Professional Documents

Culture Documents

Business Processes Modelling and Automation in The Banking Sector: A Case Study

Business Processes Modelling and Automation in The Banking Sector: A Case Study

Uploaded by

Vinay SurendraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Processes Modelling and Automation in The Banking Sector: A Case Study

Business Processes Modelling and Automation in The Banking Sector: A Case Study

Uploaded by

Vinay SurendraCopyright:

Available Formats

M.

NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

BUSINESS PROCESSES MODELLING AND AUTOMATION

IN THE BANKING SECTOR: A CASE STUDY

MARA NIKOLAIDOU=, DIMOSTHENIS ANAGNOSTOPOULOSV

APHRODITE TSALGATIDOU=

=

V

Department of Informatics, University of Athens

Harokopion University of Athens

Panepistimiopolis 15784, Athens, Greece

El. Venizelou Str, 17671 Athens, Greece

tel: +(301)-7275614

tel: +(301)-9549171

fax: +(301)7275214

fax: +(301)-9514579

email: {mara}{dimosthe}{afrodite}@di.uoa.gr

Abstract: The banking sector is a competitive environment, where business process re-engineering is constantly

needed. Business process modelling and automation are effective tools towards this direction, improving the

performance of business activities and enabling enterprise-wide monitoring and coordination. In this paper, we

present a case study of modelling and automating business processes in the Loan Monitoring Department of a

medium-sized Bank. Loan monitoring is a typical banking activity, which includes business processes

concerning loan approval, collection of delinquent loans and initiation of appropriate legal claims. These

processes are often performed in cooperation with external business partners, such as legal firms and brokers,

have collaborative properties and are considered to be of dynamic nature. Their efficiency strongly depends on

human operator experience and subjective criteria. The loan monitoring policy employed is a significant factor

for determining profits. Thus, relevant business processes should always be monitored, evaluated and refined.

Business process modelling was conducted using the Modified Petri-Net (MPN) model, which allows the

description of ad-hoc and collaborative business activities. Business process automation was performed using

Lotus Domino/Notes groupware platform, since widely known workflow management systems do not provide

the means for the description of such activities. The direct mapping and support of MPN main entities within

Notes environment ensured the accurate and complete implementation of all business processes and reduced

significantly programming cost. Loan Management System is the integrated environment build to support loan

monitoring activities. Our experience and the potential of the business process modelling and automation

approach are also presented.

Keywords: business process modelling and automation, petri-nets, banking applications, workflow support

procedures and it is usually followed by BP

automation, aiming at improving business process

performance and enabling organisation-wide

monitoring and coordination. An automated BP is

referred to as a workflow, while a Workflow

Management System (WMS) is software used for its

coordination and control [Mohan et al, 2000].

WMSs also provide a set of interfaces to users and

applications involved in the workflow progress. For

efficient workflow development, one should start

with defining and understanding business processes

(BP modelling), before specifying and implementing

the corresponding workflow applications (BP

automation). Provision of generic and flexible

modelling methods is thus required both at BP

modelling and BP automation levels. Several

methods have been suggested for BP modelling,

most of which are based on textual programmable

languages or graphical notations, such as dataflow

diagrams, state transition diagrams, Petri-Nets and

related notations. Combination of different BP

1. INTRODUCTION

Integrating and managing complex organisations and

their information systems requires understanding,

partitioning and simplification of their complexity.

Business modelling supports these requirements by

providing means for describing process-oriented

systems and decomposing them into manageable

parts. Business processes (BPs) are collections of

activities with a common objective, such as fulfilling

a business contract or satisfying a customer need.

Business process definition (i.e. a description of a

BP at a high conceptual level necessary for process

understanding, evaluation and redesign) requires a

well-defined model, that provides a set of concepts

appropriate to describe BPs [Zelm et al, 1995]. The

model should be rich enough and enable process

validation (e.g. by simulation or static analysis) to

decide whether the process definition accurately

represents the system under study. BP modelling is a

significant tool for re-engineering organisational

I. J. of SIMULATION Vol. 2 No. 2

65

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

modelling methods has also been examined to give

new, enhanced approaches [Abeysinghe and Phalp,

1996].

companies, with relatively loose terms was one of its

most profiTable activities. The bank decided to offer

other loan types as well and, after three years, it

became clear that, as business grew, profits deviated

significantly from the expected ones.

Four types of business processes are usually studied

in the literature [Alonso and Mohan, 1997]. These

are: production, administrative, ad-hoc and

collaborative. Administrative and production BPs

refer to bureaucratic procedures that include welldefined steps and are controlled by a set of wellknown rules. Such processes can be easily described

by conventional modelling tools and are usually

automated using a WMS [Hollingsworth, 1995]. Adhoc processes are similar to administrative

processes, except for the fact that they deal with

unique or loosely defined conditions, which are not

easily modelled, and can not be efficiently supported

by current WMSs. Collaborative processes are

characterised by the number of participants involved

and the synchronisation needed, and are handled

more effectively using groupware technology.

LMD is responsible for the approval and monitoring

of loans. The main objectives of the department

include approving loans, collecting delinquent loan

instalments and initiating legal claims against noncredible customers. LMD is in constant

collaboration with the Credit Office, all local

branches of the Bank as well as external business

partners (e.g. legal firms). Department employees

handle three main loan types: corporate, housing and

consuming. Monitoring and approval of each loan

type is performed according to a different policy and

data maintained for each category differ.

LMD is divided into two sections: The first for

handling consuming and housing loans and the

second for handling corporate loans. Each section

has its own Manager and consists of groups, formed

by no more than ten employees including Group

Leaders. All employees, including Managers, handle

loan cases, while under specific circumstances a

consuming or housing loan case may be also

assigned to an employee working in the corporate

loan section.

In this paper, we present our experience on business

process modelling and automation of the Loan

Monitoring Department (LMD) of a medium sized,

private Bank. Loan Monitoring includes business

processes concerning loan approval, loan collection

and loan case assignment, which are considered as

collaborative and dynamic. Business process

modelling was conducted using the Modified PetriNet (MPN) model [Tsalgatidou et al, 1996], which is

an extension of Coloured Petri-Nets and allows the

description of dynamic activities. To automate

business processes modelled with MPN, we decided

to extend the capabilities of Lotus Domino/Notes

groupware product [Lotus Co, 2000]. The MPN

modelling environment and the WFS developed for

LMD, named Loan Management System (LMS), use

the same repositories maintained within Lotus

Domino platform, enabling the direct mapping of all

entities defined during BP modelling within the

WFS.

Although the account management system produced

detailed daily reports for loan monitoring, there was

no information system support for LMD. Due to the

enormous amount of data, classification and

processing was far from efficient, resulting in poor

coordination and low productivity. Furthermore,

data of dynamic nature concerning the history of a

delinquent loan case, e.g. delayed payments and

payment enforcement actions, was not maintained.

Both the re-engineering and WMS support of the

LMD were thus approved.

The first step towards automating LMD operation

was the identification and complete specification of

the business processes supported. After carefully

reviewing the organisational scheme and

interviewing employees, we concluded that three

main business processes are supported:

The rest of the paper is organised as follows: Section

2 provides an overview of loan monitoring processes

and their specific characteristics. Section 3 describes

the MPN modelling approach and its integration

with the workflow support environment. Section 4

provides an analytical description of the MPN model

for the delinquent loan collection process. In section

5, we discuss process automation using Lotus

Domino platform. Our experiences concerning the

system deployment over the last two years and its

impact on LMD operation are presented in Section

6. Conclusions reside in Section 7.

Loan approval process is initiated by the Credit

Office at local branches, which serve as the entry

point for any loan approval request. The approval or

rejection of the request must be announced within a

period of 24 hours for consuming loans and 3 to 7

days for housing and corporate loans. Without

2. BUSINESS PROCESS DESCRIPTION

Bank of Athens is a medium sized, private bank. The

assignment of corporate loans to healthy, small

I. J. of SIMULATION Vol. 2 No. 2

Loan Approval

Delinquent Loan Collection

Loan Case Assignment (for both approval and

collection)

66

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

information system support, the approval of

consuming loans was performed by the LMD

employee at the specific branch, based on locally

available data. The requests for housing and

corporate loans and the relevant certificates were

photocopied and forwarded to LMD. While LMD is

responsible for loan approval, contract establishment

and customer account updates are performed by the

Credit Office.

1992], provide the means to understand the

behaviour of static systems [Starke, 1994].

Production and administrative activities usually fall

in this category. BP modelling is also used to tackle

the problem of changing or evolving systems [Phalp,

1998]. Ad-hoc processes can be viewed as an

evolving system. The business model used to depict

such systems should be flexible enough to facilitate

the accurate description of business activities. BP

modelling approaches based on extending Petri-Net

functionality [Murata, 1989] can provide better

solutions for this kind of problem [Oberweis, 1996],

[Tsalgatidou et al, 1996], since they focus on

depicting the relationship between activities and

resources rather than the relationship between

activities. BP models based on Petri-Nets can be

simulated using discrete event simulation [Rajala

and Savolainen, 1996].

Delinquent loan collection is the most important

activity of LMD, initiated whenever the payment of

a loan instalment is delayed. In practice, this was not

feasible due to the large number of delinquent loans,

especially consuming ones. LMD had no mechanism

to detect delinquent loans and assign them to a

collector in a daily basis. In addition, loan

assignment could not be performed dynamically

according to evolving criteria, concerning either loan

groups or a specific loan case. Moreover, section

and group managers were not in position to modify

the criteria for delinquent loan case assignment to

the collectors supervised by them.

Advantages of simulation-based validation of

business processes have been well recognised in

[Nidumolu et al, 1998] and [Hlupic and Robinson,

1998]. Some of them are: modelling of cyclic and

stochastic behaviour and complex rule-based

interactions between activities and resources,

visualisation of process steps, development of

accurate models through comparing them with

mathematical data and enhanced confidence in

predictions regarding performance impacts of

changes to the process [Gladwin, 1994]. Although

the benefits of simulation are not yet widely

exploited by the business engineering community,

there is a great potential offered, as indicated in

[Hlupic and Robinson, 1998], especially when

dealing with dynamic BPs.

The requirement to assign the loan to a collector that

had already handled it in the past was also not

satisfied, as delinquent loan case history was only

kept in paper files. If the collector was an external

partner, all files had to be copied and sent via mail.

This was one of the reasons external partners

handled only a small portion of permanently

delinquent loans.

In spite of the three loan categories, we concluded

that loan handling was performed according to a set

of common rules, which are then customised on the

basis of predefined parameters, such as loan

category, amount owed, etc. However, the employee

approving or monitoring the delinquent loan case

makes decisions according to subjective criteria.

Lack of knowledge of the loan case history and

customer information affected the collectors

judgement.

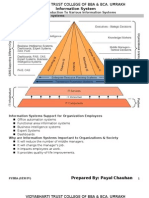

As described in the previous section, loan

monitoring processes are both ad-hoc and

collaborative, thus of dynamic nature. Figure 1

depicts the steps accomplished for implementing a

workflow system to support LMD operation. After

gathering and evaluating information concerning the

department operation and policies, a BP model was

constructed, evaluated and then mapped into the

workflow environment.

Loan monitoring activities described above can be

characterised as collaborative processes, since many

participants are involved in the completion of a

single step. The delinquent loan collection procedure

is an ad-hoc BP, since the steps to be accomplished

are not well established and exceptions may occur.

Furthermore, each loan case may be reassigned to

another collector at any time and collection policies

may be changed while handling a case. Thus,

collection activities evolve in a dynamic way [Casati

et al, 1998].

The BP model

requirements:

fulfil

the

following

Enable the accurate description of ad-hoc

processes

Facilitate the evaluation of BPs through

simulation

Support the direct mapping of entities into the

workflow

environment

to

minimise

implementation cost.

3. BUSINESS PROCESS MODELLING

The modelling formalism adopted is the Multi-level

Modified Petri-Net (MPN) [Tsalgatidou et al, 1996],

which is an extension of Coloured Petri-Nets

Numerous modelling methodologies, such as IDEF0

[Marca and McGowan, 1993] and RADs [Ould,

I. J. of SIMULATION Vol. 2 No. 2

must

67

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

[Jensen, 1992]. The formal and execuTable nature of

MPN models enables the employment of simulation

techniques for validation purposes.

tasks, respectively, while places represent resources

[Jensen, 1992]. An overview of other modelling

approaches based on Petri-Nets and their

comparison with MPN is included in [Tsalgatidou,

1996].

Objective Definition

Automate LMD operation

MPN is used for modelling BPs at various levels of

abstraction. Transition decomposition depicts the

decomposition of a BP to its activities, sub-activities

and tasks and demonstrates the control and data

flows between the different organisational units

involved in the BP.

MPN also facilitates the description of an

organisational model. Places in the Petri-Net can be

inscribed with organisational entities, such as actors

and roles, making the integration among

organisation models and process models smooth and

tightly coupled. Since places can also be inscribed

with resource and control objects, a desirable

integration between control flow, data flow and the

organisation model is attained. All entities inscribed

in Petri-Net places are stored as objects within the

MPN Repository.

Information Gathering

Review official policy

documentation

Interview Personnel

BP Model Definition

Formally define ad-hoc

activities

MPN facilitates the representation of ad-hoc BPs, as

each activity is not connected with others, i.e. it does

not follow nor is followed by another activity, as in

IDEF0, and there is no activity ordering. Activities

can be initiated whenever all input places are

occupied by the appropriate token, i.e. whenever the

necessary resources and participants are available.

Upon completion, each activity provides tokens to

its output places, i.e. releases the resources needed

for the activation of another activity. Thus, both

static and dynamic processes are described

uniformly. It also provides a clear, visual

representation of the activity steps executed with the

collaboration of many actors, facilitating the

description of cooperative processes.

BP Model Evaluation

Using Simulation Techniques

Workflow Implementation

Mapping all entities in the

implementation environment

Although MPN model can be simulated using

discrete event simulation, this feature was not

implemented within this project due to time

constrains. The main objective of the project was to

have an operational version of the system as soon as

possible, before the full scale re-engineering of

LMD operation. A discrete event simulator for the

evaluation of BPs described according to the MPN

model is currently under development.

System Testing

In the case of LMD, FlowMark WMS [IBM, 1999]

and Lotus Domino/Notes groupware product [Lotus

Co., 2000] were examined for BP automation, as the

Bank already had a contract with IBM for

information system support. FlowMark is a high-end

product supporting modelling of well-defined

business

processes,

usually

representing

administrative

procedures

characterised

by

transactional features [Reinwald and Mohan, 1996].

Figure 1: BP Modelling and Automation Steps

A Petri-Net consists of places and transitions

between them. Arcs are used to denote relations

between places and transitions. A transition is

performed whenever all its input places are filled

with tokens. When a transition is completed, output

places are filled with tokens. Transitions depict

processes and their components as activities and

I. J. of SIMULATION Vol. 2 No. 2

68

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

useful in the case of simple tasks that are not further

decomposed.

FlowMark is not flexible enough to efficiently

describe

collaborative

or

ad-hoc

process

functionality. Lotus Domino/Notes platform

provides the basic infrastructure to coordinate,

manage and monitor activities and share data in a

distributed environment. It also facilitates constraint

definition, provides a secure communication

mechanism and expands easily. While less

demanding than FlowMark, it provides an integrated

object-based database management mechanism and

simple programming tools.

Control information, resources and performers

required for the execution of activities are modelled

as objects inscribing the MPN places. Control

objects are either signals (representing messages

among activities) or events (representing

occurrences of incidents) and enable the

representation of control flows within the process.

Resource objects are data objects used by the

process, such as invoices, and enable the

representation of data flows and data modification

within the process limits. Resource objects are

maintained in MPN Repository. Each resource is

identified by properties and can be either simple or

complex. The organisational structure supported is

also maintained in the Repository in the hierarchical

form presented in Figure 2.

To support the direct mapping of BP modelling

entities within the workflow implementation

environment, we decided to integrate MPN within

Notes/Domino platform. The repository needed to

support the MPN model is implemented as a Notes

database and it is used during both BP modelling

and workflow operation. Workflow definition is

performed using the MPN model, as MPN

constructs are directly mapped into Notes workflow

entities. In this way, workflow implementation cost

is minimised, since the developer only adds code

segments in the preconstructed Notes structures.

consists_of

(1:m)

Organisation Entity

Employee

works_as

(m:1)

Actor

consists_of

3.1. Modified Petri-Net Model

has

(n:m)

A BP model should encapsulate information related

to: (a) activities, (b) resources assigned to activities,

i.e. objects necessary for the execution of activities,

such as actors, documents, data, etc, (c) control of a

BP which describes 'when' and 'which' activity is

executed, (d) the flow of data in the process and (e)

the organisational structure which consists of

organisational units, people, roles, competence, etc

[Tsalgatidou & Junginger, 1995]. These entities

must be therefore mapped within MPN. The formal

definition of MPN model is given in [Tsalgatidou et

al, 1996]. In this paper, we discuss MPN structure

and the functionality of its components.

(1:m)

Role

consists_of

(1:m)

Figure 2: Organisation Structure Model

Actors represent a position profile, e.g. manager or

programmer, assigned to a specific employee within

the organisation. More than one employee may be

associated with one Actor. Roles group sets of duties

and responsibilities assigned to a specific actor.

Roles can be described in terms of other roles.

Roles, Actors or Employees are required at the input

places of a given transition, where the presence of

specific operators (performers) is essential for its

enactment.

The MPN modelling approach is based on the

following principles:

The overall MPN model represents a specific BP and

consists of different SubMPNs depicting the

decomposition of the BP into a more detailed level.

MPN constructs are presented in Figure 3. Red

places indicate performers, blue ones indicate

resources and green ones indicate control. Control

places represent control flow. A control place has

more than one outputs, while the decision

concerning which output will be activated may

depend on deterministic or random rules (e.g.

employee decision). Control places are particularly

useful when describing semi-constructed or ad-hoc

BPs. Places filled with colour indicate the existence

Activities, that may either be simple tasks or further

decomposed, are modelled as transitions. If the

activity is further decomposed, a lower level MPN is

used for its description. A script is related with each

activity and represents the set of steps to be carried

out during its execution. Scripts can be described

using a high level language and are particularly

I. J. of SIMULATION Vol. 2 No. 2

belongs_to

(n:m)

works_in

(m:1)

The MPN model and the repository architecture are

presented in the following paragraphs. Workflow

implementation concepts are described in section 5.

69

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

of tokens. Grey rectangles indicate activities further

decomposed by a SubMPN model. In this case,

performers and input/output resources can be

redefined, but not altered in a more detailed level of

description.

ACTIVITY

RESOURCE

PERFORMER

MPN Entity

Notes Representation

Employee

Notes User and Employee form

Actor

Actor form

Role

Role form

Organisational entity

Organisational entity form

Resource

Resource form

BP definition

(new MPN model)

BP form

Activity definition

Activity form

Task definition

Supported Tasks form

Table 1: Mapping of MPN entities within Notes

Platform

RESOURCE

The definition of the organisational structure is

performed through the Organisation Entity form,

where the user defines the name of organisational

entities, their level and the supervising entity. Actors

are represented through the corresponding form.

Constraints, such as the number of employees acting

as an Actor, can also be defined. For example, each

department can only have one manager. Roles are

represented by the Role form. All the roles an actor

may obtain appear in the corresponding field within

the Actor form. The template provided to support

this overall functionality is presented in Figure 4.

ACTIVITY

RESOURCE

RESOURCE

CONTROL

ACTIVITY

ACTIVITY

RESOURCE

RESOURCE

Figure 3: MPN Model Representation

3.2. Integrating MPN within Notes Platform

According to Domino/Notes architecture, all entities

defined within Notes platform are stored as Notes

Objects. Different kinds of object classes can be

defined using Notes Forms. Notes Templates are

used to implement a basic functionality. Based on

these templates, it is possible to construct Notes

Databases supporting the characteristics of specific

applications. Both templates and databases are

constructed using Notes programming tools.

Figure 4: Control Template View

Resources are also defined using the Resource form

and are maintained in the Resource Notes Database.

The corresponding form and view are automatically

created for each resource defined. Forms are left

black so that the developer can customise them

during workflow development.

In order to construct MPN models, a graphical

interface was developed using Java. The GUI

module, named MPN editor, communicates with

Repository database stored within Domino Server.

The same database is used to maintain activity

description and the activity decomposition scheme.

The Repository Database is based upon Control

Template (CT) that is used for the definition of main

MPN entities. The authors suggest the following

mapping of MPN entities within Lotus Notes, as

depicted in Table 1.

I. J. of SIMULATION Vol. 2 No. 2

Finally, the definition of BPs, BP activities and tasks

(simple activities) is respectively supported using

BP, Activity and Supported Tasks forms. Only the

Supported Tasks form is used during workflow

implementation. As an example of the structures

created within CT, the formal description of the

object class corresponding to Activity form is

presented in Table 2. Activity_Script is the code

executed upon activation.

70

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

Class Activity

{

Name:

Parent_Activity:

SubActivities:

Activity_Script:

Guards:

Input:

Output:

Performer:

}

modification of the loan status. Reminder data for

the loan case are also maintained. There is a

predefined set of actions initiated by collectors,

some of which are:

String;

String;

Activity[];

Script[];

Script[];

String[];

String[];

String[];

Client contact without success

Client contact with success/ no payment scheduled

Client contact with success/ payment scheduled

Sending a letter to the client

Table 2: Class Definition within Notes

Defining an auction

Guards contain the conditions for triggering the

activity and are realised as an array of script

sentences that calculates to a Boolean value.

Input/Output contain input and output places,

respectively.

Defining a new payment settlement

The loan case is handled by LMD until delinquent

loan instalments are paid. The generic MPN model

depicting delinquent loan collection is depicted in

Figure 6.

The overall architecture supporting BP modelling

and automation is depicted in Figure 5.

Loan_Balance

C

Guards

A=C

Loan Case

Removal

Guards

Assigned_Loan

A.Responsible = B

A.Reminding_Date = @Today

A

Collection

Action

Collector

B

Domino

Server

MPN Editor

Workflow

Workflow

DB

Repository

Workflow

DB

Workflow

DB

DB

BP Model

Definition

Delinquent_Loan

D

Figure 6: Delinquent Loan Collection Model

(level 0)

Loan collection process consists of two main

activities: Collection Action and Loan Case

Removal. The first one is further analysed by another

MNP, while the second one is a simple task. Loan

Case Removal has no performer place as input and it

is performed automatically. For Collection Action

activity, which has such an input, the symbol R

within the place indicates that a role has been

defined as the performer, more specifically the

Collector Role. Guards specify transition

constraints. The Collection Action activity may be

initiated when the collector responsible for the

specific loan case is available (A.Responsible=B)

and a reminder is set in his/her daily diary

(A.Reminding_Date=@Today). To simplify guard

definition, places are numbered using capital letters

or numbers.

Notes Client

Workflow

Execution

Figure 5: BP Modelling and Automation

Environment

4.

LOAN MONITORING PROCESS

MODELLING

We discuss the Delinquent Loan Collection process,

since it combines both ad-hoc and collaborative

properties. Delinquent loan collection may be

performed by any LMD employee. As Actors, we

have defined all LMD employee positions:

Department Manager, Section Manager, Group

Leader and Collector. Collector role describes the

task of collecting delinquent loans. Other roles are

Administrator, Case Assignor, Supervisor etc.

Collector is a simple role obtained by all employees,

while Case Assignor or Supervisor roles are only

obtained by specific managers.

At the more detailed level, collection actions are

distinguished into three categories: simple actions

completed by the collector, actions requiring the

approval of his/her supervisor and actions for which

sending a letter is necessary. Determining the proper

action is based partially on LMD policy and partially

on the collectors strategy and experience. The

sequence of actions is thus not predetermined and

this is depicted in the MPN model using a control

place, as indicated in Figure 7.

New delinquent loan cases and loan payments are

downloaded from the account management system

on a daily basis. When a loan case is assigned to a

specific collector, it appears in his/her daily diary.

Performing loan collection actions results in the

I. J. of SIMULATION Vol. 2 No. 2

71

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

5. BUSINESS PROCESS AUTOMATION

G uards

C_Responsible =D

C.Reminding_Date =@T oday

Assigned_Loan

A

Collector

B

Action

Selection

Workflow execution (e.g. BP automation) is

performed using Lotus Domino/Notes platform.

Loan Monitoring System (LMS) supports the

operation of LMD by enabling the description,

enactment

and

monitoring

of

workflows

corresponding to the supported BPs. LMS provides

flexibility during business process description,

allowing the modification of a workflow while it is

running, and is adapted according to the scenarios

defined by authorised actors. It also provides tools

for monitoring workflow evolution and actor

productivity. Although the system is oriented

towards bank specifications, it is not proprietary and

can be customised to support any organisation with

similar structure and requirements.

B .S elect

C

Simple

Action

Complex

Action

D:=

D.History := A.History + B.Write

D.Reminding_Date:= B.Write

Prepare

Letter

F:=

F:=

F.History := A.History + B.Write F.History := A.History + " Letter w ill be sent"

F.Reminding_Date:= B.Write

F.Reminding_Date:= B.Write

E.Creation_Date := @T oday

E.Editor :=

Assigned_L oan

D

Assigned_Loan

F

G uards

F.Responsible.Manager =G

Action

Approval

Letter

E

G uards

F.Responsible.Manager =G

Workflow description is based upon MPN BP

models. Repository database, build upon Control

Template (CT) is used to obtain entity definition,

while workflow databases corresponding to different

BPs are constructed using the Workflow Template

(WT). Mapping MPN main entities within CT is

crucial to ensure the complete description of

activities. The developer only fills the code

segments needed to describe activity functionality,

as similar structures are provided and the conditional

invocation of activities is pre-endured. If direct

mapping were not feasible, process description

would have to be also performed at the

implementation level, without ensuring that

consistency is maintained throughout the modelling

process.

Letter

Approval

Supervisor

G

H:=

H.Status := " A pproved"

G uards

F =H.L oan

F.Responsible=H

Letter

H

Send

Letter

Collector

B

R

D:=F

D.History := D.History +" L etter Sent"

D.Reminding_Date := B.Write

Figure 7: Collection Action Model (level 1)

The in-depth description of the Collection Action

activity is beyond the purpose of this paper.

However, one should note some points of interest.

Input and output places of the MPN must be the

same as the input and output places of Collection

Action activity presented in Figure 6. Although other

resources, such as Letter, are produced during this

activity, they are not indicated as output. In the MPN

model presented in Figure 7, the Supervisor role is

also depicted as a performer. This is allowed, as the

Supervisor role also includes Collector role. As

indicated in Action Approval activity, guards are not

static and enable the representation of BPs with

dynamic evolution. Although it is not mandatory,

scripts can be defined to describe activity

functionality (scripts are depicted under activities).

Scripts are useful especially when describing tasks,

as they are automatically transformed into code

within the workflow environment. An example

concerning the Send Letter task is presented in the

next section.

Regarding WMS architecture, the CT is used for the

maintenance of the organisational structure and

resource description [Bussler, 1999], while WT is

used for the construction, execution and

management of the actual workflows. It is controlled

by parameters defined in CT. Each workflow

corresponding to a BP is characterised by its state

[Kappel et al, 1995]. Depending on the state status,

specific tasks, modelled as supported Notes Actions,

can be initiated.

Using the BP form in CT, a new workflow and a set

of valid states are defined. The actions

corresponding to simple activities, the initial state of

the workflow for the activation of each action and

the resulting state are recorded in the Supported

Tasks form. Actions can be performed automatically

(system participant) or manually (human

participant). Action types are also defined in the

Supported Task form. Authorised actors are allowed

to add new states and modify the relationship

between states and actions, resulting in modifying

the workflow evolution.

Using the MPN model presented in Figure 7, one

can simulate the execution of the business processes

and reach conclusions concerning the behaviour

exhibited by specific collectors, as well as the

effectiveness of various strategies and the indication

of potential inefficiencies and bottlenecks.

I. J. of SIMULATION Vol. 2 No. 2

72

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

5.1. Workflow Template

The Workflow Template includes a basic workflow

form, called Main Workflow form, depicting the

progress of a business process. This form includes

State field to depict workflow state, which is

handled by the system. For each task, the Workflow

template automatically creates the proper Notes

Agents in the database. The developer must add the

necessary code for the agents using the

programming tools provided by Notes. These

include a simple proprietary language, which is an

object-oriented extension of Basic and Java, called

LotusScript. Agents correspond to manual or

automated activities. In the first case, the

corresponding button for agent activation is

automatically added in Main Workflow form. The

button is visible only when the Workflow State

permits the activation of the corresponding action. In

the second case, the agent is properly scheduled for

execution by Lotus Notes Client or Domino Server.

The developer has to extend the functionality of the

Main Workflow form to support specific application

needs. Workflow Template also includes a basic

Notes view, called Main View, providing access to

all active workflow instances created using Main

Workflow form. Table 3 summarises the mapping of

MPN entities within WT.

Guards:

Activity_Script:

Main Workflow form

Task script

Agents

Actor's Work List

Main view

Collection Action Workflow form is depicted in

Figure 8. Buttons enable accessing resource

information, such as customer personal data, loan

history and the instalment payment timeTable. All

previous actions concerning this particular case are

also accessible. Through the Select Keyword Menu,

the Collector selects an action and initiates the

corresponding activity.

Figure 8: Collection Action Workflow Form

Task Description

Output:

Notes Representation

BP implementation

Table 3: Mapping of MPN Entities within WT

The script corresponding to Send Letter task and the

corresponding agent automatically extracted from

the script description are presented in Table 4. The

agent code is not fully execuTable, as the developer

is responsible for adding the desired functionality.

Name:

Parent_Activity:

SubActivities:

Input:

MPN Entity

Agent Code

Send Letter

Collection Action

NULL

[F Assigned Loan as Loan

Resource; H Letter as Letter

Resource; B Collector as

Performer]

[D Assigned Loan as Loan

Resource]

[F =H.Loan; F.Responsible=B]

[D:=F; D.History := D.History

+"Letter Sent";

D.Reminding_Date := B.Write]

CreateAgent SendLetter

{IN AssignedLoan:Loan; IN Letter:Letter;

OUT AssignedLoan:Loan}

Begin

AssignedLoan.History:=AssignedLoan.History+

"Letter Sent";

Write(AssignedLoan.Reminding_Date);

End;

Table 4: Agent Automated Creation

I. J. of SIMULATION Vol. 2 No. 2

73

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

In the second version of the system, client

replication was introduced for branch users,

especially the ones having a slow connection. The

Control Database was fully replicated to eliminate

the communication cost for look-ups. Replication of

workflow databases was partial, according to the

privileges of each user. The Central System was also

upgraded to include a second server handling control

databases in order to balance load and improve

performance. Static data concerning supplementary

information, e.g. guarantor data, were moved to an

external relational database system (DB2) and were

retrieved upon user request. This decision minimised

data download time and improved on-line

performance, as the cost of Notes database search

proved to be more expensive for this type of data

than the corresponding cost of an external relational

database based on indexed fields through ODBC.

6. EXPERIENCE AND POTENTIAL OFFERED

LMS was operational after a development period of

seven months and two months of testing. It enabled

the formal description and management of all

business processes performed within LMD.

Gathering and evaluating information concerning the

department operation and policies in a systematic

way was one of the major contributions. Business

process analysis proved to be time consuming due to

the complexity encountered in gathering collector

experience. The description of all business processes

within MPN and the direct mapping between BP

models and workflow implementation contributed

significantly to the effectiveness of the overall

approach.

Users within LMD have access to the system using a

switched 10 Mbps Ethernet network. Branch users

are connected to the system via private WAN

connections with a rate between 64Kbps and 1Mbps.

An overview of LMS is presented in Figure 9.

Local User

Local User

Switched Ethernet

Network

Branch User

The system was well accepted by users, both

collectors and executives. As collectors no more

waste time on searching paper files, they are able to

monitor more cases and concentrate on improving

collection policies, which results in a considerable

productivity increase. Collectors working at

branches can actively participate in the department

operation, as they now have access to the relevant

data and may consult their colleagues at LMD.

Business success ratio increased by almost 25% over

the last two years. One of the main contributions of

the system was the active monitoring of all loan

cases. Based on the delay period, the system either

handles the case itself or asserts a new task to the

corresponding collectors daily work list.

Branch User

Private

WAN

Network

Branch User

Local User

Central Information System

Workflow

Databases

Control

Database

Management obtains productivity measurements in

real time, while executives are able to monitor the

results of slightly changing collection policies, e.g.

allowing collectors to establish settlements without

further approval, and consequently tune the overall

process. This resulted in the progressive reengineering of LMD. The productivity of this unit

increased by 40% in the last quarter of the first year

and by another 19% within the second year.

Application Related

Databases

Notes Platform

Loan Management System

Figure 9: LMS Architecture

LMS was first introduced for managing consuming

loans. This was due to the simplicity of consuming

loan delinquent cases compared to the corresponding

cases of corporate loans. After the successful

employment of the system for a test period of 3

months, LMS functionality expanded to handle all

loan types. The system is currently used to monitor

an average of 10,000 delinquent loan cases. An

average of 600 new cases is added on a daily basis

and an average of 1,400 transactions per day is

executed by all users. LMS supports 15 users in

LMD and 64 remote users at branches. An average

of 60% of delinquent loan cases concerns one to

three delinquent instalments. Less than 30% are

permanently treated by the system either due to a

special settlement with the customer or the initiation

of legal claims against the customer. Most such

cases concern corporate loans.

I. J. of SIMULATION Vol. 2 No. 2

6.1. Virtual Enterprise Support

After a year of full operation, the Bank decided to

examine the possibility to assign the collection of

permanent delinquent loans to brokers, in order to

reduce operational cost. Brokers collect the

delinquent instalments on behalf of the Bank and

initiate legal claims in cooperation with legal firms.

Seven legal firms and ten brokers are currently

connected to LMS. Although the Bank is responsible

for controlling business processes, external business

partners are responsible for their partial execution,

as indicated in Figure 10. In this context, business

processes are performed within the limits of a virtual

74

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

enterprise consisting of all cooperating organisations

[Alonso, 1999].

7. CONCLUSIONS

Recent research studies for collection activities in

the banking sector indicated the lack of efficient

information system support. This is due to the

complexity and the dynamic nature of business

processes. Business process automation provides

significant results only if all activities, independent

of their nature, are fully described in a formal way.

MPN BP modelling method allowed the complete

description of dynamic business activities. Direct

mapping of MPN main entities within Notes

environment ensures the transition of all business

activities within the workflow environment and

provides the means for constantly monitoring their

efficiency.

Although the Bank maintains its own private

network, external business partners are connected to

LMS via the Internet, which is a relatively

inexpensive solution. The expansion of workflow

management over the Internet introduced the

following additional requirements, which were

appropriately handled:

Data Security: The Bank handles private data that

must be transferred securely. In addition, each

partner must have access only to the data needed

to accomplish a specific task.

Performance: System performance must be

efficient for all users, although operating in a

distributed environment.

LMS is an integrated environment supporting the

management and execution of dynamically evolving

business processes. LMS contributed to the effective

re-organisation of the Loan Monitoring Department

and facilitated constant monitoring and refinement

of business processes and the on-line evaluation of

new collection policies.

Every partner (legal firm or broker) signing a

contract with the Bank is obliged to install a Lotus

Domino Server communicating with the LMS

Server over the Internet. In this External LMS

Server, replicas are kept for all LMS databases. For

security reasons, administrators of LMS are also

responsible for these databases. External Servers are

synchronised with LMS Server on a daily basis,

using the replication mechanism provided by Notes

platform at the field level. The replication protocol

uses encryption at both the network and the

application level to ensure security during data

transfer.

REFERENCES

Abeysinghe G. and Phalp K. 1997, Combining

Process Modelling Methods. In Information and

Software Technology, Elsevier Science, Holland,

Vol 39, pp 107-124.

Alonso G. and Mohan C. 1997, Workflow

management systems: The next generation of

distributed processing tools. In Advanced

Transaction Models and Architectures, chapter 1,

Kluwer Academic Publishers, UK, pp. 35-62.

Modifications of the existing application were

minimal: Brokers were incorporated as Collectors in

the Organisational Structure of the LMD, but no

special privileges were assigned to them and no

modification of the collection policy was required.

Only Loan Case Assignment criteria were modified

to include the new collectors.

Alonso G., Fiedler U., Hagen C., Lazcano A.,

Schuldt H. and Weiler N. 1999, Wise: Business to

Business E-Commerce. In Proc. RIDE-VE99 9th

International Workshop on Research Issues on Data

Engineering (Sydney, Australia, March), IEEE, CA,

USA, pp 132-139.

Delinquent Loan Collection Process

Phone Call

View Data

Choose Action

Bussler C. J. 1999, Enterprise-Wide Workflow

Management. In IEEE Concurrency, Vol 7, No 3,

IEEE, CA, USA, pp 32-43.

Set Reminder Date

Send Letter

Initiate Legal Claims

Casati F., Ceri S., Pernici B. and Pozzi G. 1998,

Workflow Evolution. In Data & Knowledge

Engineering, Elsevier Science, Holland, Vol 24, pp

211-238.

Broker

Bank of Athens

Local Branch

File Loan Approval

Request

Loan Approval

Process

Loan Monitoring

Department

Permanant Delinquent

Loan Collection

Internet

Permanant

Delinquent Loan

Collection

Temporary Delinquent

Loan Collection

Cho Y., Kim J. and Kim S. 1998, Role-Based to

Business Process Simulation Modelling and

Analysis. In Computer and Industrial Engineering,

Pergamon Press, UK, Vol 35, pp 343-346.

Legal Firm

Legal Claim

Initiation

Figure 10: Loan Monitoring over the Internet

I. J. of SIMULATION Vol. 2 No. 2

75

ISSN 1473-804x online, 1473-8031 print

M. NIKOLAIDOU et al: BANKING SECTOR CASE STUDY

Gladwin B. and Tumay K. 1994, Modelling

Business Processes with Simulation Tools. In Proc.

WSC94 Winter Simulation Conf.(Lake Buena Vista,

FL, December), SCS, San Diego, CA, USA, pp 114121.

Oberweis A. 1996, An Integrated Approach for the

Specification of Processes and Related Complex

Structured Objects in Business Applications. In

Decision Support Systems, Elsevier Science,

Holland, Vol 17, pp 31-53.

Hlupic V. and Robinson S. 1998, Business Process

Modelling and Analysis Using Discrete Event

Simulation. In Proc. WSC98 Winter Simulation

Conf. (Washington DC, USA, December) SCS, San

Diego, CA, USA, pp 1363-1369.

Ould A. M. 1995, Business Processes Modelling

and Analysis for Re-engineering and Improvement,

John Wiley, UK.

Phalp K. 1998, The CAP Framework for Business

Process Modelling. In Information and Software

Technology, Elsevier Science, Holland, Vol 40, pp

731-744.

Hollingsworth D. 1995, Workflow Management

Coalition The Workflow Reference Model, DN

TC00-1003, WfMC Publications, UK.

Rajala M. and T. Savolainen 1996, A framework

for customer oriented business process modelling.

In Computer Integrated Manufacturing Systems,

Elsevier Science, Holland, Vol. 9, pp 127-135.

IBM Co. 1999, Functional Assessment of IBM

MQSeries FlowMark 3.1, White Paper

Jensen K. 1992, Coloured Petri Nets - Basic

Concepts, Analysis Methods and Practical Use,

Volume 1, Basic Concepts - Monographs in

Theoretical Computer Science, Springer-Verlag.

Reinwald B. and Mohan C. 1996, Structured

Workflow Management with Lotus Notes Release

4. In Proc. 41th IEEE CompCon (Santa Clara

CA, USA, April), IEEE, CA, USA, pp 451-457.

Kappel G., Lang P., Rauch-Scott S. and

Retschitzegger W. 1995, Workflow management

based on objects, rules and roles. In Data

Engineering Bulletin, IEEE, CA, USA, Vol 18 , No

1 , pp 11-18.

Starke, G. 1994, Business Models and their

Description. In Proc. CON94 Workflow

Management - Challenges, Paradigms and Products

(Wien, Austria, March), Springer Verlag, Germany,

pp. 134-147.

Lotus Co. 2000, Lotus Domino Architecture,

Technical Paper

Marca D. A. and McGowan C. L. 1993,

IDEF0/SADT Business Process and Enterprise

Modelling, Eclectic Solutions Corporation

Tsalgatidou, A. and Junginger, S. 1995, Modelling

in the Re-engineering Process. In ACM SIGOIS

Bulletin: Special Issue on Business Process

Reengineering, ACM Press, USA, Vol 16, No 1, pp

17-24.

Mohan C., Barber R, Watts S. et al 2000,

Evolution of Groupware for Business Applications:

A Database Perspective on Lotus Domino/Notes .

In Proc. VLDB2000 - 26th International Conference

on Very Large Databases (Cairo, Egypt,

September), VLDB Publications, USA, pp 684-687.

Tsalgatidou A, Louridas P., Fesakis G. and Schizas

Th. 1996, Multilevel Petri Nets for Modelling and

Simulating Organizational Dynamic Behaviour. In

Simulation & Gaming, Special Issue on Simulation

of Information Systems, Sage Publications, Vol 27,

No 4, pp 484-506.

Murata T. 1989, Petri Nets: Properties, Analysis

and Applications. In Proceedings of the IEEE,

IEEE, CA, USA, Vol 77, No 4, pp 541-580.

Zelm M., Vernadat F. and Kosanke K. 1995, The

CIMOSA Business Modelling Process. In

Computers in Industry, Elsevier Science, Holland,

Vol 27, pp 123-142.

Nidumolu S., Menon N. and Zeigler B. 1998,

Object-Oriented Business Process Modelling and

Simulation: A Discrete Event System Specification

Framework. In Simulation Practice and Theory,

Elsevier Science, Holland, Vol 6, pp 533-571.

I. J. of SIMULATION Vol. 2 No. 2

Zobel R.N. and Lee K.H. 1992, "A Graphical User

Interface Based Simulation System for Mixed

Application Areas". In Proc. SCSC 92 Summer

Computer Simulation Conf. (Reno, USA, July)

SCSI, San Diego, CA, USA. pp 62-66.

76

ISSN 1473-804x online, 1473-8031 print

You might also like

- Operations Management in BankingDocument12 pagesOperations Management in Bankinggmurali_17956883% (12)

- Comparison of Business Process Modeling Notation ToolsDocument5 pagesComparison of Business Process Modeling Notation Toolsfsosa1No ratings yet

- Thesis PDFDocument65 pagesThesis PDFApril Jane FabreNo ratings yet

- Business Process Re Engineering at Exim Bank LTDDocument17 pagesBusiness Process Re Engineering at Exim Bank LTDFred Raphael IlomoNo ratings yet

- The Impact of Computer Technology On Accounting System and Its Effect On EmploymentDocument25 pagesThe Impact of Computer Technology On Accounting System and Its Effect On EmploymentMoud Khalfani100% (1)

- Appian Interview QuestionsDocument22 pagesAppian Interview QuestionsAnonymous 2Fx1dy100% (1)

- PMO Process ModelDocument11 pagesPMO Process Modelsg.pasha6567100% (1)

- Business Processes Modelling and Automation in TheDocument13 pagesBusiness Processes Modelling and Automation in TheGudla AkanshaNo ratings yet

- αςερτυθξη PDFDocument5 pagesαςερτυθξη PDFmic_manosNo ratings yet

- Busines Process MGMTDocument86 pagesBusines Process MGMTshireesh mishraNo ratings yet

- Business Process Management of Telecommunications Companies7Document14 pagesBusiness Process Management of Telecommunications Companies7Anastasia IonasNo ratings yet

- Business Process Management 2Document11 pagesBusiness Process Management 2Puri AshutoshNo ratings yet

- Business Process Models AisDocument18 pagesBusiness Process Models AisSmohammed RasheedNo ratings yet

- BUS 4080A BPMN MODEL (TERM PAPER) North Western UniversityDocument14 pagesBUS 4080A BPMN MODEL (TERM PAPER) North Western UniversityImad AliNo ratings yet

- So Thank You NikitaDocument4 pagesSo Thank You NikitaPuri AshutoshNo ratings yet

- Business Process ManagementDocument25 pagesBusiness Process ManagementfernandoNo ratings yet

- Retail Banking Process Series - # 1 Introduction and Recurring ElementsDocument25 pagesRetail Banking Process Series - # 1 Introduction and Recurring ElementsKwanda ZuluNo ratings yet

- (Template) MIDBS - Midterm Exam 2020Document6 pages(Template) MIDBS - Midterm Exam 2020sahil suranaNo ratings yet

- Ch3.Intro To Various IsDocument18 pagesCh3.Intro To Various IsRajdeep M. MahidaNo ratings yet

- Business Process Management: Remain Unclear Because It LacksDocument7 pagesBusiness Process Management: Remain Unclear Because It LacksWill Mensah-DodooNo ratings yet

- Credit Scoring System For Small Business LoansDocument10 pagesCredit Scoring System For Small Business LoansAlexandru NechiforNo ratings yet

- Business Process Management: Remain Unclear Because It Lacks - PleaseDocument7 pagesBusiness Process Management: Remain Unclear Because It Lacks - PleaseJudyanta KristiadjiNo ratings yet

- Lecture 2Document21 pagesLecture 2Vidousha GobinNo ratings yet

- BPM Project ReportDocument12 pagesBPM Project Reportrohitshetty2011100% (1)

- Business Process ManagementDocument12 pagesBusiness Process Managementemma698No ratings yet

- Ais Synthesis Chapter 7 and 8Document4 pagesAis Synthesis Chapter 7 and 8JenniferNo ratings yet

- IBE Chapter 5Document19 pagesIBE Chapter 5veenaNo ratings yet

- BUS209 2.3.2 ProcessMappingInPracticeDocument21 pagesBUS209 2.3.2 ProcessMappingInPracticeabimanyubawonoNo ratings yet

- Obstacles and Implementation of Accounting Software System in Small Medium Enterprises (SMEs) : Case of South Asian Perspective.Document9 pagesObstacles and Implementation of Accounting Software System in Small Medium Enterprises (SMEs) : Case of South Asian Perspective.ijsab.comNo ratings yet

- BPM (E-Woks) SystemDocument3 pagesBPM (E-Woks) SystemshrimankarNo ratings yet

- Mohammad Essam Hejazi Chapter 1&2Document8 pagesMohammad Essam Hejazi Chapter 1&2desiestNo ratings yet

- Enhancing Cooperative Loan Scheme Through Automated Loan Management SystemDocument9 pagesEnhancing Cooperative Loan Scheme Through Automated Loan Management SystemRosaleo TolibasNo ratings yet

- Computerized Accounting Systems and Financial Performance Among Firms in KenyaDocument8 pagesComputerized Accounting Systems and Financial Performance Among Firms in Kenyakumpepertuazhia11No ratings yet

- Enterprise Resource Planning: MODULE 9: Business Process Management (BPM)Document4 pagesEnterprise Resource Planning: MODULE 9: Business Process Management (BPM)PradeeP VNo ratings yet

- Business ProcessesDocument2 pagesBusiness ProcessesMangkaNo ratings yet

- Business Process Management 1Document8 pagesBusiness Process Management 1Omar Ahmed ElkhalilNo ratings yet

- Anne Siddiqui Anil Kumar Babbar Aditi Khanna Deepenshu Dua Anurag GambhirDocument22 pagesAnne Siddiqui Anil Kumar Babbar Aditi Khanna Deepenshu Dua Anurag GambhirAditi Khanna100% (1)

- Bradford University School of Management PT MBA 2010/2012 Operations ManagementDocument14 pagesBradford University School of Management PT MBA 2010/2012 Operations ManagementNeilan MylvaganamNo ratings yet

- Magic Quadrant For Intellige 255421Document34 pagesMagic Quadrant For Intellige 255421Leidy PaolaNo ratings yet

- A Study of CRM Implementation in Financial IndustryDocument8 pagesA Study of CRM Implementation in Financial IndustryJarjis AhmedNo ratings yet

- 00 BPM A Practical Way To Improve Business Processes 3763Document20 pages00 BPM A Practical Way To Improve Business Processes 3763Eduardo FalicoffNo ratings yet

- Computarised System ProjectDocument30 pagesComputarised System ProjectChintamaniChoiceNo ratings yet

- Defining Business Rules - What Are They ReallyDocument6 pagesDefining Business Rules - What Are They ReallyIoana BogdanNo ratings yet

- Continuous Improvement Plan of Business Process in Construction CompanyDocument7 pagesContinuous Improvement Plan of Business Process in Construction CompanyRoland EttemaNo ratings yet

- Information Sciences: M. Lourdes Borrajo, Juan M. Corchado, Emilio S. Corchado, María A. Pellicer, Javier BajoDocument17 pagesInformation Sciences: M. Lourdes Borrajo, Juan M. Corchado, Emilio S. Corchado, María A. Pellicer, Javier Bajorakeshh421No ratings yet

- Paper3 PDFDocument13 pagesPaper3 PDFdco123No ratings yet

- Application Viplan Methodology and Method - BOWLING DP and ESPEJO 2000Document20 pagesApplication Viplan Methodology and Method - BOWLING DP and ESPEJO 2000Claudia GonzalesNo ratings yet

- Business Process ModellingDocument8 pagesBusiness Process ModellingMARTIN MAINGINo ratings yet

- Business-Driven Decision Support For Change Management: Planning and Scheduling of ChangesDocument13 pagesBusiness-Driven Decision Support For Change Management: Planning and Scheduling of ChangesKishore KumarNo ratings yet

- Data Mining For Financial Statement AnalysisDocument4 pagesData Mining For Financial Statement Analysisalokkhode100% (1)

- Unit 3-Business Process AutomationDocument13 pagesUnit 3-Business Process AutomationSoumya S PatilNo ratings yet

- Business ProcessDocument8 pagesBusiness ProcessDebabrat MishraNo ratings yet

- Introduction To E-Business Systems: Prof. Anatoly SachenkoDocument4 pagesIntroduction To E-Business Systems: Prof. Anatoly SachenkoJungie Rubinos PuadaNo ratings yet

- Operations Management - MultichoiceDocument24 pagesOperations Management - MultichoiceAkintunde AyeniNo ratings yet

- 3-Mecanica Maintenance Parte Del FMDocument5 pages3-Mecanica Maintenance Parte Del FMJosé Escalona C.No ratings yet

- Compusoft, 3 (7), 1007-1011 PDFDocument5 pagesCompusoft, 3 (7), 1007-1011 PDFIjact EditorNo ratings yet

- Erp 3rd Assignment - Susanta RoyDocument9 pagesErp 3rd Assignment - Susanta RoySusanta RoyNo ratings yet

- Supply Chain Managment Macro ProcessDocument6 pagesSupply Chain Managment Macro ProcessGajesh PatelNo ratings yet

- Business Process Management in The Finance Area ofDocument16 pagesBusiness Process Management in The Finance Area oframandkahlonNo ratings yet

- Unit 8Document7 pagesUnit 8Shaik UsmanNo ratings yet

- Business Intelligence in Banking IndustryDocument11 pagesBusiness Intelligence in Banking IndustryKrishna Bhaskar100% (1)

- Business Process Management & IT: Learning ObjectivesDocument50 pagesBusiness Process Management & IT: Learning Objectiveskumarmm1234No ratings yet

- Ready To PrintDocument81 pagesReady To PrintVinay SurendraNo ratings yet

- Cost OptiDocument70 pagesCost OptiVinay SurendraNo ratings yet

- E Share BrokingDocument84 pagesE Share BrokingVinay SurendraNo ratings yet

- Cost Analysis and Control HeroDocument8 pagesCost Analysis and Control HeroVinay SurendraNo ratings yet

- A Project Report ON Cost Analysis: Chapter - 1Document17 pagesA Project Report ON Cost Analysis: Chapter - 1Vinay SurendraNo ratings yet

- Study of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesDocument60 pagesStudy of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesVinay SurendraNo ratings yet

- Cost OptiDocument70 pagesCost OptiVinay SurendraNo ratings yet

- Study of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesDocument60 pagesStudy of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesVinay SurendraNo ratings yet

- Working Capital MangDocument70 pagesWorking Capital MangVinay SurendraNo ratings yet

- Indian Infra DevpDocument376 pagesIndian Infra DevpVinay SurendraNo ratings yet

- Financial SecuritiesDocument5 pagesFinancial SecuritiesVinay SurendraNo ratings yet

- Week 5 Blow MoldingDocument29 pagesWeek 5 Blow MoldingVinay SurendraNo ratings yet

- 4 - Process ModellingDocument34 pages4 - Process ModellingJake Blogger100% (1)

- Redbook - Master Data Management With InfosphereDocument596 pagesRedbook - Master Data Management With InfosphereAndrea FoschiniNo ratings yet

- Witold Abramowicz, Heinrich C. Mayr - Technologies For Business Information Systems-Springer (2007)Document429 pagesWitold Abramowicz, Heinrich C. Mayr - Technologies For Business Information Systems-Springer (2007)Masriani SaragihNo ratings yet

- BA TecniquesDocument55 pagesBA Tecniquesloveykhurana5980100% (2)

- VENKAT-BA ResumeDocument7 pagesVENKAT-BA ResumeShiva ShankarNo ratings yet

- What Are Functional Specification in SAP?Document3 pagesWhat Are Functional Specification in SAP?kaushikname100% (2)

- Oracle BPA 11g Quick Start Sample GuideDocument210 pagesOracle BPA 11g Quick Start Sample GuideLora VitNo ratings yet

- BPMN by Example: Bizagi SuiteDocument17 pagesBPMN by Example: Bizagi Suiteyogie baskaraNo ratings yet

- Process CapabilityDocument75 pagesProcess CapabilityNzeza CarineNo ratings yet

- Statistical Machine Learning in Natural Language Understanding: Object Constraint Language Translator For Business ProcessDocument4 pagesStatistical Machine Learning in Natural Language Understanding: Object Constraint Language Translator For Business ProcessAman AlviNo ratings yet

- Infosystem Analysis PDFDocument25 pagesInfosystem Analysis PDFgalz_phNo ratings yet

- White Bpmn2 Process Bookmark WebDocument35 pagesWhite Bpmn2 Process Bookmark WebEli_HuxNo ratings yet

- TMG Practical Guide To BPI May 2016 v2.1 PDFDocument54 pagesTMG Practical Guide To BPI May 2016 v2.1 PDFcristian De la OssaNo ratings yet

- Fah Imp GuideDocument320 pagesFah Imp GuidevadefemiNo ratings yet

- 7 An Overview Enterprise Resource Planning ERPDocument20 pages7 An Overview Enterprise Resource Planning ERPReema DawraNo ratings yet

- Chap 002Document33 pagesChap 002Yudhi KurniawanNo ratings yet

- Aris Express 395-6510Document10 pagesAris Express 395-6510waterloofNo ratings yet

- BPMJ 03 2013 0039Document27 pagesBPMJ 03 2013 0039Harry WidodoNo ratings yet

- Sybase PowerDesigner 16.5Document38 pagesSybase PowerDesigner 16.5Indra Nugraha100% (1)

- Business ModelingDocument44 pagesBusiness ModelingNaila AkbarNo ratings yet

- Jayaram BG-BADocument9 pagesJayaram BG-BAkartikb60No ratings yet

- Business Process Modelling - Introduction To ARIS MethodolgyDocument41 pagesBusiness Process Modelling - Introduction To ARIS Methodolgyapi-19646331No ratings yet

- IBM Insurance IAA Warehouse GIMv85Document23 pagesIBM Insurance IAA Warehouse GIMv85Matthew ReachNo ratings yet

- Business Driven Technology 7th Edition by Baltzan ISBN 125956732X Solution ManualDocument65 pagesBusiness Driven Technology 7th Edition by Baltzan ISBN 125956732X Solution Manualdonald100% (26)

- BPMN Modeling and Reference Guide - StephenDocument216 pagesBPMN Modeling and Reference Guide - StephenAshfaqullah Khan100% (3)

- KAIST IE461 & CS452 Syllabus (F2013)Document3 pagesKAIST IE461 & CS452 Syllabus (F2013)June Sung ParkNo ratings yet

- TechTarget IT AcronymsDocument91 pagesTechTarget IT AcronymsTaha ShahzadNo ratings yet