Professional Documents

Culture Documents

Genpact Consumer Good Analytics Maximizes The Impact of Point of Sale

Uploaded by

genysen2015Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Genpact Consumer Good Analytics Maximizes The Impact of Point of Sale

Uploaded by

genysen2015Copyright:

Available Formats

Solution

Overview

Generating consumer goods Impact

Maximize the impact of point

of sale data with Data-toAction AnalyticsSM

Consumer packaged goods (CPG) companies and retailers lose close to $100

billion in annual sales when customers cannot find what they want. Nearly

90% of out-of-stock conditions stem from inconsistent, inaccurate in-store

operations. CPG companies no longer have to accept this situation: They can

lead in integrated business reporting and point of sale (POS) data analytics to

help their own brands and retailers satisfy customers and perform better.

DESIGN TRANSFORM RUN

POS data is rich in actionable insights. For

instance, trading partners that know customer

demand and inventory levels can precisely match

supply chains to projected sales and smooth

product flow to retail

shelves and displays.

Retailers have shown

86% of consumers

they want analytics help

say they stop doing

to grow sales against

business with an

online and physical store

organization after

competitors. According

one bad experience.

to a study, up to 40%

share shopper data with

their suppliers. The

business impact is significant, since about 70%

of purchases occur on impulse, 38% of customers

use a mobile device to help decide on an in-store

purchase, and stores can achieve a 3.7% sales rise

just by stocking shelves better. Automated data

management is the quickest, most productive way

to support real-time decision making.

Bridge the data gap

There is a chasm between the exponential growth

of data and the ability of the CPG industry to master

it. The retail trade generated data at a rate of 7

zettabytes (ZB) in 2014, was up from 1 ZB in 2010.

POS data plays a pivotal role in this fast-changing

scene because it reflects the sales action in stores

and brings other benefits such as:

It enables CPG companies and retailers to

improve order performance by 20%

It lowers supply chain costs, which can be as

much as 5% of the revenue

It gives twice the visibility into store-level sales

and inventory trends

It increases understanding of customer demand

and behaviors, and informs strategic decisions

about pricing and trade promotions

To develop on-target actionable reports, data is

best acquired, collated, and analyzed within the

context of varied sources: the Internet, social

media, customer contact centers, mobile devices,

shipments, research studies, and syndicated

third-party data. Additional types of data could be

coming soon. Research indicates that 2% of master

data changes every month.

This data surge brings new opportunities to extract

more value through effective reporting and

analytics. The rewards will go to CPG companies

that are best able to make real-time, fact-based

business decisions built on data insights

particularly POS data. Others that lag will face a

competitive disadvantage.

However, the state of the industry today has 75%

of leading companies conceding they are incapable

of creating a unified view of their customers,

according to one study. Other research suggests

the potential heavy cost of this shortcoming: 86%

of consumers say they stop doing business with an

organization after one bad experience.

Turn complex data into insights

and results

Data reports and insights are key drivers of dayto-day business. However, the fast-scaling growth

of data volume and sources challenges CPG

companies and retailers to blend and analyze all the

data appropriately. Too often, companies underutilize or misrepresent data and pursue costly,

ineffective strategies as a result.

In POS data, for example, inconsistencies such

as empty fields, incorrect values, and character

mismatches are common and lead to erroneous

reports such as out-of-stocks. Complexity

multiplies for CPG companies that receive data

from numerous retailers globally in multiple data

types, on various storage platforms, and in different

database engines and platforms.

No wonder research shows more than 40% of

retailers prefer a single consumer platform to manage

interactions and transactions across various data

channels and that 70% of retailers plan to refresh

their current POS software every 3 years.

Retailers and CPG companies aim to avoid costly

out-of-stocks, which 70% to 90% of the time

stem from in-store operations problems and 10%

to 30% of the time from upstream supply chain

GENPACT | Solution Overview

issues, reports the International Journal of Logistics.

How costly? More than 30% of customers will

visit another store to find an out-of-stock item,

reveals Food Marketing Institute research. Another

26% will buy a different brand, 19% will buy a

substitute item from the same brand, 15% will delay

the purchase, and 9% would not buy the item.

Incidences of non-purchase translate into lost sales

opportunities of 2.5% for manufacturers.

Out-of-stocks are common. Every day, a customer

has only a 4% chance of buying all 40 items on his

or her shopping list. On promotion, the out-of-stock

incidence rate often exceeds 10%. If retailers could

slash these rates through better shelf-stocking,

they could raise store sales by more than 3.5%

on average. The right data insights also pay off,

as shown in a study by the National Association

of Chain Drug Stores that established a clear link

between the on-shelf availability of goods and sales:

A 3% gain in on-shelf availability raises CPG

sales by 1%

A 2% gain in on-shelf availability raises retailer

sales by 1%

Marketplace shifts raise stakes

for CPG companies to manage

POS data

Todays retail backdrop has smaller stores on

the way, more online competitors, more privatelabel sales, and increased use of mobile devices

to research, plan, keep lists, shop, and pay. These

trends make it more compelling for CPG companies

to manage POS data because of:

Planogram shelf space: It will soon be at a

premium in small-grocer formats reportedly

being tested by Walmart, Publix, and Kroger to

fill in densely populated markets. The stronger a

companys analytics, the better its CPG brands

can compete for less-available shelf space. In

addition, the better the CPG brand can manage its

marketing and media mix.

Informed customer: Shoppers are more informed

before they purchase and often pick the value

choice of a private label or buy from a website.

Abundant data from mobile devices will enrich

the process of CPG brands and stores getting

closer to their customers.

Genpact automates processes,

drives gains for CPG

Most CPG companies find the complex

management of POS data to be beyond their

current capabilities. Genpact has a holistic POS

data management solution, Genpact DataCentralSM,

which encompasses three critical pillars: master

data management, retailer management, and

holistic reporting.

We help clients extract data based on requirements,

and complete end-to-end processing (encryption,

validation, harmonization, and integration) using

custom tools and technology infrastructure. We

also automate real-time holistic reports, with clientcustomizable dashboards for complete operational

views of POS data.

Genpact DataCentralSM enables retailers to

check their business health through various key

performance indicators (KPIs) such as daily sales,

retailers market share, sales growth, product

performance, incremental sales, average purchase

value, stock-to-sales ratio, and on-shelf availability,

with advanced reporting capabilities, including

visual reporting formats, and across three tiers,

Standard, Business Insights, and Advanced

Analytics, to empower clients every day.

Case studies prove DataCentralSM processes are

50% more efficient and six times speedier in cycle

time than current CPG processes. DataCentralSM

integrates data from multiple sources in multiple

formats. It automates data management workflow

end-to-end and notifies stakeholders on the status

of each task. CPG clients can host the solution

behind their own firewall or in the cloud. It has

robust data security measures in place.

The Genpact advantage

Genpact has recorded global successes as a CPG/

Retail domain expert and analytics pioneer for

nearly two decades. We currently manage 160

CPG client portals and have completed more than

GENPACT | Solution Overview

750 advanced analytics projects in the past 12

months alone.

We help deliver more than 12,000 client reports

monthly, across 1.2 billion retail transactions and

seven nations. For the top syndicated market

research firm, Genpact updates 3,000 categories and

codes 16,000 universal product codes (UPC) weekly,

handling 2.8 million new products added every year.

Genpact produces business impact in many ways,

chief among them are:

Solution accelerators, which are customized,

ready-to-deploy tools with pre-set scripts to

analyze multiple data types, across various

storage databases running on different engines

and platforms

Process expertise and CPG/Retail industry

knowledge, including that of retailer data and

POS system landscapes across North America,

Western/Eastern Europe, the Middle East,

Africa, South America, and Asia-Pacific

In-house technology expertise, including

custom technology frameworks such as

Genpact DataCentralSM (automation framework

for CPG companies)

About Genpact

Genpact (NYSE: G) stands for generating business impact. We design, transform, and run intelligent business operations including those

that are complex and specific to a set of chosen industries. The result is advanced operating models that support growth and manage cost,

risk, and compliance across a range of functions such as finance and procurement, financial services account servicing, claims management,

regulatory affairs, and industrial asset optimization. Our Smart Enterprise Processes (SEPSM) proprietary framework helps companies

reimagine how they operate by integrating effective Systems of EngagementTM, core IT, and Data-to-Action AnalyticsSM. Our hundreds of

long-term clients include more than one-fourth of the Fortune Global 500. We have grown to over 70,000 people in 25 countries with key

management and a corporate office in New York City. Behind our passion for process and operational excellence is the Lean and Six Sigma

heritage of a former General Electric division that has served GE businesses for more than 16 years.

For more information, contact, consumergoods.services@genpact.com and visit www.genpact.com/home/industries/consumer-goods

Follow us on Twitter, Facebook, LinkedIn, and YouTube.

2015 Copyright Genpact. All Rights Reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CH 5 NOTES - Data Organization and Descriptive StatisticsDocument32 pagesCH 5 NOTES - Data Organization and Descriptive StatisticsMila SmithNo ratings yet

- Seriales Dimension ProDocument6 pagesSeriales Dimension ProAndres Obrecht100% (2)

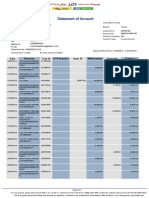

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument8 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits Balancedinesh namdeoNo ratings yet

- Rational Root TheoremDocument9 pagesRational Root TheoremAerown John Gonzales TamayoNo ratings yet

- Block Diagram and Signal Flow GraphDocument15 pagesBlock Diagram and Signal Flow GraphAngelus Vincent GuilalasNo ratings yet

- Hardware Recommendations For SOLIDWORKS 2015Document18 pagesHardware Recommendations For SOLIDWORKS 2015febriNo ratings yet

- Design App Themes With Theme EditorDocument4 pagesDesign App Themes With Theme Editorsenze_shin3No ratings yet

- CSEC Information Technology June 2015 P02Document18 pagesCSEC Information Technology June 2015 P02SiennaNo ratings yet

- Qawvware 3Document29 pagesQawvware 3sree4u86No ratings yet

- OXYGEN™ Cabinet - Integration Guide For Player Tracking and Online Components 1.2Document13 pagesOXYGEN™ Cabinet - Integration Guide For Player Tracking and Online Components 1.2villa1960No ratings yet

- Rockwell Automation TechED 2018 - PR26 - Endress+HauserDocument33 pagesRockwell Automation TechED 2018 - PR26 - Endress+HauserAlex Rivas100% (1)

- STAAD ANALYSIS - Adrressing Requirements AISC 341-10 - RAM - STAAD Forum - RAM - STAAD - Bentley CommunitiesDocument2 pagesSTAAD ANALYSIS - Adrressing Requirements AISC 341-10 - RAM - STAAD Forum - RAM - STAAD - Bentley Communitieschondroc11No ratings yet

- Problem Set No.2 SolutionDocument9 pagesProblem Set No.2 SolutionAshley Quinn MorganNo ratings yet

- Practice Test A1Document7 pagesPractice Test A1Khang Nguyen TienNo ratings yet

- New Advances in Machine LearningDocument374 pagesNew Advances in Machine LearningMücahid CandanNo ratings yet

- Employee Verification FormDocument7 pagesEmployee Verification FormAparna NandaNo ratings yet

- Journal of Business Research: Enrico Battisti, Simona Alfiero, Erasmia LeonidouDocument13 pagesJournal of Business Research: Enrico Battisti, Simona Alfiero, Erasmia LeonidoualwiNo ratings yet

- CV-Sushil GuptaDocument3 pagesCV-Sushil Guptaanurag_bahety6067No ratings yet

- OBM 247 Tutorial c5Document3 pagesOBM 247 Tutorial c5syazmiraNo ratings yet

- Iot Based Switching of Microgrids For Ups ReportDocument61 pagesIot Based Switching of Microgrids For Ups ReportSrinidhi ShanbhogNo ratings yet

- Guidely Age Set 1 PDFDocument5 pagesGuidely Age Set 1 PDFPriya KumariNo ratings yet

- Technote On - Communication Between M340 and ATV312 Over Modbus Using READ - VAR and WRITE - VARDocument14 pagesTechnote On - Communication Between M340 and ATV312 Over Modbus Using READ - VAR and WRITE - VARsimbamike100% (1)

- Lathi Ls SM Chapter 2Document33 pagesLathi Ls SM Chapter 2Dr Satyabrata JitNo ratings yet

- Adept PovertyDocument21 pagesAdept PovertyKitchie HermosoNo ratings yet

- NVIDIA System Information 01-08-2011 21-54-14Document1 pageNVIDIA System Information 01-08-2011 21-54-14Saksham BansalNo ratings yet

- Week 2: Introduction To Discrete-Time Stochastic Processes: 15.455x Mathematical Methods of Quantitative FinanceDocument58 pagesWeek 2: Introduction To Discrete-Time Stochastic Processes: 15.455x Mathematical Methods of Quantitative FinanceBruné100% (1)

- Manual Elisys DuoDocument322 pagesManual Elisys DuoLeydi Johana Guerra SuazaNo ratings yet

- DevOps Tools InstallationDocument4 pagesDevOps Tools InstallationNitin MandloiNo ratings yet

- Sorting Out Centrality: An Analysis of The Performance of Four Centrality Models in Real and Simulated NetworksDocument21 pagesSorting Out Centrality: An Analysis of The Performance of Four Centrality Models in Real and Simulated NetworksComplejidady EconomíaNo ratings yet

- Recommender System With Sentiment Analysis: Summer Internship ReportDocument58 pagesRecommender System With Sentiment Analysis: Summer Internship ReportbhargavNo ratings yet