Professional Documents

Culture Documents

A Study On The Efficacy of Islamic Pawn Broking Services in Fulfilling Socio

Uploaded by

Global Research and Development ServicesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On The Efficacy of Islamic Pawn Broking Services in Fulfilling Socio

Uploaded by

Global Research and Development ServicesCopyright:

Available Formats

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Zor Zaihan Bin Mohd Noar and Mohd Aminul Islam

Special Issue Vol.1 Issue 1, pp. 890-903

A STUDY ON THE EFFICACY OF ISLAMIC PAWN BROKING

SERVICES IN FULFILLING SOCIO ECONOMIC NEEDS: A

CASE OF TWO CITIES-KUANTAN AND KUALA

TERENGGANU IN MALAYSIA

Nor Zaihan bin Mohd Noar

Department of Computational & Theoretical Sciences, Faculty of Science, IIUM Kuantan

Campus, 25200 Kuantan norzaihan@iium.edu.my

Mohd Aminul Islam

Department of Computational & Theoretical Sciences, Faculty of Science, IIUM Kuantan

Campus, 25200 Kuantan aminulislam@iium.edu.my

____________________________________________________________________________________________

Abstract

In this paper we aim to examine the effectiveness of Al-Rahnu (Islamic pawn broking) services in

fulfilling and enhancing socio-economic needs of its users as an alternative source of managing

short term cash flow problem. To achieve our objectives we conducted a survey in two cities of

Malaysia: Kuantan and Kuala Terengganu in the states of Pahang and Terengganu respectively.

A sample of 128 users of Ar-Rahnu services were used to collect data through distributing a

semi-structured questionnaire. The results were analyzed via the cross tabulation using excel

spreadsheets. The findings from this study revealed that the community, especially the Malay

ethnicity found Al-Rahnu services effective in fulfilling their needs of getting access to small

short term loans with fast and hassle freeway and hence making them loyal to Al-Rahnu services.

This implies that the Ar-rahnu services are well accepted as a better mean to ease short term

financial difficulties and hence able to empower socio-economic needs of the people. The

fulfillment of needs are derived from two main components of Al-Rahnu survey questions i.e. the

loan tenure and the loan sufficiency.

Keywords

Al-Rahn, Islamic pawn broking, socio-economy, loan tenure, loan sufficiency, Malaysia

_____________________________________________________________________________________________

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

890

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

1. Introduction

Pawn broking services in Malaysia began before 1811 and were introduced by the

Chinese merchants. This business continued to flourish, especially after the discovery of tin

mining in Larut in the 19th century. Other ethnic groups such as Malays and Indians rarely own

pawn shops. In 1871, licensed pawn shops were introduced by the British Colonial of Pawn

Shops Ordinance 1871 (Abdul Razak, 2011). In 1983 a new atmosphere of pawn broking was

created with the inclusion of Shariah regulation in the finance sector in Malaysia, which gave

birth to Islamic pawn broking.

Al-Rahn means a pledge or a security related to a loan. Under the Shariah, Al-Rahn

means possessing a guarantee (Bashir et al., 2012). Al-Rahn also refers to an arrangement

whereby a valuable asset is placed as collateral for debt. The collateral may be disposed in the

event of default (Bashir et al., 2012). Pricing is very important under the Al-Rahn scheme as it

usually serves the less economically privileged group of people. The cost of borrowing cash in

an Islamic pawn broking system is relatively cheaper compared to the conventional pawn

broking system. The cost of borrowing in the Al-Rahn in Malaysia is the lowest when compared

to the conventional pawn broking scheme (Cheong & Sinnakkannu, 2012). When compared

between Bank Rakyat versus conventional pawn broking they found that the annual cost of

borrowing in the Al-Rahn Bank Rakyat scheme is about half the cost of the conventional pawn

broking scheme. By comparing the annual cost of borrowing in Al-Rahn Bank Islam and Kedai

Al-Rahn Kelantan they again found that the annual cost of borrowings are still about half the cost

of conventional pawn broking schemes. Collateral is also the other important element of the

Islamic pawn broking system. Islamic pawn brokers only accept gold or gold jewelry as

collateral as opposed to the conventional pawn brokers who accepted other valuables such as

Rolex watches, gemstones and diamonds etc.

The main reason why the Islamic pawn brokers accept only gold is to eliminate the

element of gharar i.e. the uncertainty. According to the Institute of Islamic Banking and

Insurance (2015), Gharar is forbidden by the Qur'an, which explicitly forbids trades that are

considered to have excessive risk due to uncertainty. To an untrained valuer the value of

collaterals such as watches, gemstones and diamonds etc. might differ widely. These items need

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

891

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

to be evaluated by trained personals. Gold on the other hand, has a standard price which

fluctuates according to the international gold market price. The price of gold or gold jewellery is

therefore standard and this eliminates the element of gharar.

In Malaysia, the first Islamic pawn broking institution named Muassasah Gadaian Islam

Terengganu (MGIT), was set up by the Terengganu State Islamic Affairs and Malay Customs, in

January 1992 (Majlis, 2012; Abdul Razed, 2004). The establishment of MGIT is to provide

immediate financing to assist individuals in overcoming cash flow needs, thereby eliminating the

element of interest or riba, which is forbidden in the Islamic term (Majlis, 2012, Abdul Razak,

2004). In the Holy Quran usury or interest is forbidden as in Surah An-Nisa verse 161:

And [for] their taking of usury while they had been forbidden from it, and their

consuming of the people's wealth unjustly. And we have prepared for the disbelievers among

them a painful punishment.

The introduction of Islamic pawn broking in Malaysia is seen as a new micro credit

instrument (Mohd Ali, 2005) providing cash loan for the lower income group when a need arises

for additional cash or for small businesses, which usually have limited capital or working capital.

Pawn broking also provides a fast and hassle free method of obtaining cash for immediate needs

and also benefits those people who are excluded from the mainstream financial system due to

lack of collateral. Since people go to Al-Rahn for quick and short term loan, they expect the

process to be fast and hassle free. When compared to a bank personal loan, a customer has to

produce related documents such as certified copies of identity cards, salary slips, bank

statements, tax forms and business registration for businessmen. There are banks that require the

loaner to have a minimum salary before they are qualified for a loan. And on top of that banks

may or may not require a personal guarantor depending on the loan scheme offered (May bank,

2015).

Ever since the introduction of Islamic pawn broking the demand for it increases

continuously.

Unlike the conventional pawnbrokers where businesses were mainly family

operated, the Al-Rahn business seems to develop through corporate entities. After Majlis Agama

Islam Dan Adat Melayu (MAIDAM) had taken the first step in January 1992 to start Islamic

pawn broking, this was soon followed by Permodalan Kelantan Berhad in March 1992 and then

by Bank Kerjasama Rakyat Malaysia in 1993 (Abdul Razak 2011). In 2010, there were 133

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

892

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

branches of Bank Kerjasama Rakyat Malaysia offering this scheme throughout Malaysia which

increased to 144 as of the middle of 2015. Yippee had also launched 59 counters of Al-Rahn

scheme though Yippee cooperatives. The next financial institutions to enter Islamic pawn

broking was EON Bank (August 2002) and Bank Pertanian Malaysia (Agro Bank) in 2002.

Other financial institutions that provide the Al-Rahn scheme include Hong Leong Bank Bhd, Pos

Malaysia, Bank Muamalat Bhd, Bank Islam Malaysia Bhd, RHB bank, Habib Jewels etc.

Currently there are 461 pawnshops throughout the country providing financial services to low

income as well as middle income earners to assist easing their short term financial difficulties.

In the neighboring countries, Thailand operated Al-Rahn through the Pattani Islamic Cooperative

Limited (Koperasi Islam Pattani Berhad) in 1987, Brunei through Bank Islam Brunei Berhad,

and Indonesia through Perum Pegadaian with the cooperation of Bank Muamalat Indonesia in

2003 (Abdul Razak 2011).

This paper aims to examine the effectiveness of Al-Rahn in meeting the socio-economic

needs of its customers. We exclusively focused on two cities in Malaysia namely Kuantan in

Pahang and Kuala Terengganu in Terengganu. The primary criteria to examine the effectiveness

of Ar-rahnus ability to fulfill its customers socio-economic needs were based on the question of

the sufficiency of cash obtained and borrowing period of the transactions among borrowers. The

questionnaire is also designed to seek information from borrowers for reasons they use the AlRahn service and their inclination towards using similar services in the future. In addition, the

paper also took into consideration the respondents profile such as race, age, gender, occupation

and income.

2. Literature Review

There are few studies which discussed the development and trend of pawnshop in

Malaysia both in conventional and Islamic pawnshop. Selama & Abdul Gafar (2006) in their

working paper discussed the development of pawnshops: conventional vs. Islamic in Malaysia in

details. They have listed several factors or beneficial aspects behind gaining the popularity of the

pawnshop s among users relative to the formal financial institutions in Malaysia. Few of the

main factors they identified are the easy, quick and hassle free way of obtaining short term loans.

As far as Islamic pawn broking is concerned, quick, hassle free, interest free, and transparency in

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

893

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

dealings are the main factors. Some studies have found that the Islamic pawn broking services in

Malaysia as an alternative to the conventional pawnshop getting more popularity even among the

non-Muslims (e.g., Payal b. & Jothee S., 2008; Hanudin, A. & Chong, R 2011, etc). Maamor et

al. (2006) in their studies explained how the Al-Rahn as an Islamic pawn broking scheme is

important to Muslim societies. According to Abdul Razak (2011), Al-Rahn is important because

it provides financial relief for lower income groups and small business that have been excluded

from the mainstream financial system. Since Al-Rahn is known for lending small amount of loan,

in this study, we are interested to know whether the amount given out is sufficient to the

borrower. Otherwise this would lead for the user to go to another lender for additional loans.

Al-Rahn is also known for giving short term loan. Banks and other financial institutions

on the other hand, prefer a medium to long term loan. May bank Islamic Personal Financing-i

(MIPF-I) have a tenure length of 2-6 years whereas CIMB Xpress Cash Financing-i has tenure

length of at least 6 months to 5 years. We want to know whether this short tenure period of loan

is sufficient for the borrowers. According to Abdul Razak (2011), Islamic pawn broking

institutions in Malaysia agreed that in establishing the Islamic pawn broking business the interest

of the public regardless of the purpose of getting the loan should be taken into consideration. Our

study will look into the category of the reasons for obtaining the loan whether for personal or

business purposes.

Generally, customer satisfaction level and service quality of Al-Rahn services is high

which is another indicator why the Al-rahnu is gaining rapid popularity (Othman et al. 2012).

According to Caruana et al (2014), customer satisfaction and corporate reputation have both

been studied as antecedents of customer loyalty. They found that the effect of corporate

reputation on customer loyalty is completely mediated by customer satisfaction. Our study

showed that repeated business is high that is a positive indicator of good customer services

provided by Al-Rahn institutions.

3. Methodology

A quantitative piece of research using random sampling technique was employed. Total

sample size was 128. The research/geographical scope were limited to Kuala Terengganu and

Kuantan and respondents selected were patrons/customers of the Al-Rahn shops. Data were

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

894

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

collected using a structured questionnaire distributed among the sample customers and also by

intercepting respondents outside Al-Rahn shops. The questionnaire was designed to capture

information to meet the objective of the study in the first and second sections, while the third

section captures the respondents demographic profile. The first section targeted respondents

who have used the Al-Rahn services for more than once, while the second section focused on

respondents who have used the Al-Rahn for the first time. The questions asked were: (i) purpose

of using the Al-Rahn services, (ii) duration of utilization of the Al-Rahn services, (iii) sufficiency

of the funds obtained, (iv) sufficiency of the duration for each schedule, (v) consideration of

using other services to replace Al-Rahn and (vi) the possibility of using Al-Rahn in the future.

The last section gathers respondents demographic profile i.e. race, gender, age, occupation and

income. The framework of the questionnaire is as below:

Al-Rahn Needs Fulfillment

Target Group Socio-economic Profile

1.

2.

3.

4.

5.

Purpose of borrowing

Loan sufficiency for each schedule

Duration sufficiency for each schedule

Use of alternative borrowing channel

Probability of replacing Al-Rahn with other borrowing

channel

6. Probability of repeat /future use of Al-Rahn

1. Age

2. Race

3. Gender

4. Occupation

5. Income Bracket

Effectiveness of Al-Rahn on Socio-Economic Needs

4. Results and Discussions

4.1 Utilization of the Al-Rahn Services

A total of 128 respondents participated in this research from Kuantan and Kuala

Terengganu. 70% of the respondents said that they used Al-Rahn services more than once or

multiple times while 30% were first time users of the Al-Rahn services. This suggests that for

those who have used Al-Rahn services before they came back and used the service repeatedly for

their needs.

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

895

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

4.2 Purpose of Using Al-Rahn Services

With respect to the purpose of borrowing through Al-Rahn among respondents, about

42%, which is nearly half of the respondents used Al-Rahn services for the purpose of obtaining

capital for their business which are mainly working capital in helping to ease their cash flow.

The other half of the respondents used Al-Rahn in period of needs. About 30% of the

respondents used Al-Rahn to obtain cash for their daily expenses, while 11% obtained it to meet

up with situations of emergency cash demand. Parents also constituted another 11% that utilized

Al-Rahn for the settlement of childrens school fees. The remaining 9% of respondents stated

miscellaneous reasons for using Al-Rahn.

4.3 Duration of Al-Rahn Loan

The duration of Al-Rahn loan tenure was evaluated to verify whether the objective of AlRahn services i.e. short term borrowing or financing is actually fulfilled. The survey revealed

that the most popular duration of borrowing is 6-7 months; this is about 51% of the sample

collected, followed by 2-3 months duration of borrowing (22%). As a matter of fact, 90% of the

transactions fell below seven months duration. Therefore, it could be concluded that Al-Rahn

actually met its objective in terms of short term funding/borrowing.

4.4 Sufficiency of Al-Rahn Loan Duration (tenure)

Findings revealed that loan extension periods are at times required by customers. About

9.6% of the Al-Rahn customers responded that the loan duration is insufficient i.e. they requested

for the loan period to be extended. However, the statistics show that the majority of the Al-Rahn

customers do not require the loan period to be extended which might suggest that they are aware

of the length of loan period that they require and they are able to pay it off to redeem their

collateral within the 6-month periods.

4.5 Sufficiency of the Loan Amount

Regarding sufficiency of the loan amount, majority of the respondents claimed that the

amount obtained from their Al-Rahn loan is sufficient to meet their purpose of borrowing.

However, there is a small percentage amounting to 11% who claimed that the amount is

insufficient. The research included a question to obtain further information from respondents

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

896

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

who claimed the loan amount was insufficient to their needs. The question was, Did you use

any other services to obtain additional money to make up for the insufficiency? The responses

were that despite the insufficiency, only 15% claimed that they used other services to get money

to make up for the insufficiency.

4.6 Intention to Replacement of Al-Rahn Services with other Loan Services

In order to evaluate respondents loyalty towards Al-Rahns services, a question was

raised as to whether they would replace Al-Rahn services with some other loan services in future.

The findings strongly suggested that the loyalty level for Al-Rahn services is high. That is only

15% of the respondents claimed they will use other loans in replacement of Al-Rahn service.

However, they do not have any particular loan service in mind that they will use in the future

except for only two respondents who mentioned that they would use loan services of Bank Islam

and Bank Muamalat.

4.7 Probability of Using Al-Rahn in the Future

In the previous question which showed high loyalty level towards Al-Rahn is further

confirmed by another question posted to them on the probability of repeated use of Al-Rahn in

the future. Only 1% claimed that they will definitely not use Al-Rahn services in the future,

while a high percentage, 93%, showed interest in future use. This fact suggested high loyalty and

repeated use of Al-Rahn services by those who have used this service before.

4.8 Demographics Profile of Al-Rahn Customers

This section of the report focused on the demographic profile of Al-Rahn users in order to

understand the socio-economic background of the people. The demographic data gathered are

ethnicity, gender, age, education level, occupation and household income bracket.

4.8.1 Ethnicity

Analysis revealed that about 92% of the 128 respondents are Malays. However, given the

population mix of the two geographical areas in this research, i.e. Kuantan which is situated in

Pahang with a total Malay population of 70% (Population and Housing Census, 2010) and Kuala

Terengganu which is situated in the state of Terengganu with the Malay population of 95%

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

897

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

(Population and Housing Census, 2010) the ethnic composition of the respondents is skewed

towards the total population spread since the sampling method of this research is by random

sampling.

Besides the argument above suggesting the possibility of the predominantly Malay based

geographical areas where this research was conducted resulting from a high usage of Al-Rahn

among the Malays, a discussion on ethnic awareness on Islamic pawn broking research

(Apennine & Doris, 2011) in Sg. Petani, Kedah, which also has a high percentage of Malay

population suggested there was no issue of unawareness of Islamic pawn broking among the

Chinese which might lead to low usage of Al-Rahn. The research indicated that 78% of Chinese

respondents were aware of Islamic pawn broking.

To further strengthen the findings of this study in relations to the ethnic composition of

Al-Rahn customers, a study carried out by Abdul Razak (2011) revealed that among the 311

respondents from three main regions of Peninsula Malaysia (Northeast, Central and Southern)

more than 90% of the respondents were Malays, where Malays show preference to Islamic pawn

broking shops as opposed to conventional pawnshops.

.

4.8.2 Gender Mix of Al-Rahn Customers

Majority of Al-Rahn consumers (70%) are predominantly female. Findings further

revealed that housewives constituted 25% of Al-Rahn customers.

It is also worth to note that

among the female Al-Rahn customers, 48% came from households where the income is

RM2,000 and below. Also, around 30% of the female respondents ran their own businesses using

Al-Rahn services. The findings in this study slightly differ from that of Abd. Hamid and Abdul

Aziz (2003), which was conducted in Kelantan based on 267 respondents, showed that customers

from institutional Al-Rahn spread equally well among male and female.

The domination of the female over the male Al-Rahn customers may not be unconnected

with the fact that most females often use and store gold jewelries as compared to the males,

whereas, it is the gold that is being used as collateral in Al-Rahn transactions.

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

898

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

4.8.3 Al-Rahn Customers Occupations

In terms of occupation breakdown among Al-Rahn customers, those who run their own

businesses constituted the highest percentage i.e. 37%, as compared to other varying

occupations. As indicated earlier, the introduction of Islamic pawn broking in Malaysia is seen as

a new micro credit instrument, as it provides financial supports for the lower income group and

small business owners (Bashir et al., 2012). This is an indication therefore, that the objective of

establishing Al-Rahn is met. The second largest percentage of occupation is made up of

housewives (25%), while those working in the private and government establishments

constituted 18 and 14 percentages respectively.

4.8.4 Household Income Level of Al-Rahn Customers

Majority of Al-RahnAl-Rahn customers (48%) fell under the lower household income

bracket of RM2000 and below. 26% of customers household income are between RM2001 to

RM3000, while 25% customers household income are between RM3001 to RM4000 and above.

This shows that 51% of the customers are from income bracket of RM2001 to RM4000.

4.8.5 Education Level of Al-Rahn Customers

More than half of Al-Rahn customers (54%) completed secondary school level of

education, while 31% had tertiary education qualifications.

4.8.6 Age Bracket of Al-Rahn Customers

About 81% of Al-Rahn customers fell within the employable age of 19-49 years old with

the majority (57%) within the 19-39 years old age bracket. The remaining 19% are those whose

age fell under 18 years old. The Al-Rahn services provided by organizations such as Bank

Rakyat, requires that a customer must be 18 years old. The overall findings of this study

suggested that based on the current profile of Al-Rahn customers, this ar-rahnu service is able to

meet their needs and requirements in terms of short term borrowings and hence enhance the

socio-economic development of its customers. However, further study could be made to extend

Al-Rahn services to other people from a more diverse background.

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

899

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

In the process of analysis, the first section measures the technical features of Al-Rahn in

terms of the purpose of customers borrowings, duration of borrowing, sufficiency of loan tenure

and loan amount. It was found that Al-Rahn is effective in meeting socio-economic needs of

customers. The survey results also show that majority of customers are repeat customers of AlRahn i.e. they have used Al-Rahn before and came back again to make loans with Al-Rahn. At

the same time, among early institutions that provided Islamic pawn broking services such as

MGIT with the objective to provide immediate financing to assist individuals in overcoming

cash flow needs, was also met. It is evident from the results that around half of the respondents

use Al-Rahn as a platform to obtain capital for their businesses. At the same time, Al-Rahn act as

a means to reduce their burden when faced with emergencies and incidences that require extra

cash.

In terms of borrowing duration, customers use Al-Rahn to obtain short term borrowings

where the majority of customers borrowing tenure are under 7 months. However, Al-Rahn has

the flexibility to extend the borrowing tenure in cases where customers were unable to settle their

loans within the stipulated initial agreement tenure. This is definitely a feature that is most

welcomed by customers.

The majority of customers also claimed that the loan amount that they obtained from AlRahn is sufficient for their needs and they do not go to other sources to get additional funds.

Customers also display high loyalty towards Al-Rahn as most of them claimed that they will use

Al-Rahn in the future and they do not have any intention to replace Al-Rahn with other services

or have any other financial institutions in mind for small short term borrowings.

A further analysis of the customer profile strongly shows that Al-Rahn is mostly used by

Malays, although there is a small percentage of Chinese who also used Al-Rahn services but

none at all among Indians. Although this research covers areas dominated by the Malays in

terms of population, previous research works on Islamic pawn broking, revealed that high level

of awareness of Islamic pawn broking among the Chinese, does not influence a high use of AlRahn among them (Apennine & Doris, 2011; Skully, 2005). Similarly, Al-Rahn is observed to

be more popular among those who are in the active working age bracket of 19-49 years old to

fulfill more demanding life commitments as opposed to the younger or the older income groups.

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

900

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Those who ran their own businesses show higher inclination to use Al-Rahn as a platform

to obtain capital for their businesses. Al-Rahn borrowing terms which do not require any

guarantor, fast or almost immediate disbursement of loans with very little documentation

requirement makes Al-Rahn a popular financial institution among them. At the same time, the AlRahn feature which usually accepts only gold items or jewelries makes it popular among

housewives as a means to obtain cash in times of need since they have at hand, the collateral to

make an Al-Rahn loan.

5. Conclusions

The findings from this study implies that the community, especially the Malay ethnicity

found Al-Rahn to be able to fulfill their needs for fast and hassle free way of obtaining small

short term loans, hence providing loyalty to Al-Rahn. The perceived limitations to this study is

the geographical areas used for sampling, which are both predominantly high in Malay

population and within the east coast geographical areas where Al-Rahn is known to be a popular

source of micro financing among the population there. Hence, it will do good to conduct a

similar form of study in other geographical areas in Malaysia to get a full picture of the

effectiveness of Al-Rahn on socio-economic needs of the people. The promotional mix of

advertising, public relations, sales promotions, personal selling and social media are all

important instruments to be adopted in marketing Al-Rahn services to the general public (Mc

Daniel, 2013) . According to Sam, the desired ultimate responses from the target market are the

purchase of the service of Al-Rahn, high satisfaction with the service and favorable word of

mouth among customers. He recommended that awareness and knowledge on the services of AlRahn be enhanced. Linking the target customers to Al-Rahn is important because there are those

who feel shy to deal with Al-Rahn. Preference and conviction over other similar financial

services will encourage more customers to doing business with Al-Rahn (Sam et al., 2010).

REFERENCES

Abd. Hamid, S and Abdul Aziz, A. (2003). Development of Islamic Pawn-broking Services:

Differentiating Profiles of Their Respective Patrons. International Islamic Conference

2003. (n.d.).

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

901

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Abdul Razak, A. (2004). Malaysian Practise of Al-Rahn Scheme: Trends and Developmen.

Paper presented at Conference on Malaysian Study of Islam, Lampeter, United Kingdom,

28-29 June 2004. (n.d.).

Abdul Razak, A. (2011). Economic and Religious Significance of the Islamic and Conventional

Pawnbroking in Malaysia. Paper as thesis submitted in fulfillment of the requirements for

the degree of Doctor of Philosophy at Durham University. (n.d.).

Al-Quran. Surah An-Nisa verse 161.

Appannan and Doris. (2011). AIMST University: A Study on Islamic Pawn Broking Awareness

and Factors Influencing the Scheme in Sg. Petani Kedah. (n.d.).

Bashir, A, Norudin, M, A.Nurul, N. (2012). Customer Acceptance on Islamic Pawnbroking: A

Malaysian Case. (n.d.).

Bhatt, P. & Sinnakkannu, J. (2008), Ar-Rahnu (Islamic Pawn Broking) Opportunities and

Challenges in Malaysia, in 6th International Islamic Finance Conference 2008, Monash

University, Sunway Campus, Malaysia.

Cheong, C and Sinnakkannu, J (2012) Monash University Sunway Campus Al-Rahn:

Opportunities and Challenges in Malaysia. (n.d).

Hanudin Amin, Rosita Chong, Dahlan & Supinah (2007), Ar Rahnu Shop Acceptance Model.

Labuan e-Journal of Muamalat. 1, 82-94.

Hisham, S., Abdul Shukor, S., Ummi Salwa, A.B., Jusoff, K.

(2013). The Concept and

Challenges of Islamic Pawn Broking (Al-Rahn). (n.d).

Institute of Islamic Banking and Insurance (2015). Islamic Economics. (n.d.).

Majlis Agama Islam dan Adat Melayu Terengganu (2012). Pengurusan Gadaian Islam [online].

Retrieved

from,

http://maidam.terengganu.gov.my/maxc2020/agensi/article2.php?2&aid=2422. (n.d.).

Maybank2u.com (2015). May bank Islamic Personal Financing-I (MIPF-I) (n.d)

Mc Daniel, C, Lamb, C and Hair, J (2013). Introduction to Marketing. (n.d).

Mohamad Shukri, Nur Azura, Mohamed Ishak ( 2008). (n.d.).

Mohd Ali, B. (2005). A New Era in Microfinance in Malaysia. Retrieved

from:

http//www.pptsearch.net/tag/al-Rahn-a-new-era-in-Malaysia. (n.d.).

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

902

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Population Distribution and Basic Demographics Characteristics (2010): Population and Housing

Census Malaysia. (n.d.).

Sam, M.F, Tahir, M.N.H, Latif, N.K (2010) The Awareness and the Acceptance of Islamic

Pawnshops. (n.d.).

Selama Maamor & Abdul Gafar, (2006), Micro Credit Program: Pawnshop vs. Ar-Rahn in

Working paper in Islamic Economics and Finance, No. 0609, Faculty of economics,

UKM,

Skully, M.S. (2005). Islamic Pawnbroking: The Malaysian Experience. Paper presented at the

3rd International Islamic Banking and Finance Conference 2005. (n.d.).

2015 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/PEOPLE/people.html

903

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Analyzing The Relationship Between Industrial Policy and Entrepreneurial EcosystemDocument13 pagesAnalyzing The Relationship Between Industrial Policy and Entrepreneurial EcosystemGlobal Research and Development ServicesNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Resolving A Realistic Middle Ground Towards The Sustainability Transition in The Global Political and Economic Landscape: A Comprehensive Review On Green CapitalismDocument29 pagesResolving A Realistic Middle Ground Towards The Sustainability Transition in The Global Political and Economic Landscape: A Comprehensive Review On Green CapitalismGlobal Research and Development ServicesNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Ethical Perception On Utang Na Loob As Basis of Voter's ChoiceDocument18 pagesThe Ethical Perception On Utang Na Loob As Basis of Voter's ChoiceGlobal Research and Development Services100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Examine The Effects of Goods and Services Tax (GST) and Its Compliance: Reference To Sierra LeoneDocument18 pagesExamine The Effects of Goods and Services Tax (GST) and Its Compliance: Reference To Sierra LeoneGlobal Research and Development ServicesNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Interpretation and Justification of Rules For Managers in Business Organizations: A Professional Ethics PerspectiveDocument10 pagesInterpretation and Justification of Rules For Managers in Business Organizations: A Professional Ethics PerspectiveGlobal Research and Development ServicesNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Perceived Self-Efficacy and Academic Performance of Stem Senior High School StudentsDocument13 pagesPerceived Self-Efficacy and Academic Performance of Stem Senior High School StudentsGlobal Research and Development ServicesNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Design and Implementation of An Arabic Braille Self-Learning WebsiteDocument17 pagesDesign and Implementation of An Arabic Braille Self-Learning WebsiteGlobal Research and Development ServicesNo ratings yet

- Effect of Metacognitive Intervention Strategies in Enhancing Resilience Among Pre-Service TeachersDocument12 pagesEffect of Metacognitive Intervention Strategies in Enhancing Resilience Among Pre-Service TeachersGlobal Research and Development ServicesNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Potential Factors Influence Failure of The Village-Owned Business: The Entity Village Autonomy of Indonesian Government's ProgramDocument12 pagesPotential Factors Influence Failure of The Village-Owned Business: The Entity Village Autonomy of Indonesian Government's ProgramGlobal Research and Development ServicesNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Refining The English Syntax Course For Undergraduate English Language Students With Digital TechnologiesDocument19 pagesRefining The English Syntax Course For Undergraduate English Language Students With Digital TechnologiesGlobal Research and Development ServicesNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Challenges in The Implementation of Schoolbased Management of Developing Schools: Basis For A Compliance FrameworkDocument14 pagesChallenges in The Implementation of Schoolbased Management of Developing Schools: Basis For A Compliance FrameworkGlobal Research and Development ServicesNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Teacher Educators' Perceptions of Utilizing Mobile Apps For English Learning in Secondary EducationDocument28 pagesTeacher Educators' Perceptions of Utilizing Mobile Apps For English Learning in Secondary EducationGlobal Research and Development ServicesNo ratings yet

- Global E-Learning and Experiential Opportunities For Programs and StudentsDocument12 pagesGlobal E-Learning and Experiential Opportunities For Programs and StudentsGlobal Research and Development ServicesNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Loss Analysis in Bread Production Process Using Material Flow Cost Accounting TechniqueDocument16 pagesLoss Analysis in Bread Production Process Using Material Flow Cost Accounting TechniqueGlobal Research and Development ServicesNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Influence of Iot On Smart LogisticsDocument12 pagesInfluence of Iot On Smart LogisticsGlobal Research and Development ServicesNo ratings yet

- Bank-Specific and Macroeconomic Determinants of Banks Liquidity in Southeast AsiaDocument18 pagesBank-Specific and Macroeconomic Determinants of Banks Liquidity in Southeast AsiaGlobal Research and Development ServicesNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Using Collaborative Web-Based Maps To Promote Geography Teaching and LearningDocument13 pagesUsing Collaborative Web-Based Maps To Promote Geography Teaching and LearningGlobal Research and Development ServicesNo ratings yet

- Investigating The Effects of Social Media On The Well-Being of TeenagersDocument18 pagesInvestigating The Effects of Social Media On The Well-Being of TeenagersGlobal Research and Development ServicesNo ratings yet

- The Development of Nursing Care Model in Patients With Total Knee Replacement Reconstructive SurgeryDocument17 pagesThe Development of Nursing Care Model in Patients With Total Knee Replacement Reconstructive SurgeryGlobal Research and Development ServicesNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Global E-Learning and Experiential Opportunities For Programs and StudentsDocument12 pagesGlobal E-Learning and Experiential Opportunities For Programs and StudentsGlobal Research and Development ServicesNo ratings yet

- Implementation of Biorhythm Graph With Trigonometric Functions Using PythonDocument8 pagesImplementation of Biorhythm Graph With Trigonometric Functions Using PythonGlobal Research and Development ServicesNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Review of Vibration-Based Surface & Terrain Classification For Wheel-Based Robot in Palm Oil PlantationDocument14 pagesReview of Vibration-Based Surface & Terrain Classification For Wheel-Based Robot in Palm Oil PlantationGlobal Research and Development ServicesNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Study of Urban Heat Island in Yogyakarta City Using Local Climate Zone ApproachDocument17 pagesStudy of Urban Heat Island in Yogyakarta City Using Local Climate Zone ApproachGlobal Research and Development ServicesNo ratings yet

- Thai and Non-Thai Instructors' Perspectives On Peer Feedback Activities in English Oral PresentationsDocument22 pagesThai and Non-Thai Instructors' Perspectives On Peer Feedback Activities in English Oral PresentationsGlobal Research and Development ServicesNo ratings yet

- Leadership Initiative To Enrich The Hiv/aids Education For Senior High SchoolsDocument21 pagesLeadership Initiative To Enrich The Hiv/aids Education For Senior High SchoolsIshika JainNo ratings yet

- How Bi-Lingual Fathers Support Their Children To Learn Languages at HomeDocument35 pagesHow Bi-Lingual Fathers Support Their Children To Learn Languages at HomeGlobal Research and Development ServicesNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Development of A Topical Gel Containing A Dipeptidyl Peptidase-4 Inhibitor For Wound Healing ApplicationsDocument15 pagesDevelopment of A Topical Gel Containing A Dipeptidyl Peptidase-4 Inhibitor For Wound Healing ApplicationsGlobal Research and Development ServicesNo ratings yet

- Work-Related Problems and Performance Level of Senior High School TeachersDocument22 pagesWork-Related Problems and Performance Level of Senior High School TeachersGlobal Research and Development ServicesNo ratings yet

- The Knowledge-Sharing Culture in An Operational Excellence Plant As Competitive Advantage For Forward-Thinking OrganizationsDocument17 pagesThe Knowledge-Sharing Culture in An Operational Excellence Plant As Competitive Advantage For Forward-Thinking OrganizationsGlobal Research and Development ServicesNo ratings yet

- The Hijiri Calendar and Its Conformance With The Gregorain Calendar by Mathematical CalculationsDocument19 pagesThe Hijiri Calendar and Its Conformance With The Gregorain Calendar by Mathematical CalculationsGlobal Research and Development ServicesNo ratings yet

- Unit 4.2Document69 pagesUnit 4.2ainhoa cNo ratings yet

- Y4A Practice Book Answers White Rose Maths EditionDocument20 pagesY4A Practice Book Answers White Rose Maths EditionNgọc YếnNo ratings yet

- Philippine Cartoons: Political Caricatures of the American EraDocument27 pagesPhilippine Cartoons: Political Caricatures of the American EraAun eeNo ratings yet

- Onagolonka CV WeeblyDocument2 pagesOnagolonka CV Weeblyapi-247895223No ratings yet

- 6000 EN 00 04 Friction PDFDocument30 pages6000 EN 00 04 Friction PDFM Ferry AnwarNo ratings yet

- CH 05 Wooldridge 5e PPTDocument8 pagesCH 05 Wooldridge 5e PPTMomal IshaqNo ratings yet

- UntitledDocument23 pagesUntitledjaanharafNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Employee Evaluation Form SummaryDocument3 pagesEmployee Evaluation Form SummaryRahmatur RizalNo ratings yet

- Chapter 05Document65 pagesChapter 05Tony DiPierryNo ratings yet

- EBM CasesDocument1 pageEBM CasesdnaritaNo ratings yet

- EUROPEAN LAW: HISTORY AND INSTITUTIONSDocument32 pagesEUROPEAN LAW: HISTORY AND INSTITUTIONSDavidNo ratings yet

- Jamanisal 2015 4 1 5 PDFDocument7 pagesJamanisal 2015 4 1 5 PDFDuge AnggrainiNo ratings yet

- Lesson 4-The Taximan StoryDocument3 pagesLesson 4-The Taximan StoryZian Tallongon100% (2)

- Self DayaoskiiiDocument5 pagesSelf DayaoskiiiJoan Tabuena100% (1)

- IMC PlanDocument6 pagesIMC PlanRizwan Ahmed KhanNo ratings yet

- Tijing Vs CA DigestDocument1 pageTijing Vs CA DigestLeo GuillermoNo ratings yet

- Eating Disorders Reading AssignmentDocument2 pagesEating Disorders Reading AssignmentNasratullah sahebzadaNo ratings yet

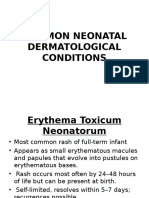

- Common Neonatal Dermatological ConditionsDocument27 pagesCommon Neonatal Dermatological ConditionsArslan SiddiquiNo ratings yet

- A Case Study of A Turnaround PrincipalDocument7 pagesA Case Study of A Turnaround PrincipalReynante Roxas MalanoNo ratings yet

- Architecture Statement of PurposeDocument4 pagesArchitecture Statement of PurposeAZAR HOSNo ratings yet

- OMCC Board ResolutionDocument1 pageOMCC Board ResolutionOrient MansionNo ratings yet

- MSI Privacy Policy - EnglishDocument11 pagesMSI Privacy Policy - Englishojik31No ratings yet

- Ks3 Mathematics 2009 Level 3 5 Paper 2Document28 pagesKs3 Mathematics 2009 Level 3 5 Paper 2spopsNo ratings yet

- Notes in Readings in Philippine History: Act of Proclamation of Independence of The Filipino PeopleDocument4 pagesNotes in Readings in Philippine History: Act of Proclamation of Independence of The Filipino PeopleAiris Ramos AgillonNo ratings yet

- Plunket, Patricia (Editora) - Domestic Ritual in Ancient Mesoamerica PDFDocument148 pagesPlunket, Patricia (Editora) - Domestic Ritual in Ancient Mesoamerica PDFJesus CaballeroNo ratings yet

- Old English Rune Poem PDFDocument156 pagesOld English Rune Poem PDFGus Soria Castellón100% (1)

- A. Two Subsequences: Codeforces Round #751 (Div. 2)Document4 pagesA. Two Subsequences: Codeforces Round #751 (Div. 2)Trần Nhật KhánhNo ratings yet

- Guia Presente Perfecto (Sin Have Been)Document8 pagesGuia Presente Perfecto (Sin Have Been)Nataly BarreraNo ratings yet

- Online: ExistDocument16 pagesOnline: Existjyjc_admNo ratings yet

- Jopillo Vs PeopleDocument1 pageJopillo Vs PeopleivybpazNo ratings yet

- Learn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIFrom EverandLearn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIRating: 5 out of 5 stars5/5 (1)

- The Designer’s Guide to Figma: Master Prototyping, Collaboration, Handoff, and WorkflowFrom EverandThe Designer’s Guide to Figma: Master Prototyping, Collaboration, Handoff, and WorkflowNo ratings yet

- Excel Essentials: A Step-by-Step Guide with Pictures for Absolute Beginners to Master the Basics and Start Using Excel with ConfidenceFrom EverandExcel Essentials: A Step-by-Step Guide with Pictures for Absolute Beginners to Master the Basics and Start Using Excel with ConfidenceNo ratings yet

- How to Create Cpn Numbers the Right way: A Step by Step Guide to Creating cpn Numbers LegallyFrom EverandHow to Create Cpn Numbers the Right way: A Step by Step Guide to Creating cpn Numbers LegallyRating: 4 out of 5 stars4/5 (27)

- Mastering YouTube Automation: The Ultimate Guide to Creating a Successful Faceless ChannelFrom EverandMastering YouTube Automation: The Ultimate Guide to Creating a Successful Faceless ChannelNo ratings yet

- Skulls & Anatomy: Copyright Free Vintage Illustrations for Artists & DesignersFrom EverandSkulls & Anatomy: Copyright Free Vintage Illustrations for Artists & DesignersNo ratings yet