Professional Documents

Culture Documents

Páginas DesdeHP DIC 2015-2

Uploaded by

Robert Montoya0 ratings0% found this document useful (0 votes)

13 views1 pageho02

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentho02

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pagePáginas DesdeHP DIC 2015-2

Uploaded by

Robert Montoyaho02

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Business Trends

LNG growth is expected to be even stronger than overall

gas growth moving forward, although the expansion will be

tempered by maturing markets, price sensitivity from buyers

and the removal of price subsidies in non-OECD markets.

FIG. 3 shows projected global LNG capacity and demand between 2015 and 2025. The global LNG export market has been

dominated by Qatar, Australia, Algeria, Malaysia and Indonesia over the past 15 years. In the next decade, however, North

America and East Africa are expected to become prominent

LNG exporters, due to the huge gas reserves being discovered

and produced in US shale plays and offshore East Africa. More

than $700 B could be invested in LNG facilities worldwide

through 2035, with more than half of this amount allocated to

700

Capacity, metric MMtpy

600

500

Demand

Speculative

Possible

Under construction

Existing

400

300

200

100

0

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

FIG. 3. Projected global LNG capacity and demand, 20152025.

North American facilities. However, analysts expect that only

a fraction of the LNG export projects around the world will be

built due to high capital expenditures, the threat of price volatility, and a possible glut of LNG capacity past 2020.

The response of the LNG market to sporadic bouts of LNG

supply and the introduction of import markets will be a key

factor in the direction of global LNG supply and demand over

the next few years.

The usage of floating LNG (FLNG) and floating regasification and storage unit vessels will become more prominent

over the next decade. These vessels enable the swift development of stranded gas reserves at sea that would be too expensive to pump to onshore liquefaction plants. FLNG is being

touted by its proponents as a flexible, alternative solution to

onshore LNG projects, which usually require extensive permitting processes and excess capital investment for the landbased units. According to GDF Suez, FLNG could open as

many as 800 stranded gas fields to development, representing

more than 1.5 Tcf of gas.

Petrochemicals. The global petrochemical wave is not

over, but the crash in energy markets has shifted the outlook

from bullish to cautiously optimistic. Many new construction

projects remain in the works, especially within ethylene for

shale-derived ethane cracking in the US. While some delays

have been reported, project economics remain sound for the

foreseeable future. After all, lower oil and gas prices mean that

Mission critical power systems deserve mission critical testing.

The best testing requires the right equipment in the right place at the

right time. ComRent Load Bank Solutions is the industry leading load

bank solutions provider with the largest inventory and variety of load

banks in North America. With ComRents range of medium-voltage

and direct-connect load banks, extensive experience, 24/7 365 support,

and specialized products that can test up to 100MW, you test better.

comrnt1921

Hydrocarbon

toggle 7x4.872.indd 1

16

DECEMBER

2015|HydrocarbonProcessing.com

LOAD BANK SOLUTIONS

Our Knowledge, Your Power.

ComRent.com

Select 153 at www.HydrocarbonProcessing.com/RS

1-888-881-7118

3/16/15 4:42 PM

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Line Sizing Criteria As Per Different International StandardsDocument4 pagesLine Sizing Criteria As Per Different International StandardsTiano BaLajadia100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- SAFE Chart TemplateDocument19 pagesSAFE Chart TemplateRobert MontoyaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 1 PBDocument6 pages1 PBRobert MontoyaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Compressor Troubleshooting ChecklistDocument8 pagesCompressor Troubleshooting Checklistankur2061No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Untitled 1Document1 pageUntitled 1Robert MontoyaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Untitled 13Document1 pageUntitled 13Robert MontoyaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Fired Furnace Excess Air CalculationDocument3 pagesFired Furnace Excess Air CalculationAtul kumar KushwahaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Páginas DesdeHydrocarbon Processing 12 2014-8Document1 pagePáginas DesdeHydrocarbon Processing 12 2014-8Robert MontoyaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Páginas DesdeHP DIC 2015Document1 pagePáginas DesdeHP DIC 2015Robert MontoyaNo ratings yet

- The Death of Cap and Trade For The US: CommentDocument1 pageThe Death of Cap and Trade For The US: CommentRobert MontoyaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Emergency Response: Human Error in Process Plant Design and OperationsDocument1 pageEmergency Response: Human Error in Process Plant Design and OperationsRobert MontoyaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Untitled 1Document1 pageUntitled 1Robert MontoyaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Untitled 13Document1 pageUntitled 13Robert MontoyaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Untitled 1Document4 pagesUntitled 1Robert MontoyaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Identifying Human Error PotentialDocument1 pageIdentifying Human Error PotentialRobert MontoyaNo ratings yet

- Páginas DesdeHydrocarbon Processing 12 2014-5Document1 pagePáginas DesdeHydrocarbon Processing 12 2014-5Robert MontoyaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Páginas DesdeHydrocarbon Processing 12 2014-9Document1 pagePáginas DesdeHydrocarbon Processing 12 2014-9Robert MontoyaNo ratings yet

- Páginas DesdeHydrocarbon Processing 12 2014-2Document1 pagePáginas DesdeHydrocarbon Processing 12 2014-2Robert MontoyaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Páginas DesdeHydrocarbon Processing 12 2014-4Document1 pagePáginas DesdeHydrocarbon Processing 12 2014-4Robert MontoyaNo ratings yet

- Páginas DesdeHP DICDocument1 pagePáginas DesdeHP DICRobert MontoyaNo ratings yet

- Páginas DesdeHydrocarbon Processing 12 2014Document1 pagePáginas DesdeHydrocarbon Processing 12 2014Robert MontoyaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Páginas DesdeHydrocarbon Processing 12 2014-3Document1 pagePáginas DesdeHydrocarbon Processing 12 2014-3Robert MontoyaNo ratings yet

- Páginas DesdeHP DIC 2015-2Document1 pagePáginas DesdeHP DIC 2015-2Robert MontoyaNo ratings yet

- Páginas DesdeHP DIC 2015-2Document1 pagePáginas DesdeHP DIC 2015-2Robert MontoyaNo ratings yet

- Páginas DesdeHP DIC 2015Document1 pagePáginas DesdeHP DIC 2015Robert MontoyaNo ratings yet

- Páginas DesdeHP DIC 2015-5Document1 pagePáginas DesdeHP DIC 2015-5Robert MontoyaNo ratings yet

- Páginas DesdeHP DIC 2015-7Document1 pagePáginas DesdeHP DIC 2015-7Robert MontoyaNo ratings yet

- Páginas DesdeHP DIC 2015-4Document1 pagePáginas DesdeHP DIC 2015-4Robert MontoyaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Páginas DesdeHP DIC 2015-3Document1 pagePáginas DesdeHP DIC 2015-3Robert MontoyaNo ratings yet

- Páginas DesdeHP DIC 2015-3Document1 pagePáginas DesdeHP DIC 2015-3Robert MontoyaNo ratings yet

- TSM Octnov 2021 Vol 17 Issue 6 HRDocument80 pagesTSM Octnov 2021 Vol 17 Issue 6 HREngels VillanuevaNo ratings yet

- WisonDocument29 pagesWisonYoon SDNo ratings yet

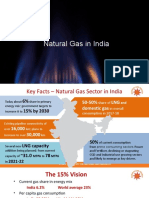

- Natural Gas in IndiaDocument19 pagesNatural Gas in IndiaAnkit PandeyNo ratings yet

- Handbook of LNGDocument3 pagesHandbook of LNGBorisvc8No ratings yet

- LNG Infrastructure Bulk TankDocument2 pagesLNG Infrastructure Bulk TankChow KheeyewNo ratings yet

- LBA Company ProfileDocument15 pagesLBA Company ProfileAndrianoNo ratings yet

- Uzu With CPF Upgrade - Construction Execution PlanDocument46 pagesUzu With CPF Upgrade - Construction Execution PlanOkeymanNo ratings yet

- Cyprushydrocarbons Scenariosandoptions Rev1Document172 pagesCyprushydrocarbons Scenariosandoptions Rev1api-267193525No ratings yet

- World Oil - Sep 2019Document88 pagesWorld Oil - Sep 2019minurkashNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Brochure TOV 2018Document16 pagesBrochure TOV 2018brunoNo ratings yet

- Est May 2021Document5 pagesEst May 2021Laiq Ur RahmanNo ratings yet

- Mohd Zafri Bin Mazri - 12694 - Chemical Engineering - Cold Energy Utilization From LNG Regasification PDFDocument75 pagesMohd Zafri Bin Mazri - 12694 - Chemical Engineering - Cold Energy Utilization From LNG Regasification PDFThanh Phong NguyễnNo ratings yet

- 15 Zero Emissions From FPSOsDocument1 page15 Zero Emissions From FPSOsarch_ianNo ratings yet

- De-Carbonization of Ocean-Going Vessels: Ammonia Energy Association 2020 ConferenceDocument18 pagesDe-Carbonization of Ocean-Going Vessels: Ammonia Energy Association 2020 ConferencetavgimtbmzlggkqzmvNo ratings yet

- Ortloff TechnologyDocument10 pagesOrtloff TechnologyFaradisa AyuNo ratings yet

- LNGDocument2 pagesLNGbernardinodinoNo ratings yet

- ISO 23306 2020 (En)Document28 pagesISO 23306 2020 (En)SAMKUMARNo ratings yet

- Painting SpecDocument30 pagesPainting SpecQuỳnh Chi Dương100% (1)

- Sea 301Document6 pagesSea 301PetricaNo ratings yet

- Gas in ThailandDocument13 pagesGas in ThailandMidi RiyantoNo ratings yet

- Mini Mid-Scale LNG PDFDocument22 pagesMini Mid-Scale LNG PDFGeoffreyHunter100% (3)

- Overview of CGD in IndiaDocument31 pagesOverview of CGD in Indiasandeep7162No ratings yet

- PT Perusahaan Gas Negara (Persero) TBKDocument26 pagesPT Perusahaan Gas Negara (Persero) TBKKaryn KadarNo ratings yet

- Rystad Energy Commentary - 3539361 - Australasia 2020 ReviewDocument9 pagesRystad Energy Commentary - 3539361 - Australasia 2020 ReviewRaam WilliamsNo ratings yet

- Reading Assignment 5Document3 pagesReading Assignment 5Ninuca KalandarishviliNo ratings yet

- EnerChemTek - The Reach of Energy and Its Value ChainDocument15 pagesEnerChemTek - The Reach of Energy and Its Value ChainmdavilasNo ratings yet

- DNV QRA Sample ReportDocument133 pagesDNV QRA Sample Reporttansg100% (2)

- Giignl The LNG Industry in 2012Document46 pagesGiignl The LNG Industry in 2012abhishekatupesNo ratings yet

- Platts BrochureDocument8 pagesPlatts BrochureRohit HarlalkaNo ratings yet

- Presentation Slides About India LNGDocument3 pagesPresentation Slides About India LNGSatish Kumar100% (1)

- ChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindFrom EverandChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindNo ratings yet

- Hero Found: The Greatest POW Escape of the Vietnam WarFrom EverandHero Found: The Greatest POW Escape of the Vietnam WarRating: 4 out of 5 stars4/5 (19)

- Sully: The Untold Story Behind the Miracle on the HudsonFrom EverandSully: The Untold Story Behind the Miracle on the HudsonRating: 4 out of 5 stars4/5 (103)

- The End of Craving: Recovering the Lost Wisdom of Eating WellFrom EverandThe End of Craving: Recovering the Lost Wisdom of Eating WellRating: 4.5 out of 5 stars4.5/5 (82)

- The Fabric of Civilization: How Textiles Made the WorldFrom EverandThe Fabric of Civilization: How Textiles Made the WorldRating: 4.5 out of 5 stars4.5/5 (58)

- How to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerFrom EverandHow to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerRating: 4.5 out of 5 stars4.5/5 (122)