwilltendtoberegressive.Itisthereforecommontoexemptfood,utilitiesandother

necessitiesfromsalestaxes,sincepoorpeoplespendahigherproportionoftheirincomesonthese

commodities,sosuchexemptionsmakethetaxmoreprogressive.Thisistheclassic"Youpayforwhat

youspend"tax,asonlythosewhospendmoneyonnonexempt(i.e.luxury)itemspaythetax.

AsmallnumberofU.S.statesrelyentirelyonsalestaxesforstaterevenue,asthosestatesdonotlevya

stateincometax.Suchstatestendtohaveamoderatetolargeamountoftourismorinterstatetravelthat

occurswithintheirborders,allowingthestatetobenefitfromtaxesfrompeoplethestatewould

otherwisenottax.Inthisway,thestateisabletoreducethetaxburdenonitscitizens.TheU.S.states

thatdonotlevyastateincometaxareAlaska,Tennessee,Florida,Nevada,SouthDakota,Texas,[14]

Washingtonstate,andWyoming.Additionally,NewHampshireandTennesseelevystateincometaxes

onlyondividendsandinterestincome.Oftheabovestates,onlyAlaskaandNewHampshiredonotlevy

astatesalestax.AdditionalinformationcanbeobtainedattheFederationofTaxAdministrators

(http://www.taxadmin.org/)website.

IntheUnitedStates,thereisagrowingmovement[15]forthereplacementofallfederalpayrolland

incometaxes(bothcorporateandpersonal)withanationalretailsalestaxandmonthlytaxrebateto

householdsofcitizensandlegalresidentaliens.ThetaxproposalisnamedFairTax.InCanada,the

federalsalestaxiscalledtheGoodsandServicestax(GST)andnowstandsat5%.Theprovincesof

BritishColumbia,Saskatchewan,Manitoba,andPrinceEdwardIslandalsohaveaprovincialsalestax

[PST].TheprovincesofNovaScotia,NewBrunswick,Newfoundland&Labrador,andOntariohave

harmonizedtheirprovincialsalestaxeswiththeGSTHarmonizedSalesTax[HST],andthusisafull

VAT.TheprovinceofQuebeccollectstheQuebecSalesTax[QST]whichisbasedontheGSTwith

certaindifferences.MostbusinessescanclaimbacktheGST,HSTandQSTtheypay,andsoeffectively

itisthefinalconsumerwhopaysthetax.

Excises

Anexcisedutyisanindirecttaximposedupongoodsduringtheprocessoftheirmanufacture,

productionordistribution,andisusuallyproportionatetotheirquantityorvalue.Excisedutieswerefirst

introducedintoEnglandintheyear1643,aspartofaschemeofrevenueandtaxationdevisedby

parliamentarianJohnPymandapprovedbytheLongParliament.Thesedutiesconsistedofchargeson

beer,ale,cider,cherrywineandtobacco,towhichlistwereafterwardsaddedpaper,soap,candles,malt,

hops,andsweets.Thebasicprincipleofexcisedutieswasthattheyweretaxesontheproduction,

manufactureordistributionofarticleswhichcouldnotbetaxedthroughthecustomshouse,andrevenue

derivedfromthatsourceiscalledexciserevenueproper.Thefundamentalconceptionofthetermisthat

ofataxonarticlesproducedormanufacturedinacountry.Inthetaxationofsucharticlesofluxuryas

spirits,beer,tobacco,andcigars,ithasbeenthepracticetoplaceacertaindutyontheimportationof

thesearticles(acustomsduty).[16]

http://en.wikipedia.org/wiki/Tax

7/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Excises(orexemptionsfromthem)arealsousedtomodifyconsumptionpatterns(socialengineering).

Forexample,ahighexciseisusedtodiscouragealcoholconsumption,relativetoothergoods.Thismay

becombinedwithhypothecationiftheproceedsarethenusedtopayforthecostsoftreatingillness

causedbyalcoholabuse.Similartaxesmayexistontobacco,pornography,etc.,andtheymaybe

collectivelyreferredtoas"sintaxes".Acarbontaxisataxontheconsumptionofcarbonbasednon

renewablefuels,suchaspetrol,dieselfuel,jetfuels,andnaturalgas.Theobjectistoreducetherelease

ofcarbonintotheatmosphere.IntheUnitedKingdom,vehicleexcisedutyisanannualtaxonvehicle

ownership.

Tariff

Animportorexporttariff(alsocalledcustomsdutyorimpost)isachargeforthemovementofgoods

throughapoliticalborder.Tariffsdiscouragetrade,andtheymaybeusedbygovernmentstoprotect

domesticindustries.Aproportionoftariffrevenuesisoftenhypothecatedtopaygovernmenttomaintain

anavyorborderpolice.Theclassicwaysofcheatingatariffaresmugglingordeclaringafalsevalueof

goods.Tax,tariffandtraderulesinmoderntimesareusuallysettogetherbecauseoftheircommon

impactonindustrialpolicy,investmentpolicy,andagriculturalpolicy.Atradeblocisagroupofallied

countriesagreeingtominimizeoreliminatetariffsagainsttradewitheachother,andpossiblytoimpose

protectivetariffsonimportsfromoutsidethebloc.Acustomsunionhasacommonexternaltariff,and

theparticipatingcountriessharetherevenuesfromtariffsongoodsenteringthecustomsunion.

Insomesocieties,tariffsalsocouldbeimposedbylocalauthoritiesonthemovementofgoodsbetween

regions(orviaspecificinternalgateways).Anotableexampleisthelikin,whichbecameanimportant

revenuesourceforlocalgovernmentsinthelateQingChina.

Othertaxes

Licensefees

Occupationaltaxesorlicensefeesmaybeimposedonbusinessesorindividualsengagedincertain

businesses.Manyjurisdictionsimposeataxonvehicles.

Polltax

Apolltax,alsocalledapercapitatax,orcapitationtax,isataxthatleviesasetamountperindividual.

Itisanexampleoftheconceptoffixedtax.OneoftheearliesttaxesmentionedintheBibleofahalf

shekelperannumfromeachadultJew(Ex.30:1116)wasaformofpolltax.Polltaxesare

administrativelycheapbecausetheyareeasytocomputeandcollectanddifficulttocheat.Economists

haveconsideredpolltaxeseconomicallyefficientbecausepeoplearepresumedtobeinfixedsupplyand

polltaxesthereforedonotleadtoeconomicdistortions.However,polltaxesareveryunpopularbecause

poorerpeoplepayahigherproportionoftheirincomethanricherpeople.[4]Inaddition,thesupplyof

peopleisinfactnotfixedovertime:onaverage,coupleswillchoosetohavefewerchildrenifapolltax

isimposed.[17]TheintroductionofapolltaxinmedievalEnglandwastheprimarycauseofthe1381

Peasants'Revolt.Scotlandwasthefirsttobeusedtotestthenewpolltaxin1989withEnglandand

Walesin1990.Thechangefromaprogressivelocaltaxationbasedonpropertyvaluestoasinglerate

formoftaxationregardlessofabilitytopay(theCommunityCharge,butmorepopularlyreferredtoas

thePollTax),ledtowidespreadrefusaltopayandtoincidentsofcivilunrest,knowncolloquiallyasthe

'PollTaxRiots'.

Other

http://en.wikipedia.org/wiki/Tax

8/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Sometypesoftaxeshavebeenproposedbutnotactuallyadoptedinanymajorjurisdiction.These

include:

Banktax

Financialtransactiontaxesincludingcurrencytransactiontaxes

Descriptivelabelsgivensometaxes

Advaloremandperunit

Anadvaloremtaxisonewherethetaxbaseisthevalueofagood,service,orproperty.Salestaxes,

tariffs,propertytaxes,inheritancetaxes,andvalueaddedtaxesaredifferenttypesofadvaloremtax.An

advaloremtaxistypicallyimposedatthetimeofatransaction(salestaxorvalueaddedtax(VAT))but

itmaybeimposedonanannualbasis(propertytax)orinconnectionwithanothersignificantevent

(inheritancetaxortariffs).

Incontrasttoadvaloremtaxationisaperunittax,wherethetaxbaseisthequantityofsomething,

regardlessofitsprice.Anexcisetaxisanexample.

Consumptiontax

Consumptiontaxreferstoanytaxonnoninvestmentspending,andcanbeimplementedbymeansofa

salestax,consumervalueaddedtax,orbymodifyinganincometaxtoallowforunlimiteddeductions

forinvestmentorsavings.

Environmentaltax

Thisincludesnaturalresourcesconsumptiontax,greenhousegastax(Carbontax),"sulfurictax",and

others.Thestatedpurposeistoreducetheenvironmentalimpactbyrepricing.

Proportional,progressive,regressive,andlumpsum

Animportantfeatureoftaxsystemsisthepercentageofthetaxburdenasitrelatestoincomeor

consumption.Thetermsprogressive,regressive,andproportionalareusedtodescribethewaytherate

progressesfromlowtohigh,fromhightolow,orproportionally.Thetermsdescribeadistribution

effect,whichcanbeappliedtoanytypeoftaxsystem(incomeorconsumption)thatmeetsthe

definition.

Aprogressivetaxisataximposedsothattheeffectivetaxrateincreasesastheamounttowhich

therateisappliedincreases.

Theoppositeofaprogressivetaxisaregressivetax,wheretheeffectivetaxratedecreasesasthe

amounttowhichtherateisappliedincreases.Thiseffectiscommonlyproducedwheremeans

testingisusedtowithdrawtaxallowancesorstatebenefits.

Inbetweenisaproportionaltax,wheretheeffectivetaxrateisfixed,whiletheamounttowhich

therateisappliedincreases.

Alumpsumtaxisataxthatisafixedamount,nomatterthechangeincircumstanceofthetaxed

entity.Thisinactualityisaregressivetaxasthosewithlowerincomemustusehigherpercentage

oftheirincomethanthosewithhigherincomeandthereforetheeffectofthetaxreducesasa

functionofincome.

http://en.wikipedia.org/wiki/Tax

9/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Thetermscanalsobeusedtoapplymeaningtothetaxationofselectconsumption,suchasataxon

luxurygoodsandtheexemptionofbasicnecessitiesmaybedescribedashavingprogressiveeffectsasit

increasesataxburdenonhighendconsumptionanddecreasesataxburdenonlowend

consumption.[18][19][20]

Directandindirect

Taxesaresometimesreferredtoas"directtaxes"or"indirecttaxes".Themeaningofthesetermscan

varyindifferentcontexts,whichcansometimesleadtoconfusion.Aneconomicdefinition,byAtkinson,

statesthat"...directtaxesmaybeadjustedtotheindividualcharacteristicsofthetaxpayer,whereas

indirecttaxesareleviedontransactionsirrespectiveofthecircumstancesofbuyerorseller."[21]

Accordingtothisdefinition,forexample,incometaxis"direct",andsalestaxis"indirect".Inlaw,the

termsmayhavedifferentmeanings.InU.S.constitutionallaw,forinstance,directtaxesrefertopoll

taxesandpropertytaxes,whicharebasedonsimpleexistenceorownership.Indirecttaxesareimposed

onevents,rights,privileges,andactivities.[22]Thus,ataxonthesaleofpropertywouldbeconsideredan

indirecttax,whereasthetaxonsimplyowningthepropertyitselfwouldbeadirecttax.

Feesandeffectivetaxes

Governmentsmaychargeuserfees,tolls,orothertypesofassessmentsinexchangeofparticulargoods,

services,oruseofproperty.Thesearegenerallynotconsideredtaxes,aslongastheyareleviedas

paymentforadirectbenefittotheindividualpaying.[23]Suchfeesinclude:

Tolls:afeechargedtotravelviaaroad,bridge,tunnel,canal,waterwayorothertransportation

facilities.Historicallytollshavebeenusedtopayforpublicbridge,roadandtunnelprojects.They

havealsobeenusedinprivatelyconstructedtransportlinks.Thetollislikelytobeafixedcharge,

possiblygraduatedforvehicletype,orfordistanceonlongroutes.

Userfees,suchasthosechargedforuseofparksorothergovernmentownedfacilities.

Rulingfeeschargedbygovernmentalagenciestomakedeterminationsinparticularsituations.

Somescholarsrefertocertaineconomiceffectsastaxes,thoughtheyarenotleviesimposedby

governments.Theseinclude:

Inflationtax:theeconomicdisadvantagesufferedbyholdersofcashandcashequivalentsinone

denominationofcurrencyduetotheeffectsofexpansionarymonetarypolicy[24]

Financialrepression:Governmentpoliciessuchasinterestratecapsongovernmentdebt,financial

regulationssuchasreserverequirementsandcapitalcontrols,andbarrierstoentryinmarkets

wherethegovernmentownsorcontrolsbusinesses.[25]

History

ThefirstknownsystemoftaxationwasinAncientEgyptaround

30002800BCinthefirstdynastyoftheOldKingdom.[26]The

earliestandmostwidespreadformoftaxationwasthecorveand

tithe.Thecorvewasforcedlabourprovidedtothestateby

peasantstoopoortopayotherformsoftaxation(labourin

Egyptianpeasantsseizedfornon

ancientEgyptianisasynonymfortaxes).[27]Recordsfromthe

paymentoftaxes.(PyramidAge)

timedocumentthatthepharaohwouldconductabiennialtourof

thekingdom,collectingtithesfromthepeople.Otherrecordsare

granaryreceiptsonlimestoneflakesandpapyrus.[28]EarlytaxationisalsodescribedintheBible.In

http://en.wikipedia.org/wiki/Tax

10/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Genesis(chapter47,verse24theNewInternationalVersion),itstates"Butwhenthecropcomesin,

giveafifthofittoPharaoh.Theotherfourfifthsyoumaykeepasseedforthefieldsandasfoodfor

yourselvesandyourhouseholdsandyourchildren".JosephwastellingthepeopleofEgypthowto

dividetheircrop,providingaportiontothePharaoh.Ashare(20%)ofthecropwasthetax(inthiscase,

aspecialratherthananordinarytax,asitwasgatheredagainstanexpectedfamine).[29]

InthePersianEmpire,aregulatedandsustainabletaxsystemwasintroducedbyDariusItheGreatin

500BC[30]thePersiansystemoftaxationwastailoredtoeachSatrapy(thearearuledbyaSatrapor

provincialgovernor).Atdifferingtimes,therewerebetween20and30SatrapiesintheEmpireandeach

wasassessedaccordingtoitssupposedproductivity.ItwastheresponsibilityoftheSatraptocollectthe

dueamountandtosendittothetreasury,afterdeductinghisexpenses(theexpensesandthepowerof

decidingpreciselyhowandfromwhomtoraisethemoneyintheprovince,offermaximumopportunity

forrichpickings).Thequantitiesdemandedfromthevariousprovincesgaveavividpictureoftheir

economicpotential.Forinstance,Babylonwasassessedforthehighestamountandforastartling

mixtureofcommodities1,000silvertalentsandfourmonthssupplyoffoodforthearmy.India,a

provincefabledforitsgold,wastosupplygolddustequalinvaluetotheverylargeamountof4,680

silvertalents.EgyptwasknownforthewealthofitscropsitwastobethegranaryofthePersian

Empire(and,later,oftheRomanEmpire)andwasrequiredtoprovide120,000measuresofgrainin

additionto700talentsofsilver.[31]ThistaxwasexclusivelyleviedonSatrapiesbasedontheirlands,

productivecapacityandtributelevels.[32]

TheRosettaStone,ataxconcessionissuedbyPtolemyVin196BCandwritteninthreelanguages"led

tothemostfamousdeciphermentinhistorythecrackingofhieroglyphics".[33]

InIndia,Islamicrulersimposedjizya(apolltaxonnonMuslims)startinginthe11thcentury.

Taxationlevels

NumerousrecordsofgovernmenttaxcollectioninEuropesinceatleastthe17thcenturyarestill

availabletoday.Buttaxationlevelsarehardtocomparetothesizeandflowoftheeconomysince

productionnumbersarenotasreadilyavailable.GovernmentexpendituresandrevenueinFranceduring

the17thcenturywentfromabout24.30millionlivresin160010toabout126.86millionlivresin

165059toabout117.99millionlivresin170010whengovernmentdebthadreached1.6billionlivres.

In178089,itreached421.50millionlivres.[34]Taxationasapercentageofproductionoffinalgoods

mayhavereached15%20%duringthe17thcenturyinplacessuchasFrance,theNetherlands,and

Scandinavia.Duringthewarfilledyearsoftheeighteenthandearlynineteenthcentury,taxratesin

Europeincreaseddramaticallyaswarbecamemoreexpensiveandgovernmentsbecamemore

centralizedandadeptatgatheringtaxes.ThisincreasewasgreatestinEngland,PeterMathiasand

PatrickO'Brienfoundthatthetaxburdenincreasedby85%overthisperiod.Anotherstudyconfirmed

thisnumber,findingthatpercapitataxrevenueshadgrownalmostsixfoldovertheeighteenthcentury,

butthatsteadyeconomicgrowthhadmadetherealburdenoneachindividualonlydoubleoverthis

periodbeforetheindustrialrevolution.EffectivetaxrateswerehigherinBritainthanFrancetheyears

beforetheFrenchRevolution,twiceinpercapitaincomecomparison,buttheyweremostlyplacedon

internationaltrade.InFrance,taxeswerelowerbuttheburdenwasmainlyonlandowners,individuals,

andinternaltradeandthuscreatedfarmoreresentment.[35]

TaxationasapercentageofGDPin2003was56.1%inDenmark,54.5%inFrance,49.0%intheEuro

area,42.6%intheUnitedKingdom,35.7%intheUnitedStates,35.2%inIreland,andamongallOECD

membersanaverageof40.7%.[36][37]

http://en.wikipedia.org/wiki/Tax

11/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Formsoftaxation

Inmonetaryeconomiespriortofiatbanking,acriticalformoftaxationwasseigniorage,thetaxonthe

creationofmoney.

Otherobsoleteformsoftaxationinclude:

Scutage,whichispaidinlieuofmilitaryservicestrictlyspeaking,itisacommutationofanon

taxobligationratherthanataxassuchbutfunctioningasataxinpractice.

Tallage,ataxonfeudaldependents.

Tithe,ataxlikepayment(onetenthofone'searningsoragriculturalproduce),paidtotheChurch

(andthustoospecifictobeataxinstricttechnicalterms).Thisshouldnotbeconfusedwiththe

modernpracticeofthesamenamewhichisnormallyvoluntary.

(Feudal)aids,atypeoftaxorduethatwaspaidbyavassaltohislordduringfeudaltimes.

Danegeld,amedievallandtaxoriginallyraisedtopayoffraidingDanesandlaterusedtofund

militaryexpenditures.

Carucage,ataxwhichreplacedthedanegeldinEngland.

Taxfarming,theprincipleofassigningtheresponsibilityfortaxrevenuecollectiontoprivate

citizensorgroups.

Socage,afeudaltaxsystembasedonlandrent.

Burgage,afeudaltaxsystembasedonlandrent.

Someprincipalitiestaxedwindows,doors,orcabinetstoreduceconsumptionofimportedglassand

hardware.Armoires,hutches,andwardrobeswereemployedtoevadetaxesondoorsandcabinets.In

somecircumstances,taxesarealsousedtoenforcepublicpolicylikecongestioncharge(tocutroad

trafficandencouragepublictransport)inLondon.InTsaristRussia,taxeswereclampedonbeards.

Today,oneofthemostcomplicatedtaxationsystemsworldwideisinGermany.Threequartersofthe

world'staxationliteraturereferstotheGermansystem.UndertheGermansystem,thereare118laws,

185forms,and96,000regulations,spending3.7billiontocollecttheincometax.IntheUnitedStates,

theIRShasabout1,177formsandinstructions,[38]28.4111megabytesofInternalRevenueCode[39]

whichcontained3.8millionwordsasof1February2010,[40]numeroustaxregulationsintheCodeof

FederalRegulations,[41]andsuppmentarymaterialintheInternalRevenueBulletin.[42]Today,

governmentsinmoreadvancedeconomies(i.e.EuropeandNorthAmerica)tendtorelymoreondirect

taxes,whiledevelopingeconomies(i.e.IndiaandseveralAfricancountries)relymoreonindirecttaxes.

Economiceffects

Ineconomicterms,taxationtransferswealthfromhouseholdsorbusinessestothegovernmentofa

nation.Thesideeffectsoftaxation(suchaseconomicdistortions)andtheoriesabouthowbesttotaxare

animportantsubjectinmicroeconomics.[4]Taxationisalmostneverasimpletransferofwealth.

Economictheoriesoftaxationapproachthequestionofhowtomaximizeeconomicwelfarethrough

taxation.

Taxincidence

Lawestablishesfromwhomataxiscollected.Inmanycountries,taxesareimposedonbusiness(suchas

corporatetaxesorportionsofpayrolltaxes).However,whoultimatelypaysthetax(thetax"burden")is

determinedbythemarketplaceastaxesbecomeembeddedintoproductioncosts.Economictheory

suggeststhattheeconomiceffectoftaxdoesnotnecessarilyfallatthepointwhereitislegallylevied.

Forinstance,ataxonemploymentpaidbyemployerswillimpactontheemployee,atleastinthelong

http://en.wikipedia.org/wiki/Tax

12/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

run.Thegreatestshareofthetaxburdentendstofallonthemostinelasticfactorinvolvedthepartof

thetransactionwhichisaffectedleastbyachangeinprice.So,forinstance,ataxonwagesinatown

will(atleastinthelongrun)affectpropertyownersinthatarea.

Dependingonhowquantitiessuppliedanddemandedvarywithprice(the"elasticities"ofsupplyand

demand),ataxcanbeabsorbedbytheseller(intheformoflowerpretaxprices),orbythebuyer(inthe

formofhigherposttaxprices).[4]Iftheelasticityofsupplyislow,moreofthetaxwillbepaidbythe

supplier.Iftheelasticityofdemandislow,morewillbepaidbythecustomerand,contrariwiseforthe

caseswherethoseelasticitiesarehigh.Ifthesellerisacompetitivefirm,thetaxburdenisdistributed

overthefactorsofproductiondependingontheelasticitiesthereofthisincludesworkers(intheformof

lowerwages),capitalinvestors(intheformoflosstoshareholders),landowners(intheformoflower

rents),entrepreneurs(intheformoflowerwagesofsuperintendence)andcustomers(intheformof

higherprices).

Toshowthisrelationship,supposethatthemarketpriceofaproductis$1.00,andthata$0.50taxis

imposedontheproductthat,bylaw,istobecollectedfromtheseller.Iftheproducthasanelastic

demand,agreaterportionofthetaxwillbeabsorbedbytheseller.Thisisbecausegoodswithelastic

demandcausealargedeclineinquantitydemandedforasmallincreaseinprice.Thereforeinorderto

stabilizesales,thesellerabsorbsmoreoftheadditionaltaxburden.Forexample,thesellermightdrop

thepriceoftheproductto$0.70sothat,afteraddinginthetax,thebuyerpaysatotalof$1.20,or$0.20

morethanhedidbeforethe$0.50taxwasimposed.Inthisexample,thebuyerhaspaid$0.20ofthe

$0.50tax(intheformofaposttaxprice)andthesellerhaspaidtheremaining$0.30(intheformofa

lowerpretaxprice).[43]

Increasedeconomicwelfare

Governmentspending

Thepurposeoftaxationistoprovideforgovernmentspendingwithoutinflation.Theprovisionofpublic

goodssuchasroadsandotherinfrastructure,schools,asocialsafetynet,healthcarefortheindigent,

nationaldefense,lawenforcement,andacourtssystemincreasestheeconomicwelfareofsocietyifthe

benefitoutweighsthecostsinvolved.

Pigoviantaxes

Theexistenceofataxcanincreaseeconomicefficiencyinsomecases.Ifthereisanegativeexternality

associatedwithagood,meaningthatithasnegativeeffectsnotfeltbytheconsumer,thenafreemarket

willtradetoomuchofthatgood.Bytaxingthegood,thegovernmentcanincreaseoverallwelfareas

wellasraisingrevenue.ThistypeoftaxiscalledaPigoviantax,aftereconomistArthurPigou.

PossiblePigoviantaxesincludethoseonpollutingfuels(likepetrol),taxesongoodswhichincurpublic

healthcarecosts(suchasalcoholortobacco),andchargesforexisting'free'publicgoods(like

congestioncharging)areanotherpossibility.

Reducedinequality

Progressivetaxationmayreduceeconomicinequality.Thiseffectoccursevenwhenthetaxrevenueisn't

redistributed.[citationneeded]

Reducedeconomicwelfare

http://en.wikipedia.org/wiki/Tax

13/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Mosttaxes(seebelow)havesideeffectsthatreduceeconomicwelfare,eitherbymandating

unproductivelabor(compliancecosts)orbycreatingdistortionstoeconomicincentives(deadweight

lossandperverseincentives).

Costofcompliance

Althoughgovernmentsmustspendmoneyontaxcollectionactivities,someofthecosts,particularlyfor

keepingrecordsandfillingoutforms,arebornebybusinessesandbyprivateindividuals.Theseare

collectivelycalledcostsofcompliance.Morecomplextaxsystemstendtohavehighercompliancecosts.

Thisfactcanbeusedasthebasisforpracticalormoralargumentsinfavoroftaxsimplification(suchas

theFairTaxorOneTax,andsomeflattaxproposals).

Deadweightcostsoftaxation

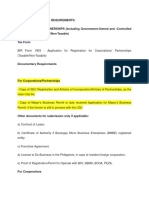

Intheabsenceofnegativeexternalities,the

introductionoftaxesintoamarketreduceseconomic

efficiencybycausingdeadweightloss.Ina

competitivemarketthepriceofaparticular

economicgoodadjuststoensurethatalltrades

whichbenefitboththebuyerandthesellerofagood

occur.Theintroductionofataxcausestheprice

receivedbythesellertobelessthanthecosttothe

buyerbytheamountofthetax.Thiscausesfewer

transactionstooccur,whichreduceseconomic

welfaretheindividualsorbusinessesinvolvedare

lesswelloffthanbeforethetax.Thetaxburdenand

theamountofdeadweightcostisdependentonthe

elasticityofsupplyanddemandforthegoodtaxed.

Diagramillustratingdeadweightcostsoftaxes

Mosttaxesincludingincometaxandsalestaxcanhavesignificantdeadweightcosts.Theonlyway

toavoiddeadweightcostsinaneconomythatisgenerallycompetitiveistorefrainfromtaxesthat

changeeconomicincentives.Suchtaxesincludethelandvaluetax,[44]wherethetaxisonagoodin

completelyinelasticsupply,alumpsumtaxsuchasapolltax(headtax)whichispaidbyalladults

regardlessoftheirchoices.Arguablyawindfallprofitstaxwhichisentirelyunanticipatedcanalsofall

intothiscategory.

Deadweightlossdoesnotaccountfortheeffecttaxeshaveinlevelingthebusinessplayingfield.

Businessthathavemoremoneyarebettersuitedtofendoffcompetition.Itiscommonthatanindustry

havingafewbutverylargecorporationshaveaveryhighbarrierofentryofnewentrantsinthe

marketplace.Thisisduetothefactthatthelargerthecorporationthebetterthepositionofittonegotiate

withsuppliers.Alsothefinancialpositioncanprovidethemeansforthecompanytobeabletooperate

forextendedperiodsoftimewithverylowornegativeprofits,inordertopushthecompetitionoutof

business.Thetaxationofprofitsinaprogressivemannerwouldreducethebarriersforentryinaspecific

marketfornewentrantstherebyincreasingcompetition.Thiswouldultimatelybenefittheconsumers

sinceincreasedcompetitionbenefitsconsumers.[45]

Perverseincentives

http://en.wikipedia.org/wiki/Tax

14/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Complexityofthetaxcodeindevelopedeconomiesofferperversetaxincentives.Themoredetailsof

taxpolicythereare,themoreopportunitiesforlegaltaxavoidanceandillegaltaxevasion.Thesenot

onlyresultinlostrevenue,butinvolveadditionalcosts:forinstance,paymentsmadefortaxadviceare

essentiallydeadweightcostsbecausetheyaddnowealthtotheeconomy.Perverseincentivesalsooccur

becauseofnontaxable'hidden'transactionsforinstance,asalefromonecompanytoanothermightbe

liableforsalestax,butifthesamegoodswereshippedfromonebranchofacorporationtoanother,no

taxwouldbepayable.

Toaddresstheseissues,economistsoftensuggestsimpleandtransparenttaxstructureswhichavoid

providingloopholes.Salestax,forinstance,canbereplacedwithavalueaddedtaxwhichdisregards

intermediatetransactions.

Reducedproduction

Ifataxispaidonoutsourcedservicesthatisnotalsochargedonservicesperformedforoneself,thenit

maybecheapertoperformtheservicesoneselfthantopaysomeoneelseevenconsideringlossesin

economicefficiency.[46][47]

Forexample,supposejobsAandBarebothvaluedat$1onthemarket.Andsupposethatbecauseof

youruniqueabilities,youcandojobAtwiceover(100%extraoutput)inthesameeffortasitwould

takeyoutodojobB.ButjobBistheonethatyouneeddonerightnow.Underperfectdivisionoflabor,

youwoulddojobAandsomebodyelsewoulddojobB.Youruniqueabilitieswouldalwaysbe

rewarded.

Incometaxationhastheworsteffectondivisionoflaborintheformofbarter.Supposethattheperson

doingjobBisactuallyinterestedinhavingjobAdoneforhim.Nowsupposeyoucouldamazinglydo

jobAfourtimesover,sellinghalfyourworkonthemarketforcashjusttopayyourtaxbill.Theother

halfoftheworkyoudoforsomebodywhodoesjobBtwiceoverbuthehastoselloffhalftopayhistax

bill.You'releftwithoneunitofjobB,butonlyifyouwere400%asproductivedoingjobA!Inthiscase

of50%taxonbarterincome,anythinglessthan400%productivitywillcausethedivisionoflaborto

fail.

Insummary,dependingonthesituationa50%taxratecancausethedivisionoflabortofailevenwhere

productivitygainsofupto300%wouldhaveresulted.Evenamere30%taxratecannegatethe

advantageofa100%productivitygain.[48]

Taxationindevelopingcountries

ResearchersforEPSPEAKS[49]statedthatthecorepurposeoftaxationisrevenuemobilisation,

providingresourcesforNationalBudgets,andforminganimportantpartofmacroeconomic

management.Theysaideconomictheoryhasfocusedontheneedto'optimise'thesystemthrough

balancingefficiencyandequity,understandingtheimpactsonproduction,andconsumptionaswellas

distribution,redistribution,andwelfare.

Theystatethattaxesandtaxreliefshavealsobeenusedasatoolforbehaviouralchange,toinfluence

investmentdecisions,laboursupply,consumptionpatterns,andpositiveandnegativeeconomicspill

overs(externalities),andultimately,thepromotionofeconomicgrowthanddevelopment.Thetax

systemanditsadministrationalsoplayanimportantroleinstatebuildingandgovernance,asaprinciple

formof'socialcontract'betweenthestateandcitizenswhocan,astaxpayers,exertaccountabilityonthe

stateasaconsequence.

http://en.wikipedia.org/wiki/Tax

15/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

Theresearcherswrotethatdomesticrevenueformsanimportantpartofadevelopingcountry'spublic

financingasitismorestableandpredictablethanOverseasDevelopmentAssistanceandnecessaryfora

countrytobeselfsufficient.Theyfoundthatdomesticrevenueflowsare,onaverage,alreadymuch

largerthanODA,withaidworthlessthan10%ofcollectedtaxesinAfricaasawhole.

However,inaquarterofAfricancountriesOverseasDevelopmentAssistancedoesexceedtax

collection,[50]withthesemorelikelytobenonresourcerichcountries.Thissuggestscountriesmaking

mostprogressreplacingaidwithtaxrevenuetendtobethosebenefitingdisproportionatelyfromrising

pricesofenergyandcommodities.

Theauthor[49]foundtaxrevenueasapercentageofGDPvaryinggreatlyaroundaglobalaverageof

19%.[51]ThisdataalsoindicatescountrieswithhigherGDPtendtohavehighertaxtoGDPratios,

demonstratingthathigherincomeisassociatedwithmorethanproportionatelyhighertaxrevenue.On

average,highincomecountrieshavetaxrevenueasapercentageofGDPofaround22%,comparedto

18%inmiddleincomecountriesand14%inlowincomecountries.

Inhighincomecountries,thehighesttaxtoGDPratioisinDenmarkat47%andthelowestisinKuwait

at0.8%,reflectinglowtaxesfromstrongoilrevenues.Longtermaverageperformanceoftaxrevenueas

ashareofGDPinlowincomecountrieshasbeenlargelystagnant,althoughmosthaveshownsome

improvementinmorerecentyears.Onaverage,resourcerichcountrieshavemadethemostprogress,

risingfrom10%inthemid90stoaround17%in2008.Nonresourcerichcountriesmadesome

progress,withaveragetaxrevenuesincreasingfrom10%to15%overthesameperiod.[52]

ManylowincomecountrieshaveataxtoGDPratiooflessthan15%whichcouldbeduetolowtax

potential,suchasalimitedtaxableeconomicactivity,orlowtaxeffortduetopolicychoice,non

compliance,oradministrativeconstraints.

SomelowincomecountrieshaverelativelyhightaxtoGDPratiosduetoresourcetaxrevenues(e.g.

Angola)orrelativelyefficienttaxadministration(e.g.Kenya,Brazil)whereassomemiddleincome

countrieshavelowertaxtoGDPratios(e.g.Malaysia)whichreflectamoretaxfriendlypolicychoice.

Whileoveralltaxrevenueshaveremainedbroadlyconstant,theglobaltrendshowstradetaxeshave

beendecliningasaproportionoftotalrevenues(IMF,2011),withtheshareofrevenueshiftingaway

frombordertradetaxestowardsdomesticallyleviedsalestaxesongoodsandservices.Lowincome

countriestendtohaveahigherdependenceontradetaxes,andasmallerproportionoffromincomeand

consumptiontaxes,whencomparedtohighincomecountries.[53]

Oneindicatorofthetaxpayingexperiencewascapturedinthe'DoingBusiness'survey,[54]which

comparesthetotaltaxrate,timespentcomplyingwithtaxproceduresandthenumberofpayments

requiredthroughtheyear,across176countries.The'easiest'countriesinwhichtopaytaxesarelocated

intheMiddleEastwiththeUAErankingfirst,followedbyQatarandSaudiArabia,mostlikely

reflectinglowtaxregimesinthosecountries.CountriesinSubSaharanAfricaareamongthe'hardest'to

paywiththeCentralAfricanRepublic,RepublicofCongo,GuineaandChadinthebottom5,reflecting

highertotaltaxratesandagreateradministrativeburdentocomply.

Keyfacts

ThebelowfactswerecompiledbyEPSPEAKSresearchers[49]

TradeliberalisationhasledtoadeclineintradetaxesasashareoftotalrevenuesandGDP.[49][55]

ResourcerichcountriestendtocollectmorerevenueasashareofGDP,butthisismorevolatile.

http://en.wikipedia.org/wiki/Tax

16/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

SubSaharanAfricancountriesthatareresourcerichhaveperformedbettertaxcollectingthan

nonresourcerichcountries,butrevenuesaremorevolatilefromyeartoyear.[56]Bystrengthening

revenuemanagement,therearehugeopportunitiesforinvestmentfordevelopmentandgrowth

[49][57]

Developingcountrieshaveaninformalsectorrepresentinganaverageofaround40%,perhapsup

to60%insome.[58]Informalsectorsfeaturemanysmallinformaltraderswhomaynotbeefficient

inbringingintothetaxnet,sincethecostofcollectionishighandrevenuepotentiallimited

(althoughtherearebroadergovernancebenefits).Thereisalsoanissueofnoncompliant

companieswhoare'hardtotax',evadingtaxesandshouldbebroughtintothetaxnet.[49][59]

Inmanylowincomecountries,themajorityofrevenueiscollectedfromanarrowtaxbase,

sometimesbecauseofalimitedrangeoftaxableeconomicactivities.Thereistherefore

dependenceonfewtaxpayers,oftenmultinationals,thatcanexacerbatetherevenuechallengeby

minimisingtheirtaxliability,insomecasesabusingalackofcapacityinrevenueauthorities,

sometimesthroughtransferpricingabuse[49][59]

Developinganddevelopedcountriesfacehugechallengesintaxingmultinationalsand

internationalcitizens.Estimatesoftaxrevenuelossesfromevasionandavoidanceindeveloping

countriesarelimitedbyalackofdataandmethodologicalshortcomings,butsomeestimatesare

significant[49][60]

Countriesuseincentivestoattractinvestmentbutdoingthismaybeunnecessarilygivingup

revenueasevidencesuggeststhatinvestorsareinfluencedmorebyeconomicfundamentalslike

marketsize,infrastructure,andskills,andonlymarginallybytaxincentives(IFCinvestor

surveys)[49]

Inlowincomecountries,compliancecostsarehigh,theyarelengthyprocesses,frequenttax

payments,bribesandcorruption[49][59][61]

Administrationsareoftenunderresourced,resourcesaren'teffectivelytargetedonareasof

greatestimpact,andmidlevelmanagementisweak.Coordinationbetweendomesticandcustoms

isweak,whichisespeciallyimportantforVAT.Weakadministration,governanceandcorruption

tendtobeassociatedwithlowrevenuecollections(IMF,2011)[49]

Evidenceontheeffectofaidontaxrevenuesisinconclusive.Taxrevenueismorestableand

sustainablethanaid.Whileadisincentiveeffectofaidonrevenuemaybeexpectedandwas

supportedbysomeearlystudies,recentevidencedoesnotsupportthatconclusion,andinsome

cases,pointstowardshighertaxrevenuefollowingsupportforrevenuemobilisation.[49]

Ofallregions,Africahasthehighesttotaltaxratesbornebybusinessat57.4%ofprofiton

average,buthasreducedthemostsince2004,from70%,partlyduetointroducingVATandthis

islikelytohaveabeneficialeffectonattractinginvestment.[49][62]

FragilestatesarelessabletoexpandtaxrevenueasapercentageofGDPandanygainsaremore

difficulttosustain.[63]Taxadministrationtendstocollapseifconflictreducesstatecontrolled

territoryorreducesproductivity.[64]Aseconomiesarerebuiltafterconflicts,therecanbegood

progressindevelopingeffectivetaxsystems.Liberiaexpandedfrom10.6%ofGDPin2003to

21.3%in2011.Mozambiqueincreasedfrom10.5%ofGDPin1994toaround17.7%in

2011.[49][65]

Summary

Aidinterventionsinrevenuecansupportrevenuemobilisationforgrowth,improvetaxsystemdesign

andadministrativeeffectiveness,andstrengthengovernanceandcompliance.[49]Theauthorofthe

EconomicsTopicGuidefoundthatthebestaidmodalitiesforrevenuedependoncountrycircumstances,

butshouldaimtoalignwithgovernmentinterestsandfacilitateeffectiveplanningandimplementation

ofactivitiesunderanevidencebasedtaxreform.Lastly,shefoundthatidentifyingareasforfurther

http://en.wikipedia.org/wiki/Tax

17/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

reformrequirescountryspecificdiagnosticassessment:broadareasfordevelopingcountriesidentified

internationally(e.g.IMF)include,forexamplepropertytaxationforlocalrevenues,strengthening

expendituremanagement,andeffectivetaxationofextractiveindustriesandmultinationals.[49]

Viewsontaxation

Supportfortaxation

Accordingtomostpoliticalphilosophies,taxesarejustifiedastheyfund

activitiesthatarenecessaryandbeneficialtosociety.Additionally,

progressivetaxationcanbeusedtoreduceeconomicinequalityina

society.Accordingtothisview,taxationinmodernnationstatesbenefit

themajorityofthepopulationandsocialdevelopment.[67]Acommon

presentationofthisview,paraphrasingvariousstatementsbyOliver

WendellHolmes,Jr.is"Taxesarethepriceofcivilization".[68]

Everytax,however,is,tothe

personwhopaysit,abadge,

notofslavery,butofliberty.

AdamSmith(1776),

WealthofNations[66]

Itcanalsobearguedthatinademocracy,becausethegovernmentisthe

partyperformingtheactofimposingtaxes,societyasawholedecideshowthetaxsystemshouldbe

organized.[69]TheAmericanRevolution's"Notaxationwithoutrepresentation"sloganimpliedthisview.

Fortraditionalconservatives,thepaymentoftaxationisjustifiedaspartofthegeneralobligationsof

citizenstoobeythelawandsupportestablishedinstitutions.Theconservativepositionisencapsulatedin

perhapsthemostfamousadageofpublicfinance,"Anoldtaxisagoodtax".[70]Conservativesadvocate

the"fundamentalconservativepremisethatnooneshouldbeexcusedfrompayingforgovernment,lest

theycometobelievethatgovernmentiscostlesstothemwiththecertainconsequencethattheywill

demandmoregovernment'services'."[71]Socialdemocratsgenerallyfavorhigherlevelsoftaxationto

fundpublicprovisionofawiderangeofservicessuchasuniversalhealthcareandeducation,aswellas

theprovisionofarangeofwelfarebenefits.[72]AsarguedbyTonyCroslandandothers,thecapacityto

taxincomefromcapitalisacentralelementofthesocialdemocraticcaseforamixedeconomyas

againstMarxistargumentsforcomprehensivepublicownershipofcapital.[73]Manylibertarians

recommendaminimalleveloftaxationinordertomaximizetheprotectionofliberty.

Compulsorytaxationofindividuals,suchasincometax,isoftenjustifiedongroundsincludingterritorial

sovereignty,andthesocialcontract.Defendersofbusinesstaxationarguethatitisanefficientmethodof

taxingincomethatultimatelyflowstoindividuals,orthatseparatetaxationofbusinessisjustifiedonthe

groundsthatcommercialactivitynecessarilyinvolvesuseofpubliclyestablishedandmaintained

economicinfrastructure,andthatbusinessesareineffectchargedforthisuse.[74]Georgisteconomists

arguethatalloftheeconomicrentcollectedfromnaturalresources(land,mineralextraction,fishing

quotas,etc.)isunearnedincome,andbelongstothecommunityratherthananyindividual.They

advocateahightax(the"SingleTax")onlandandothernaturalresourcestoreturnthisunearnedincome

tothestate,butnoothertaxes.

Oppositiontotaxation

Becausepaymentoftaxiscompulsoryandenforcedbythelegalsystem,somepoliticalphilosophies

viewtaxationastheft,extortion,(orasslavery,orasaviolationofpropertyrights),ortyranny,accusing

thegovernmentoflevyingtaxesviaforceandcoercivemeans.[75]Voluntaryists,individualistanarchists,

Objectivists,anarchocapitalists,andlibertariansseetaxationasgovernmentaggression(seezero

aggressionprinciple).Theviewthatdemocracylegitimizestaxationisrejectedbythosewhoarguethat

allformsofgovernment,includinglawschosenbydemocraticmeans,arefundamentallyoppressive.

http://en.wikipedia.org/wiki/Tax

18/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

AccordingtoLudwigvonMises,"societyasawhole"shouldnotmakesuchdecisions,dueto

methodologicalindividualism.[76]Libertarianopponentsoftaxationclaimthatgovernmentalprotection,

suchaspoliceanddefenseforcesmightbereplacedbymarketalternativessuchasprivatedefense

agencies,arbitrationagenciesorvoluntarycontributions.[77]WalterE.Williams,professorofeconomics

atGeorgeMasonUniversity,stated"Governmentincomeredistributionprogramsproducethesame

resultastheft.Infact,that'swhatathiefdoesheredistributesincome.Thedifferencebetween

governmentandthieveryismostlyamatteroflegality."[78]

Socialistview

KarlMarxassumedthattaxationwouldbeunnecessaryaftertheadventofcommunismandlooked

forwardtothe"witheringawayofthestate".InsocialisteconomiessuchasthatofChina,taxation

playedaminorrole,sincemostgovernmentincomewasderivedfromtheownershipofenterprises,and

itwasarguedbysomethatmonetarytaxationwasnotnecessary.[79]Whilethemoralityoftaxationis

sometimesquestioned,mostargumentsabouttaxationrevolvearoundthedegreeandmethodoftaxation

andassociatedgovernmentspending,nottaxationitself.

Taxchoice

Taxchoiceisthetheorythattaxpayersshouldhavemorecontrolwithhowtheirindividualtaxesare

allocated.Iftaxpayerscouldchoosewhichgovernmentorganizationsreceivedtheirtaxes,opportunity

costdecisionswouldintegratetheirpartialknowledge.[80]Forexample,ataxpayerwhoallocatedmore

ofhistaxesonpubliceducationwouldhavelesstoallocateonpublichealthcare.Supportersarguethat

allowingtaxpayerstodemonstratetheirpreferenceswouldhelpensurethatthegovernmentsucceedsat

efficientlyproducingthepublicgoodsthattaxpayerstrulyvalue.[81]ouldendrealestatespeculation,

businesscycles,unemploymentanddistributewealthmuchmoreevenly.JosephStiglitz'sHenryGeorge

TheorempredictsitssufficiencybecauseasGeorgealsonotedpublicspendingraiseslandvalue.

GeoistView

Geoists(Georgistsandgeolibertarians)statethattaxationshouldprimarilycollecteconomicrent,in

particularthevalueofland,forbothreasonsofeconomicefficiencyaswellasmorality.Theefficiency

ofusingeconomicrentfortaxationis(aseconomistsagree[82][83][84])duetothefactthatsuchtaxation

cannotbepassedonanddoesnotcreateanydeadweightloss,andthatitremovestheincentiveto

speculateonland.[85]ItsmoralityisbasedontheGeoistpremisethatprivatepropertyisjustifiedfor

productsoflabourbutnotforlandandnaturalresources.[86]

EconomistandsocialreformerHenryGeorgeopposedsalestaxesandprotectivetariffsfortheirnegative

impactontrade.[87]Healsobelievedintherightofeachpersontothefruitsoftheirownlabourand

productiveinvestment.Thereforeincomefromlabourand'proper'capitalshouldremainuntaxed.For

thisreasonmanyGeoistsinparticularthosethatcallthemselvesgeolibertariansharetheviewwith

libertariansthatthesetypesoftaxation(butnotall)areimmoralandeventheft.Georgestatedthere

shouldbeonesingletax:theLandValueTax,whichisconsideredbothefficientandmoral.[86]Demand

forspecificlandisdependentonnature,butevenmoresoonthepresenceofcommunities,trade,and

governmentinfrastructure,particularlyinurbanenvironments.Thereforetheeconomicrentoflandis

nottheproductofoneparticularindividualanditmaybeclaimedforpublicexpenses.Accordingto

http://en.wikipedia.org/wiki/Tax

19/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

George,thiswouldendrealestatebubbles,businesscycles,unemploymentanddistributewealthmuch

moreevenly.[86]JosephStiglitz'sHenryGeorgeTheorempredictsitssufficiencyforfinancingpublic

goodsbecausethoseraiselandvalue.[88]

JohnLockestatedthatwheneverlabourismixedwithnaturalresources,suchasisthecasewith

improvedland,privatepropertyisjustifiedundertheprovisothattheremustbeenoughothernatural

resourcesofthesamequalityavailabletoothers.[89]GeoistsstatethattheLockeanprovisoisviolated

whereverlandvalueisgreaterthanzero.Thereforeundertheassumedprincipleofequalrightsofall

peopletonaturalresources,theoccupierofanysuchlandmustcompensatetherestofsocietytothe

amountofthatvalue.Forthisreason,geoistsgenerallybelievethatsuchpaymentcannotberegardedas

atrue'tax',butratheracompensationorfee.[90]ThismeansthatwhileGeoistsalsoregardtaxationasan

instrumentofsocialjustice,contrarytosocialdemocratsandsocialliberalstheydonotregarditasan

instrumentofredistributionbutrathera'predistribution'orsimplyacorrectdistributionofthe

commons.[91]

Moderngeoistsnotethatlandintheclassicaleconomicmeaningofthewordreferredtoallnatural

resources,andthusalsoincludesresourcessuchasmineraldeposits,waterbodiesandthe

electromagneticspectrum,towhichprivilegedaccessalsogenerateseconomicrentthatmustbe

compensated.Underthesamereasoningmostofthemalsoconsiderpigouviantaxesascompensationfor

environmentaldamageorprivilegeasacceptableandevennecessary.[92][93]

Theoriesontaxation

Laffercurve

Ineconomics,theLaffercurveisatheoreticalrepresentationoftherelationshipbetweengovernment

revenueraisedbytaxationandallpossibleratesoftaxation.Itisusedtoillustratetheconceptoftaxable

incomeelasticity(thattaxableincomewillchangeinresponsetochangesintherateoftaxation).The

curveisconstructedbythoughtexperiment.First,theamountoftaxrevenueraisedattheextremetax

ratesof0%and100%isconsidered.Itisclearthata0%taxrateraisesnorevenue,buttheLaffercurve

hypothesisisthata100%taxratewillalsogeneratenorevenuebecauseatsucharatethereisnolonger

anyincentiveforarationaltaxpayertoearnanyincome,thustherevenueraisedwillbe100%of

nothing.Ifbotha0%rateand100%rateoftaxationgeneratenorevenue,itfollowsfromtheextreme

valuetheoremthattheremustexistatleastonerateinbetweenwheretaxrevenuewouldbeamaximum.

TheLaffercurveistypicallyrepresentedasagraphwhichstartsat0%tax,zerorevenue,risestoa

maximumrateofrevenueraisedatanintermediaterateoftaxationandthenfallsagaintozerorevenue

ata100%taxrate.

OnepotentialresultoftheLaffercurveisthatincreasingtaxratesbeyondacertainpointwillbecome

counterproductiveforraisingfurthertaxrevenue.AhypotheticalLaffercurveforanygiveneconomy

canonlybeestimatedandsuchestimatesaresometimescontroversial.TheNewPalgraveDictionaryof

Economicsreportsthatestimatesofrevenuemaximizingtaxrateshavevariedwidely,withamidrange

ofaround70%.[94]

Optimaltax

Mostgovernmentstakerevenuewhichexceedsthatwhichcanbeprovidedbynondistortionarytaxesor

throughtaxeswhichgiveadoubledividend.Optimaltaxationtheoryisthebranchofeconomicsthat

considershowtaxescanbestructuredtogivetheleastdeadweightcosts,ortogivethebestoutcomesin

http://en.wikipedia.org/wiki/Tax

20/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

termsofsocialwelfare.[4]TheRamseyproblemdealswithminimizingdeadweightcosts.Because

deadweightcostsarerelatedtotheelasticityofsupplyanddemandforagood,itfollowsthatputtingthe

highesttaxratesonthegoodsforwhichthereismostinelasticsupplyanddemandwillresultintheleast

overalldeadweightcosts.Someeconomistssoughttointegrateoptimaltaxtheorywiththesocialwelfare

function,whichistheeconomicexpressionoftheideathatequalityisvaluabletoagreaterorlesser

extent.Ifindividualsexperiencediminishingreturnsfromincome,thentheoptimumdistributionof

incomeforsocietyinvolvesaprogressiveincometax.Mirrleesoptimalincometaxisadetailed

theoreticalmodeloftheoptimumprogressiveincometaxalongtheselines.Overthelastyearsthe

validityofthetheoryofoptimaltaxationwasdiscussedbymanypoliticaleconomists.[95]

Taxrates

Taxesaremostoftenleviedasapercentage,calledthetaxrate.Animportantdistinctionwhentalking

abouttaxratesistodistinguishbetweenthemarginalrateandtheeffectivetaxrate.Theeffectiverateis

thetotaltaxpaiddividedbythetotalamountthetaxispaidon,whilethemarginalrateistheratepaid

onthenextdollarofincomeearned.Forexample,ifincomeistaxedonaformulaof5%from$0upto

$50,000,10%from$50,000to$100,000,and15%over$100,000,ataxpayerwithincomeof$175,000

wouldpayatotalof$18,750intaxes.

Taxcalculation

(0.05*50,000)+(0.10*50,000)+(0.15*75,000)=18,750

The"effectiverate"wouldbe10.7%:

18,750/175,000=0.107

The"marginalrate"wouldbe15%.

Seealso

12monthrule

Advancetaxruling

Confiscation

Excessburdenoftaxation

Fiscalincidence

Governmentbudgetbalance

Internationaltaxation

Listoftaxes

Modelaudit

Priceceiling

Pricefloor

Revolutionarytax

Taxcompetition

Taxexporting

Taxhaven

Taxresistance

Taxshelter

Taxpayerreceipt

Bycountryorregion

Listofcountriesbytaxrates

ListofcountriesbytaxrevenueaspercentageofGDP

Category:Taxationbycountry

Notes

1. CharlesE.McLure,Jr."Taxation"(http://www.britannica.com/EBchecked/topic/584578/taxation).

http://en.wikipedia.org/wiki/Tax

21/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

1. CharlesE.McLure,Jr."Taxation"(http://www.britannica.com/EBchecked/topic/584578/taxation).

Britannica.Retrieved3March2015.

2. "20132014TheworldwidepersonaltaxguideUnitedArabEmirates"

(http://www.ey.com/GL/en/Services/Tax/TheworldwidepersonaltaxguideXMLQS?

preview&XmlUrl=/ec1mages/taxguides/TGE2013/TGEAE.xml).Ernst&Young.Retrieved3March2015.

3. Seeforexample26U.S.C.7203(http://www.law.cornell.edu/uscode/26/7203.html)inthecaseofU.S.

Federaltaxes.

4. Simkovic,Michael."DistortionaryTaxationofHumanCapitalAcquisitionCosts"

(http://ssrn.com/abstract=2551567).SocialScienceResearchNetwork.

5. "DefinitionofTaxes(NotebytheChairman),1996"(http://www.oecd.org/daf/mai/pdf/eg2/eg2963e.pdf)

(PDF).Retrieved20130122.

6. "SocialSecurityProgramsThroughouttheWorldontheU.S.SocialSecuritywebsiteforlinkstoindividual

countryprogramdescriptions"(http://www.ssa.gov/policy/docs/progdesc/index.html).Ssa.gov.Retrieved

20130122.

7. Bycontrast,somecountries,suchasNewZealand(http://www.ssa.gov/policy/docs/progdesc/ssptw/2010

2011/asia/newzealand.html),financetheprogramsthroughothertaxes.

8. See,e.g.,IndiaSocialSecurityoverview(http://labour.nic.in/ss/overview.html)

9. See,e.g.,UnitedStatesFederalUnemploymentTaxAct.

10. Taxesonthenetwealthofcorporationsareoftenreferredtoascorporatetax.

11. McCluskey,WilliamJ.Franzsen,RilC.D.(2005).LandValueTaxation:AnAppliedAnalysis

(http://books.google.com/?

id=jkogP2U4k0AC&pg=PA73&lpg=PA73&dq=disadvantages+of+land+value+taxation).AshgatePublishing,

Ltd.p.4.ISBN0754614905.

12. "TPCTaxTopics|FederalBudget"(http://www.taxpolicycenter.org/taxtopics/budget.cfm).

Taxpolicycenter.org.Retrieved20090327.

13. "26USC877"(http://www.law.cornell.edu/uscode/html/uscode26/usc_sec_26_00000877000.html).

Law.cornell.edu.Retrieved20130122.

14. AlthoughTexashasnoindividualincometax,thestatedoesimposeafranchisetaxsoontobereplacedbya

margintaxonbusinessactivitythat,whilenotdenominatedasanincometax,isinsubstanceakindof

incometax.

15. "Economist.com"(http://www.economist.com/business/displaystory.cfm?story_id=13110436).

Economist.com.20090212.Retrieved20090327.

16. Quick,JohnGarran,Robert(1January1901).TheAnnotatedConstitutionoftheAustralianCommonwealth

(https://books.google.com/books?id=VRCAAAAIAAJ).Australia:Angus&Robertson.p.837.Retrieved

12March2015.

17. "TaxFacts|TaxFactsListing"(http://www.taxpolicycenter.org/TaxFacts/listdocs.cfm?topic2id=60).

Taxpolicycenter.org.Retrieved20090327.

18. "InternalRevenueService"

(http://web.archive.org/web/20070816190910/http://www.irs.gov/app/understandingTaxes/jsp/whys/lp/IWT5L

1lp.jsp).webcache.googleusercontent.com.Retrieved20090327.

19. "luxurytaxBritannicaOnlineEncyclopedia"(http://concise.britannica.com/ebc/article9370763/luxury

tax).Concise.britannica.com.Retrieved20090327.

20. http://links.jstor.org/sici?sici=00028282(196909)59%3A4%3C596%3ACEASTR%3E2.0.CO%3B23

21. A.B.Atkinson,OptimalTaxationandtheDirectVersusIndirectTaxControversy,10Can.J.Econ.590,592

(1977)

22. "WhatisDifferenceBetweenDirectandIndirectTax?"(http://www.investorguide.com/iguarticle1138tax

basicswhatisdifferencebetweendirectandindirecttax.html).InvestorGuide.Retrieved20111028.

23. "Taxesversusfees"

(http://www.ncsu.edu/project/calscommblogs/economic/archives/2007/05/the_difference.html).Ncsu.edu.

20070502.Retrieved20130122.

24. Someeconomistsholdthattheinflationtaxaffectsthelowerandmiddleclassesmorethantherich,asthey

holdalargerfractionoftheirincomeincash,theyaremuchlesslikelytoreceivethenewlycreatedmonies

beforethemarkethasadjustedwithinflatedprices,andmoreoftenhavefixedincomes,wagesorpensions.

Somearguethatinflationisaregressiveconsumptiontax.AlsoseeAndrsErosaandGustavoVentura,"On

inflationasaregressiveconsumptiontax

(http://www.ssc.uwo.ca/economics/econref/workingpapers/researchreports/wp2000/wp2000_1.pdf)".Some

claimtherearesystemiceffectsofanexpansionarymonetarypolicy,whicharealsodefinitivelytaxing,

imposingafinancialchargeonsomeasaresultofthepolicy.Becausetheeffectsofmonetaryexpansionor

counterfeitingareneveruniformoveranentireeconomy,thepolicyinfluencescapitaltransfersinthemarket,

http://en.wikipedia.org/wiki/Tax

22/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

counterfeitingareneveruniformoveranentireeconomy,thepolicyinfluencescapitaltransfersinthemarket,

creatingeconomicbubbleswherethenewmoniesarefirstintroduced.Economicbubblesincreasemarket

instability,andthereforeincreaseinvestmentrisk,creatingtheconditionscommontoarecession.This

particulartaxcanbeunderstoodtobeleviedonfuturegenerationsthatwouldhavebenefitedfromeconomic

growth,andithasa100%transfercost(solongaspeoplearenotactingagainsttheirinterests,increased

uncertaintybenefitsnoone).OneexampleofastrongsupporterofthistaxwastheformerFederalReserve

chairBeardsleyRuml.

25. See,e.g.,Reinhart,CarmenM.andRogoff,KennethS.,ThisTimeisDifferent.PrincetonandOxford:

PrincetonUniversityPress,2008(p.143),TheLiquidationofGovernmentDebt,Reinhart,CarmenM.&

Sbrancia,M.Belen,p.19(https://www.imf.org/external/np/seminars/eng/2011/res2/pdf/crbs.pdf),

Giovannini,AlbertoanddeMelo,Martha,GovernmentRevenuefromFinancialRepression.TheAmerican

EconomicReview,Vol.83,No.4Sep.1993(pp.953963).

26. TaxesintheAncientWorld(http://www.upenn.edu/almanac/v48/n28/AncientTaxes.html),Universityof

PennsylvaniaAlmanac,Vol.48,No.28,April2,2002

27. DavidF.Burg(2004).AWorldHistoryofTaxRebellions(http://books.google.co.uk/books?

id=T91k6HAODzAC&lpg=PP1&pg=PP1#v=onepage&q&f=false).pp.viviii.ISBN9780415924986.

28. Olmert,Michael(1996).Milton'sTeethandOvid'sUmbrella:Curiouser&CuriouserAdventuresinHistory,

p.41.Simon&Schuster,NewYork.ISBN0684801647.

29. "TheBible"(http://www.biblegateway.com/passage/?search=Genesis+41%3A3336&version=NIV).

30. "DariusI(DariustheGreat),KingofPersia(from521BC)"

(http://www.1902encyclopedia.com/D/DAR/dariusithegreat.html).1902encyclopedia.com.Retrieved

20130122.

31. "HistoryOfIran(Persia)"(http://www.historyworld.net/wrldhis/PlainTextHistories.asp?historyid=aa65).

Historyworld.net.Retrieved20130122.

32. TheTheocraticIdeologyoftheChroniclerbyJonathanE.Dyckp.96BRILL,1998

33. BritishMuseum."HistoryoftheWorldin100Objects:RosettaStone"

(http://www.bbc.co.uk/ahistoryoftheworld/about/transcripts/episode33//).BBC.

34. Hoffman,PhillipeandKathrynNorberg(1994),FiscalCrises,Liberty,andRepresentativeGovernment,

14501789,p.238.

35. Hoffman,PhillipeandKathrynNorberg(1994),FiscalCrises,Liberty,andRepresentativeGovernment,

14501789,p.300.

36. "OECDnationalaccounts"

(http://www.oecd.org/topicstatsportal/0,2647,en_2825_495684_1_1_1_1_1,00.html).Retrieved20070301.

37. Tax/SpendingBurden(http://www.forbes.com/global/2004/0524/074chart2.html),Forbesmagazine,052404

38. "IRSpicklist"(http://apps.irs.gov/app/picklist/list/formsInstructions.html).IRS.Retrieved21January2013.

39. "title26USCode"(http://uscode.house.gov/download/title_26.shtml).USHouseofReperesentitives.

Retrieved21January2013.

40. Caron,PaulL.(October28,2011)."HowManyWordsAreintheInternalRevenueCode?"

(http://taxprof.typepad.com/taxprof_blog/2011/10/slatehowmany.html).Retrieved21January2013.

41. "26CFRTableOfContents"(http://www.gpo.gov/fdsys/search/pagedetails.action?

collectionCode=CFR&searchPath=Title+26%2FChapter+I&granuleId=CFR2012title26vol1toc

id2&packageId=CFR2012title26

vol1&oldPath=Title+26%2FTOC&fromPageDetails=true&collapse=true&ycord=0).Gpo.gov.20120401.

Retrieved20130122.

42. "InternalRevenueBulletin:201223"(http://www.irs.gov/irb/201223_IRB/ar08.html).InternalRevenue

Service.4June2012.Retrieved7June2012.

43. Parkin,Michael(2006),PrinciplesofMicroeconomics,p.134.

44. McCluskey,WilliamJFranzsen,RilC.D(2005).LandValueTaxation:AnAppliedAnalysis,WilliamJ.

McCluskey,RilC.D.Franzsen(http://books.google.com/?

id=jkogP2U4k0AC&pg=PA73&lpg=PA73&dq=disadvantages+of+land+value+taxation).Books.google.com.

ISBN9780754614906.Retrieved20090327.

45. AviYonah,ReuvenS.Slemrod,JoelB.(April2002)."WhyTaxtheRich?Efficiency,Equity,and

ProgressiveTaxation".TheYaleLawJournal111(6):13911416.doi:10.2307/797614

(https://dx.doi.org/10.2307%2F797614).JSTOR797614(https://www.jstor.org/stable/797614).

46. Johnsson,Richard."TaxationandDomesticFreeTrade"(https://ideas.repec.org/p/hhs/ratioi/0040.html).

Ideas.repec.org.Retrieved20090327.

47. Corsi,Jerome,2007."TheVAT:MenacetoFreeTrade",WorldNetDailyExclusiveCommentary,

WorldNetDaily,February3,2007

48.

Johnsson,Richard,2004."TaxationandDomesticFreeTrade,"RatioWorkingPapers40,TheRatio

http://en.wikipedia.org/wiki/Tax

23/26

7/5/2015

TaxWikipedia,thefreeencyclopedia

48. Johnsson,Richard,2004."TaxationandDomesticFreeTrade,"RatioWorkingPapers40,TheRatio

Institute,revisedJune7,2004.

49. HazelGranger(2013)."EconomicsTopicGuideTaxationandRevenue"(http://partnerplatform.org/?

c158bbx3).EPSPEAKS.

50. AfricaEconomicOutlook2010,Part2:PublicResourceMobilisationandAidinAfrica,AfDB/OECD(2010)

51. AccordingtoIMFdatafor2010,fromRevenueDataforIMFMemberCountries,asof2011,(unpublished)

52. IMFFAD(2011),RevenueMobilizationinDevelopingCountries

53. IMFWP/05/112,TaxRevenueand(or?)TradeLiberalization,ThomasBaunsgaardandMichaelKeen

54. 'DoingBusiness2013',WorldBank/IFC(2013)

55. Keen&Mansour,20100901,DevelopmentPolicyReview,Vol.28No.5,pp.553555

56. Keen&Mansour2010,RevenueMobilisationinSubSaharanAfrica:ChallengesfromGlobalisationI

TradeReform,DevelopmentPolicyReview,Vol.28,No.5,pp.553571,September2010

57. SeeforexamplePaulCollier(2010),ThePoliticalEconomyofNaturalResources,socialresearchVol77:

No4:Winter2010.

58. Schneider,Buehn,andMontenegro(2010),ShadowEconomiesallovertheWorld:NewEstimatesfor162

Countriesfrom1999to2007.

59. IMF,2011,RevenueMobilizationinDevelopingCountries,FiscalAffairsDepartment

60. SeeSection3'InternationalTaxation'e.g.Torvik,2009inCommissiononCapitalFlightfromDeveloping

Countries,2009:TaxHavensandDevelopment

61. 'DoingBusiness2013',WorldBank/IFC2013

62. PayingTaxes2013:Totaltaxrateisacompositemeasureincludingcorporateincometax,employmenttaxes,

socialcontributions,indirecttaxes,propertytaxesandsmallertaxese.g.environmentaltax.

63. IMFWorkingPaper108/12(2012),MobilizingRevenueinSubSaharanAfrica:EmpiricalNormsandKey

Determinants

64. AfricanEconomicOutlook(2010)

65. IMFRevenueData,2011:TotalTaxRevenueasapercentageofGDP

66. Smith,Adam(1776),WealthofNations(http://www2.hn.psu.edu/faculty/jmanis/adamsmith/Wealth

Nations.pdf),PennStateElectronicClassicsedition,republished2005,p.704

67. PopulationandSocialIntegrationSection(PSIS)

(http://www.unescap.org/esid/psis/publications/theme2002/chap5.asp),UnitedNationsSocialandEconomic

CommissionforAsiaandthePacific

68. Gerhart,EugeneC(September1998).QuoteitCompletely!(http://books.google.com/?

id=kjwVASsTUm0C&pg=PA1045&lpg=PA1045&dq=taxation+price+civilisation+holmes+quote).

Books.google.com.au.ISBN9781575884004.Retrieved20090327.

69. Logue,Danielle.2009."Movingpolicyforward:'braindrain'asawickedproblem."Globalisation,Societies

&Education7,no.1:4150.AcademicSearchPremier,EBSCOhost.RetrievedFebruary18,2009.

70. "TaxHistoryProject:TheDepressionandReform:FDR'sSearchforTaxRevisioninN.Y.(Copyright,2003,

TaxAnalysts)"

(http://www.taxhistory.org/thp/readings.nsf/ArtWeb/44DC64199FBB0ED885256DFE005981FE?

OpenDocument).

71. "DoConservativesHaveaConservativeTaxAgenda?"(http://www.heritage.org/Research/Taxes/HL349.cfm).

Heritage.org.Retrieved20130122.