Professional Documents

Culture Documents

Compensation Claims Under Workmen

Compensation Claims Under Workmen

Uploaded by

ShaziaAshrafOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compensation Claims Under Workmen

Compensation Claims Under Workmen

Uploaded by

ShaziaAshrafCopyright:

Available Formats

COMPENSATION CLAIMS UNDER WORKMENS

COMPENSATION ACT 1923

AIM

1.

GREF officers and personnel (barring clerical staff ) are entitled to

death/injury benefit in accordance with the provisions of Workmens Compensation

Act 1923 as amended from time to time, as per Para 196 of Border Roads

Regulations. As per Para 514 of Border Roads Regulations, the said Act shall also

apply to the casually paid labourers (CPLs) employed by the Projects. The aim of

this module is to lay down detailed procedure for processing the claims of

compensation of entitled GREF personnel and CPLs under the said Act.

ELIGIBLE CATEGORIES

2.

Only a person who is covered by the definition of Workman, given in

Section 2 (n) of the Act will be eligible for the benefits under this Act. Sub Section

2 (n) (ii), lays down that a person who is employed in any such capacity as

specified in Schedule II of the Act will be a Workman. In accordance with Para

(viii) Sub Para (a) and (c) of schedule II, the persons employed in the construction,

maintenance, repair or demolition of any building (of given specification) or any

road, bridge, tunnel or canal are included in the definition of Workman. GREF

personnel and CPLs employed on such duties thus fall within the definition of

Workman,. With the removal of upper monthly emoluments limit, the GREF

officers employed on such duties are also covered in the definition of Workman.

Army officers/ men are not entitled to benefits under this Act. Clerical staff is also

not covered in the definition of Workman.

CIRCUMSTANCES UNDER WHICH COMPENSATION IS

PAYABLE

3.

In accordance with Section 3 of the Act, a Workman will be entitled to

compensation only when his death or permanent total disablement is caused through

an injury by an accident which has arisen out of and in the course of his

employment. In case of permanent total disablement, a workman will not be

eligible to compensation if his disablement is caused by an accident which is

directly attributable to :(a)

The workman having been at the time of accident under the influence of

drink or drugs or

(b)

The wilful disobedience of the workman to an order expressly given, or to

a rule expressly framed, for the purpose of securing the safety of

workman, or

(c)

The wilful removal or disregard by the workman of any safety guard or

other device he knew to have been provided for the purpose of securing

the safety of workman.

4. If a workman employed in any employment specified in Part A of schedule III

of the Act, contracts any disease specified there in as an occupational desease

peculiar to that employment, or if a workman, whilst in the service of an

employer in whose service he has been employed for a continuous period of not

less than six months (which period shall not include a period of service under

any other employer in the same kind of employment) in any employment

specified in Part B of schedule III, contracts any disease specified therein as an

occupational disease peculiar to that employment, the contracting of the disease

shall be deemed to be an injury by accident for the purpose specified in Para 3

above.

AMOUNT OF COMPENSATION

5.

In accordance with Section 4 of the Act, the amount of compensation payable

will be as under :(a)

(b)

Where death results from an injury, an amount equal to fifty percent of the

monthly wages of the deceased workman multiplied by the relevant factor

given in Schedule IV of the Act or an amount of Eighty Thousand Rupees

whichever is more.

Where permanent total disablement results from the injury an amount

equal to sixty percent of the monthly wages of the injured workman

multiplied by the above mentioned relevant factor or an amount of

Rs.90000/- (Rs.Ninty Thousand only) whichever is more.

6.

It may be borne in mind that the age given in first column of Schedule IV is

the completed years of age on the last birth day of the workman immediately

preceding the date on which the compensation fell due. The same may be worked

out accordingly.

7.

Where the monthly wages of a workman exceed Four thousand rupees, his

monthly wages for the purpose of calculation of amount of compensation shall be

deemed to be Four thousand rupees only.

8.

For computing the monthly-wages, charges on the following counts shall also

be included:-

(a)

(b)

(c)

(d)

(e)

(f)

Bonus

Accommodation

Ration

Clothing

Medical re-imbursement

Washing Allowance

9.

The above charges will be calculated based on the SSR rates as circulated

from time to time.

METHOD OF CALCULATING WAGES

10. Where a workman has worked for a continuous period of twelve months

immediately preceding the accident, the monthly wages of the workman shall be

one twelfth of the total wages earned during last twelve months.

11. Where the whole of the continuous period of service of a workman is less

than one month, the monthly wages of the workman shall be average monthly

amount which during the twelve months immediately preceding the accident was

being earned by a workman employed on the same work by the same employer or if

there was no workman so employed, by a workman employed on similar work in

the same locality.

12. In other cases including cases in which it is not possible for want of necessary

information to calculate the monthly wages under Para 11 above, the monthly wages

shall be thirty times the total wages earned in respect of the last continuous period

of service divided by the number of days comprising such period.

PROCESSING OF COMPENSATION CLAIMS

13.

SEQUENCE OF EVENTS

As soon as a case of an accident involving a workman during his course of

employment with GREF comes to notice of an OC unit, he shall take action as

enumerated in succeeding paragraphs.

14.

WHERE THE WORKMAN (MEN) DIES IN AN ACCIDENT

(a)

(b)

Lodge a FIR with the police authorities within six hours of the accident

and obtain copy of the same.

Obtain death certificate from the medical authority who declared the

workman as dead.

(c)

(d)

(e)

(f)

(g)

Arrange post-mortem report on the body of workman in liaison with the

police/medical authorities and obtain copy of the same by fastest means.

Order a One Man Inquiry (OMI) within 24 hrs of the accident, to be held

by a gazetted/commissioned officer. If more than one unit is involved,

OMI will be ordered by Task Force Commander within 48 hrs of the

accident. The One Man Inquiry will be held to establish eligibility of

compensation to the concerned workman (men). The OMI will be

completed within ten days of the accident and proceedings transmitted to

the concerned T.F. After examination at the T.F. HQ orders of T.F

Commander will be endorsed on the OMI. The sole aim of holding a OMI

is to establish admissibility of compensation.

Other issues like

circumstances leading to the accident, MT discipline, regularisation of loss

to the vehicle will not be combined. A separate Court of Inquiry to

investigate such issues may be held as considered necessary.

Simultaneously the wages statement along with calculation sheet and

contingent bill should be got verified from audit authorities.

Forward compensation claim within 20 days of the accident to the

prescribed authority for sanction along with the following documents:i. Manuscript copy of OMI.

ii. Singed copy of convening order of OMI.

iii. Orders of T.F Cdr on the OMI.

iv. Original death certificate.

v. Post-mortem report in original (if no original issued by Medical

authority, copy duly attested by the medical authority)

vi. Signed copy of FIR with FIR number registered with police.

vii. Application for compensation under WCA 1923 on form X/Z as

applicable.

viii. Wages statement/pay drawn statement for last 12 months

immediately preceding the accident.

ix. Calculation sheet.

x. Contingent bill.

xi. No demand certificate.

xii. Statement of case.

xiii. Delay report.

xiv. DO Part II notifying the death casualty.

xv. In case of CPL, photo copy of Recruitment-cum-Medical form

and certificate from OC unit regarding correctness of date of

birth.

xvi. Job/Head No. against which amount of compensation to be

booked (to be shown on contingent bill).

In case of claims requiring sanction of DGBR/Govt. the following

additional documents will be enclosed:

i.

Audit report of AO/ACDA(Project) in original indicating name of

AO/ACDA who has signed on it.

ii. Recommendation of Task Force Commander.

iii. Recommendation of Chief Engineer.

iv. Index indicating serial-wise/systematic details of documents

with proper numbering of pages.

v. All the documents enclosed with the claim will be authenticated.

15.

WHERE THE WORKMAN IS INJURED IN AN ACCIDENT

In case of an accident not resulting in death, eligibility of compensation

can be established only after permanent disability of the workman, if any, is

assessed. In such cases also the OMI will be completed and orders of T.F Cdr given

thereon. Thereafter, the required documents will also be prepared and kept ready

for processing immediately after permanent disability of the workman is assessed.

In such cases, compensation claim will be initiated within 10 days of assessment of

permanent disability of the workman. Such cases will be supported with the

following documents:(a)

(b)

(c)

16.

Original medical documents including medical board.

Disability certificate duly countersigned by T.F SMO and Project CMO

and concurred by DDG (Med).

All other documents mentioned under Para 14 (f) and (g) above except

srl (iv) and (v).

WHERE THE WORKMAN HAS SUFFERED FROM AN

OCCUPATIONAL DISEASE.

Where death/permanent disability is caused as a result of an

occupational disease, orders on the OMI will be given. Such cases will be

processed duly supported with the following documents:(a)

(b)

(c)

17.

Original Medical documents/case sheets.

Attributability certificate on form AFMSF-93 (Pt II) (to be initiated by

AMA and concurred by SMO & Dy.CMO & DDG (Med))

All other documents mentioned under Para 14 (f) & (g) above except Srl.

(vi) for death cases and except Srl (iv), (v) and (vi) for permanent

disability cases.

COMPETENT AUTHORITY FOR SANCTION OF COMPENSATION

The authorities competent to sanction compensation are laid down in

Govt. of India, Ministry of Road Transport & Highways, BRDB letter

No.BRDB/01/134/BEA/2001 dated 19th November 2001 and are as under :DGBR

Rs.4,50,000/Chief Engineers

Rs.3,50,000/Cdr T.Fs/Commandants GREF Centre Rs.2,50,000/Cases involving payment in excess of Rs.4,50,000/- should be

submitted to Government for sanction.

18. The compensation claims will be processed through audit channel and audit

reports will be obtained by hand as far as possible.

19.

DISBURSEMENT OF COMPENSATION

Sanction of the competent authority for compensation will be sent to the

concerned unit through fastest means. On receipt of sanction, the unit will claim the

amount and make disbursement within 10 days of the receipt of sanction. In death

cases and in cases where payment is to be made to a woman, the compensation

amount will be sent to the Commissioner of Compensation of the concerned district

for further disbursement in terms of Sec 8 of the Act.

20. In accordance with Rule 6 of the Workmens Compensation Rules 1924, the

Commissioner is required to give a Receipt for compensations in Form B

(Specimen enclosed at Annexure A) in respect of the compensation amount

deposited with him. Likewise, after disbursing the compensation amount, the

Commissioner is required to render Statement Of Disbursements in Form C

(specimen enclosed at Annexure B). It will be ensured by the OC Unit remitting

the amount of compensation that Receipt in Form B is obtained from the

Commissioner immediately after making remittance to him. Likewise, Statement

Of Disbursement as per Form C will be obtained by the OC Unit from the

Commissioner immediately after the compensation amount is disbursed by him.

Constant monitoring in this regard will be done.

21. After obtaining the above mentioned forms, a copy each of the same will be

sent by the OC Unit to the authority which sanctioned the compensation i.e.TF

Commander, CE, DGBR and Govt. as the case may be.

22. Sec 8 (3) of the Act provides that a receipt of Commissioner shall be a

sufficient discharge in receipt of any compensation deposited with him. However,

in larger interests of the beneficiary, cases should not be treated as settled or closed

based on the receipt from Commissioners. The words sufficient discharge should

be understood to mean sufficient discharge of the liability of the department to pay

compensation. It is our moral responsibility to ensure that the amount of

compensation is received by the beneficiary as soon as possible after remittances to

the Compensation Commissioner. Accordingly, the cases should be pursued till

payment of compensation is actually received by the beneficiaries.

The statement of disbursement as per Form C obtained by the Unit

will invariably be verified by the AO Task Force/Project. These statements will be

watched through the medium of a register. The cases where the payment

receipt/cash receipts is delayed more than three months, be referred to the Secretary

of the Labour Department of the concerned State as per instructions issued vide HQ

DGBR

letter

Nos.15066/Policy/DGBR/01/EIC

A

dated

29.11.96,

15066/DGBR/Policy/EIC-A dated 14.10.99 and 15066/Policy/50/EIC-A dated 16

.1.2002.

23.

HALF MONTHLY PAYMENTS

When an injury is caused to a workman as a result of an accident

occurring during his course of employment with GREF and the same results in

temporary disablement a half monthly payment of the sum equivalent to twenty five

percent of monthly wages of the workman, can be paid to him under the provisions

of Sub Sections 2 of Sec 4 of the Act. The amount is recoverable from the amount

of lump sum compensation payable.

FUNERAL EXPENDITURE

24.

If the injury to the workman results in his death, the department shall,

in addition to the compensation amount deposited with the Commissioner a sum of

one thousand rupees for payment to the eldest surviving dependent of the workman

towards the expenditure of the funeral of such workman or where the workman did

not have a dependent or was not living with his dependent at the time of death, to

the person who actually incurred such expenditure.

Where funeral expenditure in respect of deceased GREF personnel is

claimed under Para 166 of Border Roads Regulations, the same will not be claimed

under the above provision.

MONITORING SLIP

25.

A monitoring Slip will accompany the OMI proceedings till the

compensation amount is finally disbursed to the concerned beneficiary. The slip

will be signed by officers handling the case at various stages starting from the

ordering of OMI till the compensation is disbursed.

NON PAYMENT OF COMPENSATION CLAIM

26.

In case payment of compensation could not be remitted to the

concerned beneficiary/N.O.K due to one or the other reason the amount of

compensation so received back from the Commissioner be deposited in bank and

TR for amount adjusted by AO Task Force/ (P).

CONCLUSION

27.

In terms of Section 4 A of the Act, compensation claims are required to

be finalised and amount deposited with the Commissioner or made to the workman,

as the case may be, within one month of their falling due. In case of default, the

Commissioner can direct to pay simple interest at the rate of 12% per annum and in

case of further default he can direct additional penalty upto 50% of the amount of

arrears and interest. It is imperative that to avoid imposition of any penalty, all out

efforts should be made to make payment of compensation within stipulated period.

Officers/Staff dealing with the case at Unit/T.F/Project level will be held responsible

for delay in processing the case.

Compensation paid in satisfaction of the Court order under WCA

1923 will not be treated as charged expenditure. Any court order on the subject

should be treated as declaratory order.

ANNEXURE A

FORM B

(Rule 6)

RECEIPT FOR COMPENSATION

(Deposit under Section 8(1) of the Workmens Compensation Act, 1923)

Book No Receipt No Register No.

Depositor

Deceased or injured workman...

Date of deposit

Sum deposited Rs.

Dated The ..

Commissioner

ANNEXURE B

FORM C

(Rule 6)

STATEMENT OF DISBURSEMENTS

(Section 8(4) of the Workmens Compensation Act, 1923)

Serial No..

Depositor

Date

Rs.

Amount deposited

Amount deducted and re-paid to the employer under the proviso to section

8(1)..

Funeral expenses paid.

Compensation paid to the following dependant(s):

Name

Relationship

...

10

Total...

Dated the..

Commissioner

You might also like

- JOINT MANUAL of OPERATIONS in Providing Assistance To Migrant WorkersDocument46 pagesJOINT MANUAL of OPERATIONS in Providing Assistance To Migrant WorkersAnonymous dtceNuyIFI100% (1)

- E-Commerce - Basic Nondisclosure AgreementDocument1 pageE-Commerce - Basic Nondisclosure Agreementmccal006100% (1)

- BCPC PresentationDocument40 pagesBCPC PresentationJoy Navaja Dominguez88% (41)

- Notes - Employees Compensation ActDocument23 pagesNotes - Employees Compensation ActDanika JoplinNo ratings yet

- AssignmentDocument18 pagesAssignmentabdul_mnb785No ratings yet

- The First Act Related To Social Security Measures Introduced in India Prior To IndependenceDocument37 pagesThe First Act Related To Social Security Measures Introduced in India Prior To IndependenceSonal Acharan ChandelNo ratings yet

- Workmen'S Compensation ActDocument19 pagesWorkmen'S Compensation ActGospelNo ratings yet

- Workman Compensation Act 1923: ObjectivesDocument40 pagesWorkman Compensation Act 1923: ObjectivesSooryakanth PvNo ratings yet

- The Employees' Compensation Act, 1923Document23 pagesThe Employees' Compensation Act, 1923Charan Kamal SinghNo ratings yet

- WC Act 1923Document14 pagesWC Act 1923PCFSM EHSNo ratings yet

- Employee State Insurance - IntroductionDocument7 pagesEmployee State Insurance - IntroductionMrignayani SinghNo ratings yet

- WcactDocument5 pagesWcactRajendra KumarNo ratings yet

- Notice of AccidentDocument18 pagesNotice of AccidentSukhdeep SinghNo ratings yet

- Worker - S Compensation Act 1923Document22 pagesWorker - S Compensation Act 1923sonaleebhuNo ratings yet

- 12 11 Workmen Compensation ActDocument6 pages12 11 Workmen Compensation ActArunima SarkarNo ratings yet

- The Workmen'S Compensation Act, 1923Document4 pagesThe Workmen'S Compensation Act, 1923dplpthk1502No ratings yet

- Workmen S Compensation Act 1923Document33 pagesWorkmen S Compensation Act 1923manojmalliaNo ratings yet

- Labour Law-II Second WeekDocument28 pagesLabour Law-II Second WeekAkanksha BohraNo ratings yet

- Prateek-Workman Compensation Act, 1923Document14 pagesPrateek-Workman Compensation Act, 1923Prateek GeraNo ratings yet

- Maharashtra National Law University, NagpurDocument49 pagesMaharashtra National Law University, NagpurAkanksha BohraNo ratings yet

- Workmen's Compensation Act Rules ThereunderDocument52 pagesWorkmen's Compensation Act Rules ThereunderJyothiPunemNo ratings yet

- ECA-Liability of EmployerDocument4 pagesECA-Liability of EmployerIndrajit DuttaNo ratings yet

- The Workmen Compensation ActDocument5 pagesThe Workmen Compensation Actpriyanka sharmaNo ratings yet

- Maternity Benefit - M&C - Rules 1963Document25 pagesMaternity Benefit - M&C - Rules 1963Satyam Kumar AryaNo ratings yet

- Workmen's Compensation Act, 1923Document15 pagesWorkmen's Compensation Act, 1923Saksham Gaur50% (2)

- Part II Gratuity Act 1972Document9 pagesPart II Gratuity Act 1972Kanishk ChaddhaNo ratings yet

- Mormugao Port Employees' (Pension and Gratuity) Regulations, 1966Document52 pagesMormugao Port Employees' (Pension and Gratuity) Regulations, 1966Latest Laws TeamNo ratings yet

- Amended Rules On Employees CompensationDocument24 pagesAmended Rules On Employees CompensationMary Jovilyn MauricioNo ratings yet

- Presantion On Workmen'S Compensation Act 1923Document10 pagesPresantion On Workmen'S Compensation Act 1923hgnagarajNo ratings yet

- Responsibility For Payment of Wages - : S.4. Fixation of Wage-PeriodsDocument11 pagesResponsibility For Payment of Wages - : S.4. Fixation of Wage-Periodsanshika agarwalNo ratings yet

- 3.3 Workman Ti 198 - 225Document28 pages3.3 Workman Ti 198 - 225s4sahithNo ratings yet

- Amended Rules On EmployeesDocument27 pagesAmended Rules On EmployeesCrislene CruzNo ratings yet

- Amended Rules On EmployeesDocument21 pagesAmended Rules On EmployeeslchieSNo ratings yet

- Worksmen CompensationDocument50 pagesWorksmen CompensationArpi ShahNo ratings yet

- 'Y 'Y 'Y 'Y 'Y 'Y 'Y 'Y 'Y 'Y 'YDocument33 pages'Y 'Y 'Y 'Y 'Y 'Y 'Y 'Y 'Y 'Y 'Ynirusha28No ratings yet

- Employers Liability For CompensationDocument14 pagesEmployers Liability For Compensationadityaagrawal00007100% (2)

- Amended Rules On EmployeesDocument37 pagesAmended Rules On EmployeesNova Kris Mae Balverde-BiriNo ratings yet

- Workmens Compensation Act 19232Document63 pagesWorkmens Compensation Act 19232Rajeev Kumar SharmaNo ratings yet

- Workers Compensation and Course of Employment: Labour and Industrial Law-IiDocument7 pagesWorkers Compensation and Course of Employment: Labour and Industrial Law-IiPulkit ChannanNo ratings yet

- The Haryana Maternity Benefit RulesDocument19 pagesThe Haryana Maternity Benefit RulesAdi BahetiNo ratings yet

- Workmen's Compensation ActDocument22 pagesWorkmen's Compensation Actyuvi75No ratings yet

- Labour Law - Docx 1Document6 pagesLabour Law - Docx 1monal guptaNo ratings yet

- Maharashtra Maternity Benefit Rules 1965Document6 pagesMaharashtra Maternity Benefit Rules 1965Gopi KrishnaNo ratings yet

- PAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheDocument4 pagesPAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheVenkata Rao NaiduNo ratings yet

- Maternity Benefit Punjab Rules 1967Document17 pagesMaternity Benefit Punjab Rules 1967Sakshi VermaNo ratings yet

- Labour Law Short Answers Labour Law Short Answers: Semester 3&4 (Osmania University) Semester 3&4 (Osmania University)Document4 pagesLabour Law Short Answers Labour Law Short Answers: Semester 3&4 (Osmania University) Semester 3&4 (Osmania University)Srini VasaNo ratings yet

- Employees Compensation ActDocument12 pagesEmployees Compensation ActNithin rajeevNo ratings yet

- Workers Compensation Act Chapter - 225Document34 pagesWorkers Compensation Act Chapter - 225Ibra SaidNo ratings yet

- Haryana Maternity Benefit RulesDocument21 pagesHaryana Maternity Benefit RulesAnkit DahiyaNo ratings yet

- Amended Rules On Employee CompensationDocument20 pagesAmended Rules On Employee Compensationmc.rockz14No ratings yet

- Workmen Compensation ActDocument33 pagesWorkmen Compensation Actfor.nageshNo ratings yet

- Maha - Maternity Benefit RulesDocument7 pagesMaha - Maternity Benefit RulesHarshit.TiwariNo ratings yet

- Management Labor Laws55555252Document3 pagesManagement Labor Laws55555252Pushpendra SinghNo ratings yet

- Workmen Compensation Act 1923Document25 pagesWorkmen Compensation Act 1923shravaniNo ratings yet

- Rules 1972Document30 pagesRules 1972venkateshbedhreNo ratings yet

- Topic Six - Work Injury Benefits Act 2007Document8 pagesTopic Six - Work Injury Benefits Act 2007Scolanne WagicheruNo ratings yet

- Labor Code - P.D. 442Document32 pagesLabor Code - P.D. 442ganggingskiNo ratings yet

- Workmen Compensation Act IndiaDocument3 pagesWorkmen Compensation Act IndiaKunwar Apoorv Singh PariharNo ratings yet

- Labor Law ReviewDocument3 pagesLabor Law ReviewRohanisah Hadji ShaeefNo ratings yet

- Amended Rules On EmployeesDocument15 pagesAmended Rules On EmployeesEthel Joi Manalac MendozaNo ratings yet

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

- FAR-FC 2019: Federal Aviation Regulations for Flight CrewFrom EverandFAR-FC 2019: Federal Aviation Regulations for Flight CrewNo ratings yet

- Mittsure Table Book5-6Document2 pagesMittsure Table Book5-6Bijay Krishna DasNo ratings yet

- Bentley Civil Guide: V8I Selectseries 3Document110 pagesBentley Civil Guide: V8I Selectseries 3Bijay Krishna DasNo ratings yet

- The Behaviour of Concrete by Partial Replacement of Fine Aggregate With Copper Slag and Cement With GGBS - An Experimental StudyDocument6 pagesThe Behaviour of Concrete by Partial Replacement of Fine Aggregate With Copper Slag and Cement With GGBS - An Experimental StudyBijay Krishna DasNo ratings yet

- Makripani Bridge L - SECTION of NallahDocument1 pageMakripani Bridge L - SECTION of NallahBijay Krishna DasNo ratings yet

- Aimil Asphalt TestingDocument31 pagesAimil Asphalt TestingBijay Krishna DasNo ratings yet

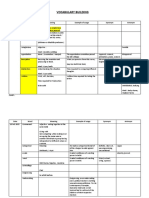

- Vocabulary Building: Date Word Meaning Example of Usage Synonym AntonymDocument9 pagesVocabulary Building: Date Word Meaning Example of Usage Synonym AntonymBijay Krishna DasNo ratings yet

- MI Room R1 21 MayDocument1 pageMI Room R1 21 MayBijay Krishna DasNo ratings yet

- Overlay Stripping and Widening Practice WorkbookDocument62 pagesOverlay Stripping and Widening Practice WorkbookBijay Krishna DasNo ratings yet

- Second Floor Plan 3760.88 - 2101.1 1659.78 SQM: D3 D3 D3 D3 D3 D3 D3Document1 pageSecond Floor Plan 3760.88 - 2101.1 1659.78 SQM: D3 D3 D3 D3 D3 D3 D3Bijay Krishna DasNo ratings yet

- Concept of Class 9 EqvtDocument2 pagesConcept of Class 9 EqvtBijay Krishna DasNo ratings yet

- FL-2 - Book B - Online - PDocument28 pagesFL-2 - Book B - Online - PBijay Krishna DasNo ratings yet

- What Is The Difference Between Codes IRC 37-2001 & 2012Document5 pagesWhat Is The Difference Between Codes IRC 37-2001 & 2012Bijay Krishna Das100% (1)

- Cold Mix For Road ConstructionDocument43 pagesCold Mix For Road ConstructionBijay Krishna DasNo ratings yet

- Brief On Construction of Deopani BridgeDocument9 pagesBrief On Construction of Deopani BridgeBijay Krishna DasNo ratings yet

- What Is The Difference Between Codes IRC 37-2001 & 2012Document5 pagesWhat Is The Difference Between Codes IRC 37-2001 & 2012Bijay Krishna Das100% (1)

- Enforcing International Human Rights LawDocument5 pagesEnforcing International Human Rights LawloschudentNo ratings yet

- Rustans Vs Dalisay GR L-32891Document3 pagesRustans Vs Dalisay GR L-32891Breth1979No ratings yet

- Succession Sample ExamDocument4 pagesSuccession Sample ExamCarla VirtucioNo ratings yet

- Civ UST QuAMTO Civil Law 1990 2013 PDFDocument71 pagesCiv UST QuAMTO Civil Law 1990 2013 PDFdoraemonNo ratings yet

- DPWH Issuances On Approval of Detailed Engineering Design Plan For Dredging ProjectsDocument2 pagesDPWH Issuances On Approval of Detailed Engineering Design Plan For Dredging ProjectsrubydelacruzNo ratings yet

- Adzaku GalenkuDocument7 pagesAdzaku GalenkuNaa Odoley OddoyeNo ratings yet

- APM Act 1965 1 PDFDocument13 pagesAPM Act 1965 1 PDFgopinadh.civil gopinadhNo ratings yet

- Accession - 4. Leviste Management System Inc. vs. Legazpi Towers 200, Inc. GR. No. 199353 April 4, 2018Document15 pagesAccession - 4. Leviste Management System Inc. vs. Legazpi Towers 200, Inc. GR. No. 199353 April 4, 2018Melanie ManatadNo ratings yet

- RESIDENTS 123net Fibre Service AgreementDocument10 pagesRESIDENTS 123net Fibre Service AgreementLuvashen GoundenNo ratings yet

- 2019 Bar Examinations Criminal LawDocument7 pages2019 Bar Examinations Criminal LawCamille Angelica GonzalesNo ratings yet

- Credtrans Case DigestsDocument23 pagesCredtrans Case DigestslingotranslateNo ratings yet

- Stronghold Insurance Co., Inc. vs. CA G.R. No. 89020 May 5, 1992 (RULE 60 - Replevin) FactsDocument2 pagesStronghold Insurance Co., Inc. vs. CA G.R. No. 89020 May 5, 1992 (RULE 60 - Replevin) FactsChiic-chiic SalamidaNo ratings yet

- World Legal Systems - 231201 - 162542Document11 pagesWorld Legal Systems - 231201 - 162542Надія ЛяшкоNo ratings yet

- A15 - Enrile v. Salazar - G.R. No. 92163 - AlarinDocument29 pagesA15 - Enrile v. Salazar - G.R. No. 92163 - AlarinJenNo ratings yet

- 12-2297 Karron CoA Appendix v10Document306 pages12-2297 Karron CoA Appendix v10D B Karron, PhDNo ratings yet

- BIR Vs OmbudsmanDocument5 pagesBIR Vs OmbudsmanKahlanZiazThereseNo ratings yet

- RR No. 8 2018Document35 pagesRR No. 8 2018zul fanNo ratings yet

- Business Law 2Document7 pagesBusiness Law 2Rose Jean Raniel OropaNo ratings yet

- Corp Code Violations ApplicableDocument4 pagesCorp Code Violations ApplicableCybill DiazNo ratings yet

- Echegaray V SecDocument3 pagesEchegaray V SecAli NamlaNo ratings yet

- Proposed Rule: Economic Enterprises: Gaming On Trust Lands Acquired After October 1988 Determination ProceduresDocument8 pagesProposed Rule: Economic Enterprises: Gaming On Trust Lands Acquired After October 1988 Determination ProceduresJustia.comNo ratings yet

- Sanlakas vs. Executive Secretary Reyes (GR 159085, 3 February 2004)Document3 pagesSanlakas vs. Executive Secretary Reyes (GR 159085, 3 February 2004)adobopinikpikan100% (1)

- PMLADocument28 pagesPMLARatnadeep MitraNo ratings yet

- Surf Horizon Limited V Paul Manafort, Richard Gates SUMMONS COMPLAINTDocument28 pagesSurf Horizon Limited V Paul Manafort, Richard Gates SUMMONS COMPLAINTShane BolsterNo ratings yet

- Unalienable Rights 2017-04-23Document1 pageUnalienable Rights 2017-04-23John KronnickNo ratings yet

- Mlra 2021 2 70Document43 pagesMlra 2021 2 70fidastarfishNo ratings yet

- Wills 2nd ReviewerDocument5 pagesWills 2nd ReviewerronaldNo ratings yet