Professional Documents

Culture Documents

「アジア経済見通しセミナー」(2016年4月13日)配布資料

Uploaded by

ADBJROCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

「アジア経済見通しセミナー」(2016年4月13日)配布資料

Uploaded by

ADBJROCopyright:

Available Formats

13/04/2016

Shang-Jin Wei

Chief Economist, Asian Development Bank

The views expressed in this document are those of the author and do not necessarily reflect the views and

13/04/2016

policies of

the Asian Development Bank or its Board of Governors or the governments they represent.

Key messages

Growth in developing Asia softens to 5.7% in 2016 and

2017, from 5.9% last year

PRC growth moderating to 6.5% in 2016 and 6.3% in 2017

underscores the importance of supply-side reforms

India growth projected at 7.4% in 2016 and 7.8% in 2017

While CPI inflation remains subdued, many economies

face possibly harmful PPI deflation

Reforms to raise labor productivity can invigorate

developing Asias potential growth

13/04/2016

13/04/2016

Asias growth continues to

moderate

7.4

7.5

Developing Asias growth

7.0

6.3

6.5

6.4

6.3

5.9

6.0

5.7

5.7

5.5

5.0

4.5

4.2

4.0

3.4

3.5

3.3

3.4

2013

2014

3.6

3.4

3.1

3.0

2011

2012

2015

2016f

2017f

f: forecast

World GDP growth

13/04/2016

Uneven recovery in industrial

economies

GDP growth (%)

2015

2016f

2017f

Major industrial economies

1.8

1.8

1.9

United States

2.4

2.3

2.5

Euro area

1.5

1.5

1.6

Japan

0.5

0.6

0.5

f= forecast

13/04/2016

13/04/2016

Divergence across subregions and

economies

(%)

13/04/2016

Asia still accounts for 60% of global growth in PPP terms

Contributions to world growth (%), 2016 vs. 20112015

40

Contributions, 2016 (%)

30

People's Rep. of China

20

India

United States

10

ASEAN

Euro area

Indonesia

Japan

0

0

10

20

30

Average contributions, 2011-2015 (%)

40

Note: Uses PPP-adjusted weights

13/04/2016

13/04/2016

...or 40% in market exchange rate terms

Contributions to world growth (%), 2016 vs. 20112015

40

Contributions, 2016 (%)

30

People's Rep. of China

20

United States

10

Euro area

India

ASEAN

Indonesia

Japan

0

0

10

20

30

Average contributions, 2011-2015 (%)

40

Note: Uses market exchange rates

13/04/2016

PRC growth still decelerating; projected at

6.5% in 2016

Fixed asset investment growth, %, ytd

Economic growth

30

25

20

15

10

5

0

18

15

12

9

Retail sales

GDP

Value-added by

industry

2012

2013

2014

2015

Manufacturing

Real estate

Jan

2014

0

2011

Infrastructure

Jan 2016 Feb 2016

Demand-side contributions to growth

Apr

Jul

Oct

Jan

2015

Apr

Jul

Oct

Jan

2016

Supply-side contributions to growth

%

10

%

12

%

100

100

10

80

80

8

6

120

Investment

GDP (rhs)

GDP (rhs)

Services

60

60

40

40

20

20

0

-20

0

Consumption

2011

2012

13/04/2016

Net exports

2013

2014

-2

2015

0

2011

2012

2013

Agriculture

2014

Industry

2015

13/04/2016

Indias growth slowing slightly to 7.4% in 2016

before picking up

Export growth, USD, %, year-on-year

40

20

0

-20

-40

-60

-80

Foreign investment inflows, USD million

15000

Non-oil exports

10000

5000

0

Portfolio investment

Direct investment

Foreign investment inflows

-10000

Jan-2013 Sep-2013 May-2014 Jan-2015 Sep-2015

Oil exports

Jan2013

Jul2013

Jan2014

Jul2014

Jan2015

-5000

Jul2015

Jan2016

Demand-side contributions to growth

%

150 Gross fixed capital Net exports

%

9

GDP (rhs)

formation

100

50

Government

consumption

Others

-50

2012

2013

Private consumption

-3

2014

2015

Supply-side contributions to growth

%

100

%

10

GDP (rhs)

Services

80

60

40

20

0

-20

0

2012

Agriculture

2013

2014

2015

Industry

-2

13/04/2016

ASEAN growth to edge up this year

and next

GDP growth, Southeast Asia (%)

2015

2016f

2017f

10

8

6

4

2

0

-2

ASEAN INO

THA

PHI

MAL

SIN

VIE

BRU CAM LAO MYA

f: forecast

ASEAN=Association of Southeast Asian Nations; BRU=Brunei Darussalam; CAM=Cambodia; INO=Indonesia;

LAO=Lao PDR; MAL=Malaysia; MYA=Myanmar; PHI=Philippines; SIN=Singapore; THA=Thailand; VIE=Viet Nam

13/04/2016

10

13/04/2016

Indonesias growth to slightly rise to

5.2% in 2016

Growth in fixed investment and private

consumption, %

18

Policy and inflation rates, %

10

Fixed

investment

14

Bank

Indonesia

rate

6

10

Private

consumption

Inflation

2

0

Jan2013

Q1-2013 Q3-2013 Q1-2014 Q3-2014 Q1-2015 Q3-2015

Demand-side contributions to growth

%

160

Government

consumption

GDP (rhs)

120

%

8

Net exports

2011

Investment

2012

2013

Statistical

discrepancy

2014

Jan2015

Jul2015

Jan2016

Supply-side contributions to growth

%

100

Services

GDP (rhs)

%

7

6

5

40

20

-2

40

-40

Jul2014

60

Private

consumption

Jan2014

80

80

Jul2013

2

2011

2015

2012

2013

Agriculture

2014

Industry

2015

13/04/2016

11

Slow recovery in global commodity

prices

Commodity price indexes

2010=100

170

Futures

Brent crude

150

130

Food

110

Gold

90

Copper

Beverage

70

50

Natural gas

30

2010

2011

2012

2013

2014

2015

2016

Sources: World Bank Pinksheets; Bloomberg

13/04/2016

12

13/04/2016

will keep CPI inflation low

CPI inflation (%)

5-year average

5.9

3.9

3.8

3.0

2.2

2.5

2.7

2015

2016f

2017f

0

2011

2012

2013

2014

f: forecast

13/04/2016

13

But there are risks

1. Rise in US interest rate and market

volatility

2. PRCs growth moderation

3. Producer price deflation

13/04/2016

14

13/04/2016

1. Future path of US interest rate and market

volatility

The Fed raised interest rates

in December 2015

The Fed sees further gradual

tightening going forward

The Fed indicated that first

stirrings of rising US inflation

is present

Changes to US monetary

policy have implications on

6

5

4

3

2

1

0

Actual

Trade

Capital flows

Foreign debt burden

Fed baseline (as of Mar 2016)

GPM Mar 2016

ADO 2016 baseline

Roubini Global Economics

13/04/2016

15

Strong dollar raises foreign debt

burden

US dollar per Asian currency, 1 Jan 2013=100

110

110

LAO

110

PRC

100

100

90

VIE

PHI

80

INO

70

MAL

80

IND

ARM

80

70

GEO

60

60

50

50

50

40

Jan-13

40

Jan-13

40

Jan-13

110

105

100

95

90

85

80

75

70

65

60

Jan-14

Jan-15

Jan-16

LAO

VIE

PHI

MAL

INO

1-Jan 12-Jan 23-Jan 3-Feb 14-Feb25-Feb 7-Mar

13/04/2016

110

105

100

95

90

85

80

75

70

65

60

KGZ

UZB

90

70

AZE

TAJ

100

SRI

90

Jan-14

Jan-15

Jan-16

60

KAZ

Jan-14

Jan-15

Jan-16

90

80

PRC

UZB

70

SRI

ARM

IND

GEO

60

50

40

KGZ

TAJ

AZE

KAZ

30

1-Jan 12-Jan 23-Jan 3-Feb 14-Feb25-Feb 7-Mar

1-Jan 12-Jan 23-Jan 3-Feb 14-Feb 25-Feb 7-Mar

$ appreciation tends to increase domestic currency value of debt, posing a threat

to economies with large foreign liabilities

Lower index indicates depreciation of local currency

16

13/04/2016

2. PRCs growth moderation has had global

impact

Global Projection Model:

PRC growth moderation scenario

Assume PRC growth

weaker by 0.85pp

0.4

Then

0.0

0.00

Rest of developing

Asias growth falls by

0.3pp

-0.05

-0.20

-0.4

-0.20

-0.15

-0.30

-0.30

Japans growth drops by

0.2pp

-0.8

-0.85

-1.2

PRC

USA

Euro

area

Trade and policies

Japan

EA ex

PRC

LA

Commodity prices

RC

World

EA = Emerging Asia; LA = Latin America; PRC =

Peoples Rep. of China; RC = remaining countries.

Total effect

13/04/2016

17

Sharper fall is unlikely,

but if it happens, it could generate a bigger impact

Assume 4.6pp fall in PRC

growth

Then

0

-0.60

-0.65

-1

Global growth to decline

by 1.75pp

Japans growth to drop by

1.5pp

Rest of developing Asias

growth to tumble by

1.8pp

-1.10

-0.95

-1.50

-1.80

-2

-1.75

-3

-4

-4.60

-5

EA = Emerging Asia; LA = Latin America;

PRC = Peoples Rep. of China; RC = remaining

countries.

13/04/2016

Global Projection Model:

PRC sharp slowdown scenario

PRC

US

Euro

area

Japan

EA ex

PRC

LA

RC

Trade and policies

Commodity prices

Global financial shock

Total effect

World

18

13/04/2016

PRCs structural change is transforming the structure of its

imports

Share of parts and components in PRC's imports

%

50

40

30

20

10

0

1992

1995

1998

2001

2004

2007

2010

2013

13/04/2016

19

but some countries could grow faster

Index of Competition with PRC, 2014

Cambodia

Viet Nam

Bangladesh

Sri Lanka

Pakistan

Hong Kong, China

Nepal

Philippines

Rep. of Korea

Tonga

Thailand

Malaysia

India

Singapore

Samoa

Indonesia

Fiji

0

13/04/2016

10

20

30

40

20

10

13/04/2016

3. Many Asian economies experiencing producer

price deflation

Consumer and producer prices,

2015 (% change)

Singapore

Philippines

People's Republic of China

Malaysia

Thailand

Rep. of Korea

India

Hong Kong, China

Viet Nam

Indonesia

Euro area

Japan

United States

-10

-8

-6

-4

-2

Producer prices

Consumer prices

13/04/2016

21

Strong inverse association between PPI inflation and

growth..

Average per capita GDP growth rate in

low, high, and negative inflation

In the postwar era,

per capita real GDP

growth is visibly

lower during PPI

deflations than

during CPI

deflations

%

3.0

2.8

2.8

2.8

2.6

2.6

2.4

2.3

2.3

2.2

2.1

2.0

CPI

PPI

Low inflation

13/04/2016

CPI

PPI

High inflation

CPI

PPI

Deflation

22

11

13/04/2016

0.02

0.00

-0.02

-0.04

-0.06

Changes in log Investment

0.04

0.06

adverse effect of lower producer prices on investment

-0.04

-0.02

0.00

0.02

0.04

0.06

Changes in log PPI

13/04/2016

23

Theme chapter:

Asias potential

growth

13/04/2016

24

12

13/04/2016

Growth momentum has flagged: temporary or

persistent?

Average Regional Growth Rate

(% per year)

12.0

10.1

10.0

8.0

5.9

6.0

4.0

1.8

2.0

1.5

0.0

-2.0

-4.0

Developing Asia

Latin America

OECD

-6.0

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

13/04/2016

25

Temporary vs. persistent effects depend on gauging

potential growth

Potential growth is the maximum growth rate associated

with the full employment of productive resources

= Growth of labor force + Growth of labor productivity

Consistent with natural rate of unemployment

If realized growth is very different from potential

growth, aggregate demand management might be

deployed

Potential growth depends on an economys institutions

and economic structure.

Not immutable, i.e., amenable to policy

Can move closer to frontier potential growth by

removing obstacles to efficient factor allocation

13/04/2016

26

13

13/04/2016

Developing Asias potential growth fell by 0.32

pp between 2000-2007 and 2008-2014. Down in

14 of 22 economies

Percentage change in actual and potential

output growth (2008-2014) / (2000-2007)

Developing Asias average potential output

growth rate

10

7.3-7.4%

(1995-96)

7.39%

(Ave. 2000-07)

8.45%

7.07% (Ave. 2008-14)

6.68

6

4

Asian-13 Average

Asian-12 Average (No PRC)

Asian-4 Average

2014

2012

2010

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

1988

Falling potential growth accounts for about

40% of the moderation in post-crisis actual

average growth

5.21

Papua New Guinea

Uzbekistan

Pakistan

Indonesia

Philippines

Bangladesh

Fiji

India

Malaysia

Singapore

Thailand

Sri Lanka

People's Republic of China

Viet Nam

Taipei,China

Japan

Tajikistan

Hong Kong, China

Cambodia

Kazakhstan

Rep. of Korea

Turkmenistan

Azerbaijan

-15

Actual

Potential

-10

13/04/2016

-5

0

Percentage point

10

27

Determinants of potential growth and frontier

potential growth

Labor

productivity

growth

(80%)

Labor force

growth

(20%)

Initial income per

capita

Productivity gap

with the US

Tertiary

enrollment ratio

Trade ratio

Convergence effect

through capital

accumulation (-0.33

per additional $1,000)

Positive advantages of

backwardness (0.077);

larger for less

politically stable

countries

Positive effect up to

50%

Positive effect up to

440% of GDP

Good Institutions

Financial capital

integration

Macroeconomic

stability

Positive (0.004); larger

effect for countries

with low regulatory

quality

Volatile gap between

actual and potential

growth rates has a

negative effect (0.19)

Efficient factor

allocation of

capital and labor

at firm level

Labor market

flexibility

Government quality

Citizen participation

Working-age

population

(ages 1564)

growth

Unequal access to

credit makes firms too

labor intensive

Lack of access to land

makes firms too small

One-to-one effect on

potential growth

13/04/2016

28

14

13/04/2016

Reforms can offset the demographic drag

Impact on potential growth, annual increment, percentage points

Weighted average

Cambodia

Azerbaijan

Uzbekistan

Viet Nam

Turkmenistan

Kazakhstan

Tajikistan

Bangladesh

Pakistan

PRC

India

Thailand

Sri Lanka

Indonesia

Philippines

Malaysia

Taipei,China

Republic of Korea

Singapore

Hong Kong, China

-0.31

0.99

-1.01

0.98

-0.87

0.97

-0.6

0.95

-0.32

0.94

-0.63

0.94

-0.43

0.92

-0.01 0.85

-0.2

0.8

-0.34

0.8

-0.13 0.76

-0.33

0.74

0.38

0.73

-0.11 0.72

-0.26 0.68

-0.38

0.59

-0.65

0.54

-0.41

0.5

-0.93

0.36

-0.59 0.2

-1.5

-1

-0.5

Impact of demographics

0

0.5

1

Impact of reforms

1.5

13/04/2016

29

A new normal for potential growth?

Without structural reforms, potential growth could

fall further.

End of the demographic dividend in some

countries

Past success has narrowed the gap with the

advanced economies

Moderating growth in the PRC spilling over to

other economies

13/04/2016

30

15

13/04/2016

Policy reform can invigorate potential

growth

Offset the impact of less-favorable demographics

Supply-side policies to raise labor productivity

Productive capital investment

Reforms to boost labor productivity growth

Reforms to reduce factor misallocation

Sound macroeconomic management

13/04/2016

31

Policy space to engage in countercyclical

measures

Developing Asian economies still equipped with

some policy spaceboth fiscal and monetaryto

provide more aggregate demand if needed

But scope for policy intervention more limited than

in the past

Legacy of past policy and external constraints often

bound the actual amount of policy space

13/04/2016

32

16

13/04/2016

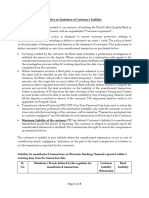

Corporate Income

Household

Country

Tax

Income Tax

Flexible with Both Fiscal and Monetary Policies

Armenia

20

36

China, People's

Rep. of

25

45

Philippines

30

32

Tajikistan

24

13

Georgia

15

20

Taipei,China

17

45

Thailand

20

35

Afghanistan

20

20

Flexible with Fiscal Policy

Bangladesh

45

30

Indonesia

25

30

Kiribati

35

30

Azerbaijan

20

25

Bhutan

30

25

Korea, Rep. of

24.2

38

Mongolia

25

10

Papua New Guinea

30

42

Kazakhstan

20

10

Flexible with Monetary Policy

Maldives

15

Sri Lanka

28

24

Cambodia

20

20

India

40

30

Pakistan

34

20

Samoa

27

27

Consider other type of policy options

Brunei Darussalam

18.5

0

Hong Kong, China

16.5

17

Lao People's Dem.

Rep.

24

24

Sample Median

24.6

27

Japan

25.5

45

US

35

39.6

VAT

Social Security

Contribution Tax

Govt. Debt

Ratio

Fiscal

Balance

20

10

41

-4.6

8.5

3.7

17

12

18

18

5

7

28

17

26

41

36

-3.5

-0.9

-2.3

-3.7

-1

-2.5

0.7

2.25

5

16

8

1.625

1.5

17

20

1.5

10

25

8.5

8

1.4

1.4

5.1

4

-0.3

-0.9

-1.5

15

10

12.5

18

25

15.7

15

25

22

17.7

23

34

25

6.75

7

6.5

6.5

5

7

1.5

12

0.5

10

3.5

12

10

15

-4.3

-2.5

-1.1

-1.2

-2.2

-3

-3.1

-3.2

-2.2

17

6.4

6.4

1.4

4

6.6

0.7

6.6

5.1

6.6

14

20

-7.4

-4.5

-2.4

-3.9

-5.3

-3.9

10

8

20

6

12

73

76

34

66

65

55

6.75

6

0.17

10

7.5

12.5

4

5

15

1

3.8

1.2

5

4.5

1.9

10

10

2

0

-14

1.3

5

0.75

-0.4

3

5

7.5

0.75

10

1.3

10

10

10

12

11

10

17

15

0

10

11.5

8

12

10

16

11.5

15.7

29

15.3

35

38

44

16

36

-4.7

246

105

-5.4

-2.7

Policy Interest Required Reserve

Rate

Ratio

Inflation

4.5

6

-0.5

0.5

0.8

0.1

13/04/2016

33

Economies having space in both fiscal and monetary

policies: Armenia, People's Rep. of China, Philippines,

Tajikistan, Georgia, Taipei,China, Thailand, and

Afghanistan

Economies having space in fiscal policies: Bangladesh,

Indonesia, Kiribati, Azerbaijan, Bhutan, Rep. of Korea,

Mongolia, Papua New Guinea, and Kazakhstan

Economies having space in monetary policies:

Maldives, Sri Lanka, Cambodia, India, Pakistan, and

Samoa

13/04/2016

34

17

13/04/2016

Key messages

Growth in developing Asia softens to 5.7% in 2016 and

2017, from 5.9% last year

PRC growth moderating to 6.5% in 2016 and 6.3% in 2017

underscores the importance of supply-side reforms

India growth projected at 7.4% in 2016 and 7.8% in 2017

While CPI inflation remains subdued, many economies

face possibly harmful PPI deflation

Reforms to raise labor productivity can invigorate

developing Asias potential growth

13/04/2016

35

18

You might also like

- 1 ADBアジア経済見通し2017年改訂版プレゼン資料 PDFDocument23 pages1 ADBアジア経済見通し2017年改訂版プレゼン資料 PDFADBJRONo ratings yet

- 1 ADBアジア経済見通し2017年改訂版プレゼン資料 PDFDocument23 pages1 ADBアジア経済見通し2017年改訂版プレゼン資料 PDFADBJRONo ratings yet

- アジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017Document36 pagesアジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017ADBJRONo ratings yet

- 1 ADBアジア経済見通し2017年改訂版プレゼン資料 PDFDocument23 pages1 ADBアジア経済見通し2017年改訂版プレゼン資料 PDFADBJRONo ratings yet

- アジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017Document14 pagesアジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017ADBJRONo ratings yet

- アジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017Document22 pagesアジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017ADBJRONo ratings yet

- Developing Knowledge Partnerships in ADB: Ryu FukuiDocument11 pagesDeveloping Knowledge Partnerships in ADB: Ryu FukuiADBJRONo ratings yet

- 「CSO/NGO フォーラム」(2016年9月2日)資料Document25 pages「CSO/NGO フォーラム」(2016年9月2日)資料ADBJRONo ratings yet

- アジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017Document51 pagesアジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017ADBJRONo ratings yet

- 特別セミナー「アジアにおけるPPPの課題と新設されたアジア・太平洋プロジェクト組成ファシリティ(AP3F)について」2016年3月8日配布資料2Document12 pages特別セミナー「アジアにおけるPPPの課題と新設されたアジア・太平洋プロジェクト組成ファシリティ(AP3F)について」2016年3月8日配布資料2ADBJRONo ratings yet

- アジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017Document15 pagesアジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017ADBJRONo ratings yet

- アジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017Document17 pagesアジア開発銀行(ADB) ビジネス・オポチュニティ・セミナー 2017ADBJRONo ratings yet

- セミナー「タイの経済・政治動向と地域協力プログラムの進捗状況について」(2015年11月26日)配布資料Document34 pagesセミナー「タイの経済・政治動向と地域協力プログラムの進捗状況について」(2015年11月26日)配布資料ADBJRONo ratings yet

- ADB・JICA共催セミナー「アジアインフラパートナーシップ信託基金(LEAP) の概要について」(2016年8月30日)Document2 pagesADB・JICA共催セミナー「アジアインフラパートナーシップ信託基金(LEAP) の概要について」(2016年8月30日)ADBJRONo ratings yet

- ナレッジ・パートナーシップ・フォーラム(2016年3月9日)配布資料3Document53 pagesナレッジ・パートナーシップ・フォーラム(2016年3月9日)配布資料3ADBJRONo ratings yet

- Developing Knowledge Partnerships in ADB: Ryu FukuiDocument11 pagesDeveloping Knowledge Partnerships in ADB: Ryu FukuiADBJRONo ratings yet

- ナレッジ・パートナーシップ・フォーラム(2016年3月9日)配布資料2Document29 pagesナレッジ・パートナーシップ・フォーラム(2016年3月9日)配布資料2ADBJRONo ratings yet

- 「アジア経済見通し」セミナー(2015年4月9日)配布資料(インド)Document16 pages「アジア経済見通し」セミナー(2015年4月9日)配布資料(インド)ADBJRONo ratings yet

- Enabling Women, Energizing Asia: Asian Development Outlook 2015 UpdateDocument12 pagesEnabling Women, Energizing Asia: Asian Development Outlook 2015 UpdateADBJRONo ratings yet

- Presentation Outline: Development in The Greater Mekong Subregion: Connectivity, Community, and CompetitivenessDocument15 pagesPresentation Outline: Development in The Greater Mekong Subregion: Connectivity, Community, and CompetitivenessADBJRONo ratings yet

- Business Opportunities Seminar Tokyo, Japan Procurement of Goods and Works 14 December 2015Document13 pagesBusiness Opportunities Seminar Tokyo, Japan Procurement of Goods and Works 14 December 2015ADBJRONo ratings yet

- 国連・豊田市「持続可能な都市に関するハイレベル・シンポジウム」(2015年1月16日)プレゼン資料Document12 pages国連・豊田市「持続可能な都市に関するハイレベル・シンポジウム」(2015年1月16日)プレゼン資料ADBJRONo ratings yet

- Business Opportunities Seminar Tokyo, Japan Consulting Services 14 December 2015Document17 pagesBusiness Opportunities Seminar Tokyo, Japan Consulting Services 14 December 2015ADBJRONo ratings yet

- 防災インフラセミナー(2014年10月31日)配布資料7Document12 pages防災インフラセミナー(2014年10月31日)配布資料7ADBJRONo ratings yet

- Indonesian Economy: Recent Developments, Prospects, and ChallengesDocument10 pagesIndonesian Economy: Recent Developments, Prospects, and ChallengesADBJRONo ratings yet

- 防災インフラセミナー(2014年10月31日)配布資料6Document12 pages防災インフラセミナー(2014年10月31日)配布資料6ADBJRONo ratings yet

- 防災インフラセミナー(2014年10月31日)配布資料9Document9 pages防災インフラセミナー(2014年10月31日)配布資料9ADBJRONo ratings yet

- 防災インフラセミナー(2014年10月31日)配布資料8Document6 pages防災インフラセミナー(2014年10月31日)配布資料8ADBJRONo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Trial Balance: By: Justine V Andrada Kean Angelie RelatorDocument14 pagesThe Trial Balance: By: Justine V Andrada Kean Angelie RelatorCj BolidoNo ratings yet

- DBA Macroeconomics Topic 1Document13 pagesDBA Macroeconomics Topic 1raul velazquez tepepaNo ratings yet

- Customer Protection PolicyDocument3 pagesCustomer Protection PolicyJorden BelfortNo ratings yet

- Chapter 8 SolutionsDocument4 pagesChapter 8 SolutionsNikulNo ratings yet

- Sec 23 CompiledDocument26 pagesSec 23 CompiledAleezah Gertrude RaymundoNo ratings yet

- FABM1 LAS 7 Adjusting-EntriesDocument11 pagesFABM1 LAS 7 Adjusting-EntriesfeyNo ratings yet

- BBLD0919Document93 pagesBBLD0919Syifa Musvita Ul BadriahNo ratings yet

- Economic Value AddedDocument14 pagesEconomic Value Addedmanish singh rana0% (1)

- USA v. Luis DiazDocument20 pagesUSA v. Luis DiazdolartodayNo ratings yet

- Valid Tender of Payment Stops Interest AccrualDocument1 pageValid Tender of Payment Stops Interest Accrualxx_stripped52100% (1)

- Chap 6Document65 pagesChap 6ahmad altoufailyNo ratings yet

- A4 Special Issues in AccountsDocument22 pagesA4 Special Issues in AccountsThasveer AvNo ratings yet

- 23010517220260948V7H626472791273BMB137076626R7Document3 pages23010517220260948V7H626472791273BMB137076626R7SiddharthNo ratings yet

- UK Money Creation GuideDocument2 pagesUK Money Creation Guidematts292003574No ratings yet

- Introduction To Corporate ValuationDocument19 pagesIntroduction To Corporate ValuationAkchikaNo ratings yet

- Finance Q14Document17 pagesFinance Q14Paodou HuNo ratings yet

- Introductory Econometrics For Finance' © Chris Brooks 2002 1Document11 pagesIntroductory Econometrics For Finance' © Chris Brooks 2002 1tagashiiNo ratings yet

- Lesson 3 Business Transaction AnalysisDocument2 pagesLesson 3 Business Transaction Analysisamora elyseNo ratings yet

- Marketing Management - Individual Assigment 2Document5 pagesMarketing Management - Individual Assigment 2francis MallyaNo ratings yet

- Chapter 2 of Fundamentals of Corporate FinanceDocument25 pagesChapter 2 of Fundamentals of Corporate FinanceDdsfalkdfjs100% (1)

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- WSO Resume 119861Document1 pageWSO Resume 119861John MathiasNo ratings yet

- Problems-Chapter 3Document4 pagesProblems-Chapter 3An VyNo ratings yet

- Momentum Investing, An Underused Investment Style. Oct. 2014Document16 pagesMomentum Investing, An Underused Investment Style. Oct. 2014Pierluigi GandolfiNo ratings yet

- 1ETHEA2020003Document38 pages1ETHEA2020003Edlamu AlemieNo ratings yet

- Accounting Test Bank - Bank ReconciliationDocument2 pagesAccounting Test Bank - Bank ReconciliationAyesha RGNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- Kina Bank Fees Charges ScheduleDocument15 pagesKina Bank Fees Charges SchedulemarcialitovivaresNo ratings yet

- Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Document11 pagesChapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Jan OleteNo ratings yet

- Bir Form 0605Document4 pagesBir Form 0605Manoy BermeoNo ratings yet