Professional Documents

Culture Documents

Standalone Financial Results, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

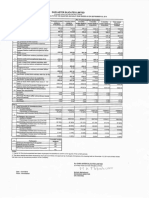

GOLD COIN HEALTH FOODS LIMTED

CIN: L15419GJ1989PLCO12041

Reg,off. : 66/3t?Pragatinagar'Nar.npur.,Ahned!bad-380013

cndcd3rnMa,th,20l6

AudiledfincncirlrBUlaf0rlhequ.rcf

PART

I

Audilql

Fin

cirl Rgulrs for ihc Quln . ended

31.03.2016

3l

Mlrcb

2016

90.36

25.14

licone tom Opearions

313.2015

31J.2016

31.03.2015

31,12.2015

322.36

254.12

0.

lbl Other ooqatincln@m

Totrl Incone frcm ODer.tions (net)

25.14

2

a. Cost

ofmaterial consune

Work-in-?togres

ut_

'15

20 00

in inventories of nnished goods

c Chege

424

d. Enplove benen$ expenses

e. Deprec'ation & Anonistion

2.t4

105

before Other

l.come, Finance Cost

ad

2.

4.24

1.16

2.\4

3.08

253.23

6.69

314.J5

l.9l

8.01

a.2l

76.17

?!oir from Operalions

296.42

4d

47,

\2.25,

1.43

.l 16

(2.25.

l-43

383

1.93

(2.25)

1.43

3.74

l.9l

8.64

8.64

4.12

Profil flofr ordinary activ'lis before

F,nae

Cosl

dd

tixceplronal

8.7.1

0.09

?ofit fod o.dinary aclivities a{ier Finece

Cosls bul I

(2 25)

Profit(Los) from ordindr lctivilies befoie Td (?+8)

93

1.34

t0

Profit(Loss) fron Ordinary aclivilies Aner

t2 Extordinarv lrens (Nt of Td)

Nct Proffl / &oss) for th Deriod {1r-1?)

Td

(2.

(9-10)

?aid-up Equity Shae Capiial (F&e value Rs.l0l Each)

l5 Resoe excludi.e rcvaluation re*Nes

l6 Edins oer Shd (Bdic ad dilured)'

314

1,.44

t2.24.,

1.43

300.09

300.09

0.59

5.17

300.09

300.09

0.19

3.

300 09

4.0c

4.0c

(0-0?

0.59

4.00

4.0c

0.05

0.12

0.02

678 80r 00

t.418,100 00

1,678,80100

PARTICULARS OF SHARETIOLDINGS

1,678,80t 00

55 94%

Promorer

&

Pi@otage

Promoler Croup

ofshdes (as

% of tbe lotal shaehold'ng or p.omle.

Prcentaee of Shdes

(a

% of the total shareholding of promler and

ol Shdes

{s

% of the total shde capital ollhe Conpay)

ofs

Ptrcehrage

4193v,

1,438,300.00

41.93e/o

55.94o/r

ed

% of the lotal shde capihl otlhe Compdy)

Snres

55.94Yo

Shdeholding

(as a

?ercenrage of

1,322,09900

1.322.099.00

1.562.600.00

1.122.099.00

1.562.600 00

44 06Yr

44.O6Yr

52.A1Yo

44.A6yo

52.41%

t00.00%

100.00%

100 ocr"/.

100 0o"z

l00.0cz

IN!'ESTOR COMPLAINTS

Pendinq al ihe be!inninq

olrhe

lDisDosed of during the quane.

Remainine unresolved at lhe nd

oftheauaner

l. The above.esulls wre reviewed by the Audil Commillee oflhe Bord of Dneto6 in then meting held on 30ih May,20l6.

2. The finmcial iesulh for the quaner ended 3I st Mrch, 2016 have beeo subjected to a'Linited Revie by the Slatulory Audnors oflhe Compey.

I The previous psiods tglrs have bem regtouped whreever nessary.

Forcold coin seahh foods

;:T.tifiJ1X,.

Linitd

I n n .,'

,^""!h,rla.Uv

lK It{.}.

11

.-Y

1i:i"

|

\(t

f':'-."'.. Iri:er]fr"

'l' rl

-.;;/

o.-i-- . -".

GOLDCOIN IIEALTII BOODS LIl\ItrTDD

(CIN:Ll54l9GJl989PLCol204l)

neo r)ffice: 66/392- Prasatinasar. Naranpura, Ahmedabad-380013

PARTICULARS

AS

AUDITED

AUDITED

AT 31.03.2016

AS AT 31.03.2015

EQUITY AND LTABILITIES

ShaYeholdcrs' Funds

(a) Share Capital

(b) Reserves aod Surplus

(c

',

Money rcceined against share warants

Sub Total - Shareholders fund (a+b+c)

Shar application money pending allotment

3 Minority interest"

Non-Current Liabilities

(a) Inng Tern borrowhgs

(b) Deferred ta.{ liabilities (neD

(c) Other long tern liabilities

(d) Long telm provlstons

Sub total Non currcnt liabilities

3 Current liabilities

(a) Short term bonowmgs

:

30,009,000.00

6,t96,344.04

6,136,915.00

0.0c

0.01

36,205,344.00

36,14s,915.00

0.00

0.00

0.00

0.00

0.0c

0.00

78,851.00

78,851.00

0.0(

0.00

0.00

0.00

78,851.00

78,E5r.UU

0.00

0.00

(b) trade payebles

(c) Other current liabilities

155,919.00

15s,000.00

0.00

0.00

(d) Shon term provisions

Sub total current liabilities

t91,2'10.00

366,000.00

347,189.00

521,000.00

36,631t84.00

36J4sJ66.00

IOTAL EQUITY AND LIABILITIS

B

30,009,000.00

ASSETS

Non-CurrDt Nssets

(a) Fixed assets

fb) Goodwill on consolidation *

(c) Non ourrent investrnents

s,6s9 ,797 .0C

0.00

0.00

486,564.00

1157845.00

0.00

0.00

(e) Long term loans and advances

15,503,598.00

15,503,598.00

(f) Ofier non-current assets

Sub total Non currenf assets

7,806,932.0C

7806932.0C

29,242,577.00

30,128,172.00

(d) Deferred tax assets (net)

s,445,483.00

Current assets

(a) current investmenl

(b) lnventories

(c) Trade receivables

(d) oash and cash equivalents

(e) Short telm loans and advances

(0 Other current assets

Sub totsl current assets

TOTAL - ASSETS

0.00

0.00

0.00

0.00

1,34s,640.00

6,505,908.00

30,998.0r

102,707.0C

0.00

0.00

12,169.00

8,979.00

7,388,807.00

6,617,s94.00

36,631,384.00

36;7 45;766.0n

Place : Ahmedabad

Date

30th May,2016

'L*x

}.c'

f-'t

,n

iJ i:ritlil:l;l'i illt#

J,',.-,

\i'.'r-"--:

\i.y it \'/

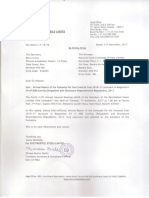

VISHVES A. SHAH & CO.

Chartered Accountants

316, Abhishek Plaza, B/h. Navgujarat College,

Income tax, Ahmedabad - 380014

+91

98254 71782, +9r 93777 71182

Ph.

E-Mail : vishvesca@gmail.com

To,

Board of Directors of

Gold coin Health Foods Limited

(CIN: L15419GJ1989PLC012041)

for the quarter ended

we trave Audited the quafterly financial Results of Golil coin Ilealth Foods limited

to 31"March, 2016, attached

31'tMarch,2016 and the year to date results for the period 1't Apri1,2015

herewitl,,beingsubmittedbytliecompanypursuanttotherequirementofRegulation33oftheSEBI

financial results as

(Listing obligation and Disclosure Requirements) Regulations, 2015. These Quarterly

financial

well as the year to date finaircial results have been prepared on the basis of the interim

Statements,whicharetheresponsibilityofthecompany,smanagement.ourresponsibilityistoexpressan

which have

opinion on these financial results based on our audit of such interim financial statements,

Accounting

in

blen prepared in accordance with the recognition and measurement principles laid down

prescribed, under section 133 of the

Standards for Interim Financial Reporting (AS 25l Ind AS 34),

of chartered

companies act, 2013 read with relevant rules issued thereunder; or by the Institute

India'

generally accepted in

Accountant oflndia, as applicable and other accounting principles

India' Those

We conducted our audit in accordance with the auditing standards genelally accepted _in

the financial

whether

assurance

reasonable

to

obtain

audit

sta-ndards require that we plan and peform the

evidence

basis,

a

test

on

examining,

includes

results are free of materiil misstatement(s). An audit also

accounting

the

assessing

supporting the amounts disclosed as financial results. An audit also includes

provides a

piiicipt"s"usecl and significant estimates made by management. We believe that our audit

reasonable basis for our oPinion.

given to us

In our opinion and to the best of our information and according to the explanation

quarterly financial results as well as the year to date results:

(i) are presented in accordance with the requirements of Regulation 33

and Diiclosure Requirements) Regulations, 2015 in this regard; and

these

ofthe SEBI (Listing obligations

(ii) give a true and fair view of the net profit/loss and other financial hformation for the quarter ended

i ti'iaarctr, zOte as well as the year to date results for the period from l't April,2015 to 31"tMarch,2016.

Date

: 30tn May, 2016

Place :Ahmedabad

For. Vishves A. Shah & Co.

Chartered Accountants

Firm No:-121356W

A. Shah)

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document17 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- All E Technologies RHPDocument295 pagesAll E Technologies RHPShrey ShahNo ratings yet

- Trial BalanceDocument2 pagesTrial BalanceJoseph Bayo BasanNo ratings yet

- Insight To Pfrs 3Document7 pagesInsight To Pfrs 3Elisa ArimasNo ratings yet

- Guide To Using Inter Nation A 2Document321 pagesGuide To Using Inter Nation A 2Viviana TorresNo ratings yet

- Marikina City Audit ReportDocument55 pagesMarikina City Audit ReportArvin F. VillodresNo ratings yet

- Chapter 03 Test Bank AuditingDocument64 pagesChapter 03 Test Bank Auditingabed abusalamehNo ratings yet

- IBIG 04 02 Accounting 3 StatementsDocument99 pagesIBIG 04 02 Accounting 3 StatementsCarloNo ratings yet

- Financial Reporting For Schools: Presented By: Hashim Salie Professional Accountant (SA)Document32 pagesFinancial Reporting For Schools: Presented By: Hashim Salie Professional Accountant (SA)Mohamed abdi norNo ratings yet

- Bokaro or Electrosteel Annual Report of 2017Document126 pagesBokaro or Electrosteel Annual Report of 2017Sachidananda SubudhyNo ratings yet

- Bolinao Executive Summary 2021Document5 pagesBolinao Executive Summary 2021Quinn HarloweNo ratings yet

- Advanced Corporate Accounting On13april2016 PDFDocument198 pagesAdvanced Corporate Accounting On13april2016 PDFDidier NkonoNo ratings yet

- Jang 2014Document23 pagesJang 2014Yuthi MaradaNo ratings yet

- Practice Questions 1 (AIS)Document8 pagesPractice Questions 1 (AIS)UroobaShiekhNo ratings yet

- ATD Accounting Technicians Diploma Examination SyllabusDocument42 pagesATD Accounting Technicians Diploma Examination SyllabusEdwardNo ratings yet

- Securities & Exchange Commission: Standard Setting ProcessDocument186 pagesSecurities & Exchange Commission: Standard Setting ProcessChris Jay LatibanNo ratings yet

- Advanced Accounting Baker Test Bank - Chap012Document67 pagesAdvanced Accounting Baker Test Bank - Chap012donkazotey50% (2)

- PSA 100 Phil Framework For Assurance EngagementsDocument4 pagesPSA 100 Phil Framework For Assurance EngagementsSkye LeeNo ratings yet

- Monash University - Bachelor of Business AdministrationDocument22 pagesMonash University - Bachelor of Business AdministrationBao TranNo ratings yet

- IPSAS 1 Financial Statement Present Including Cash)Document34 pagesIPSAS 1 Financial Statement Present Including Cash)zelalemNo ratings yet

- Ar 2018-19 English NewDocument512 pagesAr 2018-19 English Newprem chand tiwariNo ratings yet

- LESSON 2 BRANCHES OF ACCOUNTING Lecture Lesson 2Document3 pagesLESSON 2 BRANCHES OF ACCOUNTING Lecture Lesson 2ACCOUNTING STRESSNo ratings yet

- Accountancy Department College of Business & AccountancyDocument41 pagesAccountancy Department College of Business & AccountancyNhlakanipho NgobeseNo ratings yet

- Aps Stawi 23 001Document23 pagesAps Stawi 23 001kithomez100% (1)

- Summary Audit Chapter 6Document9 pagesSummary Audit Chapter 6RilvinaNo ratings yet

- Engro-Polymer-Chemicals 2021 ReportDocument197 pagesEngro-Polymer-Chemicals 2021 ReportUmer FarooqNo ratings yet

- Audit Report Format For IndividualDocument4 pagesAudit Report Format For IndividualEiron Almeron100% (3)

- Chapter 1 Overview of Government AccountingDocument4 pagesChapter 1 Overview of Government AccountingSteffany Roque100% (1)

- International Accounting: HighlightsDocument9 pagesInternational Accounting: Highlightsabid hussainNo ratings yet

- Bus Software Week 3Document4 pagesBus Software Week 3Ashley Niña Lee HugoNo ratings yet

- Introduction To Management AccountingDocument71 pagesIntroduction To Management AccountingAnonymous kwi5IqtWJNo ratings yet