Professional Documents

Culture Documents

Untitled

Uploaded by

api-274468947Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

api-274468947Copyright:

Available Formats

J.K.K.

Week of June 15th, 2015

MARKET OUTLOOK

Earnings Central

Here are some of the major companies reporting this week:

Symbol

ADBE

BOBE

FDX

PIR

JBL

ORCL

KR

RAD

FNSR

RHT

SWHC

Company

Adobe Systems

Bob Evans Farms

FedEx

Pier 1 Imports

Jabil Circuit

Oracle

Kroger

Rite Aid

Finisar Corporation

Red Hat

Smith & Wesson

KBH

KMX

KB Home

CarMax

Industry

Application Software

Restaurants

Air Delivery & Freight

Home Furnishings

Printed Circuit Boards

Application Software

Grocery Stores

Drug Stores

Networking/Communication

Application Software

Aerospace/Defense

Products

Residential Construction

Auto Dealerships

Earnings Date

Tuesday AMC

Tuesday AMC

Wednesday BMO

Wednesday BMO

Wednesday AMC

Wednesday AMC

Thursday BMO

Thursday BMO

Thursday AMC

Thursday AMC

Thursday AMC

Friday BMO

Friday BMO

Earnings & Options

th

Tuesday June 16 Before the Open

FactSet Research Systems (FDS):

The July 165 Puts were bought 1000x between 5.20 5.47 on 6/4/2015.

th

Tuesday, June 16 After the Close

Adobe Systems (ADBE):

The July 82.5 Calls were bought 15000x for 1.13 on 4/30/2015.

Bob Evans Farms (BOBE):

The July 40 Puts were rolled from the June 40 Puts on 6/9/2015 and bought for 0.50.

1|Page

th

Wednesday June 17 Before the Open

Actuant Corporation (ATU):

The July 25 Calls were bought for 0.45 on 6/11/2015.

Pier 1 Imports (PIR):

The June 13 Puts were bought for 0.50 and the June 12 Puts were sold for 0.20 (Put Spread / 0.30 Debit)

on 5/27/2015. This spread was done 10000x.

The June 12 Calls were bought for 0.70 on 6/8/2015.

The June 13 Calls were bought between 0.30 0.35 on 6/8/2015.

The stock has moved higher the past couple of earnings reports. In its last release, the company beat on

EPS and Revenue and showed an increase in comps by 5.7%.

th

Wednesday June 17 After the Close

Oracle (ORCL):

The July 39 Puts were bought for 0.23 on 6/4/2015.

th

Thursday June 18 Before the Open

Kroger (KR):

The June 70 Calls were bought between 2.26 2.29 on 4/22/2015.

The June 72.5 Calls were bought for 1.10 on 6/5/2015.

Rite Aid (RAD):

The June 8 Calls were bought for 0.65 on 5/4/2015.

The July 9 Calls were bought for 0.30 on 5/21/2015. Total volume in the strike on the day was 144,670.

Open Interest jumped from, 17,741 to 139,197 the following day.

th

Thursday June 18 After the Close

Red Hat (RHT):

The June 77.5 Calls were bought between 1.70 1.75 on 5/5/2015.

The June 80 Calls were bought for 1.05 on 5/5/2015.

The July 80 Calls were bought 2000x between 2.85 3.10 on 6/8/2015.

2|Page

Smith & Wesson (SWHC):

The June 16 Calls were bought 3500x for 0.55 on 4/15/2015.

th

Friday June 19 Before the Open

CarMax (KMX):

The July 75 Calls were bought 5000x for 2.30 on 6/4/2015.

IPO Schedule (subject to change)

Nivalis Therapeutics (NVLS) A clinical stage pharmaceutical company committed to the discovery, development,

and commercialization of product candidates for patients with cystic fibrosis, or CF. Expected to Trade on

Wednesday.

Principal Solar (PSWW) Acquires, builds, owns, and operates profitable, large-scale solar generation facilities.

Expected to Trade on Wednesday.

Cynapsus Therapeutics (CYNA) A specialty CNS pharmaceutical company developing and preparing to

commercialize a Phase 3, fast-acting, easy-to-use, sublingual thin film for the on-demand turning ON of debilitating

OFF episodes associated with Parkinsons disease. Expected to Trade on Thursday.

Fitbit (FIT) Combines connected health and fitness devices with software and services, including an online

dashboard and mobile apps, data analytics, motivational and social tools, personalized insights, and virtual

coaching through customized fitness plans and interactive workouts. Expected to Trade on Thursday.

Ritter Pharmaceuticals (RTTR) Develops novel therapeutic products that modulate the human gut microbiome to

treat gastrointestinal diseases. Expected to Trade on Thursday.

Univar (UNVR) A leading global chemical distributor and provider of innovative value-added services. Expected

to Trade on Thursday.

8point3 Energy Partners (CAFD) A growth-oriented limited partnership formed by First Solar and SunPower to

own, operate, and acquire solar energy generation projects. Expected to Trade on Friday.

Fogo de Chao (FOGO) A leading Brazilian steakhouse, which has specialized for over 35 years in fire-roasting

high-quality meats utilizing the centuries-old Southern Brazilian cooking technique of churrasco. Expected to Trade

on Friday.

MINDBODY (MB) The leading global online wellness marketplace with over 42,000 local business subscribers.

Expected to Trade on Friday.

3|Page

Conferences and Events

th.

Paris Air Show starts on June 15 Companies to watch:

o Boeing (BA)

o General Electric (GE)

o Honeywell (HON)

o Lockheed Martin (LMT)

o Raytheon (RTN)

o Textron (TXT)

o L-3 Communication Holdings (LLL)

th

Gartner IT Operations Strategies & Solutions Summit starts on June 15 . Companies to watch:

o International Business Machine (IBM)

o CA Technologies (CA)

o Red Hat (RHT)

o VMWare (VMW)

th

BIO International Convention starts on June 15 . Companies to watch:

o Amgen (AMGN)

o Eli Lilly (LLY)

o Merck (MRK)

o Biogen (BIIB)

o Shire (SHPG)

th

Electronics Entertainment Expo (E3) starts on June 16 . Companies to watch:

o Electronic Arts (EA)

o Microsoft (MSFT)

o Sony Corp. (SNE)

o Take Two Interactive (TTWO)

o Nintendo (NTDOY)

th

Stifel Industrials Conference starts on June 16 . Companies to watch:

o Xylem (XYL)

o Donaldson Company (DCI)

o Quanta Services (PWR)

th

Goldman Sachs dotCommerce Day starts on June 18 . Companies to watch:

o Walmart (WMT)

o Home Depot (HD)

o Williams Sonoma (WSM)

o Wayfair (W)

th

Impact Investor Conference starts on June 19 . Companies to watch:

o GWG Holdings (GWGH)

o MagneGas Corporation (MNGA)

o Perma-Fix Environmental Services (PESI)

o VolitionRX Ltd (VNRX)

th

Jefferies Shipping Conference starts on June 17 .

4|Page

Other

Barrons Highlights over the weekend:

o Prudential (PRU)

o Precision Castparts (PCP)

o Goodyear Tire & Rubber (GT)

o Dennys (DENN)

o Smith & Wesson (SWHC)

Commodity Calendar

Crop Progress Monday

API Energy Stocks Tuesday

EIA Petroleum Status Wednesday

EIA Natural Gas Storage Thursday

Cattle on Feed Friday

Coffee: World Markets and Trade - Friday

Economic Calendar (major events)

Industrial Production 6/15/2015

Housing Starts 6/16/2015

Federal Open Market Committee Rate Decision 6/17/2015

Consumer Price Index 6/18/2015

Consumer Price Index Ex Food & Energy 6/18/2015

Initial Jobless Claims 6/18/2015

Consumer Price Index 6/16/2015

Bank of England Minutes 6/17/2015

German ZEW Survey (Economic Sentiment) 6/16/2015

5|Page

Consumer Price Index 6/19/2015

Bank of Japan Monetary Policy Statement 6/19/2015

Kuroda Press Conference 6/19/2015

RBA June Meeting Minutes 6/16/2015

Gross Domestic Product 6/17/2015

Swiss National Bank 3-Month LIBOR Lower Target Range 6/18/2015

Swiss National Bank 3-Month LIBOR Upper Target Range 6/18/2015

Swiss National Bank Sight Deposit Interest Rate 6/18/2015

6|Page

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- UntitledDocument5 pagesUntitledapi-274468947No ratings yet

- UntitledDocument3 pagesUntitledapi-274468947No ratings yet

- Market Outlook: Week of June 22, 2015Document6 pagesMarket Outlook: Week of June 22, 2015api-274468947No ratings yet

- Morning Market Briefing: July 29, 2015Document4 pagesMorning Market Briefing: July 29, 2015api-274468947No ratings yet

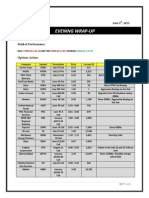

- Evening Wrap-Up: June 16, 2015Document5 pagesEvening Wrap-Up: June 16, 2015api-274468947No ratings yet

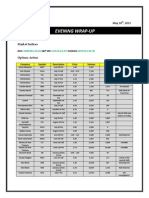

- Evening Wrap-Up: June 12, 2015Document4 pagesEvening Wrap-Up: June 12, 2015api-274468947No ratings yet

- Evening Wrap-Up: June 5, 2015Document5 pagesEvening Wrap-Up: June 5, 2015api-274468947No ratings yet

- Market Outlook: Week of June 8, 2015Document5 pagesMarket Outlook: Week of June 8, 2015api-274468947No ratings yet

- Morning Market Briefing: June 17, 2015Document4 pagesMorning Market Briefing: June 17, 2015api-274468947No ratings yet

- UntitledDocument4 pagesUntitledapi-274468947No ratings yet

- UntitledDocument5 pagesUntitledapi-274468947No ratings yet

- Evening Wrap-Up: June 9, 2015Document5 pagesEvening Wrap-Up: June 9, 2015api-274468947No ratings yet

- Evening Wrap-UpDocument4 pagesEvening Wrap-Upapi-274468947No ratings yet

- Leap Report: Options Research June 2, 2015Document3 pagesLeap Report: Options Research June 2, 2015api-274468947No ratings yet

- UntitledDocument3 pagesUntitledapi-274468947No ratings yet

- Market Outlook: Week of May 25, 2015Document5 pagesMarket Outlook: Week of May 25, 2015api-274468947No ratings yet

- Morning Market SnapshotDocument2 pagesMorning Market Snapshotapi-274468947No ratings yet

- Market Outlook: Week of June 1, 2015Document5 pagesMarket Outlook: Week of June 1, 2015api-274468947No ratings yet

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocument4 pagesEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947No ratings yet

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocument4 pagesEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947No ratings yet

- Educational & Training Services: Under The Radar Research May 25, 2015Document4 pagesEducational & Training Services: Under The Radar Research May 25, 2015api-274468947No ratings yet

- Morning Market SnapshotDocument2 pagesMorning Market Snapshotapi-274468947No ratings yet

- Market Outlook: Week of May 18, 2015Document5 pagesMarket Outlook: Week of May 18, 2015api-274468947No ratings yet

- Morning Market SnapshotDocument2 pagesMorning Market Snapshotapi-274468947No ratings yet

- Morning Market SnapshotDocument3 pagesMorning Market Snapshotapi-274468947No ratings yet

- Morning Market SnapshotDocument3 pagesMorning Market Snapshotapi-274468947No ratings yet

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocument4 pagesEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947No ratings yet

- Morning Market SnapshotDocument2 pagesMorning Market Snapshotapi-274468947No ratings yet

- Morning Market SnapshotDocument2 pagesMorning Market Snapshotapi-274468947No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Copd PDFDocument24 pagesCopd PDFyabaeveNo ratings yet

- Chronic Pulmonary Aspergillosis An Updated On Diagnosis and TreatmentDocument13 pagesChronic Pulmonary Aspergillosis An Updated On Diagnosis and TreatmentCahrun CarterNo ratings yet

- Rubifen 10 MG Immediate Release TabletsDocument8 pagesRubifen 10 MG Immediate Release TabletsMuse LoverNo ratings yet

- UJI TOKSISITAS XANTHONE KULIT MANGGISDocument6 pagesUJI TOKSISITAS XANTHONE KULIT MANGGISRetta Gabriella PakpahanNo ratings yet

- Development and Validation of Uv Spectrophotometric Method For Simultaneous Estimation of Naproxen PDFDocument7 pagesDevelopment and Validation of Uv Spectrophotometric Method For Simultaneous Estimation of Naproxen PDFVirghost14 WNo ratings yet

- WHO - 2017 12 31 - INN Stem Book 2018Document220 pagesWHO - 2017 12 31 - INN Stem Book 2018Khoa Dang TruongNo ratings yet

- A REVIEW Selection of Dissolution MediaDocument21 pagesA REVIEW Selection of Dissolution MediavunnamnareshNo ratings yet

- Drug Dispensing PracticeDocument23 pagesDrug Dispensing PracticeParth VasaveNo ratings yet

- Prescription: Manager, SBMD Asiatic Laboratories LTDDocument16 pagesPrescription: Manager, SBMD Asiatic Laboratories LTDNuton ChowdhuryNo ratings yet

- Manulife CoverMe FollowMe Health Comp Chart Jan 2018 ENGLISHDocument2 pagesManulife CoverMe FollowMe Health Comp Chart Jan 2018 ENGLISHMamacintNo ratings yet

- Investigational New Drug (Ind) : N.Kanaka Durga DeviDocument65 pagesInvestigational New Drug (Ind) : N.Kanaka Durga DeviNaresh Kumar Dhanikonda0% (1)

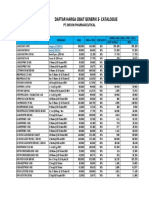

- Daftar Harga E-Catalogue Infion GenerikDocument1 pageDaftar Harga E-Catalogue Infion GenerikInstalasi FarmasiNo ratings yet

- 9 Nov 23 LKDocument182 pages9 Nov 23 LKaadidilanNo ratings yet

- RAGA Irs 2017 Year EndDocument84 pagesRAGA Irs 2017 Year Endpaul weichNo ratings yet

- Different Types of Packaging MaterialsDocument43 pagesDifferent Types of Packaging MaterialsShailesh Jadhav50% (2)

- Phase 2 Massachusetts Medical Marijuana Dispensary ApplicantsDocument26 pagesPhase 2 Massachusetts Medical Marijuana Dispensary ApplicantsNickDeLucaNo ratings yet

- Identifikasi Steroid (Akonitin)Document3 pagesIdentifikasi Steroid (Akonitin)Kurnia MegawatiNo ratings yet

- Abstractbook Si-Pmse 13Document80 pagesAbstractbook Si-Pmse 13Leslie Wilson50% (2)

- Cox 2 InhibitorsDocument9 pagesCox 2 InhibitorsirlandagarandaNo ratings yet

- Sivakumar Etal 2009Document8 pagesSivakumar Etal 2009mosman5No ratings yet

- Board Review Questions: Pharmacology and Therapeutics MCQsDocument15 pagesBoard Review Questions: Pharmacology and Therapeutics MCQsVince Cabahug100% (4)

- Package Insert - PYROSPERSE™ Dispersing Agent (English) - Original - 27876Document7 pagesPackage Insert - PYROSPERSE™ Dispersing Agent (English) - Original - 27876Putri DozanNo ratings yet

- Goodman and Gilman 13th EditionDocument3 pagesGoodman and Gilman 13th EditionStfctayt23% (13)

- Phardose - Transdermal Drug Delivery SystemDocument25 pagesPhardose - Transdermal Drug Delivery SystemEdrick RamoranNo ratings yet

- Excipients PharmaceuticalsDocument28 pagesExcipients Pharmaceuticalsmarcelo1315No ratings yet

- R.A. 10918 Philippine Pharmacy ActDocument40 pagesR.A. 10918 Philippine Pharmacy ActLyn MaeNo ratings yet

- Know Common Disease ManagementDocument14 pagesKnow Common Disease Managementcdx25No ratings yet

- Ijpar - 14 - 607 - 109-117 Madhavi PDFDocument9 pagesIjpar - 14 - 607 - 109-117 Madhavi PDFSriram NagarajanNo ratings yet

- Advanced Pharmaceutics: International Journal ofDocument8 pagesAdvanced Pharmaceutics: International Journal ofdini hanifaNo ratings yet

- DMF Ceftriaxone Sodium USPDocument94 pagesDMF Ceftriaxone Sodium USPArebuNo ratings yet