Professional Documents

Culture Documents

Notice To The Market

Uploaded by

Usiminas_RIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice To The Market

Uploaded by

Usiminas_RICopyright:

Available Formats

Usiminas Belo Horizonte

Rua Prof. Jos Vieira de Mendona, 3011

31310-260 Belo Horizonte MG

T 55 31 3499-8000

F 55 31 3499-8899

www.usiminas.com

USINAS SIDERRGICAS DE MINAS GERAIS S.A. - USIMINAS

CNPJ/MF 60.894.730/0001-05

NIRE 313.000.1360-0

Publicly Traded Company

NOTICE TO THE MARKET

Usinas Siderrgicas de Minas Gerais S.A. USIMINAS (Usiminas or Company), by its

Finances and Investors Relations Vice-President Officer undersigned, in attention to the

clarification request sent by the Comisso de Valores Mobilirios ("Securities Commission CVM"), hereby informs the following.

Initially, we inform that we make reference to the Notice n 157/2016-CVM/SEP/GEA-2,

received on May 24th, 2016, which is transcribed below:

Notice n 157/2016-CVM/SEP/GEA-2

Rio de Janeiro, May 24th, 2016.

To Mr.

Ronald Seckelmann

Investors Relations Officer of

USINAS SIDERRGICAS DE MINAS GERAIS S.A.-USIMINAS

Rua Prof. Jos Vieira de Mendona, 3011 - Engenho Nogueira

31310-260 - BELO HORIZONTE MG

Tel.: (31) 3499-8775 Fax: (31) 3499-8771

E-mail: dri@usiminas.com

C/C: gre@bvmf.com.br

Matter: Request of clarification about article published in the press

Dear Officer,

1. We refer to the article published on 05/24/2016, in the Valor

Econmico newspaper, Editora Empresas, under the title Ternium decide entrar

em capitalizao da Usiminas (Ternium decides to enter into the capitalization of

Usiminas), which contains the following information:

Usiminas Belo Horizonte

Rua Prof. Jos Vieira de Mendona, 3011

31310-260 Belo Horizonte MG

T 55 31 3499-8000

F 55 31 3499-8899

www.usiminas.com

The Italian-Argentine Group Ternium-Techint decided to participate in

the Usiminas Capital Increase to avoid the dilution of its equity in the

steelmaker company from Minas Gerais. In a Notice disclosed

yesterday, the holding company informed that its subsidiaries will stay

with 38.7 million ordinary shares in the transaction. At the price of R$5

each, the amount to be paid is of R$ 193.5 million.

Also in accordance with the notice, the companies Ternium, Siderar

and Prosid, in addition to subscribe the papers, manifested interest to

participate of potential apportionment of leftovers. The three holds

32.9% of the voting stock of Usiminas and 16.4% of the total. The

group also controls Confab, which holds 4.9% and 2.5%, respectively.

Tenaris, owner of Confab, also announced that stays with 5.1 million

shares or R$ 25.3 million ()

The capital increase was necessary for Usiminas to equilibrate its

accounts. If wasnt the transaction, the Companys cash would have

exhausted and it would not be able to honor with the short-term debt.

The nonpayment just not occurred due to an agreement of " standstill",

which freezes the payment of obligations.

Nippon Steel & Sumitomo Metal, which is part of the steelmaker's

controlling group along with Ternium-Techint and Previdncia

Usiminas, had told that it could subscribe the entire transaction if

necessary.

Companhia Siderrgica Nacional (CSN), which holds 14.1% of the

voting stock and 17.4% of the total of the competitor Usiminas, had

already deposited in court their part of the capitalization of R$ 178.8

million. The company, however, awaits trial to try to cancel the

transaction and Usiminas is not entitled to the amount until the merits

of the suit be decided. (...) "

2. In this regard, we request your position, about the veracity of the

information provided in the article, (in special about the highlight stretch) and, if it is

true, we ask statement about the measures that are being taken by the Company in

respect, as well as the reasons why it decided not to be matter of Material Fact,

pursuant to CVM Instruction 358/02.

3. Such statement shall be forwarded through the system

Empresas.Net, category: Notice to the Market, type: Clarifications on

Inquiries CVM/BOVESPA, subject: Article Published in the Press, which shall

include the copy of this Notice.

4. We emphasize that, pursuant to article 3 of the CVM Instruction

n 358/02, complies with the Investor Relations Officer to disclose and inform CVM

and, if applicable, the stock exchange and entity of the organized counter market in

which the securities issued by the company are admitted to trading any relevant act or

fact occurred or related to its business as well as ensure its wide and immediate

dissemination, simultaneously in all markets where such securities are admitted to

trading.

Usiminas Belo Horizonte

Rua Prof. Jos Vieira de Mendona, 3011

31310-260 Belo Horizonte MG

T 55 31 3499-8000

F 55 31 3499-8899

www.usiminas.com

5. We also remind of the obligation referred to in sole paragraph of

article. 4 of CVM Instruction 358/02, of inquiring managers and controlling

shareholders, in order to verify if they would have knowledge of any information that

should be disclosed to the market.

6. In addition, pursuant to the sole paragraph of article. 6 of CVM

Instruction 358/02, it is up to the controlling shareholders and the management,

directly or through the Investor Relations Officer, disclose immediately any relevant

act or fact occurred in case of the information escapes to the control or if there is an

atypical oscillation in the price or traded volume of securities issued by the publicly

traded company or referred thereto.

7. By order of the Superintendence of Corporate Relations SEP, we

warn that it will be up to this administrative authority in the exercise of its statutory

duties and, on the basis of section II of Article 9 of Law No. 6,385/1976, and Article 7

c/c of Article 9 of CVM Instruction 452/2007, to determine the application of injunction

fine of R$ 1,000.00 (one thousand reais), without prejudice to any possible verification

of responsibility for noncompliance to this Notice, also sent e-mail within one (1)

business day.

8. In case you have questions about this Notice, please contact the

analyst Jairo Corra de S, by phone (21) 3554-8216 or email jairo@cvm.gov.br.

Best regards,

Document digitally signed by Fernando D'Ambros Lucchesi, Acting Manager, on

05/24/2016, at 12:47PM, pursuant to article 1, III, "b", of Law n 11.419/2006.

In this regard, the Company hereby clarifies that took notice of the Notice disclosed by

Ternium S.A., in which it informs that the companies related to the Ternium/Techint Group

(including Ternium and Siderar, in addition to its wholly owned subsidiary Prosid) exercised

their preemptive right in the subscription of shares issued due to the Capital Increase of

Usiminas approved at the Extraordinary Shareholders Meeting of 04.18.2016 ("Capital

Increase"), as well as expressed interest in subscribe possible leftovers. According to the

abovementioned Notice, the Ternium/Techint Group subscribed 38.7 million common shares, in

the total amount of R$ 193.5 million.

Furthermore, the Company also took notice of Material Fact disclosed by Companhia

Siderrgica Nacional, in which it states that it and VR1 Fundo de Investimento Multimercado

(VR1), whose shares are held in their entirety by CSN, subscribed shares issued due to the

Capital Increase "at the limit of their preemptive right". The Company also confirms that the

amount related to the payment of shares by CSN and VR1 was object of deposit in court,

authorized by the judge of the 1st Business Court (Vara Empresarial) of Belo Horizonte - MG.

Usiminas Belo Horizonte

Rua Prof. Jos Vieira de Mendona, 3011

31310-260 Belo Horizonte MG

T 55 31 3499-8000

F 55 31 3499-8899

www.usiminas.com

In additional, the Company clarifies that hasnt received yet, from the financial depositary

institution of the book-entry shares issued by the Company, the complete information

regarding the subscription of new shares arising from the Capital Increase, which the term for

exercising the preemptive right ended on 05.23.2016. In this sense, as soon as such

information is provided by the depositary institution, the Company will promote the disclosure

of Notice to Shareholders regarding the procedures for the subscription of possible leftovers.

Belo Horizonte, May 25th, 2016

Ronald Seckelmann

Vice President of Finances and Investors Relations

You might also like

- Weidner - Fulcanelli's Final RevelationDocument22 pagesWeidner - Fulcanelli's Final Revelationjosnup100% (3)

- AP Macroeconomics Review Sheet 2013Document7 pagesAP Macroeconomics Review Sheet 2013Crystal Farmer100% (4)

- Battle of Five Armies - GW PDFDocument34 pagesBattle of Five Armies - GW PDFJustin Larson88% (17)

- SEC Manual On Registration of SecuritiesDocument10 pagesSEC Manual On Registration of SecuritiesGeoanne Battad Beringuela100% (1)

- The Ultimate Closed SicilianDocument180 pagesThe Ultimate Closed SicilianJorge Frank Ureña100% (4)

- Piano 2023 2024 Grade 6Document13 pagesPiano 2023 2024 Grade 6Lucas Moreira0% (1)

- This Study Resource Was: Management Consultancy June Dane Yuri D. Abieras BSA-5Document5 pagesThis Study Resource Was: Management Consultancy June Dane Yuri D. Abieras BSA-5Jicell FerrerNo ratings yet

- Highland GamesDocument52 pagesHighland GamesolazagutiaNo ratings yet

- NEW HOLLAND - Trucks, Tractor & Forklift Manual PDDocument14 pagesNEW HOLLAND - Trucks, Tractor & Forklift Manual PDAjjaakka0% (2)

- Francisco Motors Corporation Vs CA Case DigestDocument25 pagesFrancisco Motors Corporation Vs CA Case DigestCh YmnNo ratings yet

- Primanila Plans V SecDocument4 pagesPrimanila Plans V SecThameenah ArahNo ratings yet

- Hydraulic Design of Spillways - EM 1110-2-1603Document70 pagesHydraulic Design of Spillways - EM 1110-2-1603bdawgg100% (1)

- Customer Agreement 2Document16 pagesCustomer Agreement 2Hari Hari kumarNo ratings yet

- People Vs Que Po Lay DigestDocument4 pagesPeople Vs Que Po Lay DigestRoger Ranigo100% (1)

- Notice To The MarketDocument4 pagesNotice To The MarketUsiminas_RINo ratings yet

- Notice To MarketDocument4 pagesNotice To MarketUsiminas_RINo ratings yet

- Estacio Comunicado Resposta Ao Ofício CVM 05072016 enDocument4 pagesEstacio Comunicado Resposta Ao Ofício CVM 05072016 enEstacio Investor RelationsNo ratings yet

- 2021 Ad Vice SorryDocument4 pages2021 Ad Vice SorryWilhelmina EspejoNo ratings yet

- Material Fact - Shares AcquisitionDocument2 pagesMaterial Fact - Shares AcquisitionUsiminas_RINo ratings yet

- Estacio Comunicado Resposta Ao Oficio CVM 207 2016 30062016 EngDocument6 pagesEstacio Comunicado Resposta Ao Oficio CVM 207 2016 30062016 EngEstacio Investor RelationsNo ratings yet

- Notice To MarketDocument2 pagesNotice To MarketUsiminas_RINo ratings yet

- Notice To The MarketDocument2 pagesNotice To The MarketUsiminas_RINo ratings yet

- Primanila Plans Inc. v. SecuritiesDocument8 pagesPrimanila Plans Inc. v. SecuritiesArjayNo ratings yet

- Agreement For The Access To RMCDocument6 pagesAgreement For The Access To RMCYassin TamarNo ratings yet

- Sec Advisory: "NFP Investment Group"Document2 pagesSec Advisory: "NFP Investment Group"Kyla RodriguezNo ratings yet

- Complaints Handling ProcedureDocument5 pagesComplaints Handling ProcedureOfficial PageNo ratings yet

- Estacio Resposta Ofício CVM 227 EngDocument5 pagesEstacio Resposta Ofício CVM 227 EngEstacio Investor RelationsNo ratings yet

- Extraordinary Shareholders' Meeting - 05.20.2016 - Appraisal Report ApsisDocument24 pagesExtraordinary Shareholders' Meeting - 05.20.2016 - Appraisal Report ApsisBVMF_RINo ratings yet

- Collection of Online Tender Fee and EMDDocument3 pagesCollection of Online Tender Fee and EMDPranabesh SenNo ratings yet

- Notice To The MarketDocument2 pagesNotice To The MarketUsiminas_RINo ratings yet

- Cir v. EssoDocument4 pagesCir v. EssoDeanne Mitzi SomolloNo ratings yet

- Washington: New York 1101 New York Avenue, NW 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305Document10 pagesWashington: New York 1101 New York Avenue, NW 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305ABC DEFNo ratings yet

- 3MPhils Vs CIRDocument3 pages3MPhils Vs CIRJDR JDRNo ratings yet

- G.R. No. 160756Document12 pagesG.R. No. 160756Jason BuenaNo ratings yet

- Reference FormDocument304 pagesReference FormUsiminas_RINo ratings yet

- How Much Will The Amnesty Cost?Document8 pagesHow Much Will The Amnesty Cost?gustafgeysbertNo ratings yet

- 203 Code SheetDocument2 pages203 Code SheetRyzen LlameNo ratings yet

- SEC AdvisoryDocument1 pageSEC AdvisoryJJ De Peralta Bueno IIINo ratings yet

- Republic of The Philippines Manila: CREBA, Inc. v. Romulo G.R. No. 160756Document18 pagesRepublic of The Philippines Manila: CREBA, Inc. v. Romulo G.R. No. 160756Jopan SJNo ratings yet

- Notice To The Market - Clarification On News ReportDocument1 pageNotice To The Market - Clarification On News ReportBVMF_RINo ratings yet

- Agreement Between IMPERO SOLUTIONS and The CLIENTDocument4 pagesAgreement Between IMPERO SOLUTIONS and The CLIENTSiaka KoneNo ratings yet

- Publice Notice Merger Notification Arise B.V and NMB 20170629Document2 pagesPublice Notice Merger Notification Arise B.V and NMB 20170629Anonymous iFZbkNw100% (2)

- Estacio Comunicado Esclarecimento Bovespa 20140521 EngDocument2 pagesEstacio Comunicado Esclarecimento Bovespa 20140521 EngEstacio Investor RelationsNo ratings yet

- G.R. No. 213446 Confederation For Unity Reognitioni and Advancement of Government Employees Vs CIR BIRDocument54 pagesG.R. No. 213446 Confederation For Unity Reognitioni and Advancement of Government Employees Vs CIR BIRChatNo ratings yet

- Risk Disclosure and Warnings NoticeDocument11 pagesRisk Disclosure and Warnings NoticeJavier SaldaNo ratings yet

- Client Agreement BZ enDocument20 pagesClient Agreement BZ enGustavo JaramilloNo ratings yet

- Rmo 13-2003 Prescribing The Use of Bir Printed ReceiptsDocument4 pagesRmo 13-2003 Prescribing The Use of Bir Printed ReceiptsremoveignoranceNo ratings yet

- DellfxDocument2 pagesDellfxHelenNo ratings yet

- Management?s Proposal To The Extraordinary Shareholders? MeetingDocument8 pagesManagement?s Proposal To The Extraordinary Shareholders? MeetingUsiminas_RINo ratings yet

- Acquisition/ Disposal of ShareholdingDocument1 pageAcquisition/ Disposal of ShareholdingUsiminas_RINo ratings yet

- Latam NyseDocument2 pagesLatam NyseLorena MatosNo ratings yet

- STCW ADVISORY NO. 2020 03 MergedDocument7 pagesSTCW ADVISORY NO. 2020 03 MergedEvrything Top 10 tvNo ratings yet

- Boletín 9 Feb 2009 EnglishDocument8 pagesBoletín 9 Feb 2009 EnglishRodriguez-Azuero AbogadosNo ratings yet

- 019 G.R. Nos. L-28508-9 PDFDocument4 pages019 G.R. Nos. L-28508-9 PDFRod WamilNo ratings yet

- CFTC Charges "My Forex Funds" With Fraudulently Taking Over $300 Million From Customers Hoping To Become Professional Traders - CFTCDocument2 pagesCFTC Charges "My Forex Funds" With Fraudulently Taking Over $300 Million From Customers Hoping To Become Professional Traders - CFTCBernardo CoutoNo ratings yet

- Creba V RomuloDocument18 pagesCreba V RomuloJuhainah TanogNo ratings yet

- Sec - Ogc Opinion No 11-30 & 38Document6 pagesSec - Ogc Opinion No 11-30 & 38Mary Anne R. BersotoNo ratings yet

- Chamber of Real Estate and Builders' Association v. RomuloDocument19 pagesChamber of Real Estate and Builders' Association v. RomuloNxxxNo ratings yet

- Notice Board2Document3 pagesNotice Board2bhushan khoriNo ratings yet

- Risk Acknowledgement and Disclosure enDocument15 pagesRisk Acknowledgement and Disclosure enFam DragutaNo ratings yet

- Enf Wealth Generators Order 091418Document6 pagesEnf Wealth Generators Order 091418Spondeo MediaNo ratings yet

- Notice To The Market - Clarification of CVM/Bovespa S InquiryDocument3 pagesNotice To The Market - Clarification of CVM/Bovespa S InquiryFrancianne SousaNo ratings yet

- Tridharma Vs Cta & Cir Escra (Tax Case)Document16 pagesTridharma Vs Cta & Cir Escra (Tax Case)Anonymous VtsflLix1No ratings yet

- United States Court of Appeals, Second Circuit.: Docket No. 02-7492Document10 pagesUnited States Court of Appeals, Second Circuit.: Docket No. 02-7492Scribd Government DocsNo ratings yet

- Sentnal Pilipinas: EianokoDocument3 pagesSentnal Pilipinas: EianokoGilbertGalopeNo ratings yet

- Sec Advisory: SHANTAL Also Offers A Program Called REVOLVING FUND SCHEME WhereinDocument2 pagesSec Advisory: SHANTAL Also Offers A Program Called REVOLVING FUND SCHEME WhereinNiel FelicildaNo ratings yet

- 2017 05 11 Material Fact AF1 V2Document1 page2017 05 11 Material Fact AF1 V2Usiminas_RINo ratings yet

- 1Q17 PresentationDocument46 pages1Q17 PresentationUsiminas_RINo ratings yet

- 4Q16 PresentationDocument43 pages4Q16 PresentationUsiminas_RINo ratings yet

- CADE's DecisionDocument1 pageCADE's DecisionUsiminas_RINo ratings yet

- 1Q17 WebcastDocument15 pages1Q17 WebcastUsiminas_RINo ratings yet

- Minutes of The Ordinary Meeting of The Board of DirectorsDocument1 pageMinutes of The Ordinary Meeting of The Board of DirectorsUsiminas_RINo ratings yet

- Usinas Siderúrgicas de Minas Gerais S.A. - Usiminas: (Free Translation: For Reference Only - Original in Portuguese)Document1 pageUsinas Siderúrgicas de Minas Gerais S.A. - Usiminas: (Free Translation: For Reference Only - Original in Portuguese)Usiminas_RINo ratings yet

- 3Q16 - WebcastDocument16 pages3Q16 - WebcastUsiminas_RINo ratings yet

- 2Q16 PresentationDocument48 pages2Q16 PresentationUsiminas_RINo ratings yet

- Webcast 2Q16Document16 pagesWebcast 2Q16Usiminas_RINo ratings yet

- ACSFCover Letter ExampleDocument2 pagesACSFCover Letter ExampleDarkwinger 1430No ratings yet

- Screen & Conveyorgad, Data Sheet & Qap - SP-1326Document14 pagesScreen & Conveyorgad, Data Sheet & Qap - SP-1326ankit singlaNo ratings yet

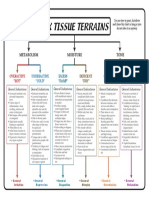

- 6 Tissue Terrains ColorDocument1 page6 Tissue Terrains Colorஆ.க.கோ. இராஜேஷ்வரக் கோன்No ratings yet

- R 480200Document6 pagesR 480200Shubhi JainNo ratings yet

- PEOPLE Vs Rodolfo DiazDocument9 pagesPEOPLE Vs Rodolfo DiazRaymondNo ratings yet

- Dhilp ProjectDocument53 pagesDhilp ProjectSowmiya karunanithiNo ratings yet

- Scribe America Final, Emergency DepartmentDocument41 pagesScribe America Final, Emergency DepartmentJulio CastilloNo ratings yet

- IIM Indore US Pathway BrochureDocument20 pagesIIM Indore US Pathway Brochurecinofi7972No ratings yet

- Hammer Group SeptDec 2023Document5 pagesHammer Group SeptDec 2023Adilah AzamNo ratings yet

- 4 Measurement of AirspeedDocument23 pages4 Measurement of AirspeedNagamani ArumugamNo ratings yet

- Hci - Web Interface DesignDocument54 pagesHci - Web Interface DesigngopivrajanNo ratings yet

- Handbook 2018 v2 15Document20 pagesHandbook 2018 v2 15api-428687186No ratings yet

- Architecture Firms: CCBA DesignsDocument1 pageArchitecture Firms: CCBA DesignspallaviNo ratings yet

- Big Dog's Leadership Page - Presentation Skills: OutlineDocument16 pagesBig Dog's Leadership Page - Presentation Skills: OutlinekathirNo ratings yet

- Assignment Two CartoonsDocument3 pagesAssignment Two CartoonsAbraham Kang100% (1)

- Contrasting MO and VB TheoryDocument4 pagesContrasting MO and VB TheoryPhillimonNo ratings yet

- Instruction Guide: Playing VolleyballDocument5 pagesInstruction Guide: Playing Volleyballapi-606741192No ratings yet

- Obstetric Fistula 2015 PDFDocument86 pagesObstetric Fistula 2015 PDFRakha Sulthan Salim100% (1)

- Different Parts of The Engine and Their Function Explained in Detail Notes PDF (PDFDrive)Document20 pagesDifferent Parts of The Engine and Their Function Explained in Detail Notes PDF (PDFDrive)Andres RvNo ratings yet

- Random Puzzle Questions PDF For Ibps RRB Clerk Prelims ExamDocument22 pagesRandom Puzzle Questions PDF For Ibps RRB Clerk Prelims ExamApyrvaNo ratings yet