Professional Documents

Culture Documents

Group Case Study 1 - Budget 2016

Uploaded by

awieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Case Study 1 - Budget 2016

Uploaded by

awieCopyright:

Available Formats

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

INTRODUCTION

The Honourable Prime Minister, YAB Dato Sri Mohd Najib Tun Abdul Razak as the Finance

Minister, tabled the 2016 Budget on Friday, 23 October 2015. The 2016 Budgets theme of

Prospering the Rakyat and its 5 priorities reflect the Governments aspiration to achieve its

goals of safeguarding the rights and interests of the Rakyat, achieving inclusive and

sustainable growth and transforming Malaysia into a high income and advanced economy.

Budget 2016 allocates total RM267.2 billion, an increase from a revised allocation of 260.7

billion for 2015. The initial allocation for 2015 was RM273.9 billion. For 2016, federal

government revenue collection is projected at RM225.7 billion, up RM3.2 billion from 2015.

Malaysia is currently facing three challenges:

a) Declining global demand, which has hurt its export income, especially as it has

become more reliant on commodity exports;

b) Dampening domestic consumption and investment due to high household debt

levels;

c) Deteriorating confidence in the leadership, which has hurt both private investment

as well as foreign capital inflows.

These three issues were not adequately addressed by the 2016 Budget, which we believe will

continue to plague in the economy in the near term.

While spending is expected to continue spurring growth, Budget 2016 will also be watched to

see if it will take steps such as reducing the rate of the goods and services tax (GST) to ease

the rising cost of living, and for substantive and transformative measures that will go beyond

cash handouts to closing the wealth inequality gap as Malaysia strives to become a highincome nation. Notably, this budget will be the first under the 11th Malaysia Plan a master

plan to chart the countrys development from next year until 2020.

BUDGET 2016 PRIORITIES : PROSPERING THE RAKYAT

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 1 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

There have 5 priorities in budget 2016 :

Strengthening Economic Resilience

Increasing Productivity, Innovation and Green Technology

Empowering Human Capital

Advancing Bumiputera Agenda

Easing the Cost of Living of the Rakyat

This is in line with the people-oriented 11th Malaysian Plan (11MP). The Six Strategic

Thrusts of 11MP contain people-centric elements: Enhancing inclusiveness towards equitable society, with specialfocus on the

Bottom-40% (B40) of the household by income as well as rural areas via better access

to quality education and training, efficient infrastructure and amenities, improved

connectivity, better employment and entrepreneurial opportunities, as well as wealth

ownership.

Improving well-being for all by rising standards of living and quality of life,

among others by providing quality healthcare, affordable housing and safer

neighborhoods.

Accelerating human capital development for an advanced nation through

improvement in labor market productivity and create more high-skilled job

opportunities, supported by reform of the education system to produce talents, and

shift in Technical and Vocational Education and Training (TVET) towards industry-

led programmes to supply workforce that meets industry demand.

Pursuing green growth for sustainability and resilience to ensure environment and

natural endowment are conserved and protected for current and future generations.

Strengthening infrastructure to support economic expansion and ensure the

people have access to essential amenities and services such as transport,

communications, electricity and clean water.

Re-engineering growth for greater prosperity by migrating all economic sectors

into more knowledge-intensive and high-value added activities that not just create

jobs per se, but generate higher-paying jobs.

BUDGET OVERVIEW

Budget 2015

Economic growth and declining commodity prices. Other promising performance indicators

for The Malaysian economy impressively grew by 5.3% in the first half of 2015, despite the

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 2 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

slowdown in global 2015 include a reduction in the fiscal deficit to 3.2% of Gross Domestic

Product (GDP) and an unemployment rate of 2.9%.

Budget 2016

Against this background, the Governments predictions for 2016 include a 4% 5% increase

in GDP and a manageable inflation rate of 2% 3% with private investment and consumption

being touted as the key drivers of growth. With national revenue and expenditure forecasted

at RM225.7 billion and RM267.2 billion respectively, Malaysias fiscal deficit for 2016 is

expected to decline to 3.1% of GDP. National revenue is still expected to register some

growth in 2016 despite the weak oil prices due to strong Goods and Services Tax (GST)

collection, which will be a key contributor to Government revenue.

In line with the Governments assurance that revenue from GST will be returned to benefit

the Rakyat, 2016 Budget contains several laudable measures, clearly aimed at striking a

balance between a Capital Economy and a People Economy. Amongst others, a wide range

of tax incentives have been proposed to promote and strengthen investment in targeted key

sectors. For the Rakyat, many individuals and families stand to benefit from the enhanced

personal tax reliefs and expansion of the GST zero-rated list to include a wider variety of

controlled medicines and basic food items.

Overall, 2016 Budget provides a promising foundation to support both businesses and

individuals in our collective pursuit of a robust economy.

IMPACT TO HRM

Extract Budget 2016 :

Salary adjustment whereby 1.6m civil servants will benefit

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 3 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

30% of the human resource development fund to implement training programmes to

meet the needs of local industries in Sabah & Sarawak as well as an outplacement

centre to retrain retrenched workers

1Malaysia training scheme (SL1M) with RM250m allocation to be financed by GLCs

Good focus for housing, vocational training , various tax breaks for the middle class

Less allocation for KPT by RM1.4b

Pro & Cons :

Tax breaks and salary adjustments will ensure a more satisfied workforce and higher

disposable income to circulate into the economy

The salary adjustment will also ensure that the workers will better cope and adjust to

the rising cost of living

Relative price increase in the consumer goods after the announcement of the salary

adjustment to government servants may increase the cost of living

Empowering the human capital in measures to improve both the current and future

workforce with vocational trainings and other development programmes ~ more

skilled and semi-skilled workers

Recommendation on implementation :

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 4 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

Government to encourage involvement of GLCs and other corporation bodies in

providing on-the-job training to the potential workforce i.e. joint venture between

IPTAs and GLCs to provide practical training to students.

Government to provide tax incentive for GLCs or other corporation bodies that give

grants to IPTAs to do research and other related programmes for the benefits of

students and enhancing the skill of the future workforce

Government agencies to work closely together to avoid conflicting purposes in

building our nations and handling the problem of rising cost of living. For example,

imposing price control over more consumer items to avoid price hike after the

announcement of the salary adjustment to government servants.

Government to reverse the mentality of our people that working in certain industries

such as domestic helps, constructions and agriculture is not degrading by providing

training to up-skill our workforce to a professional levels that can demand higher

wages, salaries and benefits. It may be a gradual and slow process but constant efforts

and exposure to other countries that recognize the workers in these industries as

professionals i.e. Australia and United Kingdom, will be beneficial and eye-opening.

IMPACT TO ENTREPRENEURSHIP / SMEs

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 5 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

RM6.26b in 2016 against RM6.52b in 2015 a reduction of RM260 million.

Extract Budget 2016 :

RM1.55b in 2016 for Bumiputera Entrepreneurs against RM980m in 2015

RM250m in 2016 for Indian Entrepreneurs compared to RM50m in 2015

Chinese Entrepreneurs to get RM140m in 2016 against RM50m in 2015

Young Entrepreneurs is allocated RM170m in 2016

RM2.17b allocated for Small and Medium Enterprises (SMEs) in 2016 against

RM5.29b in 2015

Other Generalised Entrepreneurship Benefits (RM1.98b)

Pro & Cons :

Incentives mostly focus on domestic entrepreneurship to increase in productivity for

entrepreneurs and boost local economies, indirectly generate entrepreneurs with

higher-income.

Financial assistance to assist the entrepreneurs especially young entrepreneurs.

The assistance may not reached the targeted groups and may only be focus on certain

groups.

Recommendations on Implementation :

To make the entrepreneurs aware of the various schemes and programmes to give

financial assistance and train the entrepreneurs through seminars, courses and roadshows to villages, small towns and towns.

To disseminate the information to various local authorities and government agencies

for them to pass the correct information that can assist the entrepreneurs and SMEs in

getting the suitable and required helps and assistance.

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 6 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

To advertise the various financial assistance and loans and the target groups via

various channel i.e. television, radio and road-shows.

To organize go and meet programmes for the related agencies to go and meet the

entrepreneurs and give explanations on the available assistance.

IPTAs with entrepreneurship programmes should be equipped with all the knowledge

on the availability of the assistance to entrepreneurs and SMEs to enable them to

disseminate the information and assist the entrepreneurs and SMEs in getting the

same. They also should be in collaboration with all the agencies involve to better

assist the entrepreneurs and SMEs.

IMPACT TO LABOUR RELATIONS

The minimum wage increase for private sector workers in the peninsula from RM900

to RM1,000, and from RM800 to RM920 for those in Sabah, Sarawak and Labuan.

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 7 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

The minimum wage does not apply to domestic workers.

The minimum wage of civil servants to begin at RM1,200 and to take effect from

middle of next year.

The increase in the national minimum wage will give long-term benefit for

Employees Provident Fund (EPF) contributors, especially among the low-income

earners, would have sufficient savings for their retirement.

The government's decision to raise the minimum wage for workers in the country in

the 2016 Budget is to reduce dependence on foreign workers as it would enable more

people to have the opportunity to be employed in various occupations from the aspect

of industries and technologies.

Employers have to be creative in ensuring that the workers productivity

commensurate with the minimum wage paid. If not the increase in cost will be

burdensome to them and may also result in employers laying off workers

May result in increased price of goods as a relative effect

Pros & Cons :

May reduce dependence the nation dependence on foreign worker as the higher

salaries may attract local workforce to enter the industries

Standard minimum wage across Peninsular Malaysia and across Sabah & Sarawak

may curb the migration of workforce from small towns or villagers to big cities.

Relative effect on the price of goods may result in higher cost of living.

Employers may suffer the increase in their operational cost; especially for the

employers in smaller towns as the different in wages upon implementation of the

minimum wage is higher.

Possibility of employers to lay off their existing workers in their pursuits to manage

their cost of operation.

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 8 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

Recommendations on Implementation :

Employers to take these opportunities to recruit local workforce and start to reduce

their reliance on foreign workers.

Employers to be more creative in their planning for the job scopes and descriptions of

their employees to commensurate the rate of minimum wage. KPIs have to be

adjusted to promote productivities.

SWOT ANALYSIS

i) STRENGTH

Improved workers welfare

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 9 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

Increased household disposable income/purchasing power i.e. better cope

with rising cost of living

Better wages attract local workforce, may reduce unemployment rate

Less dependency to foreign worker

ii) WEAKNESS

Increased cost of living

Burdensome to employers in this trying economic downturn

Local workforce reluctance to enter certain industries i.e. construction or

hospitality as laborers

iii) OPPORTUNITIES

Better job opportunities with various development initiatives/plans

Vocational training and up-skills provided by Government & GLCs to

empower workforce and equip our entrepreneurs/SMEs

Better fundings, grants & loans to assist entrepreneurs/SMEs

Tax relief/incentive to SMEs/individuals

Better infrastructure development

iv) THREATS

Global economic uncertainties. Last three decades saw three major crises

in each decade which affect small and open economy economies like

Malaysia i.e. the collapse of world commodity prices in 1985; Asian

financial crisis in 1997/1998 and the Global Financial Crisis in 2008/2009.

Clear and present danger in the current decade is prolonged softness in

commodity prices after the recent drastic falls; big realignments in

currencies including Ringgit vis--vis US Dollar; and risk of economic

downturn in major trading partners, especially China.

Lagging productivity growth. Currently, Malaysias labour productivity is

lagging behind other high-income economies e.g. 32.4% of the US and

56.1% of South Korea. This is mainly due to low contribution of MFP to

growth as inputs of factors of production (capital, labour) are still the main

driver of growth. Higher MFP will ensure sustainable growth and equitable

distribution of wealth in the long run.

Inadequate fiscal space. The Federal Government budget balance remains

in deficit, although on a declining trend during 10MP compared with 9MP.

In view of the external risks and global economic uncertainties, fiscal

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 10 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

consolidation must continue to provide room for policy flexibility in the

future, though not at the expense of delivery and quality of public services.

Low compensation to employees. The GDP share of employees in

Malaysia was 33.2% during 2010-2015 period, lower than that of

highincome and middle-income economies like Australia (47.8%), South

Korea (43.2%) and South Africa (45.9%).

Disparity in household income. Even though the Bottom 40% (B40) of

households monthly average income increased by 12% p.a. between 2009

and 2014, their share of total household income increased marginally from

14.3% in 2009 to 16.5% in 2014.

Weakening of RM i.e forex loss for importers

Declining commodity price i.e crude oil

Fluctuating investors confidence

Weakened position of employers in many industries/sectors

Lower allocation to IPT may hamper their performance in developing

nations human capital

CONCLUSION

Budget 2016 is a very important budget for Malaysia because the drop in demand

from Europe and emerging markets, weakening ringgit, falling crude oil and

commodity prices and fluctuating investor confidence presents a complex set of

challenges to policy makers.

However, the reforms undertaken by the government in past five years in the form of

the Government Transformation Programme (GTP), Economic Transformation

Programme (ETP) and the implementation of the Goods and Services Tax (GST) have

diversified the governments revenue base, created domestic engines of growth,

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 11 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

ensured greater public consumption and provided strong economic fundamentals that

will hold its own despite the growing global economic turbulence.

Wage growth, accelerating innovation and productivity, cost of living and social

mobility remain of concern as we progress on the path of developed nation status we

must also ensure that every Malaysian actually benefits from this advancement and

that there are tangible effects.

However, the question on everyones mind is whether Prime Minister Najib Razak

can deliver a gravity-defying 2016 budget that can withstand the dampening forces of

sluggish global growth, declining domestic demand, and deteriorating confidence.

Instead of opting for substantive reforms to boost Malaysias competitiveness, the PM

focused on populist policies to gain the publics support. While kind to Malaysian at

first sight, the budget will hardly help the economy gain the competitiveness it needs

to get out of its current malaise.

Yes, the medicine is harsh, but the patient requires it in order to live.

Margaret Thatcher

APPENDIX

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

Page 12 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

Page 13 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

Page 14 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

Page 15 of

MUHAMMAD NAWAWI BIN SHAMSUDDIN

NOR AZUANI BINTI MOHAMED ARIFF

HASBULLAH BIN CHE COB

NIK ROSNAH BINTI NIK ZAUDIN

ANIDA BINTI MOHD ZAIN

GST 5023 ORGANIZATIONAL DESIGN

PROF. DR. BALAKRISHNAN A/L PARASURAMAN

P14D329P

P14D352P

P14D328P

P14D351P

P14D343P

Page 16 of

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Economics: 2nd EditionDocument764 pagesEconomics: 2nd EditionOnicca67% (3)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Technology Helps Starbucks Find New Ways To Compete: LecturerDocument10 pagesTechnology Helps Starbucks Find New Ways To Compete: LecturerawieNo ratings yet

- The EconomyDocument4 pagesThe EconomymaximinNo ratings yet

- Group Case Study 3 - OrganizationDocument13 pagesGroup Case Study 3 - OrganizationawieNo ratings yet

- Group Case Study 2 - TeamworkDocument9 pagesGroup Case Study 2 - TeamworkawieNo ratings yet

- Case Study 2Document6 pagesCase Study 2awieNo ratings yet

- Vocab Writing Theo Chủ ĐềDocument94 pagesVocab Writing Theo Chủ ĐềNguynNo ratings yet

- Power CapsuleDocument73 pagesPower CapsulePrince VegetaNo ratings yet

- Privatization in Nepal: D - N M & D - P B 1. Brief Background of PrivatizationDocument38 pagesPrivatization in Nepal: D - N M & D - P B 1. Brief Background of PrivatizationBibek JoshiNo ratings yet

- Balance of Payments, Debt, Financial Crises: Source: Todaro, Michael and Smith, Stephen. (2012)Document20 pagesBalance of Payments, Debt, Financial Crises: Source: Todaro, Michael and Smith, Stephen. (2012)Florence LapinigNo ratings yet

- Local Government Finance in Bangladesh 2Document24 pagesLocal Government Finance in Bangladesh 2Md. Tajul IslamNo ratings yet

- Credit Suisse Hikes PHL GDPDocument5 pagesCredit Suisse Hikes PHL GDPIann CajNo ratings yet

- Indian Economy QuestionsDocument25 pagesIndian Economy QuestionsPadyala SriramNo ratings yet

- ASAL Economics TR Worksheet AnswersDocument39 pagesASAL Economics TR Worksheet AnswersMatej MilosavljevicNo ratings yet

- Commodity Money: Lesson 1Document8 pagesCommodity Money: Lesson 1MARITONI MEDALLANo ratings yet

- James Tooley The Global Education Industry Hobart Paper, 141 2001Document192 pagesJames Tooley The Global Education Industry Hobart Paper, 141 2001AL KENATNo ratings yet

- The Government Accounting ProcessDocument24 pagesThe Government Accounting Processyen claveNo ratings yet

- Thesis 1 .Document19 pagesThesis 1 .micckyNo ratings yet

- Mathematics0910CH01SuppEx1 (Add&Subtract)Document1 pageMathematics0910CH01SuppEx1 (Add&Subtract)潘步成Poon Po ShingNo ratings yet

- Structural Deficit PowerPointDocument11 pagesStructural Deficit PowerPointGovernor Tom WolfNo ratings yet

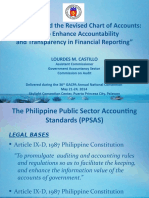

- The PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingDocument98 pagesThe PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingJhopel Casagnap EmanNo ratings yet

- Asia Credit Compendium 2014 04 12 13 05 19Document500 pagesAsia Credit Compendium 2014 04 12 13 05 19BerezaNo ratings yet

- Broad Profile of The Indian Economy & MacroDocument59 pagesBroad Profile of The Indian Economy & Macroyashaswi_raj0% (1)

- Philippine Fiscal PolicyDocument11 pagesPhilippine Fiscal PolicyHoney De LeonNo ratings yet

- Super 50 ECONOMICS CA INTER by CA Rahul GargDocument21 pagesSuper 50 ECONOMICS CA INTER by CA Rahul GargSahibjeet SinghNo ratings yet

- October 2023 BOLTDocument111 pagesOctober 2023 BOLTrsimback123No ratings yet

- Malawi 2012 Statistical YearbookDocument118 pagesMalawi 2012 Statistical YearbookcavrisNo ratings yet

- The Open Economy (N Gregory Mankiw 8th Edition)Document34 pagesThe Open Economy (N Gregory Mankiw 8th Edition)Desita Natalia Gunawan100% (1)

- NedenumitDocument17 pagesNedenumitAlice AnnaNo ratings yet

- The Impact of External Debt On Economic Growth: ADocument31 pagesThe Impact of External Debt On Economic Growth: Afayadi80% (10)

- Global Economics Paper No.187Document2 pagesGlobal Economics Paper No.187Velayudham ThiyagarajanNo ratings yet

- Computer Codes-Booklet PDFDocument55 pagesComputer Codes-Booklet PDFAnonymous 0BaD41xNo ratings yet

- Report On EicherDocument65 pagesReport On EicherJeet Mehta100% (1)

- Demirew Getachew - Tax Reform in Eth and Progress To DateDocument23 pagesDemirew Getachew - Tax Reform in Eth and Progress To Datewondimg100% (5)