Professional Documents

Culture Documents

Jones Electrical Distribution: Presented By: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Jones Electrical Distribution: Presented By: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Uploaded by

Katherine Zurita PobleteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jones Electrical Distribution: Presented By: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Jones Electrical Distribution: Presented By: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Uploaded by

Katherine Zurita PobleteCopyright:

Available Formats

Jones Electrical Distribution

Mr. Jones,

A recent evaluation of Jones Electrical Distribution has occurred in request of a

loan. An assessment of the companys financial health shows that it is profitable. The

shortage in cash flows regards managerial attention. Since Jones opened in 1999 the

company has seen rapid growth in a highly competitive field. General contractors and

electricians have preferred Jones for their business. The request for this loan also has

occurred at the end of March; past patterns show that your company is seasonal, with

most sales occurring in spring and summer months. Previously stated facts estimate that

sales will gradually increase. If managed properly Jones has potential to develop, grow,

and add additional sites in the future. Internal and external references about Jones

engineering have been beneficial in consideration for a loan.

II. Problem Statement

Recently the continued growth in sales has raised accounts receivable and

inventories considerably. This decrease in inventory turnover has caused accounts

payable to rise due to heavy reliance on credit from suppliers. There are many ways in

which you can lower the size of the line of credit needed. Good management can lower

the credit line needed by lowering the inventories and accounts receivables, which grew

in 2005 and 2006 because Jones is trying to increase production and growth by pushing

the products to the customers. In 2003 Nelson Jones was involved in an argument with

his partner Dave Verden and Jones agreed to buy out his partner for $250,000, paying him

$2,000 a month with an 8% per year interest rate. It will take Jones 10.83 years to pay

back his old partner. Having that extra expense will decrease his monthly income

requiring him to retain a higher loan amount. Since the market for Jones Electrical

Presented by: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Page 1

Jones Electrical Distribution

Distribution is fragmented, Jones is trying to increase its inventory. Inventory turnover

ratio for 2005 is (1535/278=5.52) and for 2006 is (1818/379=4.79). It shows that Jones

has been overconfident in their predictions. Increasing the inventory is a reason that the

company is facing cash money shortage. All of these have dramatically increased days

payable out standing. In past history Jones took advantage of a 2% discount if supplies

were fully paid off tens days upon purchase. With the growth of business and the

decrease in Cash Flows, payments for supplies exceed the discount period. The discount

that is disregarded only increases the accounts payable and further decreases cash flow.

In 2006 Metropolitan Branch Bank issued a loan of $250,000 to Jones in order to finance

its growth in sales. Heavy credit dependency on suppliers will continue to draw request

for larger loans and Jones must keep its line of credit at a lower rate to increase cash

flows. The risk in issuing a $350,000 loan with a company of Jones size could be

decreased in hope of creating a long term relationship. Also, the company has also

lowered the Cash Conversion Cycle from 100.12 days (during 2005) to 95.01 days

(during 2006). In 2005, days payable outstanding was around ten days and fell under the

discount agreement with suppliers. In 2006, the number of days it was taking Jones to

repay its suppliers had increased to 24. The nominal cost lost in forgoing the discount

was 37.2% of cost of goods sold, or $67,600. The first quarter in 2007 shows another

increase in sales with another increase of accounts payable. Certain changes or

improvements should be made to ensure future stability.

III. Assessment

Changes to the line of credit could be made or agreed upon. Jones Electrical

Distribution should re-evaluate a deal with suppliers for a 1% discount and a twenty day

Presented by: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Page 2

Jones Electrical Distribution

time frame of eligibility. The line of credit can be lowered also by using a home equity

loan in which Mr. Jones home is put up for collateral if he fails to make the payments.

The line of credit you receive would be the net worth of your house minus the mortgage

amount left on your home, which would be, $199,000 less $117,000 giving you a total of

$82,000. When acquiring about a $350,000 loan being able to reduce that price by

$82,000 is quite significant. After accepting a large loan of $350,000, the president of

Jones Electrical Distribution, is going to have to make cut backs and changes in everyday

life.

One area that we feel that you could improve in is your purchasing of inventory.

There seems to be a huge influx of additions to your inventory, and based on the decrease

in your inventory turnover ratio, the increase of inventory seems to be a bit unnecessary.

Looking at the financial statements we feel that you could improve your cash flows by

buying the appropriate amount of inventory. Although you are expected to continually

grow, we feel that if you purchased inventory in proportion to the growth that your

company expects, it would improve your inventory turnover rate. Doing this would help

you be more profitable.

Another area of concern for us is your collections policy. We feel that if you

enforced a more strict collections policy that it would improve other areas of your

finances. By the looks of it, it appears that the lack of enforcement has deducted your

available cash which has forced an inhibition of payment during the discount period on

your credit line. We feel that you need to take the necessary steps to collect on your

Accounts Receivables in a timely manner, so that you may take advantage of the discount

period. According to our calculations you are forgoing approximately $67,000 by

Presented by: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Page 3

Jones Electrical Distribution

capitalizing on the discount period. Although this would not completely remedy your

need for additional finances, we feel that it would reduce it significantly.

After speaking to associate Jim Lyons who is an established customer at Southern

Bank and Trusts he ensured that Jones was managed by a man that lived a modest

lifestyle and is considered a hands-on manager of great innovation in the electrical field.

We also spoke to some of the manufacturers in which Jones purchases products from; the

administrators at such manufacturers explained to us that exceptional at expense

management has always been a top priority for you and your company. This leads us to

believe that you are an outstanding candidate for our loan and that we would be grateful

to accept your business.

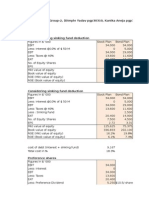

2004

2005

2006

Quick Ratio

(475-243)/222=

1.05

(562-278)/294=

0.97

(666-379)/407=

0.64

Inventory Turnover

1624/243=

1916/278=

2242/379=

6.68

6.89

5.92

Days Sales Outstanding

187/(1624/365)=

42.03

231/(1916/365)=

44.01

264/(2242/365)=

42.98

Days Payable Outstanding

36/(1304/365)=

42/(1535/365)=

120/(1818/365)=

Presented by: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Page 4

Jones Electrical Distribution

10.08

Fix Asset Turnover

1624/113=

9.99

1916/103=

14.37

Return on Asset

NI/Avg. TA=

2242/118=

18.6

NI/Avg. TA=

NI/SE=

Formula for the

Conversion Cycle:

CCC=(InvAP/COGS/365)+

(AR/Sales/365)

4.4

NI/SE=

7.6

19

NI/Avg. TA=

2.4

Return on Equity

24.09

3.8

NI/SE=

13.6

12.3

Cash

Appendixes: A

II. Income Statement (As % of

Sales)

Presented by: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Page 5

Jones Electrical Distribution

Net Sales

CoGS

2004

100

80.3

2005

100

80.11

2006

100

81.09

Gross Profit

19.7

19.89

18.91

16.75

1.66

1.29

16.02

1.57

2.3

15.48

1.58

2.05

0.43

0.86

0.78

1.51

0.71

1.34

2004

7.65

31.8

41.33

80.78

31.8

12.59

19.22

2005

7.97

34.74

41.8

84.51

30.38

14.89

15.49

2006

2.93

33.67

48.34

84.93

32.14

17.09

15.05

100

100

100

Accounts Payable

Line of Credit Pay

Accrued Expenses

Long Term Debt

Current Liabilities

6.12

25.34

2.21

4.08

37.76

6.32

32.18

2.11

3.61

44.21

15.31

31.76

1.79

3.06

51.91

Long Term Debt

Total Liabilites

30.95

68.71

23.76

67.97

17.09

69.01

Net Worth

Total Liabilities & Net Worth

31.79

100

32.03

100

30.99

100

Operating Expenses

Interest Expenses

Net Income

Provision for Income Taxes

Net Income

Balance Sheet (As % of Sales)

Cash

Account Receivables

Inventory

Total Current Assets

Property & Equipment

Acc. Depr.

Total PPE, net

Total Assets

Appendixes: B

III. Statement of Cash Flows

Presented by: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Page 6

Jones Electrical Distribution

2005

2006

29

30

Cash Flow From Operations

Net Income

Additions to Cash

Depreciation

Increase in Accounts

Receivable

Increase in Accounts Payable

Accrued expenses

99

134

231

42

14

264

120

14

Subtractions From Cash

Increase in Inventory

Net Cash from Operations

278

53

279

23

Cash Flow From Investing

Equipment

202

252

Cash Flow From Financing

Line of Credit Payable

214

249

Net Cash Flow

268

75

324040734.doc

Appendixes: C

Presented by: Ben Nalty, Nick Weyrens, Chris Mlincsek, Besian Nushi

Page 7

You might also like

- Case 48 Sun MicrosystemsDocument25 pagesCase 48 Sun MicrosystemsChittisa Charoenpanich40% (5)

- Jones Electrical Distribution Case ExhibitsDocument7 pagesJones Electrical Distribution Case ExhibitsJustin Ho100% (1)

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionPedro José ZapataNo ratings yet

- Momouth Case Study PresentationDocument18 pagesMomouth Case Study PresentationSven Mueller100% (5)

- New DollDocument2 pagesNew DollJuyt HertNo ratings yet

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Valuation Analysis For Robertson ToolDocument5 pagesValuation Analysis For Robertson ToolPedro José ZapataNo ratings yet

- FM SolutionDocument11 pagesFM SolutionBilal Naseer100% (4)

- Jones Electrical Case Study SolutionDocument6 pagesJones Electrical Case Study SolutionShak Uttam100% (2)

- Polar Sports, IncDocument15 pagesPolar Sports, IncJennifer Jackson91% (11)

- Jones Electric Case StudyDocument7 pagesJones Electric Case Studymwillar08No ratings yet

- Butler Lumber Company Case SolutionDocument18 pagesButler Lumber Company Case SolutionNabab Shirajuddoula75% (8)

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionLoleeta H. Khaleel67% (9)

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataVishal VermaNo ratings yet

- Monmouth CaseDocument8 pagesMonmouth CaseFrank Rotella100% (2)

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisTheicon420No ratings yet

- Butler Lumber Company: Following Questions Are Answered in This Case Study SolutionDocument3 pagesButler Lumber Company: Following Questions Are Answered in This Case Study SolutionTalha SiddiquiNo ratings yet

- Blaine SolutionDocument4 pagesBlaine Solutionchintan MehtaNo ratings yet

- Monmouth Inc. - SolutionDocument12 pagesMonmouth Inc. - SolutionAnshul Sehgal0% (2)

- California Pizza Kitchen Case SolnDocument8 pagesCalifornia Pizza Kitchen Case Solnkiller dramaNo ratings yet

- Jones Electrical Distribution AnswersDocument29 pagesJones Electrical Distribution AnswersVera Lúcia Batista SantosNo ratings yet

- WORKING CAPITAL DocxDocument16 pagesWORKING CAPITAL DocxGab IgnacioNo ratings yet

- Jones Electrical DistributionDocument5 pagesJones Electrical DistributionAsif AliNo ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionMichelle Rodríguez100% (1)

- Assignment #2 Workgroup E IttnerDocument8 pagesAssignment #2 Workgroup E IttnerAziz Abi AadNo ratings yet

- Flash Memory IncDocument7 pagesFlash Memory IncAbhinandan SinghNo ratings yet

- Finance Case - Blaine Kitchenware - GRP - 11Document4 pagesFinance Case - Blaine Kitchenware - GRP - 11Shona Baroi100% (3)

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- I. Title of The Case: The University Foundation II. Problems EncounteredDocument2 pagesI. Title of The Case: The University Foundation II. Problems EncounteredJoshua100% (1)

- Financial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059Document32 pagesFinancial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059josh100% (1)

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- Case SolutionDocument9 pagesCase Solutiontiko100% (1)

- Jones Electrical DistributionDocument3 pagesJones Electrical DistributionAnirudh Kowtha0% (1)

- Jones Electrical DDocument2 pagesJones Electrical DAsif AliNo ratings yet

- Corp Fin CaseDocument5 pagesCorp Fin Caselogicat1989100% (4)

- Jones Electrical DistributionDocument2 pagesJones Electrical DistributionJeff FarleyNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Jones Electrical DistributionDocument7 pagesJones Electrical Distributionsd717No ratings yet

- Jones Electrical DistributionDocument12 pagesJones Electrical DistributionJohnNo ratings yet

- MonmouthDocument16 pagesMonmouthjamn1979100% (1)

- Monmouth Case SolutionDocument16 pagesMonmouth Case SolutionAjaxNo ratings yet

- Jones Electrical SlidesDocument6 pagesJones Electrical SlidesRohit AwadeNo ratings yet

- Millions of Dollars Except Per-Share DataDocument17 pagesMillions of Dollars Except Per-Share DataWasp_007_007No ratings yet

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Monmouth Group4Document18 pagesMonmouth Group4Jake Rolly0% (1)

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionGourav DadhichNo ratings yet

- Monmouth CaseDocument6 pagesMonmouth CaseMohammed Akhtab Ul HudaNo ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- Industrial Grinders N VDocument9 pagesIndustrial Grinders N Vapi-250891173100% (3)

- Exhibits of Blaine Kitchenware, Inc - CaseDocument6 pagesExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- Case Studies On Cooper Industries IncDocument12 pagesCase Studies On Cooper Industries IncLutful Kabir71% (7)

- Cooper Case SolutionsDocument6 pagesCooper Case SolutionsDarshan Salgia100% (1)

- Finance Case Study: Jones Electrical DistributionDocument9 pagesFinance Case Study: Jones Electrical DistributionRaju SharmaNo ratings yet

- Finance Case Study: Jones Electrical DistributionDocument8 pagesFinance Case Study: Jones Electrical DistributionKathGuNo ratings yet

- Executive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonDocument3 pagesExecutive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonRakesh GyamlaniNo ratings yet

- Executive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonDocument9 pagesExecutive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonRakesh GyamlaniNo ratings yet

- Dynashears Inc CaseDocument4 pagesDynashears Inc Casepratik_gaur1908No ratings yet

- Wilson Lumber Case Group 5Document10 pagesWilson Lumber Case Group 5Falah HindNo ratings yet

- Chapter Ten: Short-Term Finance - Working Capital: QuestionsDocument3 pagesChapter Ten: Short-Term Finance - Working Capital: QuestionsR and R wweNo ratings yet

- Ros69749 ch19Document9 pagesRos69749 ch19arzoo26No ratings yet

- 2 New HSS 101Document29 pages2 New HSS 101Aviraj KhareNo ratings yet

- Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsDocument42 pagesMultinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsAhsanun NisaNo ratings yet

- Principles of Capital InvestmentDocument35 pagesPrinciples of Capital InvestmentAnam Jawaid100% (1)

- Mba Finance ProjectDocument92 pagesMba Finance ProjectArchanareddy100% (1)

- BF Q3M7 PDFDocument27 pagesBF Q3M7 PDFConeymae TulabingNo ratings yet

- Dcom505 Working Capital Management PDFDocument242 pagesDcom505 Working Capital Management PDFRaj KumarNo ratings yet

- Candle Stick PatternsDocument14 pagesCandle Stick PatternsSmile EverNo ratings yet

- BizzX Newsletter Summary: 2006-2009Document8 pagesBizzX Newsletter Summary: 2006-2009Dave LivingstonNo ratings yet

- Uber Group ProjectDocument14 pagesUber Group ProjectMichael NicolichNo ratings yet

- Compartive Study On Service of Private and Public Sector BsnksDocument83 pagesCompartive Study On Service of Private and Public Sector BsnksParveen ChawlaNo ratings yet

- Guingona v. City Fiscal of ManilaDocument4 pagesGuingona v. City Fiscal of ManilaYodh Jamin OngNo ratings yet

- Learning Objective 11-1: Chapter 11 Current Liabilities and PayrollDocument50 pagesLearning Objective 11-1: Chapter 11 Current Liabilities and PayrollMarqaz MarqazNo ratings yet

- Aro Granite LTD - Impetus Advisors - Nov-04Document8 pagesAro Granite LTD - Impetus Advisors - Nov-04Arpit JainNo ratings yet

- Project 1Document52 pagesProject 1Anurima BanerjeeNo ratings yet

- Finance Project ReportDocument7 pagesFinance Project Reporthamzaa mazharNo ratings yet

- Net Present Value of Capital Project: Cash Inflows Year 0 1 2Document4 pagesNet Present Value of Capital Project: Cash Inflows Year 0 1 2Sudhir AggarwalNo ratings yet

- UK Mid-Market PE Review: Our Perspective On Private Equity Activity During 2020Document50 pagesUK Mid-Market PE Review: Our Perspective On Private Equity Activity During 2020xen101No ratings yet

- 2011-12 - Dac 14.01.2020Document38 pages2011-12 - Dac 14.01.2020Shahaan ZulfiqarNo ratings yet

- Economics of Money and BankingDocument196 pagesEconomics of Money and BankingDenisse Garza100% (3)

- Stock Cheat SheetDocument6 pagesStock Cheat SheetalishaNo ratings yet

- The Acquirer's Multiple - How The Billionaire Contrarians of Deep Value Beat The Market PDFDocument149 pagesThe Acquirer's Multiple - How The Billionaire Contrarians of Deep Value Beat The Market PDFRamdisa100% (5)

- Finals Module: 1 Assignment Performance EvaluationDocument2 pagesFinals Module: 1 Assignment Performance EvaluationRialyn Joy KismaliNo ratings yet

- Quiz 2 - A SampleDocument2 pagesQuiz 2 - A Samplerohit_sethi89No ratings yet

- Banggawan 13 15b TFDocument10 pagesBanggawan 13 15b TFEarth PirapatNo ratings yet

- GR: Donations Inter Vivos Are Subject To Donor's Taxes While DonationsDocument8 pagesGR: Donations Inter Vivos Are Subject To Donor's Taxes While DonationsDominic EmbodoNo ratings yet

- Equitable Banking Corp v. Special Steel ProductsDocument1 pageEquitable Banking Corp v. Special Steel ProductsYsa Sumaya100% (1)