Professional Documents

Culture Documents

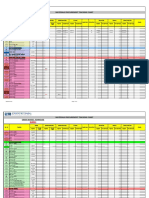

Construction Accounting

Uploaded by

Golam RabbaneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Construction Accounting

Uploaded by

Golam RabbaneCopyright:

Available Formats

Construction Accounting

www.AssignmentPoint.com

www.AssignmentPoint.com

Construction accounting is a form of project accounting applied to construction

projects. See also production accounting. Construction accounting is a vitally

necessary form of accounting, especially when multiple contracts come into

play. The construction field uses many terms not used in other forms of

accounting, such as "draw" and progress billing. Construction accounting may

also need to account for vehicles and equipment, which may or may not be

owned by the company as a fixed asset. Construction accounting requires

invoicing and vendor payment, more or less as to the amount of business done.

In the United States, the authoritative literature on Construction accounting is

AICPA Statement of Position SOP 81-1 (SOP 81-1).

Construction Costs

These are all cost related to construction process, right from materials, labor

costs, consultancy and all management expenses. Construction accounting

involves charging construction costs to the applicable contract. Costs fall into

three categories. Direct costs are labor, material, and subcontracting costs, land.

Indirect costs include indirect labor, supervision, tools, equipment costs,

supplies, insurance, and support costs. Selling, general and administrative costs,

are generally excluded from contract costs.

Revenue Recognition

Construction accounting requires unique revenue recognition rules for contracts

in progress.

www.AssignmentPoint.com

In most cases, revenue is recognized using the Percentage of Completion

Method. Under this method, revenue is recognized using an estimate for the

overall anticipated profit for a particular contract multiplied by the estimated

percent complete of that contract. This involves the inherent risk of relying upon

estimates.

Under SOP 81-1, revenue is also allowed to be computed using the Completed

Contract Method. Under this method, contract revenues and costs are not

recognized until the contract is substantially complete. However, this method is

not allowable if the results are significantly different than results using the

Percentage of Completion Method. The Completed Contract Method is allowed

in circumstances in which reasonable estimates cannot be determined. However,

these types of circumstances can be construed as a lack of internal control.

www.AssignmentPoint.com

You might also like

- PWC Engineering Construction Accounting PDFDocument10 pagesPWC Engineering Construction Accounting PDFj5656100% (1)

- Key Factors in Construction Project ControlsDocument11 pagesKey Factors in Construction Project ControlsMike KarlinsNo ratings yet

- The Management of Construction Company Overhead CostsDocument9 pagesThe Management of Construction Company Overhead CostsAlfred De Vera GabuatNo ratings yet

- Construction Financial ControlsDocument51 pagesConstruction Financial Controlsbdiit0% (1)

- Contractors ChecklistDocument5 pagesContractors ChecklistGunawan AchmadNo ratings yet

- Subcontractor's Statement PDFDocument2 pagesSubcontractor's Statement PDFAnonymous M4DMq2CZXNo ratings yet

- Cost Estimate TemplateDocument61 pagesCost Estimate TemplateCorbyFrielNo ratings yet

- Job Classification RatesDocument5 pagesJob Classification Rateswvwinters100% (1)

- Chapter 12 - Cash Flows For Construction ProjectsDocument15 pagesChapter 12 - Cash Flows For Construction ProjectsRaphael ArchNo ratings yet

- Homebuilding Estimating & Takeoff Software - The Takeoff Doctor Instant EstimatorDocument14 pagesHomebuilding Estimating & Takeoff Software - The Takeoff Doctor Instant EstimatorskillsoverstuffNo ratings yet

- Calculate construction overhead and profit margins for business successDocument15 pagesCalculate construction overhead and profit margins for business successJaswin JonsonNo ratings yet

- COA Construction General ContractorDocument16 pagesCOA Construction General ContractorLarryMatiasNo ratings yet

- User Guide For Protakeoff®: in Just A Few Steps, You'Ll Be Up & Estimating With Protakeoff Software Powered byDocument30 pagesUser Guide For Protakeoff®: in Just A Few Steps, You'Ll Be Up & Estimating With Protakeoff Software Powered byA M JNo ratings yet

- ABC Basics of Construction Accounting Webinar April 2013Document77 pagesABC Basics of Construction Accounting Webinar April 2013Gaby Pertubal100% (2)

- Cost Code Breakdown: 03-001 NW Food WarehouseDocument2 pagesCost Code Breakdown: 03-001 NW Food WarehouseAnonymous szDONqNo ratings yet

- A Checklist Construction ContractsDocument2 pagesA Checklist Construction Contractssarathirv6No ratings yet

- Cost CodesDocument5 pagesCost CodesMichael PadreJuanNo ratings yet

- Essential Steps to a Reliable Construction Cost EstimateDocument25 pagesEssential Steps to a Reliable Construction Cost EstimateGeorge IsraelNo ratings yet

- Glossary of Construction Cost EstimatingDocument8 pagesGlossary of Construction Cost EstimatingFaty BercasioNo ratings yet

- Construction Cost EstimatingDocument25 pagesConstruction Cost Estimatingabdou100% (2)

- Cem103 Lecture 2 Cost Estimating ComponentsDocument16 pagesCem103 Lecture 2 Cost Estimating ComponentsMrSamspartNo ratings yet

- Construction Estimating Using ExcelDocument19 pagesConstruction Estimating Using ExcelEl Patron 167% (6)

- INTERNAL CONTROLS AND WORKFLOWDocument5 pagesINTERNAL CONTROLS AND WORKFLOWKaren AncisNo ratings yet

- Construction ActivitiesDocument20 pagesConstruction ActivitiesErika Kirby100% (19)

- Construction Project DocumentationDocument4 pagesConstruction Project Documentationminagf2007No ratings yet

- Construction AccountingDocument12 pagesConstruction AccountingtezgajNo ratings yet

- Accounting in ConstructionDocument85 pagesAccounting in ConstructionYihun abrahamNo ratings yet

- Cash Flows For Construction ProjectsDocument15 pagesCash Flows For Construction Projectsrainbird7100% (1)

- Construction workflow and approval documentsDocument1 pageConstruction workflow and approval documentsAsepGPNo ratings yet

- Bid Markup Methodologies ExplainedDocument6 pagesBid Markup Methodologies ExplainedBTconcordNo ratings yet

- QuickBooks Pro Manual MasterCodeDocument13 pagesQuickBooks Pro Manual MasterCodeMahesh JayawardanaNo ratings yet

- Quantity Takeoff Quantity Surveying: Price of A Line Item Quantity X Standard Unit PriceDocument2 pagesQuantity Takeoff Quantity Surveying: Price of A Line Item Quantity X Standard Unit PriceEdwin Fung50% (2)

- Project Resources: Double - Storey BungalowDocument6 pagesProject Resources: Double - Storey BungalowKhalidah Abdul Aziz100% (1)

- Contractor NotesDocument2 pagesContractor NotesMICHAEL PRITCHARDNo ratings yet

- Accounting For Construction ContractsDocument8 pagesAccounting For Construction ContractsSantu DuttaNo ratings yet

- Contract Doc AnalysisDocument47 pagesContract Doc AnalysisHazirah ZieraNo ratings yet

- Building Estimation2Document14 pagesBuilding Estimation2Ashley Farai MutangiriNo ratings yet

- Division 2 Site Work Estimating TipsDocument215 pagesDivision 2 Site Work Estimating TipsMuhammad IqbalNo ratings yet

- Estimating ManualDocument56 pagesEstimating Manualfastreturn0% (1)

- Estimating ProcedureDocument16 pagesEstimating ProcedureHaneefa ChNo ratings yet

- Construction Fraud Stories From The Field PDFDocument38 pagesConstruction Fraud Stories From The Field PDFismailscipioNo ratings yet

- Masterformat: Unit Price EstimatingDocument4 pagesMasterformat: Unit Price EstimatingAbdul RafeyNo ratings yet

- Construction Project Management GraduatiDocument258 pagesConstruction Project Management GraduatiUzma IlyasNo ratings yet

- Construction Equipment Detailed NotesDocument45 pagesConstruction Equipment Detailed NotesMuhammad WaqarNo ratings yet

- CostEstimateTemplate (EPC)Document19 pagesCostEstimateTemplate (EPC)Jiso Thomas50% (2)

- Unifomat Estimate TemplateDocument4 pagesUnifomat Estimate TemplateShehzad Ahmed100% (1)

- Direct Construction Cost Audit ToolboxDocument57 pagesDirect Construction Cost Audit Toolboxbdiit100% (1)

- Procurement Tracking ChartDocument5 pagesProcurement Tracking ChartjayNo ratings yet

- Sop Construction Project ProceduresDocument18 pagesSop Construction Project ProceduresHendra Budiman50% (2)

- Estimation and QuantityDocument13 pagesEstimation and Quantitypooja shindeNo ratings yet

- TOTAL PC FLOWTEC INDIA ORGANIZATION CHARTDocument51 pagesTOTAL PC FLOWTEC INDIA ORGANIZATION CHARTHarshanand KalgeNo ratings yet

- Cost Control Spreadsheet BLK ADocument17 pagesCost Control Spreadsheet BLK AØwięs MØhãmmed100% (1)

- Building Progress ChecklistDocument1 pageBuilding Progress ChecklistRoskorossNo ratings yet

- Cost EstimationDocument7 pagesCost EstimationManoj EkNo ratings yet

- Breakdown Structure Detail Code: Codes Identifying Details Relating To A Reporting Breakdown Structure TreeDocument13 pagesBreakdown Structure Detail Code: Codes Identifying Details Relating To A Reporting Breakdown Structure TreeAnonymous szDONqNo ratings yet

- Contractor Estimate WorksheetDocument3 pagesContractor Estimate WorksheetQi ZengNo ratings yet

- Indirect Costs of Contracts: Fred Shelton, JR., CPA, MBA, CVA and Mason Brugh, CPADocument7 pagesIndirect Costs of Contracts: Fred Shelton, JR., CPA, MBA, CVA and Mason Brugh, CPAGaurav MehraNo ratings yet

- WIP FormatDocument5 pagesWIP Formatprathapsalian02No ratings yet

- In Accounting For ContractsDocument7 pagesIn Accounting For Contractsone formanyNo ratings yet

- Fly Usba FormDocument1 pageFly Usba FormGolam RabbaneNo ratings yet

- New Dimension Propelled: Hero Motocorp LTDDocument140 pagesNew Dimension Propelled: Hero Motocorp LTDAkshay VetalNo ratings yet

- Analysis of Financial Performance of BD Lamps LimitedDocument23 pagesAnalysis of Financial Performance of BD Lamps LimitedGolam RabbaneNo ratings yet

- WB QVM Weáwß: E VSKVM© WM JKKB Kwgwu Mwpevjq Evsjv 'K E VSK Cöavb KVH©VJQ GWZWSJ, Xvkv-1000Document1 pageWB QVM Weáwß: E VSKVM© WM JKKB Kwgwu Mwpevjq Evsjv 'K E VSK Cöavb KVH©VJQ GWZWSJ, Xvkv-1000Golam RabbaneNo ratings yet

- Riela Et Al J Social Personal Relationships 2010Document22 pagesRiela Et Al J Social Personal Relationships 2010Golam RabbaneNo ratings yet

- Ferrous SulphateDocument5 pagesFerrous SulphateGolam RabbaneNo ratings yet

- 2010 11L2Janpre seenOperationsManagementexamDocument22 pages2010 11L2Janpre seenOperationsManagementexamGolam RabbaneNo ratings yet

- The Insurance Function in BangladeshDocument22 pagesThe Insurance Function in BangladeshGolam RabbaneNo ratings yet

- 2012-08-30 Gemalto H1 2012 Roadshow Presentation enDocument65 pages2012-08-30 Gemalto H1 2012 Roadshow Presentation enGolam RabbaneNo ratings yet

- Internship ApplicationDocument4 pagesInternship ApplicationRayhanTariqueNo ratings yet

- Supplychainmanagementofcocacolacompany 141205193029 Conversion Gate01Document29 pagesSupplychainmanagementofcocacolacompany 141205193029 Conversion Gate01Golam RabbaneNo ratings yet

- Bcs Preliminary English by Shushanta Paul Full and Final Version (1 To 10) LectureDocument104 pagesBcs Preliminary English by Shushanta Paul Full and Final Version (1 To 10) LectureGolam Rabbane100% (1)

- Liquidity Crisis Keeps Call Money Rate Over 20pc for 2 MonthsDocument3 pagesLiquidity Crisis Keeps Call Money Rate Over 20pc for 2 MonthsGolam RabbaneNo ratings yet

- Socioeconomic Divides m41Document88 pagesSocioeconomic Divides m41Golam RabbaneNo ratings yet

- Network DiagramsDocument8 pagesNetwork Diagramscrystal50% (2)

- Multiple Choice and Descriptive Questions Practice TestDocument4 pagesMultiple Choice and Descriptive Questions Practice TestGolam RabbaneNo ratings yet

- KellerDocument23 pagesKellersaaigeeNo ratings yet

- 2012 Management ReportDocument32 pages2012 Management ReportGolam RabbaneNo ratings yet

- Call Money Rate Rises Ahead of EidDocument3 pagesCall Money Rate Rises Ahead of EidGolam RabbaneNo ratings yet

- Call-Money Rate Rises: Assignment ONDocument3 pagesCall-Money Rate Rises: Assignment ONGolam RabbaneNo ratings yet

- Bulletin Feb 13Document24 pagesBulletin Feb 13Golam RabbaneNo ratings yet

- wEDDING 1Document12 pageswEDDING 1Golam RabbaneNo ratings yet

- 3586 13666 1 PBDocument11 pages3586 13666 1 PBGolam RabbaneNo ratings yet

- BeximcoDocument27 pagesBeximcoAftab HossainNo ratings yet

- Starbuckspresentationfinal 111102173037 Phpapp01Document15 pagesStarbuckspresentationfinal 111102173037 Phpapp01Golam RabbaneNo ratings yet

- Case Final3Document60 pagesCase Final3Golam RabbaneNo ratings yet

- Turban Online W1Document12 pagesTurban Online W1Golam RabbaneNo ratings yet

- OBDocument5 pagesOBGolam RabbaneNo ratings yet

- Sandip 130307083101 Phpapp02Document121 pagesSandip 130307083101 Phpapp02Shreya Saransh GoelNo ratings yet