Professional Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

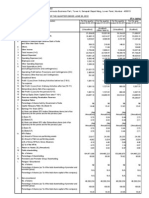

INDSIL HYDRO POWER AND MANGANESE LTD.

"Indsil House", T.V.Samy Road (West), R.S.Puram, Coimbatore - 641 002.

PH.No.0422-4522922, Fax No.0422-4522925, CIN-L27101TZ1990PLC002849, Website : www.indsil.com

Statement of Standalone Results for the Quarter ended 31st December 2014

(` in lakhs)

S. No.

Particulars

31/Dec/14

Quarter ended

30/Sep/14

Standalone Financials

Six months ended

31/Dec/13

31/Dec/14

31/Dec/13

Unaudited

Year ended

30/Jun/14

Audited

PART I

1.

2.

Income from Operations :

(a) Net Sales/Income from Operations (Net of Excise Duty)

(b) Other Operating Income

Total Income from Operations ( net )

Expenses :

(a) Cost of materials consumed

(b) Purchase of Stock - in - trade

(c) Changes in Inventories of Finished Goods ,work-in- progress &

Stock -in - Trade.

(d) Employee Benefit Expense

(e) Power (Net of Captive Consumption) & Other Manufacturing

Expenses

(f) Other expenditure

(g) Exchange Fluctuation- Net

(h) Depreciation & Amortization Expense

Total Expenditure

2572.34

2600.31

2310.50

5172.65

4836.74

195.85

205.66

142.82

401.51

393.80

651.78

2768.19

2805.97

2453.31

5574.15

5230.53

12284.94

1663.35

1241.79

1325.74

2905.15

2510.75

5320.08

229.61

469.28

698.90

(505.17)

(355.95)

2.64

(861.12)

193.18

173.85

165.50

172.30

339.35

343.37

596.52

405.18

323.08

563.86

728.25

932.31

2198.14

268.27

298.46

128.04

566.73

270.81

773.57

14.41

23.41

(73.13)

106.24

103.76

97.56

2253.80

2260.33

545.64

(87.54)

11633.16

1394.93

160.09

62.04

85.79

210.00

199.14

397.84

2313.55

4514.13

4511.60

10926.95

139.76

1060.03

718.94

1358.00

3.

Profit from Operations before Other Income Finance Costs &

Exceptional Items (1-2)

514.39

Other Income

241.11

72.06

65.77

313.17

69.60

119.42

Profit from Ordinary activities before Finance Costs & Exceptional

Items (3+4)

755.50

617.70

205.54

1373.20

788.55

1477.42

Finance Costs

138.49

109.79

86.69

248.28

152.42

371.04

Profit from Ordinary activities after Finance Costs but before

Exceptional Items (5-6)

617.01

507.91

118.85

1124.92

636.13

1106.37

Exceptional items

Profit from Ordinary Activities before tax (7+8 )

617.01

507.91

118.85

1124.92

636.13

1106.37

10

11

12

13

14

15

16

Tax expense

Net Profit/(Loss) from Ordinary Activities After Tax (9 - 10)

Extraordinary Items (Net of Tax Expenses)

Net Profit/(Loss) for the period

Share of Profit/ (loss) of Associates

Minority Interest

Net profit / (Loss) after Taxes Minority interest & share of profit /

loss of Associates

Paid-up equity share capital (Face Value of the Share shall be

indicated)

Reserve excluding Revaluation Reserves as per balance sheet of

previous accounting year

Earnings Per Share (EPS) (Before extraordinary Items)

a) Basic

b) Diluted

Earnings Per Share (EPS) (After extraordinary Items)

a) Basic

b) Diluted

139.36

90.78

13.04

230.14

11.15

20.49

477.65

417.13

105.81

894.78

624.98

1085.88

17

18

19 i

19 ii

PART II :

A)

PARTICULARS OF SHARE HOLDING

1.

Public Shareholding

- No. of shares

- Percentage of shareholding

2.

Promoters and promoter group Shareholding

a) Pledged/Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of promoter

and promoter group)

- Percentage of shares (as a % of the total share capital of the

company)

b) Non-encumbered

- Number of Shares

- Percentage of shares (as a% of the total shareholding of promoter

and promoter group)

- Percentage of shares (as a % of the total share capital of the

company)

477.65

417.13

105.81

894.78

624.98

1085.88

477.65

417.13

105.81

894.78

624.98

1085.88

1588.68

1588.68

1588.68

1588.68

1588.68

1588.68

6005.65

Rs. 3.01

Rs. 3.01

Rs. 2.63

Rs. 2.63

Rs. 0.67

Rs. 0.67

Rs. 5.63

Rs. 5.63

Rs. 3.93

Rs. 3.93

Rs. 6.84

Rs. 6.84

Rs. 3.01

Rs. 3.01

Rs. 2.63

Rs. 2.63

Rs. 0.67

Rs. 0.67

Rs. 5.63

Rs. 5.63

Rs. 3.93

Rs. 3.93

Rs. 6.84

Rs. 6.84

72,51,174 Nos

72,51,174 Nos

72,51,174 Nos

72,51,174 Nos

72,51,174 Nos

72,51,174 Nos

45.64%

45.64%

45.64%

45.64%

45.64%

45.64%

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

86,35,618 Nos

86,35,618 Nos

86,35,618 Nos

86,35,618 Nos

86,35,618 Nos

86,35,618 Nos

100%

100%

100%

100%

100%

100%

54.36%

54.36%

54.36%

54.36%

54.36%

54.36%

Notes :

The above audited financial results were taken on record by the Board of Directors at its meeting held on 9th Feb' 2015

1

2

Previous year/corresponding period figures have been regrouped/reclassified wherever necessary.

3

The Tax expense includes current tax after considering MAT Credit

B)

INVESTOR'S COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

Nil

Nil

Nil

Nil

For INDSIL HYDRO POWER AND MANGANESE LTD.

Place : Coimbatore

Date : 09.02.2015

S.N.VARADARAJAN

Executive Vice Chairman

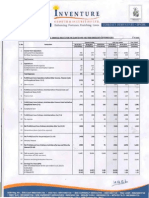

INDSIL HYDRO POWER AND MANGANESE LTD.

"Indsil House", T.V.Samy Road (West), R.S.Puram, Coimbatore - 641 002.

PH.No.0422-4522922, Fax No.0422-4522925, CIN-L27101TZ1990PLC002849, Website : www.indsil.com

SEGMENT WISE REVENUE, RESULTS & CAPITAL EMPLOYED

FOR THE QUARTER ENDED 31ST DECEMBER 2014

Particulars

3 months

ended

(31/12/2014)

(Unaudited)

Preceding 3

months ended

(30/09/2014)

(Unaudited)

Correspoding 3

months ended

(31/12/2013)

(Unaudited)

Year to date

figures for

Current period

ended

(31/12/2014)

(Unaudited)

Year to date

figures for the

previous year

ended

(31/12/2013)

(Unaudited)

Previous Year

ended 30.6.14

(Audited)

Rs. In Lakhs

1. Segment Revenue

(Net sales/income)

a) Ferro Alloys

b) Hydro Power

Total

Less : Intersegment Revenue

Net Sales/Income from Operations

2. Segment Results

(Profit/(Loss) before interest & tax)

a) Ferro Alloys

b) Hydro Power

Sub-Total

Less: Interest

I) Interest

II) Other unallocable Expenditure

III ) Other unallocable income

Total Profit/(Loss) before tax

3. Capital employed:

(Segment assets-Segment liabilities)

a) Ferro Alloys

b) Hydro Power

Total capital Employed

2,572.34

2,600.31

2,310.50

5,172.65

4,836.74

11,633.16

862.42

818.53

519.12

1,680.95

1,418.59

2,386.01

----------------- ----------------- -------------------- ------------------------------------- ------------------3,434.76

3,418.84

2,829.62

6,853.59

6,255.33

14,019.17

666.57

612.87

376.31

1,279.44

1,024.80

1,734.23

----------------- ----------------- -------------------- ------------------------------------- ------------------2,768.19

2,805.97

2,453.31

5,574.15

5,230.53

12,284.94

----------------- ----------------- -------------------- ------------------------------------- -------------------

(8.77)

(99.59)

(308.45)

(108.36)

(468.58)

(515.47)

764.27

717.29

513.97

1,481.56

1,257.12

1,992.89

----------------- ----------------- -------------------- ------------------------------------- ------------------755.50

617.70

205.52

1,373.20

788.55

1,477.42

138.49

109.79

86.69

248.28

152.42

371.04

----------------- ----------------- -------------------- ------------------------------------- ------------------617.01

507.91

118.85

1,124.92

636.12

1,106.37

----------------- ----------------- -------------------- ------------------------------------- -------------------

8,099.33

7,307.03

6,413.51

8099.33

6,413.51

7,126.12

3,630.90

3,505.72

3,003.89

3630.90

3,003.89

3,337.66

----------------- ----------------- -------------------- ------------------------------------- ------------------11,730.23 10,812.75

9,417.41

11,730.23

9,417.41

10,463.78

----------------- ----------------- -------------------- ------------------------------------- -------------------

INDSIL HYDRO POWER AND MANGANESE LIMITED

Statement of Assets & Laibilities.

Standalone

` in Lacs

Particulars

31.12.2014

A. Equity and Liabilites

1 Shareholder's Funds

(a) Share Capital

(b) Reserves & Surplus

(c) Money Received against share warrants

Sub-total - Shareholder's funds

1,588.68

7,796.27

9,384.95

2 Share Application money pending allotment

3 Minority interest

4 Non-Current liabilities

(a) Long-term borrowings

(b) Deferred Tax liabilities (Net)

(c) Other Long term Liabilities

(d) Long-term Provisions

Sub-total - Non-current liabilities

5 Current Liabilities

(a) Short term borrowings

(b) Trade payables

(c) Other current liabilities

(d) Short term provisions

TOTAL

30.6.2014

1,588.68

6,863.37

8,452.04

835.78

276.11

504.90

281.76

1,233.39

2,345.28

1,225.09

2,011.74

1,933.46

2,027.61

731.97

4,693.04

1,449.07

2,176.13

664.56

228.77

4,518.53

16,423.27

14,982.31

3,914.48

3,593.91

16.63

15.69

B ASSETS

1 Non-current assets

(a) Fixed assets

(i) Tangible assets

(ii) Intangible assets

(iii) Capital work-in-progress

(iv) Intangible assets under development

(b) Goodwill on consolidation

(c) Non-current investments

(d) Deferred Tax asset

(e) Long-term loans and advances

Sub-total - Non-current assets

2,194.95

1,521.19

7,662.95

527.71

18.11

2,186.81

1,571.82

7,898.36

2 Current assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and Cash equivalents

(e) Short-term loans and advances

(f) Other current assets

Sub-total - Current assets

5.06

3,790.05

1,364.41

577.11

2,837.37

186.33

8,760.32

4.98

3,018.65

1,003.19

672.68

2,139.77

244.68

7,083.95

TOTAL

16,423.27

14,982.31

For INDSIL HYDRO POWER AND

MANGANESE LTD.

Place : Coimbatore

Date : 09.02.2015

Sd/S.N.VARADARAJAN

Executive Vice Chairman

You might also like

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Financial Results For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document8 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- India BullsDocument2 pagesIndia Bullsrajesh_d84No ratings yet

- Q1FY2013Document1 pageQ1FY2013Suresh KumarNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetgagandeepdb2No ratings yet

- Financial Results & Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Document1 pagePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2011 12 31) PDFDocument1 pageAvt Naturals (Qtly 2011 12 31) PDFKarl_23No ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- Sebi Million Q3 1213 PDFDocument2 pagesSebi Million Q3 1213 PDFGino SunnyNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document1 pageStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Ref: Code No. 530427: Encl: As AboveDocument3 pagesRef: Code No. 530427: Encl: As AboveShyam SunderNo ratings yet

- Year Ended Quarter Ended: 30th June, 2014 UnauditedDocument2 pagesYear Ended Quarter Ended: 30th June, 2014 UnauditedHitesh Pratap ChhonkerNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document3 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Document3 pagesBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNo ratings yet

- June 2015Document2 pagesJune 2015Aarush VermaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Document1 pageRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2012 (Result)Document3 pagesFinancial Results For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Miscellaneous General Purpose Machinery World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous General Purpose Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- FINAL FABM2 Handouts #3.pdf  Version 1Document12 pagesFINAL FABM2 Handouts #3.pdf  Version 1Kristy Veyna BautistaNo ratings yet

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- Canopy Growth Corporation: Canada First and The World NextDocument14 pagesCanopy Growth Corporation: Canada First and The World NextAayush AgarwalNo ratings yet

- Sol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Document10 pagesSol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Crown Garcia50% (4)

- Miscellaneous Government TransactionsDocument3 pagesMiscellaneous Government TransactionsGem BaguinonNo ratings yet

- Darantan, KC T. - FAR Module 6Document3 pagesDarantan, KC T. - FAR Module 6Li LiNo ratings yet

- Internal Account GL and PL Categories To Be Opend For Branches TWM 111Document53 pagesInternal Account GL and PL Categories To Be Opend For Branches TWM 111Major GezahegnNo ratings yet

- Income Statement and Accrual AccountingDocument7 pagesIncome Statement and Accrual AccountingJordan Neo Yu Hern100% (1)

- Acc 109 p2 Exam TeachersDocument13 pagesAcc 109 p2 Exam TeachersWilmz SalacsacanNo ratings yet

- Argamassa Construction Materials Case Study: Course: Managing Employee - 78-613-02Document7 pagesArgamassa Construction Materials Case Study: Course: Managing Employee - 78-613-02Parth GandhiNo ratings yet

- Report G1 IS202Document25 pagesReport G1 IS202Nonelon SalvadoraNo ratings yet

- Chapter 23 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocument3 pagesChapter 23 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangNo ratings yet

- Stock Analysis Excel Revised March 2017Document26 pagesStock Analysis Excel Revised March 2017Sangram Panda100% (1)

- Tax Principles Broad Basing Simplicity EfficiencyDocument8 pagesTax Principles Broad Basing Simplicity EfficiencyPrithvi PrasadNo ratings yet

- Iodised Salt PDFDocument74 pagesIodised Salt PDFAjjay Kumar GuptaNo ratings yet

- Depreciation Methods Depreciation MethodsDocument31 pagesDepreciation Methods Depreciation MethodsAddo Mawulolo100% (1)

- Audit Risks for ACCA F8 Scenario QuestionsDocument6 pagesAudit Risks for ACCA F8 Scenario Questionsramen pandeyNo ratings yet

- Financial Outlook of Transwarranty Finance LimitedDocument47 pagesFinancial Outlook of Transwarranty Finance LimitedAtaye Waris KhanNo ratings yet

- Hyperion Master Sheet NL 2013 FinalDocument22 pagesHyperion Master Sheet NL 2013 Finalannemarie van zadelhoffNo ratings yet

- Woven SacksDocument27 pagesWoven SacksThomas MNo ratings yet

- MATLA PAYROLLDocument2 pagesMATLA PAYROLLTshikani JoyNo ratings yet

- Solution Set PDocument14 pagesSolution Set PChristina JazarenoNo ratings yet

- Finance BE7Document23 pagesFinance BE7Yanah Zia CalachanNo ratings yet

- Potato Chips CompanyDocument48 pagesPotato Chips Companyshani2783% (6)

- American Diner Business Plan for Healthy Comfort Food CafeDocument15 pagesAmerican Diner Business Plan for Healthy Comfort Food CafepanjatinNo ratings yet

- London Philatelist:: Old Lamps For FlewDocument28 pagesLondon Philatelist:: Old Lamps For FlewVIORELNo ratings yet

- Chapter 1Document9 pagesChapter 1craig52292No ratings yet

- SMChap 004Document49 pagesSMChap 004Rola KhouryNo ratings yet

- F2 Tax August 2020 - 1Document24 pagesF2 Tax August 2020 - 1paul sagudaNo ratings yet