Professional Documents

Culture Documents

Interconnected Stock Exchange

Interconnected Stock Exchange

Uploaded by

gspkishore7953Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interconnected Stock Exchange

Interconnected Stock Exchange

Uploaded by

gspkishore7953Copyright:

Available Formats

Inter-connected Stock Exchange Ltd.

(ISE) is an Indian national-level stock exchange, providing trading, clearing, settlement, risk management and

surveillance support to its trading members. It started its operation in 1998[1] in Vashi, Mumbai,[2] and has 841 trading members, who are located in 18

cities. These intermediaries are administratively supported through the regional offices at Delhi, Kolkata, Patna, Ahmedabad, Coimbatore and Nagpur,

besides Mumbai.[3]

The ISE is promoted by 12 regional stock exchanges[4] namely at Bangalore, Bhubaneshwar, Chennai, Kochi, Coimbatore, Guwahati, Indore, Jaipur,

Kanpur, Mangalore, Magadh and Vadodara.[5] The participating exchanges of ISE have 4,500[6] members and listed securities. It is a stock exchange

of stock exchanges,[7] members of the stock exchanges being traders on the ISE.

Contents [hide]

1 History

2 Services

2.1 Membership

2.2 Depository services

2.3 Research and Training

2.4 Listing

3 References

4 External links

History[edit]

At a meeting of the Federation of Indian Stock Exchanges held in October 1996, a Steering Committee was formed to evolve an Inter-Connected

Market System. As a result, Inter-connected Stock Exchange (ISE), which was promoted by 14 regional stock exchanges of the country (excluding

Calcutta, Delhi, Ahmedabad, Ludhiana and Pune Stock Exchange, apart from NSE, BSE and OTCEI) was incorporated by SEBI under the Securities

Contracts (Regulations) Act, 1956 on November 18, 1998, ISE commenced trading on February 26, 1999.[citation needed]

ISE was launched with an objective of converting small, fragmented and illiquid markets into large, liquid national-level markets. ISE is also a

professionally managed stock exchange with the Chairman of the Exchange being also a Public Representative Director from its inception.

Unfortunately for the RSEs, particularly small brokers, the ISE experiment did not succeed. The daily turnover, which used to be Rs. 1 to 2 crore in the

first six months, gradually declined to virtually zero level. Failure of ISE was, due to the bigger brokers of the participating RSEs failing to support any

interest in trading on ISE due to commercial considerations. As a result, it becomes virtually impossible for ISE to create any worthwhile liquidity in its

markets in competition with the breadth and depth of NSE and BSE. Markers continued to be fragmented as the participating RSEs did not close down

their regional segments. All the while the small fragmented and illiquid market failed to emerge. ISE has also not succeeded in getting companies listed

on it despite the stipulation by SEBI that the State of Maharashtra constituted the regional area for ISE due to lack of regulatory support for making it

applicable to over 3,000 already listed companies in the State of Maharashtra.[citation needed]

Services[edit]

Membership[edit]

A registered Member is entitled to execute trades and to clear and settle trades executed on his own account as well as on account of his clients in the

Capital Markets Segment. Membership of the Exchange is open to corporate entities, individuals and partnership firms who fulfill the eligibility criteria

laid down by SEBI and ISE

Depository services[edit]

Inter-connected Stock Exchange is a Depository Participant of Central Depository Service (India) Limited (CDSL)[8] and National Securities Depository

Limited (NSDL).[9] ISE-DP has branches at Delhi, Kolkata, Patna, Guwahati, Ahmedabad, Hyderabad, Nagpur, Coimbatore, Tirunelveli and 155

Collection Centers across the country. Following depository services of CDSL are provided to the individual and corporate investors by ISE-DP:[10]

Dematerialisation (Demat)

Rematerialisation (Remat)

Pledge of Demat securities

Electronic Access to Securities Information & Execution of Secured Transactions (easiest)

Settlement of securities in Demat Mode

Electronic Access to Securities Information (easi)

Research and Training[edit]

The ISE Training centre was established in November, 2000.[11] It is a classroom training program on subjects related to the capital market, such as

equities trading and settlement procedure, derivatives trading, day trading, arbitrage operations, technical analysis, financial planning, and compliance

requirement.[12] ISE also offers Joint Certification Training programmes in association with its partners.

Listing[edit]

The trading platform of ISE enables the 'Indian companies to access equity capital, by providing a liquid and well-regulated market.[13] Scrips which

are already being traded on stock exchanges across India are traded on the Exchange. ISEs trading members in India trade on the scrips and provide

liquidity and visibility to such scrips.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2nd de DollarizationDocument10 pages2nd de Dollarizationgspkishore7953No ratings yet

- Simple Sanskrit Lesson 1Document5 pagesSimple Sanskrit Lesson 1gspkishore7953No ratings yet

- PALM:nomics: Ali Muhammad LakdawalaDocument39 pagesPALM:nomics: Ali Muhammad Lakdawalagspkishore7953No ratings yet

- Affidavit of Financial Support For International Students: Student'S NameDocument2 pagesAffidavit of Financial Support For International Students: Student'S Namegspkishore7953No ratings yet

- A.P.Co - Op.Oilseeds Growers' Federation Limited Divisional Office: AnantapurDocument2 pagesA.P.Co - Op.Oilseeds Growers' Federation Limited Divisional Office: Anantapurgspkishore7953No ratings yet

- Status of Ground Water Quality in India Part II PDFDocument431 pagesStatus of Ground Water Quality in India Part II PDFrashingNo ratings yet

- Guidelines For Research Project of NMOOP-1Document9 pagesGuidelines For Research Project of NMOOP-1gspkishore7953No ratings yet

- Youth AffairsDocument1 pageYouth Affairsgspkishore7953No ratings yet

- Notes On NBFCDocument9 pagesNotes On NBFCgspkishore7953No ratings yet

- Mentor Programme (1) 23Document2 pagesMentor Programme (1) 23gspkishore7953No ratings yet

- Real Numbers ShreyaDocument15 pagesReal Numbers Shreyagspkishore7953No ratings yet

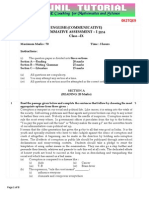

- English (Communicative) Summative Assessment - I (2013) Class - IXDocument8 pagesEnglish (Communicative) Summative Assessment - I (2013) Class - IXgspkishore7953No ratings yet

- Shri Hanuman Chalisa DohaDocument2 pagesShri Hanuman Chalisa Dohagspkishore7953No ratings yet

- Overview of Banking Sector and Credit Analysis ofDocument23 pagesOverview of Banking Sector and Credit Analysis ofrahuln181No ratings yet

- Retail Market Stratetegy Final 5th July PDFDocument40 pagesRetail Market Stratetegy Final 5th July PDFmayur6790No ratings yet

- CPG Analytics - MarketelligentDocument2 pagesCPG Analytics - MarketelligentMarketelligent100% (3)

- Sales and Trading or Relationship Manager or Fixed Income SalesDocument2 pagesSales and Trading or Relationship Manager or Fixed Income Salesapi-121440494No ratings yet

- CVP Excel Exercise UpdatedDocument6 pagesCVP Excel Exercise Updatedyyshu11No ratings yet

- Rediscover The Lost Art of Chart Reading - Using VSA - Todd KruegerDocument5 pagesRediscover The Lost Art of Chart Reading - Using VSA - Todd KruegerRecardo AndyNo ratings yet

- Competitive Profile MatrixDocument4 pagesCompetitive Profile MatrixDikshit KothariNo ratings yet

- Financial Institutions - Entrepreneurship AssignmentDocument17 pagesFinancial Institutions - Entrepreneurship AssignmentDevikaKhareNo ratings yet

- Comparative Analysis of Merchant Banking Services in Public Sector Bank & Private Sector BankDocument37 pagesComparative Analysis of Merchant Banking Services in Public Sector Bank & Private Sector BankAmarbant Singh DNo ratings yet

- IPO - NetworthDocument73 pagesIPO - NetworthsaiyuvatechNo ratings yet

- AmazonDocument24 pagesAmazonRohit Soni50% (4)

- Islamic Finance Topics1Document3 pagesIslamic Finance Topics1praveen kiwiNo ratings yet

- Chapter 09Document24 pagesChapter 09Mohamed MadyNo ratings yet

- Bancassurance Main Project 2003Document83 pagesBancassurance Main Project 2003Shravan Singh100% (3)

- XXZXDocument4 pagesXXZXprits92No ratings yet

- Customer FocusDocument39 pagesCustomer Focusgurvinder12No ratings yet

- Group6 Newell Company SM2Document1 pageGroup6 Newell Company SM2Anoop SlathiaNo ratings yet

- Ch. 8. Foreign Currency DerivativesDocument32 pagesCh. 8. Foreign Currency DerivativesAnonymous 9Jj8Bgvmv100% (1)

- CASE STUDY On US 64Document9 pagesCASE STUDY On US 649897856218No ratings yet

- European Bond Futures 2006Document10 pagesEuropean Bond Futures 2006deepdish7No ratings yet

- DirectoryDocument94 pagesDirectoryShahzad ShaikhNo ratings yet

- Monopolistic Competition and OligopolyDocument17 pagesMonopolistic Competition and Oligopolyᜄᜓᜄᜓᜇᜀᜈᜄ ᜎᜒᜐᜓᜄᜀNo ratings yet

- Kevin Martis Reliance SecuritiesDocument13 pagesKevin Martis Reliance SecuritiesIna PawarNo ratings yet

- Rupeeseed Internship ReportDocument25 pagesRupeeseed Internship ReportHitesh PatniNo ratings yet

- Brand Development Index BDIDocument1 pageBrand Development Index BDIRohail SiddiqueNo ratings yet

- Indian Capital MarketDocument35 pagesIndian Capital MarketVivek Rai100% (1)

- Titan Industries Ltd. Project ReportDocument19 pagesTitan Industries Ltd. Project ReportAagam Shah100% (1)

- Shadow BankingDocument81 pagesShadow BankingPhil MatricardiNo ratings yet

- Chapter 3-Hedging Strategies Using Futures-29.01.2014Document26 pagesChapter 3-Hedging Strategies Using Futures-29.01.2014abaig2011No ratings yet

- FCCB My PointsDocument2 pagesFCCB My PointsAboozar Yunus AliNo ratings yet