Professional Documents

Culture Documents

Travel and Miscellaneous Title E.G. Surname First Prof/Dr/Mr/Mrs Name Initials Department/ Postal Address

Uploaded by

phf22Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Travel and Miscellaneous Title E.G. Surname First Prof/Dr/Mr/Mrs Name Initials Department/ Postal Address

Uploaded by

phf22Copyright:

Available Formats

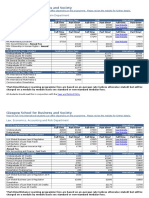

GB/GC/GD (Delete as applicable)

Employee/student/other

UNIVERSITY OF CAMBRIDGE

Faculty of Architecture & History of Art

EXPENSE CLAIM FORM

TRAVEL AND MISCELLANEOUS

Title e.g.

Prof/Dr/Mr/Mrs

Surname

(Block letters)

First

Name

Initials

Department/

Postal Address

Email Address

Claimants

Signature

Print Name

Date

Authorising

Signature

Print Name

Date

(must not be claimant)

Account to be charged

or Research Grant

Date

Purpose

Sum claimed

()

Description

Total

* Accounts use only

_________

Research Grant

Exp type

VAT () *

Net () *

___________

__________

Transaction

Code*

Faculty of Architecture & History of Art

University of Cambridge

Recovery of expenses on travelling and subsistence incurred in the UK on the business of the

Department will depend upon:

1

Form being authorised by an officer of the university other than the claimant.

Actual expenses only being claimed up to the maximum rates specified below.

The most economical means of travel and subsistence being used.

Second class rail travel and subsistence being used.

Car mileage over 75.00 being approved by a head of division.

Owners of cars being adequately insured for business use.

Supporting vouchers being provided with claims for subsistence, for airfares and travel overseas.

Research students travel and subsistence being authorised beforehand, and the claims being signed by

the respective supervisors.

Claims for travel and subsistence abroad being made for actual expenses of the most economic and

reasonable means available in the circumstances.

Subsistence Allowances

Until

31 July 2010

From

1 August 2010

For part of a day including lunch

7.00

8.00

For part of a day including dinner

19.00

20.00

For part of a day including lunch and dinner

26.00

28.00

For bed and breakfast

89.00

93.00

For bed and breakfast (London rate)

117.00

123.00

Allowance for staying with friends or family

25.00

25.00

The allowance for a complete period of 24 hours outside London

115.00

121.00

The allowance for a complete period of 24 hours in London

145.00

152.00

The allowance for a complete period of 24 hours is 121.00 outside London (152.00 in London). In all cases

reimbursement of expenditure is restricted to the allowance or the amount spent whichever is the less.

Mileage Allowance

There is no change to the rate of mileage allowance which is aligned with rates set by H M Revenue & Customs

at 40p per mile for cars (25p after 10,000 miles) and 24p for motorcycles.

You might also like

- Carnival UK - Deck & Technical Department BenefitsDocument2 pagesCarnival UK - Deck & Technical Department BenefitsMinca Constantin CosminNo ratings yet

- Cambridge Exam Fee Indonesia 19-20Document9 pagesCambridge Exam Fee Indonesia 19-20Evi Sofiawati Afifudin100% (2)

- Form SL-C: Claims Must Be Submitted Within 3 Months of Incurred Expenses With All Receipts and Proof of AttendanceDocument1 pageForm SL-C: Claims Must Be Submitted Within 3 Months of Incurred Expenses With All Receipts and Proof of AttendancedrakeNo ratings yet

- Cost of Living Guide 2010/2011: Tuition Fees - Per Year 2010/2011Document2 pagesCost of Living Guide 2010/2011: Tuition Fees - Per Year 2010/2011yagnapalrajuNo ratings yet

- Sfo Travel Bursary FormDocument2 pagesSfo Travel Bursary FormAndrei SavaNo ratings yet

- Cost of Living in Louhgborough UniDocument5 pagesCost of Living in Louhgborough UniOsslLoughboroughNo ratings yet

- Study Leave Expenses Claim Form WestDocument2 pagesStudy Leave Expenses Claim Form WestAndrewBeckNo ratings yet

- A Guide To Living Costs PDFDocument1 pageA Guide To Living Costs PDFRenzo JakaNo ratings yet

- Glasgow School For Business and Society: Social Sciences, Media and Journalism DepartmentDocument5 pagesGlasgow School For Business and Society: Social Sciences, Media and Journalism DepartmentJackieNo ratings yet

- PGG InfoDocument1 pagePGG InfoLoic ParfaitNo ratings yet

- Home Office: WWW - Ukba.homeoffice - Gov.ukDocument7 pagesHome Office: WWW - Ukba.homeoffice - Gov.ukMuhammad A. NaeemNo ratings yet

- HCI Economics Prelim 2009 (H2 Economics P1-CS) QUESDocument10 pagesHCI Economics Prelim 2009 (H2 Economics P1-CS) QUESmangojudyNo ratings yet

- Web VersionDocument19 pagesWeb VersionPiotr SzyjaNo ratings yet

- Kongsberg Oil and Gas Technology LimitedDocument1 pageKongsberg Oil and Gas Technology LimitedGhoozyNo ratings yet

- Dance School Summer Events Application FormDocument8 pagesDance School Summer Events Application FormHeinz Gilbert DenoyoNo ratings yet

- A Guide To Living CostsDocument1 pageA Guide To Living CostsJopalionNo ratings yet

- InternationalPre arrivalGuideAug2011Document20 pagesInternationalPre arrivalGuideAug2011Lijoe GeorgeNo ratings yet

- Taxation (United Kingdom) : Tuesday 4 June 2013Document22 pagesTaxation (United Kingdom) : Tuesday 4 June 2013Eric MugaNo ratings yet

- EN EN: European CommissionDocument15 pagesEN EN: European CommissionJózsef PataiNo ratings yet

- Postgraduate Study Annual Tuition Fees For Academic Session 2012-13Document24 pagesPostgraduate Study Annual Tuition Fees For Academic Session 2012-13faykissNo ratings yet

- Open Letter From Gordon DewarDocument2 pagesOpen Letter From Gordon DewarThe GuardianNo ratings yet

- 2.4 The Legal EnvironmentDocument3 pages2.4 The Legal EnvironmentCurecheriu Miluta IonelaNo ratings yet

- Itv Spot Costs - 2016Document1 pageItv Spot Costs - 2016api-268965515No ratings yet

- Offer LetterDocument2 pagesOffer LetterNoman Ul Haq SiddiquiNo ratings yet

- 2009-Management Accounting Main EQP and CommentariesDocument53 pages2009-Management Accounting Main EQP and CommentariesBryan Sing100% (1)

- Moving Kit Outside The UK: What We Know So FarDocument15 pagesMoving Kit Outside The UK: What We Know So FarMatteo CacioppoNo ratings yet

- Fees Table For Website 2016-17 v0.2Document3 pagesFees Table For Website 2016-17 v0.2Haris LesmanaNo ratings yet

- Document - Rcophth - Expenses Form 001Document1 pageDocument - Rcophth - Expenses Form 001api-559481034No ratings yet

- R Tio: Punjab Technical UniversityDocument2 pagesR Tio: Punjab Technical UniversityGurpreet Singh KambojNo ratings yet

- Fueleumaritime Faq eDocument17 pagesFueleumaritime Faq eonur2613No ratings yet

- Annual Report ON Civil Parking Enforcement 2009-2010Document7 pagesAnnual Report ON Civil Parking Enforcement 2009-2010parkingeconomicsNo ratings yet

- ADIT Prospectus 2018Document40 pagesADIT Prospectus 2018Alan HgNo ratings yet

- Documentation FileDocument2 pagesDocumentation FileRangith RamalingamNo ratings yet

- LetterDocument2 pagesLetterAmajdNo ratings yet

- School of Engineering and Built Environment: Construction and Surveying DepartmentDocument5 pagesSchool of Engineering and Built Environment: Construction and Surveying DepartmentJackieNo ratings yet

- Le Shuttle Versus The Ferries: Pricing StrategyDocument11 pagesLe Shuttle Versus The Ferries: Pricing Strategyjc1711No ratings yet

- Guide To Student Travel Around LondonDocument4 pagesGuide To Student Travel Around LondonFinbarr TimbersNo ratings yet

- TestNEFUpIn (Reading)Document3 pagesTestNEFUpIn (Reading)kieu77No ratings yet

- Travel and Accomodation Expenses - 2014 LuxembourgDocument11 pagesTravel and Accomodation Expenses - 2014 LuxembourgJakub JakubiakNo ratings yet

- 2013 PAWEES 3rd Announcement 2Document12 pages2013 PAWEES 3rd Announcement 2hirohiro8008No ratings yet

- 2011 Giveaway Promotion TeamDocument3 pages2011 Giveaway Promotion TeamTho TranNo ratings yet

- P6UK 2014 Dec QDocument14 pagesP6UK 2014 Dec QAlina TariqNo ratings yet

- Filco Supermarkets Limited Company LocationDocument2 pagesFilco Supermarkets Limited Company LocationArul JohnsonNo ratings yet

- Advanced Taxation (United Kingdom) : September/December 2016 - Sample QuestionsDocument17 pagesAdvanced Taxation (United Kingdom) : September/December 2016 - Sample QuestionsRaza AliNo ratings yet

- Taxi Fares GuideDocument1 pageTaxi Fares GuiderichardijahaNo ratings yet

- Wtm2010 Industry ReportDocument36 pagesWtm2010 Industry ReportmehmetozhanNo ratings yet

- Carbon TradingDocument13 pagesCarbon Tradingpia.malik2009No ratings yet

- The Reddin Survey of University Tuition Fees2013-14Document3 pagesThe Reddin Survey of University Tuition Fees2013-14saleemut3No ratings yet

- Taxation in UKDocument15 pagesTaxation in UKluaybazNo ratings yet

- News Bulletin From Greg Hands MP 398Document1 pageNews Bulletin From Greg Hands MP 398Greg HandsNo ratings yet

- Abta Brexit OnlineDocument9 pagesAbta Brexit OnlineManal Saad KeligNo ratings yet

- UK DVLA Driving License Requirements DG - 068659Document16 pagesUK DVLA Driving License Requirements DG - 068659saket512No ratings yet

- UKTI Taste of The South East CompetitionDocument5 pagesUKTI Taste of The South East CompetitionUKTI South EastNo ratings yet

- Exxon MobileDocument1 pageExxon MobileAlok RanjanNo ratings yet

- London To OxfordDocument3 pagesLondon To OxfordGian Carlo MirandaNo ratings yet

- Ecost Meeting CM1106 270314 037618 MRQ 475738Document2 pagesEcost Meeting CM1106 270314 037618 MRQ 475738lászló_kocsis_6No ratings yet

- Irca Fees ChargesDocument4 pagesIrca Fees ChargesramstoriesNo ratings yet

- Implications of Brexit Revision Notes: BackgroundDocument3 pagesImplications of Brexit Revision Notes: BackgroundRaymond MacDougallNo ratings yet

- Ip 06 1862 - enDocument2 pagesIp 06 1862 - enbxlmichael8837No ratings yet

- Brexit: The Impact of ‘Brexit’ on the United KingdomFrom EverandBrexit: The Impact of ‘Brexit’ on the United KingdomNo ratings yet