Professional Documents

Culture Documents

Is "Tax Day" Too Burdensome For The Rich?

Uploaded by

api-26190997Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is "Tax Day" Too Burdensome For The Rich?

Uploaded by

api-26190997Copyright:

Available Formats

April 13, 2009

Contact: Bob McIntyre

CTJ Citizens for

Tax Justice

(202) 299-1066 x22

2 pages

Is “Tax Day” Too Burdensome for the Rich?

The U.S. Tax System Is Not as Progressive as You Think

Many politicians, pundits and media outlets have recently claimed that the richest one percent

of American taxpayers are providing a hugely disproportionate share of the tax revenue we

need to fund public services. New data from Citizens for Tax Justice show that this simply is

not true. CTJ estimates that the share of total taxes (federal state and local taxes) paid by

taxpayers in each income group is quite similar to the share of total income received by each

income group in 2008.

# The total federal, state and local effective tax rate for the richest one percent of

Americans (30.9 percent) is only slightly higher than the average effective tax rate for

the remaining 99 percent of Americans (29.4 percent).

# From the middle-income ranges upward, total effective tax rates are virtually flat across

income groups.

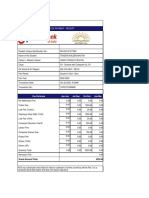

Incomes and Federal, State & Local Taxes in 2008

Shares of TAXES AS A % OF INCOME

Average

Total Total Federal State & Total

cash

income taxes taxes local taxes taxes

income

Lowest 20% $ 12,000 3.2% 2.0% 6.8% 11.9% 18.7%

Second 20% 24,500 6.7% 5.0% 11.0% 11.2% 22.3%

Middle 20% 40,000 11.1% 10.1% 15.9% 11.1% 27.0%

Fourth 20% 66,100 18.4% 18.5% 18.9% 11.1% 30.0%

Next 10% 101,000 14.0% 14.8% 20.3% 11.1% 31.5%

Next 5% 144,000 10.1% 10.9% 21.4% 10.8% 32.2%

Next 4% 253,000 14.3% 15.5% 22.0% 10.1% 32.1%

Top 1% 1,445,000 22.2% 23.0% 22.7% 8.2% 30.9%

ALL $ 70,400 100.0% 100.0% 19.4% 10.3% 29.8%

Addendum:

Bottom 99% $ 56,500 77.9% 76.8% 18.4% 10.9% 29.4%

Notes:

1. Taxes include all federal, state & local taxes (personal and corporate income, payroll, property, sales, excise,

estate etc.).

2. For calculations of income shares and taxes as a % of income, income includes employer-paid FICA taxes and

corporate profits net of taxable dividends, neither of which is included in the average cash income figures shown.

Source: Institute on Taxation and Economic Policy Tax Model, April 2009

Citizens for Tax Justice, April 2009

Page 2 of 2

Claims that the richest one percent are paying far more than their fair share usually focus only

on one type of federal tax paid (the federal income tax) while ignoring other regressive federal

taxes, like the payroll tax, which is more significant for most taxpayers. They also ignore state

and local taxes, which tend to tax low- and middle-income families more heavily than well-off

families. As these figures make clear, the richest Americans are not being “overtaxed” relative

to other Americans or relative to their share of national income.

Shares of Total Taxes Paid by Each Income Group Are Similar to Their

Shares of Total Income in 2008

25%

Share of Total Income/Total Taxes

20%

15%

Total income

10% Total taxes

5%

—

Lowest Second Middle Fourth Next 10% Next 5% Next 4% Top 1%

20% 20% 20% 20%

Income Group

Total Effective Tax Rates Are Not Significantly Higher for Richest

Taxpayers than Middle-Class in 2008

40%

35% 31.5% 32.2% 32.1%

30.0% 30.9%

Total Effective Tax Rate

30% 27.0%

25% 22.3%

18.7%

20%

15%

10%

5%

—

Lowest Second Middle Fourth Next 10% Next 5% Next 4% Top 1%

20% 20% 20% 20%

Income Group

You might also like

- MeralcoDocument2 pagesMeralcoTheo Amadeus100% (4)

- Carding Dumps Tutorial and Carding Dumps Tutorial and Cashout Dumps Method 2021 Cashout Dumps Method 2021Document7 pagesCarding Dumps Tutorial and Carding Dumps Tutorial and Cashout Dumps Method 2021 Cashout Dumps Method 2021Solange Velas100% (2)

- ICAB Manual - Tax Planning & Compliance (2020)Document584 pagesICAB Manual - Tax Planning & Compliance (2020)Tasmia Binte Habib100% (5)

- Income TaxationDocument13 pagesIncome TaxationJpagNo ratings yet

- ADIT Principles of International Taxation Module Brochure PDFDocument36 pagesADIT Principles of International Taxation Module Brochure PDFBhalchandra Dhopatkar0% (1)

- Договор отельDocument2 pagesДоговор отельСергей КаменёкNo ratings yet

- MusicDocument356 pagesMusicJilly CookeNo ratings yet

- Taxation Law Reviewer (San Beda)Document127 pagesTaxation Law Reviewer (San Beda)Ryan Aspe100% (4)

- AnnuityDocument1 pageAnnuityRechie Jhon D. RelatorNo ratings yet

- Advanced Taxation (Acfn 622) Semester 1, 2012Document12 pagesAdvanced Taxation (Acfn 622) Semester 1, 2012yebegashet100% (1)

- Ks Whopays FactsheetDocument2 pagesKs Whopays FactsheetbrentwistromNo ratings yet

- DJA - AA - PEN 06.july.2021 ArtiDocument16 pagesDJA - AA - PEN 06.july.2021 ArtiAngga AnugrawanNo ratings yet

- State and Federal SpendingDocument25 pagesState and Federal SpendingNational Press FoundationNo ratings yet

- 2009-04-01 Towards Evidence-Based Public Administration Reform in Viet NamDocument13 pages2009-04-01 Towards Evidence-Based Public Administration Reform in Viet NamInternational Consortium on Governmental Financial ManagementNo ratings yet

- CLWTAXN Income Taxation of Corporations PDFDocument10 pagesCLWTAXN Income Taxation of Corporations PDFEDUARDO JR. VILLANUEVANo ratings yet

- JPM Cembalest Eye On The Market 1.28.19Document5 pagesJPM Cembalest Eye On The Market 1.28.19Etan WeissNo ratings yet

- Averting A Fiscal CrisisDocument23 pagesAverting A Fiscal CrisisCommittee For a Responsible Federal BudgetNo ratings yet

- Interim Union Budget 2024-25 Note - 0Document3 pagesInterim Union Budget 2024-25 Note - 030091998skumarNo ratings yet

- U.S. Effective Corporate Tax Rate On New Investments: Highest in The OECD, Cato Tax & Budget BulletinDocument3 pagesU.S. Effective Corporate Tax Rate On New Investments: Highest in The OECD, Cato Tax & Budget BulletinCato InstituteNo ratings yet

- The California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextDocument16 pagesThe California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextHoover InstitutionNo ratings yet

- Overview of Fiscal Structure of PakistanDocument51 pagesOverview of Fiscal Structure of Pakistanhasan shayanNo ratings yet

- FY2018Highlights PDFDocument152 pagesFY2018Highlights PDFsrikrishna natesanNo ratings yet

- Budget Pack 84Document24 pagesBudget Pack 84api-3701429No ratings yet

- HDFC Budget 2019 20 July2019Document10 pagesHDFC Budget 2019 20 July2019sohanNo ratings yet

- Balanz Capital 232 Province of Mendoza. Ongoing Solid Fiscal Consolidation EffortDocument6 pagesBalanz Capital 232 Province of Mendoza. Ongoing Solid Fiscal Consolidation EffortGabriel ConteNo ratings yet

- Accenture Strategy Digital Disruption Growth Multiplier BrazilDocument12 pagesAccenture Strategy Digital Disruption Growth Multiplier Brazilali fatehiNo ratings yet

- En Special Series On Covid 19 Tax Policy For Inclusive Growth After The PandemicDocument14 pagesEn Special Series On Covid 19 Tax Policy For Inclusive Growth After The PandemicatescandorNo ratings yet

- BOLD 2020 Truth in Tax 11.30.20Document29 pagesBOLD 2020 Truth in Tax 11.30.20West Central TribuneNo ratings yet

- Tax BriefDocument3 pagesTax BriefHelen BennettNo ratings yet

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Document2 pagesUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiNo ratings yet

- Federal Spending and State BudgetsDocument25 pagesFederal Spending and State BudgetsNational Press FoundationNo ratings yet

- 2020 - An - Inflection - Point - in - Global - Corporate - TaxDocument12 pages2020 - An - Inflection - Point - in - Global - Corporate - Taxds2084No ratings yet

- Business Organization and TaxesDocument22 pagesBusiness Organization and TaxesChieMae Benson QuintoNo ratings yet

- Parative Public FinanceDocument66 pagesParative Public FinanceniteshNo ratings yet

- 12 Design TaxDocument43 pages12 Design TaxLai Nwe YinNo ratings yet

- Scott Hodge, President Will Mcbride, Chief EconomistDocument20 pagesScott Hodge, President Will Mcbride, Chief EconomistTax FoundationNo ratings yet

- Measuring Progressivity in Canadas Tax SystemDocument10 pagesMeasuring Progressivity in Canadas Tax SystemAbid faisal AhmedNo ratings yet

- Interest Rates: Yield Curve Flattening Yield Curve FlatteningDocument2 pagesInterest Rates: Yield Curve Flattening Yield Curve FlatteningNishtha KaushikNo ratings yet

- Unpacking The State and Local Tax Toolkit Sources of State and Local Tax Collections FY 2020Document16 pagesUnpacking The State and Local Tax Toolkit Sources of State and Local Tax Collections FY 2020gjehle57No ratings yet

- New Data Show U.S. Has Fourth Highest Corporate Tax Rate, Cato Tax & Budget BulletinDocument2 pagesNew Data Show U.S. Has Fourth Highest Corporate Tax Rate, Cato Tax & Budget BulletinCato InstituteNo ratings yet

- Target Corporation - Simple Operating Model: General AssumptionsDocument6 pagesTarget Corporation - Simple Operating Model: General AssumptionsoussemNo ratings yet

- Plan Fiscal AAFAFDocument6 pagesPlan Fiscal AAFAFViviana Tirado MercadoNo ratings yet

- Direct Tax Code, 2010, India: The Salient Features of The Code AreDocument7 pagesDirect Tax Code, 2010, India: The Salient Features of The Code AreHeena SinglaNo ratings yet

- CLOC 2019 State of The Industry FINALDocument26 pagesCLOC 2019 State of The Industry FINALDanielNo ratings yet

- Investing Essentials Power of Taxable Equivalent YieldDocument2 pagesInvesting Essentials Power of Taxable Equivalent YieldmartinNo ratings yet

- 2009-08-06 Saxo Bank Research Note - US Q2 GDPDocument8 pages2009-08-06 Saxo Bank Research Note - US Q2 GDPTrading Floor100% (2)

- Fiscal Challenge: Between An Exhausted Society and IMF: Argentina Strategy NoteDocument4 pagesFiscal Challenge: Between An Exhausted Society and IMF: Argentina Strategy NoteMaximiliano A. SireraNo ratings yet

- Current Tax ReceiptsDocument1 pageCurrent Tax ReceiptsHeidi BillodeauNo ratings yet

- CT Tax Burden 101 1-7-10Document2 pagesCT Tax Burden 101 1-7-10jon peltoNo ratings yet

- 2011 Prelim City Budget FinalDocument53 pages2011 Prelim City Budget FinalEarlynoftenNo ratings yet

- The Effects of Tax Structure On Economic Growth and Income InequalityDocument26 pagesThe Effects of Tax Structure On Economic Growth and Income InequalityAli WainceNo ratings yet

- Country Statistical Profile Greece 2018Document2 pagesCountry Statistical Profile Greece 2018Yasser SayedNo ratings yet

- Rising Tide of Taxes and Fees 07-02-09Document8 pagesRising Tide of Taxes and Fees 07-02-09Grant BosseNo ratings yet

- Political Reform and Fiscal Decentralization RevisedDocument8 pagesPolitical Reform and Fiscal Decentralization Revisedipe5520No ratings yet

- Income Tax Schedules For Australian Residents 2019-2020: CalculatorDocument5 pagesIncome Tax Schedules For Australian Residents 2019-2020: CalculatorAkshay GargNo ratings yet

- Macroeconomics: by Michael J. Buckle, PHD, James Seaton, PHD, and Stephen Thomas, PHDDocument24 pagesMacroeconomics: by Michael J. Buckle, PHD, James Seaton, PHD, and Stephen Thomas, PHDDouglas ZimunyaNo ratings yet

- PC2020 Mid Year ReportDocument9 pagesPC2020 Mid Year ReportKW SoldsNo ratings yet

- The Macroeconomic and Social Impact of COVID-19 in Ethiopia and Suggested Directions For Policy ResponseDocument51 pagesThe Macroeconomic and Social Impact of COVID-19 in Ethiopia and Suggested Directions For Policy ResponseGetachew HussenNo ratings yet

- Bridgewater ReportDocument12 pagesBridgewater Reportw_fibNo ratings yet

- Tax Foundation FF6241Document5 pagesTax Foundation FF6241muhammad mudassarNo ratings yet

- CalculationsDocument5 pagesCalculationsKhawaja HamzaNo ratings yet

- Public Ecnomics: Dr. HE ChenDocument23 pagesPublic Ecnomics: Dr. HE ChenGUDATA ABARANo ratings yet

- Union Budget FY2024Document15 pagesUnion Budget FY2024Sathiyamoorthy RethinamNo ratings yet

- The Effect of Tax Composition On Income Inequality: Sri Lankan ExperienceDocument18 pagesThe Effect of Tax Composition On Income Inequality: Sri Lankan ExperienceMuskan TyagiNo ratings yet

- Final Tax Lecture PDFDocument7 pagesFinal Tax Lecture PDFMarlo Caluya ManuelNo ratings yet

- Group 8Document7 pagesGroup 8Hoàng Tiến HọcNo ratings yet

- f6vnm 2007 Dec QDocument9 pagesf6vnm 2007 Dec QPhạm Hùng DũngNo ratings yet

- 0902 Californias Tax SystemDocument21 pages0902 Californias Tax SystemalcofribassNo ratings yet

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItFrom EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItNo ratings yet

- 2019-01 Nieuwsbrief Uzk ENUDocument2 pages2019-01 Nieuwsbrief Uzk ENUAdrian OanceaNo ratings yet

- Basics of LCDocument26 pagesBasics of LCRidhesh RaoNo ratings yet

- New Trends in Banking IndustryDocument16 pagesNew Trends in Banking IndustryRishi ChandanNo ratings yet

- PF05-Efficiency - Chapter 15Document54 pagesPF05-Efficiency - Chapter 15byuntaebaekNo ratings yet

- File 8081Document3 pagesFile 8081RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- UBS CSR Summit Awards 2019 Brochure-8Document1 pageUBS CSR Summit Awards 2019 Brochure-8akpmig29No ratings yet

- Sumit PassbookDocument5 pagesSumit PassbookSumitNo ratings yet

- Kentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovDocument28 pagesKentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovCharles Lamont BrewerNo ratings yet

- Faq Pmjdy PDFDocument10 pagesFaq Pmjdy PDFuda52No ratings yet

- Acctax1 Chapter4 ReviewerDocument6 pagesAcctax1 Chapter4 ReviewerEirene Joy VillanuevaNo ratings yet

- Basic Accounting Quiz 2.0Document4 pagesBasic Accounting Quiz 2.0Jensen Rowie PasngadanNo ratings yet

- PIONEER Current Account SOB Eff 1st Dec 2022Document2 pagesPIONEER Current Account SOB Eff 1st Dec 2022Rajat AgarwalNo ratings yet

- DICGCDocument8 pagesDICGCsatur123No ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Advance Payment of TaxDocument3 pagesAdvance Payment of TaxsadathnooriNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetJasmine ActaNo ratings yet

- International Business Law (DLW1083) : Law of Bill of ExchangeDocument11 pagesInternational Business Law (DLW1083) : Law of Bill of Exchangewafiq100% (1)

- Taxation Law Bar Questions 06-14Document49 pagesTaxation Law Bar Questions 06-14CarmeloNo ratings yet

- Receipt - 10 - 22 - 2022 12 - 00 - 00 AMDocument1 pageReceipt - 10 - 22 - 2022 12 - 00 - 00 AMSumit RautNo ratings yet

- Tax Evasion NigeriaDocument11 pagesTax Evasion NigeriadaydayNo ratings yet

- Purchase GST Nagarajan GodownDocument4 pagesPurchase GST Nagarajan GodownsamaadhuNo ratings yet