Professional Documents

Culture Documents

2424rmo03 15 Annexes

Uploaded by

Arjam B. Bonsucan0 ratings0% found this document useful (0 votes)

16 views1 pageThis document outlines the documentary requirements for the sale of real property classified as an ordinary asset subject to expanded withholding tax. It lists mandatory requirements such as the TIN of the buyer and seller and a notarized deed of sale. Additional requirements are specified for real estate dealers and for ante dated sales. The checklist must be completed and signed by the Head ONETT Team before being provided to the taxpayer.

Original Description:

CDR

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the documentary requirements for the sale of real property classified as an ordinary asset subject to expanded withholding tax. It lists mandatory requirements such as the TIN of the buyer and seller and a notarized deed of sale. Additional requirements are specified for real estate dealers and for ante dated sales. The checklist must be completed and signed by the Head ONETT Team before being provided to the taxpayer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 page2424rmo03 15 Annexes

Uploaded by

Arjam B. BonsucanThis document outlines the documentary requirements for the sale of real property classified as an ordinary asset subject to expanded withholding tax. It lists mandatory requirements such as the TIN of the buyer and seller and a notarized deed of sale. Additional requirements are specified for real estate dealers and for ante dated sales. The checklist must be completed and signed by the Head ONETT Team before being provided to the taxpayer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

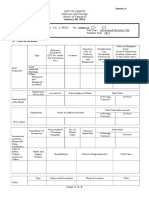

CHECKLIST OF DOCUMENTARY REQUIREMENTS (CDR)

ON SALE OF REAL PROPERTY CLASSIFIED AS ORDINARY ASSET SUBJECT TO EWT

"Annex A-2"

IMPORTANT:

a.

b.

c.

d.

1. Processing of transaction commence only upon submission of COMPLETE DOCUMENTS.

2. In all instances wherein xerox or photocopies are submitted, the original must be presented for authentication.

MANDATORY REQUIREMENTS (Taxable/Exempt)

TIN of Buyer and Seller

Notarized Deed of Absolute Sale/Document of Transfer, but only photocopied document shall be retained by the BIR

Certified true copy of the latest Tax Declaration issued by the Local Assessor's Office for land and improvement

applicable to the taxable transaction

Owner's Copy for presentation purposes only together with the photocopy thereof for authentication or Certified True

Copy of Transfer Certificate of Title (TCT), Condominium Certificate of Title (CCT), Original Certificate of Title (OCT)

Sworn Declaration of No Improvement by at least one (1) of the transferees or Certificate of No Improvement issued

by the Assessor's Office, if applicable

Official Receipt/Deposit Slip for this purpose and duly validated return as proof of payment

ADDITIONAL REQUIREMENTS; For sale of ordinary assets subject to expanded withholding tax by real estate dealer

Seller's latest certificate of registration with HLURB, HUDCC and the latest License to Sell, if habitually

engaged in real estate business, applicable to the project that covers the property sold

Copy of the Contract To Sell and ORs of Payment in case of installment sales

Other requirements, applicable

Special Power of Attorney, if the person signing on the document is not the owner as appearing in the Title

Certification of the Phil. Consulate, if document is executed abroad

Certificate of Exemption/BIR Ruling issued by the Commissioner of Internal Revenue or his authorized representative

if tax exempt

Location plan/vicinity map if zonal value cannot readily be determined from the documents submitted

Such other requirements as may be required by law/rulings/regulations/other issuances

ADDITIONAL REQUIREMENTS for Ante dated Sales

a. Certified True Copy of the Deed of Sale/Assignment/Exchange issued by the Clerk of Court of the City or Municipality where the Notary

Public is registered or from the Regional Trial Court of Office of the Executive Judge of the City or Municipality where the

Notary Public is registered or from the National Archives Office

b. Such Other requirements as may be required by law/rulings/regulations/other issuances

NAME OF TAXPAYER

DATE RECEIVED

ONETT OFFICER

DATE ISSUED

HEAD ONETT TEAM

Telephone No: ____________________

Instruction: Prepare in duplicate and ascertain that CDR is signed by Head ONETT Team before release to taxpayer

Original

- Attach to Docket

Duplicate

- Taxpayer's Copy

CHECKLIST OF DOCUMENTARY REQUIREMENTS (CDR)

ON SALE OF REAL PROPERTY CLASSIFIED AS ORDINARY ASSET SUBJECT TO EWT

"Annex A-2"

IMPORTANT:

a.

b.

c.

d.

1. Processing of transaction commence only upon submission of COMPLETE DOCUMENTS.

2. In all instances wherein xerox or photocopies are submitted, the original must be presented for authentication.

MANDATORY REQUIREMENTS (Taxable/Exempt)

TIN of Buyer and Seller

Notarized Deed of Absolute Sale/Document of Transfer, but only photocopied document shall be retained by the BIR

Certified true copy of the latest Tax Declaration issued by the Local Assessor's Office for land and improvement

applicable to the taxable transaction

Owner's Copy for presentation purposes only together with the photocopy thereof for authentication or Certified True

Copy of Transfer Certificate of Title (TCT), Condominium Certificate of Title (CCT), Original Certificate of Title (OCT)

Sworn Declaration of No Improvement by at least one (1) of the transferees or Certificate of No Improvement issued

by the Assessor's Office, if applicable

Official Receipt/Deposit Slip for this purpose and duly validated return as proof of payment

ADDITIONAL REQUIREMENTS; For sale of ordinary assets subject to expanded withholding tax by real estate dealer

Seller's latest certificate of registration with HLURB, HUDCC and the latest License to Sell, if habitually

engaged in real estate business, applicable to the project that covers the property sold

Copy of the Contract To Sell and ORs of Payment in case of installment sales

Other requirements, applicable

Special Power of Attorney, if the person signing on the document is not the owner as appearing in the Title

Certification of the Phil. Consulate, if document is executed abroad

Certificate of Exemption/BIR Ruling issued by the Commissioner of Internal Revenue or his authorized representative

if tax exempt

Location plan/vicinity map if zonal value cannot readily be determined from the documents submitted

Such other requirements as may be required by law/rulings/regulations/other issuances

ADDITIONAL REQUIREMENTS for Ante dated Sales

a. Certified True Copy of the Deed of Sale/Assignment/Exchange issued by the Clerk of Court of the City or Municipality where the Notary

Public is registered or from the Regional Trial Court of Office of the Executive Judge of the City or Municipality where the

Notary Public is registered or from the National Archives Office

b. Such Other requirements as may be required by law/rulings/regulations/other issuances

NAME OF TAXPAYER

DATE RECEIVED

ONETT OFFICER

DATE ISSUED

HEAD ONETT TEAM

Telephone No: ____________________

Instruction: Prepare in duplicate and ascertain that CDR is signed by Head ONETT Team before release to taxpayer

Original

- Attach to Docket

Duplicate

- Taxpayer's Copy

You might also like

- Land Title Transfer StepsDocument3 pagesLand Title Transfer StepsCookie100% (3)

- Titling of LotDocument12 pagesTitling of LotFatmah Azimah MapandiNo ratings yet

- Transfer Title RequirementsDocument4 pagesTransfer Title RequirementsjoebzNo ratings yet

- List of AssetsDocument3 pagesList of AssetsArjam B. Bonsucan80% (5)

- How To Transfer Land Title in The PhilippinesDocument3 pagesHow To Transfer Land Title in The PhilippinesMarilyn Perez OlañoNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- BIR ChecklistDocument34 pagesBIR ChecklistJulliene AbatNo ratings yet

- Tax Exemption Rulings RequirementsDocument7 pagesTax Exemption Rulings RequirementsArjam B. BonsucanNo ratings yet

- Annex A-2 CDRDocument34 pagesAnnex A-2 CDRnelggkramNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Transferring Land Title StepsDocument4 pagesTransferring Land Title Stepsabogado101No ratings yet

- Documentary Requirements To Be Filed at Office of The Bureau of Internal RevenueDocument3 pagesDocumentary Requirements To Be Filed at Office of The Bureau of Internal Revenuesheshe gamiao100% (1)

- Step by Step - Transfer of TitleDocument4 pagesStep by Step - Transfer of TitleRommyr P. Caballero100% (2)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Transfer of Title in The PhilsDocument6 pagesTransfer of Title in The PhilsAriel FFulgencioNo ratings yet

- Secretary S CertificateDocument2 pagesSecretary S CertificateMary Rose BarotNo ratings yet

- Secretary S CertificateDocument2 pagesSecretary S CertificateMary Rose BarotNo ratings yet

- BIR Checklist of Documentary Requirements of Estate TaxDocument1 pageBIR Checklist of Documentary Requirements of Estate TaxRuben Ayson JrNo ratings yet

- Checklist and Steps For Land Title TransferDocument3 pagesChecklist and Steps For Land Title TransferBeth de Vera100% (1)

- A. Steps in Casual Sale of Real Estate: Fees To Be IncurredDocument9 pagesA. Steps in Casual Sale of Real Estate: Fees To Be IncurredMinmin WaganNo ratings yet

- Land Registration ProcessDocument4 pagesLand Registration ProcessRheinhart Pahila100% (1)

- Capital Gains TaxDocument5 pagesCapital Gains TaxJAYAR MENDZNo ratings yet

- Extrajudicial Settlement of Estate Rule 74, Section 1 ChecklistDocument8 pagesExtrajudicial Settlement of Estate Rule 74, Section 1 ChecklistMsyang Ann Corbo DiazNo ratings yet

- Steps For Transferring A TitleDocument4 pagesSteps For Transferring A TitleLouisPNo ratings yet

- FAQs LRA Land Registration Authority Frequently Asked QuestionsDocument3 pagesFAQs LRA Land Registration Authority Frequently Asked QuestionsPrateik RyukiNo ratings yet

- Estate Tax Return: MandatoryDocument1 pageEstate Tax Return: MandatoryYna Yna100% (1)

- Public Corp Reviewer From AteneoDocument7 pagesPublic Corp Reviewer From AteneoAbby Accad67% (3)

- Checklist of Requirements - BIR - Capital Gains TaxDocument1 pageChecklist of Requirements - BIR - Capital Gains TaxLRMNo ratings yet

- Law On Natural Resources Reviewer PDFDocument108 pagesLaw On Natural Resources Reviewer PDFKrisLarrNo ratings yet

- Getting Started With OneDrive PDFDocument1 pageGetting Started With OneDrive PDFmegaNo ratings yet

- BIR Checklist Capital Gains TaxDocument2 pagesBIR Checklist Capital Gains TaxJulliene Abat33% (6)

- 6-step guide to land title transferDocument2 pages6-step guide to land title transferRyden Doculan PascuaNo ratings yet

- New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]From EverandNew York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]No ratings yet

- Sharing Expenses When Transferring Real Estate TitleDocument2 pagesSharing Expenses When Transferring Real Estate TitlePogi akoNo ratings yet

- Capital Gains Tax Return ChecklistDocument2 pagesCapital Gains Tax Return ChecklistNarkSunder0% (1)

- How to Transfer Land Title in the PhilippinesDocument5 pagesHow to Transfer Land Title in the Philippinesjayar medicoNo ratings yet

- Basic Requirements For Registering Properties in The PhilippinesDocument2 pagesBasic Requirements For Registering Properties in The Philippinescrixzam100% (1)

- Requirement SEC RegistrationDocument14 pagesRequirement SEC RegistrationbrownboomerangNo ratings yet

- Sample SMRDocument3 pagesSample SMRArjam B. BonsucanNo ratings yet

- RequirementsDocument5 pagesRequirementsAlfie OmegaNo ratings yet

- Steps of Land TransferDocument6 pagesSteps of Land TransferKeith LlaveNo ratings yet

- BIR CGT RequirementsDocument3 pagesBIR CGT RequirementsGerald MesinaNo ratings yet

- New Lawyer MCLE GuidelinesDocument2 pagesNew Lawyer MCLE GuidelinesAugie Lusung100% (1)

- Checklist of Documentary Requirements On Sale of Real Property Rmo15 - 03anxa2 PDFDocument1 pageChecklist of Documentary Requirements On Sale of Real Property Rmo15 - 03anxa2 PDFCavinti LagunaNo ratings yet

- Withholding Tax Remittance Return ChecklistDocument2 pagesWithholding Tax Remittance Return ChecklistJulliene AbatNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument2 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsJyasmine Aura V. AgustinNo ratings yet

- Documentary RequirementsDocument2 pagesDocumentary RequirementsAyetNo ratings yet

- Annex B4Document1 pageAnnex B4Idan AguirreNo ratings yet

- Requirements Involving Land TransactionsDocument3 pagesRequirements Involving Land TransactionsRAPHY T ALANNo ratings yet

- Titling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDDocument3 pagesTitling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDara abuNo ratings yet

- Administrative TitlingDocument12 pagesAdministrative TitlingDebra BraciaNo ratings yet

- The Ultimate Checklist and Steps For Land Title TransferDocument4 pagesThe Ultimate Checklist and Steps For Land Title Transferarmi tanguancoNo ratings yet

- Capital Gains Tax GuideDocument15 pagesCapital Gains Tax GuideWilma P.No ratings yet

- Capital Gains TaxDocument11 pagesCapital Gains TaxRoma Sabrina GenoguinNo ratings yet

- S40 Checklist Annex BDocument2 pagesS40 Checklist Annex BTootsieNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument6 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsCyrill L. MarkNo ratings yet

- LRA FAQ How To RegisterDocument4 pagesLRA FAQ How To RegistergayleopsimaNo ratings yet

- Capital Gains Tax - Bureau of Internal RevenueDocument1 pageCapital Gains Tax - Bureau of Internal Revenuetan limNo ratings yet

- Required Document ChecklistDocument3 pagesRequired Document ChecklistFrederick Xavier LimNo ratings yet

- FAQs On Land OwnershipDocument3 pagesFAQs On Land OwnershipBnl NinaNo ratings yet

- Bureau of Internal Revenue (Bir) Capital Gains Tax (BIR Form 1706) and Documentary Stamp Tax (2000-OT)Document3 pagesBureau of Internal Revenue (Bir) Capital Gains Tax (BIR Form 1706) and Documentary Stamp Tax (2000-OT)sheshe gamiaoNo ratings yet

- How to Get BIR CAR and TCL for Property SaleDocument4 pagesHow to Get BIR CAR and TCL for Property SalekaiNo ratings yet

- Step-by-Step Guide On Transferring Title of PropertiesDocument2 pagesStep-by-Step Guide On Transferring Title of PropertiesDoreen Joy MonsendoNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument11 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsGrace G. ServanoNo ratings yet

- FAQs - Land Registration AuthorityDocument4 pagesFAQs - Land Registration Authorityarkina_sunshineNo ratings yet

- List of Requirements BIR - Transfer of Shares of StockDocument1 pageList of Requirements BIR - Transfer of Shares of Stockiris_irisNo ratings yet

- OCA Circular No. 67 2008Document3 pagesOCA Circular No. 67 2008amazing_pinoyNo ratings yet

- First Penned Regular CaseDocument9 pagesFirst Penned Regular CaseArjam B. BonsucanNo ratings yet

- 2017 CSC RraccsDocument52 pages2017 CSC RraccsJeremy LuglugNo ratings yet

- SecDocument15 pagesSecArjam B. BonsucanNo ratings yet

- Required Document ChecklistDocument3 pagesRequired Document ChecklistFrederick Xavier LimNo ratings yet

- Rmo 22 01Document20 pagesRmo 22 01Maria Leonora Bornales100% (1)

- Required Document ChecklistDocument3 pagesRequired Document ChecklistFrederick Xavier LimNo ratings yet

- 1601E - August 2008Document4 pages1601E - August 2008HarryNo ratings yet

- Department of Labor and EmploymentDocument1 pageDepartment of Labor and EmploymentArjam B. BonsucanNo ratings yet

- Department of Labor and EmploymentDocument1 pageDepartment of Labor and EmploymentArjam B. BonsucanNo ratings yet

- Class 16 06 26 SeatworkDocument3 pagesClass 16 06 26 SeatworkArjam B. BonsucanNo ratings yet

- Required Document ChecklistDocument3 pagesRequired Document ChecklistFrederick Xavier LimNo ratings yet

- Notes On Law On Natural ResourcesDocument6 pagesNotes On Law On Natural ResourcesIvan Angelo ApostolNo ratings yet

- Location of Other CasesDocument1 pageLocation of Other CasesArjam B. BonsucanNo ratings yet

- CONSTITUTIONAL PROVISION ON DISPOSITION OF PUBLIC LANDSDocument10 pagesCONSTITUTIONAL PROVISION ON DISPOSITION OF PUBLIC LANDSElaine Llarina-RojoNo ratings yet

- Rmo No. 7-2015 Annex ADocument12 pagesRmo No. 7-2015 Annex Ablackcholo100% (1)

- Civil 2011-2015Document12 pagesCivil 2011-2015Arjam B. BonsucanNo ratings yet

- CONSTITUTIONAL PROVISION ON DISPOSITION OF PUBLIC LANDSDocument10 pagesCONSTITUTIONAL PROVISION ON DISPOSITION OF PUBLIC LANDSElaine Llarina-RojoNo ratings yet

- 2424rmo03 15 AnnexesDocument1 page2424rmo03 15 AnnexesArjam B. BonsucanNo ratings yet

- Criminal Code September-2014 (Draft)Document27 pagesCriminal Code September-2014 (Draft)Charles MJNo ratings yet

![New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/661176503/149x198/6cedb9a16a/1690336075?v=1)