Professional Documents

Culture Documents

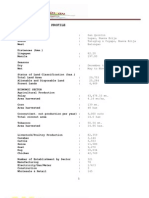

Flip Kart

Uploaded by

Sahil SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flip Kart

Uploaded by

Sahil SinghCopyright:

Available Formats

Valuationofdotcomcompanies

BeneaththeglossofscorchinggrowthandvaluationsofIndianecommercecompanies,there

arenaggingquestionsabouttheiraccountingpracticesandownershippatternsthatrecallthe

Internetbubbleof2000.Thesetwoquestionsarecentraltotheoperationsoftheposterboyof

ecommerceinIndia:flipkart.com,the70croreonlineretailerofbooksandelectronicsthatis

reportedlyclosetobaggingaprivateequityinvestmentatavaluationof$1billion(about4,500

crore).Theyalsohaveabearingonaclutchofothercompanies,includingFlipkart,Myntraand

Snapdeal.AccordingtoGrantThornton,inthefirstsixmonthsofcalendar2011,privateequity

firmsinvested$108millioninnineecommercecompanies.

Valuations,though,areaconcern."Ithinkit(valuationsingeneral)isabubble,thoughIhopeit

isnot,"saysKVaitheeswaran,founderofIndiaplaza.com,whohaslivedthroughtwocrashesin

his12yearsinthisbusiness.AddsMaheshMurthy,aventurecapitalist:"Inthesecasesofhigh

Indianvaluation,thenumberseemstobedrivenbythe'findagreaterfooltheory'whereyou

believeitisokaytovaluesomeoneat$1billionbecauseyouthinkyoucanfindafoolwhowill

buyitfromyouat$3billioninafewyears."

InflatingProfitsinCurrentYear

Thefirstissuerelatestothecredibilityofthenetprofitnumberthatsomeecommerceplayers

are putting out. This question arises from how they account for the discounts they offer

substantialinmanycases.Severalcompaniesarereportedlyindulgingincreativeaccountingof

marketingexpenses,includingdiscounts.

The net effect of this creative accounting is to postpone expenses to later years and inflate

profitsinthecurrentone.TheissuewasfirstflaggedintheIndianmediabyMurthy,who,ina

columninTehelkamagazine,datedAugust2,termedit"nonsenseaccountingpracticesatsome

oftheseecommercefirms".Itworkslikethis.Say,thecostpriceofabookforanecommerce

firmis100.Itoffersitforsalefor120,butalsooffersa30discount,beitintheformofcashor

agiftcertificate.Acustomerbuysthebookataneffectivepriceof90.ButXYZdoesnotrecord

90asrevenueand10asloss.Itbreaksitdownintotwoentries.Thefirstentryrecords120as

revenueand20(120100)asprofit.Thesecondentryrecordsthe30discountasanexpense.

But this is not expensed the same year. Instead, it is capitalised and written off over many

years,thusinflatingprofitsinthecurrentyear.

TheannualreportsofFlipkartandgroupentityWSRetailfor200910thelatestavailablewith

thecorporateaffairsministry(MCA)andtheyearbeforeitsgrowthtookoffdonotshowsuch

writeoffs."IamnotawareofsuchapracticeinFlipkart,"saysSachinBansal,thecompany'sco

founder.Whenaskedspecificallyifanycurrentexpensewasbeingcapitalised,hereplied:"Iwill

notcomment."Mostecommerceplayershavetakenoffinthepast18months,gainingtraction

withtheonlineconsumer.AidedbycashfromPEandVCfirms,ecommercecompanieshave

rolledoutaggressivepricinganddealstodriverevenues.Profits,though,areanothermatter.In

200910,Flipkartreportedalossof90lakhonsalesof11.6crore.Flipkartclockedrevenuesof

Rs500croreinFY201112,atentimeincreasefromRs50croreinFY201011.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Biz Today Camouflage Accounting - DoubtDocument5 pagesBiz Today Camouflage Accounting - DoubtSahil SinghNo ratings yet

- Sahil SinghDocument2 pagesSahil SinghSahil SinghNo ratings yet

- TG Time - Speed - DistanceDocument46 pagesTG Time - Speed - DistanceShivam Dubey80% (10)

- Static GK For Iift Snap and XatDocument19 pagesStatic GK For Iift Snap and XatnavinkumargNo ratings yet

- Fundamental Geometry ConceptsDocument0 pagesFundamental Geometry ConceptsRohit Sharma70% (10)

- Fundamental Geometry ConceptsDocument0 pagesFundamental Geometry ConceptsRohit Sharma70% (10)

- Business and Economy - 2013Document20 pagesBusiness and Economy - 2013Sahil SinghNo ratings yet

- Answers and Explanations: CAT 1991 Actual PaperDocument11 pagesAnswers and Explanations: CAT 1991 Actual PaperSahil SinghNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Contradictions That Drive Toyota's SuccessDocument7 pagesContradictions That Drive Toyota's SuccesskidurexNo ratings yet

- Hydraulic Shovel: Engine BucketDocument32 pagesHydraulic Shovel: Engine BucketJulio CRNo ratings yet

- C-TECC Principles Guide TECC EducationDocument4 pagesC-TECC Principles Guide TECC EducationDavid Sepulveda MirandaNo ratings yet

- Joint Ventures Synergies and BenefitsDocument5 pagesJoint Ventures Synergies and BenefitsleeashleeNo ratings yet

- CPAR Summary - WK 144Document6 pagesCPAR Summary - WK 144NagarajNo ratings yet

- Differendial Pressure Flow MetersDocument1 pageDifferendial Pressure Flow Metersborn2engineerNo ratings yet

- 20 5880100Document2 pages20 5880100'Theodora GeorgianaNo ratings yet

- Analysis and Design of BeamsDocument12 pagesAnalysis and Design of BeamsHasanain AlmusawiNo ratings yet

- Anchoring in Bad WeatherDocument2 pagesAnchoring in Bad WeatherDujeKnezevicNo ratings yet

- Municipal Profile of Umingan, PangasinanDocument51 pagesMunicipal Profile of Umingan, PangasinanGina Lee Mingrajal Santos100% (1)

- Digital Undated Portrait Cosy MondayDocument133 pagesDigital Undated Portrait Cosy MondayholajackNo ratings yet

- Rapidcure: Corrosion Management Products Rapidcure UwDocument1 pageRapidcure: Corrosion Management Products Rapidcure UwHeramb TrifaleyNo ratings yet

- Tribology Aspects in Angular Transmission Systems: Hypoid GearsDocument7 pagesTribology Aspects in Angular Transmission Systems: Hypoid GearspiruumainNo ratings yet

- The Art of Comeback Donald TrumpDocument1 pageThe Art of Comeback Donald TrumpMoYagzud0% (2)

- Tata Cellular V UOI: So Unreasonable That No Reasonable Person Acting Reasonably Could Have Made It)Document2 pagesTata Cellular V UOI: So Unreasonable That No Reasonable Person Acting Reasonably Could Have Made It)heretostudyNo ratings yet

- Nody D 23 01248 PDFDocument70 pagesNody D 23 01248 PDFLegis FloyenNo ratings yet

- Checklist For T&C of Chemical Fire Suppression SystemDocument2 pagesChecklist For T&C of Chemical Fire Suppression Systembeho2000No ratings yet

- Shrimp Aquaculture in Sarangani BayDocument5 pagesShrimp Aquaculture in Sarangani BayronanvillagonzaloNo ratings yet

- Construction On Soft GroundDocument9 pagesConstruction On Soft GroundyantieschumiNo ratings yet

- The 2012 FedEx Ketchum Social Business StudyDocument40 pagesThe 2012 FedEx Ketchum Social Business StudyEric PrenenNo ratings yet

- A Water Quality Monitoring RobotDocument5 pagesA Water Quality Monitoring RobotJorge NeiraNo ratings yet

- Seasonal Work Brochure 05Document2 pagesSeasonal Work Brochure 05R-lau R-pizNo ratings yet

- New Product Development ProcessDocument29 pagesNew Product Development ProcessGAURAV SHARMA100% (1)

- Ok 1889 - PDF PDFDocument40 pagesOk 1889 - PDF PDFIngeniería Industrias Alimentarias ItsmNo ratings yet

- Champions MindsetDocument48 pagesChampions MindsetDIRECTIA INVATAMINT HINCESTI100% (1)

- 11 - Surrogate Constraints 1968Document9 pages11 - Surrogate Constraints 1968asistensi pakNo ratings yet

- Government of West Bengal Ration Card DetailsDocument1 pageGovernment of West Bengal Ration Card DetailsGopal SarkarNo ratings yet

- Datasheet of DS 7608NI Q1 - 8P NVRD - V4.71.200 - 20220705Document5 pagesDatasheet of DS 7608NI Q1 - 8P NVRD - V4.71.200 - 20220705Gherel TocasNo ratings yet

- SRX835 Spec Sheet - 11 - 11 - 19Document4 pagesSRX835 Spec Sheet - 11 - 11 - 19Eric PageNo ratings yet