Professional Documents

Culture Documents

ProductBrochure Score 2.0

Uploaded by

angelamonteiro12340 ratings0% found this document useful (0 votes)

19 views1 pagehelps us to know cibil product brochure

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthelps us to know cibil product brochure

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 pageProductBrochure Score 2.0

Uploaded by

angelamonteiro1234helps us to know cibil product brochure

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

The new CIBIL TransUnion Score 2.

Predict risk more powerfully with the

score customized for the changing

Indian market

The CIBIL TransUnion Score has become the

Better, more strategic decisions about

Easy access

industry standard for credit decisioning, widely

applicants and customers

used by most leading lenders in India to make

The CIBIL TransUnion Score 2.0 enables

lenders to improve the quality of decisions

throughout the customer lifecycle. At the

point of new applications, its a crucial tool

for approving credit and defining credit terms.

The Score allows for more effective collections,

improved cross sales and superior risk

management. It has also been proven

to help lenders automate processes and

make faster, sounder decisions. Its of

benefit to consumers also, who may access

the Score to discover their credit standing,

or when seeking credit.

The CIBIL TransUnion Score 2.0 is accessible

across all channels, including web, online

and FTP. Its available with CIBIL Credit

Information Reports, CIBIL Portfolio Review

Reports, or CIBIL TransUnion Bureau Credit

Characteristics.

objective, fast and reliable credit decisions.

CIBIL TransUnion Score 2.0, the latest release

of the credit score from CIBIL and TransUnion,

is an even better and stronger predictor of risk,

helping you make the right credit decisions with

greater confidence.

The new, updated CIBIL TransUnion Score 2.0

helps you score more customers with greater

accuracy, is built on more recent and richer

credit history data, takes changing consumer

profiles into account, and is a more accurate

and effective predictor of risk.

Harnessing the power of global capabilities

Since its launch in 2007, the CIBIL

TransUnion Score has been a vital component

of the credit risk management processes of

the largest lenders in the country. By helping

them make reliable, confident decisions based

on robust data and objective analytics, the

Score enables more effective decision making

and superior business performance.

The Score is a dynamic number that is calculated

at the time a credit report is accessed and

represents an individuals credit behaviour.

The higher the numerical value of the Score,

the lower the risk profile of the individual.

Make objective risk decisions even for

borrowers with limited credit history

Score 2.0

CIBIL and TransUnion bring together data,

technology and an in-depth understanding

of your challenges to create advantages for

businesses, consumers and communities.

This powerful combination of information

and insight will help you make better decisions,

improve efficiency and identify opportunities

at every stage of your customer lifecycle

from acquiring customers to strengthening

and expanding your relationships with them.

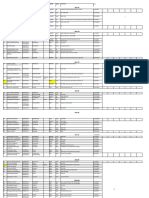

CIBIL TransUnion Score 2.0 performs better across all trades

CIBIL TransUnion Score 2.0 helps in better identification of high risk customers*

CURRENT CIBIL TRANSUNION SCORE

% Bads (Ever 90+) Identified

For consumers with a credit history of more

than six months, the CIBIL TransUnion Score

2.0 provides a value of 300 to 900. For

consumers with less than six months of credit

history, the CIBIL TransUnion Score 2.0

returns a numerical value of 1 to 5, helping

you classify new-to-credit customers as high,

medium or low risk. This allows you to

provide them with credit confidently, resulting

in inclusive financing for more people.

Achieve more with the CIBIL TransUnion

CIBIL TRANSUNION SCORE 2.0

100%

80%

+9%

+7%

+10%

60%

40%

20%

CIBIL TransUnion Score 2.0 will help

you in improving the quality of credit

decisions by enabling you to identify a

greater number of high risk customers

in the lower score bands.

0%

<20%

<30%

<40%

* based on a study of CIBIL random sample

% Lowest Scoring Consumers

To learn how you can benefit from the CIBIL TransUnion Score 2.0, please contact:

CIBIL:

TransUnion:

Tel: +91 22 6638 4700

Tel: +91 22 3086 9600

Email: mona@cibil.com

Email: mbhanot@transunion.com

2012 TransUnion LLC

All rights reserved

TransUnion Software Services Pvt. Ltd.

Peninsula Corporate Park,

702, 7th floor, Piramal Tower,

Ganpatrao Kadam Marg,

Lower Parel, Mumbai 400013

E-mail: mjain@transunion.com /

mbhanot@transunion.com

Tel: +91 22 3086 9600

You might also like

- Mein Kampf Guide PDFDocument79 pagesMein Kampf Guide PDFangelamonteiro1234No ratings yet

- 2016-NISM Series V-B - Mutual Fund Foundation-New WorkbookDocument136 pages2016-NISM Series V-B - Mutual Fund Foundation-New Workbookangelamonteiro1234No ratings yet

- BookingSummary PDFDocument1 pageBookingSummary PDFangelamonteiro1234No ratings yet

- Finance ConceptsDocument16 pagesFinance Conceptsangelamonteiro1234No ratings yet

- Technical Analysis Indicators 2Document53 pagesTechnical Analysis Indicators 2angelamonteiro1234100% (1)

- SIP 4th Sem AngelaDocument27 pagesSIP 4th Sem Angelaangelamonteiro1234No ratings yet

- Consumer Behaviour Towards The Retail Footwear Industry: A Project Report OnDocument27 pagesConsumer Behaviour Towards The Retail Footwear Industry: A Project Report Onangelamonteiro1234No ratings yet

- Mein Kampf Guide PDFDocument79 pagesMein Kampf Guide PDFangelamonteiro1234No ratings yet

- SIP 4th Sem MBA ProjectDocument9 pagesSIP 4th Sem MBA Projectangelamonteiro1234No ratings yet

- 9 Texts Matt HusseyDocument5 pages9 Texts Matt HusseyLavinia Munteanu71% (14)

- Changing Trends in Life InsuranceDocument10 pagesChanging Trends in Life Insuranceangelamonteiro1234No ratings yet

- Existing and New Score Mapping: 300 To 900: 1 To 5: - 1Document1 pageExisting and New Score Mapping: 300 To 900: 1 To 5: - 1angelamonteiro1234No ratings yet

- Su-Kam: Journey of Innovation BreakthroughsDocument6 pagesSu-Kam: Journey of Innovation Breakthroughsangelamonteiro1234No ratings yet

- Technical Analysis Indicators 2Document53 pagesTechnical Analysis Indicators 2angelamonteiro1234100% (1)

- Gopal's Kitchen: Benefits of Sattvik Food Increases Your Intelligence Pleasing To Heart Increases Your Bodily StrengthDocument1 pageGopal's Kitchen: Benefits of Sattvik Food Increases Your Intelligence Pleasing To Heart Increases Your Bodily Strengthangelamonteiro1234No ratings yet

- Topics On Banking & InsuranceDocument1 pageTopics On Banking & Insuranceangelamonteiro1234No ratings yet

- GFMP Sem 3 Session 10 - Basel NormsDocument46 pagesGFMP Sem 3 Session 10 - Basel Normsangelamonteiro1234No ratings yet

- Content ServerDocument5 pagesContent Serverangelamonteiro1234No ratings yet

- Content ServerDocument12 pagesContent Serverangelamonteiro1234No ratings yet

- Angela SmeDocument2 pagesAngela Smeangelamonteiro1234No ratings yet

- Modelling in Manufacturing Industry paraDocument34 pagesModelling in Manufacturing Industry paraangelamonteiro1234No ratings yet

- Tech RequirementsDocument3 pagesTech Requirementsangelamonteiro1234No ratings yet

- ContentServer PDFDocument6 pagesContentServer PDFangelamonteiro1234No ratings yet

- OptionsDocument3 pagesOptionsangelamonteiro1234No ratings yet

- ConsumerInformationReport-TrainingGuide CIBILDocument15 pagesConsumerInformationReport-TrainingGuide CIBILangelamonteiro1234No ratings yet

- Consumer Behaviour Footwear IndustryDocument15 pagesConsumer Behaviour Footwear IndustryGuru Katz0% (1)

- Experiential MarkatingDocument4 pagesExperiential Markatingangelamonteiro1234No ratings yet

- By Dr. Shyamalee Sinha: Group DiscussionDocument8 pagesBy Dr. Shyamalee Sinha: Group Discussionangelamonteiro1234No ratings yet

- Msme Policy 2014Document13 pagesMsme Policy 2014HemanthKumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chat group discusses joining details for new roleDocument106 pagesChat group discusses joining details for new rolejigarsampat0% (1)

- Bom Cno175925Document15 pagesBom Cno175925Yuvraj BappiNo ratings yet

- Mev Spider: Do Not Throw AwayDocument20 pagesMev Spider: Do Not Throw Awayhappysmiles44No ratings yet

- What Is A SatelliteDocument2 pagesWhat Is A SatelliteTeferi LemmaNo ratings yet

- Service Copy NewDocument86 pagesService Copy NewSKS MOTERS DEVARA HIPPARGINo ratings yet

- Lesson Plan in Aquaculture Ncii (Afa)Document3 pagesLesson Plan in Aquaculture Ncii (Afa)Adam WareNo ratings yet

- Spring Biochem Offer LetterDocument3 pagesSpring Biochem Offer LetterRocky RayNo ratings yet

- Proserv Type 5 10k 700cc PDFDocument1 pageProserv Type 5 10k 700cc PDFRefisal BonnetNo ratings yet

- Red Taction PPTDocument21 pagesRed Taction PPTRam VBIT100% (3)

- Batangas CATV Vs CADocument10 pagesBatangas CATV Vs CAMary Joyce Lacambra AquinoNo ratings yet

- 2010-2011 CatalogDocument378 pages2010-2011 CatalogHouston Community College91% (43)

- Current Affairs 2016 PDF Capsule by AffairscloudDocument348 pagesCurrent Affairs 2016 PDF Capsule by Affairscloudrgs244No ratings yet

- Siemens Air Cooled Generators Sgen 1000a Brochure enDocument4 pagesSiemens Air Cooled Generators Sgen 1000a Brochure enmanohar_033No ratings yet

- Essay QuestionsDocument5 pagesEssay QuestionsMark Imperio100% (1)

- Handbook em Final EngDocument56 pagesHandbook em Final Engigor_239934024No ratings yet

- Presentation On Gravity DamDocument22 pagesPresentation On Gravity DamSarvesh Bhairampalli100% (2)

- Piping Class B31Document142 pagesPiping Class B31interx00No ratings yet

- Applied HarmonyDocument217 pagesApplied Harmonythared3367% (3)

- Imagery Lesson PlanDocument2 pagesImagery Lesson Planapi-264110277No ratings yet

- Automan AC and AF Series ASL 62 305 448 Ed.05Document393 pagesAutoman AC and AF Series ASL 62 305 448 Ed.05yhorsNo ratings yet

- B. B. ALE Department of Mechanical EngineeringDocument36 pagesB. B. ALE Department of Mechanical EngineeringRam Krishna SinghNo ratings yet

- Results of HFSS SimulatorDocument16 pagesResults of HFSS SimulatorQuang-Trung LuuNo ratings yet

- LTA Foods GMP Inspection ChecklistDocument5 pagesLTA Foods GMP Inspection ChecklistJon MarkNo ratings yet

- In Search of Air France Flight 447: Bipattaran MandalDocument40 pagesIn Search of Air France Flight 447: Bipattaran MandalRonyNo ratings yet

- Tetra Pak Homogenizer 500: Homogenizer or High Pressure Pump For Liquid Food ApplicationsDocument4 pagesTetra Pak Homogenizer 500: Homogenizer or High Pressure Pump For Liquid Food ApplicationsKhánh HồNo ratings yet

- 3GPP TS 22.368Document25 pages3GPP TS 22.368santanameroNo ratings yet

- Occupational Health and Safety Management A Practical Approach PDFDocument2 pagesOccupational Health and Safety Management A Practical Approach PDFLogan0% (1)

- Est 1Document1 pageEst 1kanak2No ratings yet

- Web App SuccessDocument369 pagesWeb App Successdoghead101No ratings yet

- Caro - Presentation of A CAA Formulation Based On Ligthills Analogy For Fan NoiseDocument10 pagesCaro - Presentation of A CAA Formulation Based On Ligthills Analogy For Fan Noiseruffnex_86No ratings yet